Inogen Bundle

How Does the Inogen Company Thrive in the Healthcare Market?

Inogen, a trailblazer in medical technology, has reshaped respiratory care with its innovative portable oxygen concentrators (POCs). These devices offer a revolutionary alternative to traditional oxygen tanks, granting patients unparalleled freedom and ease. The Inogen SWOT Analysis reveals the company's strategic positioning within the healthcare industry.

Inogen's commitment to enhancing the lives of individuals requiring supplemental oxygen has solidified its position as a key player. Its focus on lightweight, compact, and energy-efficient POCs caters to a growing patient demographic seeking active lifestyles while managing their respiratory conditions. This exploration will delve into Inogen's business model, revenue streams, and market strategies, providing a comprehensive understanding of its value delivery and sustained profitability, answering questions like "How does Inogen G4 work" and "Inogen G5 battery life."

What Are the Key Operations Driving Inogen’s Success?

The core operations of the Inogen company center around the design, manufacturing, and distribution of portable oxygen concentrators. These devices are crucial for individuals with chronic respiratory conditions who require supplemental oxygen therapy. The company's primary products, such as the Inogen One series, are known for their compact size, lightweight design, and extended battery life, offering users enhanced mobility and independence.

Inogen's business model primarily focuses on direct-to-consumer sales, though it also collaborates with home medical equipment providers. This approach allows for direct engagement with patients and control over the customer experience. The operational process is carefully managed to ensure high-quality products and customer satisfaction.

The company's value proposition lies in providing a superior quality of life for individuals reliant on oxygen therapy. By offering portable, user-friendly devices, Inogen enables patients to maintain active lifestyles and greater independence. This focus on innovation and customer needs differentiates Inogen in the medical device market.

Inogen invests in research and development to improve its oxygen delivery technology. This includes reducing device size and weight, and enhancing battery life. The company continually seeks to innovate and meet the evolving needs of its customers. This commitment to innovation helps Inogen stay ahead of the competition.

Manufacturing takes place in-house to ensure stringent quality control and efficient production. The supply chain involves sourcing specialized components and materials. Inogen focuses on reliability and performance of its devices, ensuring that each product meets high standards.

Inogen uses a multi-channel distribution approach, including direct-to-consumer sales via its own sales force and e-commerce platform. It also partners with durable medical equipment (DME) providers and international distributors. This strategy ensures that the Inogen oxygen concentrator is accessible to a wide range of customers.

Customer service is a critical component, offering technical support and assistance to patients. Inogen's direct interaction with customers allows for personalized service and feedback. This approach helps build strong customer relationships and brand loyalty.

Inogen's operational uniqueness stems from its vertically integrated model, which allows for greater control over product quality and innovation, and its strong direct-to-consumer sales channel, which fosters direct relationships with end-users. This setup allows Inogen to offer competitive Inogen oxygen concentrator price points and high-quality service. The company's focus on portability and user-friendliness addresses a significant market need.

- Direct-to-Consumer Sales: Enables direct patient interaction and feedback.

- Vertically Integrated Model: Ensures control over quality and innovation.

- Focus on Portability: Addresses the need for mobile oxygen therapy.

- Customer-Centric Approach: Prioritizes patient needs and satisfaction.

