GoTo Bundle

Can GoTo Conquer the Digital Realm?

Born from a merger that reshaped Indonesia's digital landscape, GoTo emerged as a powerhouse, integrating ride-hailing, e-commerce, and financial services. This ambitious venture, combining Gojek and Tokopedia, has rapidly become a dominant force in Southeast Asia's tech industry. But what does the future hold for this digital giant?

This deep dive into GoTo will explore its GoTo SWOT Analysis, examining its strategic initiatives and potential for future expansion. We'll analyze GoTo's growth strategy, assessing its competitive landscape and the key drivers behind its financial performance. Understanding the GoTo company analysis is crucial for anyone looking to understand the Indonesian tech company's impact and investment opportunities, including its evolving market share and long-term vision.

How Is GoTo Expanding Its Reach?

The GoTo growth strategy centers on aggressive expansion initiatives designed to solidify its market leadership and diversify its revenue streams. A primary focus is on strengthening its core businesses within Indonesia, particularly in the e-commerce sector. This strategic direction is crucial for the GoTo future prospects.

The company is actively pursuing various avenues to enhance its market presence and revenue generation. These initiatives are critical for the long-term success of the Indonesian tech company, as it navigates the competitive landscape. The company's strategic moves are designed to capitalize on existing strengths and explore new opportunities.

A key element of GoTo's expansion involves leveraging strategic partnerships to fuel growth. The collaboration with TikTok, through TikTok's acquisition of a majority stake in Tokopedia, is a prime example of this strategy. This partnership, supported by a reported investment of over $1.5 billion from TikTok, aims to create a stronger e-commerce player by integrating TikTok's content creation and community features with Tokopedia's established e-commerce infrastructure. This is a key aspect of the GoTo company analysis.

The partnership with TikTok is expected to boost e-commerce growth by leveraging TikTok's vast user base and engagement to drive transactions on Tokopedia. This strategic move aims to create a more robust and competitive e-commerce platform. The integration of content and commerce is a significant trend in the digital market, and GoTo is positioning itself to capitalize on this.

Beyond e-commerce, GoTo is focused on expanding its on-demand services (Gojek) and financial technology (GoTo Financial) segments. While specific new market entries were not detailed in recent reports, the emphasis is on deepening penetration within Indonesia and optimizing existing service offerings. This includes expanding digital payment services and financial products to increase financial inclusion.

GoTo also emphasizes efficiency improvements across all its segments to drive sustainable growth. This involves streamlining operations and optimizing resource allocation to enhance profitability. The company's focus on efficiency is crucial for long-term financial health and competitiveness. This is a part of the GoTo financial performance strategy.

GoTo's strategic partnerships, like the one with TikTok, are a key component of its expansion strategy. These collaborations allow the company to leverage the strengths of other players in the market. This approach helps GoTo to quickly scale its operations and reach a wider audience. This is a part of GoTo's strategic partnerships and acquisitions.

GoTo's expansion strategy involves several key initiatives aimed at driving growth and enhancing market share. The company is focused on both organic growth within existing markets and strategic partnerships to accelerate expansion. These efforts are designed to position GoTo for long-term success in the dynamic Southeast Asian market.

- E-commerce: Leveraging the TikTok partnership to boost Tokopedia's growth.

- On-Demand Services: Deepening penetration within Indonesia and optimizing service offerings.

- Fintech: Expanding digital payment services and financial products.

- Efficiency: Improving operational efficiency across all segments.

For a deeper understanding of the company's background, you can read a Brief History of GoTo.

