FiscalNote Bundle

How Did FiscalNote Become a Global Powerhouse?

Navigating the complexities of government and policy is a challenge, but what if you had a guide? FiscalNote, a leading information services company, offers just that. Its mission has been to transform how organizations understand and interact with the ever-changing landscape of legislation and geopolitical developments. This brief history of FiscalNote explores how it achieved this.

Founded in 2013, FiscalNote set out to democratize access to legislative information, a sector often shrouded in opacity. From its initial funding, the company aimed to bridge the information gap between policymakers and those affected by their decisions. Today, FiscalNote provides critical data, analytics, and workflow solutions, solidifying its position in the market. By offering FiscalNote SWOT Analysis and other products, the company helps clients monitor developments, assess risks, and advocate for their interests.

What is the FiscalNote Founding Story?

The story of FiscalNote begins on July 11, 2013. The company was founded by Tim Hwang, Jonathan Chen, and Josh Tauber. Their goal was to solve the problem of fragmented government data, making it easier for businesses and citizens to understand policy.

Tim Hwang's background in political science helped him see the inefficiencies in accessing legislative information. Chen and Tauber brought the technical skills needed to build a platform. The company's initial focus was to create a real-time platform for tracking legislative changes. The name 'FiscalNote' was chosen to reflect both fiscal implications and detailed policy records.

Early funding came from a seed round, which was crucial for developing the minimum viable product (MVP). The founders' combined expertise in political science, software development, and data architecture helped the company grow. The creation of FiscalNote was influenced by the growing need for data-driven decision-making in politics and business. The increasing availability of public data, which lacked effective tools for aggregation and analysis, also played a role.

FiscalNote was founded to address the challenges of accessing and understanding government data. The initial product was a legislative tracking tool.

- The company was founded on July 11, 2013.

- Tim Hwang, Jonathan Chen, and Josh Tauber were the founders.

- The initial focus was on providing a real-time platform for tracking legislative changes.

- Early funding came from a seed round.

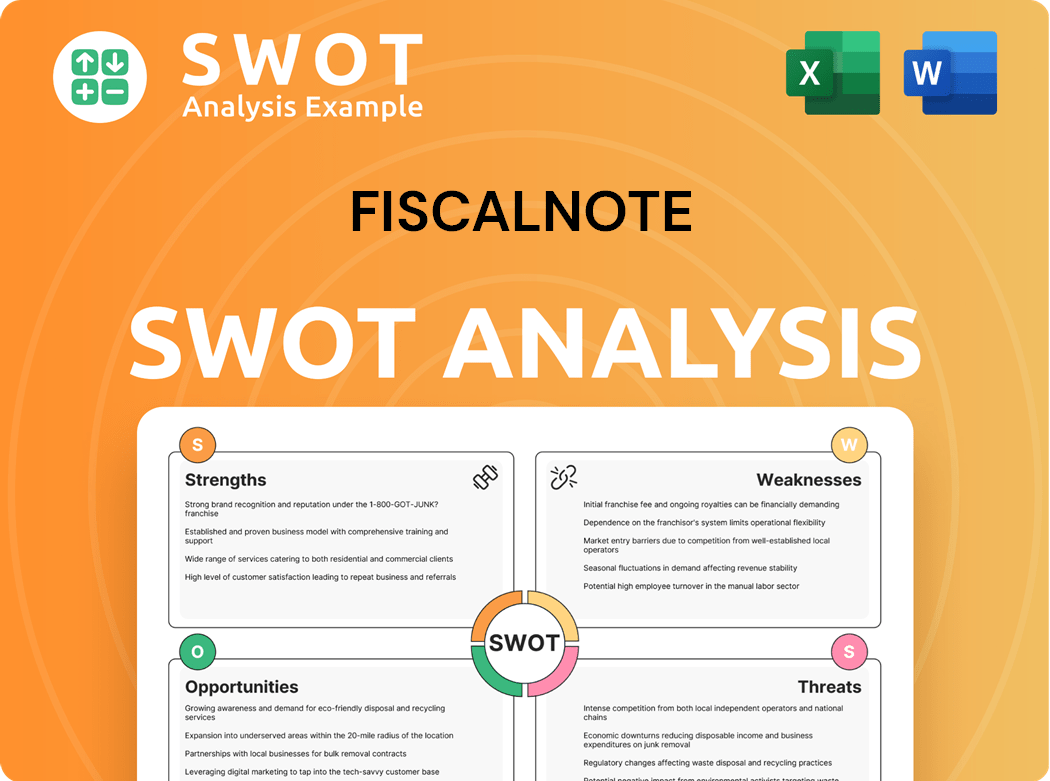

FiscalNote SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of FiscalNote?

