GCC Bundle

How Does GCC Navigate the Shifting Sands of the Construction Materials Market?

The construction materials industry is a battleground of innovation and competition, and GCC, a key player in North America, is constantly adapting. Understanding the GCC SWOT Analysis is crucial for investors and strategists alike. This analysis dives into GCC's position, revealing its strategies for success in a dynamic global environment.

This exploration of the GCC competitive landscape will examine the company's market share, key competitors, and the broader GCC business environment. We'll analyze the challenges facing GCC companies competition and identify strategies for GCC companies to gain market share, considering Middle East market trends and the impact of economic diversification on GCC competition. This comprehensive competitive analysis for GCC companies will provide actionable insights for informed decision-making.

Where Does GCC’ Stand in the Current Market?

GCC maintains a robust market position in the North American construction materials industry, particularly in cement, aggregates, and ready-mix concrete across the United States, Mexico, and Canada. The company is recognized as a leading producer in its operating regions, reflecting its significant scale and operational efficiency. Its primary product lines cater to a broad spectrum of construction needs, from residential and commercial building projects to public infrastructure.

Geographically, GCC has strategically focused its operations in areas with high construction activity, especially in the Southwest and Mountain West regions of the United States. It also holds a strong position in its core operating states in Mexico and has expanded its reach in Canada. Over time, GCC has optimized its supply chain and leveraged its integrated business model to enhance efficiency and customer service, including investments in digital transformation.

Financially, GCC has consistently demonstrated a healthy balance sheet and profitability. For the first quarter of 2024, GCC reported net sales of $309.8 million and an EBITDA of $96.8 million, indicating continued strong performance. This financial health enables the company to invest in capacity expansion, technological upgrades, and sustainable practices, further reinforcing its competitive standing. For more insights, consider reading about Owners & Shareholders of GCC.

GCC is a leading producer of construction materials in North America, with a strong presence in the cement, aggregates, and ready-mix concrete segments. The company's market share fluctuates but remains significant in its operating regions. In 2023, GCC reported net sales of $1,348.6 million and an EBITDA of $446.4 million, demonstrating its substantial market position.

GCC strategically concentrates its operations in areas with high construction activity, particularly in the United States, Mexico, and Canada. Its presence is strong in the Southwest and Mountain West regions of the U.S. and holds a dominant position in its core operating states in Mexico. The company has also expanded its reach in Canada.

GCC consistently demonstrates a healthy balance sheet and profitability, enabling investments in capacity expansion and technological upgrades. For Q1 2024, the company reported net sales of $309.8 million and an EBITDA of $96.8 million. This financial strength supports its competitive standing and future growth initiatives.

GCC focuses on optimizing its supply chain and leveraging its integrated business model to enhance efficiency and customer service. This includes investments in digital transformation initiatives to streamline operations and improve logistics. These efforts contribute to its strong competitive advantage in the GCC competitive landscape.

GCC's competitive advantages include its strong market position, strategic geographic focus, and robust financial performance. The company's integrated business model and investments in operational efficiency further enhance its ability to compete effectively.

- Leading producer in North America.

- Strategic geographic presence in key markets.

- Strong financial performance and profitability.

- Investments in digital transformation.

