GoTo Bundle

Who Really Owns GoTo?

The ownership structure of any company dictates its future, and in the fast-paced world of tech, understanding who controls the reins is paramount. The merger of Gojek and Tokopedia to form the GoTo company in 2021 created a digital powerhouse, instantly transforming Indonesia's tech landscape. This article explores the intricate web of GoTo SWOT Analysis and its ownership, offering crucial insights for anyone invested in the company's success.

From its inception, understanding the GoTo company ownership structure has been key to grasping its strategic direction. The GoTo history is a fascinating tale of mergers and acquisitions, with the GoTo parent company evolving significantly since its founding. This deep dive will unravel the influence of key investors and the impact of its public listing, revealing the forces shaping this digital ecosystem.

Who Founded GoTo?

The foundation of the current GoTo company's ownership stems from the individual histories of Gojek and Tokopedia. These two entities, which later merged, each had their own distinct beginnings and early ownership structures. Understanding the origins of both Gojek and Tokopedia is crucial to grasping the evolution of GoTo's ownership.

Gojek was co-founded in 2010 by Nadiem Makarim, Kevin Aluwi, and Michaelangelo Moran. Nadiem Makarim was the driving force behind Gojek's inception, initially starting as a call center for courier and ride-hailing services. Tokopedia, on the other hand, was founded in 2009 by William Tanuwijaya and Leontinus Alpha Edison. These founders initially held a significant portion of the equity in their respective companies, a common practice in early-stage startups.

The early ownership of GoTo is a story of how two major players in Indonesia's digital economy came to be. Both companies, Gojek and Tokopedia, attracted early investment from venture capital firms and angel investors who recognized the potential of Indonesia's digital market. This early investment played a critical role in shaping the ownership structure of the companies.

Early investors in Gojek included NSI Ventures (now Openspace Ventures) and Sequoia Capital. These firms provided crucial early-stage funding.

Tokopedia gained early support from prominent investors such as East Ventures and SoftBank. These investments were key to the company's growth.

Early investments typically involved convertible notes or equity stakes. These were often accompanied by vesting schedules for founders.

The commitment of the founding teams was crucial for attracting subsequent funding rounds. This ensured the companies' continued development.

The initial vision of both founding teams influenced the distribution of control. They maintained significant influence during rapid growth phases.

The merger brought together the ownership structures of Gojek and Tokopedia. This created a new entity with a combined shareholder base.

The early investments in Gojek and Tokopedia played a crucial role in their growth and eventual merger. These investments, often in the form of convertible notes or equity stakes, were instrumental in fueling the companies' expansion. The founders' commitment, along with the backing of early investors, helped to shape the GoTo company's ownership structure. For more insights, you can read about the Marketing Strategy of GoTo.

