GS Holdings Bundle

How did GS Holdings rise to become a South Korean powerhouse?

Uncover the captivating story of GS Holdings, a South Korean conglomerate that has significantly impacted the business landscape. From its strategic beginnings as a spinoff from the LG Group in 2004, GS Holdings embarked on a journey to establish itself as a leader in energy, retail, and construction. Explore the GS Holdings SWOT Analysis to understand its strategic positioning.

Delving into the GS Group history reveals a tale of ambition and strategic foresight, with the Huh family at the helm guiding the company's evolution. This brief history of GS Holdings Company will explore its pivotal moments, from its initial vision to its current status as a diversified entity. Learn about the company's financial performance, subsidiaries, and its impact on South Korea's economy.

What is the GS Holdings Founding Story?

The story of GS Holdings begins with a significant corporate shift. This involved separating from LG Group, a major South Korean conglomerate. This move allowed the Huh family to establish their own path after a long partnership.

The formal launch of GS Holdings, initially named GS Corporation, occurred on July 1, 2004. The legal separation was finalized on January 27, 2005, with approval from the Fair Trade Commission. This marked the independent establishment of GS Holdings under the Huh family's leadership.

Key figures like Hong Soon-ki played important roles in the company's early days, joining in 2004 and later becoming vice chairman in November 2024. The initial focus was on being a holding company, managing subsidiaries in energy, retail, and construction to boost competitiveness.

GS Holdings emerged from a separation from LG Group in 2004, establishing itself as an independent conglomerate under the Huh family's leadership.

- The separation was legally completed in early 2005.

- The initial business model was that of a holding company.

- The company manages subsidiaries in energy, retail, and construction.

- The split was influenced by the structure of Korean conglomerates.

The separation from LG Group provided the initial funding for GS Holdings. This strategic move was influenced by the structure of South Korean chaebols. The Huh family gained full control of the newly formed GS Holdings and its entities. Despite the split, a friendly relationship was maintained with LG Group.

The first products and services under the new GS brand were those that transitioned from LG, such as convenience stores and other retail businesses. This transition was part of the rebranding from LG to 'GS'. This unique founding circumstance, stemming from a long-standing partnership, set the stage for GS Holdings to become a significant diversified conglomerate in South Korea. Learn more about the Target Market of GS Holdings.

