FiscalNote Bundle

Who Does FiscalNote Serve?

In the complex world of policy and regulation, understanding the FiscalNote SWOT Analysis and its customer base is crucial for strategic success. FiscalNote Company, a leader in providing government and regulatory information, has a dynamic target market, which has significantly evolved since its inception. This evolution reflects the growing need for accessible and actionable insights in today's fast-paced global environment.

This analysis delves into the FiscalNote Company's customer demographics and target market, providing a comprehensive market analysis. We'll explore who FiscalNote's clients are, their needs, and how the company strategically positions itself to serve them. Understanding FiscalNote's customer profile examples and market segmentation strategy offers valuable insights for anyone seeking to navigate the complexities of policy and regulatory landscapes.

Who Are FiscalNote’s Main Customers?

Understanding the Owners & Shareholders of FiscalNote involves a deep dive into its primary customer segments. The company's business model is firmly rooted in serving business-to-business (B2B) clients across various sectors. Its core demographics are defined more by organizational type and need for regulatory intelligence than by traditional demographic markers like age or income.

The FiscalNote Company primarily targets organizations that require comprehensive legislative and regulatory data and analytics. These organizations span several key categories, each with specific needs that FiscalNote addresses. The common thread among these groups is a need for timely, accurate, and actionable insights to navigate complex regulatory landscapes.

The FiscalNote Target Market is composed of several key segments, including corporations, law firms, non-profits, and government agencies. Each of these groups utilizes FiscalNote's services to meet distinct needs, such as monitoring legislation, advising clients, advocating for causes, or tracking policy changes. The company's ability to cater to these diverse needs has driven its growth and market presence.

Corporations form a significant portion of FiscalNote's client base. Within these organizations, the primary users of FiscalNote's services are often public affairs departments, government relations teams, and legal and compliance divisions. These teams use the platform to understand and mitigate regulatory risks, track legislation, and stay informed about policy changes that could impact their business operations. FiscalNote's focus on enterprise clients reflects its ability to serve large organizations with complex needs.

Law firms, particularly those specializing in lobbying, regulatory compliance, or public policy, are another key segment. These firms leverage FiscalNote's data and analytics to inform their strategies and advise clients. The platform provides them with the necessary information to understand and navigate the ever-changing legal and regulatory landscape, helping them provide better services to their clients.

Non-profits and advocacy groups also utilize FiscalNote to monitor legislation relevant to their missions and to advocate for their causes. These organizations use the platform to track policy changes, understand the potential impact of new laws, and inform their advocacy efforts. This segment benefits from FiscalNote's ability to provide comprehensive and up-to-date information.

Government agencies at various levels are also users of FiscalNote. They use the platform for legislative tracking, policy analysis, and stakeholder engagement. FiscalNote's services help these agencies stay informed about legislative activities, analyze the potential impacts of policy changes, and manage their interactions with stakeholders.

The common thread among these diverse groups is their need for timely, accurate, and comprehensive legislative and regulatory intelligence. These organizations are typically well-established, with significant operational budgets, and operate in highly regulated environments. FiscalNote's customer profile examples include large corporations, law firms, non-profits, and government entities, all of whom require sophisticated data and analytics to manage risk and inform strategic decisions. The acquisitions of companies like CQ Roll Call and FrontierView have broadened its reach, attracting a wider array of institutional clients and expanding its FiscalNote's target audience by industry.

Understanding the characteristics of FiscalNote Users is crucial for grasping its market position and value proposition. These users share several key traits that define their needs and how FiscalNote serves them.

- Need for Accurate Data: Clients require precise and reliable information to make informed decisions.

- Regulatory Compliance: Organizations operating in highly regulated environments need to stay compliant.

- Strategic Decision-Making: Users leverage data to inform their strategic planning and risk management.

- Efficiency and Timeliness: Clients need up-to-date information delivered efficiently to stay ahead.

