Ferrovial Bundle

Can Ferrovial Continue Its Infrastructure Dominance?

Ferrovial, a titan in the global infrastructure arena, has masterfully navigated the complexities of the industry, evolving from a Spanish construction firm to a worldwide operator. Its strategic pivot towards international expansion and core competency focus has been a game-changer. This Ferrovial SWOT Analysis reveals the key factors behind its success.

This exploration delves into the heart of Ferrovial's

How Is Ferrovial Expanding Its Reach?

Ferrovial's Ferrovial growth strategy centers on ambitious expansion, particularly in North America and Europe. This strategy prioritizes assets with long-term growth potential, focusing on toll roads and airports after the 2021 sale of its Services division. The company is actively pursuing opportunities in public-private partnerships (PPPs) to capitalize on infrastructure investment plans.

The company's expansion includes exploring new product categories and business models, especially in sustainable infrastructure and smart mobility. Ferrovial is investing in electric vehicle charging infrastructure and intelligent transportation systems, aligning with global trends. Strategic partnerships are key, often utilizing joint ventures for large-scale projects to share resources and access local market expertise.

Ferrovial's commitment to growth is evident in its focus on high-quality infrastructure assets and adaptability to market changes. This approach is supported by a robust financial framework, enabling strategic investments and acquisitions. The company's financial performance, including revenue growth and profitability, is closely tied to these expansion initiatives.

Ferrovial is heavily focused on the North American market, aiming to capitalize on significant infrastructure investment. This includes actively seeking new concessions and development projects in the US and Canada. The company leverages its expertise in financing, designing, constructing, and operating large-scale transportation infrastructure to secure and manage these projects.

Europe remains a core market for Ferrovial, with continued investment in existing assets and exploration of new opportunities. The company's strategy involves maintaining and enhancing its presence in key European countries through strategic acquisitions and project developments. Ferrovial's focus on operational efficiency and technological advancements supports its European expansion efforts.

Ferrovial is actively involved in sustainable infrastructure projects, aligning with global trends towards decarbonization. This includes investments in electric vehicle charging infrastructure and intelligent transportation systems. The company is committed to integrating sustainable practices into its projects, focusing on environmental and social responsibility.

Strategic partnerships are a key component of Ferrovial's expansion strategy, enabling the company to share risks and access local market expertise. Joint ventures are commonly used for large-scale airport and highway projects. These partnerships allow Ferrovial to undertake more complex and capital-intensive endeavors, enhancing its market position.

Ferrovial's expansion plans are supported by a focus on core markets, sustainable infrastructure, and strategic partnerships. The company's Ferrovial business model is designed to leverage its expertise in infrastructure development and management. These initiatives are expected to drive future growth and enhance shareholder value.

- Focus on North America and Europe for infrastructure projects.

- Investment in sustainable infrastructure, including EV charging.

- Strategic partnerships to share risks and access local expertise.

- Emphasis on operational efficiency and technological advancements.

