H&R Block Bundle

How Does H&R Block Thrive in the Tax Season Frenzy?

As the 2025 tax season approaches, with e-file opening on January 27, H&R Block stands ready to assist millions with their tax preparation needs. This financial powerhouse, a leader in H&R Block SWOT Analysis, continues to adapt its services to meet the evolving demands of both individual and business clients. With a reported revenue of $3.61 billion for fiscal year 2024 and a projected revenue of up to $3.75 billion for 2025, understanding H&R Block's operational model is key.

From assisted tax return preparation to innovative DIY solutions and AI-powered support, H&R Block offers a comprehensive suite of H&R Block services to navigate the complexities of tax filing. Whether you're curious about H&R Block tax preparation fees, how to use their software, or the H&R Block tax refund timeline, this analysis will provide valuable insights into the company's strategies and its impact on the financial services landscape. Discover how H&R Block blends technology with human expertise to provide the best tax preparation experience.

What Are the Key Operations Driving H&R Block’s Success?

H&R Block's core operations revolve around providing comprehensive tax preparation and financial services. The company serves both individuals and small businesses, offering a range of options from assisted tax return preparation to do-it-yourself (DIY) solutions. These services are designed to simplify the complexities of tax filing and financial management, providing accessibility and expertise through various channels.

The company's value proposition is rooted in simplifying the tax filing and financial management process. With a network of over 9,000 offices and robust digital platforms, H&R Block offers a hybrid approach. This combines the expertise of its tax professionals with cutting-edge technology, such as AI Tax Assist, which debuted in 2024.

H&R Block's services extend beyond tax season, offering year-round support through its mobile banking app, Spruce, and services for small businesses via Block Advisors and Wave. This comprehensive approach aims to provide clients with ongoing financial solutions.

Clients can work with one of the company's 60,000 tax professionals across 9,000 offices. This service provides in-person assistance and expert guidance. H&R Block's assisted services ensure accuracy and personalized support for complex tax situations.

DIY options include online tools with AI Tax Assist and downloadable software. For the 2025 tax season, free federal filing is available for simple returns. Premium DIY services offer unlimited expert help at no extra charge. This caters to those who prefer to file their taxes independently.

H&R Block combines 70 years of trusted human expertise with cutting-edge technology. AI Tax Assist, available in paid DIY tiers, streamlines the online DIY tax preparation process. This hybrid approach ensures clients receive both technological efficiency and expert guidance.

H&R Block offers free Second Look tax reviews for up to three years of prior returns. The company provides year-round support via its mobile banking app, Spruce, and small business solutions through Block Advisors and Wave. These services extend beyond tax filing.

H&R Block's competitive edge lies in the scope of its tax advice and assistance. Expert help is bundled with paid products, providing access to tax professionals via chat without additional fees. The company's focus on customer support and comprehensive services sets it apart from competitors.

- Extensive tax advice and assistance through multiple channels.

- Bundled expert help with paid products.

- Year-round financial solutions through Spruce, Block Advisors, and Wave.

- Free Second Look tax reviews for up to three years.

H&R Block SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does H&R Block Make Money?

The company, a prominent player in the tax preparation industry, generates revenue through a diverse set of services. It primarily focuses on tax preparation and filing, offering both in-person and digital solutions. The company's financial performance reflects its robust revenue streams and effective monetization strategies.

For the fiscal year 2024, the company reported total revenue of $3.61 billion, marking a 3.98% increase from the previous year. Projections for fiscal 2025 anticipate revenue to be between $3.69 billion and $3.75 billion, showcasing continued growth and market confidence. Understanding the company's revenue streams provides insights into its financial health and market positioning.

The company's ability to adapt and innovate, as highlighted in a recent article about the Target Market of H&R Block, is essential for its continued success. This adaptability is evident in its diverse revenue streams and strategic monetization approaches.

The company's revenue streams are diversified, encompassing assisted tax preparation, DIY tax solutions, financial products, and small business solutions. Each segment contributes differently to the overall revenue, with assisted tax preparation being a significant driver. The company's strategic focus on these diverse streams allows it to cater to a broad customer base and maintain a strong financial position.

- Assisted Tax Preparation: This segment includes fees from clients using the company's tax professionals for in-person or virtual tax filing. The company saw a 4.2% increase in total revenue in the third quarter of fiscal year 2025, reaching $2.3 billion, due in part to higher net average charges and increased company-owned return volumes in the U.S.

- Do-It-Yourself (DIY) Tax Solutions: Revenue is generated from the sale of various tiers of its online tax software and downloadable software. The DIY business experienced an 11% year-over-year revenue growth in fiscal year 2024.