The early growth of FiscalNote was marked by rapid product development and strategic market entry. The company quickly transformed its initial legislative tracking tool into a more comprehensive platform. Early clients included law firms and corporations seeking to better understand policy changes. Their initial team grew, adding engineers, data scientists, and sales personnel.

Following its founding, FiscalNote rapidly evolved its legislative tracking tool, enhancing analytical capabilities and user interfaces. This allowed the company to cater to a growing client base. Their first office was strategically established in Washington D.C., positioning them at the center of policy-making. This strategic location was key to understanding and responding to policy changes.

Expansion efforts saw FiscalNote enter new markets, initially focusing on broadening coverage of state and local legislation within the United States. Key acquisitions, such as CQ Roll Call in 2018, significantly bolstered content offerings and market reach. This expansion helped the company to broaden its Marketing Strategy of FiscalNote.

Major capital raises provided resources for expansions and product development. In 2021, FiscalNote raised $160 million in a Series D funding round, accelerating its growth. Strategic hires brought in expertise in enterprise sales and global operations. These financial boosts and leadership changes were critical for scaling the business.

Strategic shifts in the business model included a move towards recurring revenue through subscriptions and expanding services to include advocacy tools and geopolitical risk assessment. Market reception to FiscalNote's offerings was largely positive, addressing a clear need for actionable policy intelligence. This evolution transformed FiscalNote from a legislative tracking service to a holistic government affairs and global intelligence solution.

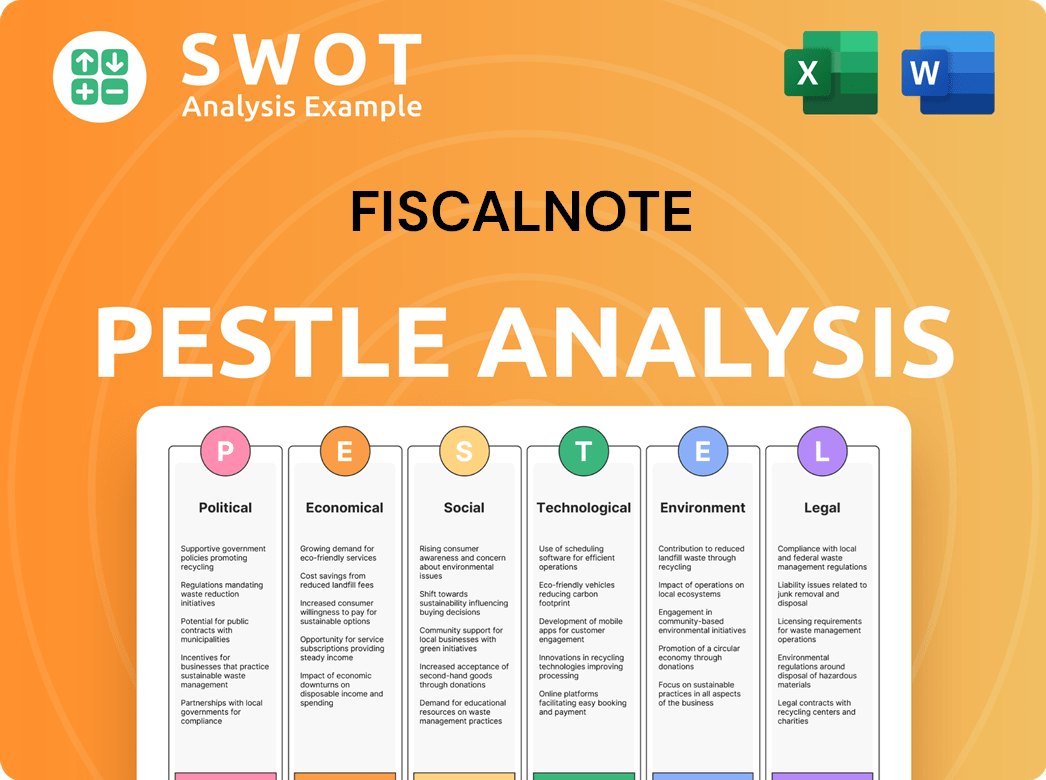

FiscalNote PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in FiscalNote history?

