FiscalNote Bundle

How Does FiscalNote Stack Up Against Its Rivals?

In a world where policy changes can make or break businesses, understanding the FiscalNote SWOT Analysis is crucial. Founded in 2013, FiscalNote has rapidly become a key player, offering critical intelligence to navigate the complex landscape of government and regulations. But how does FiscalNote fare against its FiscalNote competitors in the cutthroat world of policy and global intelligence?

This analysis delves into the FiscalNote competitive landscape, providing a detailed FiscalNote market analysis to identify its strengths, weaknesses, and opportunities. We'll explore FiscalNote's main competitors 2024, examining their FiscalNote services and business models to understand FiscalNote's market share analysis and overall FiscalNote's competitive positioning in the market. This deep dive will help you understand how FiscalNote is poised to succeed in the future, considering its FiscalNote's key strengths and weaknesses and the challenges it faces.

Where Does FiscalNote’ Stand in the Current Market?

FiscalNote holds a significant position in the government relations and policy intelligence market. It offers specialized solutions that integrate legislative, regulatory, and geopolitical information. The company is recognized as a leader in providing AI-driven insights for policy and advocacy, serving a diverse customer base including corporations, law firms, non-profits, and government agencies.

The company's core offerings include legislative tracking, regulatory monitoring, stakeholder management, and geopolitical risk assessment tools. FiscalNote's focus on providing comprehensive, integrated solutions has allowed it to address a wide array of client needs. This strategic shift has moved the company beyond basic legislative tracking, establishing it as a full-service platform for global intelligence, and influencing the Target Market of FiscalNote.

FiscalNote's strategic approach and comprehensive services have positioned it as a key player in the FiscalNote industry, with a strong focus on expanding its global footprint.

FiscalNote is considered a leader in the policy and advocacy intelligence market. It leverages AI-driven insights to provide valuable information. This leadership is reflected in its broad customer base and comprehensive service offerings.

The company offers a wide range of services, including legislative tracking, regulatory monitoring, and geopolitical risk assessment. This diversification allows FiscalNote to cater to various client needs. The integrated solutions provide a full-service platform for global intelligence.

FiscalNote reported total revenue of $133.5 million for the full year 2023, a 13% increase year-over-year. The net loss improved to $37.9 million in 2023, compared to $96.9 million in 2022. This indicates improving financial health and growth.

While strong in North America, FiscalNote is expanding internationally, particularly in Europe and Asia. This expansion is key to solidifying its global market presence. The company's growth strategy focuses on increasing its international footprint.

FiscalNote's key strengths include its comprehensive data offerings and AI-driven insights. The company's weaknesses may include the competitive landscape and the need for continued international expansion.

- Strengths: Comprehensive data, AI-driven insights, strong customer base.

- Weaknesses: Competitive market, need for global expansion, dependence on subscription revenue.

- Opportunities: Growth in international markets, expansion of service offerings.

- Threats: Competition from other data providers, economic downturns.