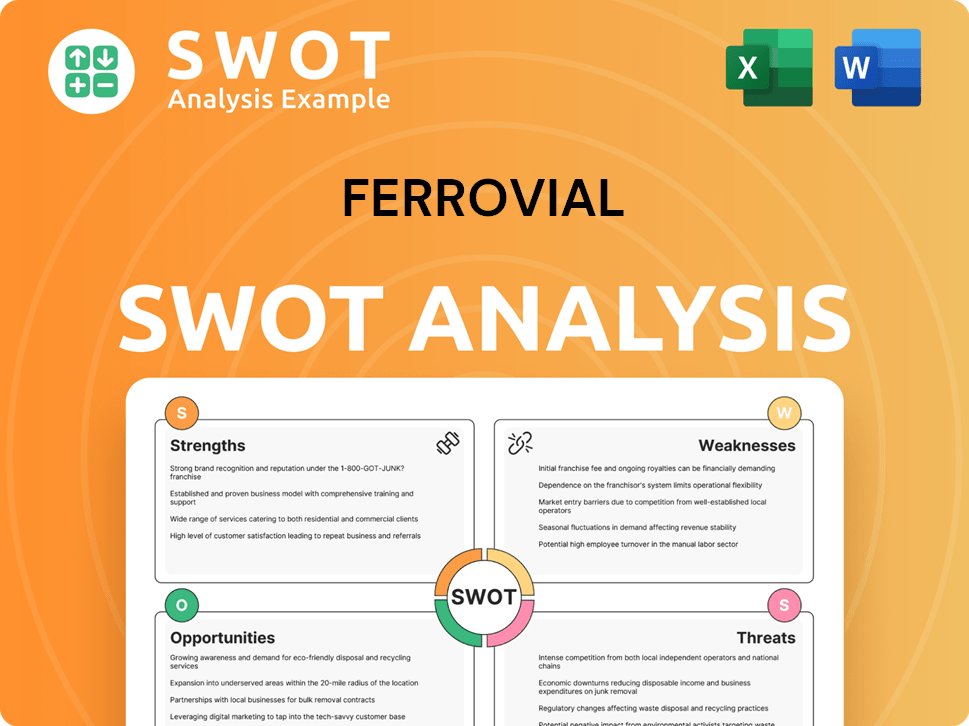

Ferrovial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ferrovial Invest in Innovation?

The core of the Ferrovial's mission revolves around leveraging innovation and technology to drive its growth strategy. This approach is crucial for enhancing operational efficiency, improving safety standards, and creating new value propositions within the infrastructure sector. By focusing on digital transformation, automation, and the integration of cutting-edge technologies, Ferrovial aims to maintain its competitive edge and capitalize on future market opportunities.

A significant portion of Ferrovial's investment is directed towards research and development (R&D). These investments are strategically allocated to improve project execution, optimize asset lifecycles, and reduce the environmental footprint of its operations. The company's commitment to innovation is evident in its adoption of advanced technologies and its pursuit of sustainable infrastructure solutions.

Ferrovial's strategic initiatives are designed to address the evolving needs of the infrastructure market, focusing on sustainability, efficiency, and resilience. The company's proactive approach to innovation is essential for achieving its financial and operational goals, contributing to its overall Ferrovial company analysis and future prospects.

Ferrovial is actively pursuing digital transformation across its operations. This includes the implementation of Building Information Modeling (BIM) for enhanced project management and the use of AI and machine learning for predictive maintenance.

BIM is used extensively across Ferrovial's projects. It allows for more precise and efficient project execution, from design to construction and maintenance. This technology helps in reducing costs and improving project timelines.

AI and machine learning are being explored for predictive maintenance in infrastructure assets. This includes optimizing operational performance and extending asset lifecycles. The goal is to minimize downtime and maximize efficiency.

Ferrovial is committed to sustainability, focusing on reducing the environmental impact of its projects. This involves integrating renewable energy, promoting circular economy principles, and developing smart city solutions.

Ferrovial utilizes drone technology for surveying and inspection, significantly improving data collection and analysis. This enhances the accuracy and efficiency of project monitoring.

The company collaborates with external innovators, including startups and academic institutions, to foster open innovation. This approach helps to bring new ideas to market faster and stay ahead of industry trends.

Ferrovial's innovation strategy is multifaceted, incorporating advanced technologies and strategic partnerships to enhance its Ferrovial infrastructure projects and overall Ferrovial financial performance. These efforts contribute to the company's Ferrovial growth strategy and long-term goals.

- Digitalization: Implementation of digital tools and platforms across all business areas.

- Data Analytics: Utilizing data analytics to improve decision-making and operational efficiency.

- Smart Infrastructure: Developing and implementing smart city solutions and intelligent transportation systems.

- Strategic Alliances: Forming partnerships with technology providers and research institutions to drive innovation.

