FiscalNote Bundle

How Does FiscalNote Navigate the Complexities of Global Policy?

In a world increasingly shaped by policy and regulation, understanding the inner workings of FiscalNote SWOT Analysis is crucial. FiscalNote, an AI-driven enterprise SaaS provider, empowers organizations to decode the intricate web of government and policy. This deep dive explores how FiscalNote, a leading company, leverages technology to provide critical insights and drive strategic advantage for its clients.

From legislative tracking to regulatory intelligence, FiscalNote's comprehensive platform offers a powerful suite of tools. The recent launch of the FiscalNote platform underscores its commitment to innovation, consolidating regulatory intelligence into a single, AI-powered hub. This analysis will explore FiscalNote's data analytics capabilities, its impact on public affairs, and how it helps businesses navigate the complexities of government relations.

What Are the Key Operations Driving FiscalNote’s Success?

The FiscalNote company operates as a Government Relationship Management (GRM) platform, providing comprehensive insights into legislative and regulatory processes. It leverages AI and machine learning to deliver actionable intelligence to a diverse clientele. Key offerings include PolicyNote, CQ, Roll Call, and VoterVoice, which cater to corporations, law firms, non-profits, and government agencies.

FiscalNote's core value proposition lies in its ability to transform complex policy landscapes into clear, actionable insights. By consolidating global-to-local data and proprietary analytics, the platform enables clients to navigate the intricacies of government affairs efficiently. This is achieved through advanced technology and strategic partnerships, ensuring clients stay ahead of regulatory changes.

The company's operational model centers on data acquisition and analysis. It uses AI-driven technology and search crawlers to extract and process data from hundreds of government websites globally. This allows the platform to provide real-time data and predictive analytics, supporting informed decision-making and strategic planning for its users. This includes legislative prediction with reported accuracy rates exceeding 95%.

FiscalNote's supply chain focuses on data sourcing and technology development. The company continuously invests in AI-driven technology to enhance its product offerings. This includes the development of proprietary technology for policy monitoring and analysis. Strategic partnerships with companies like OpenAI, Google, and Microsoft further enhance its AI product strategy.

FiscalNote's capabilities include legislative prediction, visualization tools, enterprise collaboration features, and news and open data. The integration of advanced technology with expert analysis provides contextual intelligence and actionable insights. This moves beyond traditional manual tracking and analysis, streamlining government affairs for clients.

FiscalNote offers a range of features designed to streamline government relations and policy analysis. These include real-time data, predictive analytics, and collaboration tools. The platform’s ability to consolidate information from various sources and provide actionable insights sets it apart in the industry.