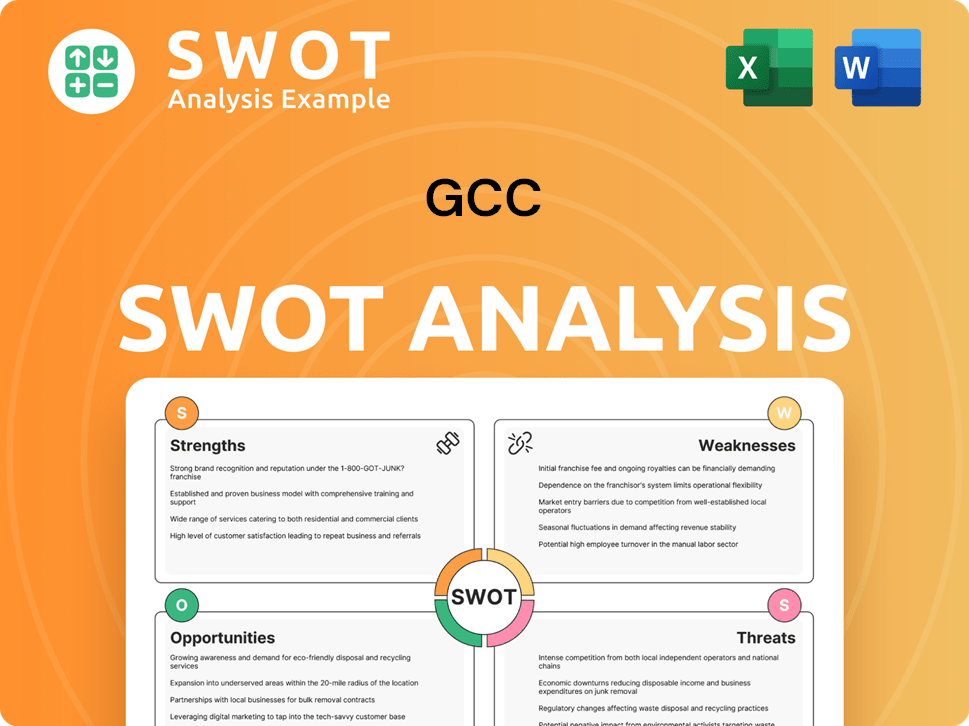

GCC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging GCC?

The GCC competitive landscape is characterized by a mix of global giants, regional specialists, and emerging players, all vying for market share in the cement, aggregates, and ready-mix concrete sectors. A thorough competitive analysis of GCC companies reveals that understanding the strategies of key rivals is crucial for sustained success. The Middle East market trends, including infrastructure development and economic diversification, significantly influence the competitive dynamics within the Gulf Cooperation Council (GCC) countries.

Key competitors challenge GCC through price competition, innovation, branding, and distribution networks. Securing large-scale infrastructure projects and expanding market presence in rapidly developing urban areas are common battlegrounds. Analyzing the competitive environment in the GCC requires a deep understanding of these factors and their impact on GCC company market share.

GCC operates within a highly competitive landscape, facing off against a mix of large international conglomerates, national players, and regional specialists in the cement, aggregates, and ready-mix concrete sectors. Its most significant direct competitors often include global giants such as Cemex, Holcim, and Heidelberg Materials. Cemex, a Mexico-based multinational, is a formidable rival with extensive operations across North America, offering a wide range of building materials and often competing directly with GCC in both the U.S. and Mexican markets through its vast distribution network and strong brand recognition. Holcim, a Swiss-based global leader, also presents a significant challenge, particularly in the aggregates and ready-mix concrete segments, leveraging its scale, technological advancements, and commitment to sustainable building solutions. Heidelberg Materials, a German multinational, is another key competitor with a substantial presence in North America, known for its diverse product portfolio and strategic acquisitions that bolster its market share.

Price competition is a constant factor, especially in commodity-driven segments like cement and aggregates. Competitors continuously adjust prices to gain market share, impacting profitability. This is a key aspect of the competitive landscape analysis for GCC companies.

Innovation in product development, such as low-carbon cement or specialized concrete mixes, is another battleground. Companies are investing in research and development to offer differentiated products that meet evolving market demands. This affects the competitive advantage of GCC companies.

Branding and extensive distribution networks play a crucial role, with competitors vying for market presence and customer loyalty. Strong brands and efficient supply chains are essential for reaching customers effectively. This is a critical factor in understanding the GCC business environment.

High-profile battles often involve securing large-scale infrastructure projects or competing for market share in rapidly developing urban areas. Securing these projects can significantly boost revenue and market share. This highlights the challenges facing GCC companies competition.

Indirect competition comes from alternative building materials and new entrants focusing on niche markets or disruptive technologies. The increasing adoption of timber in mid-rise construction or recycled materials can indirectly impact demand for traditional concrete and aggregates.

Smaller, regional players often pose a challenge in local markets due to their localized supply chains and established customer relationships. These companies can be agile and responsive to local market needs. This is a key aspect of identifying key players in the GCC market.

To succeed in this competitive environment, GCC companies must adopt several key strategies. These strategies are crucial for gaining market share and ensuring long-term sustainability. For more insights, consider reading about the Growth Strategy of GCC.

- Focus on Innovation: Invest in research and development to create differentiated products and solutions, such as low-carbon cement or specialized concrete mixes.

