GoTo Bundle

How Did GoTo Become a Southeast Asian Tech Giant?

The story of the GoTo company is a compelling narrative of innovation and strategic adaptation within Southeast Asia's rapidly evolving digital sphere. From its humble beginnings as a ride-hailing service, GoTo has remarkably transformed into Indonesia's largest digital ecosystem. This journey showcases the company's ability to leverage technology to address everyday challenges, ultimately shaping its current market position.

The GoTo SWOT Analysis provides a comprehensive overview of the company's strengths, weaknesses, opportunities, and threats, offering valuable insights into its strategic positioning. Understanding the brief history of GoTo Group, including its significant GoTo acquisitions and the GoTo IPO, is crucial for grasping its influence. Exploring the GoTo company timeline reveals key milestones in its evolution, from its early days to its current status as a major player in the digital economy.

What is the GoTo Founding Story?

The GoTo company's origin story begins with the founding of Gojek on October 26, 2010, in Jakarta, Indonesia. Nadiem Makarim, the founder, saw a problem in the informal transportation sector. He aimed to create a more reliable and standardized service using technology.

Initially, Gojek operated as a call center, connecting customers with motorcycle taxi drivers. This was a far cry from the app-based platform that would later define the company. The early days were about convincing both drivers and consumers to adopt a new approach to transportation.

The initial funding came from Makarim's personal savings and support from friends and family. The name 'Gojek' combines 'Ojek' (motorcycle taxi) and 'Go,' reflecting the company's mission of movement and progress. The founding team's understanding of local market needs and commitment to using technology for social impact drove the company forward.

The GoTo Group's roots are firmly planted in the establishment of Gojek. This early phase was crucial for understanding the market and laying the groundwork for future growth.

- Founded in 2010, Gojek started as a call center.

- Nadiem Makarim identified inefficiencies in Indonesia's informal transportation sector.

- The initial focus was on connecting customers with motorcycle taxi drivers.

- Early funding came from personal savings and support networks.

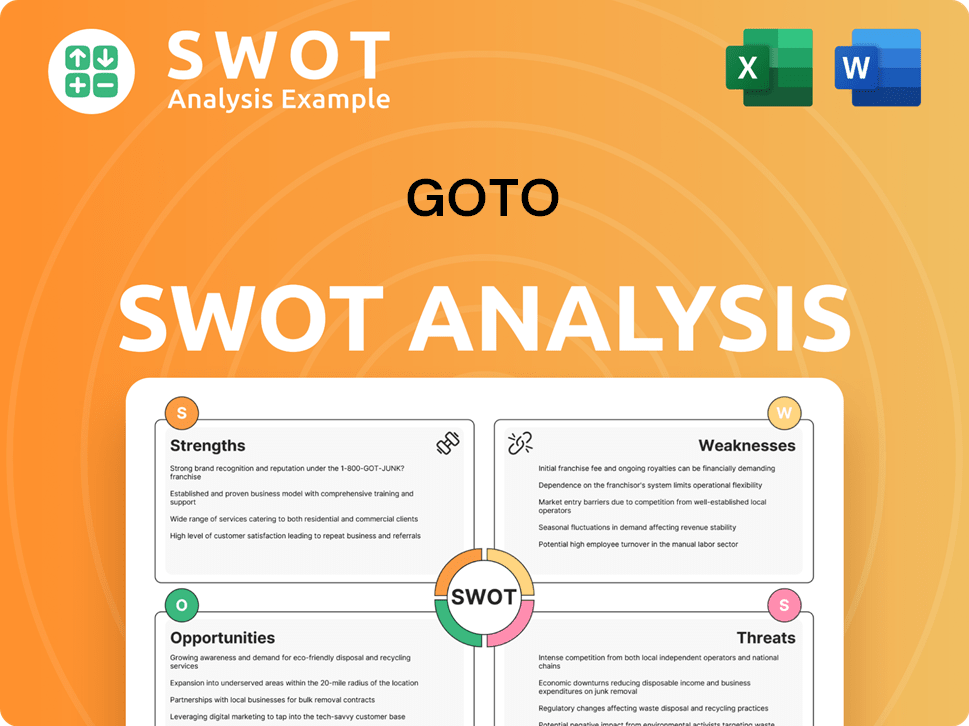

GoTo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of GoTo?

