H&R Block Bundle

How did H&R Block transform tax preparation?

In 1955, the Block brothers revolutionized tax preparation, turning a complex chore into an accessible service. This innovation birthed H&R Block in Kansas City, Missouri, aiming to simplify tax filing for all Americans. This was a bold move, especially as the IRS was ending its free tax assistance.

From its roots as a bookkeeping business, the H&R Block SWOT Analysis reveals a company that has evolved into a global leader. With a strong market position, H&R Block serves millions annually through various tax solutions. The company's journey, from its early years to its current status, showcases a remarkable history of expansion and adaptation in the tax services industry, making it a significant player in financial services.

What is the H&R Block Founding Story?

The story of H&R Block, a name synonymous with tax preparation, began on January 25, 1955. It was founded in Kansas City, Missouri, by brothers Henry W. Bloch and Richard Bloch. This marked the beginning of what would become a major player in the tax services industry.

Before H&R Block, the Bloch brothers were already involved in business. In 1946, Henry and his older brother Leon started United Business Company with a $5,000 loan. They offered bookkeeping and other services to small businesses. When Leon left, Henry brought in his younger brother Richard.

The early business model of United Business Company included accounting, bookkeeping, and payroll services, with tax preparation as a secondary offering. The brothers made a pivotal decision in 1955. After initially considering discontinuing tax services, a client encouraged them to advertise. They placed an advertisement in The Kansas City Star for $5 tax services. This proved to be incredibly successful, leading to a surge of new clients and effectively creating the tax preparation industry as we know it. The company was then renamed H&R Block, with the brothers intentionally misspelling 'Bloch' to 'Block' to ensure correct pronunciation. This early success led to a quadrupling of their revenue in just one year.

The founding of H&R Block represents a significant moment in the history of tax preparation. From its humble beginnings in Kansas City, the company quickly grew, transforming the way people approached their taxes. The founders, Henry and Richard Block, demonstrated a keen understanding of market needs and a willingness to adapt.

- 1946: United Business Company is founded by Henry and Leon Bloch.

- 1955: H&R Block is established; the company places an advertisement for tax services.

- Early Success: Revenue quadruples in the first year.

- Strategic Decision: The brothers decided to advertise tax preparation services.

The success of H&R Block in its early years set the stage for its future growth. The company's ability to capitalize on the demand for tax services was a key factor in its rapid expansion. The founders' understanding of customer needs and their willingness to innovate were crucial to their success. For further insights into the company's strategic growth, one can explore the Growth Strategy of H&R Block.

