Inogen Bundle

Can Inogen Continue to Breathe Success into the Future?

Inogen, a pioneer in portable oxygen concentrators (POCs), has revolutionized respiratory care, offering patients greater mobility and independence. Founded in 2001, Inogen's commitment to innovation has positioned it as a leader in the medical device market. With a growing global market and impressive financial performance, the company's future looks promising.

This Inogen SWOT Analysis will delve into the company's Inogen growth strategy, examining its recent financial performance, including a 5.5% revenue increase in Q1 2025, and the projected expansion of the respiratory care market. We'll explore Inogen's future prospects, analyzing its strategic initiatives and the competitive landscape to assess its long-term investment potential and address key questions about its business model and market share. Understanding Inogen's challenges and opportunities is critical for anyone interested in the oxygen therapy sector.

How Is Inogen Expanding Its Reach?

The Inogen growth strategy centers on expanding its market reach and diversifying revenue streams within the medical device market, specifically focusing on oxygen therapy and respiratory care. Their future prospects are closely tied to successful execution of these expansion initiatives and their ability to navigate the competitive landscape. A comprehensive Inogen company analysis reveals a strategic shift towards business-to-business (B2B) channels, alongside product innovation, to drive revenue growth.

Inogen's expansion initiatives are designed to capitalize on the growing demand for portable oxygen concentrators and related respiratory solutions. The company aims to broaden its product portfolio and enter new markets, notably the large Chinese market, through strategic partnerships and product launches. These efforts are crucial for sustaining long-term growth and enhancing shareholder value, as detailed in an article about Owners & Shareholders of Inogen.

In January 2025, Inogen entered into a significant collaboration with Jiangsu Yuyue Medical Equipment & Supply Co., Ltd. ('Yuwell'). This partnership is set to expand Inogen's product portfolio and accelerate its entry into the Chinese market. Yuwell's subsidiary invested approximately $27.2 million in Inogen, acquiring a 9.9% common equity interest.

In December 2024, Inogen received FDA clearance for Simeox, an airway clearance device, with a limited launch planned in the U.S. in 2025. The launch of the Rove 4 portable oxygen concentrator in October 2024 is expected to contribute meaningfully to revenue growth in 2025. The Rove 4 is the lightest POC available.

The collaboration with Yuwell includes plans to introduce stationary oxygen concentrators in the U.S. The strategic shift towards B2B channels has proven successful, with B2B international sales representing the largest revenue segment, accounting for 38.9% of total revenue in Q1 2025. This growth offsets declines in direct-to-consumer sales.

Inogen's expansion plans involve product diversification, market penetration, and strategic partnerships. The company is focusing on both domestic and international B2B channels to drive revenue growth. These initiatives are crucial for Inogen's long-term investment potential and competitive advantage in the medical device market.

- FDA clearance for Simeox and planned U.S. launch.

- Successful B2B channel growth, especially in international markets.

- Launch of the Rove 4 portable oxygen concentrator.

- Strategic partnership with Yuwell for market expansion and product portfolio enhancement.

