Hagerty Bundle

How Did Hagerty Company Rev Up Its Engine?

From protecting wooden boats to becoming a global automotive lifestyle brand, the Hagerty SWOT Analysis reveals a fascinating evolution. Founded in 1984 by Frank and Louise Hagerty, the company identified a need for specialized insurance, which laid the foundation for their success. Today, Hagerty Insurance is synonymous with Hagerty classic cars and a vibrant community of enthusiasts.

The story of Hagerty Company is a testament to recognizing and capitalizing on a niche market. Starting with Classic car insurance, Hagerty has grown exponentially, offering a range of services beyond insurance, including a Hagerty valuation tool. Their commitment to the car community, coupled with impressive financial results, makes understanding the brief history of Hagerty insurance company crucial for anyone interested in the automotive world or investment strategies.

What is the Hagerty Founding Story?

The story of the Hagerty Company began in 1984 in Traverse City, Michigan, thanks to Frank and Louise Hagerty. Their journey started with a personal need: finding proper insurance for their classic wooden boats. This experience led them to identify a gap in the market, specifically the lack of specialized insurance for unique vehicles.

Driven by this insight, the Hagertys launched Hagerty Classic Marine Insurance. This initial focus on wooden boats highlights their early commitment to a niche market. Their son, McKeel Hagerty, even contributed by designing the company's logo while in graduate school. This family-oriented beginning underscores the company's roots.

The economic and cultural context of the 1980s, where traditional insurers often overlooked specialized markets like classic wooden boats, provided fertile ground for Hagerty's business model. This approach allowed them to carve out a unique space in the insurance industry, focusing on collector vehicles and their specific needs. The company's early success set the stage for its later expansion into the broader collector car insurance market.

Hagerty was founded in 1984 by Frank and Louise Hagerty, starting with insurance for classic wooden boats.

- The company's initial focus was on insuring classic wooden boats, addressing an unmet need.

- McKeel Hagerty designed the company's logo, showcasing the family's involvement.

- The business model thrived in a market where traditional insurers overlooked niche areas.

- Hagerty's early success paved the way for its expansion into the collector car insurance sector.

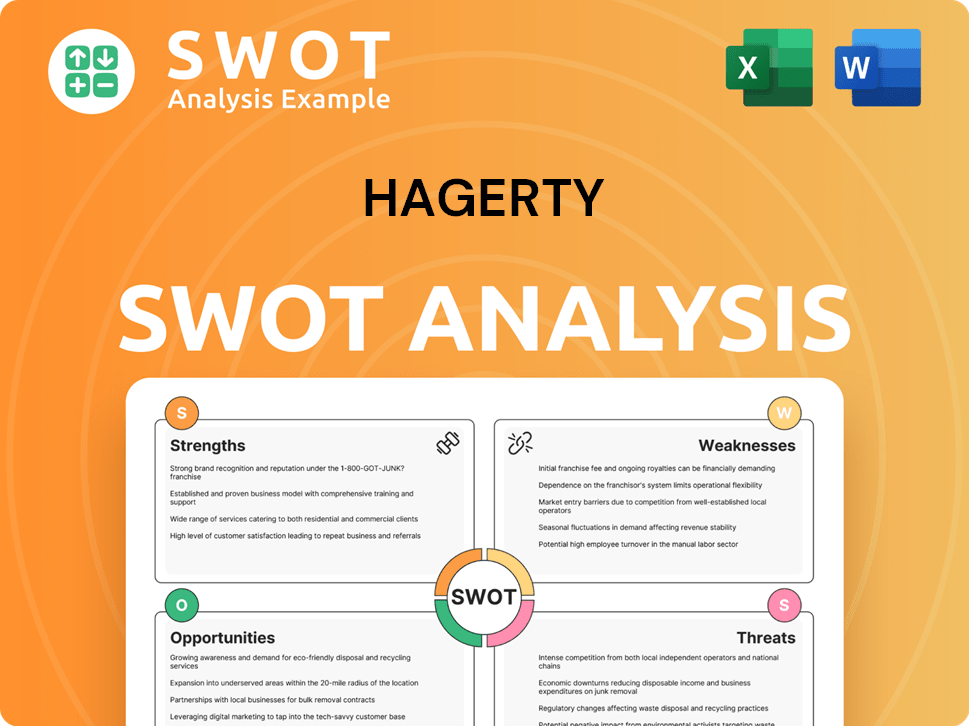

Hagerty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Hagerty?

The early growth of the Hagerty Company involved a significant shift from marine insurance to classic automobiles. This strategic move in 1991, focusing on classic car insurance, established its core market and fueled future expansion. The company's trajectory was further shaped by key personnel and strategic initiatives. The Hagerty Company has become a prominent name in the collector car insurance industry.

