Genuine Parts Bundle

How did a small auto parts store in Atlanta, Georgia, become a global powerhouse?

Genuine Parts Company, a titan in the automotive and industrial parts distribution arena, boasts a rich history dating back to 1928. From a modest beginning with a single store, the company has evolved into a diversified service organization. This journey showcases remarkable growth and strategic adaptation within the dynamic automotive parts landscape.

Delving into the Genuine Parts SWOT Analysis reveals the strategic decisions that propelled GPC from its Atlanta, Georgia roots to its current global presence. This exploration will uncover how the company, initially founded by Carlyle Fraser, navigated challenges and capitalized on opportunities, solidifying its position as a leading distribution company. Understanding the GPC history provides invaluable insights into the evolution of NAPA Auto Parts and the broader automotive parts industry.

What is the Genuine Parts Founding Story?

The story of Genuine Parts Company (GPC) began in 1928. Carlyle Fraser, with a vision for the automotive industry, laid the foundation for what would become a major player in the auto parts sector. His initial investment marked the start of a journey that would see GPC grow into a significant distribution company.

Fraser's foresight and strategic approach, including his involvement with the National Automotive Parts Association (NAPA), were crucial. This early focus on distribution and network building set the stage for GPC's future success. This early history of NAPA Auto Parts is intertwined with GPC's growth.

The company's early years were marked by challenges, but also by the potential of a growing market. This included navigating the economic downturn of the Great Depression. The company's ability to adapt and capitalize on the demand for auto parts during this period was a key factor in its early growth.

Genuine Parts Company was founded in 1928 by Carlyle Fraser in Atlanta, Georgia. He purchased Motor Parts Depot for $40,000 and, along with his business partner William 'Bill' Martin, renamed it Genuine Parts Company.

- In its first year, GPC generated $75,000 in sales.

- The company initially focused on distributing auto parts to independent garages.

- Fraser was involved in the National Automotive Parts Association (NAPA), established in 1925.

- The Great Depression increased demand for auto parts, benefiting GPC.

Fraser's initial investment in Motor Parts Depot for $40,000 marked the beginning of Genuine Parts Company. Despite the previous owner's skepticism, Fraser saw potential in the automotive parts market. The company's early business model focused on distributing auto parts to 'jobbing houses', which then sold to independent garages. This strategy was key to the company's initial growth.

In its first year, GPC achieved sales of $75,000, although it faced a loss of approximately $2,500 due to start-up costs. Fraser's foresight in joining NAPA was also a pivotal move. NAPA helped transform GPC from a single store into a network of distribution centers. The economic conditions of the Great Depression further fueled demand for auto parts, as consumers opted to repair older vehicles. This situation provided a strong foundation for GPC's expansion.

The company's early focus on distribution, combined with strategic partnerships, set the stage for its future success. The early history of NAPA Auto Parts and GPC's growth are closely linked, demonstrating the importance of collaboration in the automotive parts industry. Understanding the Marketing Strategy of Genuine Parts provides further insights into the company's evolution.

