Hagerty Bundle

Who Drives Hagerty's Success?

Understanding the Hagerty SWOT Analysis is crucial to grasping its market position. For Hagerty, a company specializing in classic and collector vehicles, knowing its customer demographics and Hagerty target market is fundamental to its business strategy. The evolving interest of younger generations in classic cars highlights the dynamic nature of this market. This exploration delves into the heart of Hagerty's customer base.

From its origins insuring wooden boats to its current status as a lifestyle brand for automotive enthusiasts, Hagerty's journey offers valuable insights. This shift reflects a deep understanding of its insurance customers and the broader community of classic car owners. This analysis will uncover the key factors driving Hagerty's success, including its approach to market segmentation and how it caters to its diverse customer base. We'll explore Hagerty's target market for classic car insurance and answer questions like "What is the Hagerty customer profile?" and "How to become a Hagerty customer?".

Who Are Hagerty’s Main Customers?

Understanding the customer demographics and target market is crucial for the success of any business. For the Hagerty Company, the primary customer segments are centered around classic and collector vehicle owners. This group is united by a shared passion for automotive history, craftsmanship, and the unique driving experience these vehicles offer.

Historically, the Hagerty target market has been perceived as older, affluent males. However, the company has actively pursued diversification within its customer base. This strategic shift recognizes the importance of engaging new generations to ensure the classic car market's long-term viability.

The core demographic still includes individuals aged 50 and above, often with higher disposable incomes. These customers view classic cars as investments, hobbies, or nostalgic connections. They are typically homeowners, well-educated, and established in their careers.

The established customer base of Hagerty primarily consists of classic car owners aged 50 and above. These individuals often have higher disposable incomes, allowing them to invest in classic vehicles. They are typically homeowners and well-established in their careers, viewing their cars as investments or hobbies.

Hagerty is actively targeting younger enthusiasts, including Gen X, Millennials, and Gen Z. This expansion is crucial for the future of the classic car market. Younger segments may enter the hobby through modern classics or digital platforms, representing a significant growth opportunity.

Hagerty segments its customers based on age, income, and interests, tailoring its services to meet specific needs. The company anticipates the fastest growth from younger segments, driven by strategic initiatives. These initiatives include digital content, events, and partnerships designed to broaden the appeal of classic car ownership.

While Hagerty's target market is diverse, the company focuses on areas with a high concentration of classic car owners. Customer buying behavior is influenced by factors such as vehicle value, coverage needs, and personal preferences. Hagerty aims to provide tailored insurance policies to meet these diverse requirements.

Hagerty's efforts include digital content, events, and partnerships aimed at making classic car ownership more accessible and appealing to a broader audience. The company recognizes the importance of adapting to changing customer preferences and market trends. For more details on the company's strategic direction, consider reading about the Growth Strategy of Hagerty. The company has noted that younger generations are entering the classic car market, with Gen Z and Millennials showing a 51% increase in classic car ownership since 2019. This indicates a significant growth segment for Hagerty. The largest share of revenue likely still comes from the established, older demographic due to their purchasing power and the value of their collections. However, the fastest growth is anticipated from the younger segments, driven by Hagerty's strategic initiatives to engage them through various channels.

Hagerty's customer base includes a mix of established and emerging segments. Understanding these demographics is key to the company's success. Hagerty's customer profile is evolving to include younger enthusiasts.

- Classic car owners aged 50+ with higher disposable incomes.

- Gen X, Millennials, and Gen Z, with a growing interest in classic cars.

- Individuals who view classic cars as investments, hobbies, or nostalgic connections.

- Homeowners and well-established professionals.

