Genuine Parts Bundle

Who Buys from Genuine Parts Company?

Understanding the Genuine Parts SWOT Analysis reveals the importance of knowing its customers. Genuine Parts Company (GPC) has evolved from its early days to become a global force in distribution. This evolution highlights the need to understand its current customer demographics and target market to maintain its competitive edge. Identifying GPC's ideal customer profile is key to its continued success.

This analysis explores the customer demographics and target market of Genuine Parts Company, offering insights into its market segmentation and customer profile. We'll examine the geographic location of GPC's target market, the age range of GPC customers, and the income levels of Genuine Parts Company customers. Furthermore, we'll investigate what industries GPC serves and how it defines its target market, including the purchasing behaviors and buying habits of GPC customers.

Who Are Genuine Parts’s Main Customers?

Understanding the Brief History of Genuine Parts Company's customer base is crucial for strategic planning. The company, also known as GPC, operates across two main segments: Automotive Parts and Industrial Parts. Analyzing the customer demographics and target market helps tailor products and services, ensuring sustained growth and market relevance.

GPC's customer base is diverse, spanning both business-to-business (B2B) and business-to-consumer (B2C) segments. The Automotive segment accounted for approximately 63% of total net sales in 2024, while the Industrial segment represented 37%. This market segmentation highlights GPC's broad reach and ability to serve various customer profiles effectively. Understanding the nuances of each segment is key to optimizing sales and marketing efforts.

The Automotive segment's customer demographics include independent repair shops, car dealerships, and DIY consumers. Demand is influenced by factors like vehicle miles driven and the total number of vehicles in operation (car parc). The increasing average age of vehicles on the road boosts demand for repair and maintenance products, favoring GPC's "Do-It-For-Me" (DIFM) channel. The Industrial Parts Group serves industries like equipment manufacturing, food and beverage, and mining.

The automotive segment includes independent repair shops, car dealerships, and DIY consumers. This segment benefits from the increasing average age of vehicles on the road. The "Do-It-For-Me" (DIFM) channel is expected to see significant growth due to the complexity of newer vehicles.

The industrial segment caters to various industries such as equipment manufacturing, food and beverage, and mining. These customers seek industrial replacement parts and value-added solutions. In 2024, the industrial sales declined by 1.2%, reflecting challenges in global manufacturing.

GPC's target market analysis reveals a focus on both B2B and B2C customers. The customer profile varies across the automotive and industrial segments, each with distinct needs and purchasing behaviors. Understanding these differences is crucial for effective customer segmentation strategies.

- Automotive: Independent repair shops, car dealerships, and DIY consumers.

- Industrial: Equipment manufacturers, food and beverage companies, and mining operations.

- Geographic Location: Primarily North America, with a growing international presence.

- Purchasing Behaviors: Driven by the need for replacement parts, maintenance, and value-added solutions.