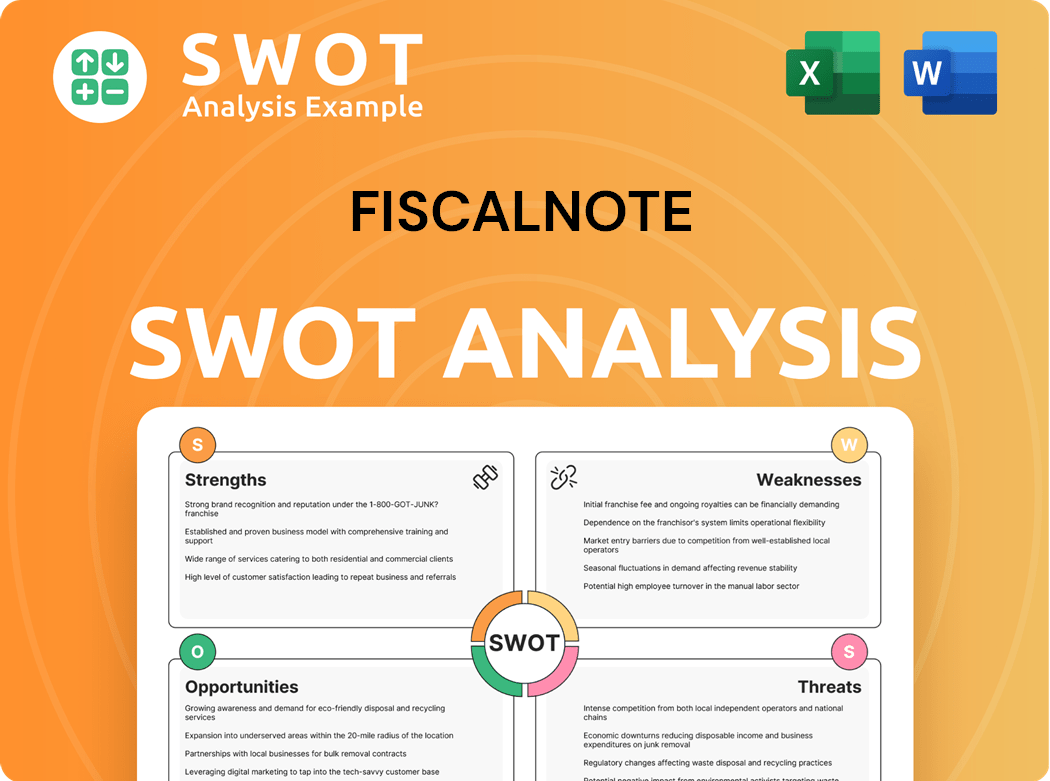

FiscalNote SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging FiscalNote?

The Revenue Streams & Business Model of FiscalNote operates within a dynamic competitive landscape. This landscape includes both direct and indirect competitors, all vying for market share in the policy and regulatory intelligence sector. Understanding these competitors is crucial for assessing the company's position and growth potential.

The competitive environment is shaped by established players and emerging GovTech companies. Factors like technological advancements, mergers and acquisitions, and the evolving needs of clients in the policy and regulatory space continuously influence the competitive dynamics. This analysis provides insights into key rivals and the strategies they employ.

The market analysis reveals a complex interplay of firms competing for dominance in the policy intelligence arena. This competition drives innovation and influences the strategies employed by companies to gain a competitive edge. Understanding these dynamics is essential for evaluating the company's performance and future prospects.

Direct competitors include established legal and regulatory information providers. These companies offer similar services and compete for the same customer base. They often have significant resources and extensive client networks.

LexisNexis is a major player, offering government and regulatory solutions. They have a vast database and a long history in the legal information market. Their broad service portfolio allows them to compete effectively.

Thomson Reuters is another significant competitor with a global reach. They provide extensive legal and regulatory information services. Their established client relationships give them a strong competitive advantage.

Quorum is a specialized policy intelligence platform. They focus on legislative tracking and stakeholder engagement tools. They compete based on the depth of their data and user interface.

Curate offers robust legislative tracking and stakeholder engagement tools. They compete based on specific feature sets tailored to advocacy and public affairs professionals. These platforms often focus on user experience and data accuracy.

Indirect competitors include consulting firms and in-house government relations departments. These entities offer policy analysis and may develop proprietary systems. They compete by providing tailored solutions.

The FiscalNote competitive landscape is shaped by several factors. Continuous innovation in AI and data analytics allows new entrants to disrupt the market. Mergers and acquisitions also play a key role in reshaping the competitive environment. For example, the company's acquisitions like CQ Roll Call, BoardRoom, and Forge.ai, have expanded its capabilities. Understanding these dynamics is crucial for assessing the company's market position and future growth. The company's ability to integrate these acquisitions and leverage their combined strengths will be key to its success.

- Market Share: The company's market share is influenced by its ability to compete with established players and new entrants.

- Technological Advancements: AI and data analytics are driving innovation, with new solutions emerging.

- Mergers and Acquisitions: Acquisitions expand service offerings and consolidate market share.

- Customer Needs: Meeting the evolving needs of clients in the policy and regulatory space is crucial.