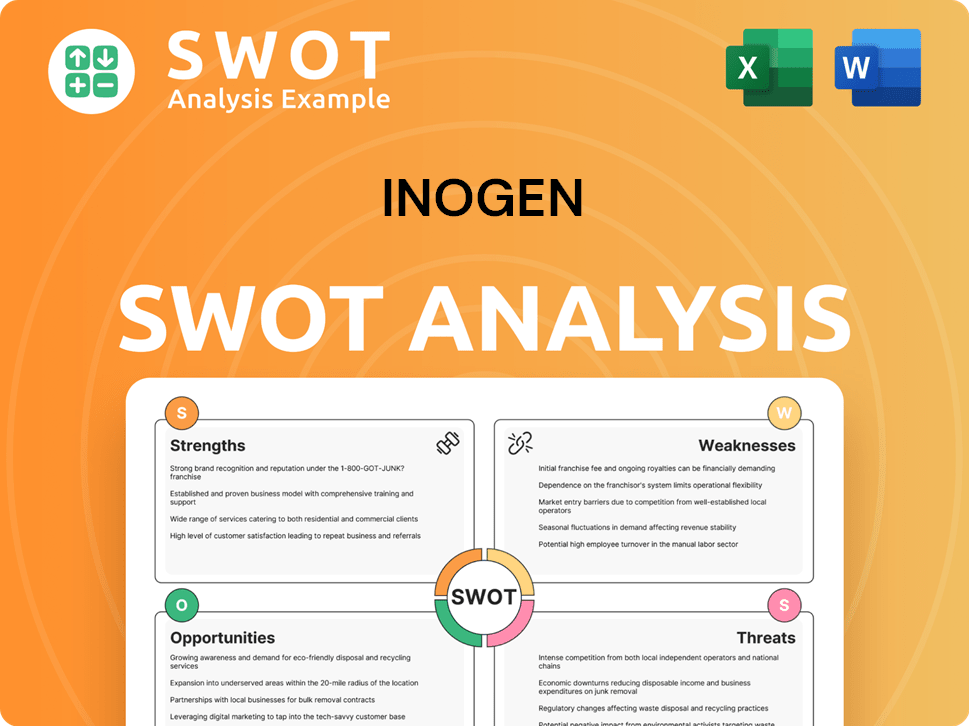

Inogen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Inogen Invest in Innovation?

The growth strategy of Inogen is heavily reliant on innovation and technological advancements. The company's commitment to these areas is a central aspect of its operations, driving product enhancements and expanding its technological capabilities. This focus is crucial in the competitive medical device market, where staying ahead of the curve is essential for success.

Inogen's approach to innovation involves continuous investment in research and development (R&D). This investment is geared towards improving existing product offerings and exploring new technologies in respiratory care. This commitment is a key factor in understanding Inogen's future prospects and its ability to capture market share.

A significant part of Inogen's innovation strategy involves developing digital health capabilities. These capabilities are designed to provide insights into usage and other data, enabling more connected and informed patient care. This move aligns with the broader trend of integrating technologies like AI and IoT into medical devices, although specific details on Inogen's direct use of AI or IoT were not extensively detailed in recent reports.

In 2024, Inogen allocated $11.7 million to research and development. This investment supports both product improvements and the exploration of new respiratory care technologies.

Inogen is developing digital health capabilities to provide visibility into usage data. These capabilities aim to enhance patient care through more connected and informed solutions, aligning with the growing trend of integrating digital technologies in medical devices.

While specifics are limited, Inogen is likely considering the integration of AI and IoT. The regulatory landscape for AI in medical devices is evolving, with the EU's AI Act classifying most AI-enabled medical devices as high-risk.

In December 2024, Inogen received FDA clearance for its Simeox airway clearance device. This marks a significant achievement and expands Inogen's ability to meet the needs of patients with chronic respiratory conditions.

Inogen plans to add ambulatory ventilation assistance in 2024-2025. The company is also looking at continuous flow and pulse oxygen delivery in 2025-2026.

The FDA is creating comprehensive guidelines for AI in medical devices, expected to be released in 2025. This regulatory environment will shape the future of Inogen's product development.

Inogen's commitment to innovation is evident in its product pipeline and strategic initiatives. The company's focus on digital health and new product development is essential for its Inogen growth strategy and its ability to compete in the oxygen therapy and respiratory care markets. For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of Inogen.

- Simeox Device: FDA clearance in December 2024 expands Inogen's product offerings.

- Ambulatory Ventilation: Planned for 2024-2025, addressing critical patient needs.

- Oxygen Delivery Systems: Continuous flow and pulse oxygen delivery planned for 2025-2026.

- Digital Health: Focus on connected components in POCs.

