H&R Block Bundle

How Does H&R Block Navigate the Ever-Changing Tax Preparation Industry?

The tax preparation industry is undergoing a significant transformation, driven by digital innovation and evolving consumer preferences. H&R Block, a long-standing leader in tax services, faces a dynamic competitive landscape. Understanding this environment is crucial for investors, analysts, and anyone interested in the financial health of a major player in the H&R Block SWOT Analysis.

This analysis delves into the H&R Block competitive landscape, examining its position within the tax preparation market and its key rivals. We'll explore the company's strategies, competitive advantages, and how it adapts to industry trends, providing a comprehensive tax preparation industry analysis. The study will also cover the company's strengths and weaknesses, and compare it to its main competitors to provide a clear picture of the industry.

Where Does H&R Block’ Stand in the Current Market?

H&R Block maintains a significant market position within the tax preparation industry. The company is a key player in both assisted and do-it-yourself (DIY) tax preparation services. It competes directly with major players like Intuit's TurboTax, particularly in the overall tax preparation market.

The company's core operations revolve around providing tax filing services. This includes assisted tax preparation, where clients work with tax professionals, and DIY solutions through its online and software platforms. H&R Block also offers additional services such as audit support and tax identity shield.

H&R Block's value proposition lies in its ability to cater to a broad customer base, from individuals with simple tax situations to those with complex financial needs. Its extensive network of physical locations offers accessibility, while its digital platforms provide convenience. The company's strategic investments in technology and digital platforms are aimed at enhancing its competitive standing in the tax preparation market.

H&R Block consistently ranks among the top tax preparation service providers. While specific 2024 or 2025 market share data is still emerging, the company typically competes for the top spot with Intuit's TurboTax. The tax preparation market is highly competitive, with both companies vying for market leadership.

H&R Block offers a comprehensive suite of tax preparation services. This includes assisted tax preparation, DIY software, and online platforms. Additional services like audit support and refund transfers enhance its offerings. These diverse services help H&R Block to meet the varied needs of its customer base.

H&R Block has a strong presence across the United States with thousands of physical locations. This extensive network provides easy access for a wide range of customers. The company also serves international clients, though the U.S. market remains its primary focus.

For the fiscal year ending April 30, 2024, H&R Block reported robust financial results, demonstrating its continued strength. While specific financial metrics for fiscal year 2025 are not yet available, the company's revenue generation and profitability are consistently highlighted by analysts. This financial performance underscores its strong market position.

The company's strategy includes a focus on digital transformation to meet the growing demand for online tax filing, as highlighted in this Marketing Strategy of H&R Block article. H&R Block serves a diverse customer base, from individuals with straightforward tax situations to those with more complex financial needs, as well as small businesses. The company faces intense competition in the rapidly expanding DIY online segment and continues to invest to strengthen its standing. This competitive landscape requires continuous adaptation and innovation.

The tax preparation industry is dynamic, with shifts in consumer preferences and technological advancements. H&R Block's ability to adapt to these changes is crucial for maintaining its market position. The company's strategic investments in its DIY platforms are a direct response to the increasing demand for online tax filing services.

- Competition: Intense competition from Intuit's TurboTax and other online tax preparation services.

- Digital Transformation: Focus on enhancing online platforms and digital services to meet evolving customer needs.

- Customer Segmentation: Serving a wide range of customers, from individuals to small businesses, with varying tax complexities.

- Geographic Reach: Extensive network of physical locations across the U.S. and international presence.

H&R Block SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging H&R Block?

The H&R Block competitive landscape is shaped by a diverse range of players in the tax preparation industry. This analysis examines the key competitors that H&R Block faces, providing insights into their strategies and market positions. Understanding these dynamics is crucial for anyone assessing the tax preparation market and the strategies of companies within it.

The tax preparation market is highly competitive, with both direct and indirect competitors vying for market share. The rise of technology and changing consumer preferences continue to influence the strategies of these companies. This overview will help you understand the key players and the competitive pressures they face.

Direct competitors offer similar services, primarily tax preparation and filing. These companies directly compete with H&R Block for customers. They often have similar business models, such as offering both in-person and online services.

Intuit, through its TurboTax brand, is a major direct competitor. TurboTax dominates the do-it-yourself (DIY) tax software market. Intuit's strengths lie in its brand recognition and user-friendly interfaces.