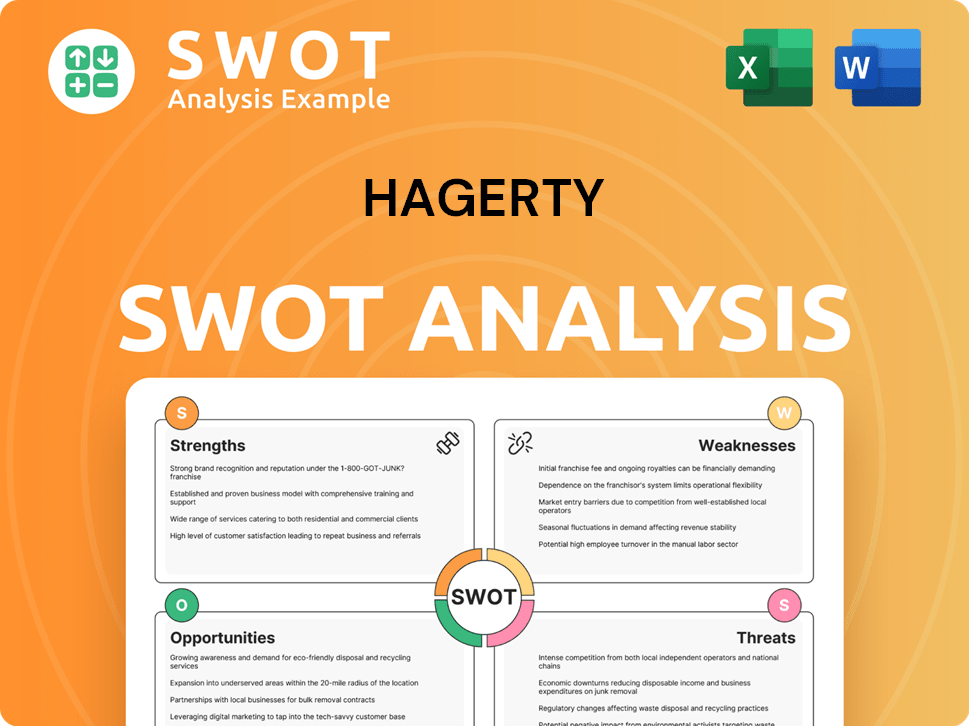

Hagerty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Hagerty’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the Hagerty Company. The company's approach extends beyond standard insurance, focusing on the unique requirements of classic car owners. This involves providing specialized insurance products, fostering a strong community, and offering resources tailored to the classic car lifestyle.

Hagerty's customers are driven by a passion for classic vehicles and a desire to protect their investments. They seek insurance that recognizes the specific value and usage patterns of collector cars. This includes features like agreed value policies and roadside assistance designed for vintage vehicles. The company's success hinges on its ability to meet these diverse needs.

The Hagerty target market values expertise, competitive pricing, and a broad range of services. Customers actively engage with Hagerty's valuation tools, content, and events. Loyalty is cultivated through community building and authenticity within the classic car world. Hagerty's ability to address pain points and adapt to market trends further strengthens its customer relationships.

Customers need specialized insurance that understands the unique value and usage patterns of collector vehicles. They seek peace of mind, asset protection, and a partner who shares their passion for classic cars. Hagerty provides agreed value policies, roadside assistance, and coverage for vehicles under restoration.

Motivations include the desire to protect significant assets and preserve automotive history. Psychological drivers involve nostalgia and the thrill of driving unique vehicles. Practical drivers focus on asset protection and access to specialized resources. Aspirational drivers may involve owning dream cars or participating in exclusive events.

Customers prefer a sense of community and authenticity within the classic car world. They value expert advice, competitive pricing, and a wide range of services beyond insurance. Hagerty's content, events, and valuation tools align with these preferences, fostering customer loyalty.

Decision-making is often based on trust in Hagerty's expertise and the breadth of services offered. Competitive pricing and the ability to provide tailored coverage options are also key. Hagerty's reputation and specialized knowledge are critical factors in attracting and retaining customers.

Customers actively utilize insurance policies and engage with Hagerty's valuation tools, content, and events. This comprehensive approach ensures that customers receive value beyond just insurance coverage. Hagerty's ecosystem supports the classic car lifestyle.

Loyalty is deeply rooted in the sense of community Hagerty fosters and its perceived authenticity within the classic car world. Customers often seek to connect with like-minded individuals and participate in events that celebrate automotive culture. Hagerty's community-building efforts drive customer retention.

Hagerty addresses customer pain points by offering specialized insurance, accurate valuation data, and a supportive community. The company adapts to market trends by providing tailored coverage and new content initiatives. For example, Hagerty tailors its marketing by showcasing diverse vehicles and owners, its product features by offering customizable policies, and its customer experiences by hosting exclusive events and providing expert advice. According to a 2024 report, the classic car market is growing, with values increasing by an average of 10% annually, indicating a strong demand for specialized insurance. Furthermore, Hagerty's customer satisfaction ratings consistently exceed industry averages, with over 90% of customers reporting satisfaction with their services. To learn more about the competitive landscape, check out the Competitors Landscape of Hagerty.