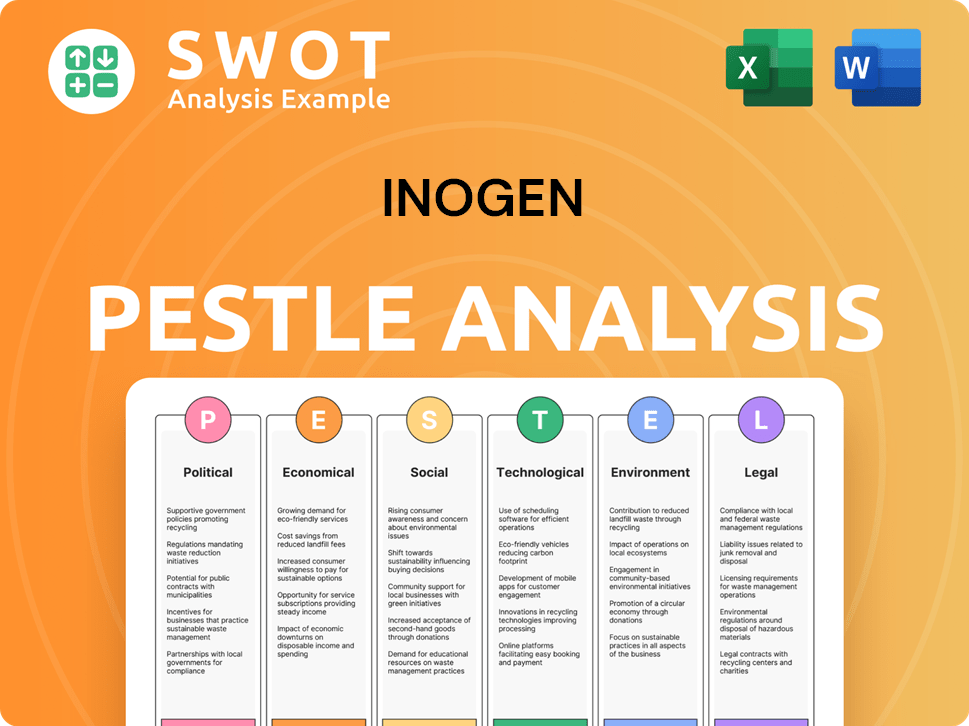

Inogen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Inogen’s Growth Forecast?

The financial outlook for Inogen in 2025 indicates a focus on revenue growth and improved profitability. The company's strategic initiatives and operational efficiencies are designed to drive financial performance. This includes a focus on expanding market share within the medical device market, specifically in the oxygen therapy and respiratory care sectors.

For the full year 2025, Inogen projects revenue to be in the range of $352 million to $355 million. This represents a growth of approximately 5% to 6% compared to the $335.7 million in revenue achieved in 2024. The company is also aiming to approach adjusted EBITDA breakeven by the end of 2025, reflecting its efforts to manage costs and enhance operational effectiveness. A detailed analysis of Inogen's target market can provide further insights into the drivers of this growth.

In the first quarter of 2025, Inogen demonstrated positive financial momentum. Total revenue reached $82.3 million, a 5.5% increase year-over-year. This growth was fueled by increased demand from both international and domestic business-to-business customers. Gross margin improved slightly to 44.2% from 44.1% in the prior year, primarily due to reduced warranty expenses. The GAAP net loss improved to $6.2 million from $14.6 million in the prior year, and adjusted EBITDA turned positive at $0.04 million, a significant improvement from a loss of $7.6 million in the same period last year.

Inogen anticipates revenue to be between $352 million and $355 million for 2025. This represents a 5% to 6% increase compared to the $335.7 million in revenue from 2024. This growth is driven by increased demand and expansion initiatives.

For the full year 2025, Inogen expects gross margin to be in the range of 43% to 45% of total revenue. The first quarter of 2025 saw a gross margin of 44.2%, an increase from 44.1% in the prior year.

In Q1 2025, adjusted EBITDA was a positive $0.04 million, a significant improvement from a negative $7.6 million in the prior year. The company aims to achieve adjusted EBITDA breakeven for the full year 2025.

As of March 31, 2025, Inogen had $122.5 million in cash, cash equivalents, and restricted cash, with no outstanding debt. The strategic collaboration with Yuwell further strengthened the balance sheet.

Inogen's financial performance in Q1 2025 and its outlook for the full year 2025 highlight several key points.

- Revenue growth is projected to continue, driven by increased demand.

