Genuine Parts Bundle

How Does Genuine Parts Company Thrive in a Cutthroat Market?

Genuine Parts Company (GPC) has built a legacy since 1928, evolving from an automotive parts distributor into a global force. Facing a dynamic market shaped by tech and supply chain shifts, GPC's strategic moves have been key to its sustained success. But how does GPC, with its diverse portfolio, really stack up against the competition?

To truly understand GPC's position, we must dissect its Genuine Parts SWOT Analysis, scrutinizing its rivals, and assessing its unique strengths. This analysis will explore the GPC competitive landscape, including its market share, the competitive advantages it wields, and the strategies it employs to maintain its edge in the automotive parts market and beyond. Analyzing GPC's performance provides crucial insights for anyone seeking to understand the aftermarket auto parts industry and the company's future trajectory, including how it competes with major players like NAPA Auto Parts.

Where Does Genuine Parts’ Stand in the Current Market?

Genuine Parts Company (GPC) holds a prominent position in the automotive and industrial parts aftermarket. It operates through two main groups: Automotive Parts and Industrial Parts. The company distributes a wide array of products, including automotive replacement parts, industrial components, and office supplies, serving a diverse customer base globally.

GPC's value proposition lies in its extensive distribution network, comprehensive product offerings, and strong brand recognition, particularly through its NAPA AUTO PARTS brand. This allows it to provide reliable and efficient service to its customers. The company's strategic focus on diversification and expansion has further strengthened its market position, enabling it to mitigate risks and capitalize on growth opportunities across different sectors.

The company's geographic presence is extensive, with operations spanning North America, Europe, and Australasia, enabling it to serve a global customer base.

GPC's Automotive Parts Group, under the NAPA AUTO PARTS brand, is a dominant force in the automotive parts market. It provides a comprehensive range of parts, accessories, and supplies. This strong market position is supported by a vast distribution network and strong brand recognition.

Through its Industrial Parts Group, operating as Motion (formerly Motion Industries), GPC is a leading distributor of maintenance, repair, and operating (MRO) replacement parts and industrial technology solutions. This diversification helps GPC maintain a robust market presence across various sectors.

GPC's operations span North America, Europe, and Australasia, allowing it to serve a global customer base. This extensive reach is crucial for its competitive advantage. The company's ability to operate in multiple regions supports its overall growth strategies.

In 2023, GPC reported net sales of $23.1 billion, with the Automotive Parts Group contributing $14.6 billion and the Industrial Parts Group contributing $8.5 billion. This financial performance underscores its significant scale compared to industry averages. The company’s robust revenue generation across diversified segments highlights its financial health.

GPC's competitive advantages include a vast distribution network, strong brand recognition, and a diversified product portfolio. These factors contribute to its solid market position. The company's ability to adapt and expand into new markets further enhances its competitive edge.

- Dominant presence in the automotive aftermarket through NAPA Auto Parts.

- Leading position in industrial parts distribution via Motion.

- Strong financial performance with significant revenue generation.

- Extensive geographic reach, serving customers globally.