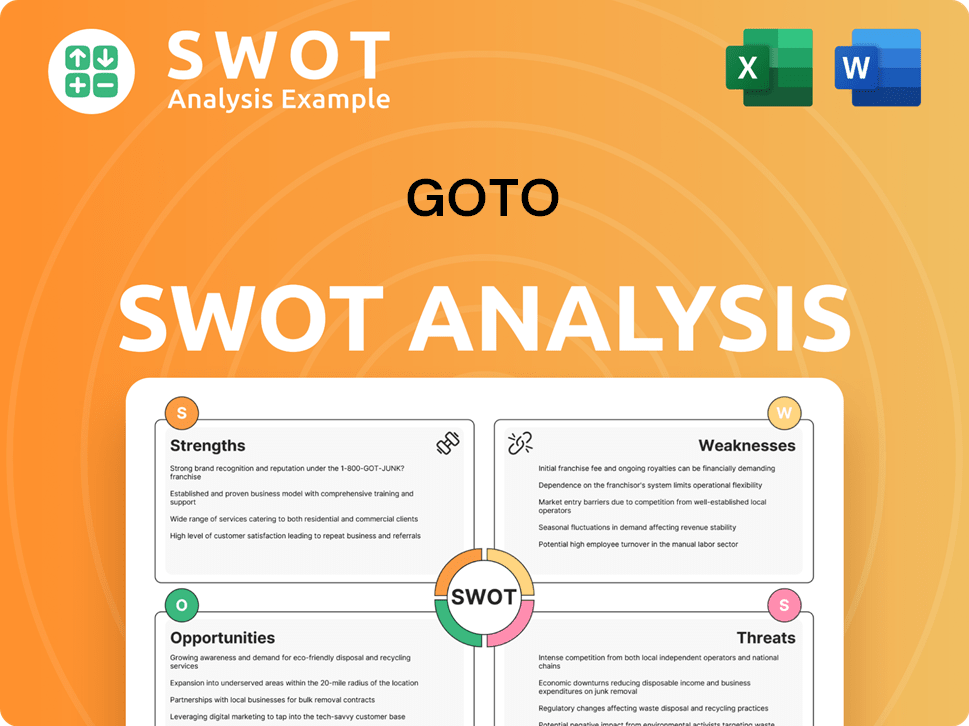

GoTo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GoTo Invest in Innovation?

The GoTo growth strategy heavily relies on innovation and technology to enhance its diverse service offerings. This focus is crucial for maintaining a competitive edge in the dynamic Indonesian market. The company continually invests in research and development to improve user experience and optimize operational efficiency across its platforms.

A key aspect of the GoTo company analysis involves the integration of artificial intelligence (AI) and data analytics. This integration is vital for personalizing services, improving logistics, and enhancing fraud detection. For example, AI is used to optimize ride-hailing routes and personalize product recommendations.

Digital transformation and automation are central to GoTo's operational strategy. This strategy aims to streamline processes and reduce costs, supporting its vast ecosystem. The company's commitment to technological advancement is evident through continuous platform enhancements and strategic partnerships.

AI is used to optimize ride-hailing routes and personalize product recommendations on Tokopedia. Data analytics enhances fraud detection and assesses creditworthiness for financial services. This improves user experience and operational efficiency.

Digital transformation streamlines processes and reduces costs. Automation supports the vast ecosystem, enabling seamless transactions. This focus is crucial for long-term sustainability and growth.

Partnerships, such as the one with TikTok, highlight technological advancements. These collaborations merge social commerce with traditional e-commerce. The goal is to create a more engaging and efficient shopping experience.

Continuous platform enhancements are vital for staying competitive. These enhancements improve user experience and operational efficiency. They drive growth and maintain market relevance.

Building a robust and scalable technology infrastructure is a key focus. This infrastructure supports the vast ecosystem. It enables seamless transactions across all platforms.

Ongoing investment in research and development is a priority. This investment drives innovation and improves user experience. It also optimizes operational efficiency across all platforms.

The company's commitment to technology is a key driver of its GoTo future prospects. Strategic partnerships and continuous platform improvements are essential for maintaining its competitive edge. For more insights into the company's core values, consider reading about the Mission, Vision & Core Values of GoTo.

The company's technological initiatives focus on AI, data analytics, and digital transformation. These efforts enhance user experience and operational efficiency. Strategic partnerships also play a crucial role.

- AI-driven route optimization and personalization.

- Data analytics for fraud detection and credit assessment.

- Digital transformation to streamline processes and reduce costs.

- Strategic partnerships to enhance platform capabilities.

