Hagerty Bundle

Who Really Owns Hagerty?

Ever wondered who steers the ship at Hagerty, the go-to name in classic car insurance? Unraveling Hagerty SWOT Analysis reveals more than just its business strategies; it unveils the very fabric of its ownership and strategic direction. From its humble beginnings to its current status as a publicly traded entity, understanding Hagerty's ownership is key to understanding its future.

Since becoming a public company in December 2021, Hagerty's ownership structure has undergone a significant transformation. This shift, coupled with the company's expansion into valuation tools and automotive content, makes understanding who owns Hagerty even more crucial. Knowing the key stakeholders provides valuable context for evaluating Hagerty's market position, its financial stability, and its long-term prospects in the classic car insurance sector. This analysis will explore the evolution of Hagerty ownership, from its founders to its current mix of public shareholders, shedding light on the company's strategic trajectory.

Who Founded Hagerty?

The story of Hagerty begins in 1984, when Frank and Louise Hagerty established the company. Their initial operations were based in the basement of their home in Traverse City, Michigan. The couple's motivation was rooted in their personal difficulty finding suitable insurance for their classic wooden boats.

Hagerty started as Hagerty Classic Marine Insurance. It pioneered an 'Agreed Value' policy for vintage boats. This was a groundbreaking approach in the insurance sector at the time. The business was a family affair from the start, indicating a self-funded beginning without significant early-stage venture capital.

Frank and Louise Hagerty were the primary owners when the company was founded. Their children, including McKeel Hagerty, Tammy Hagerty, and Kim Hagerty, played roles in the early days. McKeel Hagerty designed a new logo in 1991 and later joined officially in 1995. Kim Hagerty joined in 1996 after a law career, holding positions such as legal counsel, co-CEO, and chairman of the board before retiring in 2014. Kim Hagerty passed away in 2021.

The company started in the founders' home basement.

Children of the founders were involved early on.

High service levels and guaranteed value were key.

The initial focus was on classic wooden boats.

They introduced the 'Agreed Value' policy.

Frank and Louise Hagerty were the primary owners initially.

Understanding the early ownership structure of Hagerty is crucial for grasping its evolution. The founders' vision, centered on high service and guaranteed value, has been a key differentiator. The family's involvement shaped the company's culture and values, which remain significant today. For more information on how Hagerty generates revenue, explore the Revenue Streams & Business Model of Hagerty.

- Hagerty was founded in 1984 by Frank and Louise Hagerty.

- The company began as Hagerty Classic Marine Insurance.

- McKeel Hagerty, son of the founders, played a significant role.

- Kim Hagerty, also a child of the founders, held key positions.

