H&R Block Bundle

How Does H&R Block Stay Ahead in the Tax Game?

Witness the remarkable evolution of H&R Block's sales and marketing strategies in the ever-changing tax preparation industry. From its humble beginnings to its current omnichannel presence, the company's journey showcases a commitment to innovation and customer-centric approaches. Discover how H&R Block has navigated the digital landscape and maintained its market leadership.

H&R Block's H&R Block SWOT Analysis reveals a dynamic business model that has adapted to meet the evolving needs of its customers. This analysis will delve into the core elements of H&R Block's sales strategy, exploring its customer acquisition strategies and how it effectively markets its tax preparation services. Understanding H&R Block's marketing strategy, including its digital marketing campaigns and tax season marketing tactics, provides valuable insights for any business aiming to thrive in a competitive market.

How Does H&R Block Reach Its Customers?

The sales channels employed by H&R Block are multifaceted, designed to cater to a broad spectrum of customer preferences. Their approach includes both traditional and digital methods, ensuring accessibility and convenience for clients. This strategy is a key component of their overall Growth Strategy of H&R Block, aiming to maintain a strong market presence in the tax preparation services industry.

A significant portion of H&R Block's sales strategy revolves around its extensive network of physical retail locations. These locations provide in-person assistance from tax professionals, which is a crucial service for many customers. Simultaneously, the company has invested heavily in its digital platforms, including its website and mobile applications, to offer do-it-yourself (DIY) tax solutions and online assisted tax preparation services.

This dual approach reflects an omnichannel strategy, providing customers with flexibility in how they choose to interact with the company. The integration of online and offline experiences is designed to create a seamless customer journey, whether clients prefer in-person assistance or the convenience of digital tools.

H&R Block's extensive network of physical retail locations remains a cornerstone of its sales strategy. These locations offer in-person tax preparation services, providing direct interaction with tax professionals. This channel is particularly important for customers who prefer personalized assistance and guidance during tax season.

Digital platforms, including the company website and mobile applications, are a key component of H&R Block's sales strategy. These platforms offer DIY tax solutions and online assisted tax preparation. The digital channel has seen significant growth, reflecting changing consumer preferences and the rise of digital-first competitors.

H&R Block focuses on integrating its online and offline experiences to provide a seamless customer journey. This includes allowing customers to start their taxes online and finish in an office, or vice-versa. This strategic blending aims to provide convenience and flexibility, regardless of the chosen interaction point.

The company has explored partnerships and alliances to extend its reach. While exclusive distribution deals are less prevalent in the tax preparation industry, collaborations can help expand customer acquisition strategies. These partnerships often aim to improve brand awareness campaigns.

H&R Block's H&R Block sales strategy focuses on a blend of physical and digital channels to maximize customer reach and convenience. This approach is crucial for effective tax season marketing and overall financial services marketing.

- Physical Retail: Maintaining a strong presence with retail locations for in-person services.

- Digital Platforms: Enhancing online and mobile platforms for DIY and online assisted tax preparation.

- Omnichannel Integration: Creating a seamless experience between online and offline channels.

- Strategic Partnerships: Exploring alliances to broaden reach and improve customer acquisition.

H&R Block SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does H&R Block Use?

The company's marketing strategy, a key element of its overall Revenue Streams & Business Model of H&R Block, is a multifaceted approach designed to attract and retain customers in the competitive tax preparation services market. This strategy encompasses a blend of digital and traditional marketing tactics, carefully calibrated to reach a broad audience and address diverse tax needs. The goal is to build brand awareness, generate leads, and ultimately drive sales during tax season and beyond.

The company's marketing efforts are significantly influenced by the cyclical nature of the tax preparation business, with a heavy emphasis on campaigns during peak tax season. The company invests in data-driven marketing to personalize messaging and offers, optimizing campaign spending and understanding customer behavior. This approach allows for targeted advertising and customer segmentation, which is crucial for effective Tax season marketing.

The company's marketing strategy also focuses on user-friendly interfaces for its DIY software and emphasizes customer support across all channels. This approach aims to reduce the perceived complexity and stress of tax filing, enhancing the overall customer experience and fostering loyalty. The company's marketing budget allocation is strategically designed to maximize reach and impact during critical periods.