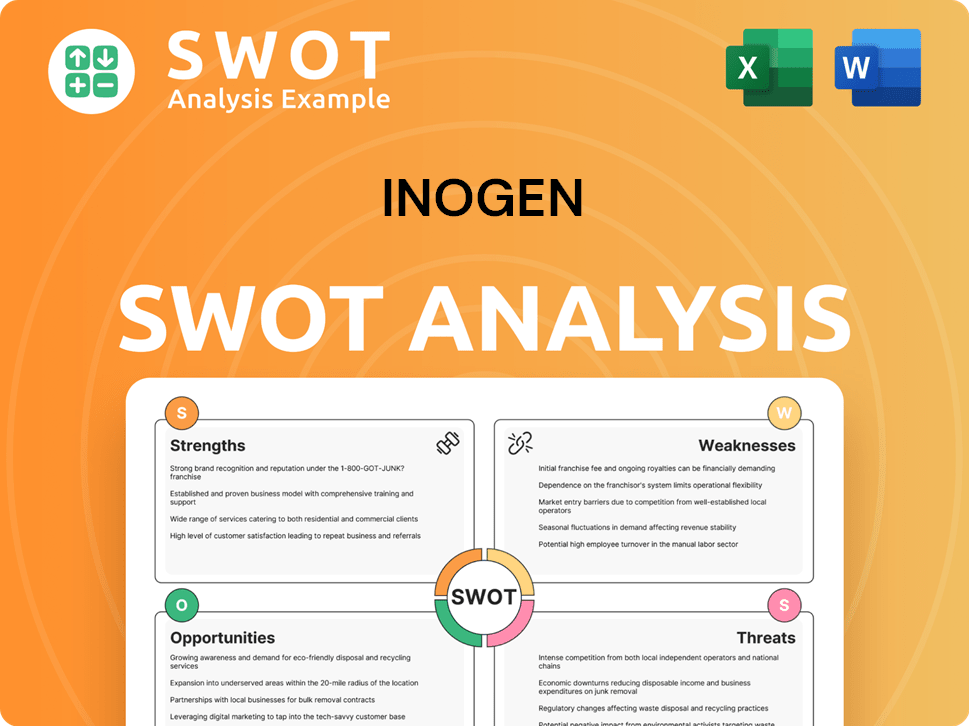

Inogen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Inogen Make Money?

The Inogen company primarily generates revenue through the sale and rental of its portable oxygen concentrators (POCs) and related accessories. Their revenue streams are categorized into business-to-business (B2B) and direct-to-consumer (DTC) sales. This dual approach allows Inogen to reach a broader customer base and diversify its market presence.

Inogen's monetization strategy focuses on both outright purchases and rental agreements for its POCs, providing flexibility for customers. They also generate revenue from the sale of accessories, such as batteries and carrying bags. Inogen’s tiered pricing for different POC models, offering varying features, is another monetization strategy.

In 2024, Inogen reported total revenue of $316.5 million. The DTC sales contributed $209.6 million, while B2B sales accounted for $106.9 million. This indicates a strong reliance on its direct sales channel. The company has increasingly focused on its direct-to-consumer channel, which typically offers higher margins compared to wholesale B2B sales.

Inogen's financial success is built on a solid foundation of product sales, rentals, and strategic market positioning. Understanding these elements is crucial for anyone looking into the Brief History of Inogen.

- Product Sales: Outright sales of portable oxygen concentrators (POCs) like the Inogen G4 and Inogen G5.

- Rental Agreements: Offering POCs for rent, providing a flexible option for customers.

- Accessory Sales: Revenue from batteries, carrying bags, and external chargers.

- Tiered Pricing: Different models with varying features and battery life, catering to diverse needs.

- Direct-to-Consumer (DTC) Focus: Increased emphasis on DTC sales for higher margins and brand loyalty.

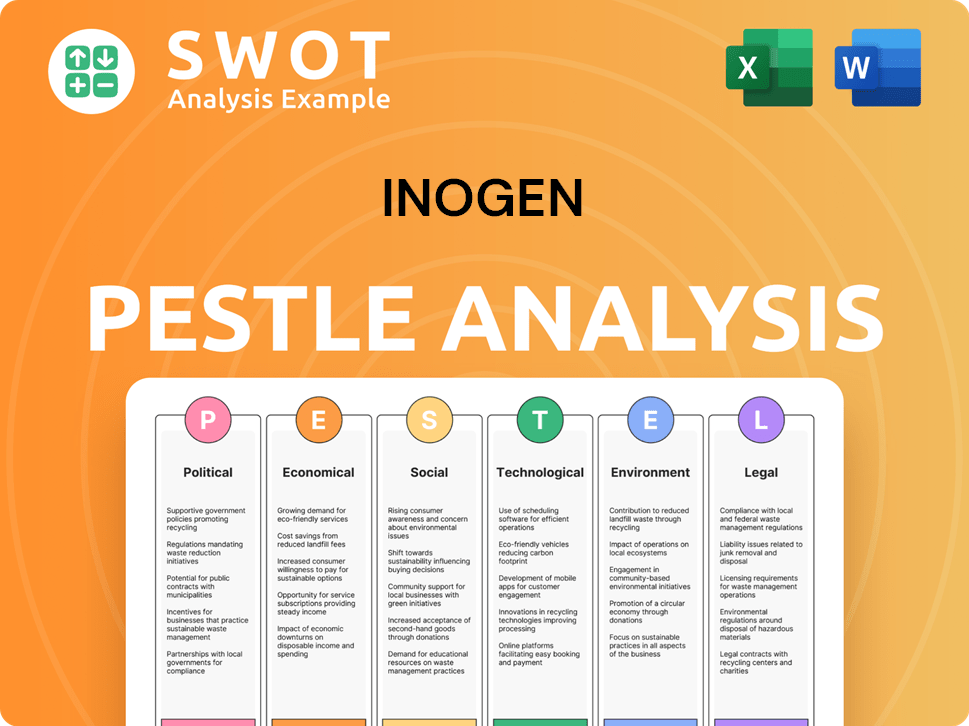

Inogen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Inogen’s Business Model?

