GCC Bundle

How is GCC Cement Poised for Future Growth?

GCC, a major player in the construction materials sector, is strategically positioned across the United States, Mexico, and Canada. Understanding GCC's growth strategy is crucial for investors and industry professionals alike. This analysis will explore how GCC plans to navigate the evolving construction landscape and capitalize on emerging opportunities.

Founded in 1941, GCC has evolved significantly, adapting to market demands and technological advancements. Its commitment to quality and strategic market positioning has been key to its success. To further understand GCC's position, consider exploring a detailed GCC SWOT Analysis, which provides insights into its strengths, weaknesses, opportunities, and threats. This examination is vital for understanding the GCC company prospects and its potential within the Gulf Cooperation Council business environment and the wider Middle East economy.

How Is GCC Expanding Its Reach?

The expansion strategy of the company focuses on solidifying its presence in key markets: the United States, Mexico, and Canada. This involves enhancing product offerings and optimizing operational capabilities to attract new customers. The company aims to diversify revenue streams by targeting high-growth segments within the construction industry.

A significant focus is placed on the renewable energy sector. In the first quarter of 2025, this sector proved to be a dynamic market segment for the company within the U.S. The company's approach includes strategic acquisitions, such as the completion of strategic aggregates acquisitions in January 2025, which suggests a focus on vertical integration or strengthening its raw material supply chain.

The CEO, Enrique Escalante, highlighted a 'robust project pipeline' as a key driver of growth for 2025. This project-driven approach, combined with operational agility and cost control, is central to the company's expansion plans. The company's growth strategy is heavily reliant on securing new construction projects, as indicated by the CEO's statements.

The company's expansion strategy prioritizes deepening its presence in the United States, Mexico, and Canada. This approach leverages existing networks and established market positions. The focus is on organic growth within these core markets, aiming to capture a larger share of the construction industry.

Strategic acquisitions are a key component of the company's expansion strategy. The acquisition of strategic aggregates in January 2025 is an example of this approach. These acquisitions are aimed at vertical integration and strengthening the supply chain to support increased production and market competitiveness.

The company targets high-growth segments within the construction industry to drive revenue diversification. The renewable energy sector in the U.S. has been a significant focus. This strategic focus allows the company to capitalize on emerging opportunities and adapt to changing market demands.

The company emphasizes a robust project pipeline as a key driver for growth in 2025. Operational agility and cost control are central to the expansion plans. The company's success is tied to securing new construction projects and maintaining efficient operations.

The company's expansion initiatives are designed to strengthen market presence and diversify revenue streams. Strategic acquisitions and a focus on high-growth segments are central to the strategy. Operational efficiency and a robust project pipeline support these goals.

- Deepening market penetration in the U.S., Mexico, and Canada.

- Strategic acquisitions to enhance vertical integration.

- Focus on high-growth segments like renewable energy.

- Emphasis on a robust project pipeline and operational efficiency.

