GS Holdings Bundle

Who Really Owns GS Holdings?

Unraveling the ownership of GS Holdings is key to understanding its strategic ambitions and market influence. Established in 2004 following a significant spin-off, GS Holdings has become a powerhouse in South Korea's economy. This investigation dives deep into the ownership structure of this influential conglomerate.

From its inception to its current status as a publicly traded entity, GS Holdings' ownership has undergone a fascinating transformation. This article will explore the evolution of GS Holdings SWOT Analysis, from its founding family roots to the involvement of institutional investors and public shareholders. Understanding the dynamics of GS Holdings ownership is essential for anyone seeking insights into its operational strategies and its impact on the broader market. We will look into its leadership, including its executives, and its company profile.

Who Founded GS Holdings?

The origins of GS Holdings are rooted in the LG Group, from which it separated in 2004. This spin-off was a formalization of an agreement between the Koo and Hur families, who were fundamental to the LG Group's formation. The Hur family took control of the newly established GS Holdings.

The early ownership structure of GS Holdings was primarily concentrated within the Hur family. They transferred their stakes in key affiliates, including those in energy, retail, and construction, into the new holding company. This strategic move allowed both the LG Group and GS Holdings to pursue distinct growth paths.

While specific equity splits at the inception aren't publicly detailed for every founding member, the Hur family, particularly members like Hur Chang-soo, played a crucial role in establishing and leading the new entity. The separation was designed to ensure operational independence and facilitate strategic investments.

The initial ownership of GS Holdings was primarily held by the Hur family. This structure provided centralized control.

The split from LG Group was a pre-arranged decision. It allowed both entities to pursue independent growth strategies.

Members of the Hur family, such as Hur Chang-soo, were instrumental in leading GS Holdings from its inception.

There were no widely reported public disputes regarding the initial ownership. The separation was a planned event.

The Hur family's vision was to create a diversified conglomerate. The goal was to enhance the competitiveness of its subsidiaries.

The early focus was on establishing a strong foundation. This included strategic investments and inter-affiliate synergy.

The initial agreements likely included mechanisms for a smooth transition. The separation was a strategic move to allow both groups to pursue distinct growth paths. The Hur family's vision for GS Holdings was to create a diversified conglomerate focused on enhancing the competitiveness of its subsidiaries and exploring new growth engines, a vision reflected in the consolidated GS Holdings ownership structure that provided centralized control for strategic investments and inter-affiliate synergy. For more insights into the company's strategic direction, you can read about the Growth Strategy of GS Holdings.

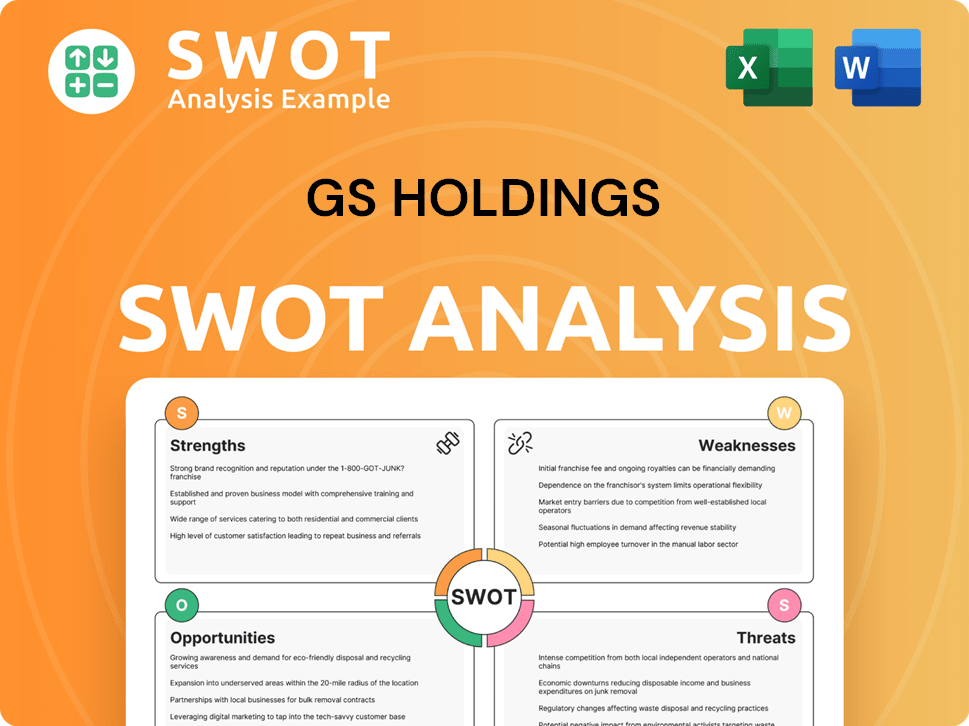

GS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has GS Holdings’s Ownership Changed Over Time?

