GCC Bundle

How Does GCC Company Thrive in a Dynamic Market?

GCC, a leading provider of cement and construction materials, has carved a significant niche in the building materials sector across North America. Its strategic presence and commitment to quality have fueled impressive financial results, as evidenced by record-breaking performance in 2024. Understanding the GCC SWOT Analysis is key to grasping the company's position.

This deep dive into GCC company operations will explore its core value propositions, revenue streams, and competitive advantages. We'll dissect the GCC business model, examining its market position, potential risks, and future growth prospects to provide a comprehensive understanding. This analysis is crucial for anyone interested in the GCC countries' construction industry and the company structure.

What Are the Key Operations Driving GCC’s Success?

The core of the GCC company operations centers on providing essential building materials to the construction sector. This includes cement, aggregates, and concrete, serving a diverse customer base. The company caters to commercial, residential, and infrastructure projects across the United States, Mexico, and Canada, making its products integral to various construction activities.

The value proposition of the GCC company lies in its ability to deliver these materials reliably and efficiently. This is achieved through a vertically integrated model that encompasses manufacturing, sourcing, and distribution. The company’s extensive network allows for efficient production and delivery of materials, supporting a wide range of construction projects.

The GCC company's operational processes are designed to ensure a consistent supply of high-quality products. It operates a network of cement plants, distribution terminals, and ready-mix plants strategically located across North America. This infrastructure supports the company's ability to meet the demands of its customers in the construction industry.

The GCC company operates a robust network of facilities. This includes 8 cement plants, 24 cement distribution terminals, and 96 ready-mix plants. This extensive network enables efficient production and delivery across North America.

The annual cement production capacity of the GCC company is 6 million metric tons. In the U.S., production capacity is 3.5 million metric tons, while in Mexico, it is 2.5 million metric tons. This capacity ensures a reliable supply of materials to meet market demands.

The GCC company holds a strong market position. It maintains a #1 or #2 market share in its core markets, particularly in 14 contiguous states in the U.S. Mid-Continent. This regional leadership provides a competitive advantage.

The GCC company is committed to sustainable practices. In 2023, blended cement represented a record 73% of its cement production. This focus on sustainability aligns with environmental goals and customer preferences.

The GCC company's success is built on several key operational strengths. These advantages include a vertically integrated business model and a strong regional presence. These factors contribute to the company's ability to deliver value to its customers.

- Vertically Integrated Model: This allows for efficient control over the entire production process, from sourcing raw materials to delivering finished products.

- Regional Leadership: Holding a strong market share in key regions insulates the company from seaborne competition, providing a competitive edge.

- Sustainable Practices: The company's focus on blended cement highlights its commitment to environmental responsibility and appeals to environmentally conscious customers.

- Efficient Logistics: The extensive network of plants and distribution centers ensures reliable and timely delivery of materials, meeting customer needs effectively.

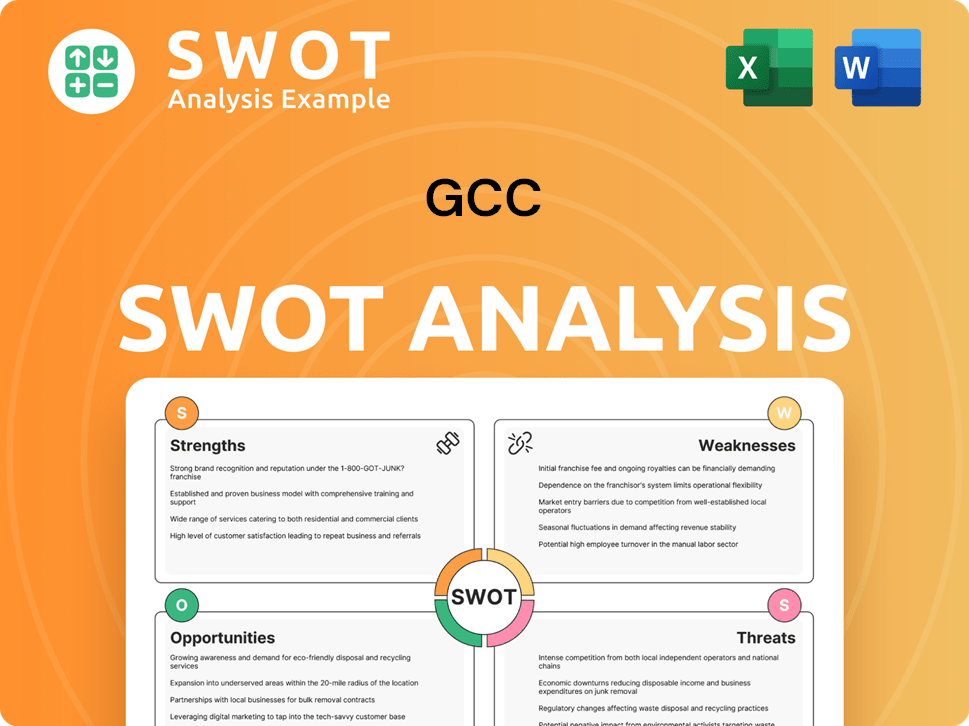

GCC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GCC Make Money?

