GS Holdings Bundle

Can GS Holdings Reclaim Its Growth Momentum?

GS Holdings, a South Korean powerhouse with roots in the LG Group, faces a pivotal moment as it navigates an evolving market. From its inception in 2004, the company has strategically diversified, building a robust portfolio across energy, retail, and construction. With a focus on "change and challenge," GS Holdings is poised to redefine its GS Holdings SWOT Analysis and future prospects.

This analysis delves into the growth strategy of GS Holdings, examining its historical performance and current strategic initiatives. We will explore the company's expansion plans, innovation efforts, and strategic financial planning, providing insights into its long-term goals and potential investment opportunities. Understanding the future prospects of GS Holdings requires a deep dive into its market analysis, competitive landscape, and industry outlook to assess its ability to overcome future challenges and drive sustainable business development.

How Is GS Holdings Expanding Its Reach?

The company is actively pursuing several expansion initiatives to drive future growth. These initiatives focus on strategic acquisitions, market diversification, and international reach, all critical components of a robust growth strategy.

A key move in the F&B sector is the proposed acquisition of Octopus Distribution Networks Pte. Ltd. for S$11.8 million. This strategic acquisition, approved by shareholders on December 13, 2024, is expected to be completed in 2025. This expansion is designed to provide immediate access to a new customer base and operating scale within Singapore's beverage sector.

In the energy sector, the subsidiary GS Inima closed 2024 with a record profit of 38 million euros on 389 million euros in sales, representing 10% of total sales. These figures highlight the company's strong financial performance and its commitment to sustainable practices.

The acquisition of Octopus Distribution Networks Pte. Ltd. is a strategic move to enhance the company's presence in the beverage sector. Octopus Distribution Networks brings a portfolio of over 1,500 SKUs across approximately 200 beverage brands. This will significantly broaden the company's market reach and product offerings.

GS Inima plans to strengthen its presence in key markets such as the UAE, Oman, Spain, Brazil, and Chile by 2025. The company is also exploring new market opportunities in Europe, the Middle East, and North Africa. This expansion reflects a broader commitment to sustainability and innovative solutions in water and energy management.

The company is expanding its brand presence across Asia and beyond through new franchising, licensing, and distribution models. This multi-faceted approach aims to access new customers and diversify revenue streams.

- The F&B group operates seven establishments in Singapore.

- The company has expanded internationally with two franchise outlets in Brunei under the 'Rasa Chicken by Sing Swee Kee' brand.

- In April 2025, GS Group acquired Scottish broker W K Insurance, integrating seven professionals into its team, reinforcing its UK presence.

- These initiatives demonstrate a multi-faceted approach to expansion, aiming to access new customers, diversify revenue streams, and stay ahead of industry changes.

