Inogen Bundle

How has the Inogen Company revolutionized respiratory care?

Discover the remarkable journey of the Inogen SWOT Analysis, a medical device company that transformed oxygen therapy. From its inception in 2001, Inogen has consistently innovated, focusing on patient-centric solutions. This Inogen history reveals how a vision for greater patient independence reshaped the industry.

The Inogen company's early years were marked by a commitment to developing the portable oxygen concentrator, offering a stark contrast to traditional oxygen tanks. With a significant market share and a focus on continuous innovation, Inogen's impact on the medical technology sector is undeniable. Exploring the brief history of Inogen unveils the strategic decisions that propelled it to its current leading position.

What is the Inogen Founding Story?

The story of the Inogen company began in 2001. It was founded by Alison Bauerlein, Brenton Taylor, and Byron Myers in Goleta, California. Their goal was to revolutionize oxygen therapy.

The founders were inspired by a personal experience. Alison Bauerlein's grandmother, Mae, needed supplemental oxygen and was frustrated by the bulky equipment available. This led to the creation of a more mobile and user-friendly solution.

The trio, then students at the University of California Santa Barbara, saw the need for a better oxygen therapy device. They aimed to create a portable oxygen concentrator. Their design, the Inogen One, was a smaller, lighter, and more efficient alternative to traditional oxygen tanks.

Inogen's journey started with a clear vision: to improve the lives of those needing oxygen therapy. They focused on creating a portable oxygen concentrator, a significant improvement over existing solutions.

- Inogen was founded in 2001 in Goleta, California.

- The founders were students at the University of California Santa Barbara.

- Their initial business plan won a competition in 2001.

- Early funding came from venture capital, including a $15 million Series C round in 2004.

The founders secured early funding through venture capital. By 2004, they had raised a significant amount, including a $15 million Series C round. This funding supported the initial product development and launch of the Inogen One.

A memorable moment in Inogen's history was when Mae, the inspiration for the company, tried the first Inogen One in October 2004. Her positive reaction validated the founders' efforts. This solidified their commitment to improving the lives of oxygen therapy users.

The Inogen company has since grown and evolved. For more insight, you can explore the Target Market of Inogen.

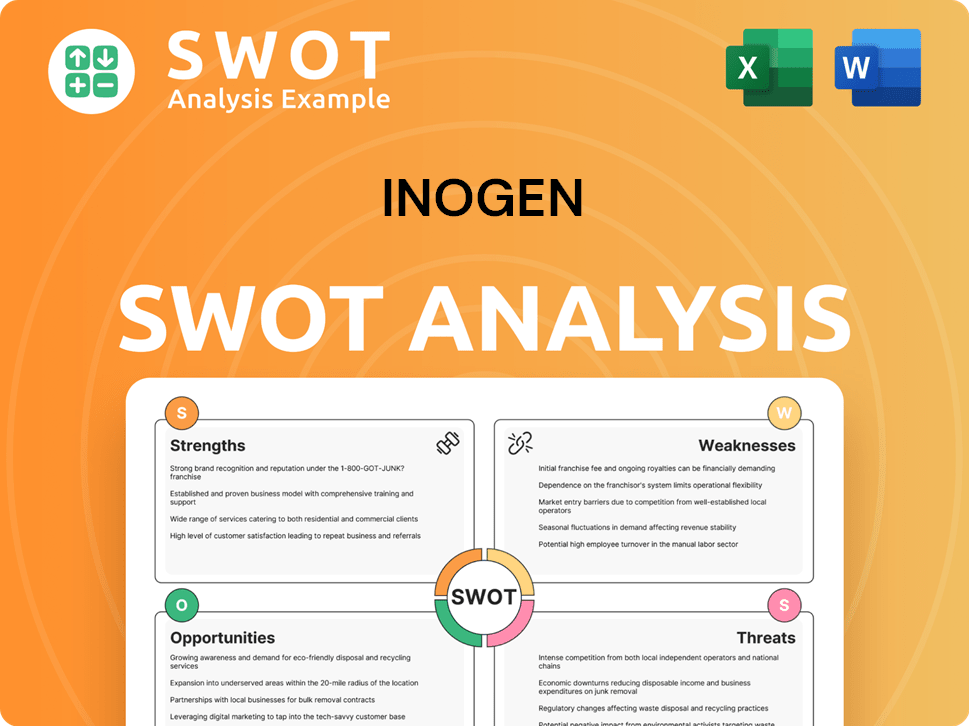

Inogen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Inogen?