The ownership structure of GS Holdings has changed significantly since its spin-off and public listing on the Korea Exchange in 2004. Initially, the Hur family held a dominant position. Over time, the company transitioned towards a more diversified ownership model. This shift involved increased participation from institutional and public shareholders. This evolution has been a key factor in shaping the company's strategic direction and corporate governance practices.

As of early 2025, the Hur family remains a major stakeholder in GS Holdings, although their controlling interest has been diluted. Their stake is managed through various individual and family-related entities. This ensures their continued influence over strategic decisions. The presence of institutional investors has also grown, with major domestic and international asset managers holding significant shares. These shifts reflect broader trends in corporate ownership, with increased emphasis on shareholder value and ESG considerations. For more insights, you can explore the Marketing Strategy of GS Holdings.

| Ownership Category | Approximate Shareholding (Early 2025) | Notes |

|---|---|---|

| Hur Family | Varies, but substantial | Held through individual and family entities; maintains strategic control. |

| Institutional Investors | Significant portion | Includes domestic and international asset managers, pension funds, and mutual funds. |

| Public Shareholders | Remainder | Represents the shares held by the general public. |

The evolution of GS Holdings' ownership structure has been influenced by several factors. Market capitalization changes, which reflect the company's diverse business operations, play a role. For example, in early 2025, GS Holdings' market capitalization was reported in the range of several trillion Korean Won. Regular disclosures through annual reports and SEC filings (if applicable) provide detailed breakdowns of shareholding. These changes have pushed the company towards enhanced corporate governance and greater transparency.

The Hur family maintains a significant, albeit diluted, controlling interest in GS Holdings. Institutional investors, including major asset managers and pension funds, hold a substantial portion of shares. These shifts reflect a broader trend toward enhanced corporate governance and shareholder value.

- The Hur family's stake is managed through various entities.

- Institutional investors include the National Pension Service of Korea.

- Market capitalization reflects GS Holdings' diverse operations.

- Regular disclosures provide detailed shareholding breakdowns.

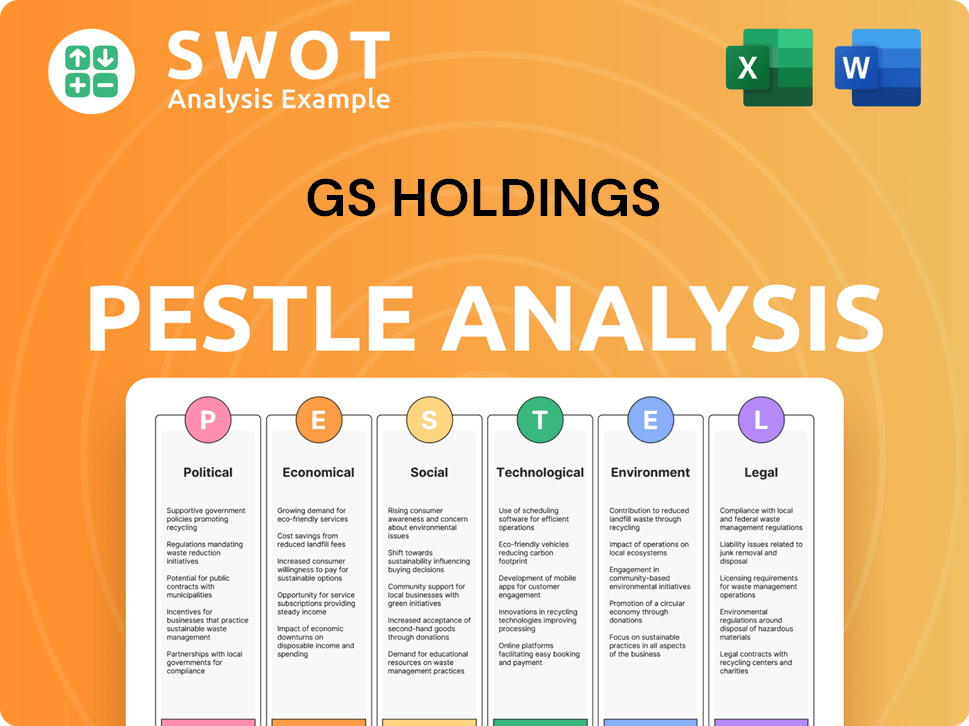

GS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on GS Holdings’s Board?

