GS Holdings Bundle

How Does GS Holdings Stack Up Against Its Rivals?

GS Holdings, a South Korean powerhouse, operates across energy, retail, and construction, making it a fascinating case study in competitive dynamics. Understanding the GS Holdings SWOT Analysis is crucial to grasp its position. This analysis will delve into the company's strategic maneuvers and financial health compared to its rivals.

This exploration into the GS Holdings competitive landscape is vital for any investor or strategist. We will dissect GS Holdings competitors, examining their strengths and weaknesses through detailed GS Holdings market analysis. Furthermore, this report will explore GS Holdings business strategy, its financial performance, and how it navigates the challenges within its GS Holdings industry.

Where Does GS Holdings’ Stand in the Current Market?

GS Holdings maintains a significant market position within South Korea, operating across diverse sectors including energy, retail, and construction and services. Its energy sector, encompassing subsidiaries like GS Caltex Corp, is a major contributor, focusing on power generation and supply. The retail segment, managed by entities such as GS Retail, further strengthens its presence through convenience stores, supermarkets, and live commerce platforms.

The company's strategic diversification and operational scale are key elements of its competitive landscape. GS Holdings' subsidiaries hold substantial positions in their respective industries, with GS Caltex being a prominent player in petroleum refining and GS Retail managing well-known brands. The company's financial health and strategic initiatives reflect its adaptability and growth focus.

While precise overall market share figures for GS Holdings as a conglomerate are not readily available, its subsidiaries hold significant standing within their respective industries. GS Caltex is a major player in petroleum refining and petrochemical products, and GS Retail operates well-known brands like GS25 convenience stores and GS THE FRESH supermarkets. This diversified approach allows GS Holdings to navigate market fluctuations and capitalize on various opportunities.

GS Holdings demonstrated robust financial performance. Its trailing twelve-month revenue reached $18.1 billion as of March 31, 2025. For the full year ended December 31, 2024, the company reported sales of SGD 9.24 million, with a net loss of SGD 2.43 million, a significant improvement from a net loss of SGD 14.49 million in the previous year.

GS Holdings has undertaken strategic shifts and acquisitions to enhance its market position. The disposal of its dishware washing business in 2020 and expansion into the F&B sector with acquisitions like Hao Kou Wei Pte. Ltd. and Sing Swee Kee Pte. Ltd. in 2019. The proposed acquisition of Octopus Distribution Networks Pte. Ltd. in 2024, expected to be completed in 2025, further demonstrates a move to enhance its customer base.

The company's financial stability is reflected in its gearing ratio. The gearing ratio was 0.31 times in 2024, indicating a stable financial position. This stability supports its strategic initiatives and provides a foundation for future growth. The company's ability to manage its financial health is crucial in the competitive market.

GS Holdings leverages its diverse portfolio to maintain a strong market presence. The company's competitive advantages include its established brand recognition, extensive distribution networks, and strategic acquisitions. These factors contribute to its ability to compete effectively within the GS Holdings competitive landscape.

GS Holdings' market position is supported by its financial performance and strategic initiatives. The company's trailing twelve-month revenue of $18.1 billion as of March 31, 2025, and the improved net loss of SGD 2.43 million for the year ended December 31, 2024, demonstrate its resilience and growth. Further insights can be found in the Marketing Strategy of GS Holdings.

- Energy Sector Dominance: GS Caltex's strong presence in petroleum refining.

- Retail Network: GS Retail's extensive network of convenience stores and supermarkets.

- Financial Health: Gearing ratio of 0.31 times in 2024, indicating financial stability.

- Strategic Acquisitions: Expansion into the F&B sector and proposed acquisitions to enhance customer base.