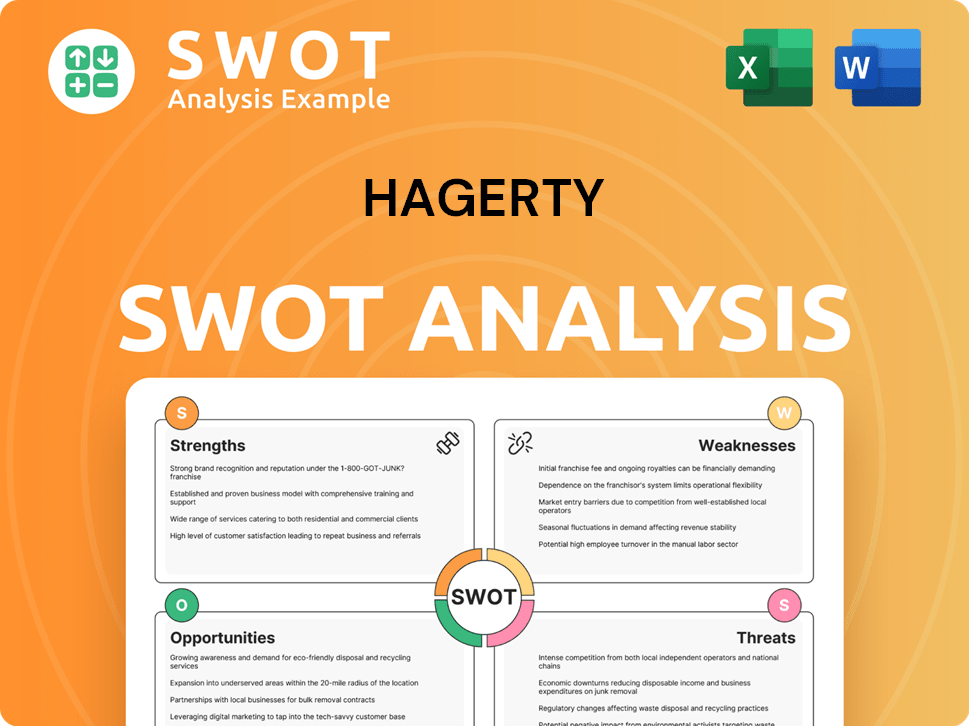

Hagerty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Hagerty’s Ownership Changed Over Time?

The ownership structure of Hagerty has significantly evolved, most notably with its transition to a public company. In December 2021, Hagerty went public through a merger with Aldel Financial Inc., a special purpose acquisition company (SPAC). This move, which valued the company at approximately $3.1 billion, marked a pivotal moment in Hagerty's history, allowing it to access public capital markets. This shift enabled accelerated growth and strategic initiatives.

Despite going public, a substantial portion of control remains with insiders, particularly the founding Hagerty family and management. This structure has allowed Hagerty to maintain strong internal direction while leveraging the benefits of being a publicly traded entity. The company's strategic direction has been influenced by these changes, enabling acquisitions such as Broad Arrow Group in 2022 to expand its presence in collector car auctions and events.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| SPAC Merger | December 2021 | Hagerty became a public company, valued at approximately $3.1 billion. |

| Institutional Investment | 2021 | State Farm and Markel Corporation led a $704 million investment. |

| Ownership Concentration | Late 2024 - April 2025 | Significant ownership remains with the Hagerty family and institutional investors. |

As of April 18, 2025, Hagerty Holding Corp. (HHC), owned by the Hagerty family, may be deemed the beneficial owner of approximately 52.8% of the Class A Common Stock outstanding. McKeel Hagerty may be deemed the beneficial owner of 50,978,823 shares, Tammy Hagerty of 57,889,514 shares, and the Kim Hagerty Revocable Trust of 44,439,894 shares of Class A Common Stock. Major institutional investors also hold significant positions. For instance, State Farm Investment Management Corp. and Markel Group Inc. are notable stakeholders. Institutional investors collectively own 20.51% of Hagerty stock as of 2025. To learn more about the company, you can read a Brief History of Hagerty.

Hagerty's ownership is primarily held by insiders and institutional investors.

- The Hagerty family, through Hagerty Holding Corp. (HHC), holds a significant stake.

- Institutional investors like State Farm and Markel Group Inc. also have substantial holdings.

- The company went public via a SPAC merger in December 2021.

- This structure allows for both insider control and access to public capital.