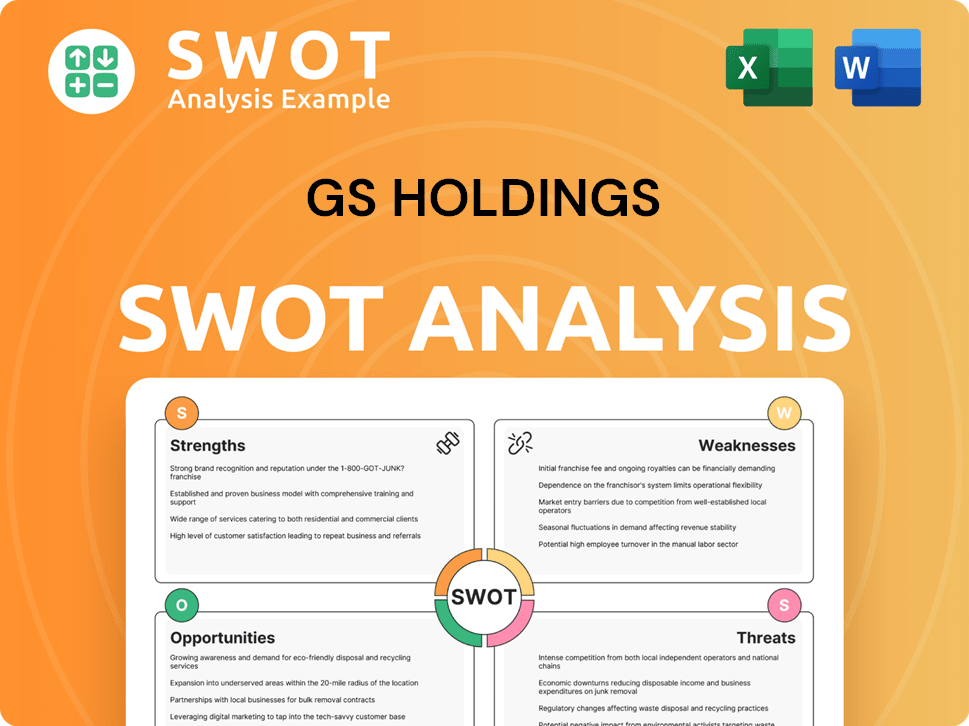

GS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of GS Holdings?

Following its separation from LG Group in 2005, GS Holdings, a prominent player among Korean conglomerates, began its journey of growth and expansion. The company strategically managed and invested in its diverse portfolio of subsidiaries, focusing on core sectors like energy, retail, and construction. Early efforts included significant acquisitions to strengthen its market position and expand its global footprint.

A major step was the acquisition of a 70% stake in GS EPS Co., Ltd. from GS E&C Corporation and LG International Corp. in December 2005. This move significantly boosted the company's presence in the energy sector. Subsidiaries like GS Global expanded internationally, establishing offices in key cities like Tokyo (1964), New York (1973), and Jakarta (1968).

The company's retail arm, GS Retail, grew to operate various formats, including convenience stores (GS25), supermarkets, and department stores. GS Engineering & Construction, another key subsidiary, gained extensive experience in refineries and petrochemical plants. These diverse operations helped shape the GS Group history.

For the fiscal year ending December 31, 2024, GS Holdings reported total revenue of approximately SGD 9.24 million (equivalent to about $6.8 million USD as of June 2025 exchange rates). Despite a net loss of SGD 2.43 million, this was a notable improvement from the previous year's net loss of SGD 14.49 million. Consolidated net assets also improved significantly to S$5,415,000 in 2024 from a negative S$3,576,000 in 2023.

A rights issue in October 2024 was oversubscribed by 131%, raising S$8.4 million for expansion and working capital, demonstrating strong shareholder confidence. Leadership transitions included Hong Soon-ki's promotion to vice chairman in November 2024 and Hur Suh-hong's appointment as CEO of GS Retail. The planned acquisition of Octopus Distribution Networks Pte Ltd for S$11.8 million in late 2024 further enhanced its business model.