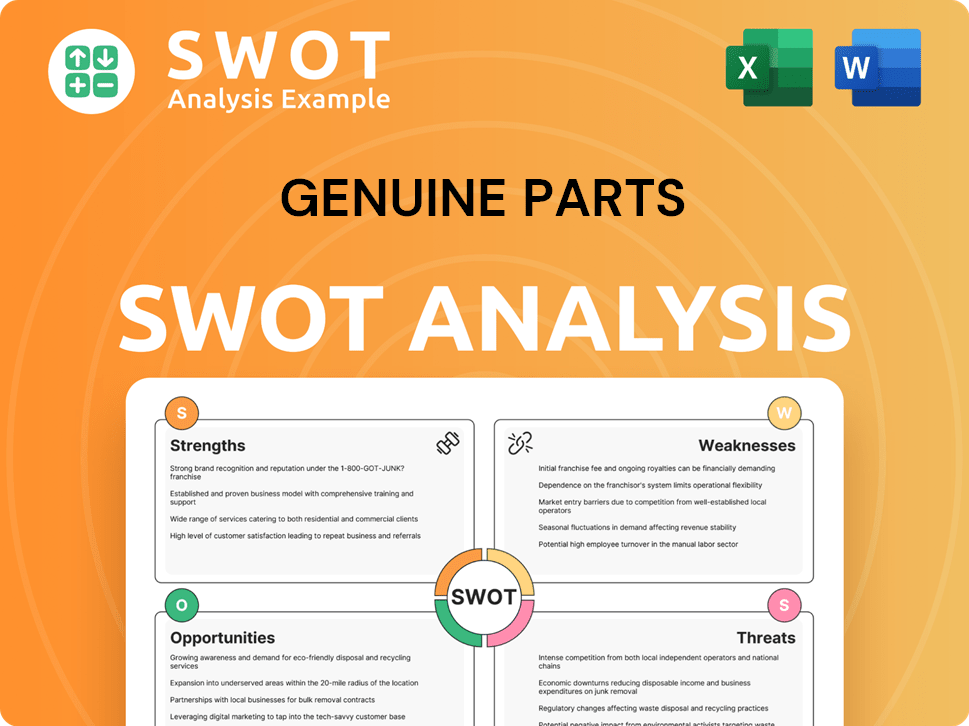

Genuine Parts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Genuine Parts’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For Owners & Shareholders of Genuine Parts, this involves a deep dive into the various customer segments and their specific demands. This analysis helps in tailoring products, services, and marketing strategies to meet and exceed customer expectations.

The customer base of Genuine Parts Company (GPC) is diverse, spanning both automotive and industrial sectors. Each segment has unique needs, influenced by factors like the nature of their business, the types of vehicles or equipment they operate, and their priorities in terms of cost, quality, and convenience.

GPC's approach to customer satisfaction involves a focus on reliability, availability, and expertise. This focus is supported by its extensive distribution network and a wide assortment of replacement parts, ensuring that customers can quickly obtain the parts they need to keep their operations running smoothly.

Automotive customers are primarily concerned with the quality of parts to ensure vehicle safety and performance. Repair shops and mechanics (B2B) prioritize fast delivery, a broad product range, and technical support. DIY customers often look for ease of installation, clear instructions, and competitive pricing.

Industrial customers require durable, high-performance parts to minimize operational disruptions and extend equipment lifespan. They seek specialized solutions, technical expertise, and efficient supply chain management. Immediate access to a vast inventory and reliable delivery are key factors.

GPC addresses customer pain points by providing immediate access to a vast inventory, especially for older or specialized equipment. Reliable delivery is also crucial to minimize operational downtime. The company's focus on supply chain and technology modernization aims to enhance its competitive edge and improve customer experience.

GPC leverages its extensive distribution network and industry-leading assortment of replacement parts to maintain its competitive edge. The company's investment in digital innovation and data-driven strategies further enhances its ability to meet customer needs effectively.

GPC customizes its offerings, such as the NAPA Rewards program, to cater to the distinct needs of its diverse customer base. This program provides tiered rewards for both commercial accounts and retail customers, including points redeemable for discounts, merchandise, or tools.

GPC's market segmentation strategy is based on understanding the specific needs of each customer group. This includes automotive customers (repair shops, mechanics, and DIYers) and industrial customers. This segmentation allows GPC to provide tailored products and services.

The primary needs of GPC customers are reliability, availability, and expertise. These needs are met through a focus on quality parts, fast delivery, technical support, and a wide product range. GPC's ability to meet these needs is supported by its extensive distribution network, loyalty programs, and investments in technology.

- Quality and Reliability: Customers prioritize parts that ensure safety and performance.

- Availability and Speed: Quick access to parts and fast delivery are crucial, especially for repair shops.

- Technical Support: Customers value expert advice and assistance.

- Competitive Pricing: Customers seek value for their investment.

- Ease of Use: DIY customers prefer easy-to-install parts with clear instructions.

