Hagerty Bundle

Who Competes with Hagerty in the Collector Car World?

Hagerty has revolutionized the Hagerty SWOT Analysis, transforming the classic car insurance niche into a thriving ecosystem. From its inception in 1984, Hagerty has expanded beyond insurance, becoming a central hub for automotive enthusiasts. This evolution has significantly reshaped the company's competitive landscape, making it crucial to understand its position in the market.

This analysis delves into the Hagerty competitive landscape, examining its key competitors within the classic car insurance and broader automotive insurance industry. We'll explore Hagerty's market share analysis, comparing it against rivals and identifying its unique advantages in the collector car market. Understanding Hagerty's strengths and weaknesses is essential for assessing its future growth strategy and financial performance in this specialized sector.

Where Does Hagerty’ Stand in the Current Market?

The company holds a significant position in the classic and collector vehicle insurance market. While specific market share data for 2024-2025 isn't readily available, industry analysis consistently positions the company as a market leader, often recognized as the largest provider of classic car insurance. Its core offerings include agreed value insurance for classic cars, motorcycles, and boats, along with related services such as roadside assistance and valuation tools.

Geographically, the company has a strong presence across North America and is expanding internationally, particularly in the UK and Germany. Its customer base primarily consists of affluent individuals and enthusiasts who own classic, antique, and special interest vehicles. The company's strategic shift from a pure insurance provider to a comprehensive automotive lifestyle brand is evident in its digital transformation efforts and diversification of offerings, including the Hagerty Drivers Club and various media initiatives.

The company reported total revenue of $802.1 million for the full year 2023, reflecting a 23% year-over-year increase. This indicates robust financial health compared to industry averages for specialized insurers. The company's strong brand recognition and community engagement further solidify its market position, especially in regions with a high concentration of automotive enthusiasts. Learn more about the company's origins in this Brief History of Hagerty.

The company is a dominant player in the classic car insurance market. It's often recognized as the largest provider in this niche. Its market position is strengthened by a focus on collector vehicles and related services.

The company offers agreed value insurance for classic cars, motorcycles, and boats. It also provides services such as roadside assistance and valuation tools, enhancing its value proposition. The company has expanded into media and lifestyle offerings.

The company has a strong foothold in North America, and it is expanding internationally. Key growth areas include the UK and Germany, reflecting a global strategy. This expansion targets regions with high concentrations of classic car enthusiasts.

The company's revenue for 2023 was $802.1 million, showing a 23% year-over-year increase. This indicates strong financial health and growth. Its financial performance is a key indicator of its market strength.

The company's strengths include its market leadership, comprehensive service offerings, and strong brand recognition. It benefits from a loyal customer base and extensive community engagement. The company's focus on the collector car market gives it a competitive edge.

- Dominant position in the classic car insurance market.

- Diversified offerings, including insurance, roadside assistance, and media.

- Strong brand recognition and a loyal customer base.

- Strategic expansion into international markets.