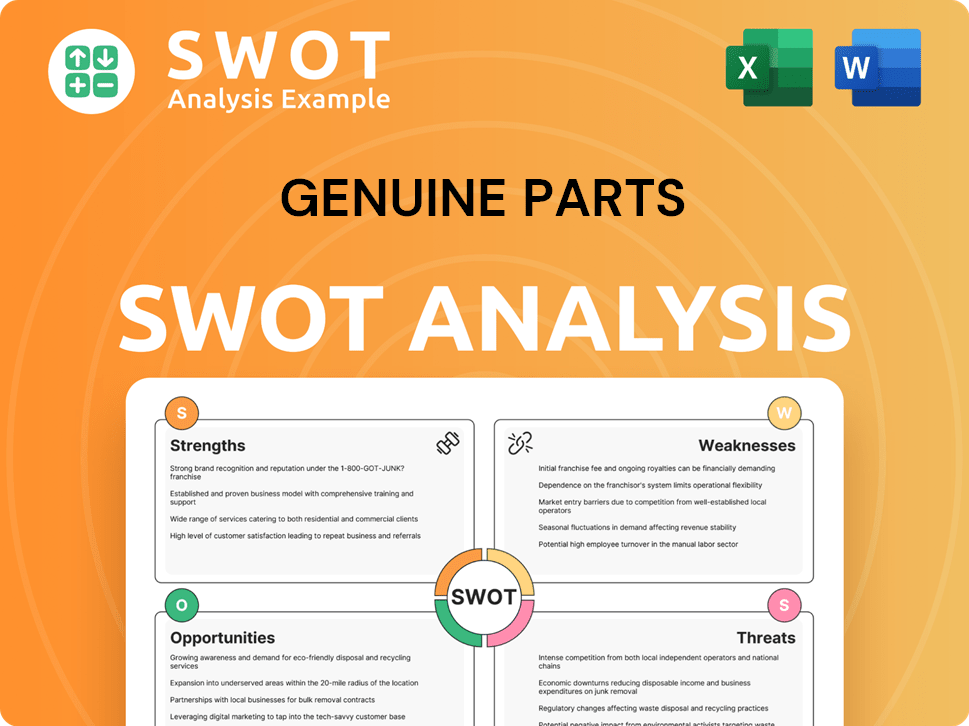

Genuine Parts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Genuine Parts?

The Genuine Parts Company (GPC) competitive landscape is characterized by a mix of large, established players and emerging competitors across the automotive and industrial parts distribution sectors. Understanding the dynamics of these rivalries is crucial for assessing GPC's market position and strategic initiatives. The GPC competitors engage in intense competition, focusing on pricing, product availability, and customer service to gain market share.

The automotive aftermarket and industrial parts distribution industries are highly competitive, with numerous companies vying for market share. The Automotive parts market is particularly dynamic, influenced by technological advancements, changing consumer preferences, and the rise of e-commerce. The Aftermarket auto parts segment is also influenced by the overall health of the automotive industry, including vehicle sales, the average age of vehicles on the road, and consumer spending on vehicle maintenance and repairs.

GPC's success hinges on its ability to navigate this complex competitive environment, leveraging its extensive distribution network, strong brand recognition, and strategic partnerships. For insights into the company's ownership structure, consider reading Owners & Shareholders of Genuine Parts.

In the automotive aftermarket, GPC, through its NAPA Auto Parts brand, faces direct competition from major distributors. These rivals compete on pricing, product selection, and customer service to gain market share.

Advance Auto Parts is a significant competitor, with a substantial retail presence and a focus on professional installers. They compete directly with NAPA in terms of market share and customer reach. Their pricing strategies and marketing efforts are key factors in their competitive approach.

AutoZone is another major player, known for its strong focus on DIY customers and efficient supply chain. This allows them to be competitive in the retail segment, often challenging GPC through pricing and product availability.

O’Reilly Auto Parts is a key competitor, known for its strong DIY customer focus and efficient supply chains. They present significant competition, particularly in the retail segment, through competitive pricing and extensive product assortments.

These competitors often challenge GPC through competitive pricing strategies, extensive product assortments, and aggressive marketing. They aim to capture market share by offering attractive deals and promotions.

The competitive landscape is dynamic, influenced by technological advancements, changing consumer preferences, and the rise of e-commerce. These factors shape the strategies and market positioning of all players.

In the industrial parts sector, GPC's Motion (formerly Motion Industries) competes with other major industrial distributors. These competitors focus on specialized solutions, supply chain efficiencies, and direct customer relationships.

- W.W. Grainger: A leading broad-line distributor offering a vast catalog and strong e-commerce capabilities, directly competing with Motion for large industrial accounts.

- Applied Industrial Technologies: Focuses on specialized solutions and technical expertise, offering a different value proposition to industrial customers.