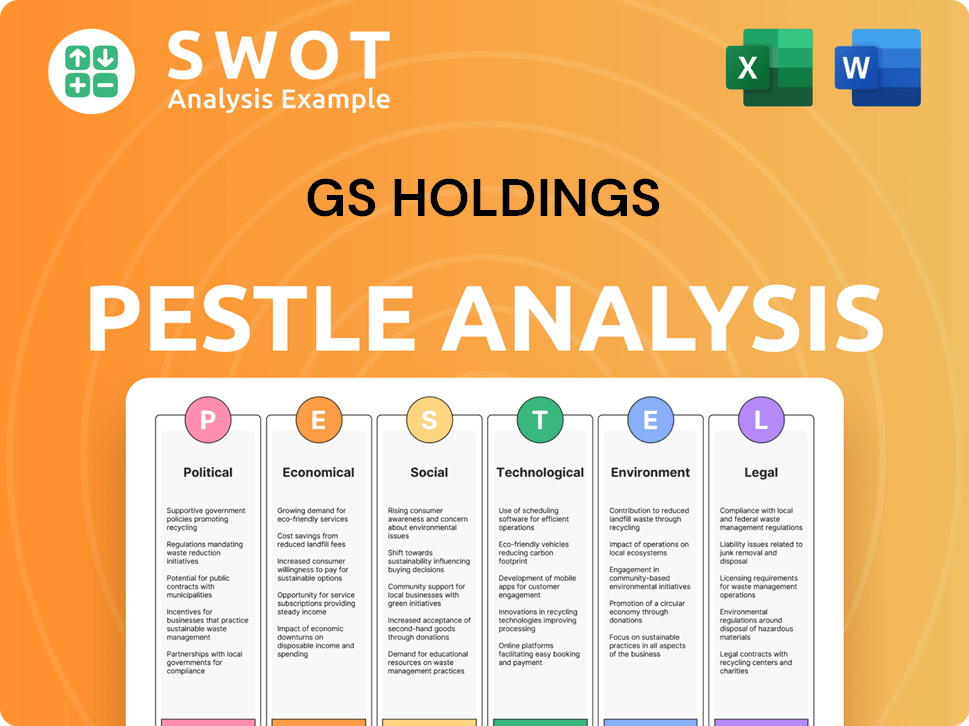

GS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in GS Holdings history?

The journey of GS Holdings, a key player in the Korean conglomerates landscape, has been marked by significant milestones. From its origins as part of LG Group to its current status, GS Holdings has continually evolved, expanding its reach and influence across various sectors. Understanding the Owners & Shareholders of GS Holdings is crucial to grasping its trajectory.

| Year | Milestone |

|---|---|

| 2004 | GS Holdings officially separated from LG Group, marking a new chapter as an independent entity. |

| 2006 | GS Caltex, a major subsidiary, was established, solidifying its presence in the energy sector. |

| 2010s | GS E&C expanded its construction projects, contributing significantly to infrastructure development. |

| 2024 | GS Holdings (Singapore-based entity) proposed the acquisition of Octopus Distribution Networks Pte Ltd, expanding its F&B business. |

| 2025 | GS Group, including GS Holdings, emphasized 'quantum transformation' with a focus on AI and advanced technologies. |

GS Holdings has embraced innovation, particularly in digital transformation and strategic partnerships. The group's commitment to technological advancement, especially in energy affiliates like GS Power and GS E&R, signifies a forward-thinking approach.

GS Group is focusing on digital transformation across its subsidiaries.

Energy affiliates are using AI for improved machine learning applications in power plants.

GS Power and GS E&R are utilizing AI for enhanced wind power forecasting.

This innovation improves operational efficiency and decision-making.

GS Global has a global footprint with offices in multiple countries.

Recent acquisitions, such as the proposed purchase of Octopus Distribution Networks Pte Ltd, demonstrate strategic expansion.

GS Global operates in countries like Japan, the US, Indonesia, Malaysia, and India.

This global presence supports diverse product offerings in steel, petrochemicals, and machinery.

Despite its successes, GS Holdings has faced challenges, including financial performance issues and regulatory scrutiny. The Singapore-based GS Holdings Limited experienced declining earnings and revenue, with a net loss reported for 2024.

The Singapore-based entity experienced a 57.7% average annual decline in earnings over the past five years.

Revenues declined at an average rate of 32.4% per year.

The company reported a net loss of S$2.43 million for the full year ended December 31, 2024.

This was an improvement compared to the previous year.

The company faced an investigation by the Commercial Affairs Department (CAD) and the Monetary Authority of Singapore (MAS).

The investigation concerned a potential offense under the Securities and Futures Act 2001.

The company faced shareholder dilution due to significant equity raisings.

This impacted the ownership structure and value for existing shareholders.