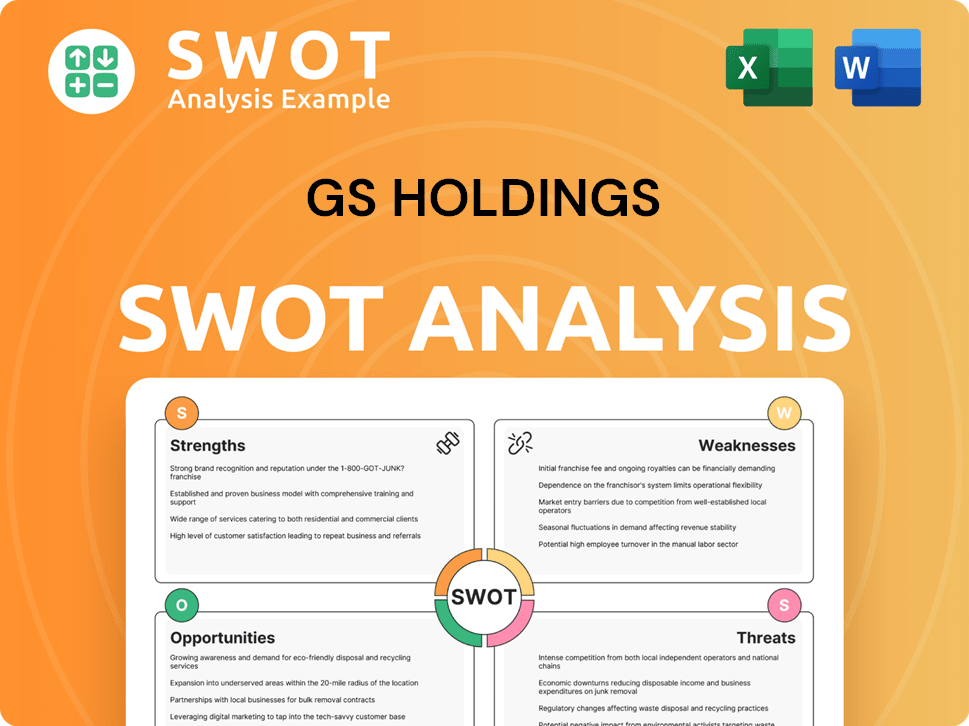

GS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GS Holdings Invest in Innovation?

GS Holdings is significantly investing in innovation and technology to foster sustained growth. This is particularly evident through its focus on digital transformation and the adoption of cutting-edge technologies. The company is actively working to streamline operations and reverse slowing growth, as highlighted during its 20th-anniversary commemoration in May 2025.

Chairman Huh Tae-soo emphasizes that while the group may not develop AI chips directly, creating new value through data management and AI technology for business transformation is a top priority. This strategic shift underscores the company's commitment to adapting to the evolving technological landscape.

A core element of GS Holdings' strategy involves integrating Artificial Intelligence (AI) and quantum computing across its diverse operations. This integration aims to modernize businesses and boost efficiency. The company's approach reflects a proactive stance toward leveraging technology for competitive advantage and future prospects.

GS Holdings is focusing on AI and quantum computing to modernize its businesses. This includes enhancing operational efficiency and driving strategic planning. The goal is to create new value through data management and AI technology.

The company is heavily investing in digital transformation. This involves streamlining operations and reversing slowing growth. Digital transformation is a key part of the growth strategy for GS Holdings.

GS Caltex is leading digital transformation efforts within the group. This includes applying digital technologies to enhance manufacturing competitiveness. The company is also developing in-house AI models to optimize production processes.

GS Holdings is exploring new business models driven by digital transformation. This includes GS Yuasa's focus on battery development for BEVs. The company aims to become a global leader in innovation and digital transformation.

Giza Systems, a GS Group entity, has launched a Global Service Delivery Center. This center provides faster, more scalable, and cost-effective solutions. The center aims to boost operational efficiency and streamline resource management.

GS Caltex plans to expand its digital expert training to include generative AI in 2025. The company has already produced over 220 internal digital experts. This investment in human capital supports its growth strategy.

GS Power has established a data platform for power plants, and GS E&R has developed a system to improve wind power forecasting by analyzing environmental data. GS Caltex is actively driving digital transformation, applying digital technologies to enhance manufacturing competitiveness and reshape employee workflows. This includes developing in-house AI models that optimize production processes and creating 'AnGen Bot,' a generative AI-based chatbot for safety guidelines. GS Caltex was recognized as the anchor company for the petrochemical sector of the AI Autonomous Manufacturing Alliance in July 2024 and received a Ministerial Award in December 2024 for contributions to Korea's industrial digital transformation. The company also plans to expand its digital expert training to include generative AI in 2025, having already produced over 220 internal digital experts. These efforts are crucial for understanding the mission, vision, and core values of GS Holdings and its future prospects.

The company is focusing on several key technological initiatives to drive growth. These initiatives include AI integration, digital transformation, and the development of new business models. These efforts are designed to enhance efficiency and competitiveness.

- AI and Quantum Computing: Integrating AI and quantum computing across operations.

- Digital Transformation: Streamlining operations and reversing slowing growth through digital initiatives.

- GS Caltex: Applying digital technologies to enhance manufacturing and employee workflows.

- New Business Models: Exploring new opportunities driven by digital transformation, such as battery development.

- Giza Systems: Launching a Global Service Delivery Center to improve operational efficiency.

- Digital Training: Expanding digital expert training to include generative AI.

