FiscalNote Bundle

Can FiscalNote's AI-Driven Strategy Reshape the Future of Policy Intelligence?

FiscalNote, a leader in government and regulatory information, is undergoing a significant transformation. Founded in 2013, the company is now leveraging AI to provide cutting-edge data and analytics to a diverse clientele. This shift, marked by the January 2025 launch of its AI-focused PolicyNote platform, signals a bold move toward innovation and sustained growth for the FiscalNote SWOT Analysis.

This exploration into FiscalNote's growth strategy will analyze its expansion plans, innovative technology, and financial performance, offering a comprehensive market analysis. We'll examine how FiscalNote's business model is evolving to address the challenges and opportunities in the competitive landscape, including its potential for long-term investment. Understanding FiscalNote's future prospects also involves assessing its strategic partnerships and predicting its impact on public policy.

How Is FiscalNote Expanding Its Reach?

The FiscalNote company is concentrating its expansion efforts on enhancing its core policy business. This is primarily achieved through product-led growth and strategic divestitures. The goal is to deepen customer engagement and retention within existing markets by launching new AI-powered products and features.

A key element of this strategy is the introduction of new AI-driven platforms. These platforms are designed to improve user experience and drive deeper customer engagement. FiscalNote aims to streamline operations and reduce debt by divesting non-core businesses, which allows for increased investment in core policy offerings.

This approach is expected to reinforce momentum and set the stage for accelerating growth in the future, particularly in 2026, by focusing on its core policy business. The company is also exploring data licensing and co-selling opportunities for its AI Agents and Copilots with new and existing partners.

FiscalNote is focusing on product-led growth to drive expansion. This involves launching new AI-powered products and features. The aim is to deepen customer engagement and retention within existing markets.

The company is divesting non-core businesses to streamline operations. This strategy aims to reduce debt and reallocate capital to higher-returning products. Divestitures are expected to accelerate the path to positive free cash flow.

FiscalNote is launching new AI-powered platforms to improve user experience. A key example is PolicyNote, unveiled in January 2025. This platform consolidates global-to-local data and AI into a single interface.

FiscalNote is exploring data licensing and co-selling opportunities. This strategy involves partnering with new and existing partners for AI Agents and Copilots. The goal is to diversify revenue streams.

FiscalNote's expansion strategy centers on product enhancements and strategic divestitures. The company aims to leverage AI to deepen customer engagement and streamline operations. These initiatives are expected to drive future growth.

- PolicyNote Launch (January 2025): A new AI-focused platform.

- Divestiture of Board.org (March 2024): Sale for up to $103.0 million.

- Divestiture of Aicel Technologies (October 2024): Sale for $9.6 million.

- Agreement to Divest Oxford Analytica and Dragonfly Intelligence (February 2025): Sale for $40.0 million.

- Sale of TimeBase (May 2025): Sale for $6.5 million to Thomson Reuters.

