Hagerty Bundle

How Does Hagerty Rev Up Its Engine for Success?

Hagerty isn't just another insurance provider; it's a cornerstone of the classic car community. Specializing in Hagerty SWOT Analysis, Hagerty has built a thriving ecosystem around the passion for vintage vehicles, offering a unique blend of insurance, valuation, and enthusiast engagement. But how does this multifaceted approach translate into a successful business model?

From providing Hagerty insurance for prized possessions to offering specialized roadside assistance, Hagerty caters to the distinct needs of classic car owners. Understanding Hagerty valuation methods and the factors influencing Hagerty insurance cost is crucial for anyone considering this specialized coverage. This article will explore how Hagerty leverages its expertise in classic car insurance and collector car insurance to drive growth and maintain its position in a competitive market, examining key aspects like its guaranteed value policy and the claims process.

What Are the Key Operations Driving Hagerty’s Success?

Hagerty's core operations are centered around providing specialized services to classic and collector vehicle owners. The company's primary offering is Hagerty insurance, designed specifically for these unique vehicles. This includes features like agreed value coverage, repair shop choice, and coverage during restoration. Beyond insurance, Hagerty offers a suite of complementary services to cater to the needs of classic car enthusiasts.

The company's value proposition extends beyond insurance coverage. Hagerty provides valuation tools, media content, and automotive events. These initiatives foster a sense of community and provide valuable resources for owners. Hagerty's operational processes are multifaceted, involving underwriting expertise, technology development, and logistics to ensure efficient service delivery.

Hagerty's deep integration into the classic car community, its data-driven insights, and community initiatives differentiate it from general insurers. This approach translates into customer benefits such as peace of mind through specialized coverage and informed decision-making via valuation tools. The company's focus on the classic car market allows it to offer tailored services that meet the specific needs of this niche.

Hagerty insurance is the primary service, providing specialized coverage for classic and collector vehicles. This includes agreed value policies, which guarantee the vehicle's insured value in the event of a covered loss. The policies also consider the unique needs of classic car owners, such as the choice of repair shops and coverage during restoration projects. Hagerty's insurance is a key component of its value proposition.

Hagerty valuation tools provide data-driven insights into vehicle values, essential for owners and potential buyers. These tools are considered an industry benchmark, offering comprehensive data on classic car values. The data helps owners make informed decisions about buying, selling, and insuring their vehicles. This is a crucial part of Hagerty's service offerings.

Hagerty fosters community through its media arm, including the Hagerty Drivers Club magazine, online articles, and events. The company hosts and sponsors numerous automotive events, which serve as crucial community-building platforms. These events range from concours d'elegance to rallies, providing opportunities for enthusiasts to connect and share their passion for classic cars.

Hagerty provides roadside assistance specifically tailored for classic cars. This service offers specialized towing and support, understanding the delicate nature of these vehicles. This is a key component of the company's commitment to supporting the needs of classic car owners. The roadside assistance program is designed to provide peace of mind.

Hagerty's operational processes include underwriting expertise, technology development, and logistics. Sales channels include direct-to-consumer platforms and a network of independent agents. The company partners with specialized towing companies and repair shops. This operational approach translates into key customer benefits.

- Specialized Coverage: Providing tailored insurance solutions.

- Informed Decision-Making: Offering valuation tools for accurate vehicle assessments.

- Community and Engagement: Fostering a sense of belonging through events and media.

- Peace of Mind: Offering specialized roadside assistance and support.

For more details on Hagerty's strategic direction, consider reading about the Growth Strategy of Hagerty.