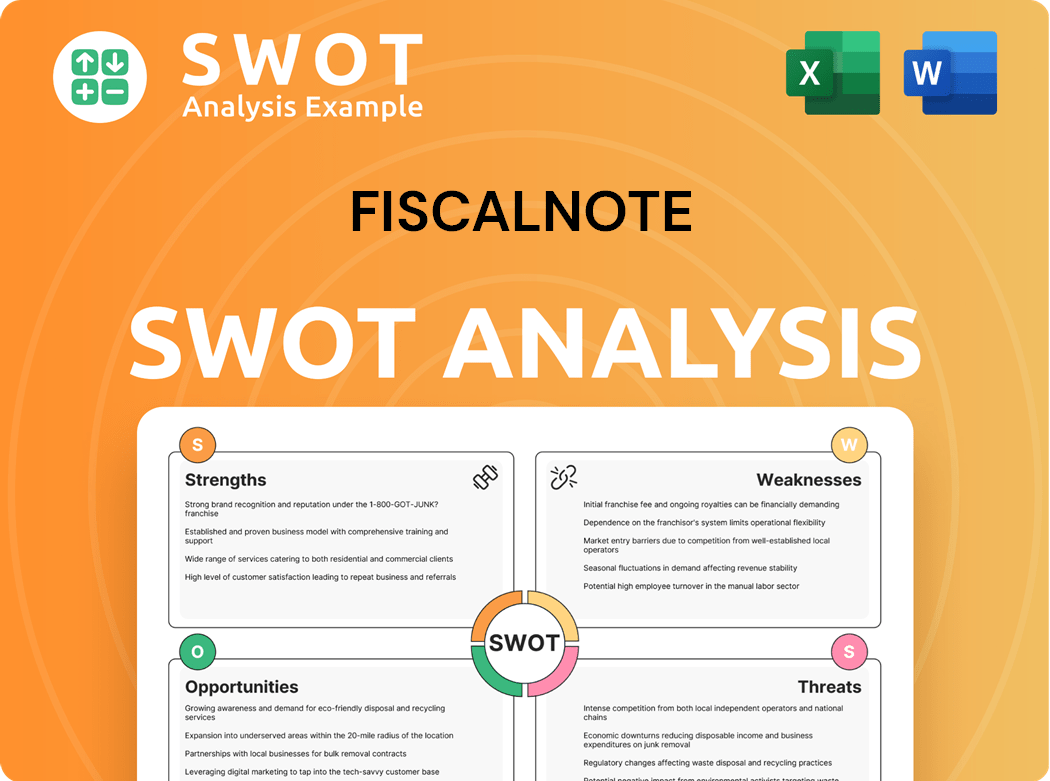

FiscalNote SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do FiscalNote’s Customers Want?

Understanding the customer needs and preferences is crucial for any company, and for Growth Strategy of FiscalNote, this understanding is central to its business model. FiscalNote's success hinges on its ability to meet the complex demands of its clients who navigate the intricate world of government and regulations. The primary goal is to provide actionable insights and tools that empower clients to make informed decisions, manage risks, and capitalize on opportunities.

The core of FiscalNote's value proposition lies in its comprehensive data coverage, advanced analytical features, and strong customer support. Clients seek a platform that offers accurate, timely, and comprehensive information, along with the ability to integrate seamlessly into their existing workflows. This focus on data-driven decision-making and ease of use is what drives customer loyalty and retention. FiscalNote's ability to consistently deliver high-value insights, coupled with continuous product innovation, solidifies its position in the market.

FiscalNote's clients are driven by the need to navigate and influence complex governmental and regulatory landscapes effectively. Their motivations include mitigating regulatory risks, identifying new business opportunities, enhancing lobbying efforts, and ensuring compliance. The purchasing behavior of FiscalNote's customers is characterized by a rigorous evaluation of data accuracy, comprehensiveness, and timeliness, as well as the platform's analytical capabilities. Decision-making criteria heavily weigh the ability to integrate FiscalNote's solutions into existing workflows, the ease of use of the platform, and the quality of customer support.

Clients need to mitigate regulatory risks and identify new business opportunities. They seek to enhance their lobbying and advocacy efforts and ensure compliance with evolving regulations.

Customers rigorously evaluate data accuracy, comprehensiveness, and timeliness. They prioritize the platform's analytical capabilities and its ability to integrate with existing workflows.

Ease of use, quality of customer support, and the ability to integrate solutions are key factors. Clients focus on how well the platform fits into their existing processes.