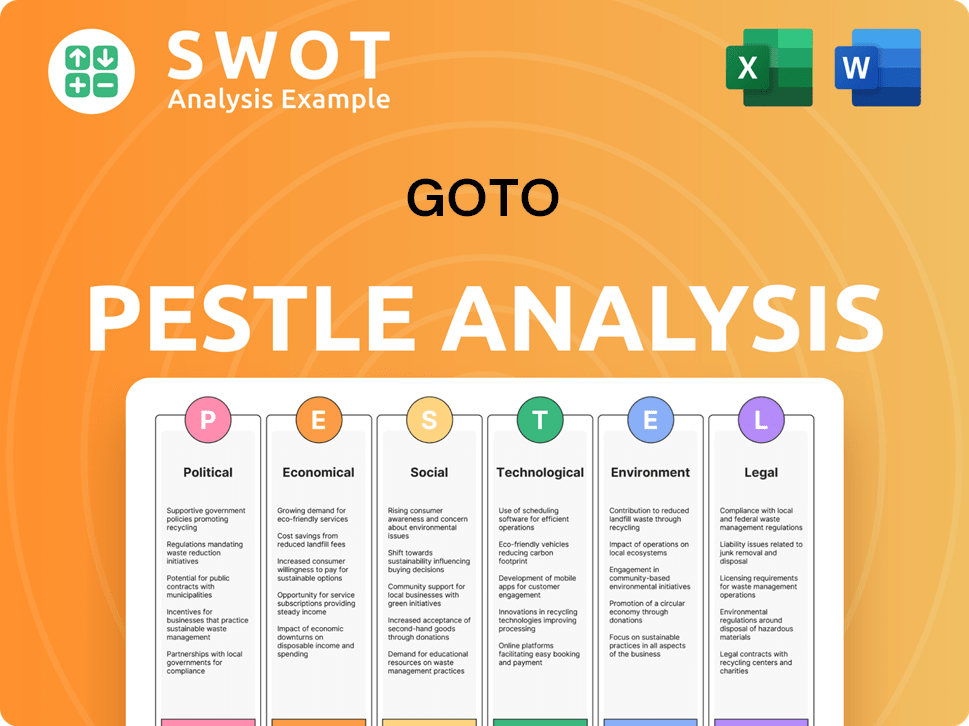

GoTo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is GoTo’s Growth Forecast?

The financial outlook for GoTo, an Indonesian tech company, indicates a strong focus on achieving profitability and sustainable growth. The company's GoTo growth strategy is centered on improving operational efficiency and leveraging strategic partnerships. Recent financial results and future guidance suggest a positive trajectory for the company.

A key highlight is the achievement of positive adjusted EBITDA in Q4 2023, a significant milestone demonstrating the effectiveness of cost management and revenue optimization strategies. This positive trend is expected to continue, with the company aiming for positive adjusted EBITDA for the full year 2024. The GoTo future prospects are closely tied to its ability to execute its strategic plans and adapt to the evolving market landscape.

GoTo's financial strategy is focused on maximizing efficiency and realizing synergies across its diverse business segments. The company aims to achieve positive free cash flow by the end of 2025, reflecting its commitment to financial sustainability. The partnership with TikTok is expected to significantly impact Tokopedia's financial performance and contribute to GoTo's overall profitability goals. For more details on the company's marketing approach, check out the Marketing Strategy of GoTo.

GoTo achieved its first-ever positive adjusted EBITDA of IDR 77 billion (approximately USD 4.9 million) in Q4 2023. This improvement was driven by reduced incentives and marketing expenses, alongside increased take rates. This demonstrates the company's progress in optimizing its cost structure and revenue generation.

For the full year 2023, GoTo reported an adjusted EBITDA loss of IDR 3.7 trillion. This marks a substantial improvement compared to the IDR 16.0 trillion loss in 2022. This significant reduction in losses underscores the company's progress in improving its financial performance.

GoTo has provided guidance for positive adjusted EBITDA for the full year 2024, indicating confidence in its continued path to profitability. This positive outlook is supported by the company's strategic initiatives and focus on operational efficiency.

The company aims to achieve positive free cash flow by the end of 2025. This target highlights GoTo's commitment to financial sustainability and its ability to generate cash from its operations. This is a key indicator of the company's long-term viability.

GoTo's strategic partnership with TikTok is expected to positively impact Tokopedia's financial performance and contribute to the company's overall profitability. This collaboration is a key element of GoTo's growth strategy. This partnership is expected to drive growth in the e-commerce segment.

- The partnership involves significant investment and integration.

- It aims to leverage TikTok's user base and e-commerce capabilities.

- This strategic move is expected to boost revenue and market share.

- GoTo's GoTo company analysis shows this partnership to be a pivotal move.