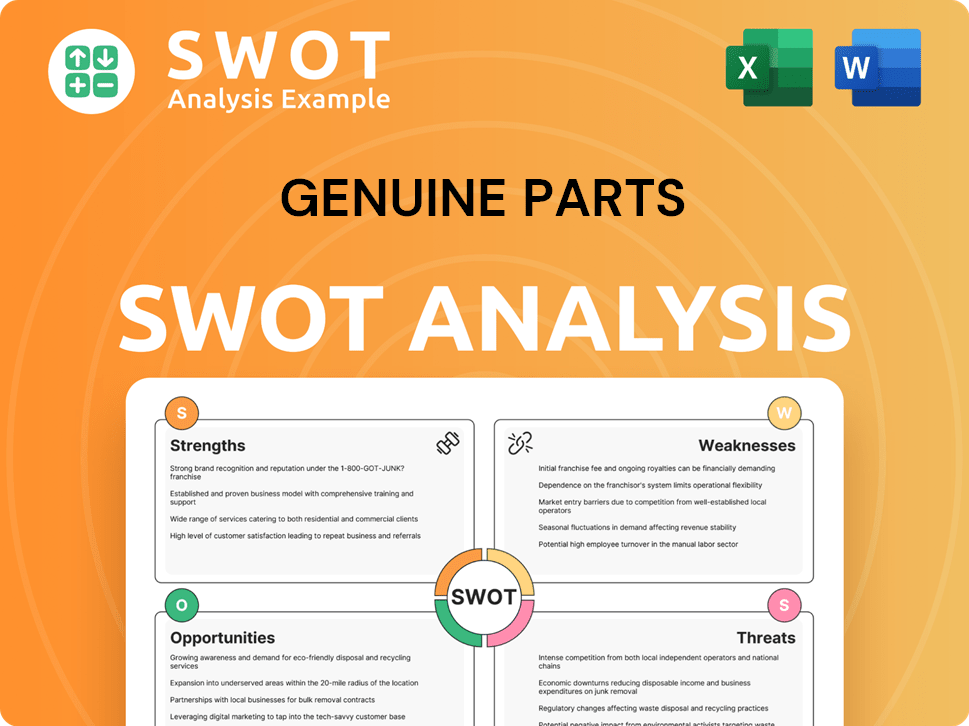

Genuine Parts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Genuine Parts?

The early years of Genuine Parts Company were marked by significant expansion, transforming it from a single store into a nationwide and then global distributor. This period was crucial for establishing its presence in the automotive parts market. The company's strategic moves during this time set the stage for its future growth and diversification. The company's history is a testament to strategic foresight and adaptability.

By 1948, celebrating its 20th anniversary, annual sales of Genuine Parts Company reached $20 million. That same year, the company went public, selling 150,000 shares of common stock at $11 per share. This early public offering helped fuel further expansion. By 1962, the company had grown to own 97 retail stores and 12 warehouses, with annual sales approximately $80 million.

The 1970s saw a strategic shift as Genuine Parts Company began diversifying beyond automotive parts. In 1972, the company expanded internationally by acquiring Corbetts, Ltd., a Canadian auto parts distributor. This was followed by the 1975 purchase of S.P. Richards, a wholesale office supplies firm. These moves expanded the company's scope. In 1976, under CEO Wilton Looney, GPC entered the industrial parts distribution business by acquiring Motion Industries, Inc.

Throughout this period, Genuine Parts Company also focused on strengthening its automotive parts business, expanding its offerings of remanufactured parts and acquiring other parts distributors to broaden its product range and geographic reach. Major acquisitions continued, including Dallas-based General Automotive Parts Corp. in 1982 for approximately $250 million. By the late 1960s, GPC was a nationwide distributor, supplying thousands of independent jobbers and owning a significant portion of NAPA Auto Parts distribution centers. The introduction of the first NAPA Auto Parts brand parts in 1966 further solidified its market presence. For more insights, explore the Growth Strategy of Genuine Parts.

These strategic expansions and diversifications laid the foundation for Genuine Parts Company's multi-segment business model and its growing global footprint. The company's ability to adapt and expand its offerings, particularly in the automotive sector with NAPA Auto Parts, has been a key driver of its long-term success. The early focus on both organic growth and strategic acquisitions set the stage for its continued evolution.