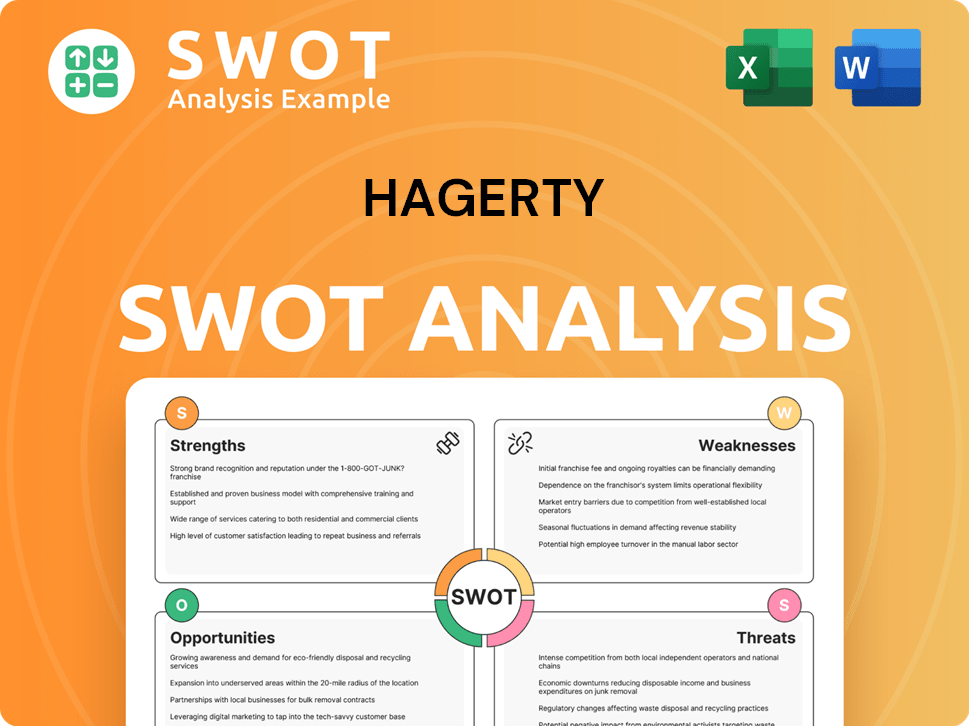

Hagerty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hagerty Make Money?

The [Company Name] generates revenue from a variety of sources, with its specialized insurance offerings forming the core. In addition to insurance premiums, the company has built an ecosystem around its core business to engage classic car enthusiasts, creating multiple revenue streams.

The primary revenue stream for [Company Name] is insurance premiums derived from policies covering classic and collector vehicles. The company also generates revenue through its membership program, advertising, sponsorships, and transaction fees. This diversification helps to create a more stable financial model, reducing dependence on the cyclical nature of insurance underwriting.

The company's strategy emphasizes leveraging its brand and community engagement to drive membership and expand its service offerings, thereby diversifying its revenue mix. This bundled services approach, combining insurance with a lifestyle membership, is a key differentiator and a notable monetization strategy.

The main revenue streams for [Company Name] include:

- Insurance Premiums: This is the largest revenue source, generated from policies for classic and collector vehicles. In 2023, the company reported strong growth in written premiums, indicating the continued strength of this core revenue stream. While specific figures for 2024-2025 are pending full financial reports, insurance premiums historically represent the dominant share of its income.

- Hagerty Drivers Club (HDC) Memberships: This subscription-based model provides recurring revenue through memberships. Members receive benefits like roadside assistance, exclusive content, discounts, and access to events.

- Advertising and Sponsorships: Revenue is generated through advertising and sponsorships related to its media content and events. This leverages the company's reach within the automotive enthusiast community.

- Transaction Fees and Commissions: Fees from ancillary services contribute to overall revenue, though typically smaller than insurance premiums or HDC memberships.

To further understand the company's market, consider reading about the Target Market of Hagerty.

