Ferrovial Bundle

How Does the Ferrovial Company Shape Our World?

Ferrovial, a global titan in infrastructure, is at the forefront of building and managing the essential networks that connect our world. From bustling airports to vital roadways, the Ferrovial SWOT Analysis reveals the company's strategic prowess in an ever-changing landscape. Its impact is felt across continents, making it a critical player for investors and industry watchers alike.

This exploration into the Ferrovial business will uncover its operational strategies and financial performance. Discover how Ferrovial company leverages its expertise in construction and concessions to create sustainable infrastructure solutions. We'll delve into the core activities, examining how this global powerhouse continues to adapt and thrive, impacting everything from airports to toll roads and beyond, shaping the economy and communities worldwide.

What Are the Key Operations Driving Ferrovial’s Success?

The Ferrovial company creates and delivers value through its comprehensive involvement in the infrastructure lifecycle. This includes design, construction, financing, and operation of various infrastructure assets. The company's core business revolves around infrastructure projects, serving a diverse range of customers, including governments and private entities.

Ferrovial's operations span toll roads, airports, rail networks, buildings, and water and energy infrastructure projects. The company's integrated approach offers end-to-end solutions, covering every stage of an infrastructure asset's life. This model, combined with a focus on innovation and sustainability, provides significant customer benefits.

Ferrovial's commitment to sustainability and innovation is evident in its project management and operational strategies. The company continuously seeks to improve connectivity, enhance safety, and deliver long-term economic value through its infrastructure projects. For more insights into the company's ownership structure, consider exploring Owners & Shareholders of Ferrovial.

Ferrovial's core operations involve the entire infrastructure lifecycle, from design and construction to financing and operation. The company manages projects using advanced engineering, efficient construction methods, and sophisticated asset management systems. These processes ensure efficiency and quality across all projects.

The value proposition of Ferrovial lies in its ability to deliver integrated infrastructure solutions. This approach improves connectivity and enhances safety, while also providing long-term economic value. Ferrovial's focus on sustainability and innovation further enhances its value proposition.

Ferrovial leverages its experience in project financing, often utilizing public-private partnerships (PPPs) for large-scale projects. This approach allows the company to undertake complex infrastructure projects. The company's financial strategies are crucial for the development and expansion of its projects.

Ferrovial serves various customer segments, including governments, public authorities, private developers, and concessionaires. The company's ability to meet the diverse needs of these segments is a key factor in its success. This diverse customer base highlights the company's adaptability.

Ferrovial's operational processes are meticulously managed to ensure efficiency and quality. This includes advanced engineering and design capabilities, efficient construction methodologies, and sophisticated asset management systems for long-term operation. The company's supply chain involves a global network of suppliers and subcontractors.

- Advanced Engineering and Design: Utilizing cutting-edge technologies to design and plan infrastructure projects.

- Efficient Construction Methodologies: Implementing streamlined construction processes to minimize costs and timelines.

- Sophisticated Asset Management: Employing systems for long-term operation and maintenance of infrastructure assets.

- Global Supply Chain: Managing a network of suppliers and subcontractors to ensure timely and cost-effective project delivery.

Ferrovial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ferrovial Make Money?

The Ferrovial company generates revenue through a multifaceted approach, leveraging its diverse portfolio of infrastructure assets and services. This includes toll road concessions, airport operations, construction projects, and energy and water management activities. The company's strategic focus on long-term concessions and performance-based contracts underpins its financial stability and growth.

A significant portion of Ferrovial's business revenue comes from its toll road concessions, where it collects tolls from users. Airport operations, particularly through its stake in Heathrow Airport, also contribute substantially, with revenue from aeronautical charges and retail concessions. Furthermore, the construction division provides revenue from building and civil engineering projects, and the energy and water infrastructure activities add to the mix.

In the first nine months of 2023, Ferrovial reported approximately €6,134 million in total revenues, showcasing its strong financial performance. The company's diverse revenue streams and geographical presence help to mitigate risks associated with economic downturns or regulatory changes.