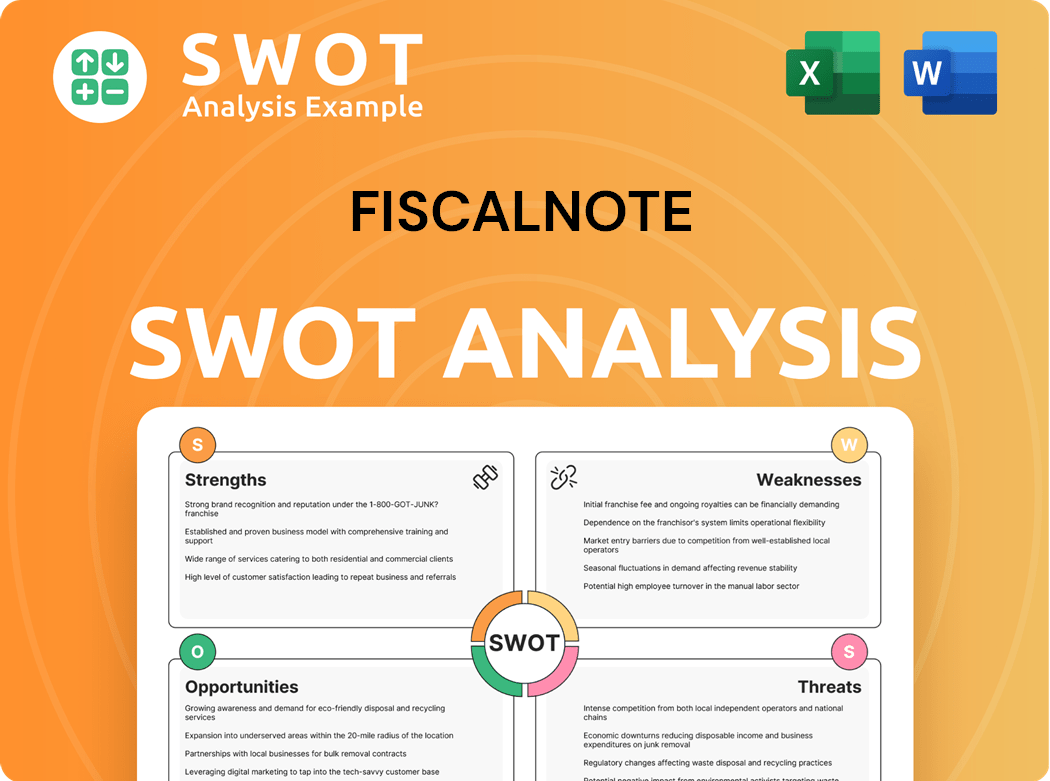

FiscalNote SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does FiscalNote Invest in Innovation?

The innovation and technology strategy of FiscalNote is heavily centered on leveraging artificial intelligence (AI) to drive sustained growth and enhance its core offerings. FiscalNote's commitment to AI is evident in its initiatives to integrate AI into its products and services to drive deeper customer engagement, strengthen retention, accelerate innovation, and expand long-term growth opportunities. This approach is crucial for the FiscalNote business model, which relies on providing comprehensive data and insights to its clients.

FiscalNote has made significant R&D investments over a decade to collect legislative, regulatory, and geopolitical information from 80 different countries, forming a robust data foundation for its AI initiatives. This extensive data collection is a key component of FiscalNote's competitive advantage. The company's focus on AI is further demonstrated by the January 2025 launch of PolicyNote, an AI-focused platform for policy and regulation, showcasing its commitment to technological advancement and its impact on public policy.

FiscalNote's approach to digital transformation and automation is evident in its development of AI Copilots designed to transform legal, regulatory, and policy workflows. These include the FiscalNote Copilot for Policy, the Global Intelligence Copilot, FiscalNote Risk Connector, and StressLens, which were showcased at 'AI Product Day 2024'. These products are designed to improve customer experience and provide deeper insights, enabling more efficient navigation of complex policy landscapes.

FiscalNote's AI-driven platforms, like PolicyNote, are designed to consolidate data and provide actionable insights. These platforms integrate extensive data, proprietary policy analysis, and AI technology into a consolidated user interface. This approach is key to FiscalNote's revenue growth strategies.

FiscalNote has formed strategic partnerships with leading AI innovators such as OpenAI (ChatGPT), Google Bard, and Microsoft Bing. These collaborations are aimed at accelerating the development of generative AI agents and Copilot products. These partnerships are crucial for FiscalNote's expansion plans in 2024 and beyond.

The development of AI Copilots is a core element of FiscalNote's innovation strategy. These Copilots are designed to transform workflows in legal, regulatory, and policy domains. FiscalNote's future predictions and forecasts include significant growth in this area.

FiscalNote has invested heavily in R&D to build a strong data foundation for its AI initiatives. These investments have been ongoing for over a decade. The company's long-term investment potential is linked to its continued R&D efforts.