The Board of Directors of GS Holdings is pivotal in its governance and strategic direction. As of early 2025, the board typically includes representatives from the Hur family, executives from GS Holdings and its subsidiaries, and independent directors. For instance, Hur Tae-soo, a key member of the Hur family, holds positions such as CEO and Vice Chairman, which highlights the family's ongoing influence. The presence of independent directors is a common practice among South Korean conglomerates to boost transparency and adhere to regulatory standards.

The board's composition reflects a balance between family interests, major shareholders, and independent expertise. Independent directors often serve on committees like audit and compensation, which is a standard practice in South Korea to enhance corporate governance. This structure aims to ensure accountability and effective oversight of the company's operations and strategic decisions.

| Board Member | Title | Affiliation |

|---|---|---|

| Hur Tae-soo | CEO and Vice Chairman | Hur Family |

| [Executive Name] | Executive Director | GS Holdings |

| [Independent Director Name] | Independent Director | Independent |

GS Holdings generally operates on a one-share-one-vote system, where voting power aligns with shareholding. However, the Hur family's significant ownership stake grants them considerable control over key strategic decisions, including board appointments. While there are no widely reported dual-class shares, the family's ownership concentration provides substantial influence. In 2024-2025, South Korean conglomerates, including GS Holdings, have faced increased scrutiny regarding corporate governance. Institutional investors are pressing for improved shareholder returns, enhanced board independence, and more transparent decision-making processes.

The Hur family's substantial ownership significantly influences GS Holdings' strategic decisions. This ownership structure is a key aspect of understanding who owns GS Holdings and the company's governance. The board of directors plays a crucial role in this structure.

- The Hur family maintains significant influence.

- Independent directors enhance transparency.

- Voting power is primarily based on shareholding.

- Institutional investors are increasing pressure for better governance.

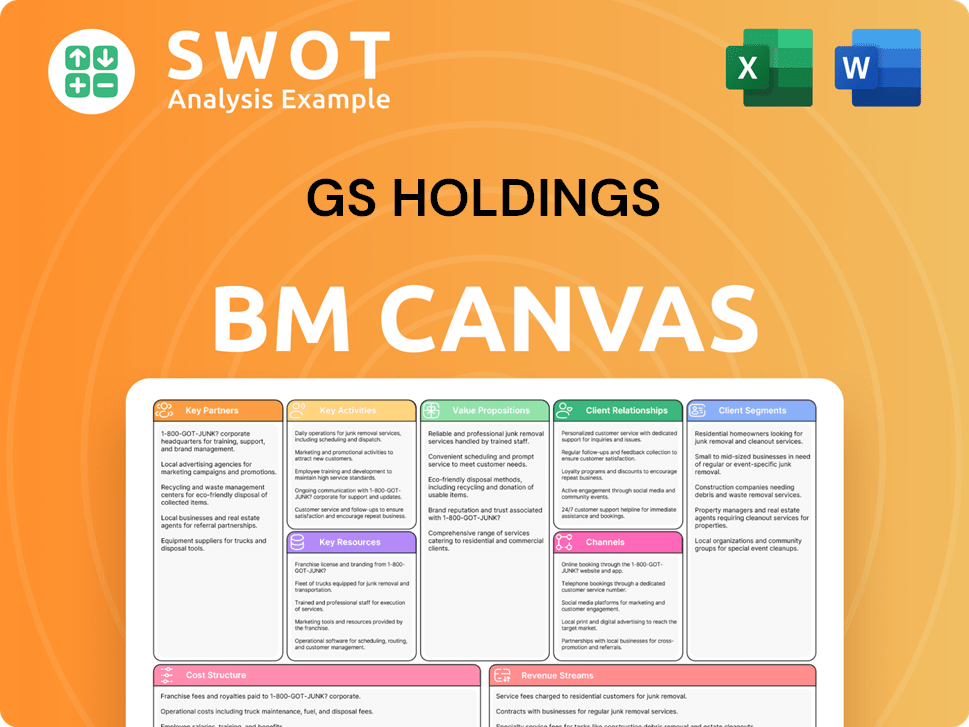

GS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped GS Holdings’s Ownership Landscape?

Over the past few years, from roughly 2022 to early 2025, the ownership landscape of GS Holdings has seen continuous evolution. This has been influenced by strategic initiatives and broader market dynamics. While large-scale share buybacks or secondary offerings haven't dominated headlines, the company actively manages its capital structure. Mergers and acquisitions within its subsidiaries, such as those aimed at expanding its energy or retail presence, indirectly impact the holding company's valuation and attractiveness to investors. Leadership changes, including succession planning within the Hur family and the appointment of professional managers, signal a shift towards more professionalized management alongside family oversight. Understanding the Growth Strategy of GS Holdings can provide further context.