- Legislative tracking and monitoring

- Regulatory intelligence and analysis

- Data visualization and reporting

- Collaboration and communication tools

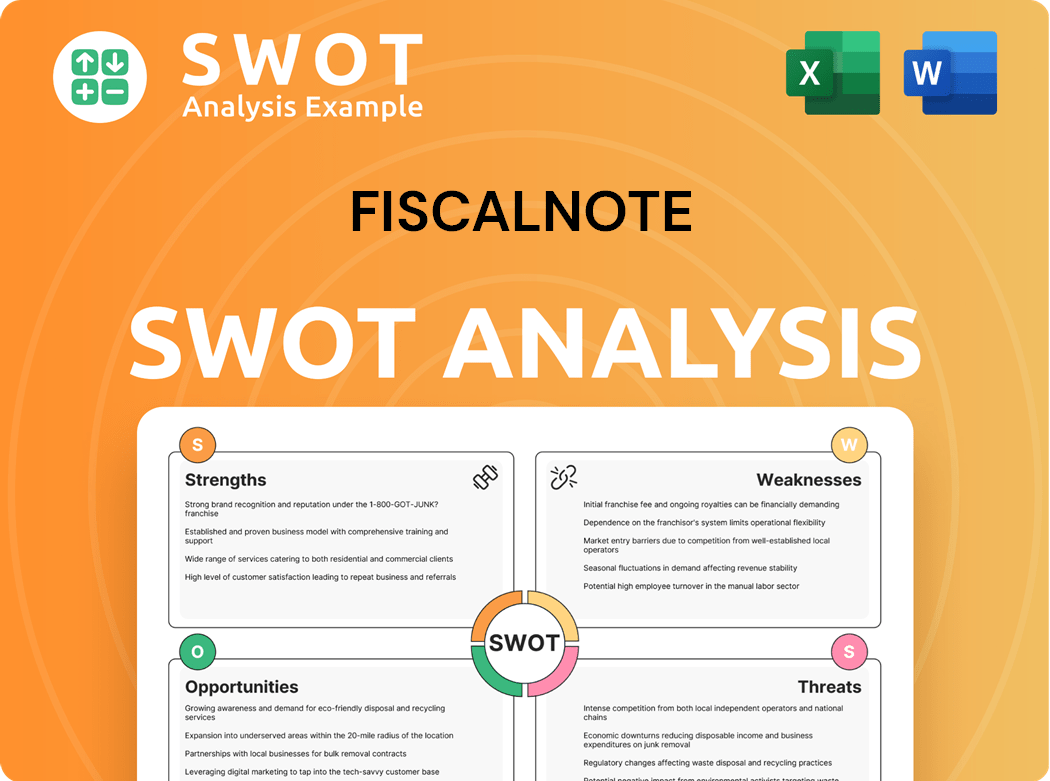

FiscalNote SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does FiscalNote Make Money?

The FiscalNote company primarily generates revenue through subscriptions, offering access to its suite of tools and insights. This subscription-based model is a cornerstone of its financial strategy. In Q1 2025, subscriptions accounted for 92% of the total revenue, highlighting its importance.

In Q1 2025, the FiscalNote platform reported total revenue of $27.5 million, exceeding guidance, but was down year-over-year due to divestitures. For the full year of 2024, the company reported total revenues of $120.3 million, demonstrating its financial performance. Beyond subscriptions, the company also generates revenue from advisory, advertising, and other services.

The company's monetization strategies involve platform fees, bundled services, tiered pricing, and cross-selling. Strategic divestitures of non-core assets have impacted the revenue mix. These moves are part of a broader strategy to streamline operations and focus on the core policy business, as discussed in detail in FiscalNote's Growth Strategy.

The company's revenue streams are diversified, with a strong emphasis on subscriptions. The company offers various subscription plans tailored to different clients, from small businesses to large enterprises and government agencies. Additionally, premium services such as bespoke analytics reports and specialized consulting engagements contribute to revenue.

- In Q4 2024, advisory, advertising, and other revenue decreased by $0.8 million, or 24%, due to the discontinuation of certain non-strategic products.

- FiscalNote divested non-core assets like Board.org and Aicel Technologies in 2024.

- In 2025, FiscalNote divested Oxford Analytica, Dragonfly Intelligence, and TimeBase.

- The projected full-year 2025 revenue forecast is between $94 million and $100 million.