FiscalNote's new products and technical capabilities are designed to improve customer experience. The focus is on providing deeper insights and enabling more efficient navigation of complex policy landscapes. This customer-centric approach supports FiscalNote's market share and growth rate.

FiscalNote believes that its strategy of investing in proprietary content and deep AI workflows will become the dominant way customers manage legislative, regulatory, and political risk. This approach differentiates FiscalNote's government relations software and regulatory compliance solutions.

FiscalNote's technological initiatives are centered around AI, with a focus on data collection, platform development, and strategic partnerships. These initiatives are designed to drive growth and enhance customer value. For more details, check out the Mission, Vision & Core Values of FiscalNote.

- AI-Powered Platforms: Launch of PolicyNote and other AI-focused platforms.

- Copilot Development: Creation of AI Copilots for various workflows.

- Strategic Partnerships: Collaborations with AI leaders like OpenAI and Microsoft.

- R&D Investments: Ongoing investments in data collection and AI technology.

- Customer-Centric Approach: Focus on improving customer experience and providing deeper insights.

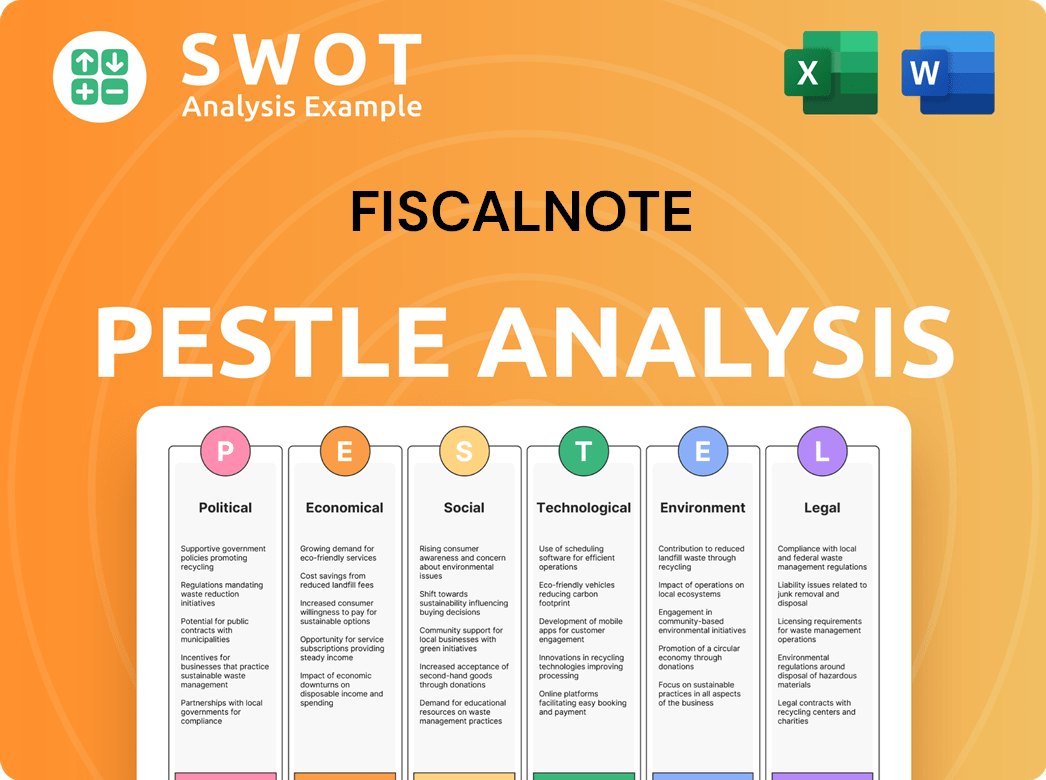

FiscalNote PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is FiscalNote’s Growth Forecast?

The financial outlook for the company in 2025 indicates a strategic focus on profitability and strengthening its financial position. The company is navigating revenue adjustments due to recent divestitures, but remains confident in its operational plans. This confidence is reflected in the reaffirmed guidance for the full year 2025.