Industry trends in South Korea indicate a rise in institutional ownership across major conglomerates. This is driven by the growth of pension funds and investment managers seeking stable returns. This often leads to gradual founder dilution as companies expand and require more capital. Founding families often retain strategic control through various mechanisms. There's also a growing emphasis on ESG (Environmental, Social, and Governance) investing, prompting companies like GS Holdings to enhance their sustainability reporting and governance practices. This influences how institutional investors allocate capital. As of early 2025, GS Holdings continuously evaluates its portfolio for optimal value creation, potentially involving future divestitures or new listings based on market conditions. The focus remains on enhancing the competitiveness of its diverse business segments and maximizing shareholder value.

| Aspect | Details | Recent Trends (2022-Early 2025) |

|---|---|---|

| Ownership Structure | Primary owners and their stakes | Focus on professional management alongside family oversight; gradual founder dilution. |

| Institutional Ownership | Percentage of shares held by institutions | Increasing due to growth of pension funds and investment managers. |

| ESG Factors | Impact of environmental, social, and governance considerations | Enhanced sustainability reporting and governance practices to attract ESG-focused investors. |

In the context of GS Holdings ownership, it's important to note that the company's approach involves balancing family involvement with professional management. The Hur family's strategic influence is gradually evolving. Institutional investors are playing a more significant role. The company's commitment to ESG factors is also becoming more prominent. These trends collectively shape the company's profile and its appeal to investors.

The ownership structure is primarily influenced by the Hur family and institutional investors. The company is continuously managing its capital structure. There's a balance between family oversight and professional management.

Pension funds and investment managers are increasing their holdings. ESG investing influences how capital is allocated. This trend is driven by the search for stable returns and sustainable practices.

Leadership changes signal a move toward more professionalized management. Succession planning within the Hur family is ongoing. The appointment of professional managers is a key trend.

The company is focused on enhancing the competitiveness of its business segments. It continuously evaluates its portfolio for optimal value creation. Future divestitures or new listings may occur.

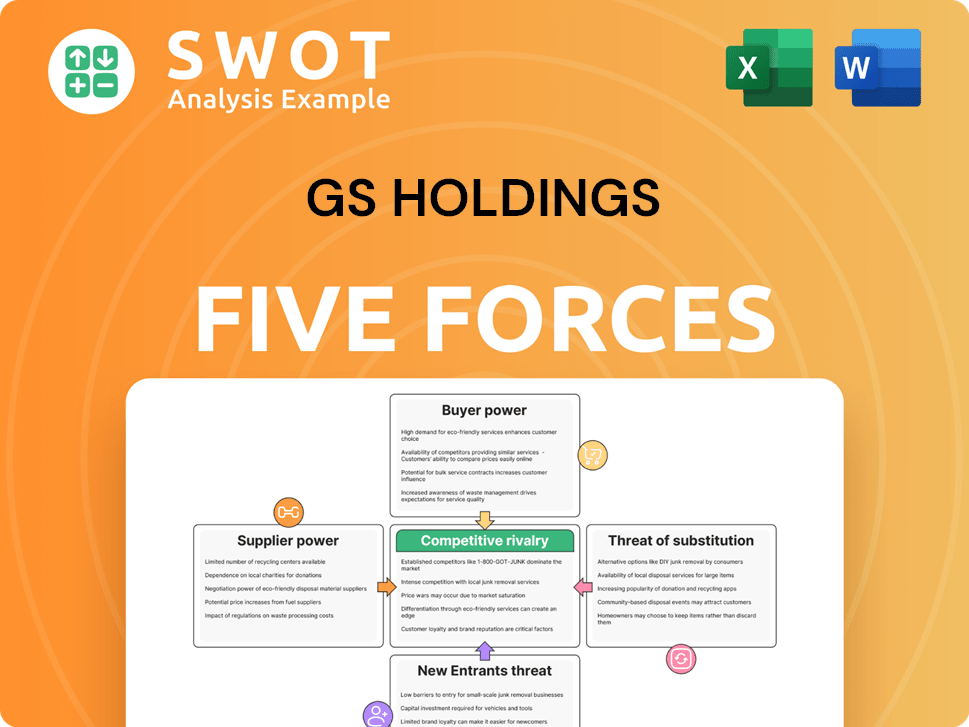

GS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GS Holdings Company?

- What is Competitive Landscape of GS Holdings Company?

- What is Growth Strategy and Future Prospects of GS Holdings Company?

- How Does GS Holdings Company Work?

- What is Sales and Marketing Strategy of GS Holdings Company?

- What is Brief History of GS Holdings Company?

- What is Customer Demographics and Target Market of GS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.