The FiscalNote company has marked its journey with significant milestones, innovations, and strategic pivots. From its inception, FiscalNote has grown to become a key player in the policy and regulatory data space, constantly adapting to market dynamics and technological advancements. Understanding the FiscalNote history provides insights into its evolution and its impact on the industry.

| Year | Milestone |

|---|---|

| 2013 | FiscalNote launches its platform, providing data and analytics for government relations professionals. |

| 2018 | FiscalNote acquires CQ Roll Call, expanding its reach in legislative tracking and policy analysis. |

| 2021 | FiscalNote goes public through a SPAC merger, marking a significant step in its growth. |

| 2022 | FiscalNote acquires Oxford Analytica, enhancing its geopolitical intelligence capabilities. |

| 2023 | FiscalNote continues to expand its product offerings and global presence, focusing on data-driven insights. |

FiscalNote has consistently introduced innovative solutions to meet the evolving needs of its clients. These innovations have included AI-powered platforms for analyzing legislative and regulatory data, and proprietary algorithms for legislative prediction. The company has also secured numerous patents for its data aggregation and analysis technologies, setting it apart in the industry.

FiscalNote launched an AI-powered platform that revolutionized how clients analyze legislative and regulatory data. This platform identified trends and predicted outcomes with greater accuracy, offering a significant advantage to its users.

FiscalNote developed proprietary algorithms for legislative prediction, enhancing its ability to forecast policy changes. This innovation provided clients with valuable insights, helping them stay ahead of the curve in a dynamic policy environment.

FiscalNote offered comprehensive coverage of global policy changes, providing clients with a broad view of regulatory landscapes. This extensive coverage allowed clients to monitor and analyze policy developments across various regions and jurisdictions.

The company has secured numerous patents related to its data aggregation and analysis technologies. These technologies are crucial for collecting, processing, and delivering policy data efficiently and accurately.

FiscalNote formed major partnerships with leading organizations, enhancing its data sources and distribution channels. These collaborations expanded the company's reach and provided clients with more comprehensive data solutions.

FiscalNote has received prestigious recognition, including industry awards and inclusion in prominent technology lists. These accolades highlight the company's impact and its position as a leader in the industry.

Despite its successes, FiscalNote has faced challenges, including market downturns and competition. The company has strategically adapted, expanding into geopolitical intelligence and diversifying its services through acquisitions. For more on FiscalNote's business model and revenue streams, check out Revenue Streams & Business Model of FiscalNote.

FiscalNote has navigated market downturns, requiring strategic adjustments to maintain growth. These challenges have necessitated a focus on efficiency and innovation to remain competitive.

The company has faced competition from both established players and emerging startups. This competitive landscape has driven FiscalNote to continuously innovate and differentiate its offerings.

Product failures are an inherent part of rapid innovation, leading to iterative improvements. The company has learned from these experiences to enhance its products.

Internal crises, common in high-growth companies, have likely involved scaling challenges and talent acquisition. Addressing these issues has been crucial for maintaining operational efficiency.

FiscalNote has undertaken major strategic pivots, including expanding into geopolitical intelligence and diversifying its service offerings. These pivots have been key to adapting to changing market demands.

The company has actively pursued acquisitions to expand its data and client base, a strategy that has proven effective in overcoming competitive pressures. The acquisition of Oxford Analytica in 2022 is a prime example.