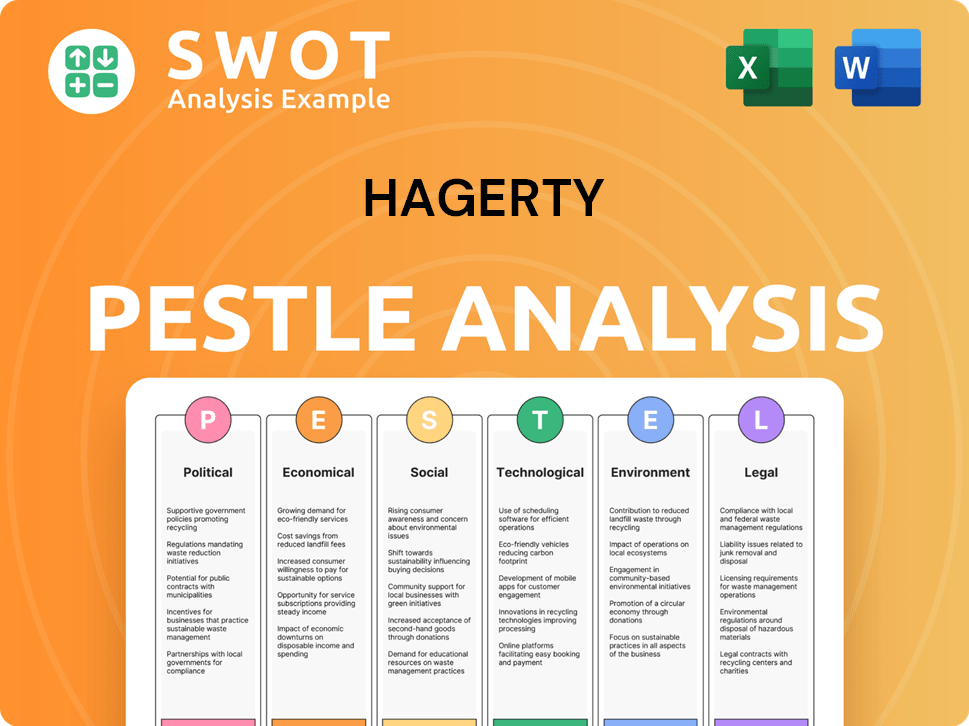

Hagerty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hagerty’s Business Model?

The journey of Hagerty has been marked by significant milestones and strategic shifts. A pivotal moment was its transition to a public company through a SPAC merger in December 2021. This move provided substantial capital for expansion and increased its visibility in the financial markets. Strategic partnerships and the continuous development of its digital valuation tools have been key operational moves.

The company has navigated challenges common in the insurance industry, such as managing underwriting risk and adapting to economic fluctuations. Supply chain disruptions, while less direct for an insurance provider, can indirectly affect the classic car restoration market. Hagerty has responded by leveraging its data insights to refine underwriting models and enhance digital engagement.

Hagerty's competitive advantages are substantial, built on decades of trust and specialized expertise within the classic car community. Its technology leadership, particularly in valuation data and digital platforms, provides a significant edge. The ecosystem effect, where insurance, content, events, and memberships reinforce each other, creates a powerful advantage. Hagerty continually adapts to new trends by investing in digital engagement and expanding its enthusiast-focused services, ensuring it remains relevant in a dynamic market.

The SPAC merger in December 2021 was a key milestone, providing capital for growth. Hagerty has also expanded its reach through strategic partnerships. These collaborations have enhanced service offerings and expanded its customer base.

Continuous development of digital valuation tools has solidified Hagerty's position. Investments in technology and acquisitions have accelerated growth. Hagerty focuses on refining underwriting models and enhancing digital engagement.

Hagerty's brand strength within the classic car community is unparalleled. Technology leadership in valuation data and digital platforms is a significant advantage. The ecosystem effect, where insurance, content, events, and memberships reinforce each other, creates a powerful moat against competitors.

Hagerty faces underwriting risk and economic fluctuations. Supply chain disruptions can indirectly affect the classic car restoration market. Hagerty leverages data insights to refine underwriting models. The company focuses on digital engagement to maintain customer loyalty.

