GS Holdings Bundle

How Does GS Holdings Shape the South Korean Economy?

GS Holdings, a leading South Korean conglomerate, is a powerhouse in diverse sectors. Its strategic diversification across energy, retail, construction, and services underscores its significant influence on the South Korean market. With substantial revenue and a broad operational reach, understanding GS Holdings SWOT Analysis is vital for anyone looking to understand its complex operations.

This deep dive into the GS Holdings business model will explore its core operations and diverse revenue streams. We'll examine how GS Holdings generates revenue, analyzing its investments and the structure that supports its extensive network of subsidiaries. Whether you're curious about GS Holdings' financial performance analysis or the GS Holdings management team, this analysis provides a comprehensive overview of this influential company.

What Are the Key Operations Driving GS Holdings’s Success?

The core of GS Holdings Company (GS Holdings) lies in its strategic management of diverse subsidiaries, spanning energy, retail, construction, and services. This integrated approach allows GS Holdings to optimize its subsidiaries' competitiveness, driving overall group growth. The company's value proposition centers on fostering synergy among these distinct business units.

GS Holdings' operations are multifaceted, encompassing refining and petrochemicals through GS Caltex, retail operations via GS Retail, and large-scale construction projects by GS Engineering & Construction. The operational processes are designed to leverage global networks for raw materials and sophisticated logistics, ensuring efficient supply chain management across all sectors. Partnerships play a crucial role in technology development, market expansion, and project execution.

The integrated holding company model sets GS Holdings apart, enabling strategic capital allocation and risk diversification. This structure facilitates shared resources, expertise, and market intelligence, enhancing the performance of individual subsidiaries. This integrated approach translates into customer benefits such as convenient access to diverse products and services, and market differentiation through a stable and diversified business portfolio.

GS Holdings operates under an integrated holding company model, allowing strategic capital allocation and risk diversification. This structure enables the company to leverage shared resources and expertise across its subsidiaries. The model supports efficient management and enhances the performance of individual business units.

GS Holdings' operations involve crude oil sourcing, refining, and distribution for GS Caltex. GS Retail focuses on supply chain management and store network expansion. GS Engineering & Construction relies on advanced engineering and project management. The company's operations are supported by global networks and strategic partnerships.

The core value proposition of GS Holdings lies in fostering synergy among its diverse business units. This integrated approach provides convenient access to diverse products and services for customers. It also creates market differentiation through a diversified business portfolio, reducing susceptibility to industry fluctuations.

Key subsidiaries include GS Caltex (energy), GS Retail (retail), and GS Engineering & Construction. These subsidiaries operate in distinct sectors but benefit from the integrated holding company model. The model enables strategic capital allocation and resource sharing, enhancing overall performance.

GS Holdings generates revenue through its subsidiaries operating in energy, retail, and construction. GS Caltex contributes significantly through petroleum products and petrochemicals. GS Retail generates revenue from convenience stores, supermarkets, and health and beauty stores. GS Engineering & Construction earns from large-scale infrastructure projects.

- GS Caltex's revenue is driven by refining and selling petroleum products.

- GS Retail's revenue comes from sales in convenience stores and supermarkets.

- GS Engineering & Construction earns revenue from construction projects.

- The integrated model allows for strategic capital allocation and resource sharing.