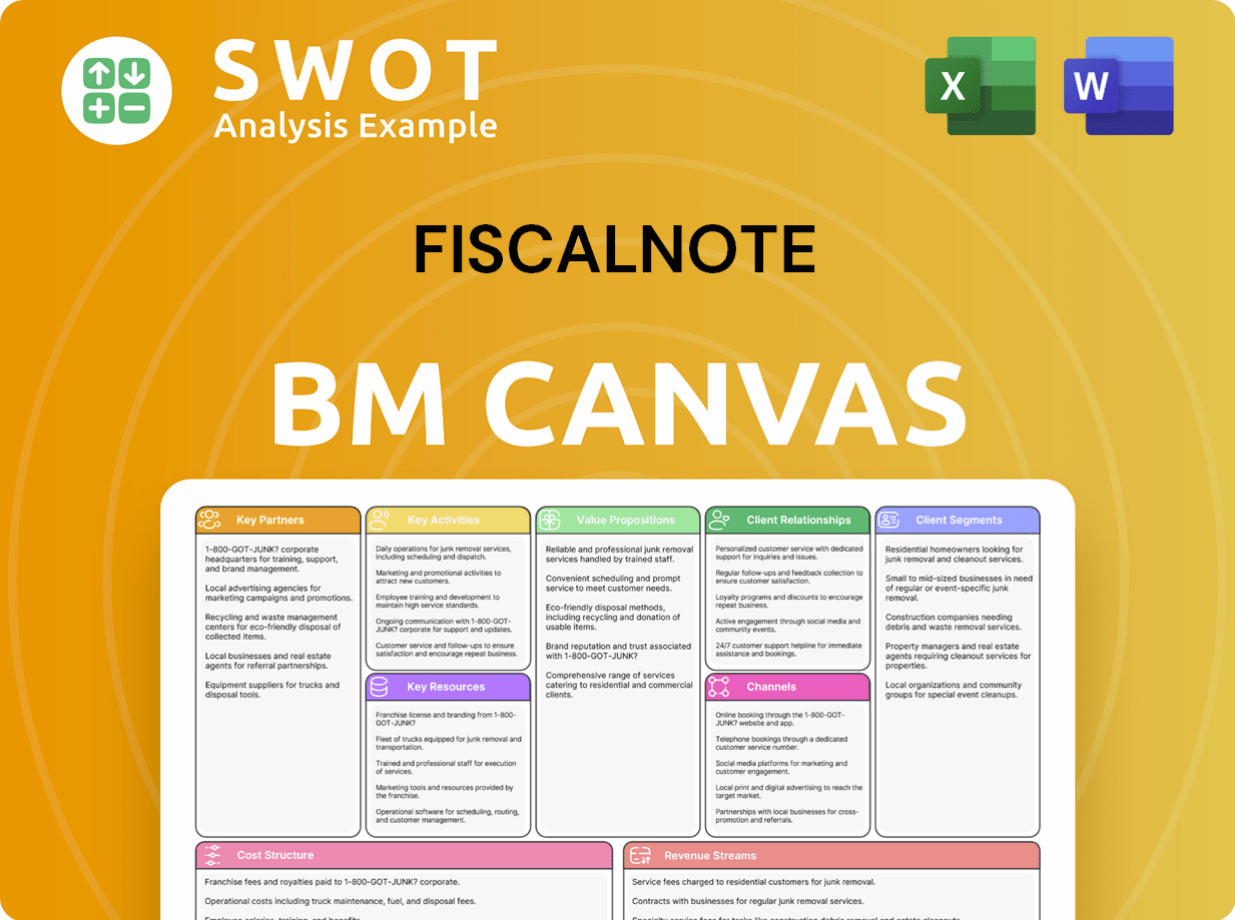

FiscalNote Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for FiscalNote?

The FiscalNote company has a rich FiscalNote history. Founded on July 11, 2013, the company quickly established itself as a key player in the policy and government intelligence sector. Early milestones included the launch of its legislative tracking platform in 2014 and securing Series A funding in 2015, which fueled its expansion. The integration of AI capabilities in 2016 marked a significant step, followed by strategic FiscalNote acquisitions like CQ Roll Call in 2018 and Oxford Analytica in 2022, broadening its reach and offerings. The company went public in 2022, trading on the NYSE under the ticker NOTE, and completed a $160 million Series D funding round in 2021. These events highlight the company's journey and its commitment to innovation and growth in the policy data and analytics space. You can learn more about the company's core values by reading Mission, Vision & Core Values of FiscalNote.

| Year | Key Event |

|---|---|

| 2013 | FiscalNote was officially founded on July 11th. |

| 2014 | The initial legislative tracking platform was launched, marking the beginning of its FiscalNote products. |

| 2015 | Secured Series A funding, facilitating significant expansion. |

| 2016 | Introduced AI-powered analytical capabilities, enhancing its FiscalNote services. |

| 2018 | Acquired CQ Roll Call, substantially expanding its content and reach. |

| 2019 | Expanded its international presence and data coverage. |

| 2021 | Completed a $160 million Series D funding round. |

| 2022 | Acquired Oxford Analytica, enhancing geopolitical intelligence offerings and became a publicly traded company. |

| 2023 | Continued expansion of AI and machine learning capabilities across its platform. |

| 2024 | Announced strategic partnerships aimed at integrating its data with other enterprise solutions. |

FiscalNote aims to enhance predictive analytics, enabling clients to anticipate policy shifts and geopolitical events with greater accuracy. This involves leveraging advanced AI and machine learning to provide deeper insights. The company plans to integrate generative AI to offer more personalized and actionable insights. This will likely lead to new ways for clients to interact with vast amounts of policy data.

