Genuine Parts Bundle

How Does Genuine Parts Company Thrive in the Parts Market?

Genuine Parts Company (GPC) is a global leader in the automotive and industrial parts distribution, but how does this company, with roots dating back to 1928, maintain its dominance? GPC's extensive Genuine Parts SWOT Analysis reveals its strengths and opportunities in a competitive market. Understanding GPC's operational model is key to appreciating its enduring success.

With its massive distribution network, GPC, including its NAPA Auto Parts brand, plays a crucial role in the automotive industry. Its robust supply chain ensures that mechanics and DIY enthusiasts have access to the parts they need. This in-depth analysis will explore the intricacies of GPC's business model, from its distribution centers to its customer base, providing insights into its financial performance and future prospects.

What Are the Key Operations Driving Genuine Parts’s Success?

Genuine Parts Company (GPC) excels in distributing automotive and industrial replacement parts, creating substantial value for its customers. The company's core operations revolve around a sophisticated supply chain and an extensive distribution network. This allows GPC to efficiently supply a wide array of parts, ensuring readily available products and expert advice.

In the automotive sector, GPC operates primarily through the NAPA Auto Parts brand, offering a comprehensive range of parts. The industrial segment, mainly through Motion, provides parts and services to various industries. This dual approach allows GPC to serve diverse customer needs, from individual vehicle owners to large industrial operations.

GPC's value proposition lies in its ability to offer high-quality parts, technical support, and efficient delivery. This operational excellence leads to reduced downtime for vehicles and machinery, contributing to its strong market position. Understanding the Owners & Shareholders of Genuine Parts is key to appreciating the company's success.

GPC's robust supply chain and distribution network are central to its operations. The company utilizes centralized and regional distribution centers, along with a vast network of retail stores and branches, to ensure timely delivery. The ability to source a wide range of products from numerous suppliers globally is a significant advantage.

Customers benefit from readily available parts, reduced downtime, and expert advice. GPC's hybrid model, combining company-owned stores and independently owned NAPA AUTO PARTS stores, allows for broad market penetration and local responsiveness. This approach enhances customer service and satisfaction.

In recent reports, GPC has demonstrated consistent financial performance. For example, in 2024, GPC reported net sales of approximately $23.9 billion. The company's automotive parts segment accounted for a significant portion of this revenue. GPC's distribution network includes over 10,000 locations across North America, demonstrating its extensive reach.

- GPC's automotive parts segment consistently generates a substantial portion of the company's revenue.

- The industrial parts segment, through Motion, contributes significantly to overall sales.

- GPC's market capitalization reflects its strong position in the automotive and industrial parts markets.

- The company's commitment to customer service and efficient operations drives its financial success.

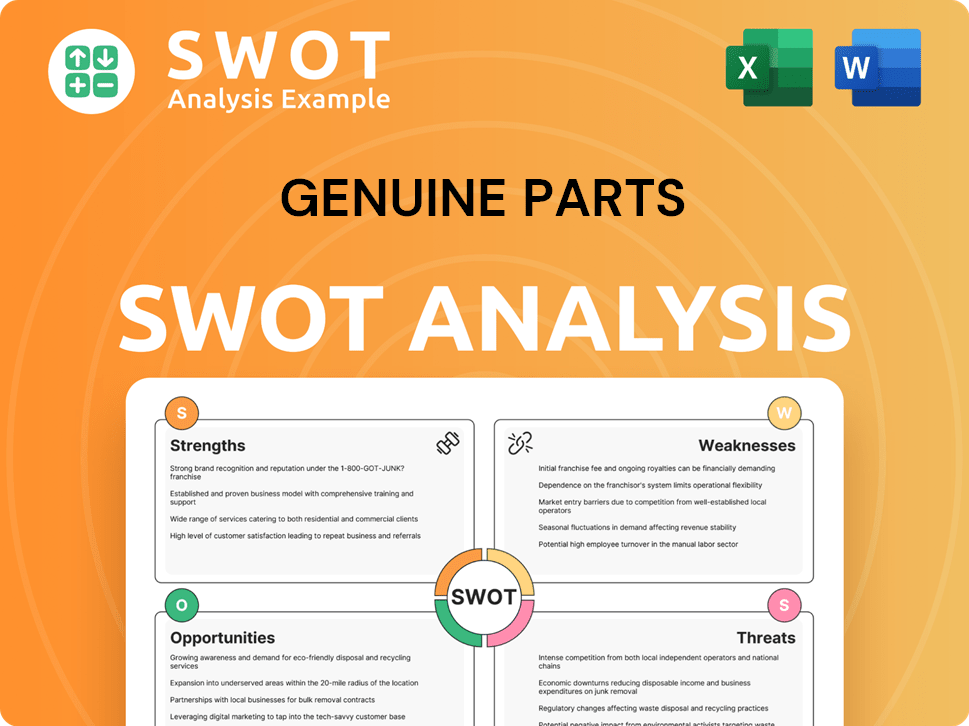

Genuine Parts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Genuine Parts Make Money?