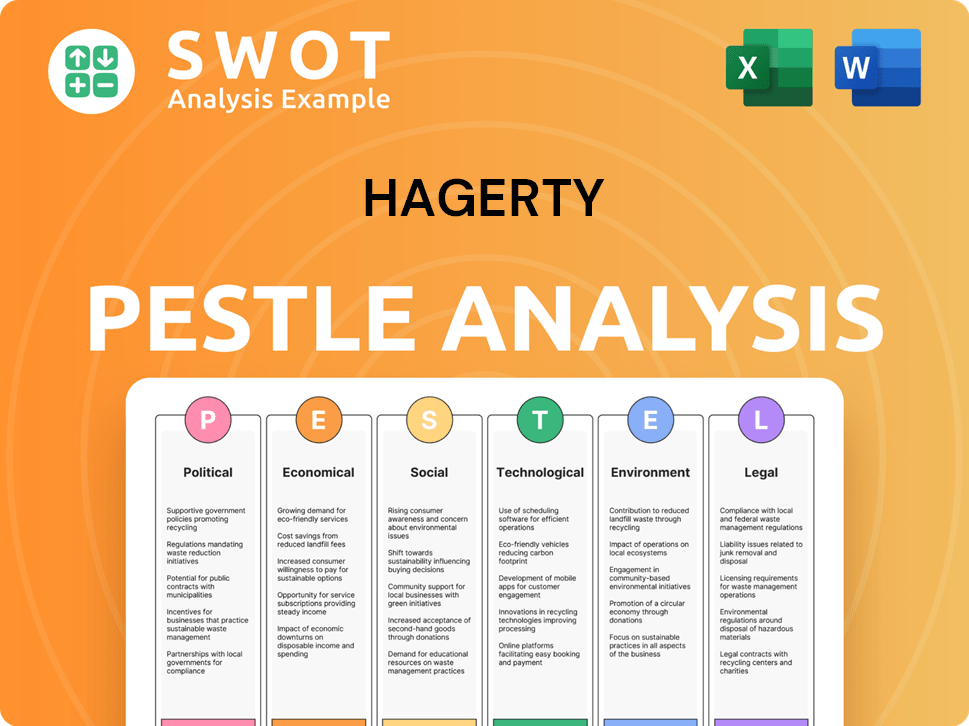

Hagerty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Hagerty’s Board?

As of April 24, 2025, the board of directors at Hagerty comprises nine members. McKeel Hagerty holds the positions of both Chairman and CEO, a dual role he assumed in February 2024. William (Bill) Swanson serves as the Lead Director, elected by the independent directors. Other board members include Randall (Rand) Harbert, Laurie Harris, Michael (Mike) Heaton, Robert (Rob) Kauffman, Sabrina Kay, and Anthony Kuczinski. Michael Heaton was a director nominee as of April 24, 2025, and Anthony Kuczinski joined the board on July 9, 2024.

The Talent, Culture and Compensation Committee, established in October 2024, is responsible for senior executive succession planning and compensation. The board emphasizes the importance of director ownership, setting a minimum stock ownership guideline for non-employee directors at five times the annual retainer. This structure ensures alignment between the directors' and stockholders' interests, contributing to the overall governance of Hagerty.

| Board Member | Role | Date Joined |

|---|---|---|

| McKeel Hagerty | Chairman and CEO | February 2024 |

| William (Bill) Swanson | Lead Director | N/A |

| Randall (Rand) Harbert | Director | N/A |

| Laurie Harris | Director | N/A |

| Michael (Mike) Heaton | Director Nominee | April 24, 2025 |

| Robert (Rob) Kauffman | Director | N/A |

| Sabrina Kay | Director | N/A |

| Anthony Kuczinski | Director | July 9, 2024 |

Hagerty's voting structure includes a dual-class share system, which gives the founding family significant control. Holders of Class V Common Stock are entitled to ten votes per share, while holders of Class A Common Stock have one vote per share. This 10-to-1 voting ratio ensures that the holders of Class V Common Stock, primarily the Hagerty family through Hagerty Holding Corp. (HHC), control a majority of the combined voting power. This control is expected to remain until at least December 2, 2036, or until certain transfers of Class V Common Stock occur. Decisions regarding the voting or disposition of Class V Common Stock held by HHC are generally made by a majority vote of the three principal voting shareholders: McKeel Hagerty, Tammy Hagerty, and The Goldman Sachs Trust Company, N.A., as trustee for the Kim Hagerty Revocable Trust. Understanding the target market of Hagerty is crucial for appreciating the company's strategic direction and its approach to classic car insurance.

Hagerty's board is structured to balance family influence, major shareholder interests, and independent oversight.

- McKeel Hagerty serves as Chairman and CEO.