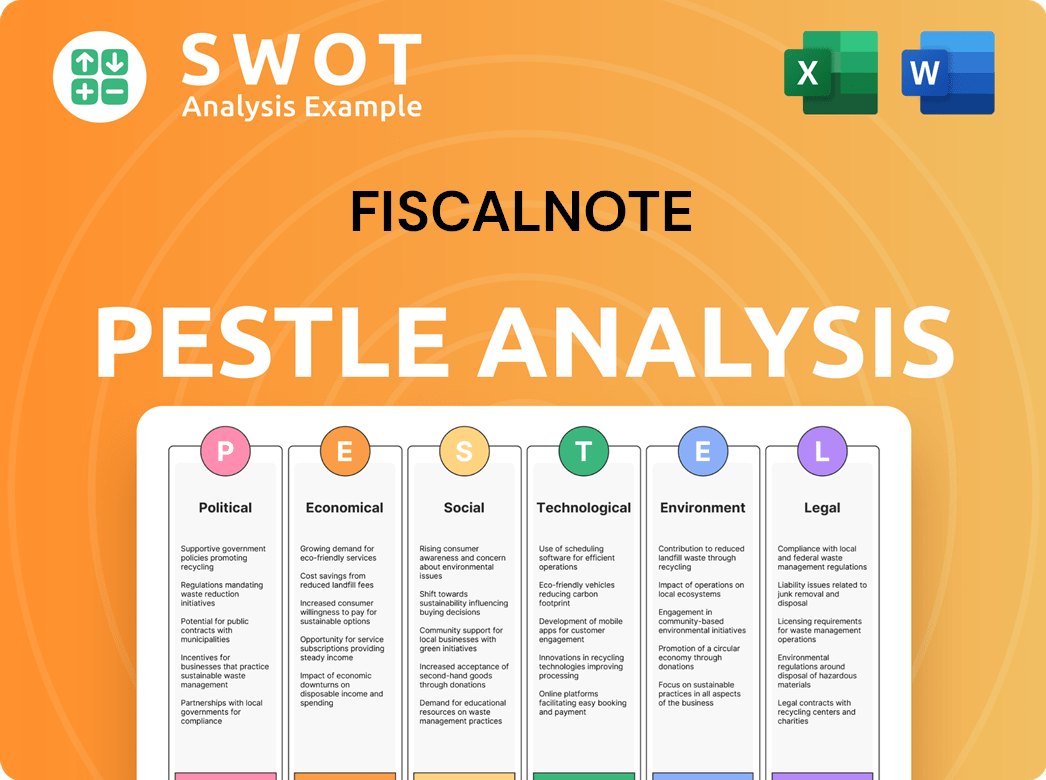

FiscalNote PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped FiscalNote’s Business Model?

FiscalNote has strategically navigated its path, achieving key milestones and making significant moves to bolster its market position. A pivotal moment was the unveiling of PolicyNote in January 2025, an AI-driven platform designed to streamline regulatory intelligence tools. This launch is central to the company's product-led growth strategy, aiming to improve customer retention and expand upsell opportunities.

The company's strategic actions have focused on streamlining operations through divestitures and cost-saving measures. FiscalNote's financial performance has shown improvement, with the company achieving its first full calendar year of positive adjusted EBITDA in 2024, reaching $9.8 million, a notable increase from a $7.5 million loss in 2023. These strategic moves aim to enhance operational efficiency and strengthen the balance sheet.

FiscalNote's competitive edge is built on its proprietary AI-driven technology, comprehensive global data, and decades of trusted analysis. The company is a leading provider of technology-enabled global policy and market intelligence services. FiscalNote's ability to integrate creativity, innovation, learning, and inclusion into its business structure fosters continuous adaptation to evolving trends and competitive threats.

The launch of PolicyNote in January 2025 was a major milestone for the FiscalNote platform. This AI-powered platform consolidates regulatory intelligence tools. It aims to improve customer experience and drive long-term scalability.

FiscalNote company has divested non-core assets to streamline its business. Divestitures include Board.org and Aicel Technologies in 2024, and Oxford Analytica and Dragonfly Intelligence in Q1 2025. These moves aim to reduce debt and improve operational efficiency.

FiscalNote achieved its first full year of positive adjusted EBITDA in 2024, reaching $9.8 million. The company's Q1 2025 adjusted EBITDA was $2.8 million, exceeding expectations. The company has reduced senior term loan debt by $96 million since December 31, 2023.

FiscalNote's competitive advantages include its proprietary AI-driven technology and comprehensive global data. The company is a category leader in the technology-enabled global policy and market intelligence services sector. The company's focus on innovation and adaptation strengthens its position.

FiscalNote is strategically refocusing on its core policy business and investing in AI-enhanced features. The company's ability to adapt to new trends, technology shifts, and competitive threats is a key strength. For more insights into FiscalNote's growth strategy, check out this article: Growth Strategy of FiscalNote.

- The launch of PolicyNote is central to FiscalNote's product-led growth strategy.

- Divestitures have helped reduce debt and streamline operations.

- The company's focus on cost-saving measures has improved operating leverage.

- Investments in AI-enhanced features solidify its market position.

