GCC Bundle

What Defines the Legacy of GCC Company?

The construction industry is constantly evolving, with companies like GCC at the forefront of innovation. Founded in 1941 in Chihuahua, Mexico, GCC has a rich history of providing essential building materials. From its inception, the company has focused on delivering high-quality cement to meet growing construction needs.

GCC Company's journey from a regional cement provider to a major player in North America is a testament to its strategic vision. The company's expansion reflects its commitment to meeting the demands of a dynamic industry, supplying cement, aggregates, and concrete. Delve deeper into the GCC SWOT Analysis to understand its market position and future prospects.

What is the GCC Founding Story?

The story of the GCC Company, now a major player in the building materials industry, began on October 1, 1941, in Chihuahua, Mexico. The company's inception was driven by a clear need for dependable, high-quality cement in a region undergoing significant changes. This marked the beginning of what would become a global enterprise.

The initial focus of the company was solely on cement production. This strategic choice was a direct response to the burgeoning demand from industrialization and urban development in Mexico at the time. The founders aimed to supply the essential materials needed for the country's infrastructure growth.

The early days saw the company producing cement using early industrial processes to meet the basic requirements of construction projects. The founders, fueled by a vision to support the infrastructural growth of Mexico, secured initial funding through a combination of private investments and local capital. The cultural and economic context of the 1940s in Mexico, marked by a drive towards self-sufficiency and industrial expansion, provided a fertile ground for the company's establishment. The company's name, 'Grupo Cementos de Chihuahua,' or GCC, directly reflected its origins and core business, symbolizing its commitment to the region and its primary product.

The GCC Company started in Chihuahua, Mexico, in 1941, focusing on cement production. The company's initial funding came from private investments and local capital.

- The company's primary product was cement.

- The company's name reflects its origins and core business.

- The establishment of the company was influenced by Mexico's drive towards industrial expansion.

- The company's early operations used early industrial processes.

For more insights into the company's values and goals, explore the Mission, Vision & Core Values of GCC.

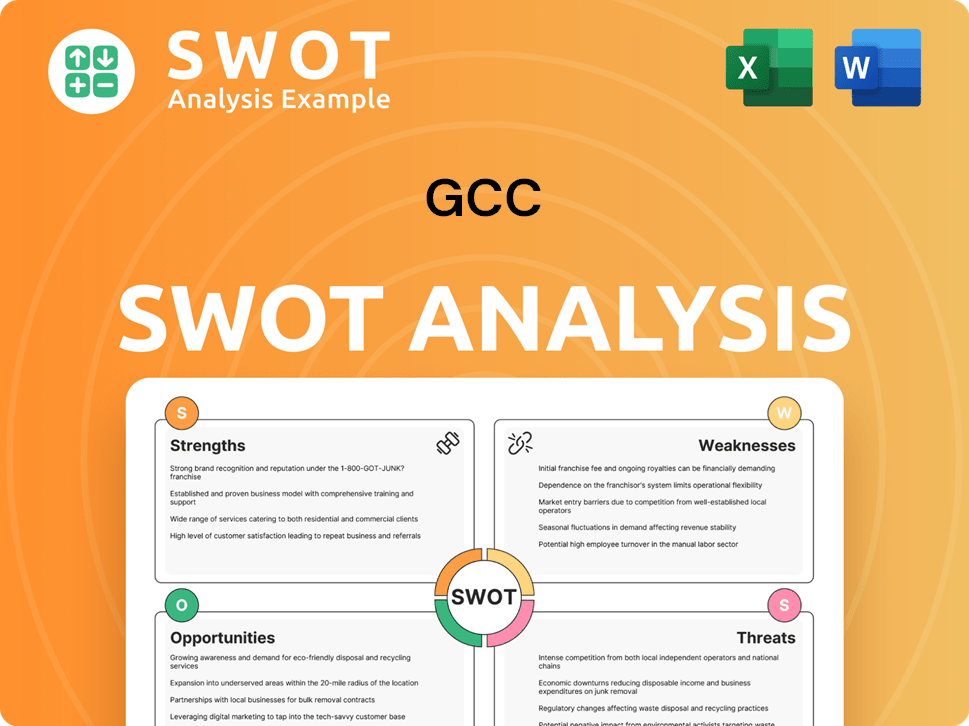

GCC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of GCC?