The early growth of the Inogen company was marked by the introduction of its first Portable Oxygen Concentrator (POC) in 2004, which offered a lightweight alternative to traditional oxygen tanks. This initial product was a significant improvement over existing in-home-only concentrators, establishing the company's core product line. The company quickly saw the potential for greater patient freedom and independence, leading to strategic expansion.

The Inogen One, launched in 2004, provided a disruptive solution for oxygen therapy. It weighed 9.8 pounds and offered 2-3 hours of battery life, a significant advancement over stationary devices. This product established Inogen as a key player in the medical device company market, focusing on making oxygen more accessible.

By 2007, Inogen secured $22 million in funding, led by Novo A/S and Arboretum Ventures. This funding supported new manufacturing capabilities and expansion into international markets. This capital was crucial for scaling operations and broadening sales channels, fueling the company's growth.

The Inogen One G2 improved pulse flow settings, increased battery life to 8 hours, reduced sound levels, and decreased weight. The adoption of a direct-to-consumer strategy significantly contributed to revenue growth, increasing from $10.7 million in 2009 to $48.6 million in 2012. Further insights into this growth can be found in the Growth Strategy of Inogen.

Inogen achieved approximately 36% in product manufacturing cost savings from the Inogen One G1 to the Inogen One G3 through design improvements and higher production volumes. In 2014, Inogen conducted its Initial Public Offering (IPO) on NASDAQ under the symbol INGN, raising approximately $86 million. This provided substantial capital for scaling and R&D.

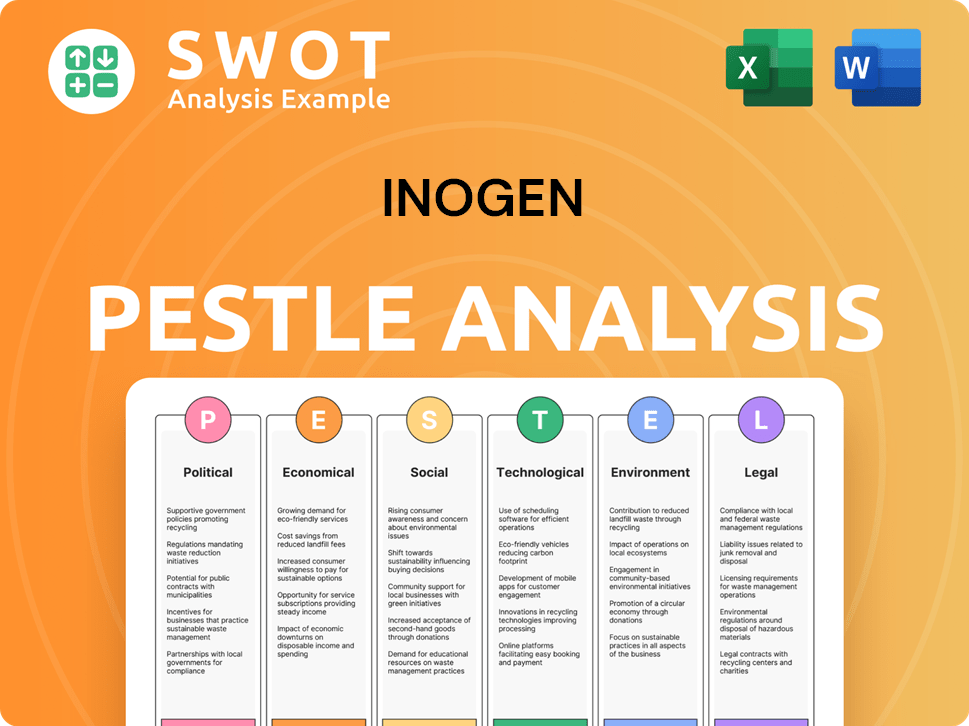

Inogen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Inogen history?

The Inogen company has a rich history marked by significant milestones that have shaped the portable oxygen concentrator industry. A key achievement was the launch of the Inogen One in 2004, which revolutionized oxygen therapy by offering a lightweight, portable alternative to traditional tanks.

| Year | Milestone |

|---|---|

| 2004 | Launch of the Inogen One, a lightweight and portable oxygen concentrator. |

| 2012 | Introduction of the Inogen One G3, enhancing portability and user convenience. |

| 2024 | Allocation of $11.7 million for research and development. |

| 2024 | FDA 510(k) clearance for the SIMEOX 200 Airway Clearance Device. |

| 2025 | Strategic collaboration with Yuwell for expanding product portfolio and global reach. |

The company's commitment to innovation is evident in its continuous product enhancements. The Inogen One G2 improved battery life and reduced weight, while the Inogen One G3 further demonstrated the company's dedication to portability and user convenience.