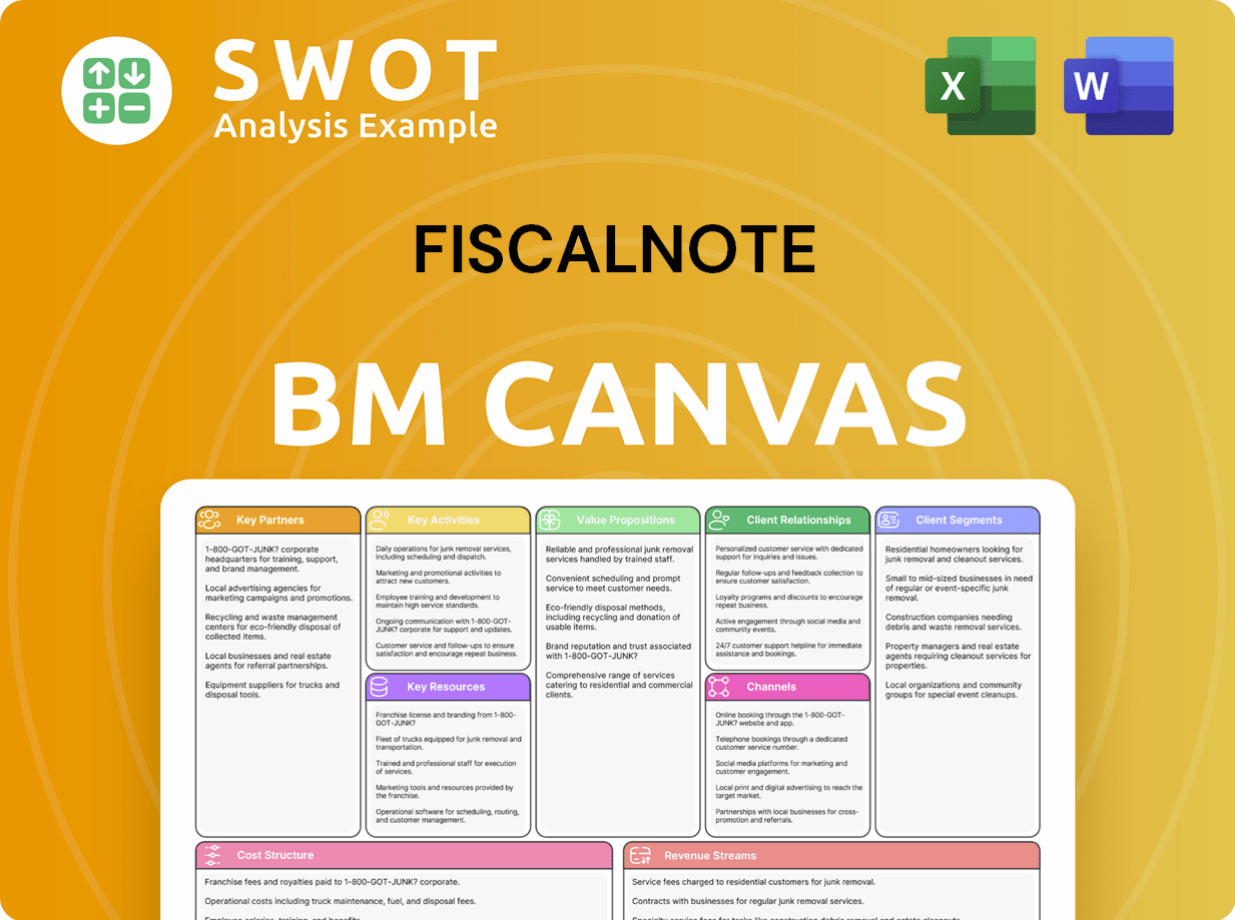

FiscalNote Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is FiscalNote Positioning Itself for Continued Success?

FiscalNote, a leader in technology-enabled global policy and market intelligence services, holds a strong position in its sector. Serving over 4,000 organizations across more than 80 countries, including a significant portion of the Fortune 100, demonstrates its wide reach and customer loyalty. The company's subscription-based revenue model, which accounted for 92% of total revenue in Q1 2025, provides a solid, recurring revenue stream.

Despite its market strength, FiscalNote faces several risks. These include potential revenue declines from ongoing divestitures, pressure to maintain high subscription revenue in a competitive market, and challenges in achieving Annual Recurring Revenue (ARR) growth in the second half of 2025. Macroeconomic factors and government contract risks also pose threats. The rapidly evolving market and the need to continuously adapt to technological advancements, particularly in AI, are ongoing challenges.

FiscalNote is a category leader in the technology-enabled global policy and market intelligence services sector. Its extensive customer base includes a significant portion of the Fortune 100, showcasing its strong market presence. The company's subscription-based model ensures a durable revenue stream.