- Strengthen Distribution Networks: Enhance supply chain efficiency and expand distribution networks to ensure product availability and reach a wider customer base.

- Strategic Partnerships: Form alliances with other companies to leverage resources, expertise, and market access.

- Cost Management: Implement cost-effective operations to maintain competitive pricing and improve profitability.

- Sustainability Initiatives: Embrace sustainable building practices and offer eco-friendly products to meet the growing demand for green construction.

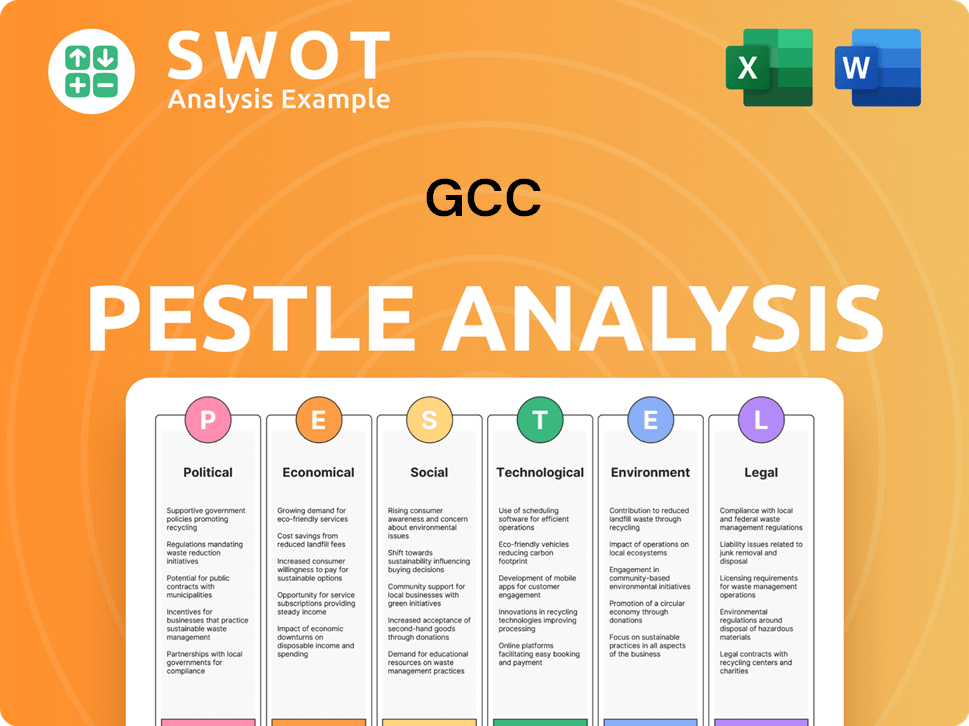

GCC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives GCC a Competitive Edge Over Its Rivals?

The company, which operates within the Gulf Cooperation Council (GCC), distinguishes itself in the competitive landscape through a combination of strategic advantages. These include an integrated business model, a strategic geographic footprint, and a strong commitment to operational efficiency. This approach allows it to maintain a strong position in the market. The company's ability to adapt to market demands and continuously improve its strategies is also a key factor in its ongoing success.

Key milestones for the company involve continuous investment in modernizing plants and adopting advanced manufacturing processes. This focus on innovation and efficiency has allowed the company to improve productivity and reduce its environmental impact. The company's commitment to sustainability, including the use of alternative fuels and raw materials, not only aligns with environmental goals but also enhances cost efficiency.

The company's competitive edge is further enhanced by its strong brand equity, built over decades of reliable service and high-quality products. This fosters significant customer loyalty, particularly with key contractors and developers in its operating regions. The company's strategic geographic presence in key growth markets within North America provides a distinct advantage, allowing for timely and cost-effective delivery of materials, a critical factor in the construction industry.

The company's vertically integrated operations, encompassing cement production, aggregates extraction, and ready-mix concrete distribution, are a significant advantage. This integration allows for control over raw materials, optimizing the supply chain, and ensuring product consistency. This contrasts with competitors who may rely on external suppliers, potentially leading to higher costs or less control.