The Inogen One was the first portable oxygen concentrator. This device was a major step forward in making oxygen therapy more convenient for patients.

The Inogen One G2 improved battery life and reduced weight. This made the device even more user-friendly and portable for patients on the go.

The Inogen One G3 further enhanced portability and convenience. This model continued the trend of making oxygen therapy more accessible and less cumbersome.

The company invested $11.7 million in research and development in 2024. This investment underscores the company's commitment to innovation and improving its product offerings.

The company has expanded its product portfolio to include a broader range of respiratory devices. This includes the SIMEOX 200 Airway Clearance Device, which received FDA clearance in December 2024.

The strategic collaboration with Yuwell, announced in January 2025, aims to expand the product portfolio and global reach. This partnership is particularly focused on growth in China and the United States.

Despite these achievements, Inogen has faced challenges, including competitive pressures and market fluctuations. The company's stock experienced significant volatility, and supply chain constraints have also hindered its potential.

The company's stock price has seen significant fluctuations, with shares reaching an all-time high in 2018 and then dropping considerably. This volatility reflects the challenges faced by the company in a competitive market.

Supply chain constraints have negatively impacted the company's performance. In August 2021, the stock price fell sharply due to these issues, highlighting the importance of a stable supply chain.

The company has reported net losses, including a $20.1 million loss in Q3 2024. These financial results reflect the ongoing challenges in the respiratory care market.

The portable oxygen concentrator market is highly competitive. The company faces challenges from other medical device companies and market fluctuations.

The company is focusing on diversifying its portfolio to include a broader range of respiratory devices. This strategic shift aims to drive growth and reduce reliance on a single product line.

The company is implementing operational improvements to address challenges and enhance efficiency. These efforts are aimed at improving financial performance and market position.

In response to these challenges, Inogen has undertaken strategic pivots and operational improvements, including diversifying its portfolio and forming strategic collaborations. For more insights, you can check out the Marketing Strategy of Inogen.

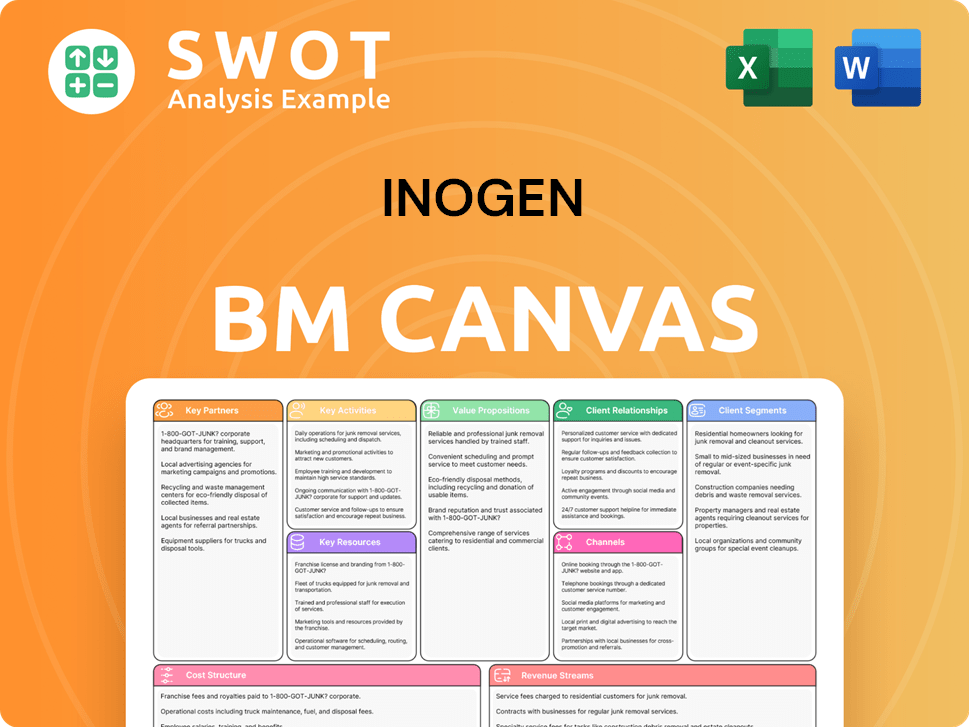

Inogen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Inogen?