Jackson Hewitt operates a significant network of franchised and company-owned tax preparation offices. It targets a similar customer base as H&R Block. Competition often revolves around price and convenience.

Independent tax professionals and smaller accounting firms offer personalized tax advice. They often leverage strong client relationships and local market expertise. They represent a fragmented but substantial competitive force.

Indirect competitors offer related services or products that can reduce the need for traditional tax preparation. These competitors may not directly offer tax filing but can influence the market. The IRS also offers free tax filing options.

Companies like QuickBooks (owned by Intuit) and other ERP systems include tax reporting functionalities. This can reduce the need for external tax preparers. These solutions are often used by businesses.

The tax preparation industry analysis reveals a dynamic competitive environment. Understanding the strengths and weaknesses of H&R Block's competitors is essential for strategic planning. The rise of technology and changing consumer preferences continue to reshape the market. For example, Intuit's TurboTax has a significant market share in the DIY segment. According to recent data, the DIY segment accounts for a substantial portion of the overall tax preparation market. Furthermore, the IRS's Free File program offers an alternative, impacting the market dynamics. To learn more about H&R Block's growth strategy, see Growth Strategy of H&R Block.

The tax preparation market is subject to various trends and competitive dynamics. These include pricing strategies, technological advancements, and changing consumer behavior. These factors influence the strategies of H&R Block and its competitors.

- Pricing Strategies: Competitors often use competitive pricing to attract customers. Promotions and discounts are common, particularly during the tax season.

- Technological Advancements: The integration of AI and machine learning is transforming the industry. This includes automated tax preparation and improved user experiences.

- Consumer Behavior: Consumers are increasingly using online tax filing services. Convenience and ease of use are key factors influencing their choices.

- Mergers and Alliances: Consolidation within the accounting industry can create more formidable rivals. These moves can impact the competitive landscape.

- Market Share: H&R Block's market share analysis shows that it competes closely with TurboTax and Jackson Hewitt. The DIY versus assisted filing models are key.

H&R Block PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives H&R Block a Competitive Edge Over Its Rivals?

The competitive landscape for H&R Block is shaped by its long-standing presence and established brand recognition within the tax preparation industry. The company's ability to maintain a significant market share is a testament to its enduring appeal to a wide range of clients. Understanding the competitive dynamics is crucial for evaluating its position and prospects.

H&R Block's strategy involves a blend of traditional brick-and-mortar locations and evolving digital services, designed to cater to diverse client preferences. This approach allows it to compete effectively against both online tax filing services and other established tax preparation firms. The company continuously adapts to industry changes, including technological advancements and evolving tax regulations.

A detailed analysis of the H&R Block competitive landscape requires an understanding of its strengths, weaknesses, opportunities, and threats, as well as a comparison with its main competitors. This includes assessing its market share, service offerings, pricing strategies, and overall business model, which is further detailed in Revenue Streams & Business Model of H&R Block.

H&R Block benefits from strong brand equity, built over decades of operation. This recognition fosters customer loyalty and attracts new clients, especially those who value reliability. The company has a reputation for expertise, which is a key differentiator in the tax preparation market.

The company's vast network of physical offices provides unmatched accessibility, especially for clients preferring in-person assistance. This widespread network allows it to serve diverse demographics and geographic areas, setting it apart from online-only competitors. The human element, with trained tax professionals, remains a key differentiator.

H&R Block leverages economies of scale in marketing, technology, and training, allowing for significant investment in product development and customer service. Proprietary tax software and internal systems contribute to operational efficiencies and data security. The company adapts its offerings, blending digital tools with assisted services.

H&R Block continuously evolves its services to meet changing market demands. This includes integrating digital tools with its assisted services, like the 'Tax Pro Review,' which combines online filing with expert oversight. The company's ability to adapt its offerings is a key advantage.

H&R Block's competitive advantages include brand strength, a widespread physical presence, and professional expertise. These factors provide a sustainable edge that is difficult for rivals to fully replicate. The company's ability to adapt and innovate further strengthens its position in the tax preparation market.

- The company's long-standing brand recognition and trust are significant assets.

- Its extensive network of physical offices provides accessibility and personalized service.

- H&R Block's ability to leverage economies of scale supports investment in technology and customer service.

- Adaptability and innovation, including the integration of digital tools, enhance its competitive position.

H&R Block Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping H&R Block’s Competitive Landscape?