Genuine Parts Company (GPC) generates revenue primarily through the sale of automotive and industrial replacement parts. This approach is straightforward, focusing on volume-based sales and competitive pricing. The company benefits from the consistent demand for replacement parts in both the automotive and industrial sectors.

In fiscal year 2023, GPC reported total sales of $23.1 billion. The company's revenue streams are well-defined, with a significant portion coming from the automotive segment. This is supported by its extensive distribution network and supply chain.

The automotive segment is the larger contributor, with sales of $14.4 billion in 2023, representing approximately 62% of total sales. The industrial segment contributed $8.7 billion in sales, accounting for roughly 38% of total sales in the same period. Its business model is built on direct product sales, with strategies including a comprehensive product catalog and value-added services.

GPC employs several strategies to monetize its operations, primarily through direct product sales. The focus is on maintaining competitive pricing and ensuring product availability. GPC also offers value-added services to encourage customer loyalty and repeat business.

- Volume-Based Sales: The core strategy involves selling a high volume of automotive and industrial parts.

- Competitive Pricing: Maintaining competitive prices is crucial to attract and retain customers in a competitive market.

- Product Availability: Ensuring a wide range of parts is available to meet customer needs promptly.

- Value-Added Services: Providing services such as technical support and delivery options enhances customer satisfaction.

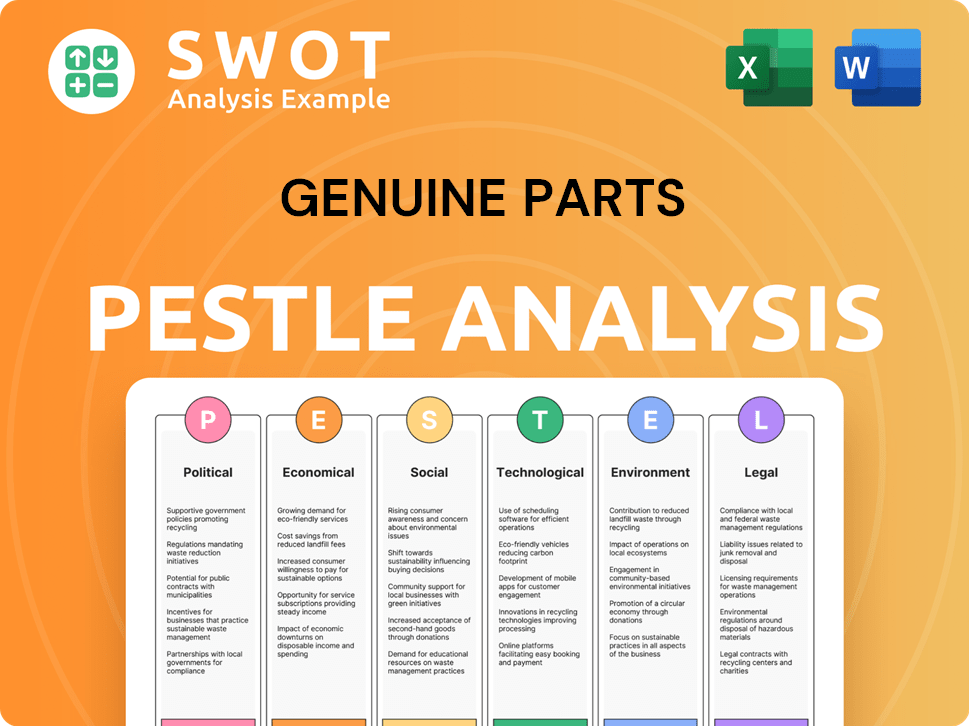

Genuine Parts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Genuine Parts’s Business Model?

Genuine Parts Company (GPC) has a rich history of strategic growth and operational excellence. Its journey is marked by significant milestones, including key acquisitions and expansions that have solidified its position in the automotive parts and industrial distribution sectors. These strategic moves have enabled GPC to adapt to changing market dynamics and maintain a competitive edge.