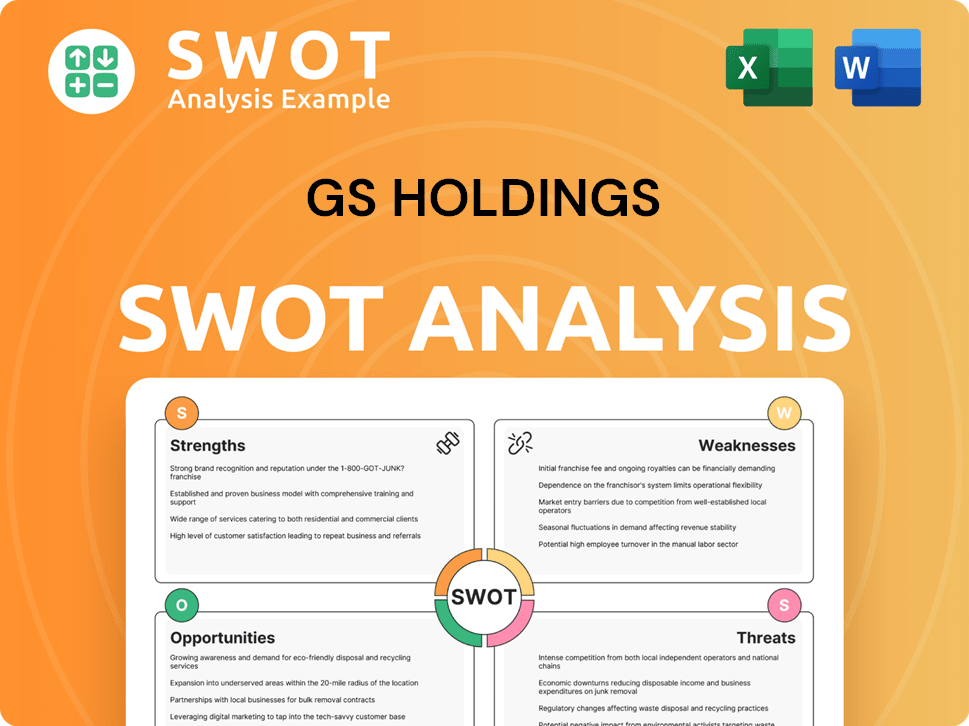

GS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GS Holdings Make Money?

The GS Holdings Company generates revenue through a diversified portfolio of businesses, ensuring financial stability across various sectors. Its core operations span energy, retail, construction, and services, each contributing significantly to the overall financial performance. In the first quarter of 2024, GS Holdings reported a consolidated revenue of KRW 6,368.6 billion, showcasing its robust market presence.

The company's revenue streams are primarily derived from its major subsidiaries. These include GS Caltex in the energy sector, GS Retail in the retail sector, and GS Engineering & Construction in the construction sector. This diversified approach is a key aspect of the GS Holdings business model, mitigating risks associated with reliance on a single industry.

The energy sector, primarily through GS Caltex, contributes significantly through the sale of petroleum products, petrochemicals, and lubricants. The retail segment, driven by GS Retail, generates revenue from product sales across its convenience stores, supermarkets, and health and beauty stores. GS Engineering & Construction's revenue comes from various construction projects, including plant construction, civil engineering, housing, and building projects.

GS Holdings employs various monetization strategies across its subsidiaries to maximize revenue. For example, GS Retail utilizes tiered pricing, loyalty programs, and cross-selling opportunities. GS Caltex may engage in long-term supply contracts and specialized product offerings. The holding company itself benefits from dividends from its subsidiaries and strategic investments. To understand more about the GS Holdings structure and how it leverages these strategies, consider reading the Growth Strategy of GS Holdings.

- Energy Sector: Revenue is influenced by global oil prices, refining margins, and demand for energy products.

- Retail Sector: Revenue is derived from product sales across convenience stores, supermarkets, and health and beauty stores.

- Construction Sector: Revenue comes from various construction projects, with revenue recognized based on project progress.

- Investment Strategy: The company's focus on diversifying its business portfolio is a continuous strategy to expand its revenue sources and adapt to market changes.

