Inogen Bundle

How is Inogen Revolutionizing Respiratory Care?

Inogen, a leader in portable oxygen concentrators (POCs), has reshaped the respiratory care landscape, offering patients unprecedented freedom and mobility. Founded in 2001, the company's innovative approach, driven by a direct-to-consumer (DTC) model, initially disrupted the traditional home healthcare market. However, with the market changing, how has Inogen adapted its Inogen SWOT Analysis and sales strategy to remain competitive?

This analysis delves into Inogen's evolving sales and marketing strategies, examining its shift from DTC to a robust business-to-business (B2B) approach. We'll explore the company's Inogen marketing strategy, including its digital marketing tactics and customer acquisition strategies, as well as its Inogen business model and how it leverages its Inogen oxygen concentrators to gain a competitive advantage. Understanding Inogen's Inogen sales strategy is crucial for anyone interested in the home healthcare market and medical device marketing.

How Does Inogen Reach Its Customers?

The company employs a hybrid sales strategy, utilizing both direct-to-consumer (DTC) and business-to-business (B2B) channels. This approach allows the company to reach a wide range of customers, including individual patients, healthcare providers, and distributors. This multifaceted approach supports the company's overall market presence and sales performance.

The company's sales strategy has evolved, with a strategic shift from a strong focus on DTC sales to a greater emphasis on B2B channels. This shift reflects an adaptation to market dynamics and a focus on expanding its reach through partnerships and distribution networks. The company's ability to navigate these changes is crucial for sustained growth.

The company's marketing strategy is designed to support its sales efforts across various channels. This includes digital marketing, content creation, and patient support programs to enhance customer engagement and brand awareness. These efforts are essential for attracting and retaining customers in a competitive market.

Historically, the DTC channel was a significant revenue source, allowing direct engagement with patients. However, DTC sales have declined. In Q4 2024, DTC domestic sales decreased by 21.3%, and for the full year 2024, they declined by 18.8%. This trend continued into Q1 2025, with DTC sales decreasing by 26.8% to $15 million.

The B2B channels have shown significant growth. Domestic B2B sales increased by 29.9% to $21.5 million in Q1 2025. International B2B sales grew by 22.9% to $32 million. These channels now account for 65% of the company's total revenue. For the full year 2024, domestic B2B sales increased by 26.2% and international B2B sales by 31.1%.

Rental services provide flexibility for patients, but revenue has decreased. Rental revenue declined by 16.5% in Q4 2024 and 7.5% in Q1 2025. This decline is primarily due to lower average billing rates and a shift towards private payers. The company has adjusted its strategy.

A significant collaboration with Yuwell Medical, announced in January 2025, is expected to expand the company's product portfolio with stationary oxygen concentrators. This partnership also involved Yuwell's subsidiary purchasing approximately 2.6 million shares of the company's common stock for $27.2 million, giving Yuwell a 9.9% stake in the company. This partnership can be seen in the Growth Strategy of Inogen.

The company's sales strategy focuses on a mix of DTC and B2B channels, adapting to market changes. Its marketing strategy supports sales through digital marketing and patient support. These strategies aim to enhance customer engagement and brand awareness.

- Consolidation of rental and domestic B2B channels under a single leader to improve alignment and scale growth.

- Expansion of product portfolio with stationary oxygen concentrators through the Yuwell Medical partnership.

- Focus on digital marketing tactics and content marketing initiatives to reach a wider audience.

- Implementation of patient support programs to improve customer acquisition strategies.