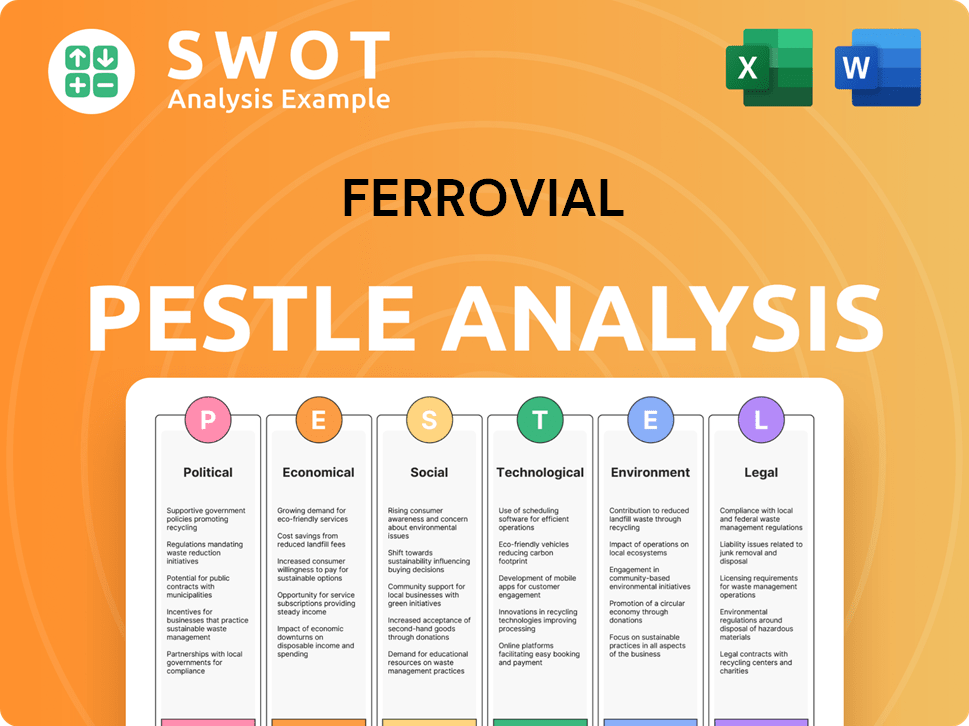

Ferrovial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ferrovial’s Growth Forecast?

The financial outlook for Ferrovial is positive, supported by its strategic focus on high-growth markets and a disciplined capital allocation strategy. The company's 2023 financial results showed an increase in EBITDA to €992 million, demonstrating the strong performance of its core assets. This positive financial performance is a key indicator of the company's potential for future growth and its ability to capitalize on emerging opportunities.

Ferrovial's robust financial position enables it to fund expansion initiatives and pursue new acquisitions. The company's long-term financial goals include a continued focus on profitability and shareholder returns, supported by efficient operations and a prudent approach to debt management. This financial strategy is designed to ensure the company has the resources needed to achieve its ambitious growth targets in the coming years. An in-depth analysis of the Marketing Strategy of Ferrovial provides further insights into the company's approach to market positioning and growth.

The company reported a significant increase in its backlog in 2023, reaching €15.9 billion, which indicates a strong pipeline of future projects. This substantial backlog provides a solid foundation for sustained revenue growth. Ferrovial's strategic positioning in resilient infrastructure sectors further supports its positive financial outlook, making it well-placed to navigate market fluctuations and achieve long-term financial success.

Ferrovial's growth strategy emphasizes expansion in key markets, particularly through its toll road and airport concessions. This includes strategic investments and acquisitions to strengthen its position in the infrastructure sector. The company aims to leverage its existing assets and expertise to drive revenue growth and enhance shareholder value.

The future prospects for Ferrovial are promising, with expectations of sustained revenue growth driven by increased traffic volumes and potential tariff adjustments. The company's focus on infrastructure projects and its strong financial position support its ability to capitalize on emerging opportunities. Analyst forecasts generally reflect a positive outlook.

Ferrovial's business model is centered on the development, construction, and operation of infrastructure assets. This includes toll roads, airports, and other infrastructure projects. The company's diversified portfolio and focus on long-term concessions provide stable revenue streams and growth opportunities.

Ferrovial's financial performance in 2023 showed an increase in EBITDA to €992 million, reflecting the positive performance of its core assets. The company's strong backlog of €15.9 billion indicates a solid pipeline of future projects. The focus remains on sustained revenue growth and shareholder returns.

Key financial metrics for Ferrovial include a focus on revenue growth, profitability, and efficient debt management. The company aims to maintain a healthy financial position to support its expansion plans and acquisitions. The strategic goals for 2024 and beyond include sustained revenue growth and enhanced shareholder value.