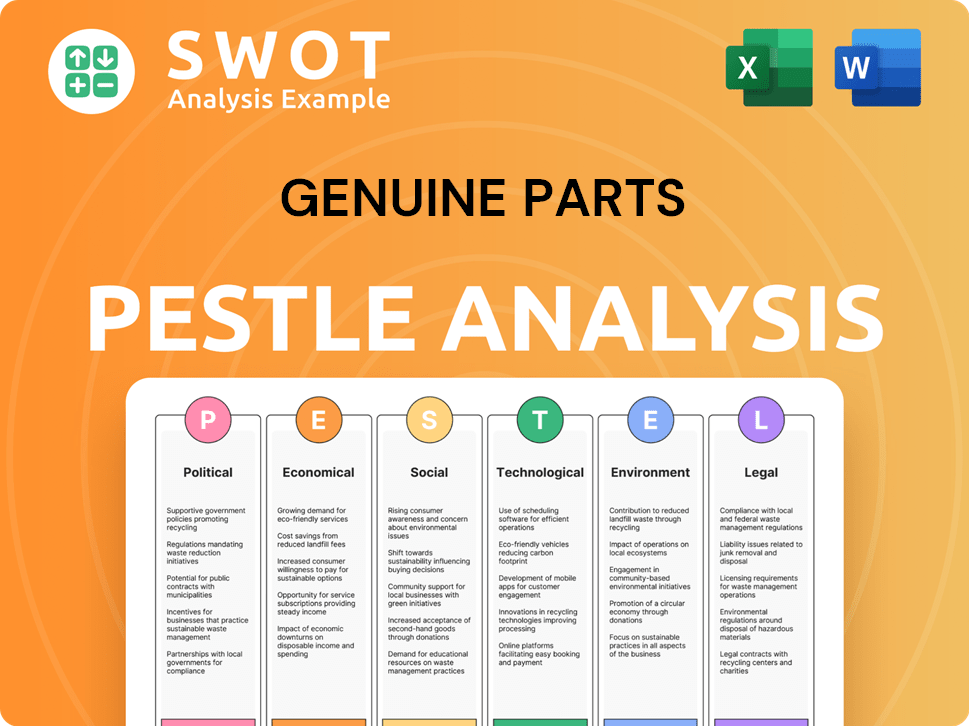

Genuine Parts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Genuine Parts history?

The GPC history is marked by significant milestones, from its founding to becoming a major player in the automotive parts and distribution industry. The company has consistently expanded its operations and product offerings, adapting to market changes and economic conditions to maintain its position.

| Year | Milestone |

|---|---|

| 1928 | Founded in Atlanta, Georgia, as a distribution company for automotive parts. |

| 1931 | Established a rebuilding shop in its Atlanta Distribution Center, enhancing its service offerings. |

| 1966 | Introduced the first NAPA brand parts, significantly boosting brand recognition. |

| 1972 | Entered the Canadian market, marking its first international expansion. |

| 1975 | Diversified into office supplies with the acquisition of S.P. Richards. |

| 1976 | Expanded into industrial parts through the acquisition of Motion Industries. |

| 1998 | Acquired EIS, Inc., expanding into electrical and electronic materials, and UAP Inc. in Canada. |

| 2013 | Acquired Exego Group in Australia, further expanding its global presence. |

| 2017 | Acquired Alliance Automotive Group in Europe, strengthening its European market position. |

| 2022 | Acquired Kaman Distribution Group (KDG), boosting its industrial solutions. |

Innovation has been a cornerstone of the Genuine Parts Company's success, particularly in establishing an effective distribution network. The company's early adoption of remanufacturing and its expansion into diverse sectors like office supplies and industrial parts showcase its commitment to adapting and evolving.

A sophisticated distribution system was developed to ensure timely delivery of automotive parts to a growing number of independent garages.

The company added a rebuilding shop in the basement of its Atlanta Distribution Center in 1931, with remanufactured parts accounting for approximately 15% of sales by the early 1960s.

The introduction of the first NAPA brand parts in 1966 was a major product launch, enhancing brand recognition and product offerings.

Strategic diversification into office supplies with the acquisition of S.P. Richards in 1975 and industrial parts with Motion Industries in 1976 were pivotal achievements, broadening its market reach and revenue streams.

Despite its robust growth, Genuine Parts Company has faced several challenges, including economic downturns and industry-specific issues. The company has consistently demonstrated resilience, adapting its strategies to navigate these obstacles.

The OPEC oil embargo in 1973 impacted the automotive parts market, leading to reduced driving and parts demand in the short term.

Recessions, such as the one in 1982, also affected the industrial parts business, which was initially thought to be recession-proof.

In 2024, the company undertook a global restructuring initiative to align assets and improve profitability, incurring approximately $231 million in restructuring costs.