The tax preparation industry, and the H&R Block competitive landscape within it, is experiencing significant shifts. Technological advancements, regulatory changes, and evolving consumer preferences are reshaping how tax filing services are delivered and consumed. This creates both challenges and opportunities for established players like H&R Block, demanding strategic adaptation to maintain and grow market share.

Understanding the tax preparation market dynamics is crucial for assessing H&R Block's future. The increasing demand for digital solutions and mobile accessibility is pushing all players towards robust online platforms and user-friendly apps. The tax preparation industry analysis shows that the companies must adapt to these changes to maintain their competitiveness.

The industry is heavily influenced by technology, with AI and ML automating processes. Digital solutions and mobile apps are increasingly important. Regulatory changes, like potential IRS direct e-file, may disrupt the market.

Intense competition from tech companies in the DIY space poses a challenge. Maintaining profitability in a seasonal business is another hurdle. Attracting and retaining skilled tax professionals is also a concern. Cybersecurity risks are increasing.

Expanding into related financial services, such as small business accounting, could diversify revenue. The complexity of tax codes may increase the need for professional help. Strategic partnerships with fintech companies can broaden reach.

The company is likely to focus on a hybrid model. This model blends its strong assisted presence with enhanced digital capabilities. This approach is designed to remain resilient and competitive.

H&R Block must balance its traditional strengths with the need for digital transformation. This involves investing in technology, adapting to regulatory changes, and meeting evolving consumer expectations. Strategic partnerships and diversification are also important.

- Embrace AI and ML to enhance efficiency and user experience.

- Explore opportunities in adjacent financial services to diversify revenue streams.

- Focus on attracting and retaining skilled tax professionals.

- Adapt to potential changes in tax filing regulations.

- Invest in cybersecurity to protect sensitive financial data.

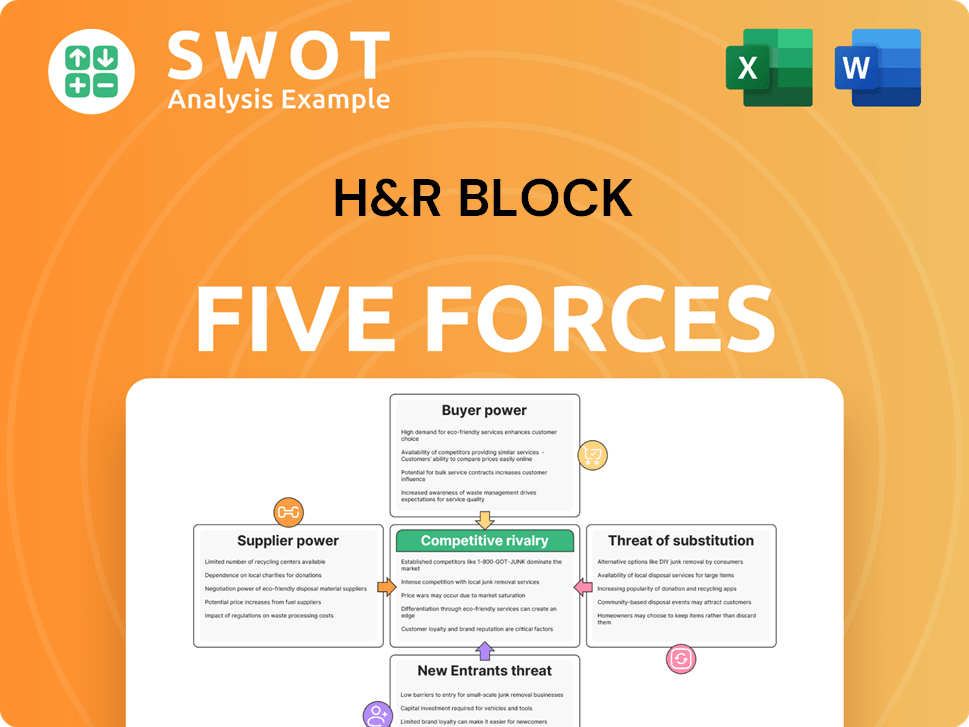

H&R Block Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of H&R Block Company?

- What is Growth Strategy and Future Prospects of H&R Block Company?

- How Does H&R Block Company Work?

- What is Sales and Marketing Strategy of H&R Block Company?

- What is Brief History of H&R Block Company?

- Who Owns H&R Block Company?

- What is Customer Demographics and Target Market of H&R Block Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.