Daily monitoring of legislative developments and in-depth research on specific policies are common. Clients utilize analytics to predict outcomes and assess impact.

Consistent delivery of high-value insights, continuous product innovation, and a strong partnership approach build loyalty. These factors ensure long-term customer relationships.

Clients seek a competitive advantage and peace of mind through proactive risk management. They aim to empower strategic decision-making.

In 2024, FiscalNote enhanced its AI-powered tools for sentiment analysis and improved integration capabilities based on client feedback, particularly from large enterprises. This focus on continuous improvement and responsiveness to customer needs is a key element of FiscalNote’s customer retention strategies. By understanding the nuances of their customer base, FiscalNote can tailor its offerings and maintain a strong competitive edge in the market. FiscalNote’s customer base size continues to grow, with a reported increase in subscription revenue. The company's ability to offer dedicated account managers and specialized training further enhances the customer experience, ensuring clients maximize the value of their subscriptions. This personalized approach is crucial for building and maintaining strong customer relationships.

FiscalNote's customers seek solutions that offer comprehensive data, advanced analytics, and seamless integration. They prioritize accuracy, timeliness, and ease of use. The company's focus on customer needs and preferences drives product development and marketing strategies.

- Data Accuracy and Timeliness: Clients require up-to-date and reliable information to make informed decisions.

- Advanced Analytics: Predictive analytics and sentiment analysis tools are highly valued.

- Ease of Integration: Solutions that integrate seamlessly with existing workflows are preferred.

- Customer Support: Dedicated account managers and specialized training enhance the customer experience.

- Competitive Advantage: Clients seek to gain a competitive edge through proactive risk management and strategic decision-making.

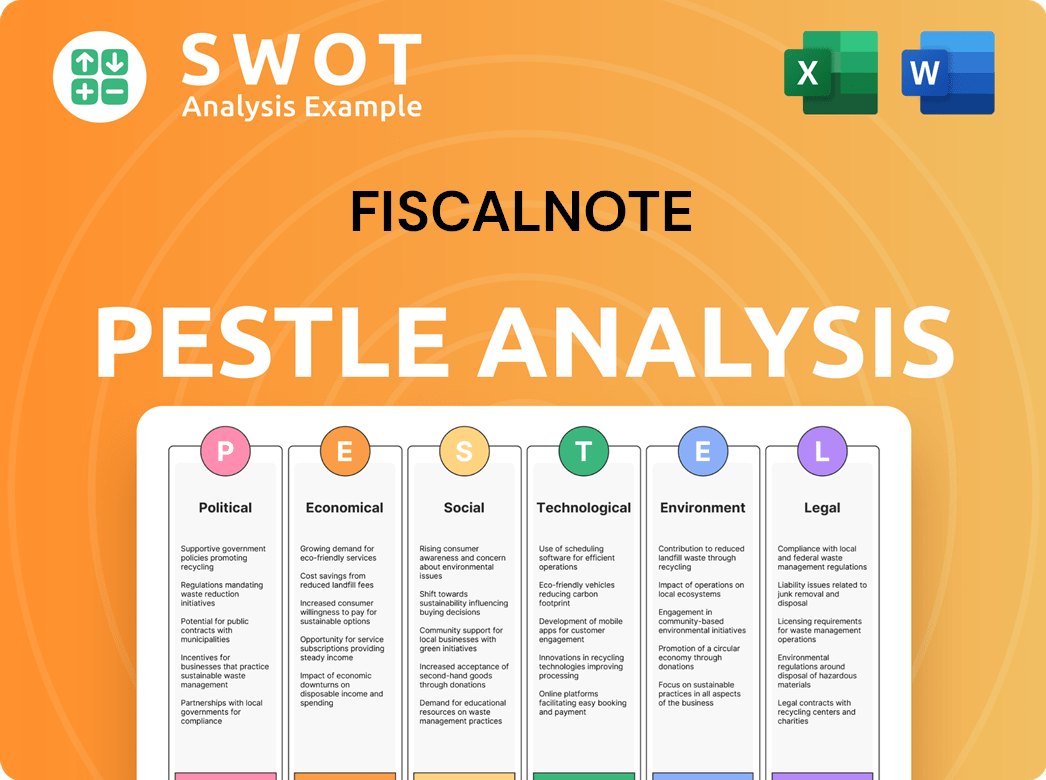

FiscalNote PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does FiscalNote operate?