Key risks include potential revenue declines due to divestitures and maintaining subscription revenue in a competitive market. Macroeconomic factors and government contract risks also pose threats. The rapidly evolving market and need for technological adaptation, especially in AI, present ongoing challenges.

FiscalNote focuses on product-led growth and sales optimization, integrating AI-enhanced features. The company reaffirmed its full-year 2025 revenue forecast of $94 million to $100 million and an adjusted EBITDA forecast of $10 million to $12 million. Positive free cash flow is a key target.

FiscalNote is focused on product-led growth and sales optimization, integrating AI-enhanced features to drive customer retention and upsell opportunities. The board of directors is reviewing strategic options to maximize shareholder value.

FiscalNote aims to achieve ARR growth in the second half of 2025 and is targeting positive free cash flow. The company is prioritizing profitability over top-line growth, with adjusted EBITDA projected to grow significantly. They aim to double their adjusted EBITDA margins on a pro forma basis in 2025.

- Product-led growth and sales optimization are key strategies.

- AI-enhanced features are being integrated to improve customer retention.

- The company is focused on maximizing shareholder value.

- FiscalNote aims to enhance its financial performance and market position.

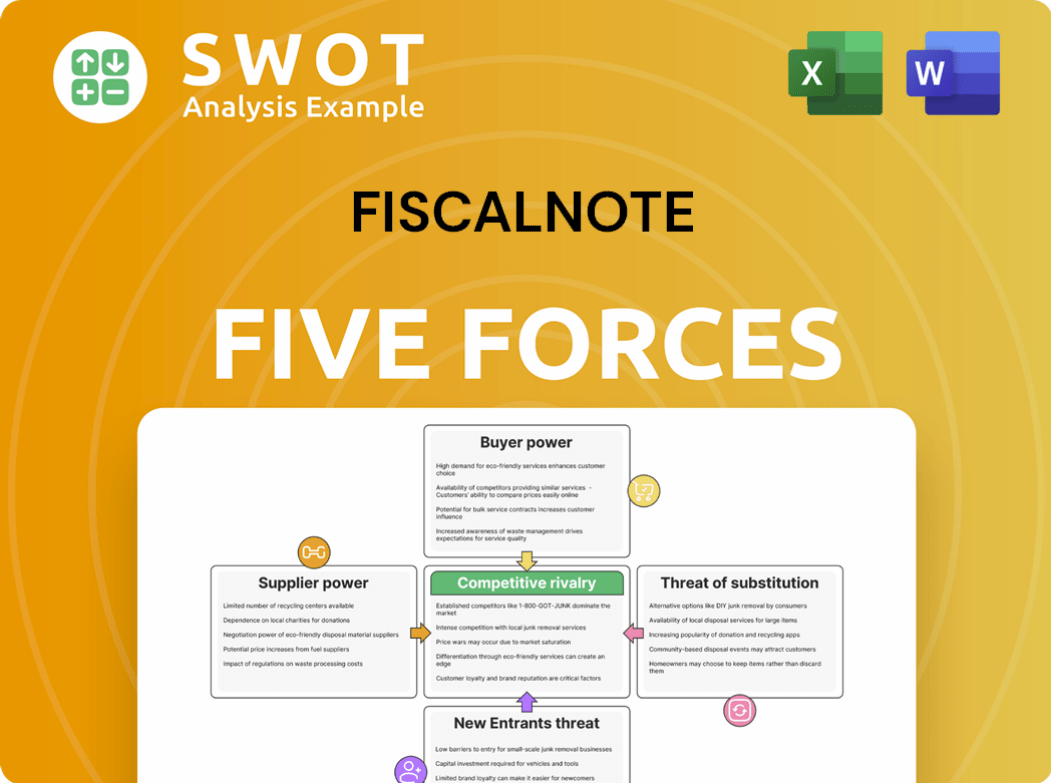

FiscalNote Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FiscalNote Company?

- What is Competitive Landscape of FiscalNote Company?

- What is Growth Strategy and Future Prospects of FiscalNote Company?

- What is Sales and Marketing Strategy of FiscalNote Company?

- What is Brief History of FiscalNote Company?

- Who Owns FiscalNote Company?

- What is Customer Demographics and Target Market of FiscalNote Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.