- Gross margins are expected to remain stable, supported by efficient cost management.

- Adjusted EBITDA is nearing breakeven, indicating improved operational efficiency.

- The company's strong cash position and strategic partnerships support its growth strategy.

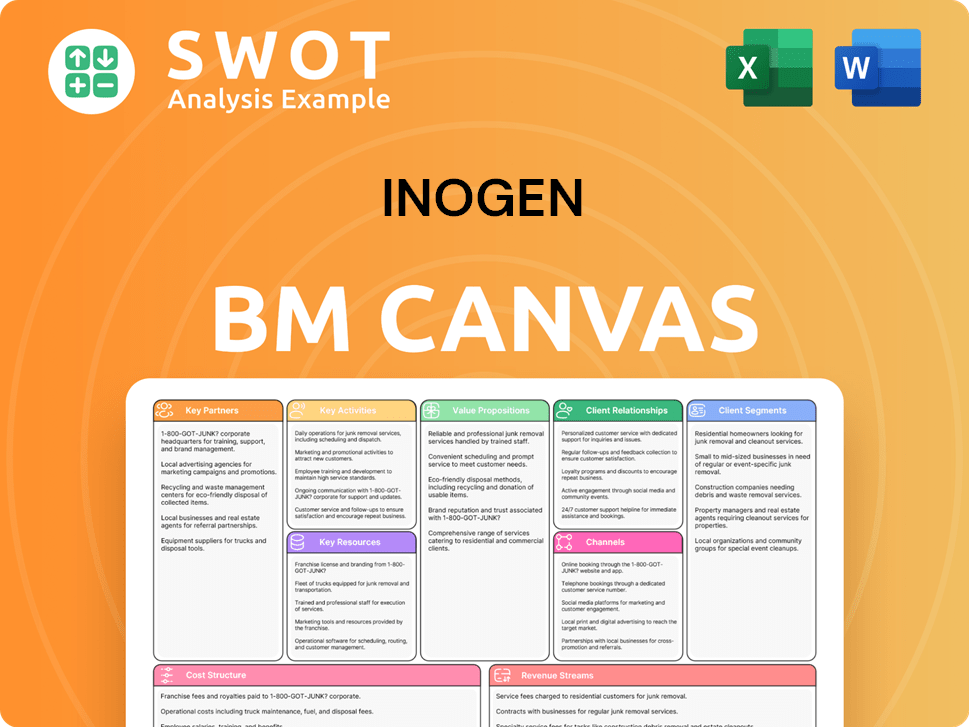

Inogen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Inogen’s Growth?

The path forward for Inogen, like any company in the medical device market, is paved with potential risks and obstacles that could impact its Inogen growth strategy and Inogen future prospects. These challenges range from intense competition and regulatory hurdles to supply chain vulnerabilities and the need for continuous technological innovation. Understanding these risks is crucial for a comprehensive Inogen company analysis.

One of the primary concerns is the competitive landscape, especially within the oxygen therapy sector. The medical device market is dynamic, with new entrants and technological advancements constantly reshaping the industry. In addition, reliance on a limited number of key customers for a significant portion of sales revenue presents a concentrated risk, as any reduction in business from these clients could materially affect Inogen's financial performance. The company must navigate these competitive pressures while maintaining strong customer relationships.

Regulatory changes also pose a significant challenge. The medical technology industry operates under stringent federal, state, and international regulations. Changes in reimbursement policies, particularly within Medicare, could significantly impact revenue streams. For example, new EU environmental regulations are taking effect in 2024 and 2025. The FDA also updated its cybersecurity guidance for medical devices. Companies operating internationally, like Inogen, are exposed to risks related to currency fluctuations and compliance with international regulations. These regulatory shifts demand proactive adaptation and compliance strategies.

The respiratory care market, including the portable oxygen concentrator market, is highly competitive. Competitors with greater resources could affect Inogen's market share analysis. Continuous innovation and differentiation are necessary to maintain a competitive edge and sustain Inogen's competitive advantage.