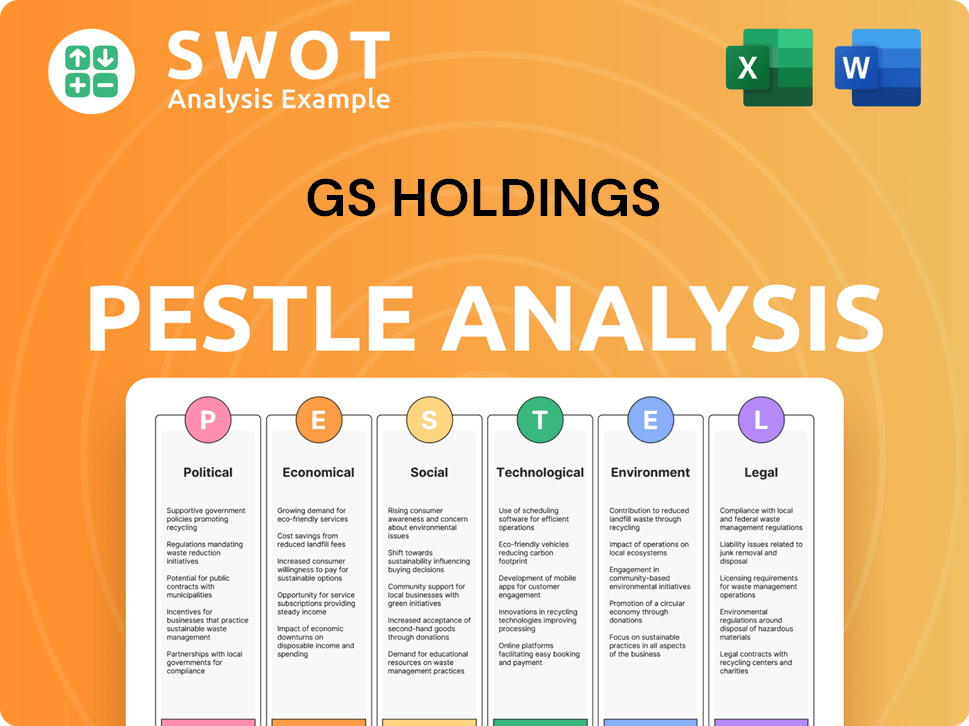

GS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is GS Holdings’s Growth Forecast?

The financial outlook for GS Holdings presents a mixed picture, yet shows signs of improvement, supported by strategic initiatives focused on future growth. The company's recent performance indicates both challenges and opportunities. For the three months ending March 2025, GS Holdings reported strong operating income, demonstrating its ability to generate profits from its core operations.

In the first quarter of 2025, GS Holdings experienced a slight decrease in revenue, but managed to increase its operating profit significantly quarter-on-quarter. The net profit also saw a substantial increase from the previous quarter, despite remaining lower than the same period last year. These figures highlight the company's efforts to streamline operations and improve profitability.

As of December 31, 2024, the F&B sector of GS Holdings reported almost unchanged annual revenue compared to the previous year. However, the annual loss improved significantly. The consolidated net assets for the F&B group improved, and cash and cash equivalents increased, largely due to financing activities. The gearing ratio also improved, indicating a more stable financial position. This data is crucial for understanding the Target Market of GS Holdings and its overall financial health.

For the three months ending March 2025, GS Holdings reported revenue of 6.24 trillion KRW and an operating income of 1.54 trillion KRW, resulting in an operating margin of 24.7%. The net income for the same period was 204.67 billion KRW, yielding a net margin of 3.3%.

GS Holdings has exceeded analyst expectations for Earnings Per Share (EPS) in the past quarter, achieving a 7.6% positive surprise. The analyst consensus target price for GS Holdings shares is KR₩49,783, which is 27.32% above the last closing price of KR₩39,100.

The annual revenue of GS Holdings Limited, primarily in the F&B sector, was S$9,235,000, almost unchanged from S$9,232,000 in 2023. The annual loss improved significantly, declining by 87.6% from S$18,781,000 to S$2,460,000.

Proceeds from recent share issuances are targeted toward future expansion and potential acquisitions, such as Octopus Distribution Networks Pte. Ltd., indicating a strategy to scale the business. Analysts forecast a consensus EPS of KR₩8,229 for the next financial year.

GS Holdings' financial performance showcases a mix of positive and negative trends, with strategic moves to enhance future prospects. The company’s ability to manage costs and improve profitability is evident. Here are some key takeaways:

- Revenue: Slight decline in Q1 2025, but stable performance in F&B sector for 2024.