Tolls collected from users of managed road networks. These are often characterized by long-term concession agreements.

Revenue from aeronautical charges, retail concessions, and other ancillary services. A key asset is its stake in Heathrow Airport.

Contracts for building and civil engineering projects. Revenue is recognized based on project completion milestones.

Development, operation, and maintenance of facilities in these sectors. This adds diversification to the revenue streams.

Long-term concession models and performance-based contracts. These strategies ensure steady income and mitigate risks.

Diversification across different infrastructure types and geographical regions. This helps in risk mitigation.

The company's approach is further detailed in an article on Growth Strategy of Ferrovial. This diversification is crucial for maintaining financial stability and growth.

Ferrovial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ferrovial’s Business Model?

The Ferrovial company has a rich history marked by significant milestones that have shaped its trajectory in the infrastructure sector. Its strategic moves, particularly its focus on international expansion, have been crucial. The company's ability to adapt to changing market dynamics and regulatory environments has been a key factor in its sustained performance. Understanding these elements provides insight into how the Ferrovial business operates and its strategic positioning.

A pivotal aspect of Ferrovial's strategy has been its geographical diversification, which has reduced its dependence on any single market. This approach has been supported by strategic acquisitions and investments in various regions. The company has consistently demonstrated an ability to navigate complex regulatory landscapes and adapt to economic fluctuations. This adaptability is central to its long-term success.

Ferrovial's competitive edge stems from a combination of factors, including its expertise in infrastructure development and its strong brand reputation. The company's commitment to innovation and sustainability further enhances its market position. Economies of scale and strategic partnerships also play a crucial role in its operational efficiency and competitive advantage. For more information about the target market of Ferrovial, read this article: Target Market of Ferrovial.

Ferrovial has achieved significant milestones, including major infrastructure projects and strategic acquisitions. These achievements have expanded its global footprint and diversified its revenue streams. The company's growth has been marked by its ability to secure and successfully execute large-scale projects.

Strategic moves include a strong focus on international expansion, particularly in North America. This has involved investments in toll roads, airports, and other infrastructure projects. Ferrovial has also adapted to evolving market demands by embracing new technologies and sustainable practices.

Ferrovial's competitive advantages include expertise in infrastructure development, a strong brand, and economies of scale. The company's commitment to innovation and sustainability further strengthens its position. Strategic partnerships and a focus on operational efficiency also contribute to its success.

Recent developments include ongoing investments in sustainable infrastructure and digital transformation. Ferrovial continues to adapt to new trends, such as the increasing demand for sustainable infrastructure and digital transformation. The company is actively involved in projects that reflect these priorities.

Ferrovial reported revenues of approximately €7.9 billion in 2023. The company's EBITDA for 2023 was around €1.3 billion, reflecting strong operational performance. Key projects include involvement in major airport expansions and toll road operations across multiple countries.

- Significant projects in North America, including toll road operations.

- Investments in sustainable infrastructure and smart solutions.

- Focus on digital transformation to improve operational efficiency.

- Strong emphasis on environmental, social, and governance (ESG) factors.

Ferrovial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ferrovial Positioning Itself for Continued Success?

The Ferrovial company holds a significant position within the global infrastructure sector, ranking among the top international developers and operators. It boasts a substantial market share in key segments such as toll roads in North America and airport operations in the UK. The company benefits from strong customer loyalty due to the essential nature of its infrastructure assets and its reputation for reliability and quality. With a global footprint spanning North America, Europe, and Australia, Ferrovial's market standing is robust.

Despite its strong market position, Ferrovial faces several risks. These include regulatory changes, especially concerning environmental regulations and concession agreements. The emergence of new competitors, including those employing innovative technologies or alternative financing models, poses a potential threat. Technological disruption, while also an opportunity, could necessitate substantial investment in new systems and processes. Changing consumer preferences, such as shifts towards alternative transportation methods or greater demand for sustainable infrastructure, also require continuous adaptation.