Compliance with regulations is a constant challenge. Changes in healthcare policies, including those related to reimbursement, can impact Inogen's revenue. The company must adapt to evolving regulatory landscapes to maintain market access and ensure product approvals.

Dependence on single-source or limited-source suppliers for critical components can lead to supply chain disruptions. Recent global supply chain issues, including those affecting semiconductor chips, have already impacted production. These disruptions can increase costs and limit the availability of raw materials.

The medical device sector requires continuous innovation. Failure to keep pace with technological advancements from competitors can hinder growth. Investing in research and development and staying ahead of the curve are vital for sustained success and product innovation.

Optimizing the direct-to-consumer (DTC) sales team can create pressure. While the DTC channel is becoming more profitable due to cost structure management, it experienced a revenue decline in Q1 2025, partially offsetting growth in B2B sales. Efficient management of resources is essential for maximizing revenue growth drivers.

Economic downturns can impact consumer spending and healthcare budgets. These uncertainties could affect demand for medical devices and the overall financial performance. Strategic financial planning and adaptability are critical for navigating economic fluctuations.

Inogen is addressing these risks through strategic initiatives. Product diversification, international expansion, and a focus on profitable growth channels are key strategies. These efforts are aimed at mitigating risks and capitalizing on opportunities within the respiratory care market.

In Q1 2025, the DTC channel experienced a revenue decline, while B2B sales showed growth. The company's management is focused on cost structure management in the DTC channel to improve profitability. A review of Inogen's financial performance is crucial to assess the impact of these challenges.

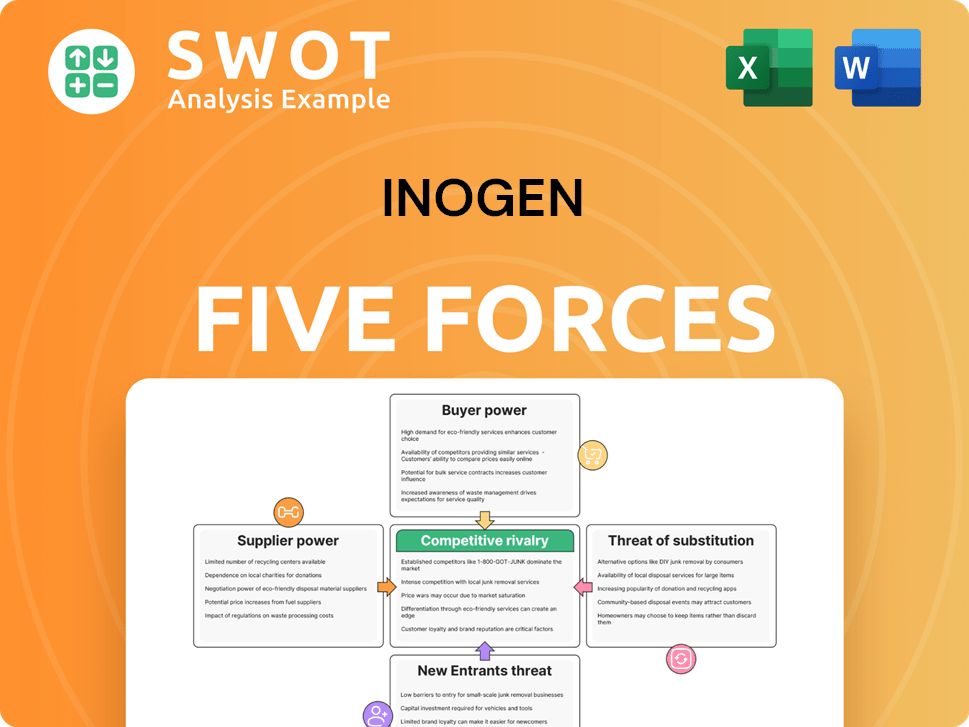

Inogen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Inogen Company?

- What is Competitive Landscape of Inogen Company?

- How Does Inogen Company Work?

- What is Sales and Marketing Strategy of Inogen Company?

- What is Brief History of Inogen Company?

- Who Owns Inogen Company?

- What is Customer Demographics and Target Market of Inogen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.