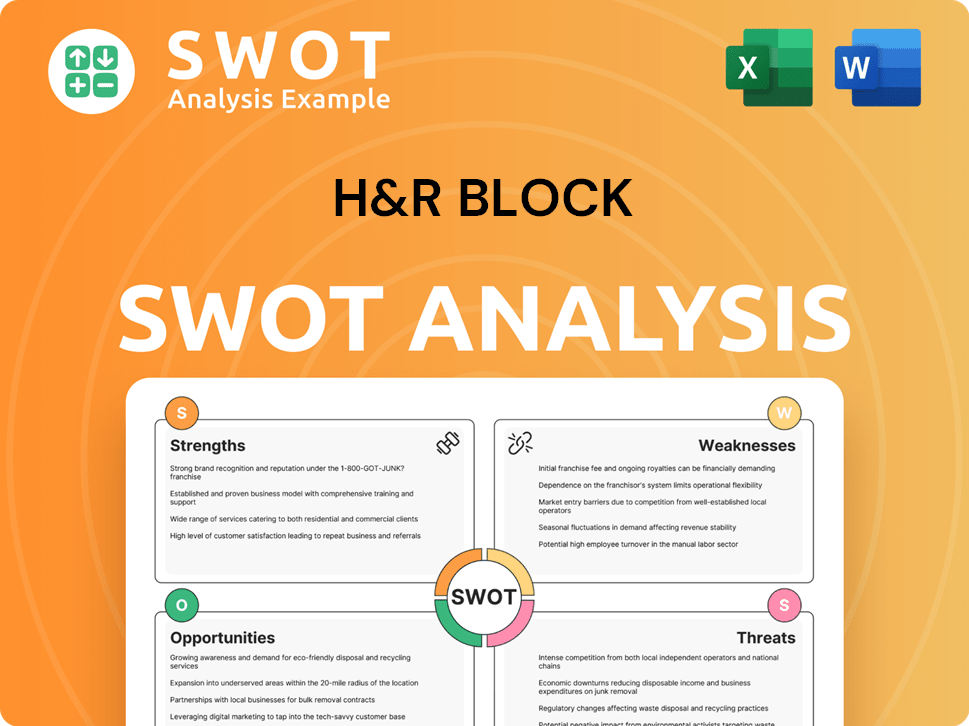

H&R Block SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of H&R Block?

Following its initial success, the H&R Block company experienced rapid expansion. The Block family's innovative approach to franchising became a key element in its growth strategy. This model enabled the company to establish a significant national presence, solidifying its position in the tax preparation industry.

In 1956, the Blochs decided to expand to New York City, recognizing the opportunity as the IRS was discontinuing its free tax preparation services there. To facilitate this expansion, they pioneered the franchise model, selling the regional operation to two CPAs. This strategy proved highly successful, driving rapid national growth for H&R Block.

By 1962, H&R Block had expanded to 206 offices, generating nearly $800,000 in revenue. The company went public with an IPO of 75,000 shares at $4 each, providing capital for further expansion and diversification. This move marked a significant step in the H&R Block history, enabling greater reach and service offerings.

The company continued to grow, processing over 10 million tax returns annually by 1986, and expanded internationally into Canada and Australia. In 1980, H&R Block acquired CompuServe, an early online service. Later, in 1993, they acquired MECA Software, creator of TaxCut, entering the consumer tax software market. For more information about the people who run the company, check out this article: Owners & Shareholders of H&R Block.

Key milestones include the establishment of the franchise model, the IPO in 1962, and the acquisitions of CompuServe and MECA Software. These strategic moves significantly shaped the H&R Block's trajectory. These actions highlight the company's commitment to innovation and expansion within the tax services sector.

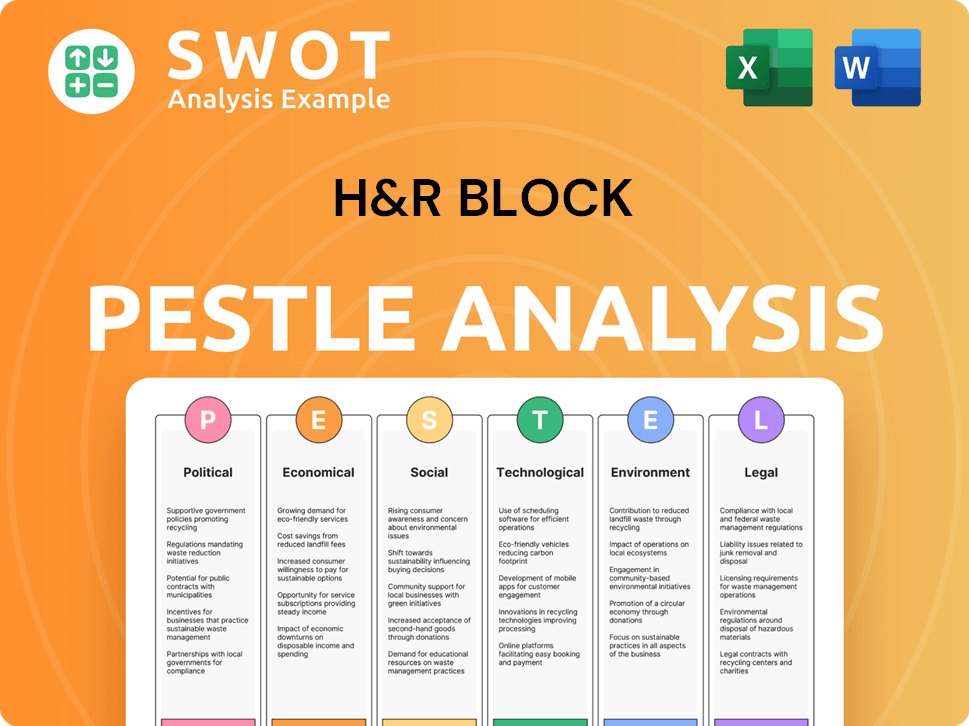

H&R Block PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in H&R Block history?