- Profitability: Operating profit increased significantly quarter-on-quarter in Q1 2025.

- Net Income: Substantial growth in net profit in Q1 2025.

- Analyst Outlook: Positive consensus target price and EPS forecast.

- Strategic Focus: Proceeds from share issuances targeted towards expansion.

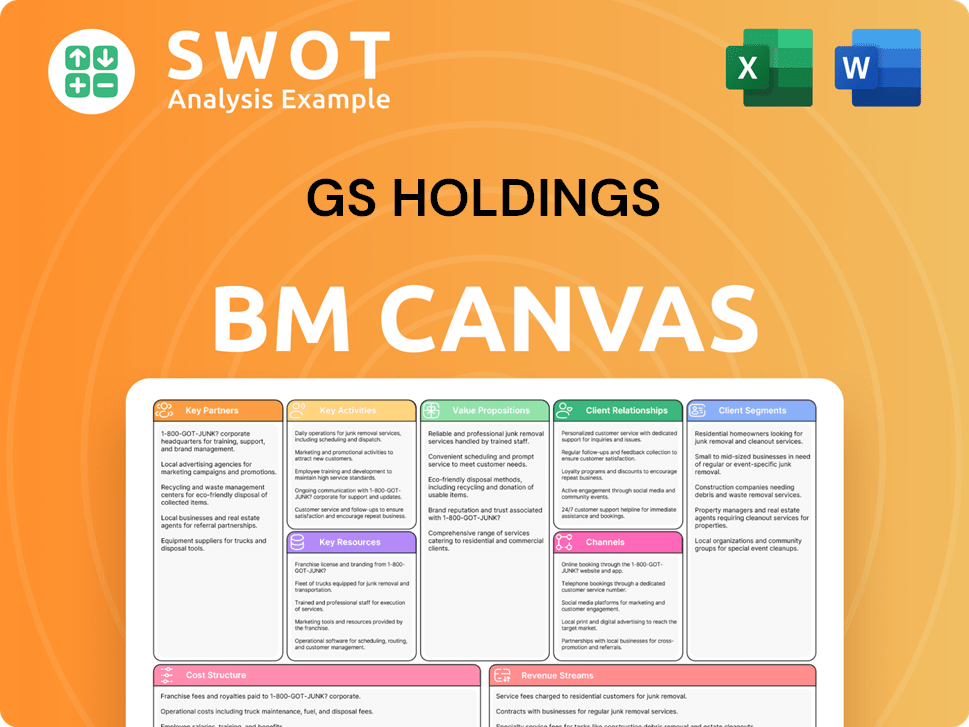

GS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow GS Holdings’s Growth?

The path forward for GS Holdings involves navigating several potential risks and obstacles that could impact its strategic goals. These challenges span market dynamics, regulatory compliance, operational efficiencies, and the broader geopolitical landscape. Understanding these risks is crucial for assessing the company's ability to execute its growth strategy and achieve its future prospects.

Market competition, particularly within the food and beverage (F&B) sector where GS Holdings Limited operates, presents a significant hurdle. The company's reliance on domestic F&B operations in a market sensitive to inflation and cost pressures adds to the risk profile. Furthermore, regulatory scrutiny and the need for continuous adaptation to technological disruptions pose ongoing challenges.

Internal and external factors, such as workforce turnover and global instability, also contribute to the complexity of GS Holdings' operating environment. These elements require proactive risk management and strategic planning to ensure sustained growth and resilience.

The F&B sector, where GS Holdings Limited operates, is highly competitive, requiring constant innovation and efficiency. The company faces pressure from both established players and emerging brands, necessitating robust marketing and operational strategies. To stay competitive, GS Holdings must continually adapt its offerings and improve its market positioning.

Regulatory changes and compliance issues can significantly impact GS Holdings. The ongoing investigation involving GS Holdings Limited by the Commercial Affairs Department (CAD) and the Monetary Authority of Singapore (MAS) highlights the importance of adhering to regulations. Any adverse findings could harm the company's reputation and financial performance.

Disruptions in the global supply chain can lead to delays, increased costs, and strained customer relationships for GS Holdings. These disruptions can arise from various factors, including natural disasters, geopolitical unrest, and supplier issues. Mitigating these risks requires a resilient supply chain strategy.