In 1991, Hagerty Insurance expanded its offerings to include classic car insurance, marking a pivotal shift. This strategic move established the company's core focus on the collector car market. The company relocated to a new office at Grandview Plaza, supporting its growing operations.

McKeel Hagerty joined the team in 1995 as Vice President of Marketing, contributing to the company's evolution. During the 2000s, Hagerty began building an ecosystem beyond insurance. This included the launch of the Hagerty Drivers Club (formerly Hagerty Plus) and its media operations.

The Hagerty Drivers Club fostered community and brand loyalty through content and member perks. By 2024, the Hagerty Drivers Club had approximately 876,000 paid members, reflecting a 7% year-over-year increase. The Hagerty Price Guide, launched in 2008, became a crucial valuation tool for classic car buyers.

Hagerty's expansion continued with acquisitions like DriveShare in 2017, entering the peer-to-peer classic car rental market. In 2022, Hagerty acquired Broad Arrow Group, enhancing its presence in collector car auctions. The company expanded into Canada, the U.K., and Germany. In 2024, Hagerty acquired Consolidated National Insurance Company for approximately $18.4 million, further bolstering its offerings and market presence.

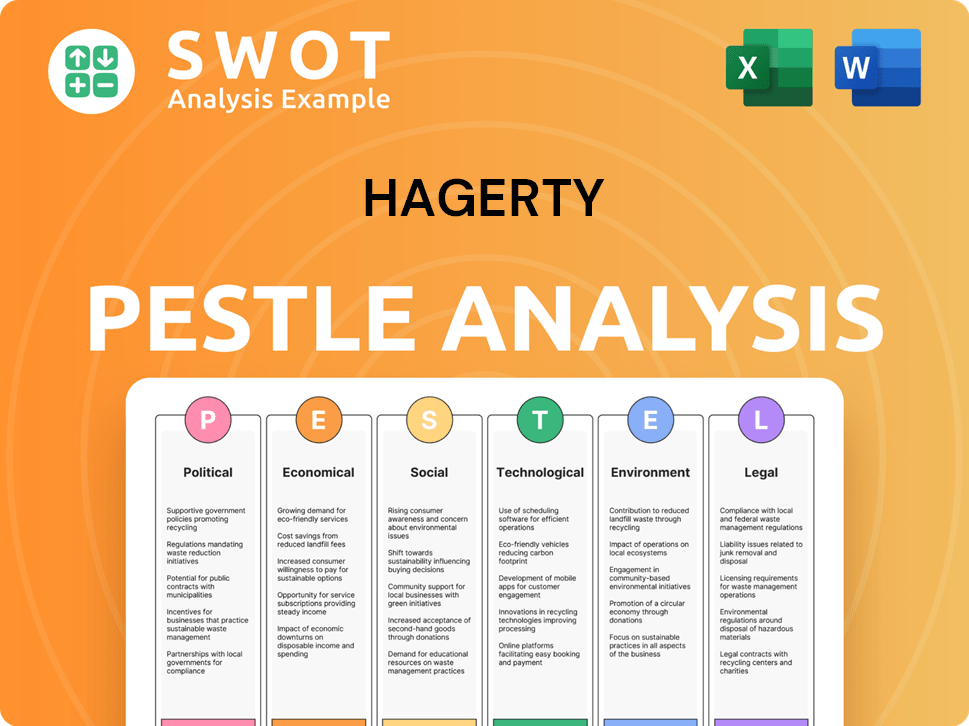

Hagerty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Hagerty history?

The Hagerty Company has achieved several significant milestones throughout its history, establishing itself as a key player in the classic and collector car insurance market. These achievements reflect its growth and adaptation within the automotive enthusiast community and the insurance industry.

| Year | Milestone |

|---|---|

| Early Years | The company pioneered specialized insurance for classic and collector vehicles, a niche underserved by traditional insurers. |

| 2008 | The Hagerty Price Guide was first published, becoming a key valuation tool for the classic car market. |

| Ongoing | The Hagerty Drivers Club was launched, offering members exclusive content, events, and roadside assistance. |

| 2024 | Hagerty released its 2025 U.S. Bull Market list, identifying collector vehicles expected to increase in value. |

Hagerty Insurance has consistently introduced innovations to better serve its customers and the classic car community. These innovations have helped the company maintain its position in the market and provide unique value to its members.

Hagerty Insurance created specialized insurance products tailored for classic and collector vehicles, which was a groundbreaking innovation. This focus allowed for the development of tailored policies and services that catered specifically to the needs of classic car owners.