The revenue streams and monetization strategies of a GCC company, such as the one in question, are primarily centered around the construction materials market. This involves the sale of essential products like cement, ready-mix concrete, and aggregates. These products are crucial for construction projects, making them a stable source of income.

The company's financial performance in FY 2024 shows a clear picture of its revenue sources. The company's consolidated net sales reached US$1,367 million. This indicates a significant scale of operations and market presence. The revenue breakdown provides insights into the relative importance of each product category.

Cement and mortar sales accounted for the largest portion, representing 66% of total net sales. Ready-mix concrete contributed 21%, highlighting its significant role. Aggregates and coal made up 3% and 4% respectively, with other services accounting for the remaining 6%.

The company's monetization strategies involve direct product sales to construction companies and contractors. This B2B approach ensures a steady flow of revenue. The company leverages regional market differences to optimize its revenue mix.

- In 2023, U.S. sales increased by 11.6%, driven by higher prices for cement and concrete. Cement prices rose by 14.1%, and concrete prices increased by 13.7%.

- Mexico sales also saw a significant increase of 29.9%, with cement and concrete prices rising by 10% and 13.5% respectively.

- In FY 2024, 71% of net sales came from the U.S., and 29% from Mexico.

- The company's strategic focus on high-margin concrete and decarbonization efforts could position it for future recovery and sustained profitability.

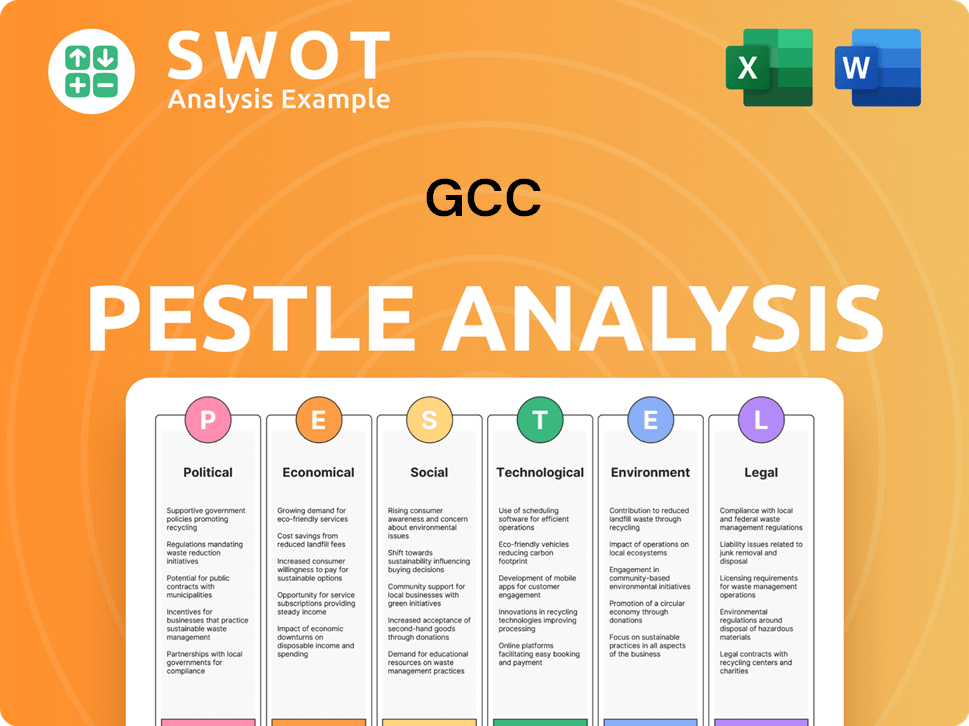

GCC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped GCC’s Business Model?

The journey of the GCC company has been marked by significant milestones, strategic shifts, and the cultivation of a strong competitive edge. These elements have collectively shaped its trajectory and position within the industry. The company's focus on operational excellence and sustainable practices underscores its commitment to long-term value creation.