- Financial Products: The company offers financial products such as refund transfers and audit support. The Spruce mobile banking app, a key financial product, neared $1 billion in customer deposits as of June 30, 2024, with almost 50% of deposits coming from non-tax sources in fiscal 2024.

- Small Business Solutions: Through Block Advisors and Wave, the company provides bookkeeping, payroll, advisory, and payment processing solutions for small businesses. The small business segment, including bookkeeping and payroll services, achieved double-digit revenue growth year-over-year in the second quarter of fiscal year 2025. Wave specifically saw 15% revenue growth in the second quarter of fiscal year 2025.

The company employs various monetization strategies to maximize revenue and enhance customer value. These strategies include tiered pricing for its DIY software, cross-selling additional services, and aggressive market share acquisition tactics.

- Tiered Pricing: Offering different software tiers allows customers to select a product that aligns with their tax complexity, optimizing revenue potential.

- Cross-Selling: The company enhances revenue per client by cross-selling services like 'peace-of-mind' insurance products and audit support.

- Market Share Acquisition: For the 2025 tax season, the company is implementing a bold price-matching initiative, offering up to 50% discounts to attract new clients. This strategy, along with the inclusion of AI Tax Assist and Live Tax Pro Support in premium packages at no extra cost, aims to capture market share while maintaining margins through upselling and customer retention.

H&R Block PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped H&R Block’s Business Model?

H&R Block has navigated significant milestones and strategic shifts, shaping its position in the tax preparation industry. A key strategic direction is the 'Block Horizons 2025' transformation strategy, launched in 2021. This strategy focuses on small business solutions, financial products, and enhancing the client experience to drive growth and improve financial performance.

A notable strategic move for the 2025 tax season involves an aggressive market share acquisition strategy. This includes a price-matching initiative offering up to 50% discounts for new clients, and the bundling of AI Tax Assist and Live Tax Pro Support in premium DIY packages at no extra cost. The introduction of AI Tax Assist in 2024, utilizing generative AI, aims to streamline the online DIY tax preparation process and support its 60,000 tax professionals.

The company also focuses on customer-centric initiatives, such as providing free expert help with paid DIY products and a 'no surprises' guarantee on pricing, which contributes to customer loyalty. H&R Block continues to adapt to new trends and technology shifts, including collaboration with OpenAI to develop generative AI solutions for tax professionals.

H&R Block, with over 70 years of experience, has established a strong brand presence in the tax preparation industry. The company has approximately 9,000 offices, providing a significant advantage for clients seeking in-person assistance. Its long history and extensive network have helped it become a leading provider of H&R Block tax filing services.

The 'Block Horizons 2025' strategy is a pivotal strategic move, focusing on three key areas: small business, financial products, and enhancing the 'Block experience'. The company's aggressive market share acquisition strategy for the 2025 tax season includes price-matching and bundled services to attract new clients. These moves are designed to enhance H&R Block services and drive growth.

H&R Block's competitive advantages include its brand strength, extensive network, and hybrid approach combining human expertise with technology. The company's diversified offerings, including small business solutions and financial products, broaden its service portfolio. Features like free expert help and a 'no surprises' guarantee contribute to customer loyalty, setting it apart from other providers of tax preparation.

The company has faced operational challenges, including regulatory hurdles. In January 2025, the Federal Trade Commission (FTC) finalized a settlement requiring H&R Block to pay $7 million and overhaul its advertising and customer service practices. These changes aim to enhance transparency and reduce consumer frustration during the tax season.

H&R Block's competitive edge stems from its brand strength, extensive network, and hybrid approach. The company's blend of digital innovation and human expertise, with 60,000 tax professionals, differentiates it from purely digital competitors. The company's initiatives and strategic moves are designed to enhance customer experience and drive growth.

- Brand Strength and Extensive Network: With over 70 years of experience and approximately 9,000 offices, H&R Block has a dominant presence.

- Hybrid Approach: The company combines digital innovation with human expertise, offering a blend of online and in-person services.

- Diversified Offerings: Beyond tax preparation, H&R Block offers small business solutions and financial products.

- Customer-Centric Initiatives: Features like free expert help and a 'no surprises' guarantee contribute to customer loyalty. For more insights, explore the Competitors Landscape of H&R Block.

H&R Block Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is H&R Block Positioning Itself for Continued Success?