- The Hagerty family maintains significant control through a dual-class share system.

- The board has a Talent, Culture and Compensation Committee.

- Non-employee directors must meet a minimum stock ownership guideline.

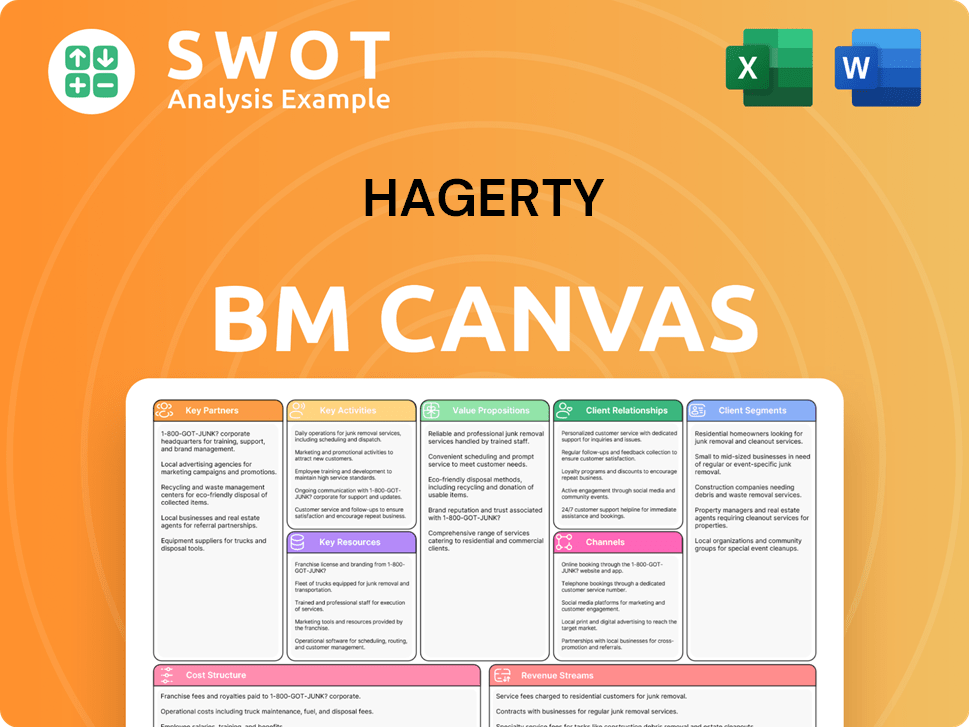

Hagerty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Hagerty’s Ownership Landscape?

In the past few years, the ownership structure of Hagerty has seen some notable changes. A key event was the warrant exchange in July 2024, resulting in the issuance of 3.9 million shares of Class A Common Stock. Such transactions, along with potential secondary offerings or strategic investments, can influence the distribution of shares among different investor groups. Understanding these shifts is crucial for assessing the company's financial health and strategic direction.

Hagerty has actively pursued strategic acquisitions to expand its automotive enthusiast ecosystem. For instance, in 2022, Hagerty fully acquired Broad Arrow Group for $64.8 million in an all-stock transaction. This acquisition strengthened Hagerty's position in the collector car auction and live events market, diversifying its revenue streams beyond its core insurance offerings. These moves demonstrate a commitment to growth and a broader market presence, which could further affect its ownership dynamics.

| Ownership Category | Approximate Percentage (March 2025) | Key Details |

|---|---|---|

| Institutional Investors | Approximately 25% | Significant holdings indicating confidence from larger financial entities. |

| Public Float/Retail Investors | Around 10% | Represents the shares available for public trading and individual investor holdings. |

| Insider Ownership (Hagerty Family) | Significant | Aligns management interests with long-term company performance. McKeel Hagerty owns 1.1 million shares as of June 11, 2025, valued at $10.9 million. |

Hagerty's financial performance in 2024 displayed robust growth. Total revenue increased by 20% year-over-year to $1.200 billion, and written premium rose by 15% to $1.044 billion. The company added a record 279,000 new members in 2024, and the Hagerty Drivers Club (HDC) membership exceeded 2.8 million paid members by the end of 2024. For the full year 2025, Hagerty anticipates total revenue growth of 12-13% and net income growth of 30-40%. The company aims to more than double its policy count to three million by 2030. This growth is further discussed in the Marketing Strategy of Hagerty.