- Tailored Coverage: Hagerty provides insurance policies specifically designed for classic, vintage, and collector vehicles, addressing the unique needs of this segment.

- Valuation Tools: Hagerty offers valuation tools and resources to help customers accurately assess the value of their vehicles, ensuring appropriate coverage.

- Community and Events: Hagerty fosters a community through events, content, and networking opportunities, creating a sense of belonging for classic car enthusiasts.

- Expert Advice: Hagerty provides expert advice and support to customers, helping them navigate the complexities of classic car ownership and insurance.

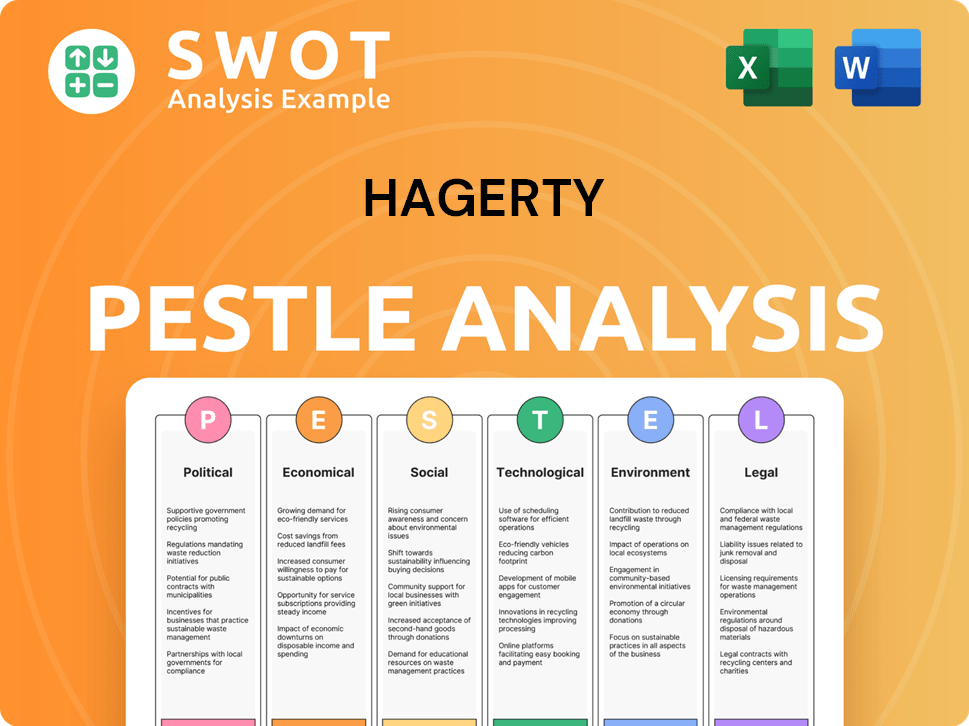

Hagerty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Hagerty operate?

The geographical market presence of Hagerty primarily centers around North America, with a strong focus on the United States and Canada. This concentration reflects the company's strategic approach to targeting regions with a high density of classic car enthusiasts. The company's success in these areas is supported by strong brand recognition and market share within these key demographics.

Within the U.S., states like California, Florida, Texas, and those in the Northeast are particularly important due to the prevalence of car shows, auctions, and restoration shops. These locations offer a rich environment for Hagerty to engage with its target market. While North America serves as the core market, Hagerty has expanded internationally, particularly in the UK and Germany, to capitalize on the global classic car market.

Understanding the nuances of its customer demographics is crucial for Hagerty. Differences in preferences, buying power, and regulatory environments across regions necessitate tailored strategies. For instance, European markets may have different tastes in classic cars, stricter regulations, and varying levels of disposable income, influencing Hagerty's approach.

Hagerty's primary market is in North America, with a significant presence in the United States and Canada. This focus allows the company to target areas with a high concentration of classic car enthusiasts. States like California, Florida, and Texas are key due to their strong car cultures.

Hagerty has expanded its reach internationally, particularly in the UK and Germany. This expansion recognizes the global nature of the classic car market. These regions offer opportunities to diversify and grow the company's customer base.

Hagerty adapts its offerings to local markets by tailoring insurance products to regional regulations. Marketing messages are designed to resonate with local car cultures. Partnerships with classic car clubs and organizations are also key.

Recent expansions include strategic acquisitions and partnerships to strengthen Hagerty's global presence. For example, the acquisition of a majority stake in Motorsport Network's Automotive portfolio in 2021 expanded content reach. These moves support Hagerty's growth strategy.