The company's strategic geographic presence in key growth markets, particularly within North America, provides a distinct advantage. Its established distribution networks and proximity to major construction hubs allow for timely and cost-effective delivery. This is critical in the construction industry, supporting its market position.

The company invests in modernizing its plants and adopting advanced manufacturing processes to improve productivity and reduce environmental impact. The focus on increasing the use of alternative fuels and raw materials enhances cost efficiency. This supports sustainability goals and strengthens its competitive position.

The company's strong brand equity, built over decades of reliable service and high-quality products, fosters significant customer loyalty. This is particularly evident in the long-standing relationships with key contractors and developers in its operating regions. This loyalty supports its market share and competitive standing.

The company's competitive advantages include its vertically integrated operations, strategic geographic presence, and operational efficiency. These factors contribute to its strong market position. The company's commitment to innovation, sustainability, and customer relationships supports its long-term success. To further enhance its market position, the company could consider strategies outlined in the Marketing Strategy of GCC.

- Vertical Integration: Controls raw materials and supply chain.

- Strategic Location: Proximity to major construction hubs.

- Operational Efficiency: Investments in modern manufacturing.

- Customer Loyalty: Strong brand equity and long-term relationships.

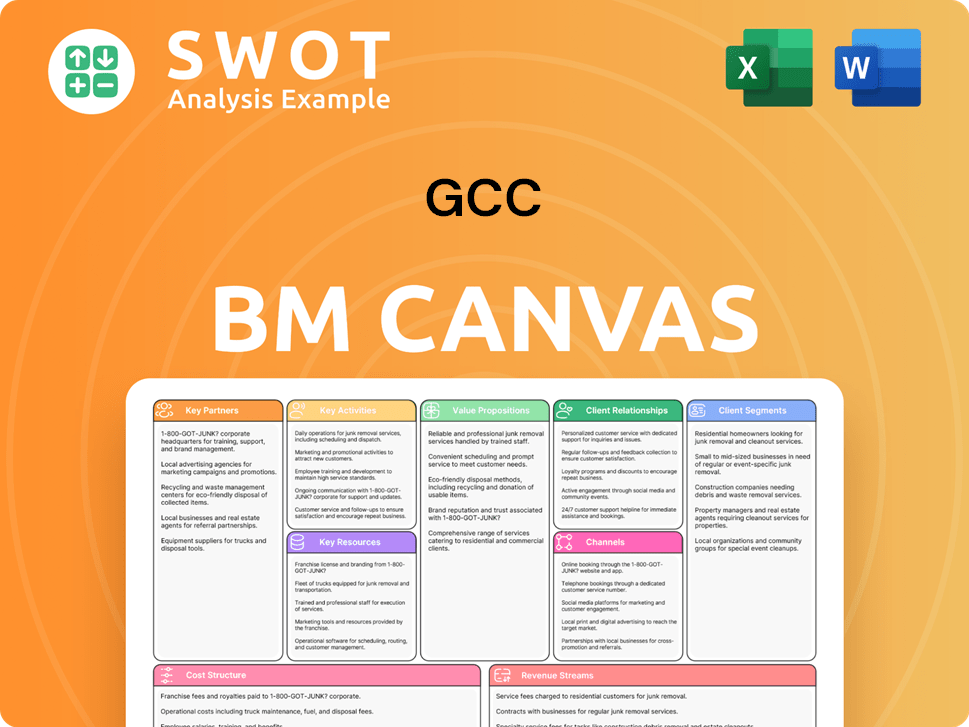

GCC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping GCC’s Competitive Landscape?

Understanding the competitive landscape of companies in the Gulf Cooperation Council (GCC) requires a deep dive into industry trends, future challenges, and opportunities. The construction materials sector, a significant component of the GCC business environment, is undergoing rapid transformation. This analysis will explore the key factors shaping the market, focusing on how companies like GCC are positioned to navigate these changes. The aim is to provide actionable insights for investors, analysts, and strategists looking to understand the dynamics of the Middle East market trends.

The GCC competitive landscape is influenced by both global and regional factors. The drive towards sustainability, technological advancements, and evolving consumer preferences are reshaping the industry. This article will highlight the strategies companies can employ to maintain and enhance their market share. For a deeper understanding of how GCC operates, consider exploring Revenue Streams & Business Model of GCC.