Institutional investors hold a significant portion of Hagerty shares, reflecting confidence from major financial institutions. The Hagerty family maintains substantial insider ownership, aligning with long-term company goals. The public float and retail investors also make up a portion of the ownership structure.

Hagerty's acquisition of Broad Arrow Group expanded its presence in the collector car market. This strategic move diversified revenue streams beyond insurance, demonstrating a proactive approach to growth. These acquisitions reflect a broader strategy to enhance the company's market position.

Hagerty's 2024 financial results showed strong revenue and premium growth. The company anticipates continued growth in 2025, with projections for increased revenue and net income. Expansion plans include doubling the policy count by 2030, indicating a focus on long-term growth.

Recent developments include a warrant exchange and strategic acquisitions. Institutional ownership is a major factor, indicating confidence in the company. Insider ownership by the Hagerty family remains significant, influencing company decisions.

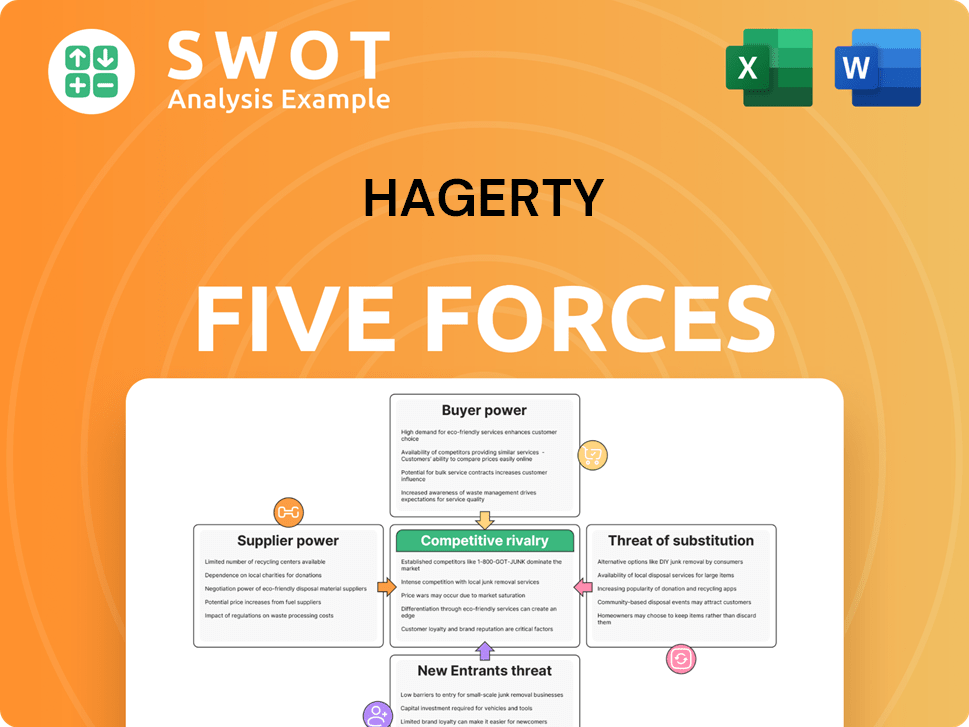

Hagerty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hagerty Company?

- What is Competitive Landscape of Hagerty Company?

- What is Growth Strategy and Future Prospects of Hagerty Company?

- How Does Hagerty Company Work?

- What is Sales and Marketing Strategy of Hagerty Company?

- What is Brief History of Hagerty Company?

- What is Customer Demographics and Target Market of Hagerty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.