Hagerty's geographic focus is strategically aligned with areas where classic car ownership is prevalent. This includes regions with active car clubs, events, and restoration services. The company's customer base analysis informs its market segmentation strategies.

- United States: California, Florida, Texas, and the Northeast.

- Canada: Key provinces with strong classic car communities.

- United Kingdom: Active partnerships with car clubs.

- Germany: Expanding presence through strategic initiatives.

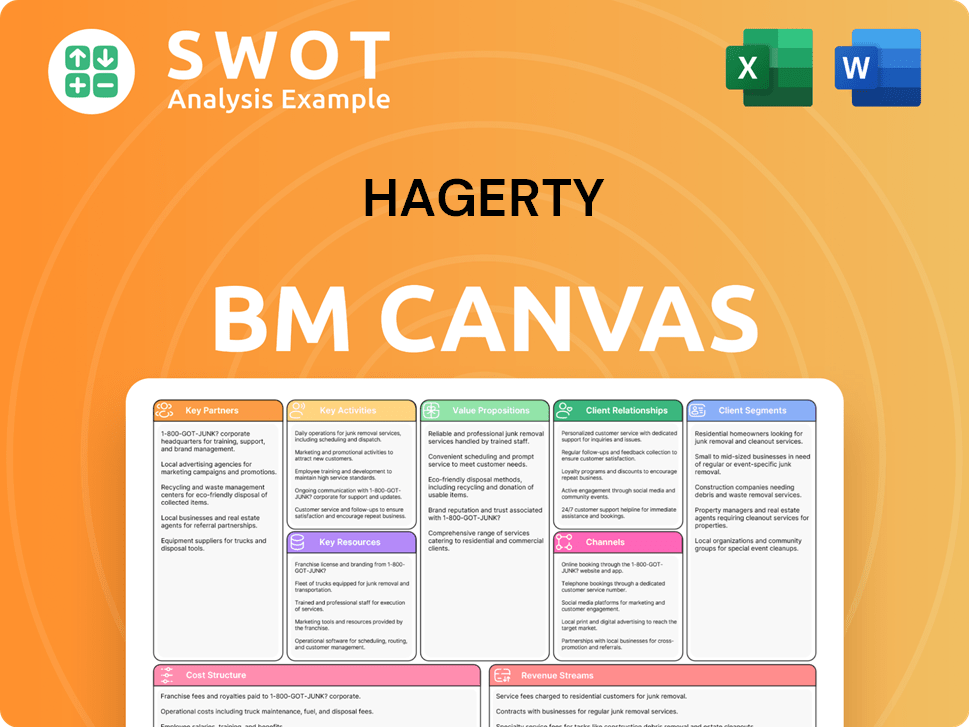

Hagerty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Hagerty Win & Keep Customers?

Understanding the customer acquisition and retention strategies of the company is crucial for assessing its long-term success, especially within the niche market of classic car insurance. This involves a deep dive into how the company attracts new clients, maintains their loyalty, and adapts to the evolving preferences of its target audience. The company's approach blends traditional marketing with digital innovation, emphasizing community engagement and personalized experiences to build strong customer relationships.

The company's ability to acquire and retain customers hinges on a multifaceted strategy that includes diverse marketing channels, loyalty programs, and a strong emphasis on customer service. By focusing on the unique needs of classic car owners, the company aims to create a loyal customer base. The effectiveness of these strategies is reflected in customer satisfaction and retention rates, which are key indicators of the company's performance.

Analyzing the company's customer acquisition and retention strategies reveals insights into its market positioning and competitive advantages. The company's focus on providing specialized insurance services and fostering a community among classic car enthusiasts sets it apart from general insurance providers. This approach not only attracts customers but also encourages long-term loyalty, contributing to the company's sustained growth and market leadership. For more details, you can explore the Marketing Strategy of Hagerty.

The company uses digital advertising extensively, including search engine marketing (SEM) and social media campaigns on platforms like Facebook and Instagram. These campaigns target potential customers based on their interests and online behavior. This approach is crucial for reaching a broad audience and driving traffic to their website.

Content marketing is a significant part of the acquisition strategy, with the company publishing articles, videos, and podcasts through its media arm. This content attracts enthusiasts and positions the company as an authority in the classic car space. This strategy helps build brand awareness and establish trust.