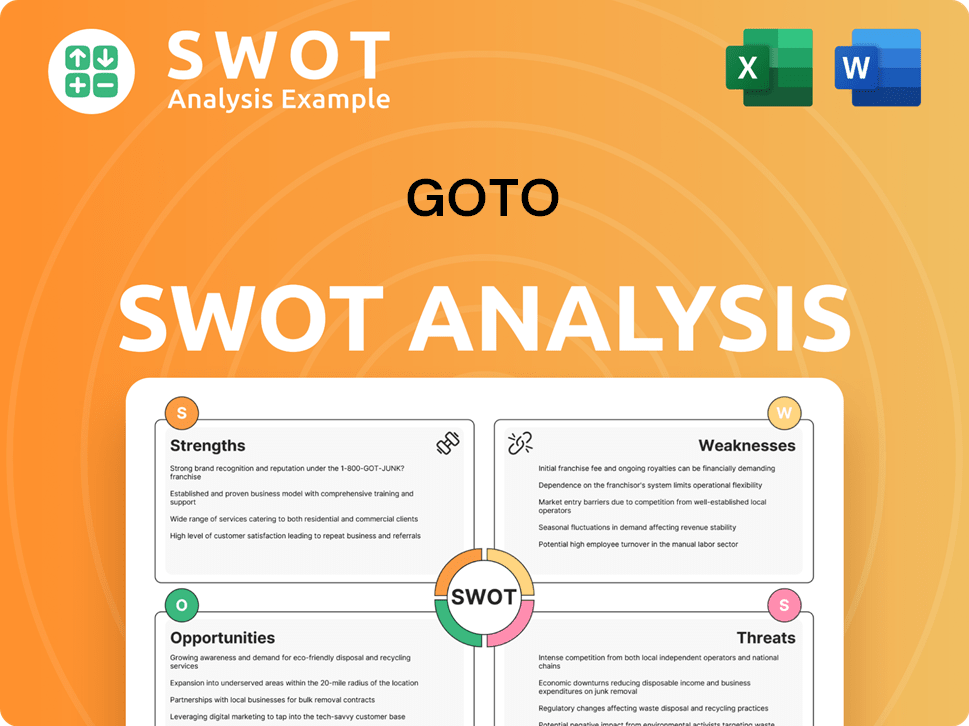

GoTo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has GoTo’s Ownership Changed Over Time?

The evolution of GoTo's ownership has been shaped by significant funding rounds and its eventual public listing. Before the merger, both Gojek and Tokopedia attracted considerable investments from global investors. Gojek received funding from Google, Tencent, KKR, Warburg Pincus, Visa, and PayPal. Tokopedia's major investors included SoftBank Vision Fund, Alibaba Group, and Sequoia Capital. These investment rounds diluted the founders' initial stakes while injecting substantial capital for expansion.

GoTo officially listed on the Indonesia Stock Exchange (IDX) on April 11, 2022, under the ticker GOTO. Its initial public offering (IPO) raised approximately US$1.1 billion, making it one of the largest IPOs in Asia in 2022. The initial market capitalization was around US$28 billion. Post-IPO, the ownership structure diversified significantly, with major institutional investors, mutual funds, and index funds acquiring stakes.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Gojek and Tokopedia Funding Rounds | Dilution of founder stakes; influx of capital from global investors. | Pre-merger |

| GoTo Merger | Creation of a combined entity; consolidation of ownership. | May 2021 |

| IPO on IDX | Diversification of ownership; entry of institutional and retail investors. | April 11, 2022 |

As of early 2024, significant individual shareholders include founders William Tanuwijaya and Leontinus Alpha Edison from Tokopedia, and Kevin Aluwi from Gojek. Major institutional stakeholders include Alibaba Group and SoftBank Vision Fund, which retain significant holdings. As of December 31, 2023, significant beneficial ownership stakes are held by entities such as Alibaba.com Singapore E-Commerce Private Limited and SoftBank Vision Fund (SVF GT Subco (Singapore) Pte. Ltd.). These changes have profoundly impacted GoTo's strategy and governance, with institutional investors often exerting influence through their voting power and engagement with the board.

The ownership structure of GoTo is complex, involving founders and major institutional investors. The IPO in 2022 significantly broadened the shareholder base. Understanding the key stakeholders is crucial for analyzing the company's strategic direction.

- Founders still hold significant shares.

- Alibaba Group and SoftBank Vision Fund are major institutional investors.

- The IPO brought in a diverse group of new investors.

- Institutional investors influence company strategy.