The increasing reliance on digital tools exposes GS Holdings to cyberattacks and technological disruptions. With the rise in cyber threats, the company must continuously update its security measures to protect its operations and data. Experts predict a rise in catastrophic cyber events, emphasizing the need for robust cybersecurity protocols.

Workforce turnover and retention pose a 'brain drain' risk for GS Holdings, requiring increased investment in safety training and digital solutions for operational risk management. Maintaining a skilled workforce is critical for operational efficiency and innovation. Addressing these challenges is essential for long-term success.

Geopolitical events, such as the war in Ukraine and the Israeli-Palestinian conflict, can significantly impact international trade and financial flows, affecting GS Holdings' operations. The company's diversification efforts, including its push into renewable energy and new markets, are aimed at mitigating these risks. The company has also trimmed its affiliates in 2024 to boost efficiency.

Effective strategic planning is crucial for navigating the risks and capitalizing on opportunities. GS Holdings needs to develop detailed plans to address market competition, regulatory changes, and supply chain vulnerabilities. This includes continuous market analysis, risk assessments, and the development of contingency plans to mitigate potential disruptions. For insights, check out the Marketing Strategy of GS Holdings.

GS Holdings' financial performance is closely tied to its ability to manage risks and achieve its growth strategy. Investment in technology, cybersecurity, and workforce development is essential. The company's financial health will be a key indicator of its ability to withstand external pressures and achieve its long-term goals. GS Holdings' stock forecast will depend on how well it navigates these challenges.

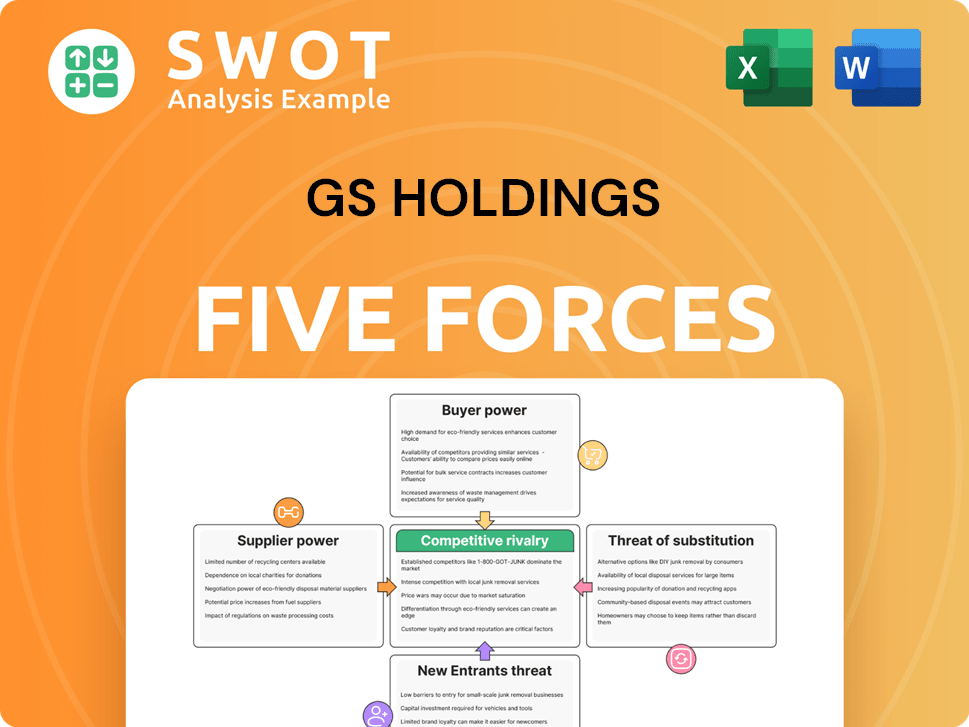

GS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GS Holdings Company?

- What is Competitive Landscape of GS Holdings Company?

- How Does GS Holdings Company Work?

- What is Sales and Marketing Strategy of GS Holdings Company?

- What is Brief History of GS Holdings Company?

- Who Owns GS Holdings Company?

- What is Customer Demographics and Target Market of GS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.