The geographical market presence of FiscalNote Company is extensive, with a strong emphasis on North America, particularly the United States, which constitutes its largest market. The company's reach also extends to Europe and Asia, reflecting its global strategy. This wide presence allows FiscalNote to serve a diverse clientele with varying needs related to policy and regulatory information.

Key markets include the United States, where FiscalNote holds a significant share in the government relations and public affairs software sector. The United Kingdom and Brussels are also crucial, given their importance as centers for European policy and regulation. Through strategic acquisitions, such as FrontierView, FiscalNote has expanded into emerging markets, gaining deeper insights into geopolitical dynamics.

The company tailors its offerings to meet the specific needs of each region. For example, in the United States, clients often prioritize comprehensive legislative tracking and lobbying tools. In Europe, there's a greater focus on EU-level regulatory compliance. FiscalNote provides region-specific data feeds, tailors analytical tools to local frameworks, and offers multilingual support to address these differences.

FiscalNote continues to strengthen its presence in key international financial and political hubs. This expansion is designed to cater to multinational corporations and global organizations. The geographic distribution of sales indicates a strong growth trajectory in North America, with increasing contributions from international operations.

FiscalNote's customer needs vary across regions. In the United States, clients require robust legislative tracking and lobbying tools. European clients need solutions for EU-level regulatory compliance. Brief History of FiscalNote offers insights into the company's evolution to meet these diverse needs.

The United States remains a core market for FiscalNote, with a focus on federal and state legislative tracking. Clients in the US often require tools for lobbying and advocacy. FiscalNote's solutions are tailored to meet these specific needs, providing comprehensive data and analytics.

In Europe, FiscalNote emphasizes EU-level regulatory compliance and monitoring policy developments across member states. The company provides region-specific data feeds and analytical tools. This ensures that clients can effectively navigate the complexities of European Union lawmaking.

FiscalNote is also expanding its presence in the Asia-Pacific region. This expansion is driven by increasing regulatory complexity and the growing need for policy intelligence. The company adapts its offerings to suit the unique needs of clients in this diverse region.

FiscalNote localizes its offerings by providing region-specific data feeds and tailoring analytical tools. It also offers support in multiple languages. This approach ensures that clients receive relevant and accessible information, regardless of their location.

FiscalNote's customer acquisition strategies vary by region, focusing on meeting local needs. The company uses targeted marketing and sales efforts to reach its ideal customer. This includes building relationships with key stakeholders in each market.

Customer retention is a priority for FiscalNote, with strategies tailored to each region. The company provides ongoing support and updates to ensure customer satisfaction. This includes regular training and access to the latest policy information.