Challenges in 2024 also included flat global automotive comparable sales due to high interest rates and inflation, and a 2.1% decline in industrial sales reflecting weaknesses in global manufacturing.

The company's net income for the fourth quarter of 2024 decreased to $133 million from $317 million in the prior year, and full-year net income dropped to $904 million from $1.3 billion in 2023.

GPC has consistently demonstrated resilience, focusing on strategic initiatives, cost management, and disciplined capital allocation to overcome these obstacles, as evidenced by its continued dividend increases and positive future outlook.

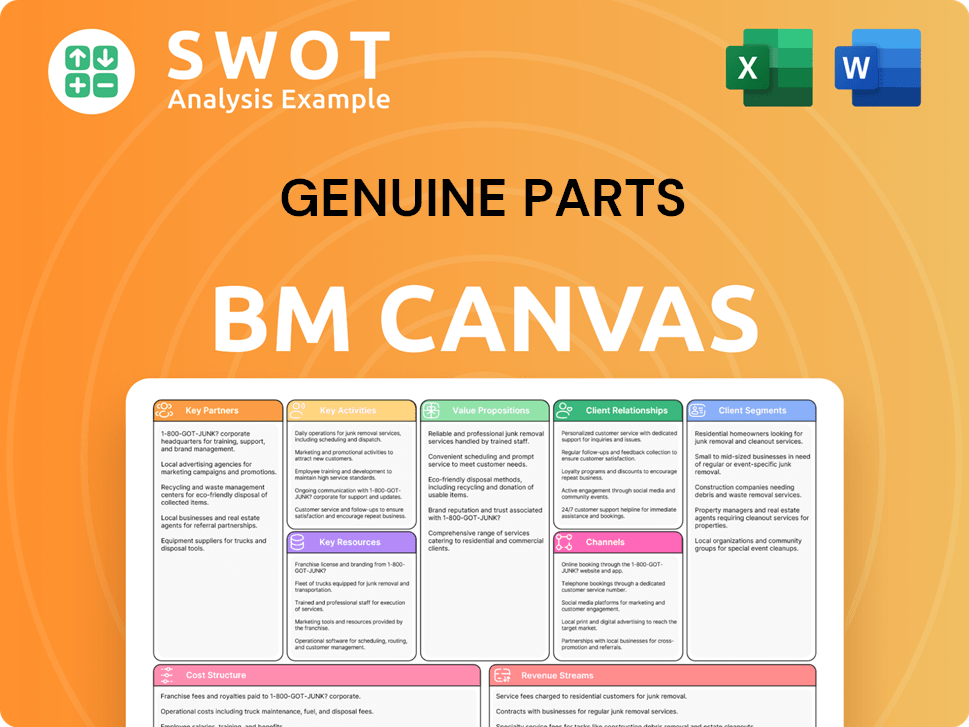

Genuine Parts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Genuine Parts?

The Genuine Parts Company (GPC) has a rich history, starting in 1928 when Carlyle Fraser founded it in Atlanta, Georgia. Over the years, GPC has grown significantly, becoming a major player in the automotive parts and distribution industry. Key milestones include going public in 1948, the introduction of NAPA Auto Parts in 1966, and expansions into Canada and Europe through strategic acquisitions. The company has consistently adapted to market changes, expanding its reach and product offerings to meet evolving customer needs.

| Year | Key Event |

|---|---|

| 1928 | Carlyle Fraser founded Genuine Parts Company in Atlanta, Georgia. |

| 1948 | The company went public, with sales reaching $20 million. |

| 1966 | The first NAPA brand parts were introduced. |

| 1972 | GPC expanded into Canada with the acquisition of Corbetts, Ltd. |

| 1975 | Genuine Parts diversified into office supplies with the purchase of S.P. Richards. |

| 1976 | The company entered the industrial parts business by acquiring Motion Industries. |

| 1982 | GPC acquired Dallas-based General Automotive Parts Corp. for approximately $250 million. |

| 1998 | Genuine Parts acquired EIS, Inc., a distributor of electrical and electronic materials, and fully acquired UAP Inc. in Montreal. |