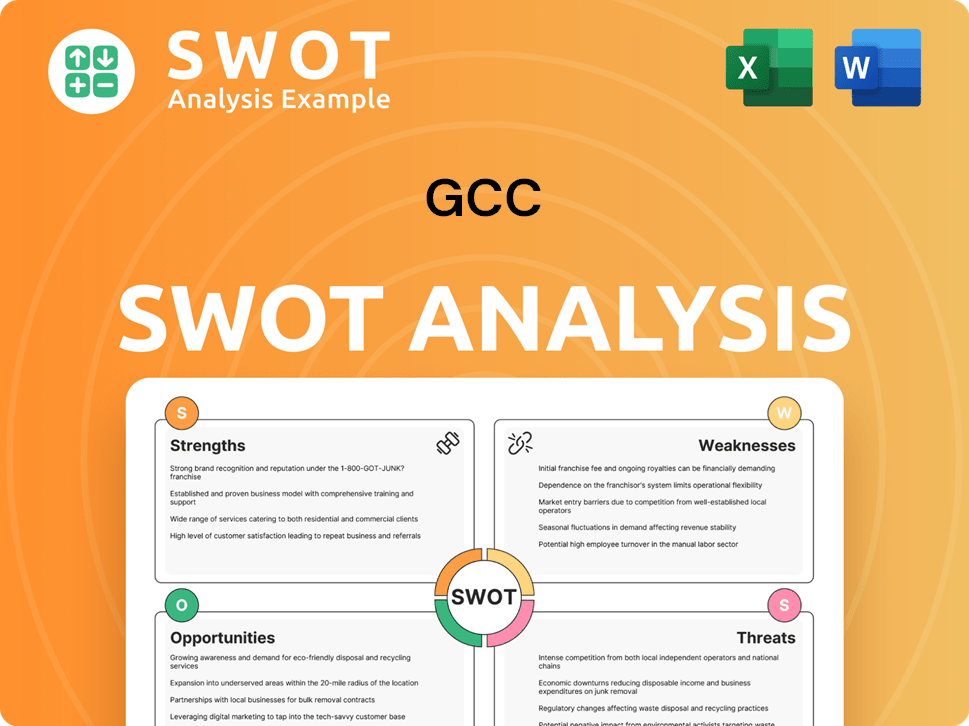

GCC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GCC Invest in Innovation?

The company leverages technology and innovation to boost its operational efficiency and product offerings, contributing to sustained growth. The construction materials industry, in which the company operates, is increasingly adopting cutting-edge technologies. This focus on digital transformation, automation, and advanced technologies is a critical trend across industries, including construction.

AI-driven solutions are expected to improve productivity and optimize decision-making, from customer service to supply chain management. Sustainability initiatives are also becoming increasingly important. The company's commitment to reducing CO2 emissions and achieving a high CDP rating demonstrates a focus on sustainability and potentially leveraging technology for environmental improvements.

These initiatives contribute to growth objectives by enhancing brand reputation, meeting regulatory requirements, and potentially leading to more efficient and environmentally friendly production processes. The company's approach aligns with broader trends in the Global Capability Centers (GCCs) and the construction industry, emphasizing innovation and sustainability.

Over 78% of new Global Capability Centers prioritized AI, machine learning, and cloud computing in 2024, indicating a strong push toward digital transformation. This trend is crucial for enhancing operational efficiency and gaining a competitive edge in the market. The adoption of AI-driven solutions is expected to boost productivity and optimize decision-making across various functions.

More than 70% of Global Capability Centers are prioritizing ESG (Environmental, Social, and Governance) initiatives. This reflects a growing emphasis on sustainability to align with global net-zero goals. The company's efforts to reduce CO2 emissions and achieve a high CDP rating demonstrate its commitment to environmental responsibility.

While specific details on R&D investments were not readily available, the construction materials industry is known for continuous innovation. The company likely invests in sustainable practices and technologies to meet evolving industry standards and customer demands. These investments are critical for long-term growth and competitiveness.

The company's focus on innovation likely includes developing new product platforms. Although specific details are not available, this is a common strategy in the construction materials sector to meet changing market needs. The development of sustainable and efficient products is a key area of focus.

Technology and innovation play a key role in enhancing operational efficiency. This includes the adoption of automation, AI, and cloud computing to streamline processes. These improvements help the company reduce costs, improve productivity, and enhance overall performance.

The company's technology and innovation strategies are designed to adapt to the evolving demands of the GCC market. This includes responding to regulatory changes, customer preferences, and competitive pressures. The ability to innovate is crucial for maintaining a strong market position. For more insights, see Revenue Streams & Business Model of GCC.

Several technological trends are shaping the future of the company and the broader GCC market. These trends are essential for driving growth and maintaining a competitive edge.

- AI and Machine Learning: Used for automation, predictive maintenance, and customer service.

- Cloud Computing: Facilitates data storage, scalability, and collaboration.

- Sustainability Technologies: Include energy-efficient materials and processes.

- Digital Transformation: Involves adopting digital tools across all operations.