The early growth of the GCC Company, a major player in the cement and construction materials industry, centered on expansion within Mexico. Initially focused on cement production, the company broadened its offerings to include ready-mix concrete and aggregates. This strategic diversification helped the company cater to the evolving needs of the construction industry, particularly within Mexico.

A significant turning point in the GCC Company's history was its expansion into the United States market. This strategic move, primarily through acquisitions, transformed the company from a regional Mexican entity into a North American one. The expansion marked a pivotal shift in its growth trajectory, broadening its operational scope and market reach.

In 2008, the GCC Company extended its presence further by entering the Canadian market, solidifying its position across all three North American countries. This expansion was supported by strategic acquisitions and partnerships, which significantly boosted production capacity and market penetration. By 2023, the company reported net sales of $1,372.5 million, showcasing substantial growth.

The GCC Company has consistently invested in its operations to enhance efficiency and expand its capabilities. Capital expenditures reached $104.1 million in 2023, reflecting ongoing efforts to improve its infrastructure and production processes. These investments support the company's long-term growth strategy and its ability to meet increasing market demands. For more details, you can read about the brief history of the GCC Company.

The GCC Company's expansion strategy, particularly its move into the United States and Canada, has been crucial for its growth. Strategic acquisitions and partnerships have enabled the company to increase its production capacity and market reach significantly. The company’s focus on expanding its geographical footprint and product offerings has positioned it as a key player in the construction materials sector across North America.

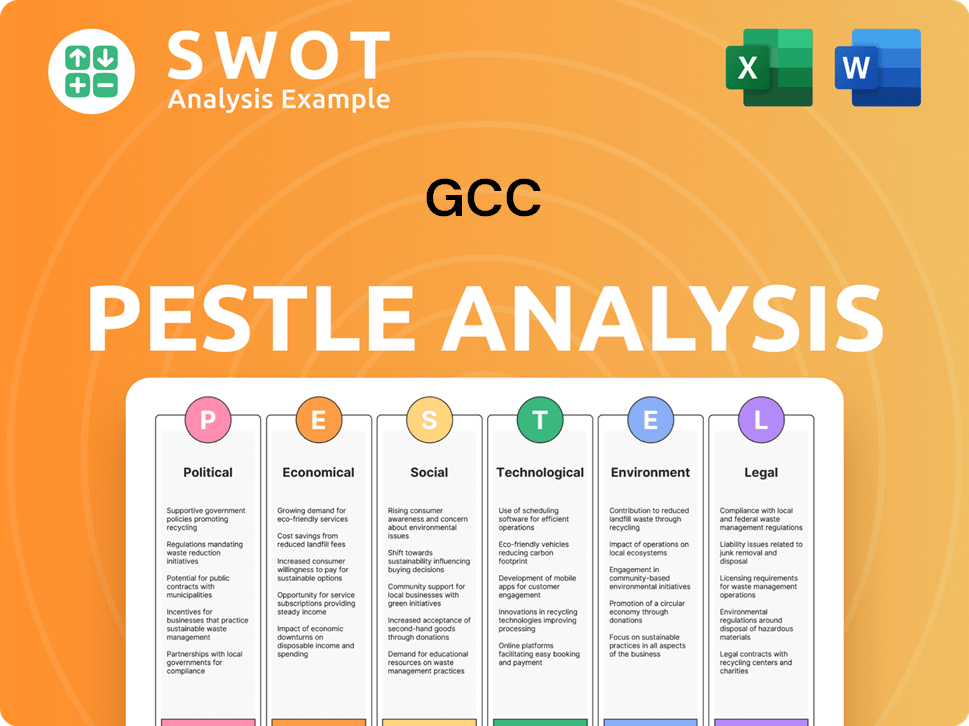

GCC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in GCC history?

The GCC Company has achieved significant milestones throughout its history, reflecting its growth and influence within the Gulf Cooperation Council (GCC) region. These achievements highlight the company's strategic evolution and its impact on the construction materials sector and the broader economy of the GCC countries.

| Year | Milestone |

|---|---|

| Early Years | Establishment of the company, marking the beginning of its operations in the construction materials sector. |

| Mid-Years | Expansion of production facilities and product lines to meet growing regional demand. |

| Recent Years | Achieved record net sales of $1,372.5 million in 2023, demonstrating sustained growth. |

Key innovations at the GCC Company include the continuous modernization of its production facilities, incorporating advanced technologies to improve efficiency. Furthermore, the company has focused on sustainability, aiming to reduce CO2 emissions and increase the use of alternative fuels.