The early growth of the GoTo company, formerly known as Gojek, was marked by significant milestones. The launch of its mobile application in January 2015 was a crucial turning point. This technological shift from a call-center model dramatically improved the ordering process, leading to a surge in users and drivers. The company quickly expanded its offerings beyond ride-hailing, embracing a super-app model.

The GoTo company's journey began with the launch of its mobile application in January 2015. This marked a shift from a call-center model to a technology-driven platform. The application streamlined the ordering process, attracting a large number of users and drivers.

By 2016, Gojek secured significant funding, including a Series A round led by Sequoia Capital. These investments enabled aggressive expansion and product development. This early financial backing was crucial for the GoTo company's rapid growth.

The GoTo company rapidly expanded its driver-partner network and user base across major Indonesian cities. The market response was overwhelmingly positive, addressing urban mobility and logistics needs. The company quickly became a dominant player in the market.

Key acquisitions, such as MVCommerce in 2016, strengthened its position in digital payments, leading to GoPay's development. These strategic moves were vital for the GoTo company's evolution. For more insights, see the Growth Strategy of GoTo.

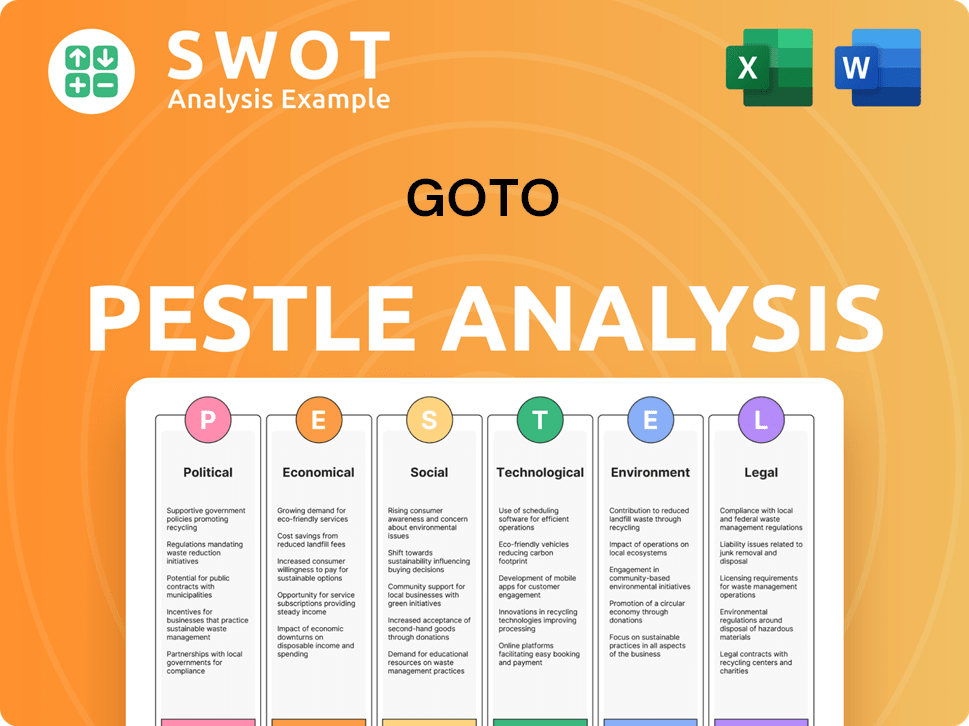

GoTo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in GoTo history?