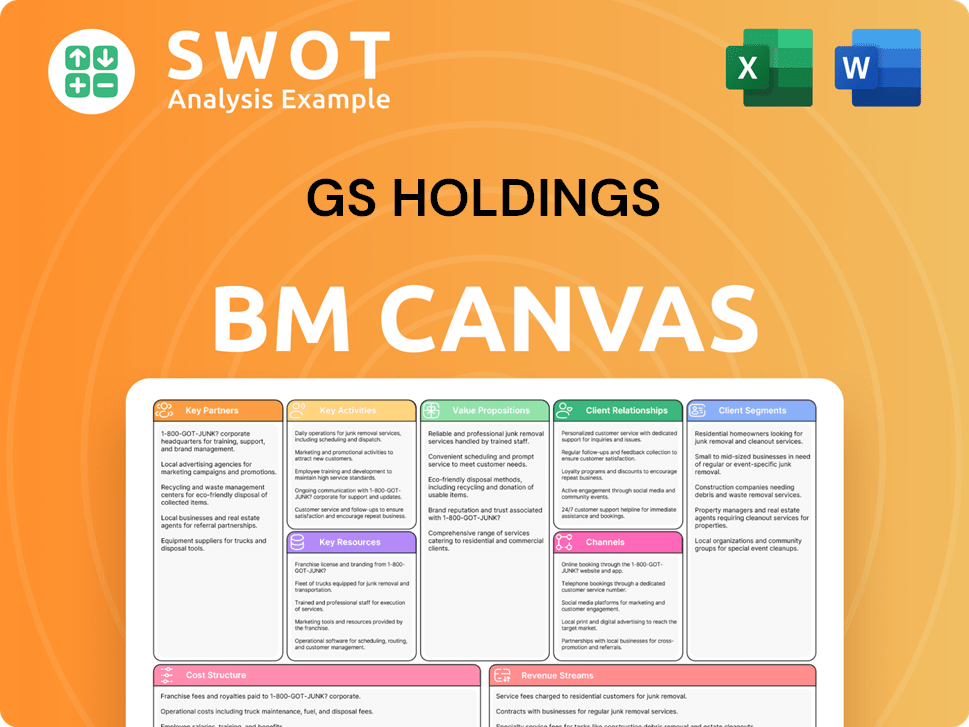

GS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for GS Holdings?

The GS Group history is characterized by its strategic evolution and expansion across diverse sectors. Initially launched as GS Corporation on July 1, 2004, as part of a separation from LG Group, it officially became an independent entity on January 27, 2005. The group's official launch followed on March 31, 2005, with a new CI and management philosophy. Over the years, GS Holdings has strategically expanded its portfolio, including acquisitions such as GS EPS Co., Ltd. in December 2005 and Hugel in 2021, while also experiencing leadership changes and financial growth.

| Year | Key Event |

|---|---|

| July 1, 2004 | GS Holdings (then GS Corporation) is launched as part of the separation process from LG Group. |

| January 27, 2005 | The legal separation from LG Group is completed, and GS Holdings becomes an independent entity. |

| March 31, 2005 | GS Group officially launches with its new CI and management philosophy. |

| December 2005 | GS Holdings acquires 70% of GS EPS Co., Ltd., strengthening its energy portfolio. |

| 2019 (end of year) | GS Group's asset size reaches 65.4 trillion KRW, ranking it as the 8th largest chaebol in Korea. |

| 2021 | GS Holdings participates in the acquisition of biotech firm Hugel, expanding the group's portfolio. |

| November 2024 | GS Group announces a major leadership reshuffle, promoting GS Holdings CEO Hong Soon-ki to vice chairman and appointing Hur Suh-hong as the new CEO of GS Retail, among other changes. |

| October 2024 | GS Holdings (Singapore entity) successfully completes an oversubscribed rights issue, raising S$8.4 million for expansion. |

| Late 2024 | GS Holdings (Singapore entity) enters into an agreement to acquire Octopus Distribution Networks Pte Ltd for S$11.8 million, aiming to enhance its F&B business. |

| December 2024 | Mr. Pang Pok retires as CEO of GS Holdings (Singapore entity), with Mr. Loo Hee Guan appointed as acting CEO. |

| February 2025 | GS Group emphasizes 'quantum transformation' and highlights the use of AI in its energy affiliates. |

| March 31, 2025 | GS Holdings reports a trailing 12-month revenue of $18.1 billion and a net income of $295.39 million. |

GS Holdings is focused on long-term strategic initiatives to create value through a diverse business portfolio. The company is actively seeking new growth engines, particularly in response to global uncertainties and the shift towards clean energy. The emphasis on 'quantum transformation' and the integration of AI in its energy sector subsidiaries indicate a clear innovation roadmap for the future.