- €992 million: EBITDA in 2023.

- €15.9 billion: Backlog in 2023.

- Focus on sustained revenue growth through toll roads and airport concessions.

- Emphasis on value-accretive investments in key markets.

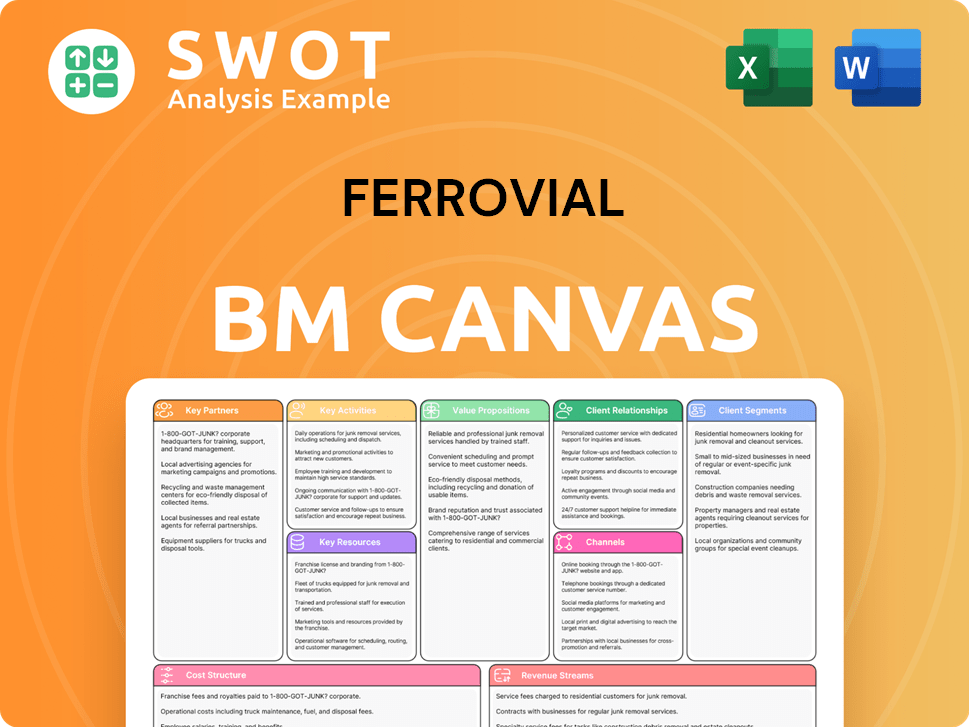

Ferrovial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ferrovial’s Growth?

The infrastructure sector presents a complex landscape for companies like Ferrovial, with various risks and obstacles that can impact its growth trajectory. Understanding these challenges is crucial for assessing the company's future prospects and its ability to maintain a strong financial performance. A thorough Ferrovial company analysis must consider these potential pitfalls.

Market competition, regulatory shifts, supply chain vulnerabilities, and technological disruptions are among the key risks. These factors can affect project profitability, operational efficiency, and the overall sustainability of Ferrovial's business model. Addressing these challenges requires a proactive and adaptive approach to ensure long-term success in the infrastructure market.

Ferrovial's growth strategy is also influenced by external factors, including economic trends and geopolitical events. The company's ability to navigate these uncertainties will be critical in achieving its strategic goals. For more context, it's beneficial to examine the Competitors Landscape of Ferrovial.

The infrastructure sector is highly competitive, with numerous global players vying for projects. This intense competition can drive down project margins and impact Ferrovial's market share. The company must continually innovate and optimize its operations to remain competitive.

Changes in regulations, particularly in areas like environmental standards or public-private partnership frameworks, can affect project development. Political instability in regions where Ferrovial operates also poses a risk, potentially impacting the viability of long-term concessions.

Global supply chain disruptions can lead to delays and increased costs for construction materials and equipment. This can directly affect project timelines and profitability. Diversifying suppliers and maintaining strong relationships are crucial for mitigating this risk.

Rapid technological advancements can create both opportunities and risks. If Ferrovial fails to adapt to new innovations, such as in construction technologies or smart infrastructure, it could lose a competitive edge. Investment in research and development is key.