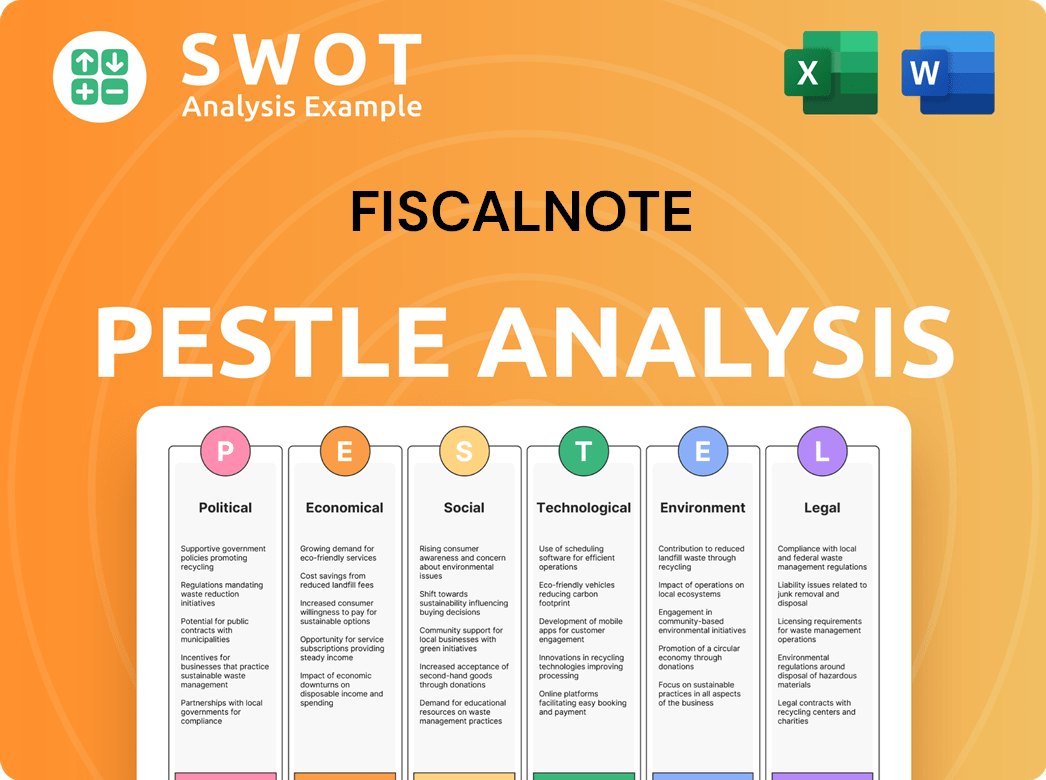

FiscalNote PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives FiscalNote a Competitive Edge Over Its Rivals?

The core competitive advantages of FiscalNote, as highlighted in a recent Growth Strategy of FiscalNote article, are rooted in its advanced technological infrastructure and comprehensive data aggregation capabilities. These strengths enable the company to provide real-time monitoring and predictive analytics. This capability gives clients insights that are often difficult to obtain through traditional methods.

A key differentiator is its proprietary AI and machine learning algorithms. These algorithms enable the company to rapidly aggregate, analyze, and contextualize vast amounts of legislative, regulatory, and geopolitical data from over 200 countries and territories. The breadth and depth of its data coverage, spanning legislative documents, regulatory filings, news, and geopolitical events, provide a holistic view of the policy landscape.

FiscalNote has cultivated a strong brand reputation for accuracy and reliability within the policy and government affairs community. This has fostered significant customer loyalty among its diverse client base, which includes over 5,000 organizations globally. These advantages have evolved as FiscalNote has integrated more AI capabilities and expanded its data sources through strategic acquisitions.

FiscalNote's advanced technological infrastructure, including its proprietary AI and machine learning algorithms, is a significant competitive advantage. These technologies enable rapid data aggregation, analysis, and contextualization of vast amounts of information. The company's ability to provide real-time monitoring and predictive analytics sets it apart in the FiscalNote competitive landscape.

The breadth and depth of FiscalNote's data coverage are crucial. It spans legislative documents, regulatory filings, news, and geopolitical events across over 200 countries and territories. This comprehensive data set allows FiscalNote to offer highly customized and actionable intelligence, providing a holistic view of the policy landscape.

FiscalNote has built a strong brand reputation for accuracy and reliability, fostering significant customer loyalty. Its diverse client base includes over 5,000 organizations globally. This reputation is a key factor in maintaining its competitive edge and attracting new clients in the FiscalNote industry.

FiscalNote continuously enhances its platform through strategic acquisitions and investments in R&D. These moves expand its data sources and improve analytical capabilities. Continuous innovation and adaptation are essential to maintaining a competitive edge in the FiscalNote market analysis.

FiscalNote's key strengths include its advanced technology, extensive data coverage, and strong brand reputation. These advantages contribute to its competitive positioning in the market. The company's continuous investment in R&D and strategic acquisitions further enhance its capabilities.

- Proprietary AI and machine learning algorithms for rapid data analysis.

- Comprehensive data coverage across legislative, regulatory, and geopolitical areas.

- Strong brand reputation and customer loyalty within the policy and government affairs community.

- Continuous investment in R&D and strategic acquisitions to enhance platform capabilities.