- Fastenal: Emphasizes its localized service and vending solutions for MRO supplies, competing on convenience and accessibility.

- Indirect Competition: GPC also faces indirect competition from original equipment manufacturers (OEMs) and smaller regional distributors.

- Emerging Threats: New online players and technology-driven solutions in parts distribution present a disruptive force, potentially shifting market share.

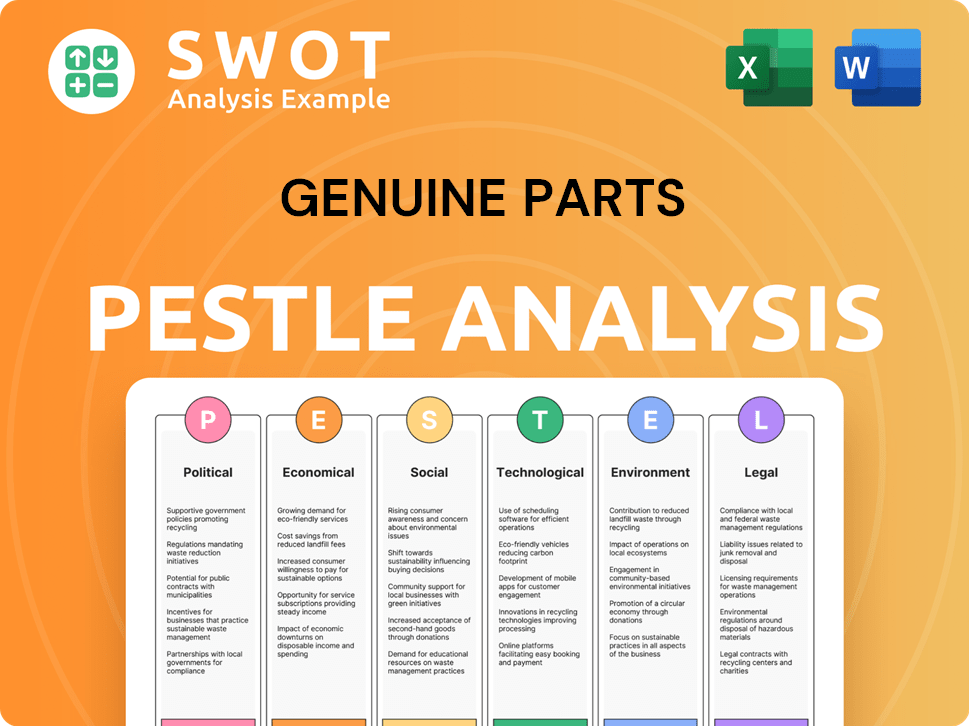

Genuine Parts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Genuine Parts a Competitive Edge Over Its Rivals?

Genuine Parts Company (GPC) maintains a robust competitive position, primarily through its extensive distribution network and strong brand recognition, especially within the automotive aftermarket. The company's strategic focus on operational efficiency and continuous adaptation to market changes has allowed it to sustain a competitive edge. GPC's ability to efficiently deliver a wide array of products across multiple geographies is a key differentiator in the marketing strategy of Genuine Parts.

GPC's competitive advantages are deeply rooted in its diversified business model, which includes automotive parts, industrial parts, and office product distribution. This diversification helps mitigate risks associated with reliance on a single market segment. Recent strategic moves, such as acquisitions and investments in technology, have strengthened its market position and expanded its global footprint.

The company's long-standing relationships with suppliers and customers, combined with its continuous adaptation, contribute to the sustainability of these advantages. GPC's focus on enhancing customer service and optimizing inventory management through technology further solidifies its operational efficiencies. The company's ability to navigate market dynamics and adapt to emerging trends is crucial for maintaining its competitive edge.

GPC's broad distribution network, particularly through NAPA AUTO PARTS and Motion, enables efficient delivery of a wide range of products. This extensive reach allows GPC to serve a diverse customer base effectively. The company's logistical capabilities are a significant advantage in the competitive landscape.