In the landscape of tax preparation, H&R Block maintains a strong position, particularly in the U.S. market. The company provides a range of H&R Block services, including both in-person and online tax filing options. H&R Block's extensive network of physical locations, coupled with its digital platforms, supports its substantial market share, solidifying its role during tax season.

However, H&R Block faces several challenges, including intense competition in the DIY tax preparation segment and the need to adapt to evolving consumer preferences and technological advancements. The company’s future success hinges on its ability to navigate these risks while capitalizing on growth opportunities in financial products and small business services.

H&R Block is a key player in the tax preparation industry, holding a significant market share. They have a strong presence in the U.S., with a vast network of physical locations. The company's click share in the PPC landscape is at 27.42%, following FreeTaxUSA.

Key risks include competition from DIY tax preparation services like TurboTax and FreeTaxUSA. Regulatory scrutiny and technological advancements also pose challenges. Economic downturns and changing consumer behaviors could impact demand for H&R Block tax filing services.

H&R Block is focusing on growth in small business services and financial products. The company is aiming to enhance client experiences, with investments in its Block Advisors business. Leadership anticipates revenue between $3.69 billion and $3.75 billion for fiscal year 2025.

The 'Block Horizons 2025' strategy emphasizes growth across multiple areas. The company is focusing on improving client experiences. H&R Block is also leveraging its mobile banking app, Spruce, and small business offerings through Wave.

H&R Block faces several challenges, including increased competition in the DIY market and the need to adapt to technological changes. The company's ability to innovate and expand its service offerings will be crucial. H&R Block’s strategic initiatives are designed to drive future growth and enhance shareholder value, as detailed in Growth Strategy of H&R Block.

- Competition: The DIY tax preparation market is highly competitive, requiring H&R Block to differentiate.

- Regulatory Changes: The company must navigate ongoing regulatory scrutiny.

- Technological Disruption: Rapid technological advancements could disrupt traditional tax preparation.

- Consumer Preferences: Adapting to digital solutions and year-round financial management is essential.

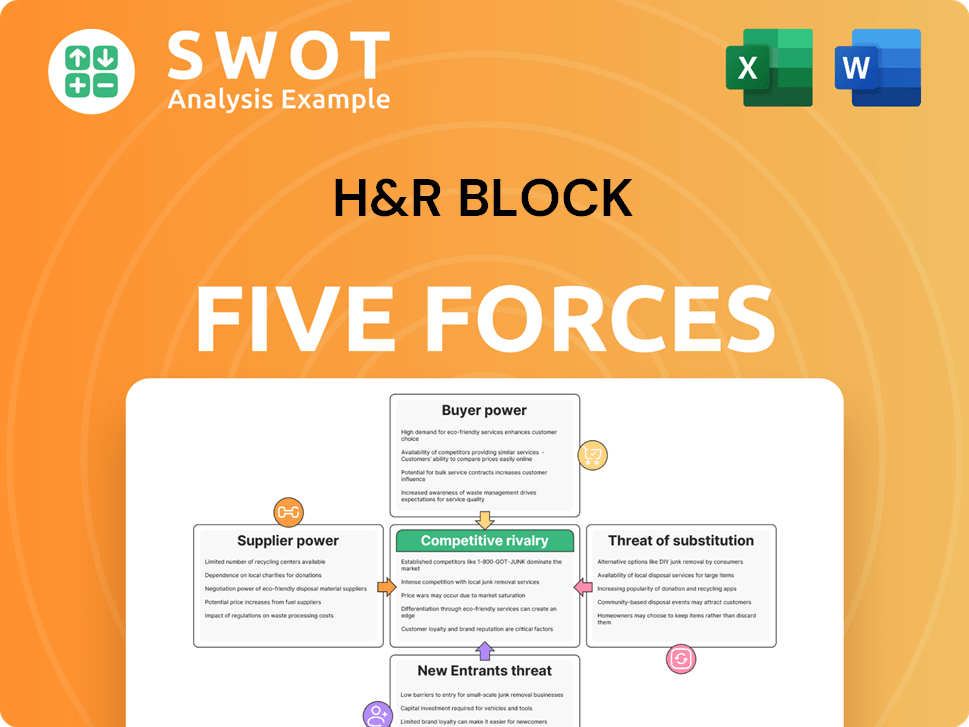

H&R Block Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of H&R Block Company?

- What is Competitive Landscape of H&R Block Company?

- What is Growth Strategy and Future Prospects of H&R Block Company?

- What is Sales and Marketing Strategy of H&R Block Company?

- What is Brief History of H&R Block Company?

- Who Owns H&R Block Company?

- What is Customer Demographics and Target Market of H&R Block Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.