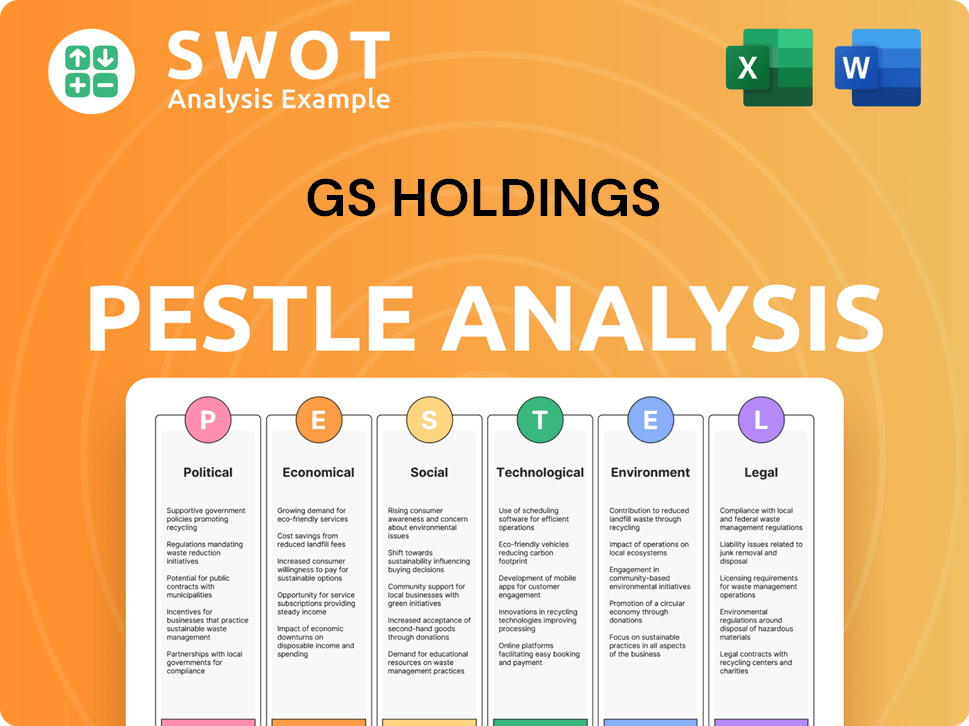

GS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped GS Holdings’s Business Model?

GS Holdings Company has marked significant milestones, influencing its operational and financial journey. A key strategic move has been its continuous diversification across key industries, including energy, retail, construction, and services. This adaptability helps it navigate market changes and economic cycles effectively. The company's strategic approach is designed to sustain growth and resilience in a dynamic business environment.

The company consistently pursues strategic partnerships and investments to broaden its reach and enhance its capabilities. While specific recent product launches or market entries weren't detailed, GS Holdings emphasizes creating synergy among its subsidiaries, which is a central strategic move. For example, the collaboration between GS Caltex, a major energy subsidiary, and other GS affiliates demonstrates an internal ecosystem designed to optimize resources and market opportunities. The company's structure facilitates collaboration and resource sharing among its subsidiaries, providing a distinct advantage.

Operational challenges, such as fluctuations in global energy prices impacting GS Caltex or competitive pressures in the retail sector, are inherent to its diverse operations. However, GS Holdings' competitive advantages lie in its robust brand strength, extensive operational infrastructure, and economies of scale. Its established presence in critical sectors provides a stable foundation. The company's ability to leverage its holding company structure to foster collaboration and resource sharing among its subsidiaries gives it a distinct edge. This includes shared expertise in areas like logistics, technology adoption, and customer insights. To understand the competitive landscape, you can explore the Competitors Landscape of GS Holdings.

GS Holdings has achieved notable milestones that have shaped its operational and financial trajectory. These achievements are a result of strategic decisions and adaptability to market changes. The company's growth is supported by its diversified business model and strategic investments.

A pivotal strategic move has been its continuous diversification across key industries, including energy, retail, construction, and services. This diversification was evident in the first quarter of 2024, when GS Holdings reported a consolidated revenue of KRW 6,368.6 billion, demonstrating the strength of its varied business units. The company also focuses on strategic partnerships to expand its reach.

GS Holdings' competitive advantages include strong brand recognition, extensive operational infrastructure, and economies of scale. The company leverages its holding company structure to foster collaboration and resource sharing among its subsidiaries. This integrated approach allows for optimized operations and better market positioning.