Strategic moves, such as the completion of the Samalayuca debottlenecking project in April 2023, have been pivotal in expanding production capacity. Furthermore, the ongoing expansion of the Odessa plant demonstrates a forward-looking approach to meeting market demands. The company's dedication to sustainability, as evidenced by its improved CDP climate change rating and ENERGY STAR certifications, highlights its responsiveness to evolving industry standards.

Navigating economic uncertainties and currency risks with agility, the GCC company has maintained a robust position in its core markets. Its competitive advantages, including a strong brand presence and regional market leadership, have been crucial for sustained success. The company's adaptability is further demonstrated through its focus on blended cement production, reflecting a commitment to sustainable practices and evolving industry demands.

The completion of the Samalayuca, Chihuahua debottlenecking project in April 2023 increased cement capacity by 0.2 million metric tons. The company's commitment to sustainability is reflected in its improved CDP climate change rating to 'A-' in 2024. Securing ENERGY STAR certifications for its Pueblo and Rapid City plants further validates its sustainability efforts.

The ongoing expansion of the Odessa, Texas plant, projected to add 1.1 million metric tons, is a key strategic move. The company has responded to economic headwinds and currency risks with cost controls and operational agility. The focus on blended cement production, which reached a record 73% of cement production in 2023, demonstrates adaptability.

The company holds a strong brand presence and leadership position in its core markets, particularly in the U.S. Mid-Continent. Its regional dominance, coupled with a vertically integrated business model, provides economies of scale. Best-in-class production facilities contribute to operational flexibility, enhancing the company's competitive advantage.

Economic headwinds and currency risks have been addressed through cost controls and operational agility. The company’s ability to adapt to new trends is evident in its focus on blended cement production. Growth Strategy of GCC includes the ability to anticipate and respond to market changes.

The GCC company's success is built on strategic investments, operational efficiency, and a commitment to sustainability. Its competitive advantages in core markets and its ability to adapt to industry trends are key drivers of its performance. The company's focus on blended cement production and its environmental initiatives showcase its commitment to sustainable practices.

- Strategic investments in capacity expansion, such as the Odessa plant, are critical.

- Strong market positions and a vertically integrated business model drive economies of scale.

- Adaptability to market trends, including blended cement production, enhances competitiveness.

- Commitment to sustainability, reflected in improved CDP ratings and certifications, is vital.

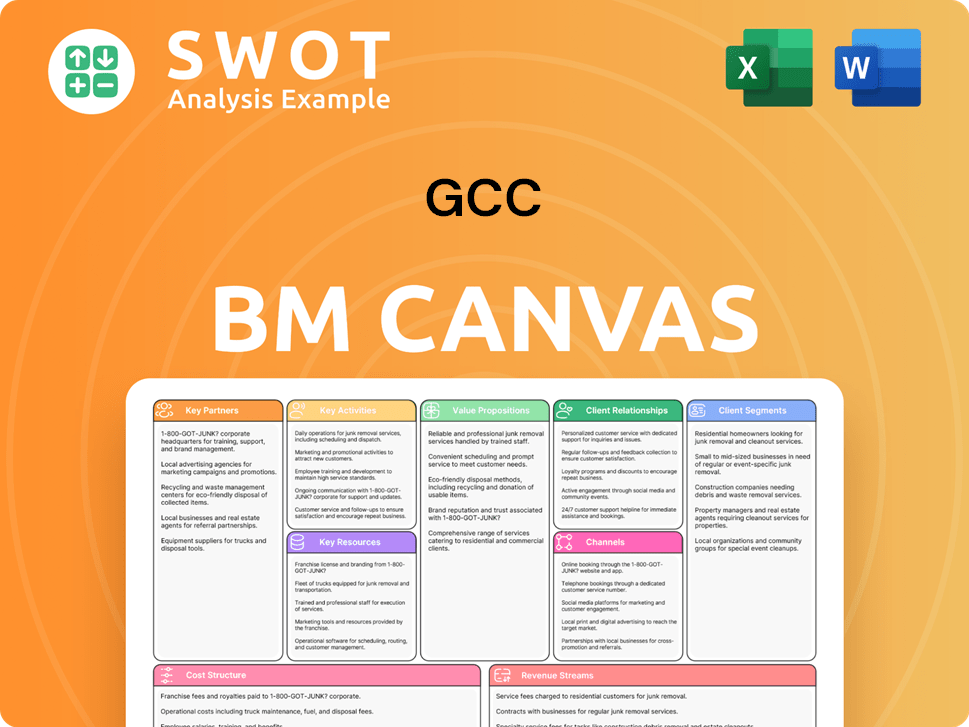

GCC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is GCC Positioning Itself for Continued Success?