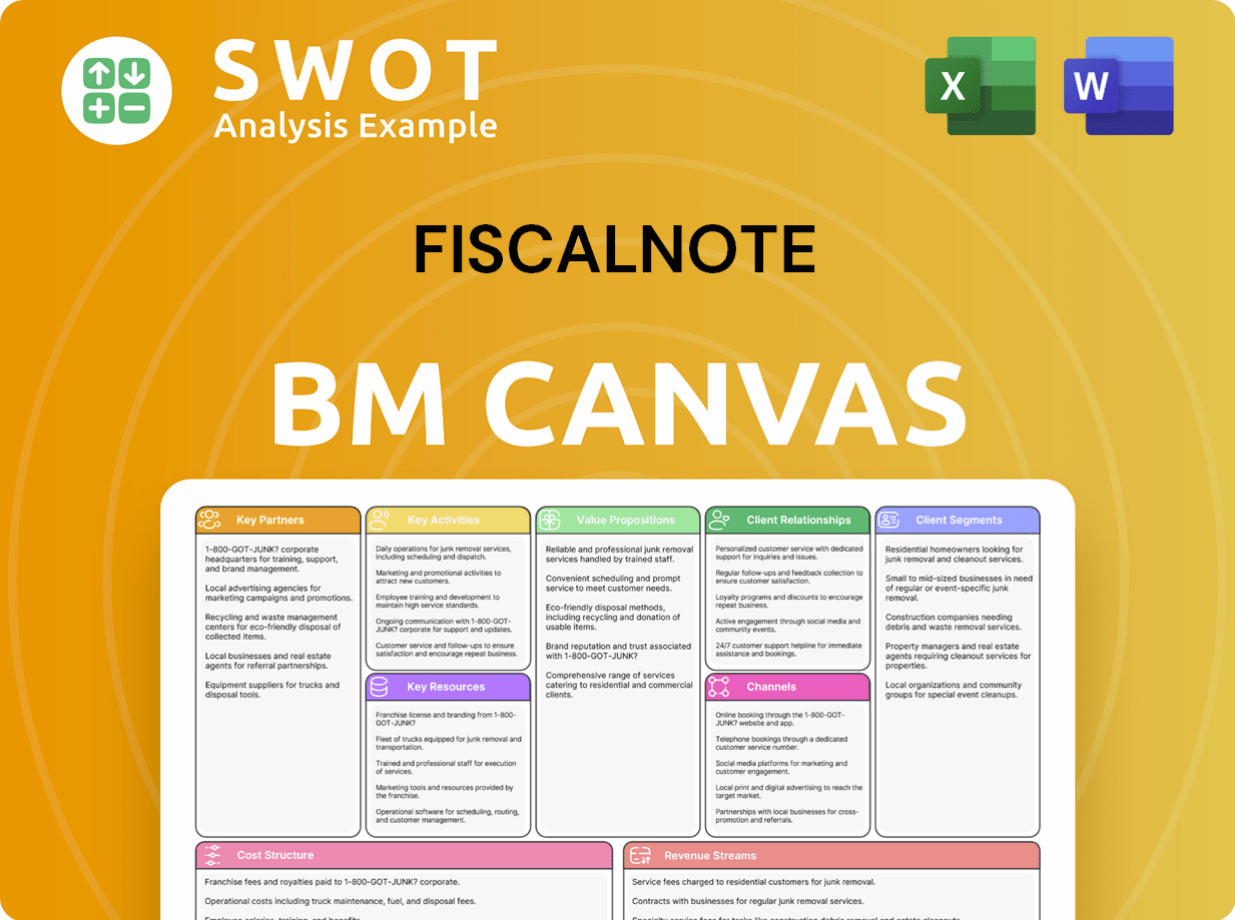

FiscalNote Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does FiscalNote Win & Keep Customers?

FiscalNote's approach to customer acquisition and retention is multifaceted, integrating digital and traditional marketing with a robust sales strategy. The company focuses on attracting organizations needing government relations and regulatory intelligence solutions through targeted online advertising, content marketing, and search engine optimization. Simultaneously, it utilizes traditional methods such as industry conferences, direct mail, and partnerships with industry associations. This comprehensive strategy helps FiscalNote reach a diverse range of potential clients effectively.

A consultative sales approach is central to FiscalNote's customer acquisition strategy. Sales teams work closely with potential clients to understand their specific needs and demonstrate how FiscalNote's platform can address their unique challenges. This personalized approach helps build trust and showcase the value proposition of the platform directly. This approach is particularly effective in converting leads into paying customers.

Customer retention is a critical focus for FiscalNote, given its subscription-based revenue model. Loyalty programs are less about discounts and more about providing continuous value through product enhancements, thought leadership, and exceptional customer support. Personalized experiences are delivered through dedicated account managers who provide ongoing training, strategic advice, and ensure clients are maximizing the platform's capabilities. After-sales service is crucial, with technical support and customer success teams readily available to address any issues or provide guidance. FiscalNote heavily utilizes customer data and CRM systems to segment its client base, allowing for highly targeted marketing campaigns and personalized outreach. For example, in 2024, FiscalNote launched an enhanced client portal, incorporating AI-driven insights to proactively suggest relevant policy updates and analytics, significantly improving user engagement and retention.

FiscalNote employs targeted online advertising to reach potential clients. This includes search engine optimization (SEO) to improve online visibility. Content marketing, such as whitepapers and webinars, educates and attracts organizations. These strategies are designed to drive traffic and generate leads effectively.