The story of the Inogen company is marked by significant achievements that have shaped its operations and financial performance. A crucial early milestone was the introduction of the Inogen One portable oxygen concentrator, which positioned the company as a leader in the mobile oxygen therapy market. Continuous improvements to the Inogen One, such as enhancements in size, weight, and battery life, have further cemented its product leadership.

Strategic moves have included expanding its direct-to-consumer sales force, which has been key in driving revenue growth and market penetration. The company has also focused on international expansion, broadening its reach to a global customer base. These initiatives reflect Inogen's commitment to adapting to the evolving needs of patients and the healthcare landscape.

Operational challenges have involved navigating the changing regulatory environment for medical devices and managing supply chain disruptions, particularly during times of global economic instability. In response, Inogen has invested in robust quality control processes and diversified its supply chain where possible. These efforts demonstrate the company's resilience and its dedication to maintaining high standards.

The launch of the Inogen One portable oxygen concentrator was a pivotal moment, establishing the company's presence in the portable oxygen concentrator (POC) market. Subsequent product iterations have improved portability and efficiency. These innovations have been crucial for Inogen's market position.

Inogen has strategically expanded its direct-to-consumer sales model, boosting revenue and market reach. International expansion has also been a key focus, allowing Inogen to serve a global customer base. These moves highlight Inogen's growth strategy.

Inogen benefits from strong brand recognition within the POC market, thanks to its focus on innovation in oxygen delivery technology. Its direct-to-consumer sales channel provides a direct link to its customer base. These factors contribute to Inogen's competitive advantage.

Navigating evolving regulations and managing supply chain issues have been ongoing challenges. Inogen has responded by investing in quality control and diversifying its supply chain. These efforts are essential for maintaining operational efficiency.

Inogen's competitive advantages include strong brand recognition and technological leadership in portable oxygen concentrators. The company's direct-to-consumer sales model also provides a significant edge. Inogen continues to innovate, focusing on enhanced connectivity and user experience to maintain its market position. For more information, read about the Growth Strategy of Inogen.

- Brand Recognition: Inogen has built a strong reputation in the portable oxygen concentrator market.

- Technological Leadership: The company is known for developing efficient and portable oxygen delivery devices.

- Direct-to-Consumer Sales: This model allows for direct interaction with customers, improving service and feedback.

- Innovation: Inogen continuously improves its products, focusing on features like longer battery life and enhanced portability.

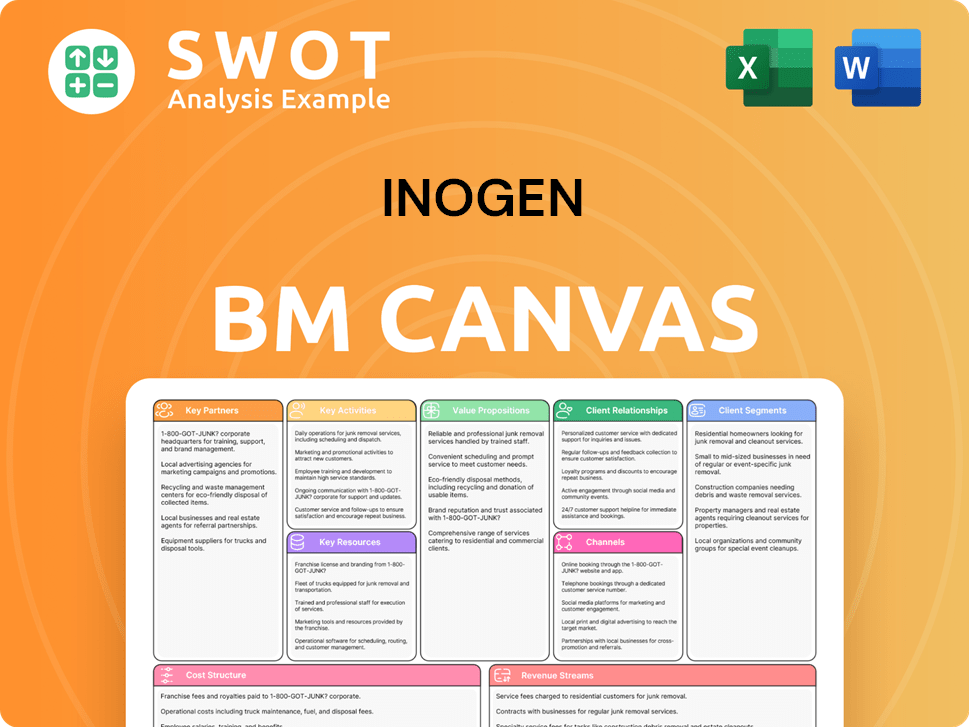

Inogen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Inogen Positioning Itself for Continued Success?