A shortage of skilled labor or difficulties in talent acquisition can impede project delivery. Effective workforce planning and investment in training programs are essential to ensure that Ferrovial has the necessary resources to execute its projects successfully.

Increasing cyber threats to critical infrastructure and the growing impact of climate change on asset resilience are emerging risks. Ferrovial needs to proactively address these challenges through robust cybersecurity measures and sustainable infrastructure development practices.

Ferrovial employs a risk management framework that includes diversifying its asset portfolio across geographies and sectors to mitigate localized downturns. The company also engages in scenario planning to prepare for various market conditions and potential disruptions. Recent examples of the company's resilience include its ability to navigate the challenges posed by the COVID-19 pandemic, adapting its operational strategies and maintaining financial stability.

Economic trends significantly influence Ferrovial's financial performance. For example, changes in interest rates can affect project financing costs, while inflation can increase construction expenses. The company must closely monitor these trends and adjust its strategies accordingly. The company's 2024 strategic goals are influenced by the current economic climate.

Geopolitical events can create uncertainty and impact Ferrovial's operations. Political instability in certain regions can disrupt project timelines and increase operational risks. The company's expansion plans must carefully consider these geopolitical factors.

The growing emphasis on sustainable infrastructure development presents both challenges and opportunities. Ferrovial is actively involved in sustainable infrastructure development, which is crucial for long-term growth. This includes integrating environmentally friendly practices into its projects and investing in renewable energy initiatives.

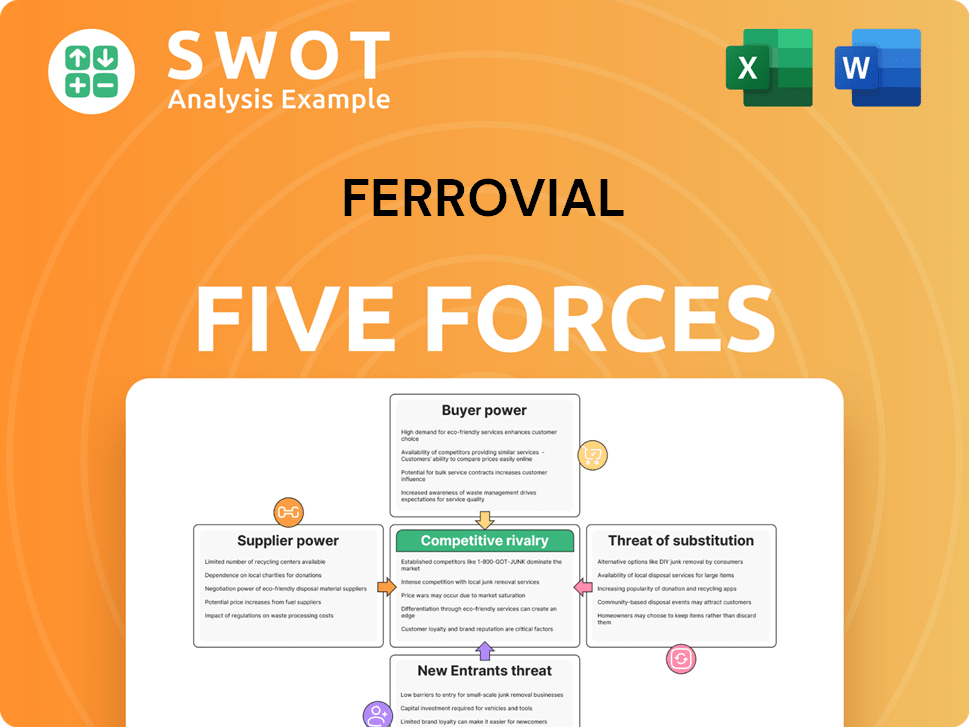

Ferrovial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ferrovial Company?

- What is Competitive Landscape of Ferrovial Company?

- How Does Ferrovial Company Work?

- What is Sales and Marketing Strategy of Ferrovial Company?

- What is Brief History of Ferrovial Company?

- Who Owns Ferrovial Company?

- What is Customer Demographics and Target Market of Ferrovial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.