Influencer marketing is utilized, particularly with well-known figures in the classic car community. Collaborations with influencers help to reach a wider audience and build credibility. This strategy leverages the trust and influence of respected figures in the industry.

The company fosters a strong community through its Hagerty Drivers Club, offering benefits like roadside assistance, valuation tools, and discounts. Exclusive events and online forums further enhance community engagement. This approach builds loyalty and strengthens customer relationships.

The company's focus on customer acquisition and retention is evident in its strategic initiatives. The company has successfully built a strong brand reputation and customer loyalty within the classic car insurance market. By understanding the needs and preferences of its target market, the company has implemented effective strategies to attract and retain customers, driving long-term growth and market leadership.

The company uses customer data and CRM systems to segment customers and personalize marketing campaigns. This allows for targeted communications about specific vehicle types, events, or content that align with individual customer profiles. This approach enhances relevance and effectiveness.

Sales tactics emphasize the value-added services provided, such as valuation tools and roadside assistance. These services differentiate the company from general insurance providers. The company's focus is on providing comprehensive support.

The Hagerty Drivers Club is a key component of the company's loyalty programs, offering benefits like roadside assistance, valuation tools, and discounts. These programs encourage customer retention and enhance brand loyalty. This is a core part of the company's strategy.

Personalized experiences are delivered through tailored insurance policies and targeted content based on customer interests and vehicle types. This customization enhances customer satisfaction and strengthens relationships. This approach ensures that customers feel valued.

After-sales service focuses on expert claims handling and dedicated customer support, often staffed by individuals with a passion for cars. This commitment to service builds trust and encourages customer loyalty. This is a key differentiator.

The company has shifted its strategy to be more digitally focused and community-driven, recognizing the importance of online engagement and experiential marketing for attracting and retaining younger generations of enthusiasts. This is a shift towards modern marketing.

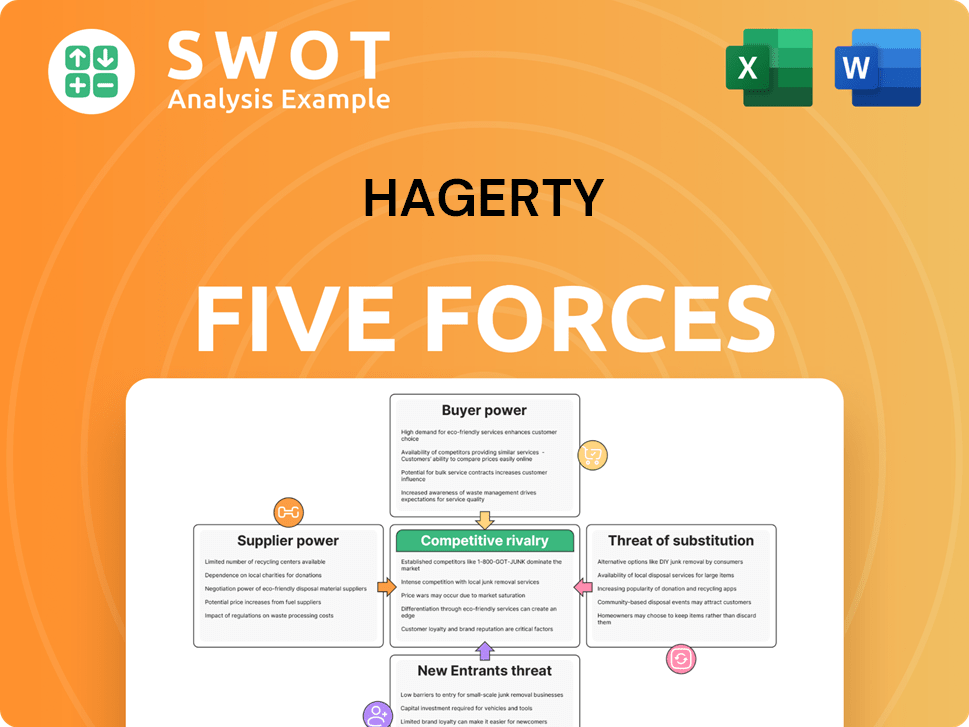

Hagerty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hagerty Company?

- What is Competitive Landscape of Hagerty Company?

- What is Growth Strategy and Future Prospects of Hagerty Company?

- How Does Hagerty Company Work?

- What is Sales and Marketing Strategy of Hagerty Company?

- What is Brief History of Hagerty Company?

- Who Owns Hagerty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.