Incorporating advanced technologies to enhance efficiency and reduce environmental impact is a key innovation. This includes upgrading equipment and processes to improve overall performance and sustainability.

Focus on reducing CO2 emissions by 30% by 2030 and increasing the use of alternative fuels to 45% by the same year. These initiatives reflect the company's commitment to environmental responsibility.

Expanding the range of products offered to cater to different market segments and reduce reliance on any single product. This diversification helps to mitigate risks and capture new opportunities.

Expanding operations into new geographic markets to increase market share and diversify revenue streams. This strategic move helps to build resilience against regional economic fluctuations.

Investing in digital technologies to enhance operational efficiency and improve customer service. This includes implementing new systems and processes to streamline operations and improve customer interactions.

The GCC Company has faced challenges, including fluctuating raw material costs and intense competition within the construction materials sector. However, the company has responded through operational efficiencies, strategic investments, and a strong focus on customer relationships.

Dealing with the volatility of raw material prices, which can impact profitability. This requires careful management of supply chains and cost control measures.

Operating in a competitive market environment, requiring continuous innovation and differentiation. This includes strategies to maintain market share and attract new customers.

Adapting to changes in regulations and compliance requirements within the construction industry. This involves staying updated on industry standards and ensuring adherence to legal frameworks.

Navigating economic downturns and market fluctuations, which can affect demand and sales. This requires strategic planning and financial resilience.

Managing disruptions in the supply chain, which can affect the availability of materials and production schedules. This requires robust supply chain management practices.

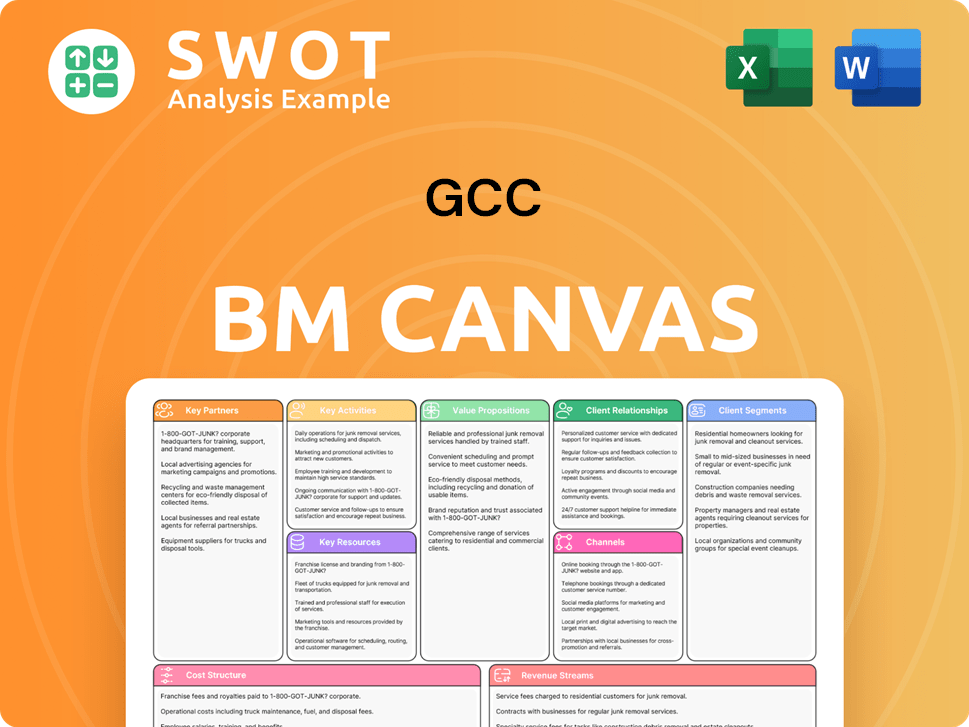

GCC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for GCC?