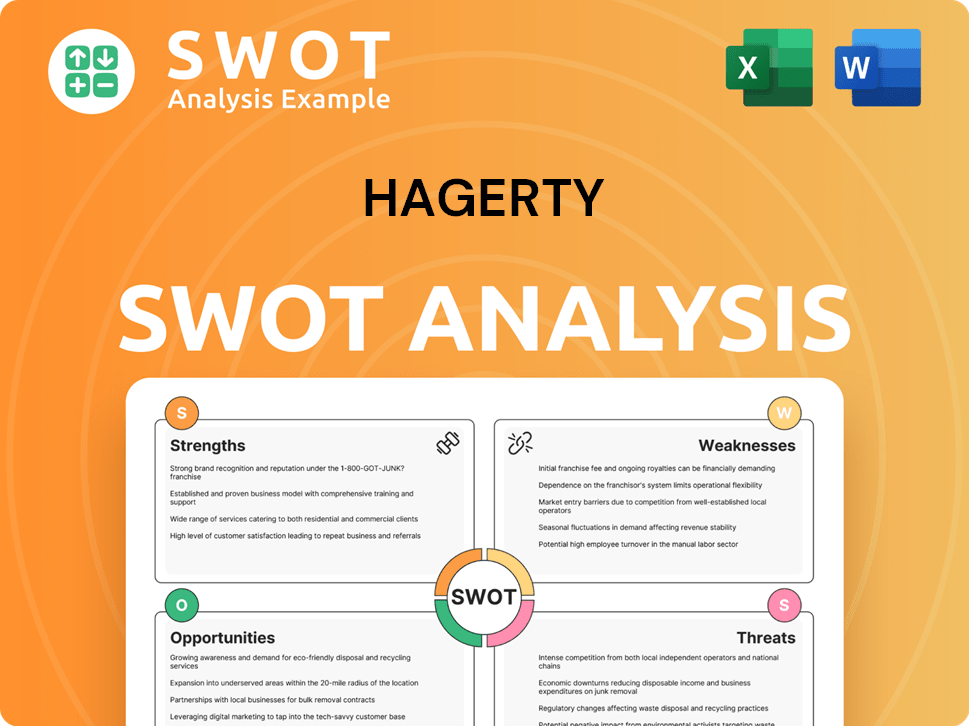

Hagerty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Hagerty?

The Hagerty competitive landscape is shaped by a mix of specialized and mainstream insurance providers. These companies vie for market share in the classic car insurance and collector car market, employing various strategies to attract and retain customers. Understanding the competitive dynamics is crucial for assessing Hagerty's position and future prospects within the automotive insurance industry.

Hagerty faces competition from both direct and indirect competitors. Direct competitors offer similar specialized insurance products, while indirect competitors are larger, more diversified insurers that may offer classic car coverage as part of their broader portfolios. Hagerty's market analysis must consider these varied competitive forces to maintain its position.

The collector car market is estimated to be worth billions, with significant growth potential. Hagerty's financial performance and market share analysis are key indicators of its success against these competitors.

Direct competitors primarily focus on classic car insurance. These companies offer similar products and services, directly competing for the same customer base.

Grundy Insurance is a direct competitor, specializing in collector vehicles. They offer agreed value policies, competing with Hagerty on coverage and pricing. Grundy's focus is exclusively on classic cars.

American Modern, a subsidiary of Munich Re, has a dedicated program for collector vehicles. They leverage their broader financial backing and agent networks to compete. American Modern's scale allows for wider market reach.

J.C. Taylor is a long-standing player in the classic car insurance space. They are known for their historical presence and traditional approach. J.C. Taylor offers established services in the collector car market.

Indirect competitors include mainstream insurers that offer classic car coverage. These companies may not specialize but have significant resources and customer bases.

Mainstream insurers like State Farm, GEICO, and Progressive offer classic car policies. Their vast customer bases and marketing budgets pose a challenge. These companies compete for less specialized collector vehicles.

The automotive insurance industry is dynamic, with competition driven by product innovation and customer retention. Key trends include the use of technology and potential mergers.

- Product Innovation: Introduction of new valuation tools and roadside assistance features.

- Customer Retention: Attracting enthusiasts through events and content.

- Technology: Emerging players using technology to streamline insurance processes.

- Mergers and Alliances: Potential impact of larger entities expanding specialized offerings.