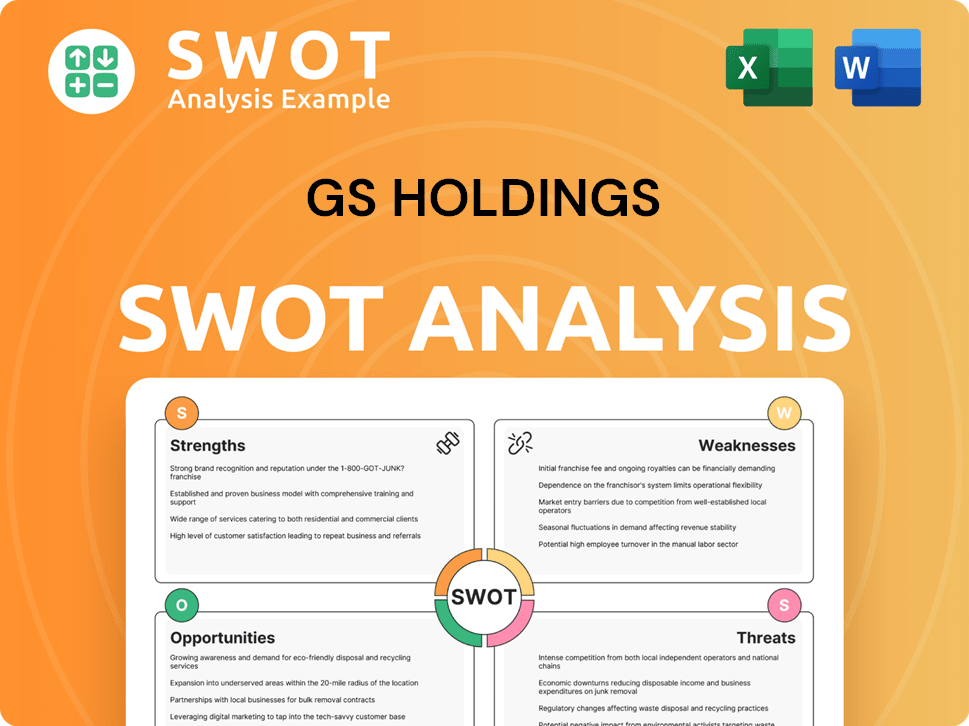

GS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging GS Holdings?

The Growth Strategy of GS Holdings faces a complex competitive landscape. GS Holdings' competitive environment is shaped by its diversified business portfolio and the broader economic conditions of South Korea. Understanding the key competitors and market dynamics is crucial for evaluating its strategic positioning and future prospects.

GS Holdings' industry presence spans multiple sectors, increasing the complexity of its competitive analysis. The company's financial performance is directly influenced by its ability to navigate these competitive pressures and capitalize on market opportunities. This analysis provides insights into the competitive dynamics affecting GS Holdings.

GS Holdings' competitive landscape is characterized by both direct and indirect competitors, depending on the specific business segment. This section examines the key players and market trends shaping its competitive environment.

GS Holdings operates within a competitive environment that includes major South Korean conglomerates. These conglomerates, such as CJ, Hanwha, LG, and SK Square, compete across multiple industries, challenging GS Holdings' market share and growth potential.

In the energy sector, GS Holdings faces competition from other major energy producers and distributors in South Korea. The specifics of these competitors are often not explicitly named in public reports, but the competitive pressure is significant, especially in areas like oil refining and distribution.

In the retail sector, GS Retail competes with a variety of players. This includes large supermarket chains, convenience store operators, and e-commerce platforms. The competition is intense, driven by changing consumer preferences and technological advancements.

For GS Holdings Limited, the Singapore-based entity with similar name, the F&B sector is particularly competitive. Competitors include local establishments in Singapore's dynamic F&B market. This sector is characterized by rapid innovation and changing consumer tastes.

Emerging players and industry consolidation significantly influence the competitive dynamics. South Korea's private equity market is growing, with firms actively acquiring non-core assets from large conglomerates. This creates new competitive pressures and partnership opportunities.

The M&A market in South Korea, though experiencing a downturn in 2024, is projected to rebound in 2025. This rebound is driven by conglomerates divesting non-core assets, particularly in sectors like chemicals, oil refining, and energy. These shifts can lead to changes in market share and the emergence of new competitive configurations.

GS Holdings' competitive landscape is shaped by the presence of large conglomerates, sector-specific competition, and the impact of emerging market trends. Understanding these dynamics is crucial for effective business strategy. Key considerations include:

- Market Share Analysis: Assessing GS Holdings' market share compared to its competitors in each business segment.