Several key industry trends are shaping the GCC competitive landscape. The increasing adoption of digital technologies and automation is improving production efficiency and supply chain management. Regulatory pressures are pushing for sustainable practices and materials, impacting operational costs. Consumer demand is growing for eco-friendly and resilient building solutions, influencing product development and market strategies.

Companies in the GCC face several challenges. The need for substantial investment in sustainable technologies to reduce carbon footprints is critical. Stricter environmental regulations could increase operational costs. Disruptions may arise from new market entrants offering innovative, sustainable alternatives. Geopolitical uncertainties and global economic shifts can also impact demand and raw material prices.

The shift towards sustainable construction presents significant opportunities for GCC. The development and promotion of low-carbon cement and concrete products can drive growth. Investing in research and development for new, high-performance materials can open new market segments. Strategic partnerships and expansion into emerging markets offer further growth potential.

Adapting to these dynamics requires strategic agility. Focusing on operational excellence, sustainability initiatives, and market diversification is crucial. Companies must leverage technological advancements and form strategic alliances to maintain a competitive edge. The ability to anticipate and respond to market changes will determine long-term success.

To thrive in the evolving GCC competitive landscape, companies should focus on several key strategies. These include prioritizing innovation in sustainable materials, forming strategic partnerships, and expanding into high-growth markets. Companies must also invest in digital transformation and enhance operational efficiencies to remain competitive.

- Invest in R&D: Develop low-carbon products and enhance material performance.

- Strategic Partnerships: Collaborate with technology providers and sustainable developers.

- Market Diversification: Explore growth opportunities in emerging markets, such as North America.

- Operational Excellence: Optimize processes and adopt digital solutions for efficiency.

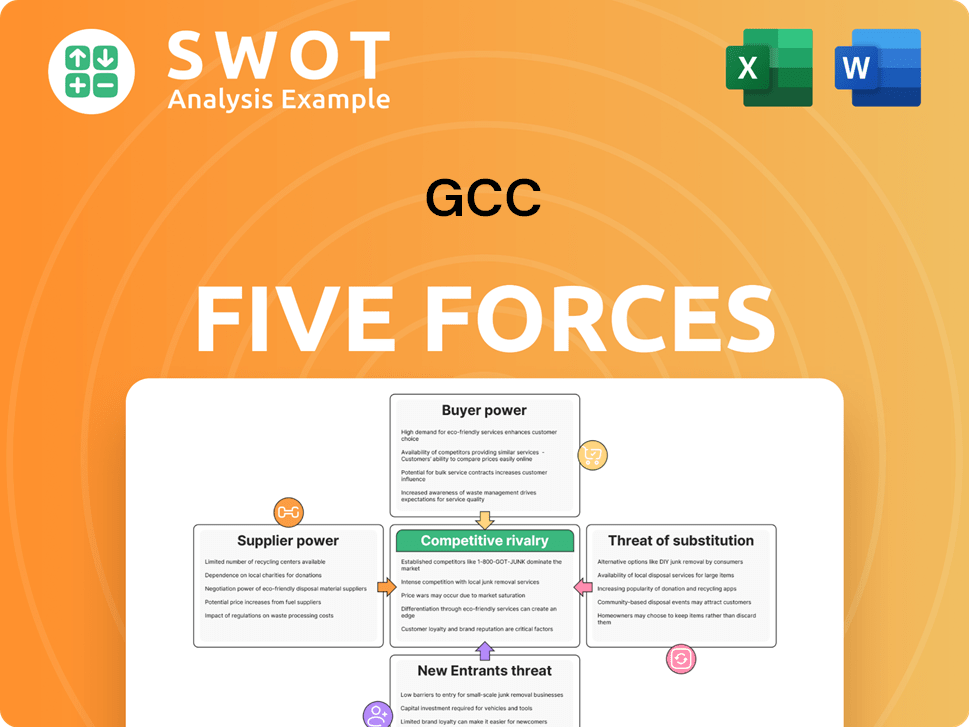

GCC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GCC Company?

- What is Growth Strategy and Future Prospects of GCC Company?

- How Does GCC Company Work?

- What is Sales and Marketing Strategy of GCC Company?

- What is Brief History of GCC Company?

- Who Owns GCC Company?

- What is Customer Demographics and Target Market of GCC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.