The Inogen company holds a prominent position in the portable oxygen concentrator (POC) market, competing with other medical device manufacturers. Its market share is notable, particularly within the direct-to-consumer segment, where brand recognition and established sales channels provide a competitive edge. Customer loyalty is often high due to the critical nature of the product and the convenience it offers. The company's global reach extends across various international markets, contributing to its overall market presence.

Key risks for the Inogen company include potential changes in healthcare regulations and reimbursement policies, which could affect product pricing and patient access. The emergence of new competitors with disruptive technologies or aggressive pricing strategies also poses a risk. Furthermore, economic downturns or shifts in consumer preferences towards alternative therapies could impact demand for POCs. The future outlook involves a continued focus on product innovation, with an emphasis on developing lighter, more efficient, and potentially smarter POCs.

Inogen has established a strong presence within the portable oxygen concentrator market. The company's focus on direct-to-consumer sales has allowed it to build brand recognition and customer loyalty. This approach is supported by a global distribution network, enabling Inogen to serve patients worldwide.

Healthcare regulations and reimbursement policies can impact the company's profitability. Competition from other medical device companies, and economic factors also present risks. Changes in consumer preferences and the emergence of alternative therapies could also affect demand for Inogen oxygen concentrator products.

Inogen is likely to continue product innovation, focusing on lighter and more efficient POCs. Further expansion of its direct-to-consumer model and exploration of new geographic markets are also anticipated. The company aims to sustain and expand its revenue through ongoing product development and strategic market penetration.

In the past, Inogen's revenue has fluctuated due to various market conditions. For example, in 2023, the company's revenue was around $368 million. Gross margins have historically been around the 40-50% range. These figures are illustrative and can change.

Inogen aims to improve patient outcomes and expand access to portable oxygen therapy. The company's success hinges on product development, efficient operations, and market penetration. The company is also focused on expanding its direct-to-consumer sales model and exploring new geographic markets.

- Continued innovation in POC technology.

- Strategic expansion into new markets.

- Enhancing the direct-to-consumer sales model.

- Focus on customer service and satisfaction.

For a deeper dive into how Inogen approaches its market, you can explore the Marketing Strategy of Inogen.

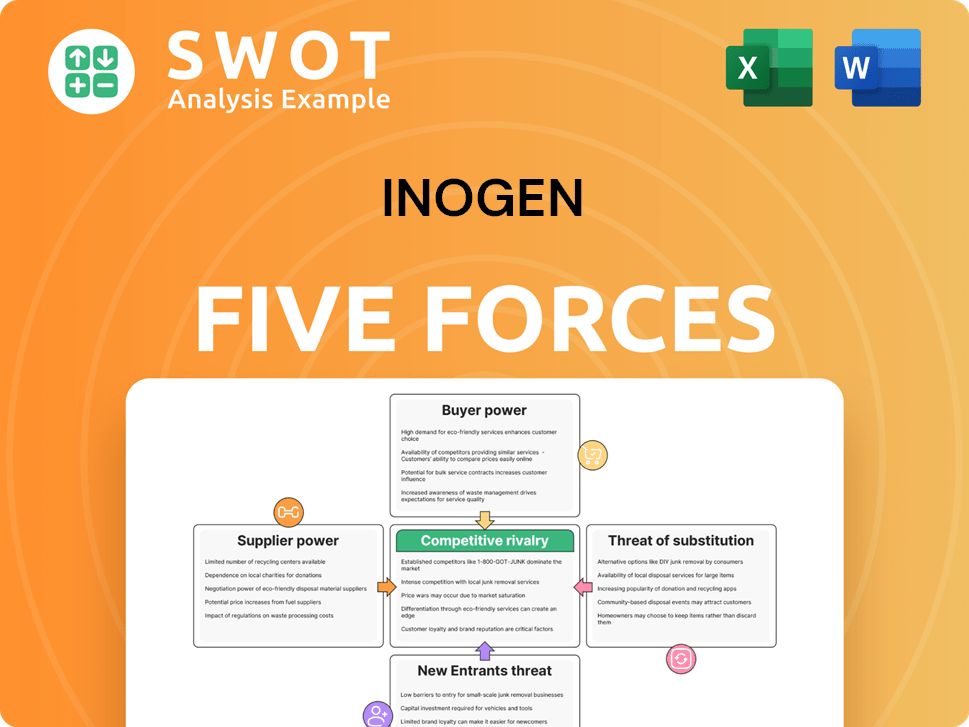

Inogen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Inogen Company?

- What is Competitive Landscape of Inogen Company?

- What is Growth Strategy and Future Prospects of Inogen Company?

- What is Sales and Marketing Strategy of Inogen Company?

- What is Brief History of Inogen Company?

- Who Owns Inogen Company?

- What is Customer Demographics and Target Market of Inogen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.