- SWOT Analysis: Evaluating GS Holdings' strengths, weaknesses, opportunities, and threats in the context of its competitors.

- Competitive Advantages: Identifying and leveraging GS Holdings' unique selling propositions.

- Financial Performance: Comparing GS Holdings' financial health and key performance indicators (KPIs) with those of its competitors.

- Growth Strategies: Analyzing GS Holdings' growth strategies compared to industry peers.

- Innovation and Technology: Assessing GS Holdings' adoption of innovation and technology relative to its competitors.

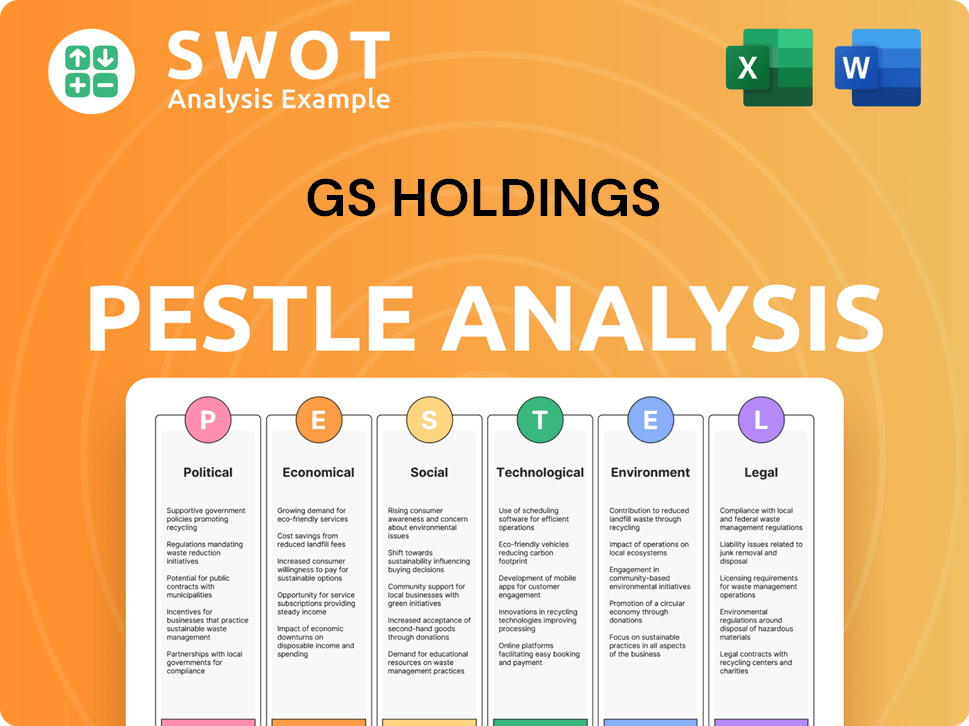

GS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives GS Holdings a Competitive Edge Over Its Rivals?

The competitive landscape of GS Holdings is shaped significantly by its diversified business model and strategic initiatives. The company, operating across energy, retail, construction, and services, leverages this diversification to create synergistic value, enhancing its overall competitiveness. This approach provides a stable revenue base, with the energy sector being a primary driver, and retail operations ensuring consistent consumer engagement. A deep dive into the Brief History of GS Holdings reveals the evolution of these strategic moves.

GS Holdings' strong brand equity and established presence in the South Korean market are crucial competitive advantages. The company benefits from consumer trust and recognition across its various business lines. Its agile management approach, demonstrated by strategic divestitures and acquisitions, allows it to maintain relevance and profitability. The company's focus on managing and investing in its subsidiaries further strengthens its market position.

Furthermore, GS Holdings' commitment to strategic investments, particularly in renewable energy and smart power solutions within its energy segment, positions it for future growth. The pursuit of carbon neutrality and environmental management initiatives by GS Energy also enhances brand reputation. These advantages, combined with a disciplined operational focus, contribute to GS Holdings' sustainable position in a competitive environment.