The company is focusing on strengthening its presence in key international markets, particularly in regions with complex regulatory environments. This expansion strategy is crucial for broadening its global reach. The demand for real-time risk assessment and the increasing volume of global legislation support this strategic direction. FiscalNote is positioned to capitalize on these trends.

Strategic partnerships are key to integrating data with other enterprise solutions, enhancing its offerings. The company is committed to being the 'operating system for advocacy and intelligence'. Innovation roadmaps include leveraging generative AI for personalized insights, potentially offering new ways to interact with policy data. This focus on data integration aims to provide more comprehensive and actionable intelligence to clients.

Industry trends, such as the increasing volume of global legislation and the growing need for real-time risk assessment, are likely to impact FiscalNote positively. Analyst predictions often highlight the company's unique position at the intersection of technology and policy, suggesting continued growth. This unique position is expected to drive demand for its services, supporting its expansion strategy.

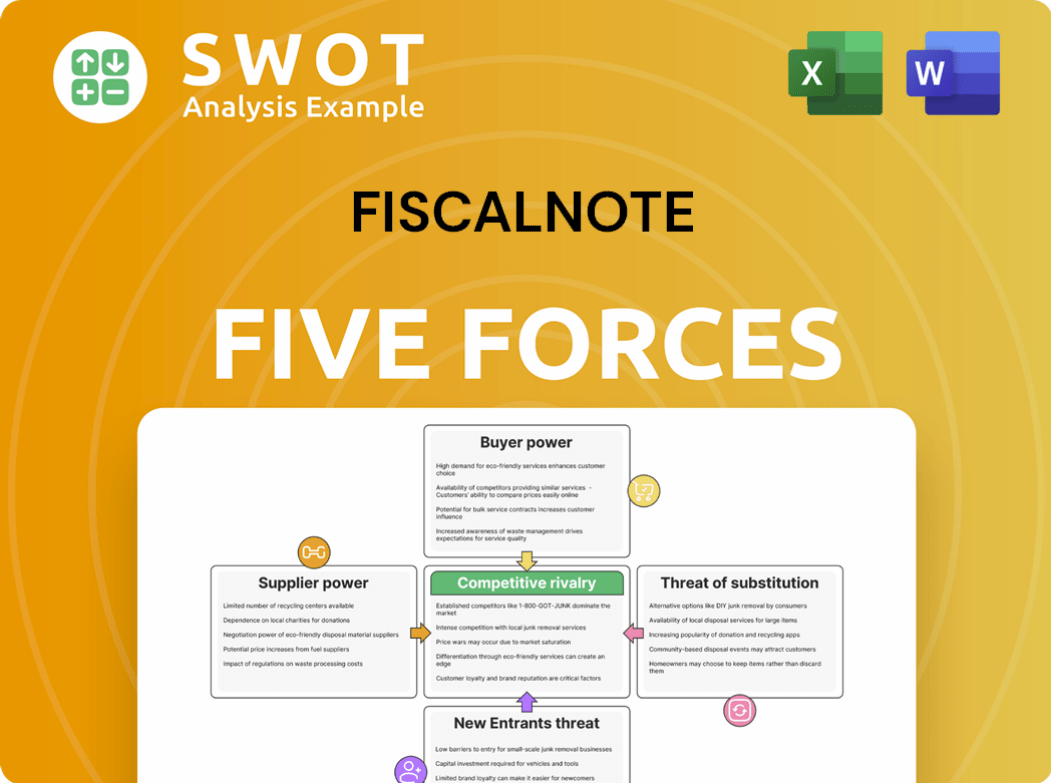

FiscalNote Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of FiscalNote Company?

- What is Growth Strategy and Future Prospects of FiscalNote Company?

- How Does FiscalNote Company Work?

- What is Sales and Marketing Strategy of FiscalNote Company?

- What is Brief History of FiscalNote Company?

- Who Owns FiscalNote Company?

- What is Customer Demographics and Target Market of FiscalNote Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.