The H&R Block company has a rich history marked by key milestones that have shaped its evolution from a small business to a leading provider of tax services. The Block family, founders of the company, played a pivotal role in its early success, establishing a foundation that would lead to significant growth and expansion. This brief history of H&R Block reveals how it adapted to the changing financial landscape.

| Year | Milestone |

|---|---|

| 1955 | Henry and Richard Block founded the company in Kansas City, Missouri. |

| 1956 | Introduced the franchise model, enabling rapid expansion across the United States. |

| 1986 | Collaborated with the IRS to introduce electronic filing, modernizing tax preparation. |

| 1993 | Acquired MECA Software, entering the consumer tax software market. |

| 2004 | Launched 'Signature' (later 'H&R Block Tax Pro Review'), a hybrid tax preparation method. |

| 2019 | Acquired Wave Financial for US$405 million (C$537 million) to expand services for small businesses. |

| 2019 | Launched its mobile banking app, Spruce, expanding its financial product offerings. |

H&R Block has consistently introduced innovations to stay ahead in the tax preparation industry. A significant move was the early adoption of computers for tax return completion in the 1980s. More recently, the company has embraced digital transformation and AI-driven tools to enhance its services, including the launch of a new data platform in 2019.

The introduction of the franchise model in 1956 allowed H&R Block to quickly expand its presence across the United States, establishing a broad network of locations.

In the 1980s, H&R Block began using computers for tax preparation and collaborated with the IRS to introduce electronic filing, streamlining the process.

The acquisition of MECA Software in 1993 allowed H&R Block to enter the consumer tax software market, competing with products like TurboTax.

The introduction of the 'Signature' (later 'H&R Block Tax Pro Review') method combined DIY tax prep with professional review, offering clients a flexible option.

In 2019, H&R Block rolled out a new data platform to digitally serve millions of clients, a strategic move that proved crucial during the COVID-19 pandemic.

The acquisition of Wave Financial expanded H&R Block's offerings to include bookkeeping, accounting, and payroll services, catering to small business owners.

The H&R Block company has faced challenges, including competition from other tax software providers and the shift towards digital solutions. However, the company has consistently responded by investing in technology and strategic acquisitions, aiming to blend digital innovation with human expertise. For fiscal year 2024, H&R Block invested $127.6 million in technology to enhance its services.

H&R Block faces strong competition from other tax software providers, which necessitates continuous innovation and adaptation to maintain market share.

Adapting to the increasing demand for digital solutions and online tax filing has been a key challenge, requiring significant investments in technology and digital platforms.

The shift in consumer behavior towards self-service and online tax preparation requires H&R Block to continually evolve its service offerings and marketing strategies.

Navigating complex and ever-changing tax regulations presents an ongoing challenge, demanding expertise and continuous training for H&R Block's tax professionals.

Economic downturns and fluctuations can impact consumer spending on tax services, requiring H&R Block to adjust its business strategies to maintain profitability.

Staying relevant in a dynamic market requires H&R Block to continuously innovate and adapt its services to meet the evolving needs of its diverse customer base, as discussed in H&R Block's Target Market.