The NAPA brand enjoys strong recognition and customer loyalty within the automotive aftermarket. This brand recognition, built over decades, provides a competitive edge. Brand strength helps in retaining customers and attracting new ones.

GPC's diversification across automotive, industrial, and office products mitigates market risks. This diversified approach provides stability and allows the company to capitalize on growth opportunities across various sectors. The diversification strategy supports long-term financial performance.

Acquisitions, such as Alliance Automotive Group, have strengthened GPC's market position and global presence. These strategic moves enhance economies of scale and purchasing power. Expansion into new markets is a key growth strategy.

GPC's competitive advantages are multifaceted, including its extensive distribution network, strong brand equity, and diversified business model. These factors enable GPC to maintain a strong position in the GPC competitive landscape. These advantages are crucial for sustained growth and profitability.

- Extensive distribution network, particularly through NAPA and Motion, ensures efficient product delivery.

- Strong brand recognition and customer loyalty, especially within the automotive aftermarket.

- Diversified business model across multiple sectors reduces risk and enhances growth opportunities.

- Strategic acquisitions that strengthen market position and expand global footprint.

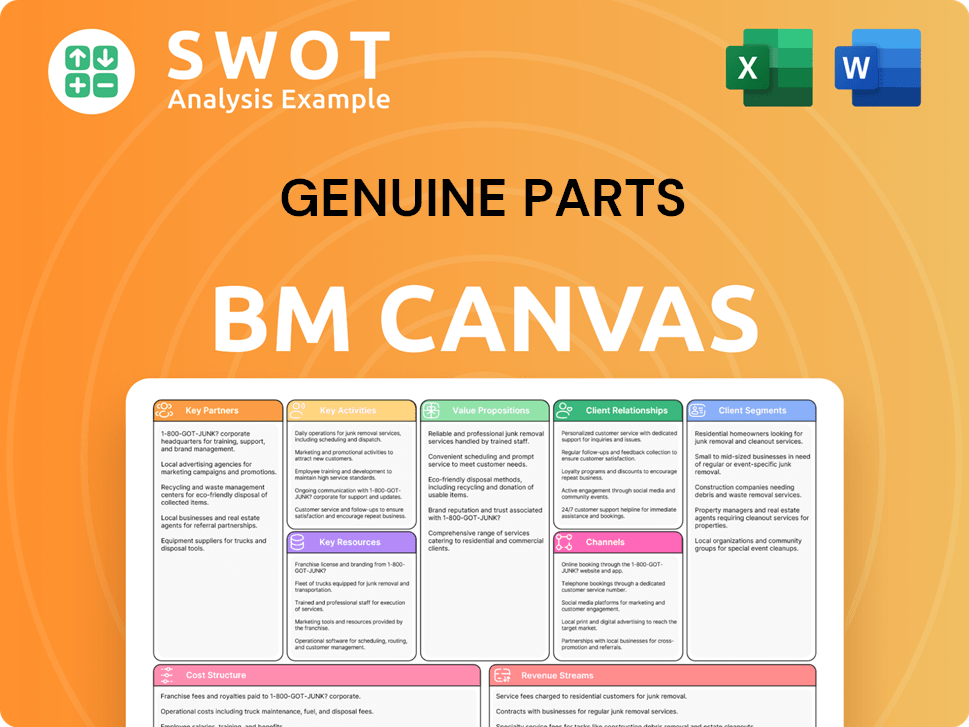

Genuine Parts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Genuine Parts’s Competitive Landscape?

The competitive landscape for Genuine Parts Company (GPC) is significantly influenced by industry trends and shifts in consumer behavior. The automotive parts market and industrial supply sectors are experiencing technological advancements and evolving customer preferences, necessitating strategic adaptations. Understanding these dynamics is crucial for assessing GPC's competitive landscape and future prospects.

Navigating this environment requires GPC to address potential risks while capitalizing on emerging opportunities. Key areas of focus include digital transformation, diversification, and supply chain optimization. The company's ability to adapt and innovate will determine its success in the face of changing market conditions and heightened competition.