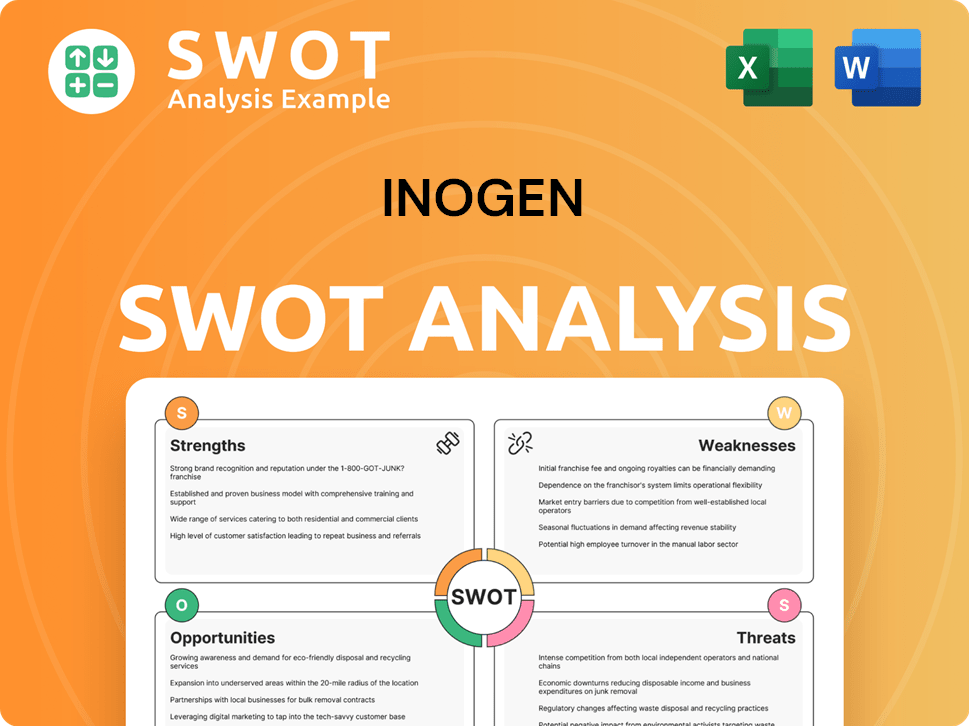

Inogen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Inogen Use?

The company employs a multi-faceted marketing approach, using both digital and traditional tactics. This strategy aims to increase awareness, generate leads, and drive sales of its portable oxygen concentrators. The focus is on reaching patients, healthcare providers, and third-party payors.

The shift towards home healthcare and telehealth offers opportunities for enhanced patient engagement through digital platforms. The company's investor relations website is a key channel for disclosing material information, indicating a strong reliance on online communication.

The company's direct-to-consumer marketing strategy aims to increase patient awareness and allows for product innovation based on direct customer feedback. The company is exploring pilot programs that engage hospitals, which could improve utilization and revenue per patient.

The company leverages content marketing, search engine optimization (SEO), and paid advertising. These digital channels are crucial for reaching the target audience and driving online engagement. The company uses digital platforms to enhance patient engagement and support.

Historically, advertising has been used to promote products. The company has also engaged in physician referral models to increase awareness among both physicians and patients. Direct-to-consumer marketing is a key part of the strategy.

Sales and marketing expenses decreased to $23.8 million in Q1 2025 from $26.9 million in the prior-year period. This reflects efforts towards cost control and operational efficiency. The company is managing its expenses effectively.

This is a wireless connectivity platform for its Inogen One and Rove systems. It supports digital health initiatives and connected components in POCs. This platform enhances the user experience and provides valuable data.

The company is exploring pilot programs aimed at capturing patients earlier by engaging hospitals. This could improve utilization and revenue per patient. Early engagement is a key focus.

The company's strategies are aligned with the growth of the home healthcare market. The increasing demand for portable oxygen concentrators drives the need for effective marketing. The company is adapting to market trends.

The company's approach to marketing is designed to effectively reach its target audience and drive sales. The integration of digital and traditional marketing tactics, along with a focus on patient engagement and cost management, positions the company well within the competitive home healthcare market. For additional insights, consider reading about the Growth Strategy of Inogen.

The company's marketing strategy is multifaceted, combining digital and traditional methods to reach its target audience effectively. This approach aims to increase awareness, generate leads, and drive sales within the home healthcare market. Key strategies include:

- Content marketing and SEO to enhance online visibility.

- Paid advertising to reach a broader audience.

- Direct-to-consumer marketing to increase patient awareness.

- Physician referral models to build trust and credibility.

- Pilot programs to engage hospitals and capture patients earlier.