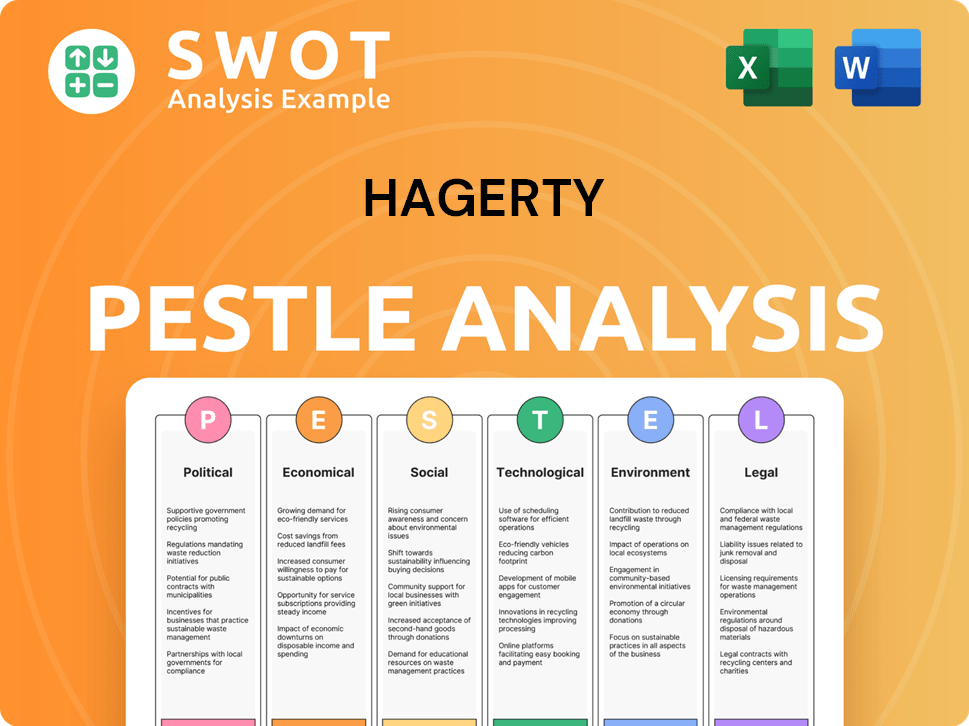

Hagerty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Hagerty a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Hagerty involves analyzing its competitive advantages within the classic and collector car insurance market. Hagerty's success stems from a combination of specialized expertise, strong brand recognition, and a unique ecosystem that caters specifically to automotive enthusiasts. This approach sets it apart from general insurance providers and positions it as a leader in a niche market.

Hagerty's competitive landscape is defined by its ability to offer tailored insurance products, like 'agreed value' policies, which provide significant peace of mind for owners. The company has cultivated a strong brand synonymous with classic car culture, fostering customer loyalty and trust. This brand equity is a key differentiator, creating a loyal customer base and making it the preferred choice for many enthusiasts. The company's focus on the collector car market allows for specialized services that are difficult for competitors to match.

The company's ecosystem, which includes valuation tools, a media platform, and the Hagerty Drivers Club, creates a powerful network effect, enhancing customer engagement. This integrated approach provides multiple touchpoints beyond policy renewals. Hagerty's valuation tools are recognized as authoritative in the collector car market. Its distribution network, which includes direct-to-consumer channels and partnerships with independent agents, also provides a broad reach. These advantages have evolved from a pure insurance focus to a broader lifestyle brand, leveraging content and community to differentiate itself.

Hagerty's deep understanding of classic and collector vehicles allows for highly tailored insurance products. This includes 'agreed value' policies, which offer superior protection compared to standard policies. This specialization is difficult for general insurers to replicate, providing a significant competitive edge in the classic car insurance market.

Hagerty has cultivated significant brand equity within the automotive enthusiast community. Its name is synonymous with classic car culture, built through decades of dedicated service and content creation. This strong brand fosters exceptional customer loyalty and trust, making it a preferred choice for many enthusiasts.

Hagerty's ecosystem, which extends beyond insurance to include valuation tools, a robust media platform, and the Hagerty Drivers Club, creates a powerful network effect. This integrated approach enhances customer engagement and provides multiple touchpoints beyond just an annual policy renewal. The ecosystem fosters a strong sense of community.

Hagerty's distribution network includes direct-to-consumer channels and partnerships with independent agents. This broad reach ensures that Hagerty can connect with a wide audience of classic car enthusiasts. This extensive network helps the company maintain a strong presence in the collector car market.