| 2013 | GPC acquired Australian car parts supplier Exego Group (now GPC Asia Pacific). |

| 2017 | GPC acquired Alliance Automotive Group, entering the European market. |

| 2021 | Acquisition of RSP Automotive & Industrial. |

| 2022 | GPC acquired Kaman Distribution Group (KDG). |

| 2024 | The company undertook a global restructuring initiative and acquired Motor Parts & Equipment Corporation (MPEC). |

| 2025 | GPC declared its 69th consecutive year of increased dividends. |

Genuine Parts Company anticipates revenue growth of 2% to 4% in 2025. The company expects adjusted diluted earnings per share (EPS) to be between $7.75 and $8.25. These projections reflect the company's strategic initiatives and focus on operational efficiencies.

GPC expects to realize approximately $100 million to $125 million in additional savings in 2025 from its global restructuring efforts. Annualized savings are projected to be approximately $200 million by 2026. These savings will contribute to improved profitability.

The company continues to invest in capital expenditures, with $120 million spent in Q1 2025, and acquisitions, with $74 million in Q1 2025. GPC is focused on enhancing customer service, improving business operations, and transforming the NAPA business through strategic acquisitions and technology investments.

Genuine Parts Company is addressing industry shifts by investing in EV parts and solutions. The company anticipates market conditions to improve in 2026, with projected 4% revenue growth. This growth will be driven by increased spending from automotive and industrial customers.

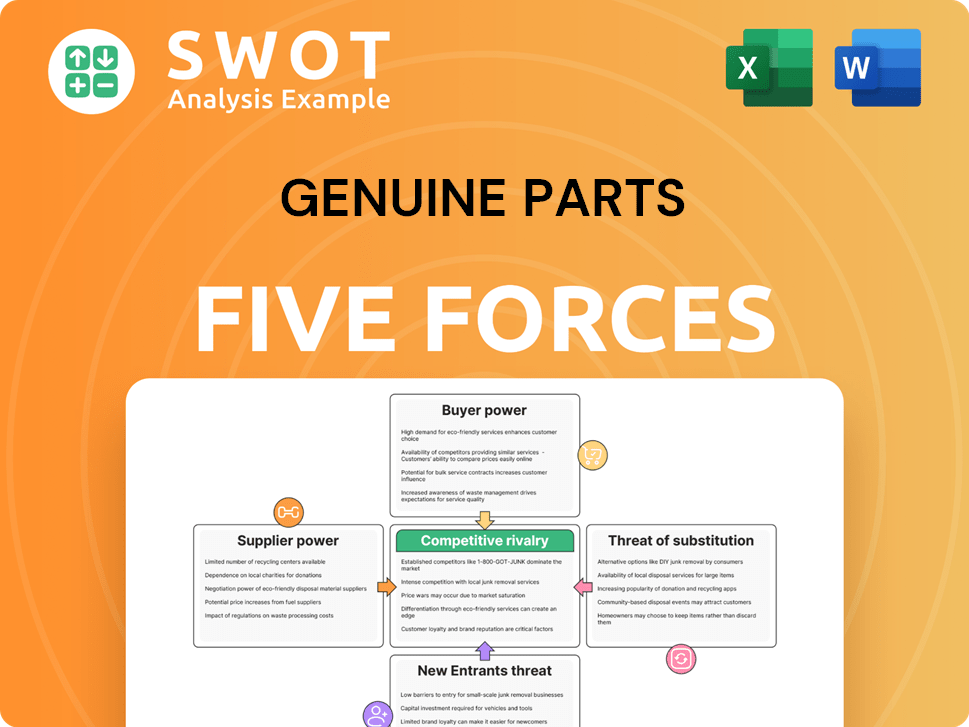

Genuine Parts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Genuine Parts Company?

- What is Growth Strategy and Future Prospects of Genuine Parts Company?

- How Does Genuine Parts Company Work?

- What is Sales and Marketing Strategy of Genuine Parts Company?

- What is Brief History of Genuine Parts Company?

- Who Owns Genuine Parts Company?

- What is Customer Demographics and Target Market of Genuine Parts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.