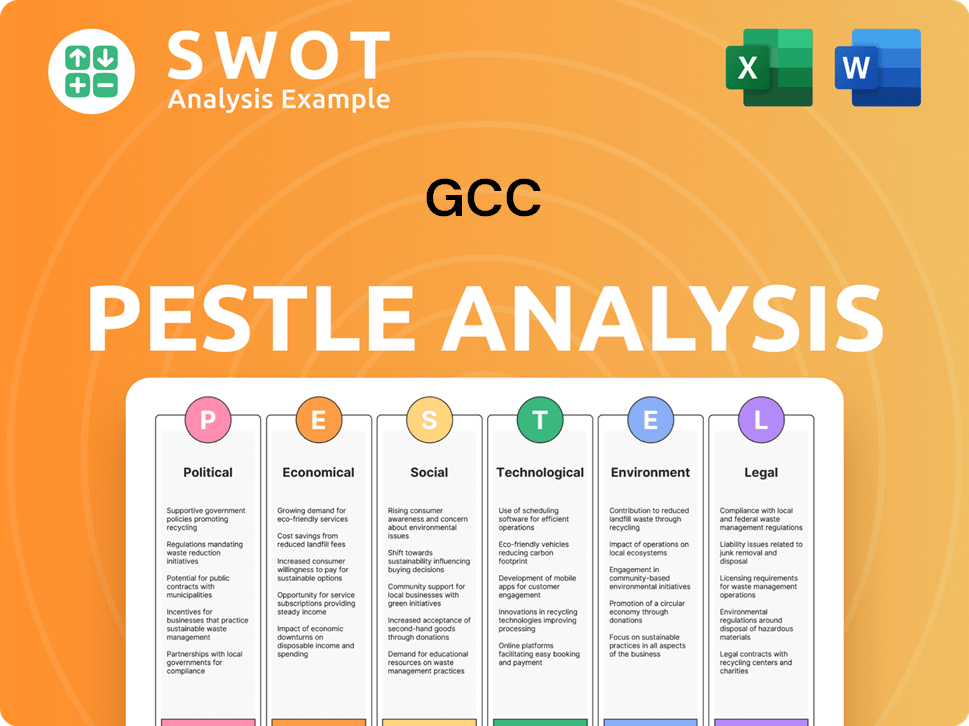

GCC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is GCC’s Growth Forecast?

The financial landscape for GCC in early 2025 reflects a period of adjustment and strategic recalibration. The company faces a mixed performance in the first quarter, with consolidated net sales decreasing by 9.6% to US$246.5 million. This decline is primarily attributed to lower cement and concrete volumes in key markets such as Mexico and the U.S. Despite these challenges, the company is implementing strategies to navigate the current economic climate and capitalize on future opportunities.

The decrease in sales is largely due to reduced volumes in both the U.S. and Mexico, coupled with currency fluctuations. The U.S. market saw a 3.3% decrease in sales, while Mexico experienced a more significant drop of 20.7%. These figures highlight the impact of regional economic conditions and currency exchange rates on the company's financial performance. However, the company is focused on leveraging its competitive advantages and adapting to market dynamics.

EBITDA for Q1 2025 fell by 11.3% to US$73.6 million, with an EBITDA margin of 29.8%. Net income decreased by 16.9% to US$40.6 million, and earnings per share were down by 17.1% to US$0.1240. Free cash flow also decreased significantly, dropping by 67.9% to US$13 million. Despite these short-term challenges, GCC maintains a strong financial position, with cash and equivalents totaling US$873.4 million and a net leverage ratio of -0.56x as of March 2025.

The U.S. market experienced a sales decrease of 3.3% in Q1 2025. However, cement and concrete prices increased by 3% and 12.1%, respectively. This indicates a mixed performance, with volume declines offset by price increases. The company is focused on maintaining profitability in this key market.

Mexico saw a significant sales decline of 20.7% in Q1 2025. This was primarily due to reduced volumes and the depreciation of the Mexican peso. The company is closely monitoring the economic situation in Mexico and adjusting its strategies accordingly.

EBITDA decreased by 11.3% to US$73.6 million in Q1 2025, with an EBITDA margin of 29.8%. Net income also decreased, reflecting the impact of lower sales and increased costs. The company is focused on improving operational efficiency.

GCC maintains a strong financial position with US$873.4 million in cash and equivalents. The net leverage ratio is -0.56x as of March 2025, indicating a healthy balance sheet. This strong financial foundation supports the company's strategic initiatives.