In Q1 2025, the company reported revenues of $27.5 million, surpassing its guidance. Despite a decrease compared to Q1 2024, this performance demonstrates resilience. The company's focus on operational efficiency and cost control is evident in its financial results, particularly in its adjusted EBITDA and expense management.

The company's strategic financial moves, including debt reduction and operational discipline, are expected to accelerate its path towards positive free cash flow. The company's focus on its FiscalNote growth strategy is clear, with expectations of improved organic revenue growth in 2026. For more details on the company's business model, you can read about Revenue Streams & Business Model of FiscalNote.

The company has reaffirmed its guidance for 2025, projecting total revenues between $94 million and $100 million. This reflects the company's confidence in its operating plan and execution.

The company anticipates adjusted EBITDA between $10 million and $12 million for 2025. This guidance includes expectations for substantially expanded Adjusted EBITDA margins.

Q1 2025 revenues reached $27.5 million, exceeding the guidance range of $26 million to $27 million. This shows the company's ability to perform despite market changes.

The company achieved an adjusted EBITDA of $2.8 million in Q1 2025. This marks the seventh consecutive quarter of positive adjusted EBITDA, highlighting strong financial discipline.

The senior term loan balance was significantly reduced from $161.4 million in Q4 2023 to $61.8 million by the end of Q1 2025. This was largely due to proceeds from asset sales.

Annual Recurring Revenue (ARR) declined to $88 million in Q1 2025 from $94 million in 2024 (proforma). The company anticipates ARR growth in the second half of 2025.

The company's financial performance and strategic moves indicate a focus on sustainable growth. The company is actively managing its financial position to ensure long-term success. The company's FiscalNote future prospects look promising, supported by strategic initiatives and disciplined financial management.

- Reaffirmed 2025 revenue guidance of $94 million to $100 million.

- Projected adjusted EBITDA between $10 million and $12 million for 2025.

- Achieved $2.8 million in adjusted EBITDA in Q1 2025.

- Reduced senior term loan balance to $61.8 million by the end of Q1 2025.