This analysis examines the industry position, risks, and future outlook of the GCC company. It will explore the company’s standing within its market, the challenges it faces, and its prospects for growth. The information provided is based on available data and industry trends, aiming to offer a clear understanding of the company's current and future performance.

The following sections delve into the specifics of the GCC company’s operational environment, financial health, and strategic direction. This includes an assessment of its market share, potential risks, and the strategies it employs to maintain and expand its business. The analysis draws upon the latest available data to provide a comprehensive view of the company's position within the construction materials industry.

The GCC company holds a leading market position in its core regions, especially in the U.S. Mid-Continent and Chihuahua, Mexico. In these areas, it often ranks as the #1 or #2 market share holder. This strong market presence is supported by its established brand and the high quality of its products, which foster customer loyalty. You can learn more about Owners & Shareholders of GCC.

Key risks for the GCC company include macroeconomic fluctuations, changes in interest rates, and currency exchange rates. The performance of the construction industry significantly impacts the company. Regulatory changes, particularly concerning carbon emissions, pose another challenge.

The future outlook for the GCC company is positive, with an anticipated mid-single-digit consolidated EBITDA growth for 2025. The company aims to sustain and expand its profitability through operational excellence, strategic investments, and a focus on decarbonization. The free cash flow conversion rate is projected to be over 60%.

The GCC cement market reached 94.5 million tons in 2024. Projections indicate that it will reach 142.8 million tons by 2033. This represents a compound annual growth rate (CAGR) of 4.7% from 2025 to 2033. Ongoing investments in growth projects, such as the Odessa plant expansion, are key strategic initiatives.

The GCC company is focused on strategic investments to drive growth and improve operational efficiency. A major focus is on decarbonization efforts to align with sustainable construction trends. These initiatives are designed to ensure long-term profitability and market leadership.

- Expansion of production capacity.

- Implementation of advanced technologies.

- Focus on reducing carbon emissions.

- Enhancing operational efficiency.

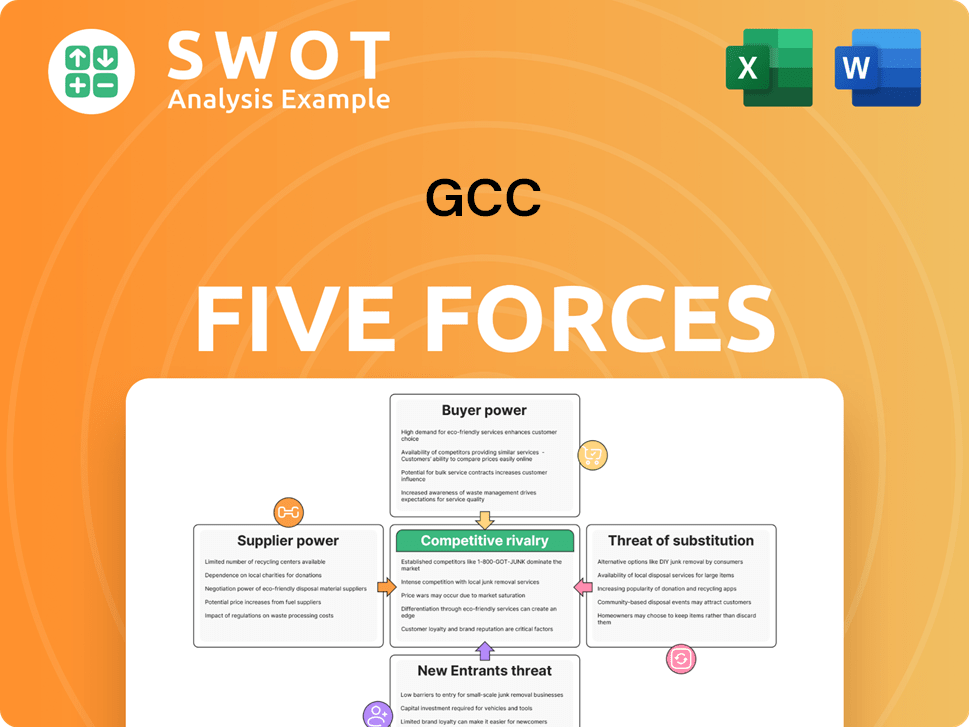

GCC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GCC Company?

- What is Competitive Landscape of GCC Company?

- What is Growth Strategy and Future Prospects of GCC Company?

- What is Sales and Marketing Strategy of GCC Company?

- What is Brief History of GCC Company?

- Who Owns GCC Company?

- What is Customer Demographics and Target Market of GCC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.