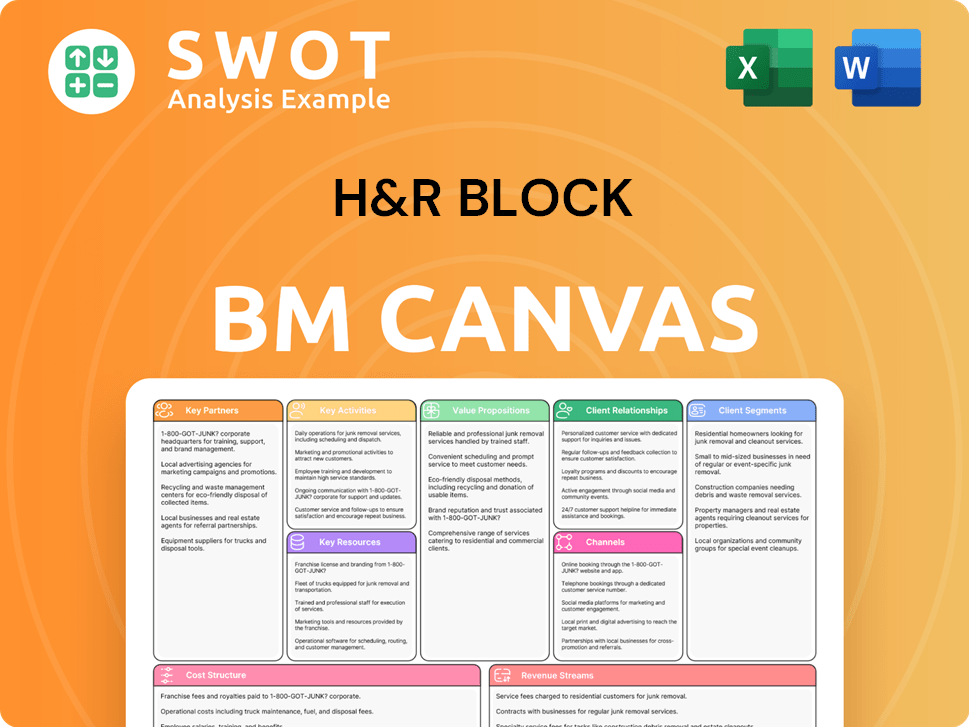

H&R Block Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for H&R Block?

The H&R Block company has a rich history marked by significant milestones, evolving from a small business to a global leader in tax preparation and financial services. The company's journey reflects its adaptation to technological advancements and its commitment to serving clients' needs in an ever-changing financial landscape.

| Year | Key Event |

|---|---|

| 1946 | Henry W. Bloch and Leon Bloch founded United Business Company. |

| 1955 | Henry W. Bloch and Richard Bloch established H&R Block in Kansas City, Missouri. |

| 1956 | H&R Block introduced the franchise model for expansion. |

| 1962 | H&R Block went public. |

| 1980 | Acquired CompuServe, entering the online services market. |

| 1986 | Worked with the IRS to introduce electronic filing. |

| 1993 | Acquired MECA Software (TaxCut), entering the consumer tax software market. |

| 2004 | Introduced a hybrid tax preparation method combining DIY with professional review. |

| 2006 | Completed its new 18-story world headquarters in Kansas City, Missouri. |

| 2017 | Opened its first Global Technology Center in India. |

| 2019 | Acquired Wave Financial for $405 million, expanding into small business services. |

| 2019 | Rolled out a new data platform for digital service. |

| 2021 | Launched its five-year 'Block Horizons 2025' transformation strategy. |

| 2024 | Reported annual revenue of $3.61 billion, an increase of 3.98% from 2023. |

| 2025 | Announces new features for the tax season, including AI Tax Assist and a free Second Look® tax review. |

H&R Block's future is guided by its 'Block Horizons 2025' strategy, focusing on small business, financial products, and enhancing the overall Block experience. This strategy aims to drive growth and innovation, ensuring the company remains competitive in the evolving financial services market. The company is committed to expanding its services and leveraging technology to better serve its clients.

For fiscal year 2025, H&R Block projects revenue to be between $3.69 billion and $3.75 billion. Adjusted diluted earnings per share are expected to be between $5.15 and $5.35. The company's financial outlook reflects its ongoing efforts to improve efficiency and expand its service offerings. This financial strategy supports the company's long-term growth and shareholder value.

H&R Block is committed to digital leadership and financial empowerment services. The company leverages data analytics, machine learning, and AI-driven tools. These technologies improve efficiency and accuracy, providing clients with enhanced tax preparation and financial solutions. Innovation is key to the company's continued success.

H&R Block is dedicated to delivering strong shareholder returns. Since 2016, the company has repurchased over 43% of its outstanding shares. It has also returned over $4.5 billion to shareholders in dividends and share repurchases. This commitment highlights the company's financial strength and its focus on creating value for its investors.

H&R Block Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of H&R Block Company?

- What is Growth Strategy and Future Prospects of H&R Block Company?

- How Does H&R Block Company Work?

- What is Sales and Marketing Strategy of H&R Block Company?

- What is Brief History of H&R Block Company?

- Who Owns H&R Block Company?

- What is Customer Demographics and Target Market of H&R Block Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.