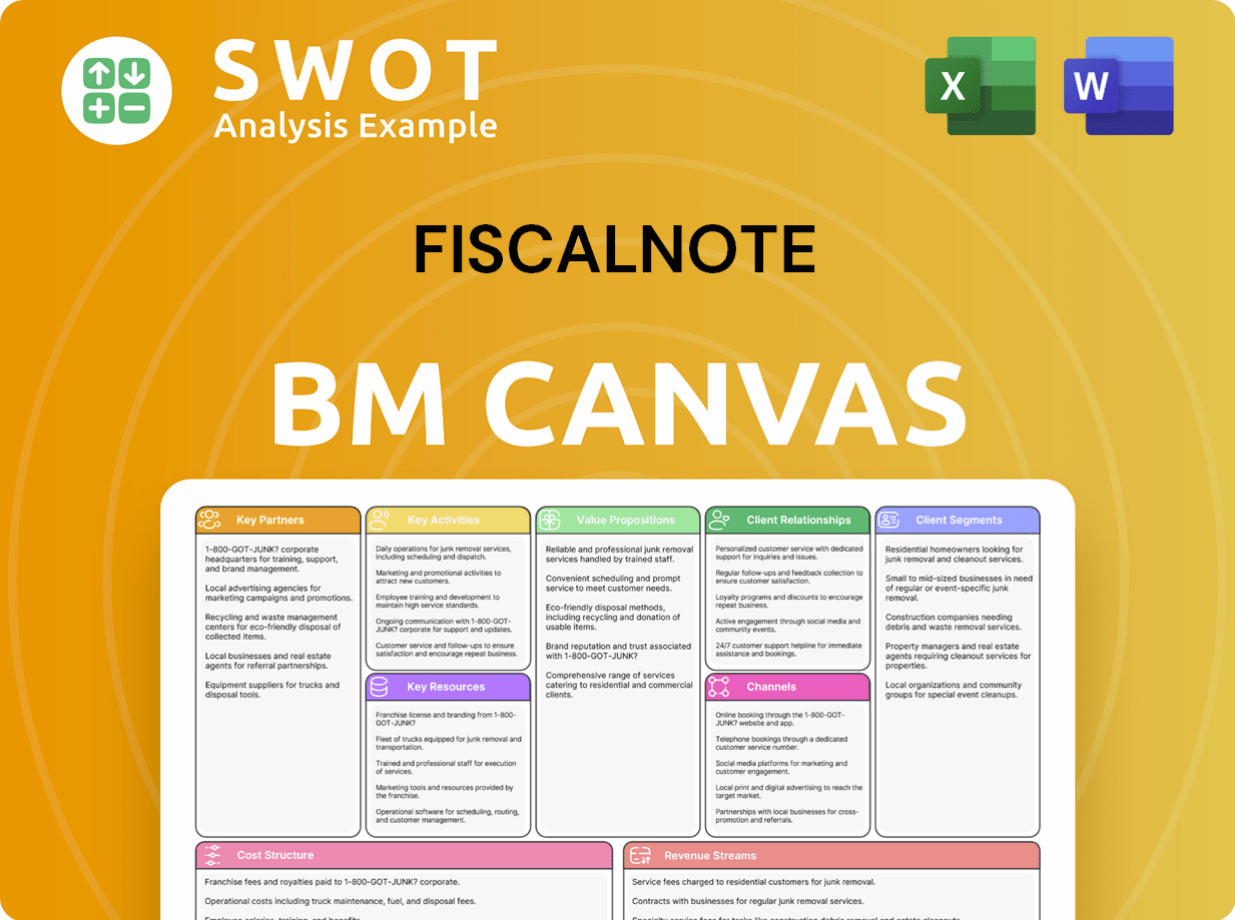

FiscalNote Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow FiscalNote’s Growth?

The path to growth for the Owners & Shareholders of FiscalNote faces several hurdles. The company's expansion plans are subject to market competition, regulatory changes, and technological disruptions. These factors could significantly impact the company's financial performance and long-term investment potential.

Competition from established players and emerging technologies presents ongoing challenges. Compliance with evolving regulations, particularly in AI and data privacy, adds complexity. Furthermore, the company's operational performance, including its ability to achieve sustainable profitability, is crucial for its future prospects.

FiscalNote's market analysis reveals a need for continuous innovation and adaptation to stay ahead. The company's ability to attract and retain customers, expand product offerings, and manage operational risks will be critical for its success.

The information services sector is highly competitive, with well-funded rivals like LexisNexis and Bloomberg. These competitors are also investing heavily in AI, intensifying the challenge for FiscalNote's market share and growth rate. Failure to compete effectively could hinder FiscalNote's revenue growth strategies.

Changes in regulations, especially those related to artificial intelligence and data privacy, pose a significant risk. Compliance costs and complexities could impact the company's ability to sell its products and services, particularly to U.S. and foreign governments. This affects FiscalNote's regulatory compliance solutions.

The rapid pace of technological advancements, particularly in AI, requires continuous innovation. FiscalNote must expand service offerings and develop new technologies to remain competitive. The success of its AI-driven platforms is crucial for its future predictions and forecasts.

FiscalNote has a history of net losses, though it has achieved positive adjusted EBITDA for seven consecutive quarters through Q1 2025. Achieving sustainable GAAP profitability remains a key objective. The company's reliance on subscription-based revenue, approximately 92% of total revenue in Q1 2025, means that a decline in renewal rates or customer spending could materially affect financial performance.

Near-term revenue declines due to strategic divestitures of non-core assets pose a risk. There is a risk that revenue growth may not offset these expenses. The company received a notice from the NYSE in November 2024 regarding non-compliance with the minimum share price requirement, a real pressure point that management is actively addressing.

Cybersecurity threats and data breaches can lead to liability and reputational damage. Protecting customer data and maintaining system integrity are crucial for maintaining trust and ensuring the company's long-term viability. This impacts how FiscalNote uses AI in its business.