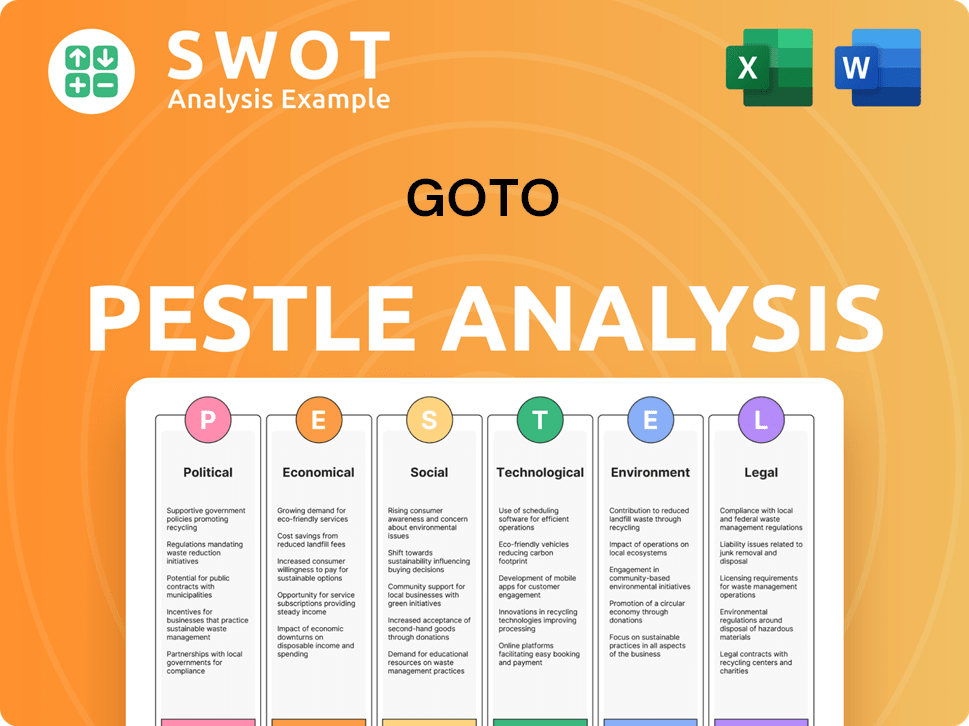

GoTo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on GoTo’s Board?

The current board of directors of the GoTo company includes a mix of representatives from significant shareholders, founders, and independent members. As of early 2024, the board features key figures from its constituent companies and representatives of major investors. Patrick Walujo serves as CEO and a director, while William Tanuwijaya, a co-founder of Tokopedia, holds a position as commissioner. Kevin Aluwi, a co-founder of Gojek, also serves as a commissioner. Independent commissioners are also appointed to ensure governance oversight. This structure aims to balance diverse interests and ensure effective corporate governance within the GoTo company.

The composition of the board reflects the GoTo company's evolution and its commitment to maintaining a balance between founder influence, investor representation, and independent oversight. This balance is crucial for navigating the complexities of the Indonesian tech market and ensuring long-term strategic alignment. The presence of independent commissioners is particularly important for providing unbiased perspectives and ensuring that the interests of all stakeholders are considered in decision-making processes.

| Board Member | Title | Affiliation |

|---|---|---|

| Patrick Walujo | CEO and Director | GoTo |

| William Tanuwijaya | Commissioner | Tokopedia (Co-founder) |

| Kevin Aluwi | Commissioner | Gojek (Co-founder) |

GoTo's voting structure utilizes a multi-voting share (MVS) scheme. This arrangement grants certain shareholders, primarily the founders, disproportionate voting rights compared to their economic ownership. This dual-class share structure allows the founders to maintain significant control over strategic decisions despite their economic dilution over time. Shares held by founders and certain early investors may carry multiple votes per share, while publicly traded shares typically carry one vote per share. This structure is designed to protect the long-term vision and strategic direction set by the founders, safeguarding it from short-term market pressures. The MVS structure significantly shapes decision-making within the company, empowering the founders with continued influence over key strategic initiatives and leadership appointments. This is a common practice among Indonesian tech companies.

The GoTo company's ownership structure involves a multi-voting share scheme. This system gives founders and early investors more voting power than their economic stake. This structure protects the founders' long-term vision.

- Multi-voting shares grant greater control to specific shareholders.

- Founders maintain influence over strategic decisions.

- Publicly traded shares typically have one vote per share.

- The structure is designed to shield the company from short-term market pressures.