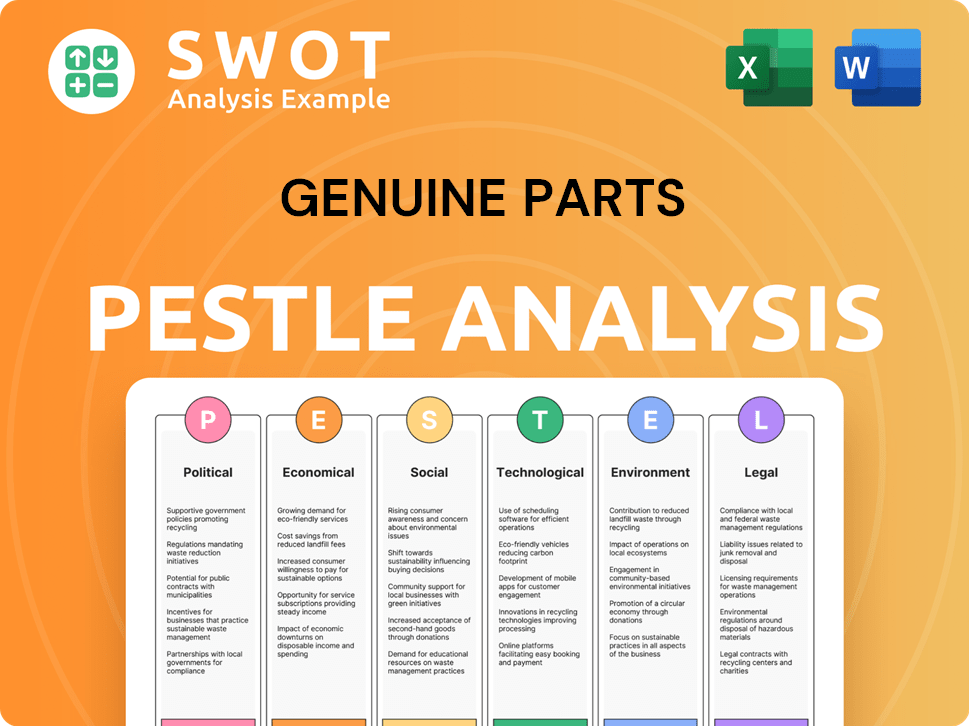

Genuine Parts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Genuine Parts operate?

The geographical market presence of the company is extensive, with operations spanning over 10,700 locations across 17 countries. This wide reach allows the company to serve a diverse customer base and capitalize on global market opportunities. The company's strategic positioning in key regions is a critical component of its overall business strategy.

The company's primary markets include North America, Europe, and Australasia. In 2024, North America generated 74% of the company's total revenue, Europe contributed 16%, and Australasia accounted for 10%. This distribution highlights the importance of these regions to the company's financial performance and market segmentation.

The company's commitment to localizing its offerings and marketing strategies is key to its success in diverse markets. This approach allows it to meet the specific needs of customers in different regions. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Genuine Parts.

In North America, the company's automotive business operates in the U.S., Canada, and Mexico. The industrial parts group also serves customers in these countries. The company has strong market share and brand recognition, particularly with its NAPA brand in the U.S. and Canada.

The European market accounts for a significant portion of the company's revenue, with ongoing efforts to optimize operations and expand its market presence. The company adapts its offerings to align with the specific demands and regulatory environments within European countries.

Australasia, including Australia and New Zealand, represents a key market for the company. The company tailors its product assortments and marketing campaigns to suit the regional vehicle models and industrial equipment prevalent in this area.

Recent strategic initiatives include the consolidation of the NAPA (U.S.) and UAP (Canada) automotive divisions. These efforts aim to improve operational efficiencies, such as streamlined inventory management, and create cross-selling opportunities. The company is continuously working to strengthen its core North American automotive markets.

The industrial segment faced challenges in 2024 due to global manufacturing weaknesses. However, the company anticipates overall sales growth of approximately 2% in 2025. This growth is expected to be driven by low single-digit inflationary pricing and flat to modestly positive comparable sales.