Hagerty's competitive advantages are rooted in specialized expertise, brand equity, and a unique ecosystem. The company's focus on the collector car market allows for tailored insurance products and services. The company's ability to offer 'agreed value' policies and build a strong brand are significant differentiators.

- Specialized Insurance Products: Tailored policies, such as 'agreed value', provide superior protection.

- Strong Brand and Customer Loyalty: Hagerty is synonymous with classic car culture, fostering trust.

- Integrated Ecosystem: Valuation tools, media, and the Drivers Club enhance customer engagement.

- Broad Distribution: Direct-to-consumer and agent partnerships ensure wide market reach.

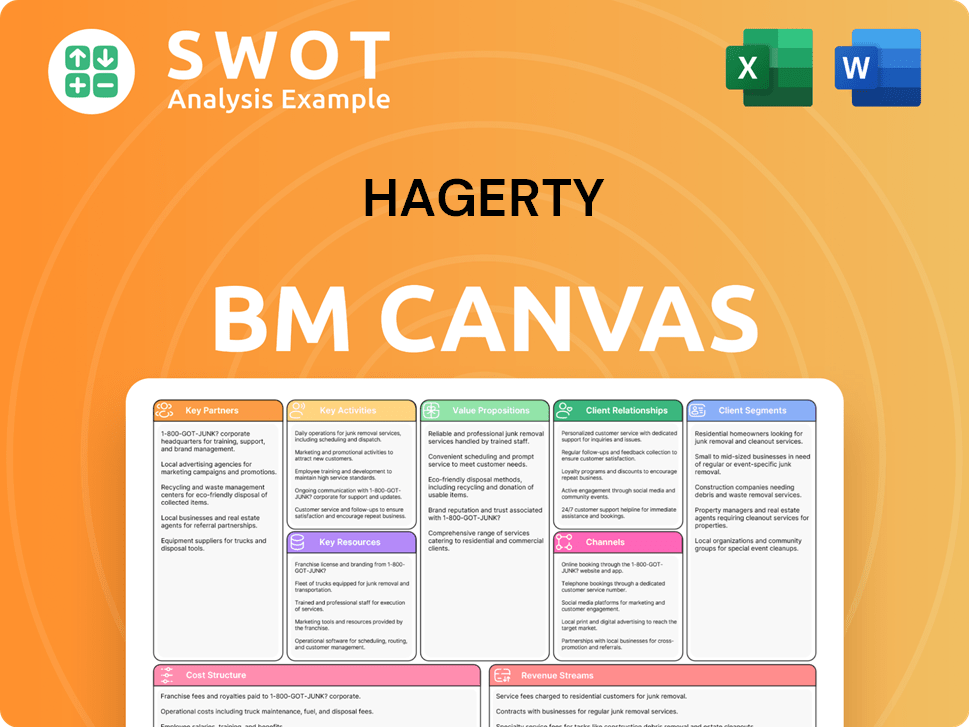

Hagerty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Hagerty’s Competitive Landscape?

The classic and collector vehicle industry is experiencing significant shifts, impacting companies like Hagerty. Understanding these trends is critical for assessing the Hagerty competitive landscape. The automotive insurance industry, including classic car insurance, is evolving due to technological advancements, changing consumer preferences, and economic factors.

Hagerty's market analysis reveals both challenges and opportunities. The company must navigate potential disruptions from new entrants and the broader shift towards electric vehicles. However, opportunities lie in emerging markets and product innovation. The company's strategy, as detailed in Revenue Streams & Business Model of Hagerty, involves digital platform investments, community engagement, and geographic expansion.

Technological advancements are crucial, especially in valuation and digital engagement. Online auction platforms and data analytics are reshaping appraisal and market insights. Consumer preferences are evolving, with increased interest in younger collector vehicles and digital experiences. Regulatory changes in the insurance sector can also affect pricing strategies.