The GoTo company has marked its journey with significant milestones, notably the merger of Gojek and Tokopedia, which reshaped the digital landscape in Indonesia. This strategic move established the GoTo Group, creating a comprehensive ecosystem that integrates various digital services. The GoTo history showcases a dynamic evolution, adapting to market changes and aiming for sustained growth in a competitive environment.

| Year | Milestone |

|---|---|

| May 2021 | Merger of Gojek and Tokopedia, forming the GoTo Group, the largest digital ecosystem in Indonesia. |

| 2021 | GoTo Financial launched, expanding digital payment solutions and financial inclusion services. |

| 2023 | Strategic partnership with TikTok, where TikTok acquired a controlling stake in Tokopedia. |

GoTo has consistently innovated to enhance its service offerings and expand its market reach. GoTo Financial's development has been a key innovation, providing digital payment solutions, lending, and insurance services, which has significantly contributed to financial inclusion. The company's adaptability is further demonstrated through strategic partnerships, such as the one with TikTok, which aims to strengthen its e-commerce business.

GoTo Financial provides digital payment solutions, lending, and insurance services, contributing to financial inclusion.

Integration of ride-hailing, e-commerce, and financial technology services under one umbrella, enhancing user experience.

Forming alliances, such as the partnership with TikTok, to strengthen market position and adapt to changing digital commerce trends.

GoTo faces several challenges, including intense competition in Southeast Asia and the need for sustained profitability. Market downturns and global economic uncertainties have impacted the company's valuation, leading to cost-cutting measures. The company's reported net loss of 90.5 trillion rupiah (approximately $5.7 billion) in 2023, mainly due to a goodwill impairment, underscores the financial pressures it navigates.

Navigating fierce competition from regional rivals in the Southeast Asian tech landscape requires continuous innovation and strategic maneuvering.

Market downturns and global economic uncertainties impact the company's valuation and profitability, necessitating cost-cutting measures.

Achieving sustained profitability remains a key challenge, as demonstrated by the reported net loss of 90.5 trillion rupiah in 2023.

A significant portion of the 2023 losses stemmed from goodwill impairment, reflecting challenges in valuation and market performance.

Adapting to the evolving digital commerce landscape, as seen in the partnership with TikTok, requires strategic adjustments and innovative approaches.

Focusing on optimizing core businesses and exploring new avenues for growth is crucial for navigating financial pressures and achieving sustained success.