The Inogen company, a medical device company, has a history marked by innovation in oxygen therapy. Founded in 2001, the company quickly established itself as a leader, launching its first Portable Oxygen Concentrator (POC) in 2004. Over the years, Inogen has achieved significant milestones, including a successful IPO in 2014 and strategic acquisitions to enhance its product offerings.

| Year | Key Event |

|---|---|

| 2001 | Inogen Inc. is founded in Goleta, California. |

| 2004 | The first Inogen One Portable Oxygen Concentrator (POC) is launched. |

| 2007 | Inogen secures $22 million in funding for manufacturing and international expansion. |

| 2009 | The company adopts a direct-to-consumer (DTC) sales strategy. |

| 2012 | The Inogen One G3 is launched, improving portability. |

| 2014 | Inogen completes its Initial Public Offering (IPO) on NASDAQ, raising approximately $86 million. |

| 2019 | Inogen acquires New Aera, Inc. to enhance its respiratory care portfolio. |

| 2021 | The last of Inogen's founding team members, Ali Bauerlein, steps down from her executive role. |

| 2024 (Q3) | Trailing twelve-month revenues reach nearly $297 million. |

| 2024 (Q4) | Total revenue increases by 5.5% to $80.1 million, and full-year 2024 revenue grows by 6.4% to $335.7 million. |

| 2024 (December) | Inogen receives FDA 510(k) clearance for the SIMEOX 200 Airway Clearance Device. |

| 2025 (January) | Inogen enters a strategic collaboration with Jiangsu Yuyue Medical Equipment & Supply Co., Ltd. (Yuwell). |

| 2025 (Q1) | Total revenue is $82.3 million, a 5.5% increase year-over-year. |

For the full year 2025, the

In Q1 2025, Inogen reported total revenue of $82.3 million, a 5.5% increase year-over-year. The company's adjusted EBITDA for Q1 2025 was positive $0.04 million, a significant improvement from negative $7.6 million in the prior-year period. In Q4 2024, total revenue increased by 5.5% to $80.1 million, and full-year 2024 revenue grew by 6.4% to $335.7 million.

Inogen is focused on developing digital health solutions for remote monitoring. The company is also exploring new technologies to enhance its product offerings. These initiatives are designed to improve patient care and support sustainable growth.

Inogen's mission remains to improve the freedom and independence of respiratory patients. The company is committed to driving sustainable growth and profitability. This focus reflects the original vision of the

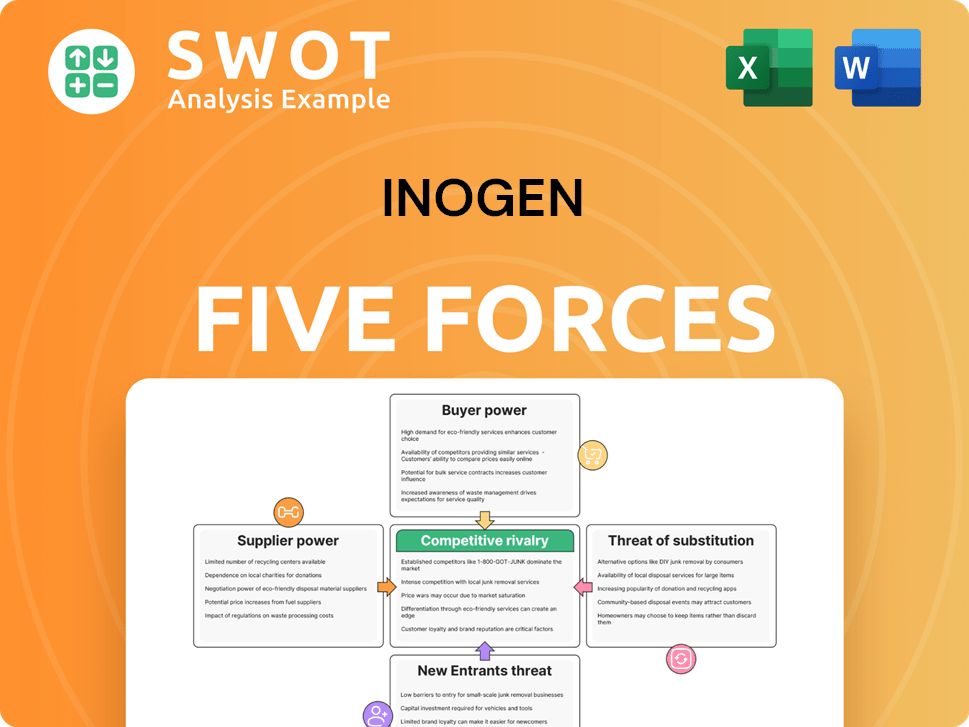

Inogen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Inogen Company?

- What is Growth Strategy and Future Prospects of Inogen Company?

- How Does Inogen Company Work?

- What is Sales and Marketing Strategy of Inogen Company?

- What is Brief History of Inogen Company?

- Who Owns Inogen Company?

- What is Customer Demographics and Target Market of Inogen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.