The automotive parts market is evolving with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). The industrial sector is increasingly embracing automation and digitalization. Consumer preferences are shifting towards sustainability, convenience, and e-commerce.

Intensified competition from online retailers and direct-to-consumer models poses a threat. Economic downturns and supply chain disruptions can impact demand. Adapting to EV technology and evolving consumer expectations presents significant challenges.

Growth in emerging markets offers expansion potential. Product innovations, such as advanced materials and smart components, provide avenues for diversification. Strategic partnerships can enhance service offerings and market reach.

GPC is expected to focus on digital transformation to enhance its online presence. Diversification into new product categories is essential. Continued optimization of its global supply chain is a priority.

GPC faces the challenge of intensified competition, particularly from online retailers and direct-to-consumer models. To maintain its market position, the company is focusing on digital transformation, diversification into new product categories, and supply chain optimization.

- Digital Transformation: Enhancing online presence and e-commerce capabilities.

- Diversification: Expanding into EV-specific components and industrial MRO solutions.

- Supply Chain Optimization: Streamlining operations to improve efficiency and reduce costs.

- Strategic Partnerships: Collaborating with technology providers.

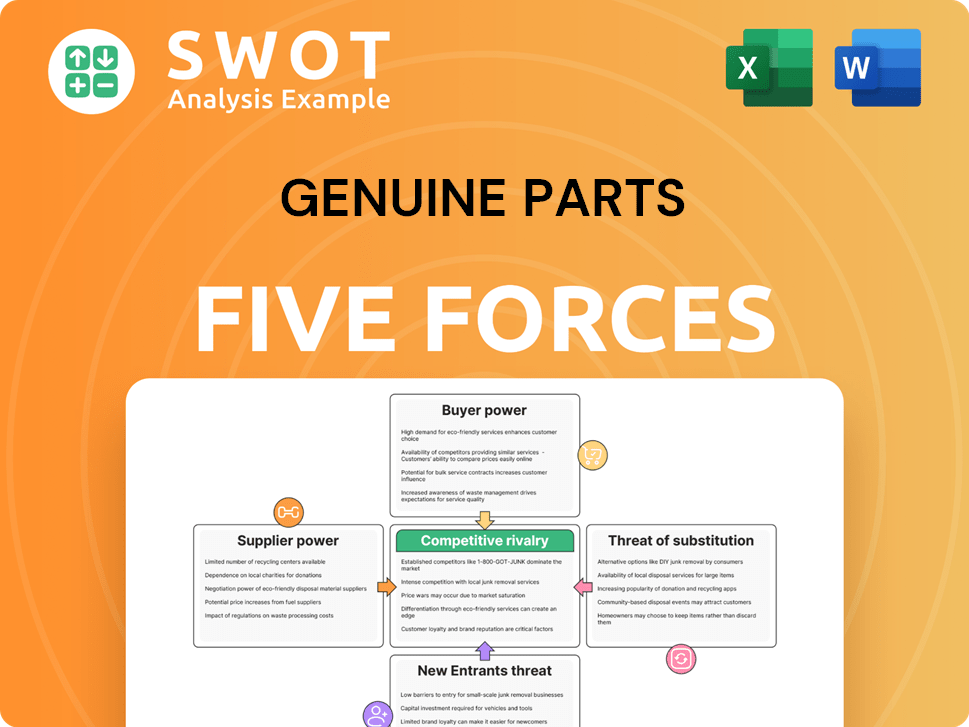

Genuine Parts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Genuine Parts Company?

- What is Growth Strategy and Future Prospects of Genuine Parts Company?

- How Does Genuine Parts Company Work?

- What is Sales and Marketing Strategy of Genuine Parts Company?

- What is Brief History of Genuine Parts Company?

- Who Owns Genuine Parts Company?

- What is Customer Demographics and Target Market of Genuine Parts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.