GS Holdings' operations are diversified across several key sectors, which helps to mitigate risks and capitalize on various market opportunities. The company's subsidiaries operate within a framework designed to maximize efficiency and synergy. This operational strategy supports the company's long-term growth and resilience.

The financial performance of GS Holdings is closely tied to its strategic moves and the success of its subsidiaries. The company's investment strategy and operational efficiency contribute to its overall financial health. GS Holdings' ability to adapt to changing market conditions is crucial for its continued success.

- Diversification across key industries provides stability and growth opportunities.

- Strategic partnerships and investments enhance capabilities and market reach.

- Emphasis on synergy among subsidiaries optimizes resources and market opportunities.

- Adaptation to new trends through innovation and business model optimization.

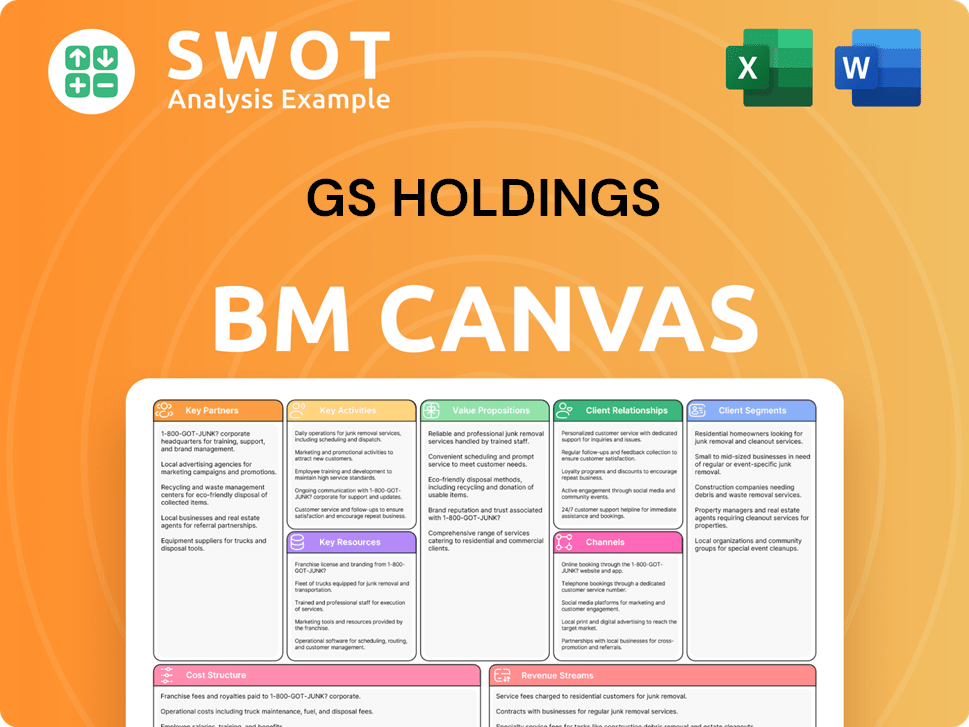

GS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is GS Holdings Positioning Itself for Continued Success?

The GS Holdings Company holds a significant position in the South Korean market, operating as a diversified conglomerate. Its structure includes key subsidiaries that command substantial market share in critical sectors, such as energy, retail, and construction. This diversified approach contributes to a robust financial performance, with consolidated revenue figures reflecting its strong market presence and operational efficiency. Understanding the GS Holdings business model is key to appreciating its success.

The company's integrated approach fosters customer loyalty across its various offerings, ranging from fuel to daily necessities. It has expanded its global reach through international construction projects and energy exports. The GS Holdings operations are designed to leverage synergies among its diverse business units, ensuring a competitive edge in multiple sectors.

GS Holdings benefits from a strong market position in South Korea, driven by its diversified portfolio and strategic investments. Its subsidiaries, like GS Caltex and GS Retail, are leaders in their respective industries. The company's integrated business model allows it to cater to a wide range of consumer needs.

The company faces risks from regulatory changes in the energy sector and intense competition in retail. Global economic downturns and geopolitical instability could impact construction projects and energy demand. Technological disruption also presents a risk if GS Holdings fails to adapt quickly.