The company employs a robust digital marketing strategy, including content marketing, Search Engine Optimization (SEO), and paid advertising. These tactics are designed to enhance online visibility and attract potential clients.

The company uses content marketing to provide valuable tax tips, guides, and resources through its website and blog. This approach helps to attract and engage potential clients by offering helpful information.

SEO is crucial for ensuring visibility in online searches for tax-related queries. This strategy helps the company rank higher in search results, making it easier for potential clients to find them.

Paid advertising campaigns are run across search engines and social media platforms to target specific demographics and tax situations. This allows for precise targeting and efficient use of advertising spend.

Email marketing plays a significant role in nurturing leads and retaining existing customers. Personalized reminders and offers are often sent to engage and retain clients.

Social media platforms are used for customer engagement, brand building, and disseminating timely tax information. This helps maintain a strong online presence and interact with clients.

The company maintains a strong presence in traditional media, including television, radio, and print advertising. This is particularly important during peak tax season to reach a broad audience. These campaigns support the overall H&R Block marketing strategy.

- Television Advertising: Television advertising remains a key component, especially during the tax season, to reach a wide audience.

- Radio Advertising: Radio ads are used to target local markets and provide timely information.

- Print Advertising: Print ads in newspapers and magazines are used to reach specific demographics.

- Data-Driven Marketing: The company uses extensive customer segmentation for personalized messaging.

- Analytics and Optimization: Analytics tools track campaign performance to optimize spending and understand customer behavior.

H&R Block PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is H&R Block Positioned in the Market?

The company strategically positions itself as a trusted expert in tax preparation, focusing on accessibility and professional guidance. This approach differentiates it within the financial services marketing landscape. The core message revolves around simplifying taxes, ensuring accuracy, and maximizing client refunds, aiming to alleviate taxpayer anxiety during tax season.

Its visual identity emphasizes reliability and professionalism, with a reassuring and authoritative tone. The customer experience promises ease, accuracy, and peace of mind, whether through assisted services or DIY software. This brand positioning is crucial for its H&R Block sales strategy, aiming to capture a broad customer base.

The company's brand consistently ranks high in brand recognition within the tax preparation services industry. The company's commitment to consistency across all channels and touchpoints reinforces its image as a reliable and familiar brand. This helps in customer retention and acquisition during tax season marketing efforts.

The company emphasizes value, expertise, and guaranteed accuracy to attract its target audience. This strategy helps it compete effectively in the financial services marketing sector. This is a key component of the H&R Block business model.

The company appeals to both individual taxpayers and small businesses. It offers a range of services to meet diverse needs. This broad appeal is central to its H&R Block sales strategy.

The company does not solely compete on price, but rather highlights the value of professional guidance. This is a key differentiator in the tax preparation market. The company's approach is part of its H&R Block marketing strategy.

The company actively responds to consumer demand for digital solutions by investing in and improving its online platforms and mobile applications. This is crucial for its long-term growth. This is part of its Brief History of H&R Block.

The company's brand is built on trust, expertise, and customer support. This is reflected in its advertising campaigns and customer interactions. The company's brand awareness campaigns are consistently implemented.

- Professional Expertise: Emphasizing the knowledge and skills of its tax professionals.

- Customer Support: Providing accessible and helpful customer service.

- Accuracy Guarantee: Assuring clients of accurate tax preparation and maximized refunds.

- Digital Accessibility: Offering user-friendly online and mobile platforms.

H&R Block Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are H&R Block’s Most Notable Campaigns?

H&R Block has consistently employed impactful sales and marketing campaigns to solidify its position in the tax preparation services market. A cornerstone of their strategy has been the 'Get Your Billions Back America' initiative, designed to underscore the value of tax refunds and position H&R Block as the facilitator of these returns. This campaign has historically been a significant driver of customer acquisition, leveraging the tangible benefit of maximizing refunds for taxpayers.

More recently, H&R Block's marketing efforts have evolved to meet the changing needs of consumers, especially during tax season. The company has invested heavily in promoting its 'Tax Pro Review' and 'Expert Live' services. These campaigns aim to blend the convenience of online tax filing with the assurance of professional support. This approach is a key element of their H&R Block sales strategy, designed to increase adoption of their DIY software while highlighting their expertise in the digital space.