The company's customer base includes a wide range of businesses and individuals. The automotive segment serves both professional repair shops and do-it-yourself (DIY) customers, while the industrial segment caters to various industries that require replacement parts and maintenance services. The company's target market is defined by its ability to provide high-quality parts and services.

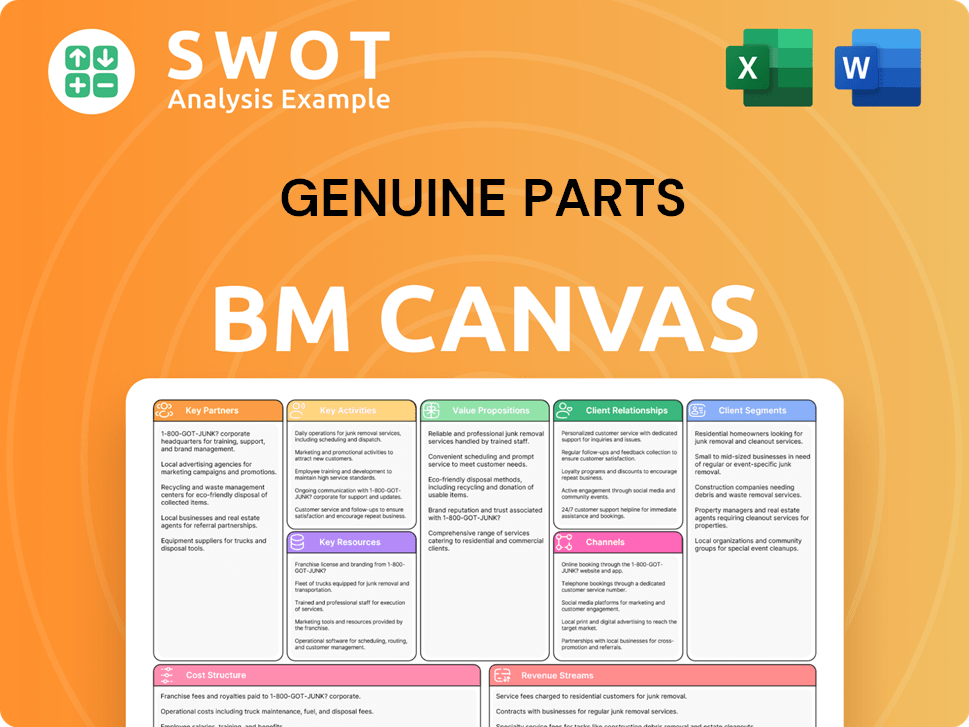

Genuine Parts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Genuine Parts Win & Keep Customers?

Genuine Parts Company (GPC) employs a multi-faceted approach to acquire and retain customers, leveraging its extensive network and diverse product offerings. For customer acquisition, GPC utilizes a combination of traditional and digital marketing channels. Its strong brand recognition, particularly through NAPA in the automotive sector, serves as a significant draw. The company also focuses on strategic acquisitions to expand its market presence and product offerings, which contributed significantly to its sales growth in 2024.

Customer retention is a key focus for GPC, and loyalty programs play a vital role. The NAPA Rewards program, for example, offers tiered benefits to both commercial and retail customers, allowing them to earn points on purchases redeemable for discounts, merchandise, or tools. This incentivizes repeat business and fosters loyalty. The company also emphasizes personalized experiences and strong after-sales service, which are crucial in both the automotive and industrial sectors.

GPC is increasingly investing in technology and digital platforms to improve customer accessibility and streamline operations. This aligns with broader industry trends in the automotive aftermarket, where digital channels are becoming increasingly important for customer engagement and sales. The company's restructuring efforts, expected to yield $200 million in savings by 2026, also aim to improve efficiency and profitability, which indirectly supports customer satisfaction through better service and competitive pricing.

GPC strategically acquires businesses to expand its market reach and product portfolios. These acquisitions significantly contribute to sales growth. For instance, acquisitions provided a 4.6% benefit to Global Automotive sales in 2024, demonstrating the effectiveness of this strategy.