The Hagerty Drivers Club was launched to provide members with exclusive content, events, and roadside assistance. This initiative enhanced the overall experience for Hagerty classic cars owners and fostered a strong community.

The Hagerty valuation tool, first published in 2008, provides valuable insights into the classic car market. This tool has become a key resource for valuing vehicles and understanding market trends.

The 2025 U.S. Bull Market list identifies collector vehicles expected to increase in value. This provides valuable information for enthusiasts and investors in the Hagerty classic cars market.

Significant technology investments, including the implementation of a new insurance IT platform, Duck Creek, are underway. These investments aim to support growth ambitions and enhance operational efficiency.

Despite its successes, Hagerty Company has faced and continues to face several challenges. Adapting to market dynamics and maintaining a competitive edge in the insurance and collector car markets are ongoing priorities.

Market downturns and competitive threats in both the insurance and collector car markets present ongoing challenges. These factors require continuous strategic adjustments and operational efficiency.

In 2023, the company initiated a strategic review, leading to the sale or reorganization of certain businesses. This was done to prioritize investments in areas with strong growth and profit potential.

In 2024, the company reported a net income increase of 178% to $78.3 million, and adjusted EBITDA growth of 41% to $124.5 million. Despite an estimated $11 million pre-tax impact from Southern California wildfires, the company demonstrated resilience.

Hagerty Insurance is continuously adapting and innovating to respond to market dynamics and internal needs. This includes significant technology investments and strategic financial management.

The company's focus on its core business of Hagerty classic cars insurance and related services is a key strategy. This allows for more efficient resource allocation and targeted growth initiatives.

The company is making significant technology investments to support its growth ambitions and enhance efficiency. This includes the implementation of a new insurance IT platform, Duck Creek.

To learn more about the company's values and mission, you can read about the Mission, Vision & Core Values of Hagerty.

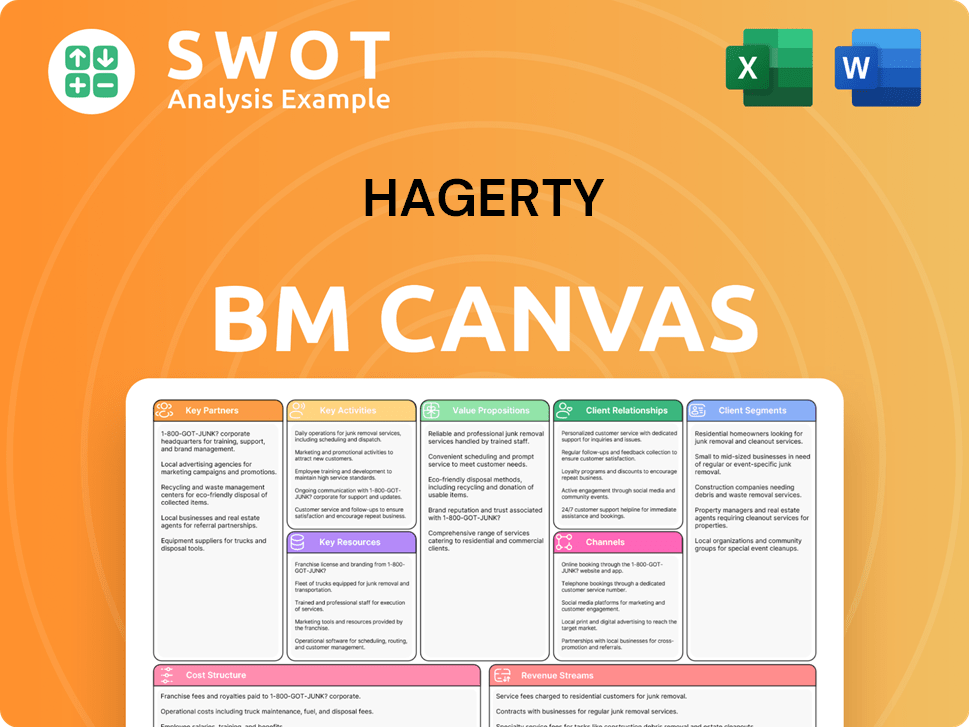

Hagerty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Hagerty?