FiscalNote's management is actively addressing these risks through cost reduction plans and enhanced product offerings focused on AI. They are also actively managing their debt through strategic divestitures, aiming to optimize the capital structure. These efforts are critical for FiscalNote's challenges and opportunities.

With approximately 92% of revenue from subscriptions in Q1 2025, maintaining high renewal rates is essential. Strategies to improve customer retention and increase spending per customer are vital for financial stability. This impacts FiscalNote's target audience and customer base.

Continuous innovation in AI-driven platforms is crucial for staying competitive. Investments in new technologies and service offerings are essential. FiscalNote's government relations software and other AI-powered tools are key components of their strategy.

A thorough understanding of the competitive landscape, including the strengths and weaknesses of competitors, is essential. Strategic partnerships and collaborations could provide additional growth opportunities. This helps in FiscalNote's competitive landscape analysis.

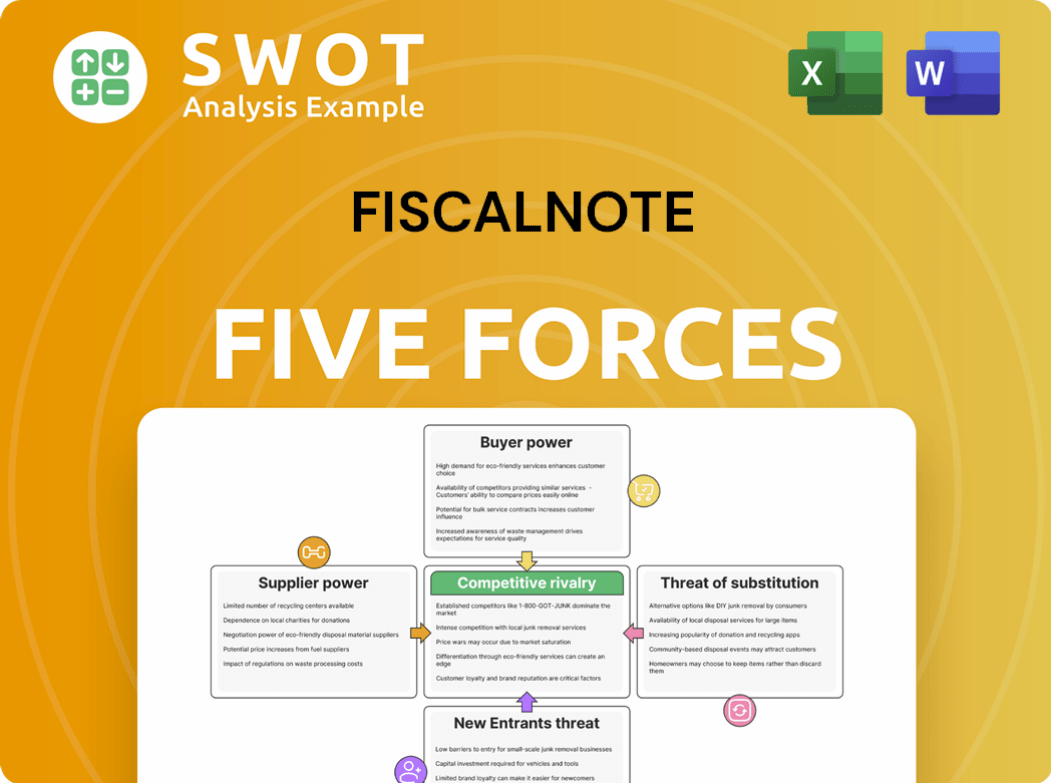

FiscalNote Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FiscalNote Company?

- What is Competitive Landscape of FiscalNote Company?

- How Does FiscalNote Company Work?

- What is Sales and Marketing Strategy of FiscalNote Company?

- What is Brief History of FiscalNote Company?

- Who Owns FiscalNote Company?

- What is Customer Demographics and Target Market of FiscalNote Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.