GS Holdings operates across multiple sectors, including energy, retail, construction, and services. This diversification allows for synergistic value creation and a stable revenue base. The energy sector, being the largest part of its portfolio, offers a robust foundation, while retail operations provide consistent consumer engagement.

GS Holdings benefits from a strong brand presence in the South Korean market, fostering consumer trust and recognition. This established brand equity is a key competitive advantage. The company's ability to adapt and strategically manage its portfolio further strengthens its position.

GS Holdings is committed to strategic investments, particularly in renewable energy and smart power solutions. These investments position the company for future growth and resilience. The company's proactive approach to sustainability, including initiatives for carbon neutrality, enhances its brand reputation.

The company demonstrates an agile management approach, strategically divesting or acquiring businesses to maintain relevance and profitability. This adaptability allows GS Holdings to respond effectively to changing market dynamics. This agility is crucial for navigating the competitive landscape.

GS Holdings' competitive advantages stem from its diversified business model, strong brand equity, and strategic investments. These factors contribute to its sustainable position in a competitive environment. The company's financial performance is supported by its strategic focus and operational discipline.

- Diversified business portfolio across energy, retail, construction, and services.

- Strong brand recognition and consumer trust in the South Korean market.

- Strategic investments in renewable energy and smart power solutions.

- Agile management approach with strategic divestitures and acquisitions.

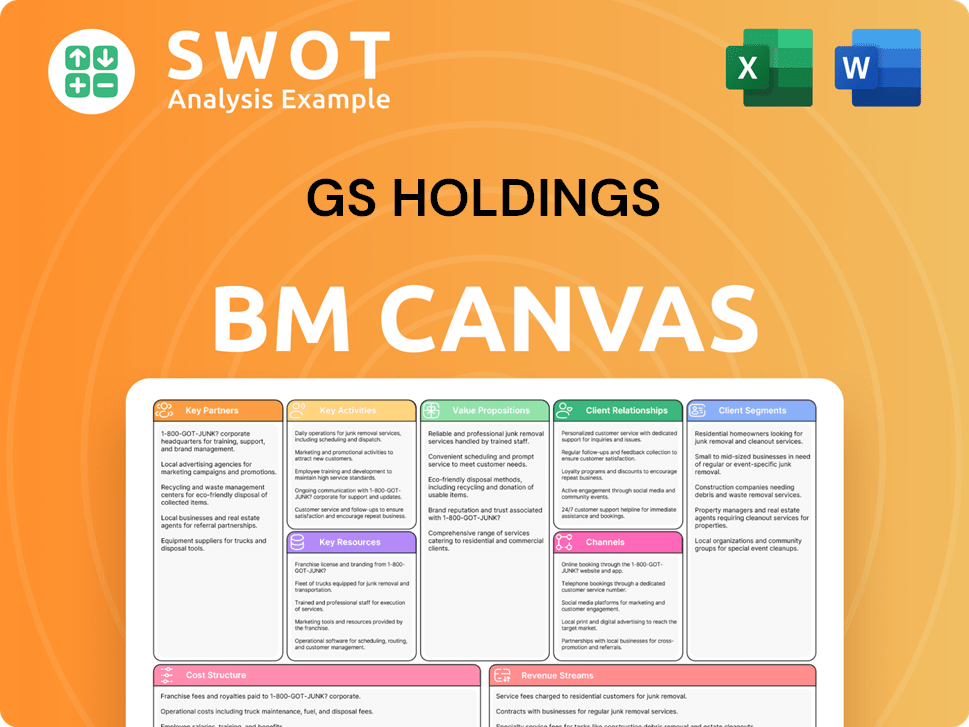

GS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping GS Holdings’s Competitive Landscape?

The competitive landscape for GS Holdings is shaped by evolving industry trends, presenting both challenges and opportunities. The company faces pressures from the global shift towards carbon neutrality and renewable energy, requiring strategic adaptation. Simultaneously, the South Korean market's ongoing streamlining of operations and divestitures creates a dynamic environment for mergers and acquisitions.

Risks include economic uncertainties, geopolitical tensions, and potential regulatory shifts. The company's financial performance in 2024, marked by a decrease in revenue and operating profit, reflects these challenges. However, opportunities emerge from the increasing demand for sustainable solutions and evolving consumer preferences, such as the growing co-living market.