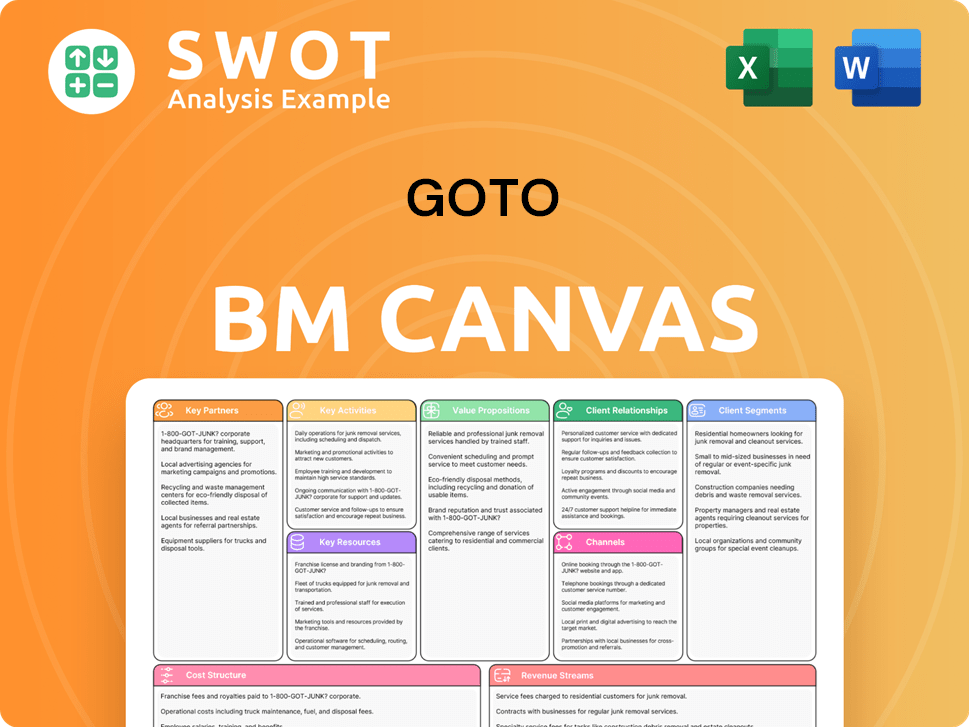

GoTo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for GoTo?

The GoTo company's journey has been marked by significant milestones, from its inception as a motorcycle taxi call center to becoming a leading digital ecosystem in Southeast Asia. The GoTo history reflects a series of strategic moves, including the launch of its mobile app, the introduction of GoPay, international expansion, and the merger with Tokopedia, culminating in its IPO. These developments showcase GoTo's evolution and its impact on the Indonesian digital landscape.

| Year | Key Event |

|---|---|

| 2010 | Gojek was founded by Nadiem Makarim as a call center for motorcycle taxis, marking the GoTo company origin story. |

| 2015 | Gojek launched its mobile application, broadening its services to include Go-Send and Go-Food. |

| 2016 | GoPay was introduced, representing Gojek's entry into digital payments and influencing the GoTo business model history. |

| 2017 | Gojek achieved unicorn status, a significant financial milestone. |

| 2018 | Gojek expanded internationally into Vietnam, Thailand, Singapore, and the Philippines. |

| 2019 | Nadiem Makarim stepped down as CEO to join the Indonesian cabinet; Andre Soelistyo and Kevin Aluwi were appointed co-CEOs, reflecting GoTo company leadership changes. |

| 2021 (May) | Gojek and Tokopedia merged to form GoTo Group, becoming Indonesia's largest digital ecosystem, a key event in GoTo mergers and acquisitions. |

| 2022 (April) | GoTo Group listed on the Indonesia Stock Exchange (IDX) in one of the largest IPOs in Asia, impacting the GoTo company financial history. |

| 2023 (December) | GoTo announced a strategic partnership with TikTok, with TikTok acquiring a controlling stake in Tokopedia, influencing GoTo company recent developments. |

| 2024 (May) | GoTo's market capitalization stood at approximately $4.7 billion, reflecting the GoTo company market performance. |

The partnership with TikTok for Tokopedia is expected to drive significant growth in the e-commerce segment, leveraging TikTok's massive user base. This collaboration aims to integrate e-commerce and social media, enhancing user engagement and sales. This strategic move is a key element in GoTo's growth strategy, focusing on market expansion and user acquisition.

GoTo is prioritizing sustainable profitability by improving operational efficiency and reducing costs. The company aims to streamline its diverse services and optimize resource allocation. This focus is crucial for long-term financial health and investor confidence. The goal is to achieve positive cash flow and demonstrate a clear path to profitability.

GoTo plans to expand its financial technology offerings to further penetrate the Indonesian market. This includes enhancing payment solutions, lending services, and other financial products. The company aims to leverage its existing user base and ecosystem to offer comprehensive financial services. This expansion is vital for increasing revenue streams and user retention.

GoTo's future is closely tied to the ongoing digitalization of Indonesia and its expanding digital economy. The company is focused on providing technology-enabled solutions for everyday challenges. The continued growth of e-commerce, digital payments, and on-demand services in Indonesia will be crucial. For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of GoTo.

GoTo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of GoTo Company?

- What is Growth Strategy and Future Prospects of GoTo Company?

- How Does GoTo Company Work?

- What is Sales and Marketing Strategy of GoTo Company?

- What is Brief History of GoTo Company?

- Who Owns GoTo Company?

- What is Customer Demographics and Target Market of GoTo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.