In 2023, Hagerty reported total revenue of approximately $1.07 billion, a significant increase from the previous year, reflecting strong growth in its insurance and membership businesses. The company's focus on digital engagement and its ecosystem approach, which includes understanding the competitive landscape, has helped it maintain a strong position in the classic car insurance market.

- Hagerty's insurance business continues to grow, with an increasing number of insured vehicles.

- Membership revenue is also a key driver, with a growing number of enthusiasts subscribing to Hagerty's services.

- The company’s digital platforms and valuation tools enhance its market position.

- Hagerty's strategic partnerships contribute to its expansion.

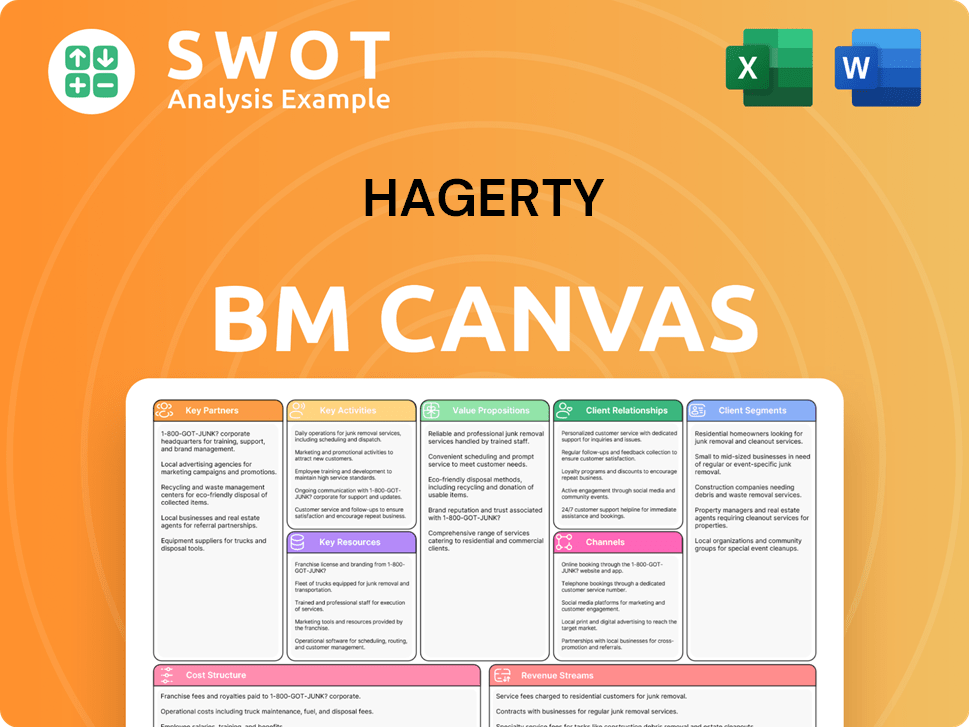

Hagerty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hagerty Positioning Itself for Continued Success?

Hagerty holds a leading position in the classic and collector vehicle insurance market, often recognized as the industry leader. Its specialized focus and comprehensive services have cultivated strong brand recognition and customer loyalty among automotive enthusiasts. The company has a significant presence in North America and is expanding internationally, particularly in Europe.

Despite its strong market position, Hagerty faces risks such as regulatory changes, competition from digital platforms, and shifts in consumer preferences. Technological disruptions and evolving collector car trends also pose challenges. However, Hagerty actively works to engage new enthusiasts and adapt to market changes.

Hagerty dominates the classic and collector car insurance market. Its specialized focus and comprehensive services have built strong brand recognition and customer loyalty. The company’s reach extends across North America with growing international presence.

Hagerty faces risks from regulatory changes, new competitors, and technological disruptions. Shifts in consumer preferences, such as evolving collector car trends, also pose challenges. However, the company actively engages new enthusiasts to mitigate these risks.