The energy sector is experiencing a global shift towards carbon neutrality and renewable energy. In South Korea, conglomerates are streamlining operations and divesting non-core assets. The co-living market is expanding due to changing consumer preferences.

Global economic uncertainties and geopolitical tensions pose risks to the South Korean economy. Potential regulatory shifts and fluctuations in commodity prices present further challenges. The company's recent financial results reflect these pressures.

Increasing demand for sustainable solutions creates investment opportunities in green technologies. The co-living market and the acquisition of Octopus Distribution Networks Pte. Ltd. offer diversification possibilities. Strategic moves toward renewable energy can also be beneficial.

The company is focusing on sustainable growth through new and renewable energy, smart power solutions, and clean hydrogen. It emphasizes managing diversified business portfolios and strategic investments. The company aims for low-carbon product certification by 2024.

The Growth Strategy of GS Holdings involves navigating industry shifts and economic uncertainties. It focuses on sustainable solutions and strategic acquisitions to enhance market position. The company faces both competitive threats and opportunities in a dynamic landscape.

- The company's revenue decreased by 2.6% in 2024 due to global economic slowdown.

- Operating profit decreased by 17.8% in 2024 due to global economic slowdown and interest rate hikes.

- South Korea's real GDP growth was estimated at 2.2% in 2024.

- The M&A market in South Korea is expected to slowly rebound in 2025.

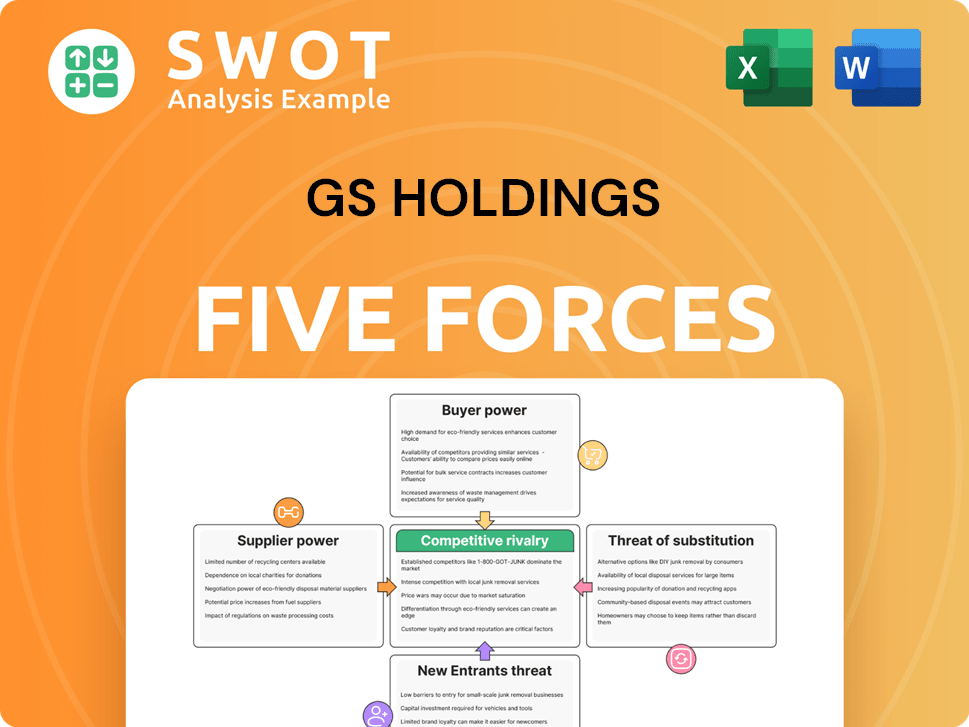

GS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GS Holdings Company?

- What is Growth Strategy and Future Prospects of GS Holdings Company?

- How Does GS Holdings Company Work?

- What is Sales and Marketing Strategy of GS Holdings Company?

- What is Brief History of GS Holdings Company?

- Who Owns GS Holdings Company?

- What is Customer Demographics and Target Market of GS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.