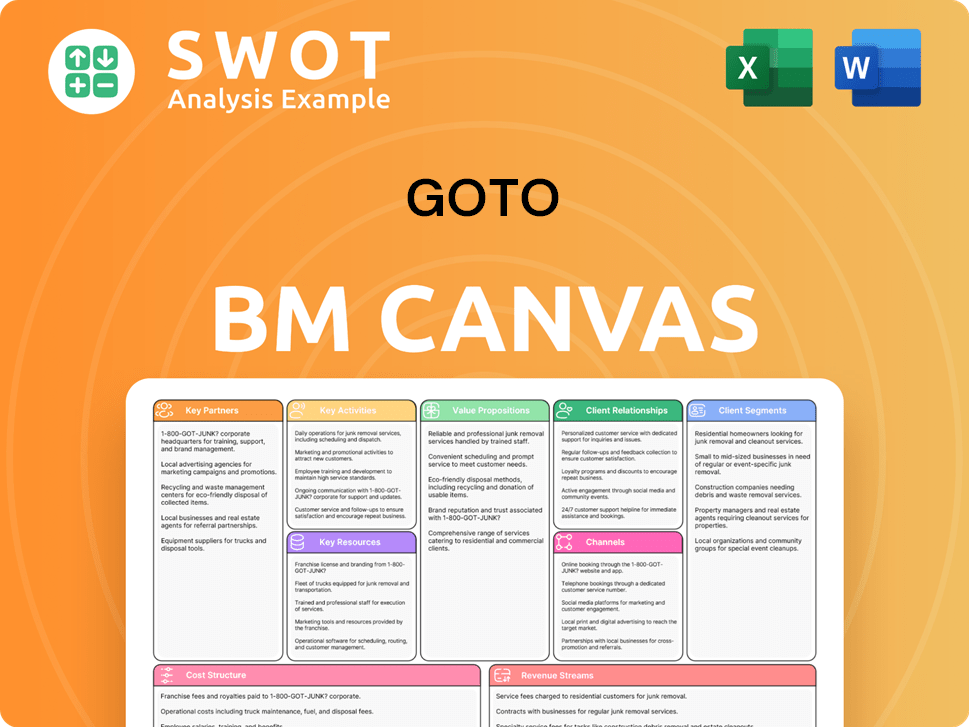

GoTo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped GoTo’s Ownership Landscape?

Over the past few years, the ownership of the GoTo company has seen significant shifts. Following its initial public offering (IPO) in April 2022, the company has navigated a fluctuating global economic climate, influencing its stock performance and ownership dynamics. A major development in early 2024 was the acquisition of Tokopedia by TikTok Shop, a subsidiary of ByteDance. This strategic partnership involved TikTok Shop investing in GoTo's e-commerce arm, Tokopedia, and acquiring a controlling stake, which has altered the ownership structure of GoTo's e-commerce segment.

Another notable trend involves potential founder dilution through further funding rounds or secondary offerings as GoTo continues to seek capital for expansion and innovation. The digital economy's growth potential is recognized by global funds, leading to increased institutional ownership. The focus on profitability and sustainable growth could result in further strategic partnerships or divestitures affecting ownership. Public statements from GoTo's leadership emphasize optimizing operations and achieving profitability, which could influence future ownership changes, including potential share buybacks or additional strategic investments. For instance, the TikTok Shop partnership indicates a significant shift in GoTo's e-commerce ownership and a strategic alignment that could redefine its market position in the coming years.

| Ownership Trend | Details | Impact |

|---|---|---|

| TikTok Shop Acquisition | ByteDance's TikTok Shop acquired a controlling stake in Tokopedia. | Altered the ownership structure of GoTo's e-commerce segment. |

| Founder Dilution | Potential further funding rounds and secondary offerings. | Could dilute the ownership stake of the founders. |

| Institutional Ownership | Increased interest from global funds. | Reflects the long-term growth potential of the digital economy. |

The evolving ownership landscape of GoTo reflects strategic adaptations to the changing market conditions and the pursuit of sustainable growth. The company’s ability to navigate these changes will be crucial for its future success and its investors.

The acquisition of Tokopedia by TikTok Shop in early 2024 significantly reshaped GoTo's e-commerce ownership. This strategic move brought a new major investor into the company.

GoTo is prioritizing operational efficiency and profitability to attract further investment and maintain a strong market position. This focus may influence future ownership changes.

GoTo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GoTo Company?

- What is Competitive Landscape of GoTo Company?

- What is Growth Strategy and Future Prospects of GoTo Company?

- How Does GoTo Company Work?

- What is Sales and Marketing Strategy of GoTo Company?

- What is Brief History of GoTo Company?

- What is Customer Demographics and Target Market of GoTo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.