Leadership statements suggest a focus on reinforcing the company's foundation to withstand external challenges and generating new growth opportunities in competitive sectors like retail. Analyst predictions and recent strategic acquisitions, such as Octopus Distribution Networks, point towards continued diversification and expansion, particularly within the F&B sector for its Singapore-based entity.

The integration of AI in its energy sector subsidiaries, like GS Power and GS E&R, is a key component of its future strategy. This forward-looking approach, rooted in strategic investments and technological advancement, aims to secure GS Holdings' position as a leading conglomerate. This technological focus aligns with the 'quantum transformation' initiative.

As of March 31, 2025, GS Holdings reported a trailing 12-month revenue of $18.1 billion and a net income of $295.39 million. These figures reflect the company's ongoing financial performance and its ability to generate revenue and profit. This data highlights the scale and financial health of the GS Group.

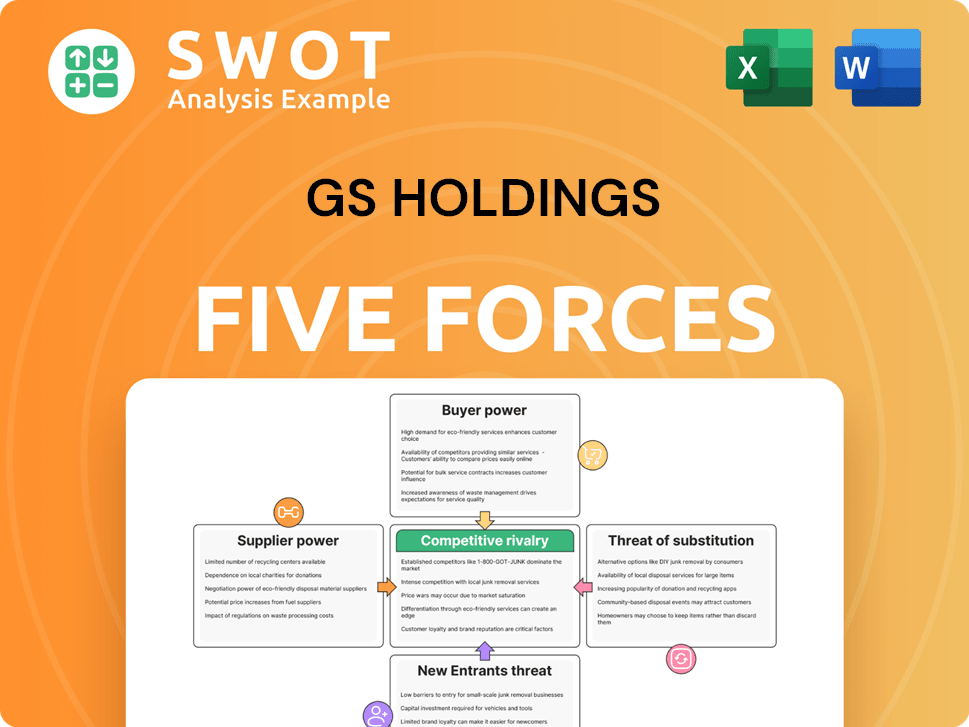

GS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of GS Holdings Company?

- What is Growth Strategy and Future Prospects of GS Holdings Company?

- How Does GS Holdings Company Work?

- What is Sales and Marketing Strategy of GS Holdings Company?

- What is Brief History of GS Holdings Company?

- Who Owns GS Holdings Company?

- What is Customer Demographics and Target Market of GS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.