Loyalty programs, like NAPA Rewards, are central to customer retention. These programs offer tiered benefits, encouraging repeat purchases. Customers earn points redeemable for various incentives, fostering long-term customer relationships and driving customer loyalty.

GPC invests in technology and digital platforms to enhance customer accessibility and streamline operations. This includes improving online ordering and customer service. This digital shift is vital in the evolving automotive aftermarket landscape and aligns with modern customer expectations.

Restructuring efforts, expected to save $200 million by 2026, aim to improve efficiency and profitability. These savings indirectly benefit customers through better service and competitive pricing. This cost-saving strategy enhances overall customer satisfaction.

GPC's approach to customer acquisition and retention is multifaceted, focusing on brand recognition, strategic acquisitions, and customer loyalty. These strategies are crucial for sustained growth and market leadership. For more insights, explore the Marketing Strategy of Genuine Parts.

- Brand Recognition: Leveraging strong brands like NAPA to attract customers.

- Strategic Acquisitions: Expanding market presence and product offerings.

- Loyalty Programs: Incentivizing repeat business through rewards.

- Digital Transformation: Enhancing customer accessibility and operational efficiency.

- Operational Efficiency: Improving service and pricing through cost savings.

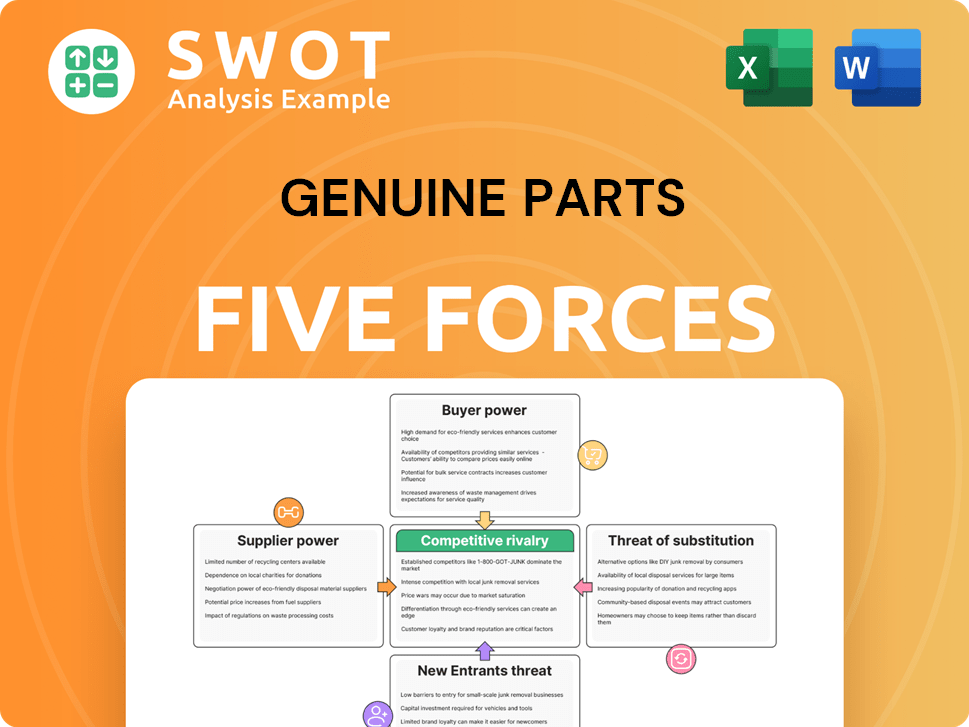

Genuine Parts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Genuine Parts Company?

- What is Competitive Landscape of Genuine Parts Company?

- What is Growth Strategy and Future Prospects of Genuine Parts Company?

- How Does Genuine Parts Company Work?

- What is Sales and Marketing Strategy of Genuine Parts Company?

- What is Brief History of Genuine Parts Company?

- Who Owns Genuine Parts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.