A core strategy for GPC has been its consistent acquisition approach, which has expanded its geographic reach and product offerings. This has been a key driver of its growth, illustrated by its acquisition of Alliance Automotive Group (AAG) in Europe in 2017. This acquisition significantly bolstered its international automotive footprint. In 2023, GPC demonstrated its continued growth trajectory, with net sales increasing by 4.4% to $23.1 billion, and diluted earnings per share from continuing operations reaching $9.21.

The company has successfully navigated various operational challenges, including supply chain disruptions. GPC’s robust distribution network and inventory management capabilities have been crucial in mitigating these challenges. GPC's ability to adapt and innovate has been critical to its success, allowing it to maintain a strong market position and deliver value to its stakeholders. For more insights, you can explore the Competitors Landscape of Genuine Parts.

GPC's journey includes significant acquisitions and expansions. The 2017 acquisition of Alliance Automotive Group (AAG) in Europe was a strategic move. In 2023, GPC achieved net sales of $23.1 billion, demonstrating its continued financial growth.

GPC focuses on acquisitions to expand its global presence and product lines. The company adapts to changing market trends, such as the increasing complexity of vehicle technology. GPC is committed to expanding its product lines and ensuring its workforce is equipped with the necessary expertise.

GPC benefits from strong brand recognition, particularly with NAPA Auto Parts, fostering customer loyalty. The scale of its operations allows for economies of scale in purchasing and distribution. Its extensive product catalog and sector diversification provide stability.

GPC has a robust distribution network and inventory management capabilities. These capabilities are crucial in mitigating supply chain disruptions. The company's ability to manage and adapt to challenges has been key to its success.

GPC's competitive advantages include strong brand recognition, particularly with NAPA Auto Parts, which fosters significant customer loyalty. The scale of operations enables economies of scale in purchasing and distribution, providing a significant competitive edge. Furthermore, GPC’s extensive product catalog and its ability to serve both the automotive aftermarket and industrial sectors provide diversification and stability.

- Strong Brand Recognition: NAPA Auto Parts is a well-known and trusted brand.

- Economies of Scale: Large-scale operations lead to cost efficiencies.

- Diversified Portfolio: Serving both automotive and industrial sectors provides stability.

- Robust Distribution Network: Efficiently manages supply chain challenges.

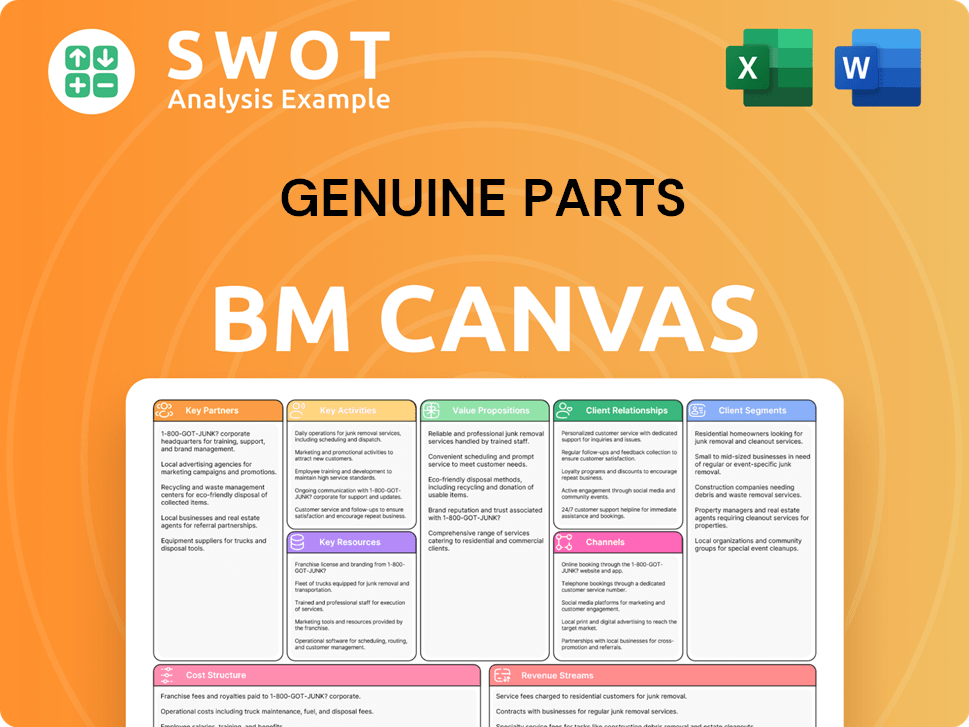

Genuine Parts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Genuine Parts Positioning Itself for Continued Success?