The GCC Company has a rich history marked by strategic expansions and a growing focus on sustainability. Founded in 1941 in Chihuahua, Mexico, the company has evolved from its origins to become a significant player in the construction materials industry. The following timeline highlights key milestones in the GCC’s journey, reflecting its growth and adaptation to changing market dynamics.

| Year | Key Event |

|---|---|

| 1941 | GCC is founded in Chihuahua, Mexico, marking the beginning of its operations. |

| 1960s | Expansion into ready-mix concrete and aggregates production broadens the company's product offerings. |

| 1990s | Strategic entry into the United States market through acquisitions accelerates its growth. |

| 2008 | Expansion into the Canadian market further strengthens its North American presence. |

| 2020 | Focus on sustainability initiatives, setting ambitious environmental goals, becomes a key priority. |

| 2023 | Achieves record net sales of $1,372.5 million, demonstrating strong financial performance. |

| 2024 | Continues investment in capital expenditures, totaling $104.1 million in 2023, to improve operations. |

| 2030 | Targets a 30% reduction in CO2 emissions and 45% use of alternative fuels, showcasing its commitment to environmental stewardship. |

The company is committed to reducing its environmental impact. By 2030, the company aims to cut CO2 emissions by 30% and increase the use of alternative fuels to 45%. These initiatives reflect a proactive approach to environmental responsibility and align with global sustainability goals.

With a strong foothold in North America, the company is well-positioned to capitalize on infrastructure development. The company’s robust financial performance in 2023, with an EBITDA of $475.2 million, provides a solid base for future expansion. The company’s strategic vision involves continuous growth.

The company continues to invest in modernizing its facilities and adopting greener technologies. Capital expenditures in 2023 reached $104.1 million, demonstrating a commitment to operational improvements. These investments aim to enhance efficiency and reduce the environmental footprint.

The company's future is geared towards continued growth and innovation. The focus remains on providing high-quality building materials while integrating sustainable practices. Analyst predictions suggest continued growth in the construction materials sector, supporting the company's strategic direction.

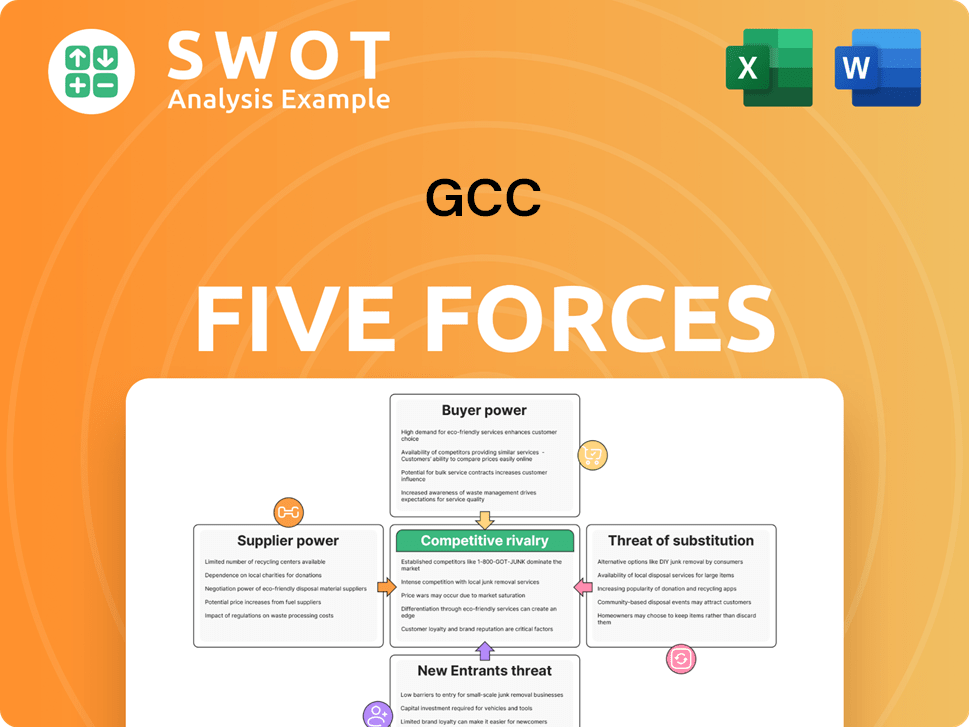

GCC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of GCC Company?

- What is Growth Strategy and Future Prospects of GCC Company?

- How Does GCC Company Work?

- What is Sales and Marketing Strategy of GCC Company?

- What is Brief History of GCC Company?

- Who Owns GCC Company?

- What is Customer Demographics and Target Market of GCC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.