Traditional marketing channels include participation in industry conferences. Direct mail campaigns are used to reach key decision-makers. Strategic partnerships with industry associations expand FiscalNote's reach. These methods complement digital efforts to ensure a broad market presence.

Sales teams focus on understanding client needs through a consultative approach. They demonstrate how FiscalNote's platform addresses unique challenges. This personalized approach builds trust and showcases the platform's value. This strategy is key to converting leads into paying customers.

Customer retention is a priority, supported by subscription-based services. Dedicated account managers provide ongoing support and strategic advice. Continuous value is delivered through product enhancements and thought leadership. After-sales service and technical support are readily available.

FiscalNote's customer acquisition and retention strategies are designed to build strong, lasting relationships with its clients. By combining digital and traditional marketing with a consultative sales approach, the company attracts a broad customer base. Ongoing support, product enhancements, and personalized service ensure high customer retention rates. The company's ability to adapt and innovate, as demonstrated by the 2024 client portal launch, further strengthens its position in the market. The integrated nature of its solutions, combining legislative tracking with geopolitical intelligence, increases customer lifetime value and reduces churn rates, particularly within the enterprise client segment. To learn more about FiscalNote's financial model, you can check out the Revenue Streams & Business Model of FiscalNote article.

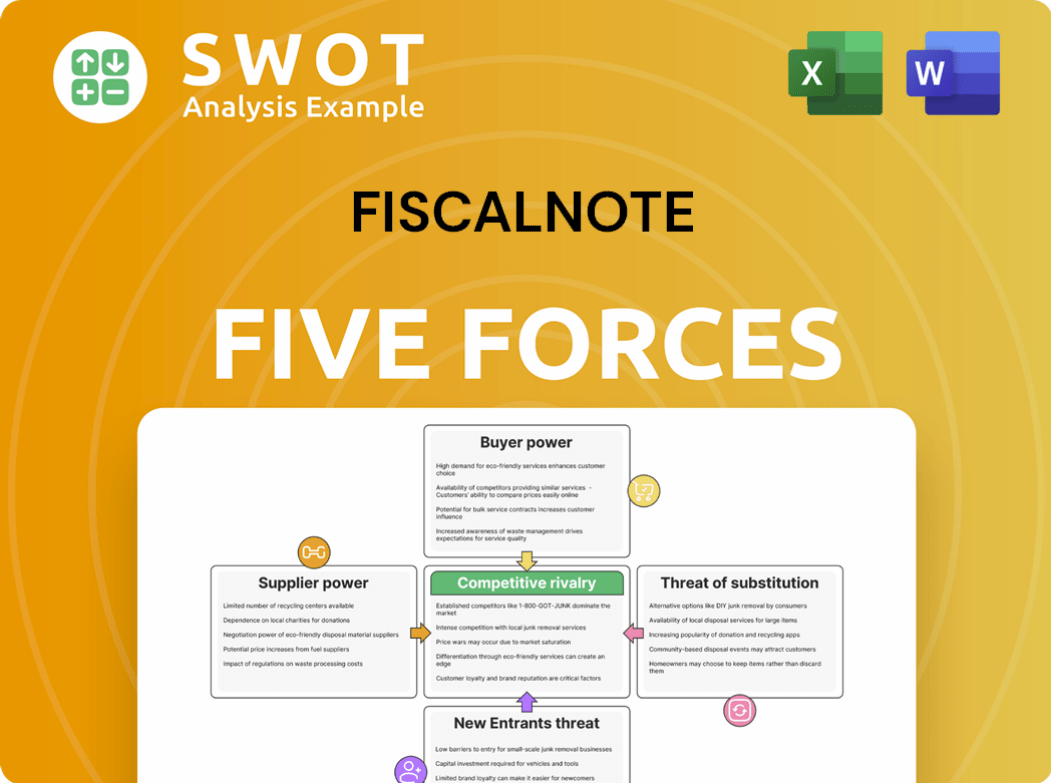

FiscalNote Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FiscalNote Company?

- What is Competitive Landscape of FiscalNote Company?

- What is Growth Strategy and Future Prospects of FiscalNote Company?

- How Does FiscalNote Company Work?

- What is Sales and Marketing Strategy of FiscalNote Company?

- What is Brief History of FiscalNote Company?

- Who Owns FiscalNote Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.