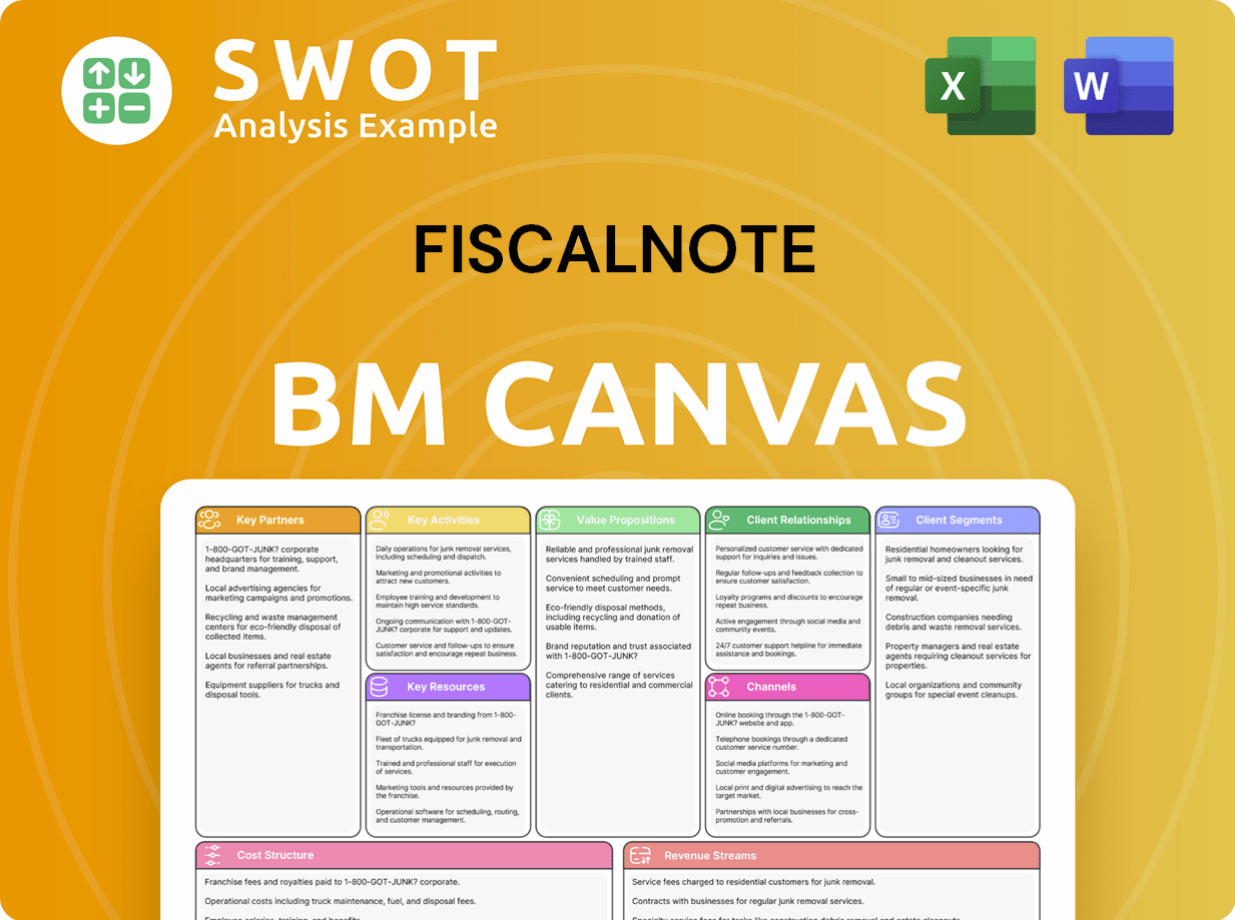

FiscalNote Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping FiscalNote’s Competitive Landscape?

The government relations and policy intelligence sector is experiencing significant shifts, driven by the need for real-time data, the increasing complexity of global regulations, and advancements in artificial intelligence. Companies like FiscalNote are navigating these changes by adapting to the evolving needs of their clients. A thorough FiscalNote market analysis is crucial for understanding the competitive dynamics.

For FiscalNote, challenges include maintaining a technological edge amidst rapid AI innovation and ensuring data accuracy. Potential regulatory changes and the emergence of new competitors also pose risks. However, opportunities exist for expansion into new markets and product innovation, shaping the FiscalNote competitive landscape.

The industry is seeing a surge in demand for real-time data and sophisticated analytical tools. The growing complexity of global regulations and geopolitical risks fuels this demand. Artificial intelligence and machine learning are transforming how policy data is collected, analyzed, and distributed, impacting the FiscalNote industry.