The success of these campaigns is evident in H&R Block's continued investment in these services. While specific sales lift numbers are proprietary, the company's focus on customer acquisition and retention indicates a positive impact. The company's business model also includes collaborations, though influencer partnerships are often campaign-specific rather than long-term. Their general strategy involves showcasing real customer testimonials and highlighting the expertise of their tax professionals to build credibility. Understanding the Target Market of H&R Block is also crucial for campaign success.

This long-standing campaign focuses on emphasizing the total amount of money taxpayers receive in refunds. It positions H&R Block as the key facilitator of these returns. The campaign's execution spans across TV, radio, and digital channels.

These campaigns highlight the convenience of online filing combined with expert assistance. Objectives include increasing DIY software adoption and reinforcing expertise in the digital space. They are promoted through digital advertising, social media, and targeted email marketing.

H&R Block utilizes digital advertising extensively to reach a broad audience during tax season. The strategy includes search engine optimization (SEO) and targeted ads. These campaigns focus on driving traffic to their website and promoting their services.

Social media is a crucial component of H&R Block's marketing strategy. They engage with customers, provide tax tips, and promote their services. This helps in building brand awareness and customer engagement.

H&R Block's marketing campaigns are designed to attract new clients and retain existing ones. The campaigns use a combination of traditional and digital marketing tactics, and they emphasize the value of professional tax preparation. The company's approach to financial services marketing is consistently evolving.

- Customer Testimonials: Showcasing real customer experiences to build trust.

- Expertise: Highlighting the knowledge and skills of their tax professionals.

- Convenience: Promoting the ease of use of their online and in-person services.

- Refund Focus: Emphasizing the value of maximizing tax refunds for customers.

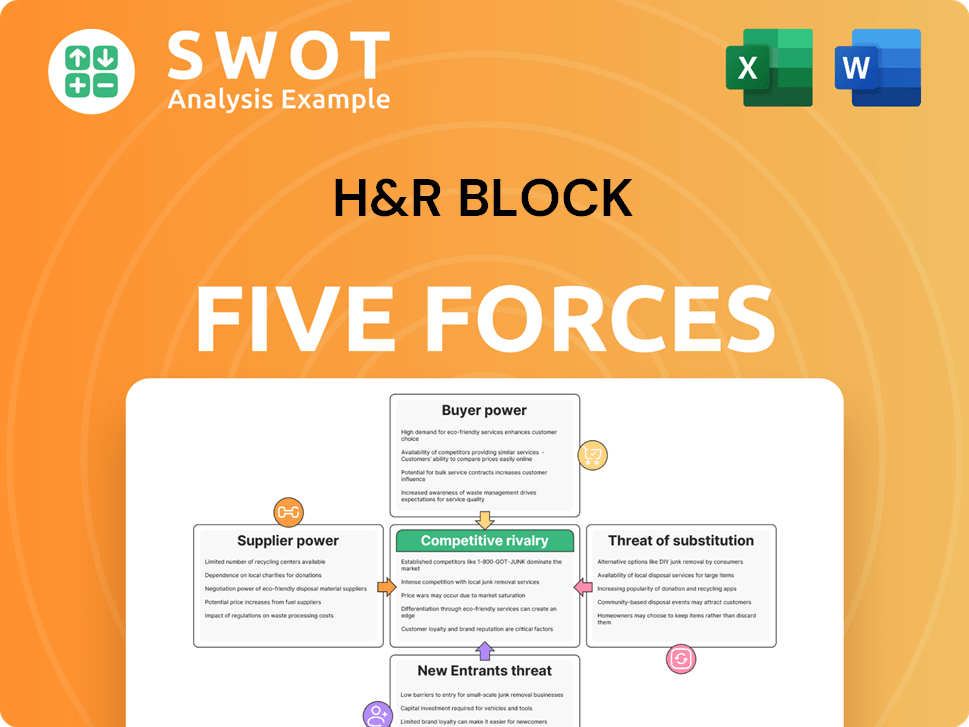

H&R Block Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of H&R Block Company?

- What is Competitive Landscape of H&R Block Company?

- What is Growth Strategy and Future Prospects of H&R Block Company?

- How Does H&R Block Company Work?

- What is Brief History of H&R Block Company?

- Who Owns H&R Block Company?

- What is Customer Demographics and Target Market of H&R Block Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.