The future outlook for GS Holdings focuses on strategic initiatives to sustain growth, including investments in innovation and operational efficiencies. The company is likely to explore opportunities in renewable energy and digital retail. Leadership emphasizes leveraging synergies among its business units.

In the first quarter of 2024, GS Holdings reported a robust consolidated revenue of KRW 6,368.6 billion. This strong financial performance underscores the effectiveness of its diversified business model and strategic market positioning. The company's ability to generate consistent revenue is a key indicator of its financial health and future potential.

GS Holdings is focused on strategic initiatives to sustain and expand its revenue generation capabilities. This includes continuous investment in innovation across its subsidiaries, enhancing operational efficiencies, and exploring new growth engines. The company is actively responding to market changes to ensure continued growth and profitability.

- Continued investment in renewable energy and sustainable solutions within its energy segment.

- Further digitalization of retail operations to enhance customer experience and supply chain management.

- Leveraging synergies among diverse business units to maximize operational efficiency.

- Proactive adaptation to market changes and technological advancements.

For more insights into the company's strategic direction, you can review the Growth Strategy of GS Holdings. This provides a deeper understanding of how the company plans to navigate industry-specific challenges while capitalizing on its diversified portfolio and integrated operational model.

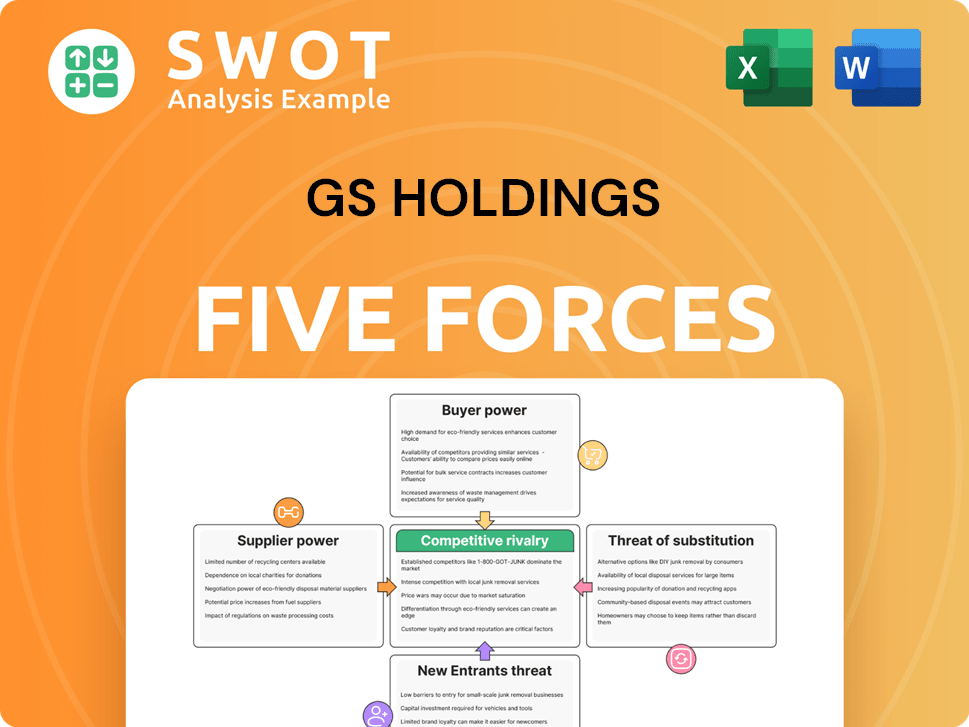

GS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GS Holdings Company?

- What is Competitive Landscape of GS Holdings Company?

- What is Growth Strategy and Future Prospects of GS Holdings Company?

- What is Sales and Marketing Strategy of GS Holdings Company?

- What is Brief History of GS Holdings Company?

- Who Owns GS Holdings Company?

- What is Customer Demographics and Target Market of GS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.