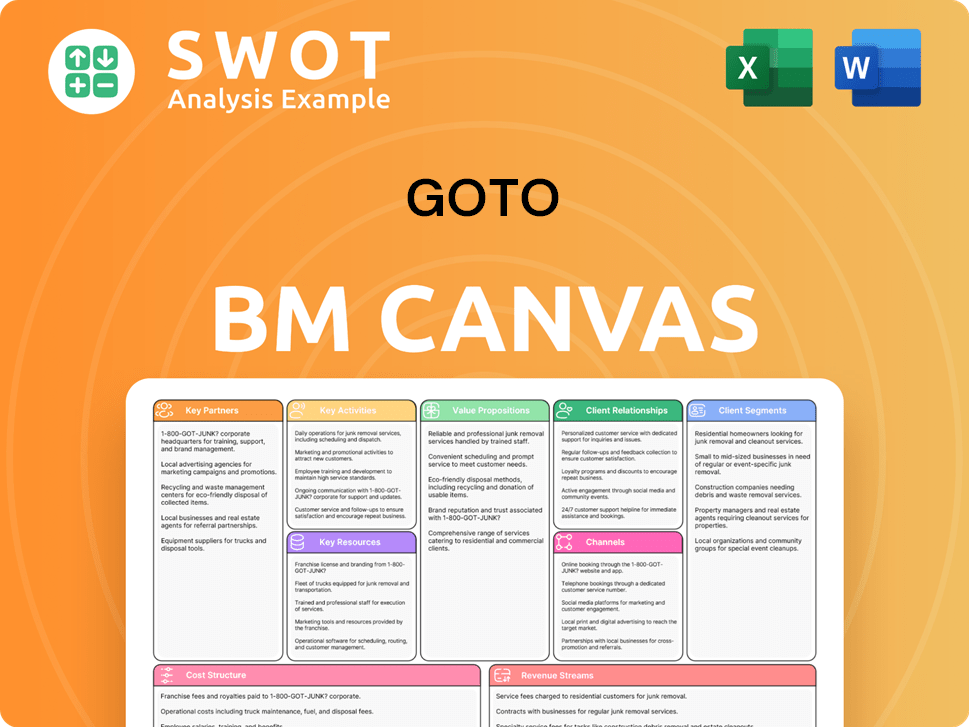

GoTo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow GoTo’s Growth?

The GoTo company analysis reveals several potential risks and obstacles that could influence its future trajectory. The Indonesian tech company faces challenges from intense market competition and evolving regulatory landscapes. Understanding these hurdles is crucial for assessing the GoTo growth strategy and its long-term viability.

One of the primary concerns is the highly competitive nature of the ride-hailing, e-commerce, and fintech sectors. Numerous players, both local and international, are vying for market share, which could impact GoTo's market share and profitability. Furthermore, shifts in regulations across Indonesia and other operating regions pose a constant threat to business models and operational strategies.

Supply chain vulnerabilities, while less critical for digital services, can still affect e-commerce logistics. This could impact delivery speeds and customer satisfaction. Technological disruptions also present an ongoing risk, as new innovations could challenge existing platforms. To mitigate these risks, the company is focused on continuous innovation and strategic partnerships.

The ride-hailing, e-commerce, and fintech sectors are highly competitive, with numerous players vying for market share. This competition could pressure pricing, reduce margins, and necessitate significant investments in marketing and technology. The competitive landscape analysis is crucial for understanding the challenges GoTo faces. In the ride-hailing market, GoTo competes with local and international companies, potentially impacting its GoTo's ride-hailing services market share. The e-commerce segment also faces strong competition from established players and new entrants. The fintech sector is seeing increased competition, requiring rapid innovation and strategic partnerships.

Regulatory changes in Indonesia and other operating regions could significantly impact GoTo's business models and operations. Changes in data privacy regulations, consumer protection laws, and pricing policies could affect the company's profitability and operational efficiency. Compliance costs may increase, and failure to comply with regulations could lead to penalties and reputational damage. The company must continuously monitor and adapt to evolving regulatory requirements. These regulations could affect GoTo's expansion plans in Southeast Asia.

Technological advancements can disrupt existing platforms and services, requiring GoTo to continuously innovate and adapt. The emergence of new technologies or business models could render existing services obsolete. The company must invest in research and development, and be agile in adopting new technologies to stay competitive. Continuous innovation is necessary to maintain market position and drive future growth. This includes adapting to AI, blockchain, and other emerging technologies to enhance its offerings. The GoTo's e-commerce platform growth depends on its technological prowess.

Acquiring and retaining talent in a competitive tech landscape can be challenging. The company requires skilled professionals in various areas, including technology, marketing, and operations. High employee turnover and difficulty in attracting top talent could hinder growth and operational efficiency. The company must offer competitive compensation, benefits, and a positive work environment to attract and retain employees. This also affects the GoTo's fintech offerings and development.

GoTo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GoTo Company?

- What is Competitive Landscape of GoTo Company?

- How Does GoTo Company Work?

- What is Sales and Marketing Strategy of GoTo Company?

- What is Brief History of GoTo Company?

- Who Owns GoTo Company?

- What is Customer Demographics and Target Market of GoTo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.