Hagerty plans to invest in its digital platform and expand membership offerings. The company aims to diversify revenue streams and explore new markets within the automotive enthusiast landscape. Continued innovation, including AI and data analytics, will refine valuation tools and personalize customer interactions.

Hagerty is focused on enhancing its digital platform and expanding membership benefits. It also explores potential acquisitions to support the automotive enthusiast lifestyle. The company's roadmap includes integrating AI and data analytics to improve services.

Hagerty is focused on expanding its membership base and diversifying revenue streams. The company leverages its strong brand and community engagement to attract and retain members. Strategic partnerships and new market exploration are also key components of its growth strategy.

- Digital platform enhancements to improve customer experience.

- Expansion of membership offerings to deepen community engagement.

- Potential acquisitions to support the automotive enthusiast lifestyle.

- Continued innovation with AI and data analytics.

Hagerty's success hinges on its ability to adapt to market changes and maintain its leadership in the collector car insurance market. Understanding the Marketing Strategy of Hagerty can provide further insights into how the company plans to navigate the future. The company's focus on innovation, customer engagement, and market expansion positions it well for sustained growth. Hagerty's ability to adapt to changing consumer preferences and technological advancements will be crucial for long-term success.

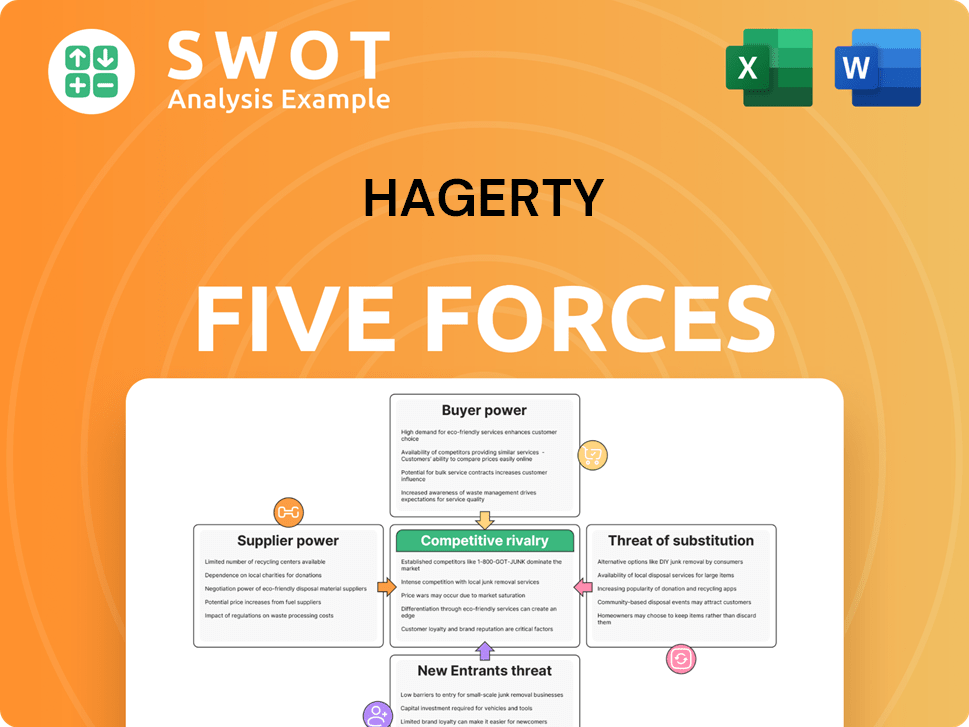

Hagerty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hagerty Company?

- What is Competitive Landscape of Hagerty Company?

- What is Growth Strategy and Future Prospects of Hagerty Company?

- What is Sales and Marketing Strategy of Hagerty Company?

- What is Brief History of Hagerty Company?

- Who Owns Hagerty Company?

- What is Customer Demographics and Target Market of Hagerty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.