Genuine Parts Company (GPC) holds a strong position in the automotive and industrial replacement parts distribution markets. In the automotive aftermarket, the NAPA Auto Parts brand is a key player, supported by a vast distribution network. The industrial sector sees GPC, through its Motion business, as a significant distributor of industrial parts and supplies, competing with other major distributors.

GPC’s market share is substantial, with a global presence across North America, Australasia, and Europe. This is supported by strong customer loyalty, built on reliability and product availability. The company’s ability to efficiently manage its supply chain and distribution network is critical to its success in these competitive markets. For a deeper dive into the company's mission, consider reading about the Growth Strategy of Genuine Parts.

GPC is a leading distributor in both the automotive and industrial parts markets. NAPA Auto Parts is a dominant brand in the automotive aftermarket. Motion is a key distributor in the industrial sector.

Economic downturns, competitive pressures, and technological shifts pose risks. The shift towards electric vehicles could impact demand for traditional automotive parts. Regulatory changes also present potential challenges.

GPC is focused on strategic initiatives to sustain and expand revenue. This includes supply chain investments, leveraging technology, and strategic acquisitions. The company aims to drive operational excellence.

In 2024, the company reported revenue of approximately $23.3 billion. The automotive parts segment accounted for roughly $16.1 billion of the total revenue. The industrial parts segment contributed around $7.2 billion.

GPC continues to invest in its supply chain to improve efficiency. Technology is being leveraged to enhance operations and customer service. Strategic acquisitions are a key part of expanding market presence and product offerings.

- Continued investment in supply chain efficiency and expansion.

- Leveraging technology for operational improvements.

- Strategic acquisitions to broaden market reach and product lines.

- Focus on customer service and satisfaction.

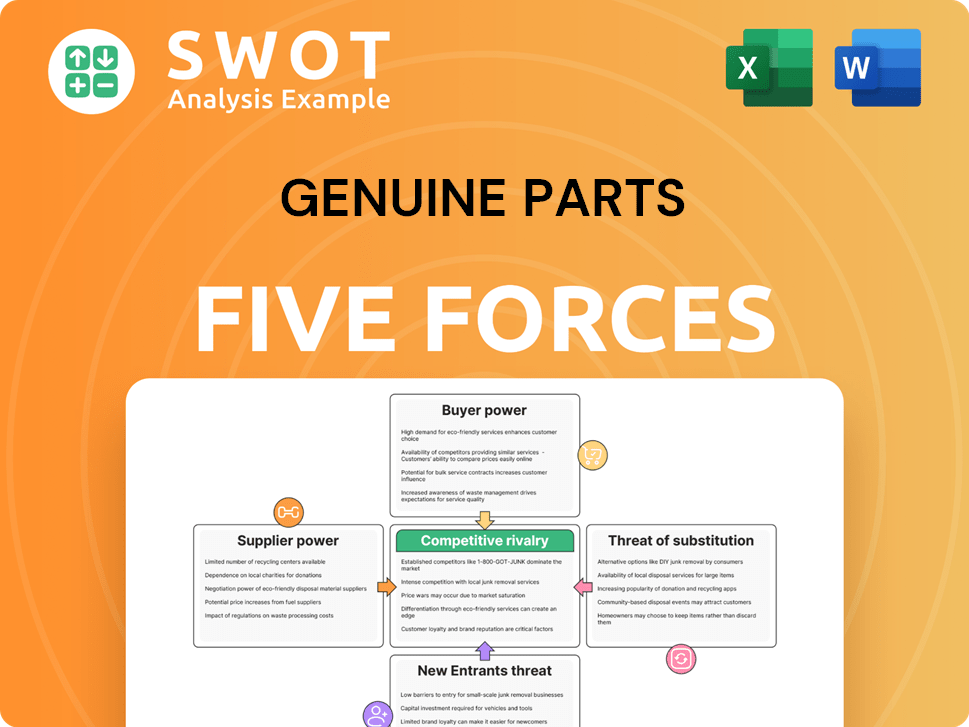

Genuine Parts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Genuine Parts Company?

- What is Competitive Landscape of Genuine Parts Company?

- What is Growth Strategy and Future Prospects of Genuine Parts Company?

- What is Sales and Marketing Strategy of Genuine Parts Company?

- What is Brief History of Genuine Parts Company?

- Who Owns Genuine Parts Company?

- What is Customer Demographics and Target Market of Genuine Parts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.