Looking back at the full year 2024, GCC demonstrated resilience with consolidated net sales increasing by 0.2% to US$1,366.7 million and EBITDA increasing by 6.2% to US$500.6 million, with a 36.6% EBITDA margin. The company’s ability to adapt and leverage its competitive advantages, especially with its robust project pipeline, supports a cautiously optimistic outlook for 2025. The company's focus on cost reduction and strategic investments is crucial for future growth. For more insights, explore the Marketing Strategy of GCC.

GCC is concentrating on cost and expense reduction strategies. The company is also continuing strategic investments to enhance its market position. These initiatives are designed to improve profitability and drive long-term growth.

The company expects demand in 2025 to remain consistent with 2024 levels. This stability provides a foundation for strategic planning. The company is well-positioned to capitalize on market opportunities.

GCC’s robust project pipeline supports its growth strategy. The company is actively pursuing new projects to expand its market presence. This pipeline is a key driver of future revenue.

The company's strong cash position and low leverage provide financial flexibility. This allows GCC to navigate market fluctuations and invest in growth opportunities. The financial health supports strategic initiatives.

Improving operational efficiency is a key focus area for GCC. The company is implementing measures to optimize costs and enhance productivity. This will positively impact profitability.

GCC is adapting to changing market dynamics in both the U.S. and Mexico. The company is implementing strategies to address volume declines and currency fluctuations. This adaptability is crucial for success.

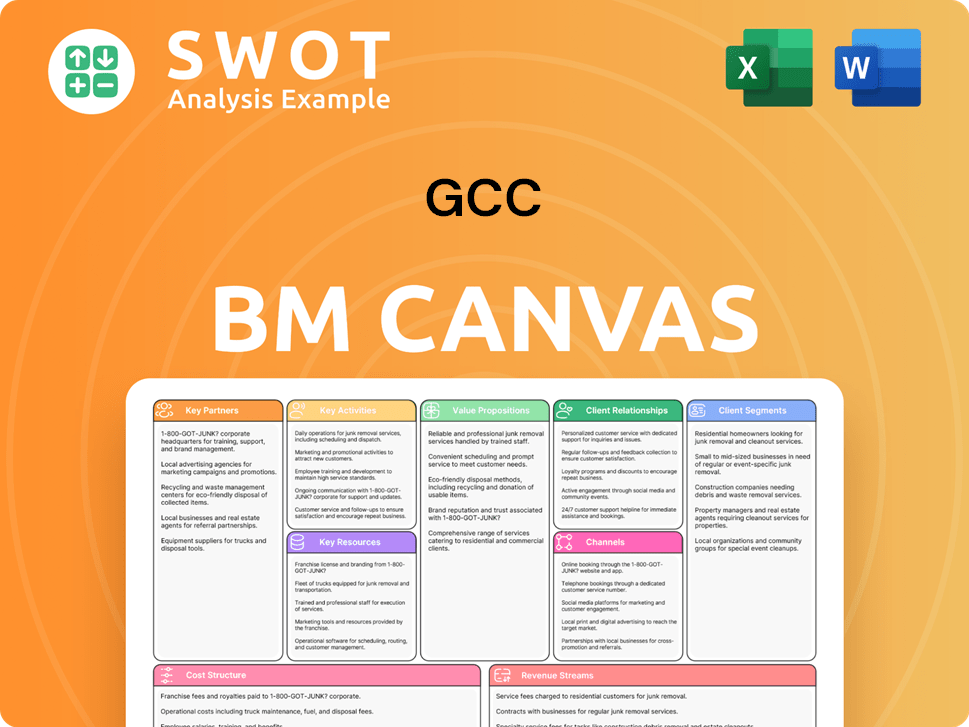

GCC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow GCC’s Growth?

The path for the [Company Name] and other GCC companies is not without its hurdles. The company faces several strategic and operational risks that could influence its growth. These challenges range from intense market competition to the impact of macroeconomic factors and regulatory changes.

Specifically, the company must navigate the complexities of supply chain vulnerabilities, technological disruption, and cybersecurity threats. These risks are compounded by the need to attract and retain skilled talent and manage operational costs effectively. Addressing these challenges is crucial for realizing the full potential of the GCC growth strategy.