Potential disruptions include new competitors using advanced analytics and direct-to-consumer models. The electrification of the automotive industry presents a long-term challenge. Declining interest in car ownership among younger generations and economic downturns impacting discretionary spending are also threats. Increased competition from diversified insurers is another challenge.

Growth opportunities exist in emerging markets where classic car culture is growing. Product innovations, such as specialized coverage for restomods or fractional ownership, offer potential. Strategic partnerships with automotive brands, auction houses, or restoration shops could expand reach. Expanding into new geographic markets also presents opportunities.

The company is investing in digital platforms, expanding content and event offerings to deepen community engagement, and exploring new geographic markets. Hagerty's strong brand and established ecosystem are key to navigating these trends. Its focus on customer experience and community building is also important.

Hagerty's competitors include companies like American Collectors Insurance and Grundy Insurance. The collector car market is influenced by factors like economic conditions and consumer interest. To stay competitive, Hagerty must adapt to digital trends and evolving consumer preferences.

- Focus on digital innovation and data analytics to refine valuation tools and enhance customer experience.

- Expand into emerging markets where classic car culture is growing.

- Develop specialized insurance products to cater to evolving collector vehicle types.

- Strengthen partnerships and community engagement to build brand loyalty.

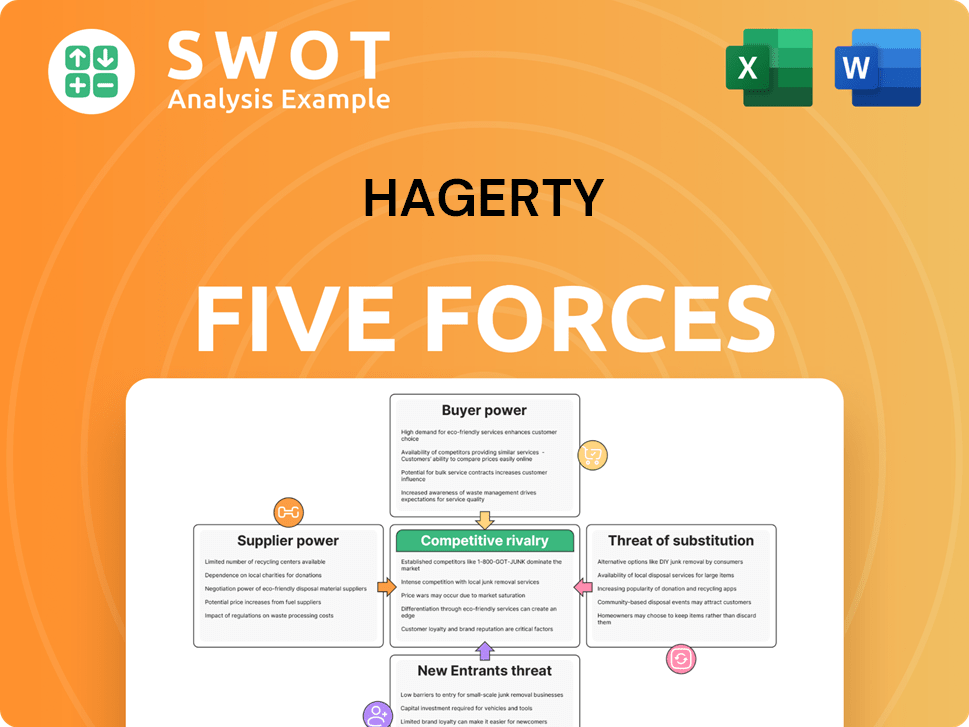

Hagerty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hagerty Company?

- What is Growth Strategy and Future Prospects of Hagerty Company?

- How Does Hagerty Company Work?

- What is Sales and Marketing Strategy of Hagerty Company?

- What is Brief History of Hagerty Company?

- Who Owns Hagerty Company?

- What is Customer Demographics and Target Market of Hagerty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.