The Hagerty Company has a rich history, evolving from its marine insurance roots to become a leading provider of classic car insurance and a prominent player in the collector car market. Here's a look at the key milestones.

| Year | Key Event |

|---|---|

| 1984 | Frank and Louise Hagerty founded Hagerty Classic Marine Insurance in Traverse City, Michigan, focusing on insuring wooden boats. |

| 1991 | The company expanded into classic car insurance, establishing its core market focus. |

| 1995 | McKeel Hagerty joined the company as Vice President of Marketing. |

| 2000 | McKeel Hagerty became CEO. |

| 2000s | Hagerty launched Hagerty Drivers Club and its media operations, including Hagerty magazine, to build an automotive enthusiast ecosystem. |

| 2008 | The first annual Hagerty Price Guide was published, providing classic car valuation data. |

| 2017 | Hagerty acquired DriveShare, entering the peer-to-peer classic car rental market. |

| 2021 | Hagerty went public via a SPAC merger, trading on the NYSE under the ticker HGTY. |

| 2022 | Hagerty acquired Broad Arrow Group, expanding into collector car auctions and live events. |

| February 2024 | Hagerty acquired Consolidated National Insurance Company for $18.4 million. |

| March 2025 | Hagerty reported full-year 2024 results, with total revenue increasing 20% year-over-year to $1.200 billion and a record 279,000 new members added. |

| May 2025 | Hagerty reported Q1 2025 financial results, with total revenue of $320 million, an 18% increase year-over-year, and net income surging 233% to $27 million. |

Hagerty aims to more than double its policy count to three million by 2030. This demonstrates a strong commitment to expanding its customer base. The company's strategic plans are geared toward long-term sustainable growth.

Key initiatives for 2025 include the rollout of the State Farm Classic Plus program to over 25 states and the launch of Enthusiast Plus insurance products. These initiatives are designed to expand market reach and product offerings. This strategy is designed to attract a wider range of customers.

Hagerty is making significant technology investments, including a $20 million elevated spend in 2025. This investment is primarily focused on its new technology platform, Duck Creek. This will enable accelerated growth in 2026 and beyond.

The company anticipates written premium growth of 13-14% and total revenue growth of 12-13% for the full year 2025. Net income is projected to grow 30-40%, and Adjusted EBITDA by 21-29% in 2025. These projections show a positive financial outlook for the company.

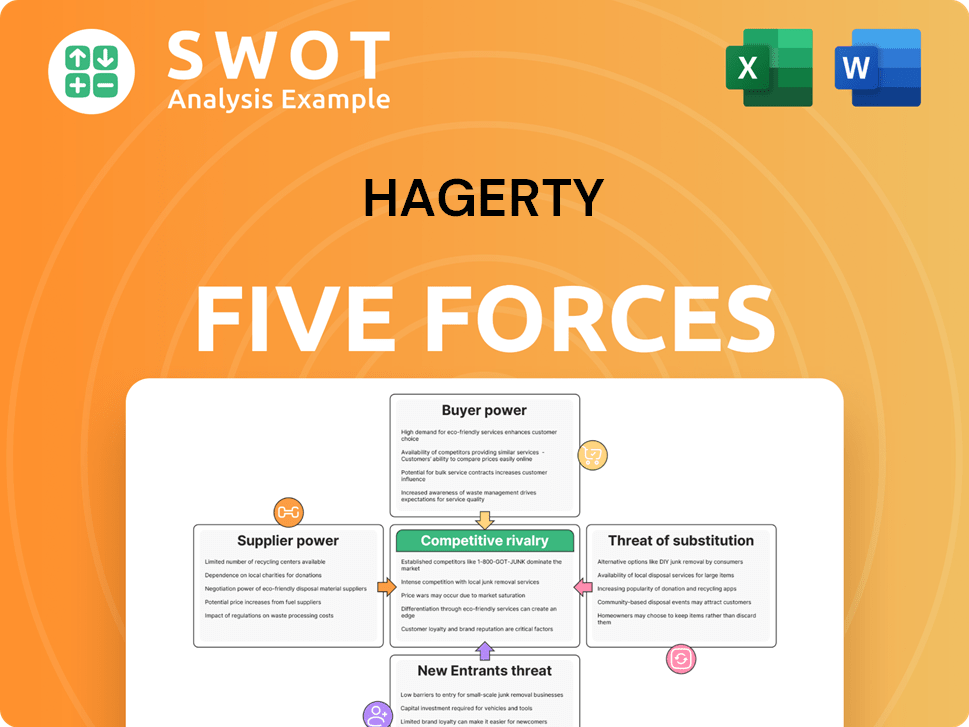

Hagerty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Hagerty Company?

- What is Growth Strategy and Future Prospects of Hagerty Company?

- How Does Hagerty Company Work?

- What is Sales and Marketing Strategy of Hagerty Company?

- What is Brief History of Hagerty Company?

- Who Owns Hagerty Company?

- What is Customer Demographics and Target Market of Hagerty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.