Understanding these potential obstacles is crucial for investors and stakeholders. The company's ability to mitigate these risks will significantly affect its future performance and its ability to capitalize on opportunities within the Middle East economy. This requires a proactive and adaptive approach to business operations and strategy.

Intense competition within the GCC market is a constant challenge. Companies must continuously innovate and differentiate themselves to gain market share. The competitive landscape requires a strong focus on efficiency and customer value.

Macroeconomic conditions, including inflation and currency fluctuations, can significantly impact financial results. For example, currency depreciation, as seen with the Mexican peso affecting Q1 2025 results, highlights the need for robust financial planning. The Middle East economy is subject to global financial trends.

Disruptions in the supply chain can lead to increased costs and delays. Companies must diversify their supply chains and build resilience. The focus on regional business development requires robust supply chain management.

Rapid advancements in technology, such as AI and machine learning, can disrupt existing business models. Companies need to invest in innovation and digital transformation. Adapting to these changes is key for the future of GCC companies in 2024.

Cybersecurity risks, including ransomware and phishing attacks, are a significant concern. The global cost of cybercrime is predicted to rise, necessitating robust cybersecurity measures. This affects all businesses, and the Competitors Landscape of GCC is no exception.

Attracting and retaining skilled talent, especially for niche roles, is a challenge in competitive markets. Companies must offer competitive compensation and development opportunities. This affects the ability to execute growth strategies for GCC businesses.

High operational costs in prime urban areas and the 'Big Center' syndrome can lead to reduced efficiency. Companies must optimize their operations and manage costs effectively. Streamlining processes and leveraging technology are crucial.

Navigating complex regulatory landscapes requires a focus on compliance and risk management. Strengthening real-time risk monitoring and embedding compliance into corporate culture are essential. Automated regulatory reporting is also key.

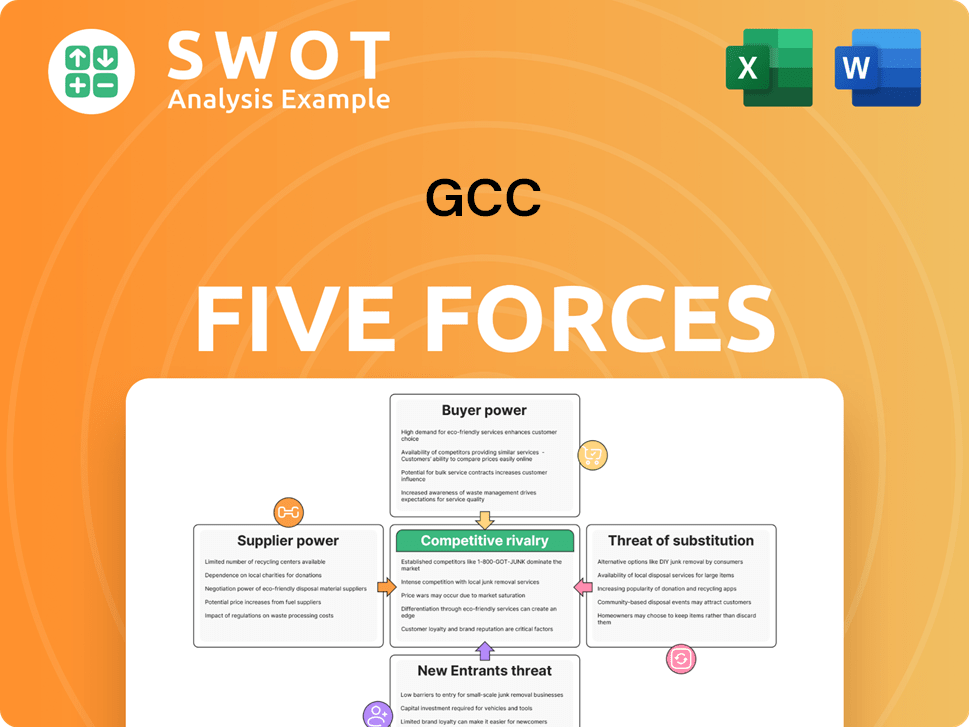

GCC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.