Maintaining a technological edge amidst rapid AI innovation is a key challenge. Ensuring data accuracy and comprehensiveness across a global information landscape is also critical. New market entrants with specialized AI solutions and regulatory changes around data privacy pose additional threats. The FiscalNote competitive landscape is dynamic.

Expanding into new geographic markets, especially emerging economies, presents significant opportunities. Product innovation, such as developing more predictive analytics tools and integrating with broader enterprise software, offers growth potential. Tailored solutions for specific industries like finance or healthcare can also drive expansion. The FiscalNote business model can be adapted.

FiscalNote's strategy includes continued investment in AI and machine learning to enhance its platform. Strategic acquisitions are used to expand data and technological capabilities. Fostering strategic partnerships to enhance market reach and service offerings is also a key focus. This approach aims to meet the evolving needs of its diverse client base.

FiscalNote's approach involves ongoing investment in AI and machine learning to enhance its platform. Strategic acquisitions are used to expand data and technological capabilities. Partnerships are fostered to enhance market reach and service offerings. For more insights, explore the Marketing Strategy of FiscalNote.

- Focus on AI and Machine Learning: Continuous investment to improve data analysis and predictive capabilities.

- Strategic Acquisitions: Expanding data sets and technological infrastructure through targeted acquisitions.

- Strategic Partnerships: Collaborations to broaden market reach and enhance service offerings.

- Market Expansion: Targeting growth in emerging economies with evolving regulatory frameworks.

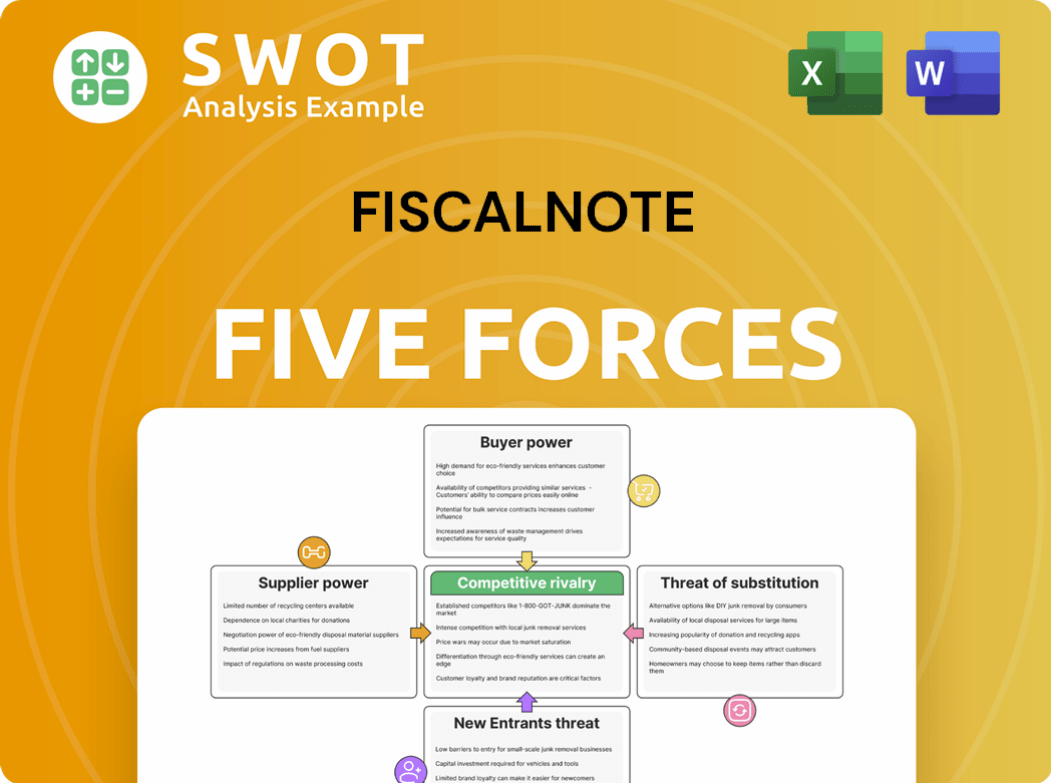

FiscalNote Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FiscalNote Company?

- What is Growth Strategy and Future Prospects of FiscalNote Company?

- How Does FiscalNote Company Work?

- What is Sales and Marketing Strategy of FiscalNote Company?

- What is Brief History of FiscalNote Company?

- Who Owns FiscalNote Company?

- What is Customer Demographics and Target Market of FiscalNote Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.