Ferrovial is a leading player in the infrastructure and construction sectors, operating globally. The company is involved in various projects, including infrastructure and construction. Its operations are spread across different countries, making it a significant participant in the international market.

Ferrovial faces risks such as regulatory changes, competition, and technological disruptions. Economic downturns and fluctuations in commodity prices can also impact its projects. The company must manage these risks to ensure its financial stability and project success.

The future outlook for Ferrovial looks promising, with a focus on sustainable development and digital transformation. The company plans to expand its presence in high-growth markets. Strategic initiatives include smart infrastructure and renewable energy integration to drive future growth.

Ferrovial is actively pursuing strategic initiatives to mitigate risks and secure its future growth. These include investing in smart infrastructure, integrating renewable energy, and adopting advanced construction techniques. The company is also focused on expanding its presence in high-growth markets.

Ferrovial is focused on sustainable development, digital transformation, and expanding its presence in high-growth markets. The company's strategic initiatives are designed to enhance its revenue generation capabilities by focusing on profitable growth in its core infrastructure businesses. Ferrovial is exploring new opportunities in sectors like electromobility and urban infrastructure, leveraging its expertise in public-private partnerships to secure new projects.

- Focus on profitable growth in core infrastructure businesses.

- Exploring opportunities in electromobility and urban infrastructure.

- Leveraging expertise in public-private partnerships.

- Emphasis on sustainable development and digital transformation.

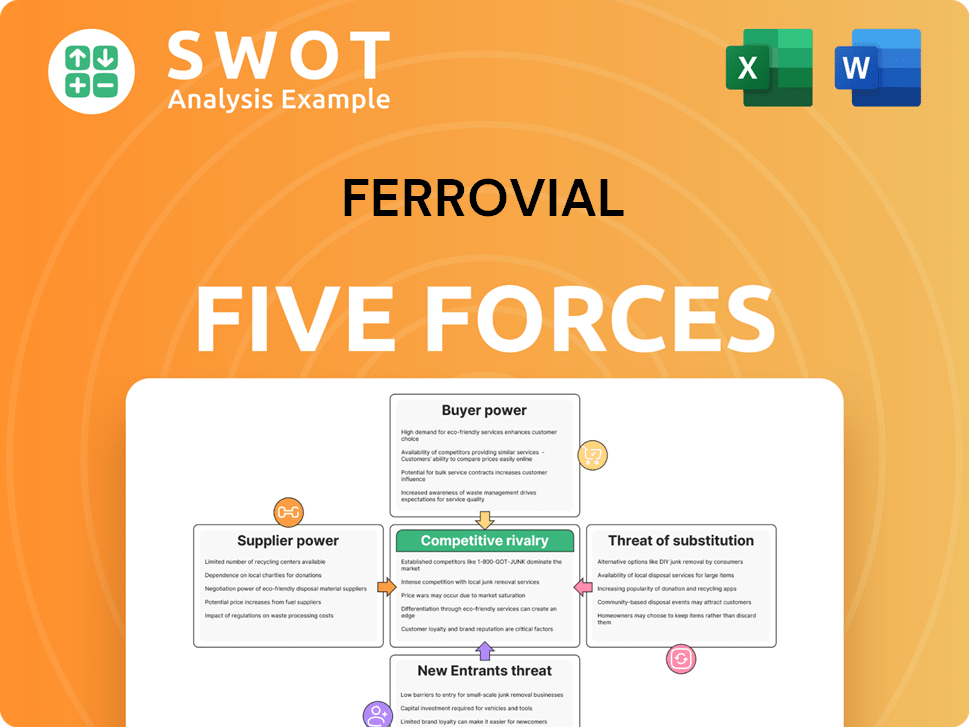

Ferrovial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ferrovial Company?

- What is Competitive Landscape of Ferrovial Company?

- What is Growth Strategy and Future Prospects of Ferrovial Company?

- What is Sales and Marketing Strategy of Ferrovial Company?

- What is Brief History of Ferrovial Company?

- Who Owns Ferrovial Company?

- What is Customer Demographics and Target Market of Ferrovial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.