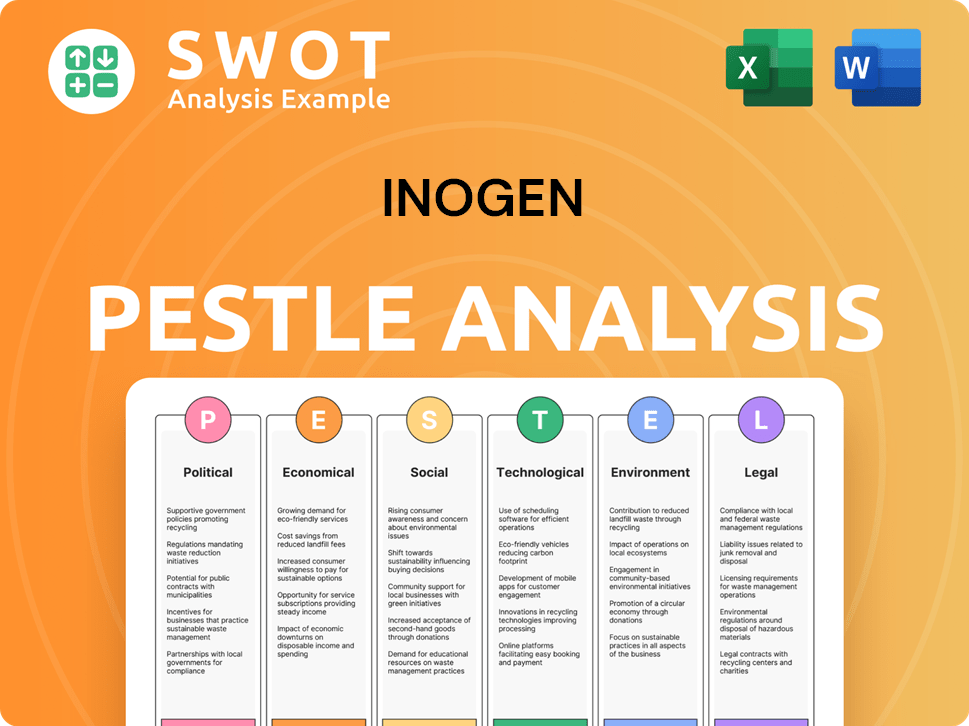

Inogen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Inogen Positioned in the Market?

The company strategically positions itself as a leader in respiratory care, focusing on providing freedom and independence to patients needing supplemental long-term oxygen therapy. This is achieved by emphasizing lightweight, portable, and user-friendly oxygen concentrators. Their core message highlights a single solution for home, ambulatory, travel, and nocturnal treatment, differentiating it from competitors.

The brand identity is built on advanced technology, efficiency, and user-friendly design. Products like the Rove and One systems reduce the reliance on stationary concentrators and scheduled tank deliveries. Key advantages include quiet operation, compact size, energy efficiency, and Intelligent Delivery Technology for precise oxygen delivery. This approach supports their Inogen sales strategy by focusing on patient convenience and mobility.

In 2023, the company was ranked second in customer satisfaction among portable oxygen concentrator manufacturers, with a Net Promoter Score of 64, indicating strong brand loyalty. Consistent brand messaging across direct-to-consumer and business-to-business channels reinforces this position. Strategic partnerships, such as the collaboration with Yuwell Medical in 2025, further enhance its global reach and product portfolio, strengthening its commitment to providing comprehensive respiratory care. This supports the Inogen marketing strategy and overall Inogen business model.

The company emphasizes its commitment to advanced technology in its oxygen concentrators. This includes features like Intelligent Delivery Technology and energy-efficient designs. This focus aligns with the Inogen sales strategy by appealing to tech-savvy consumers.

A key element of the brand positioning is the emphasis on mobility and convenience. The portable oxygen concentrators are designed to be lightweight and easy to use, catering to patients' active lifestyles. This enhances the Inogen marketing strategy.

The brand highlights the user-friendly design of its products. This includes features such as easy-to-understand controls and quiet operation. This focus simplifies the Inogen sales process analysis.

The company positions itself as a provider of comprehensive respiratory care solutions. This includes a range of products and services designed to meet the diverse needs of patients. This approach supports their Inogen's target audience demographics.

The company differentiates itself through several key factors, including lightweight and portable designs, efficient oxygen delivery, and a focus on patient convenience. These factors contribute to the company's competitive advantage in the home healthcare market.

- Portability: Lightweight and compact designs for ease of use.

- Efficiency: Energy-efficient operation and precise oxygen delivery.

- User Experience: Quiet operation and user-friendly controls.

- Customer Satisfaction: High Net Promoter Score indicating strong brand loyalty.

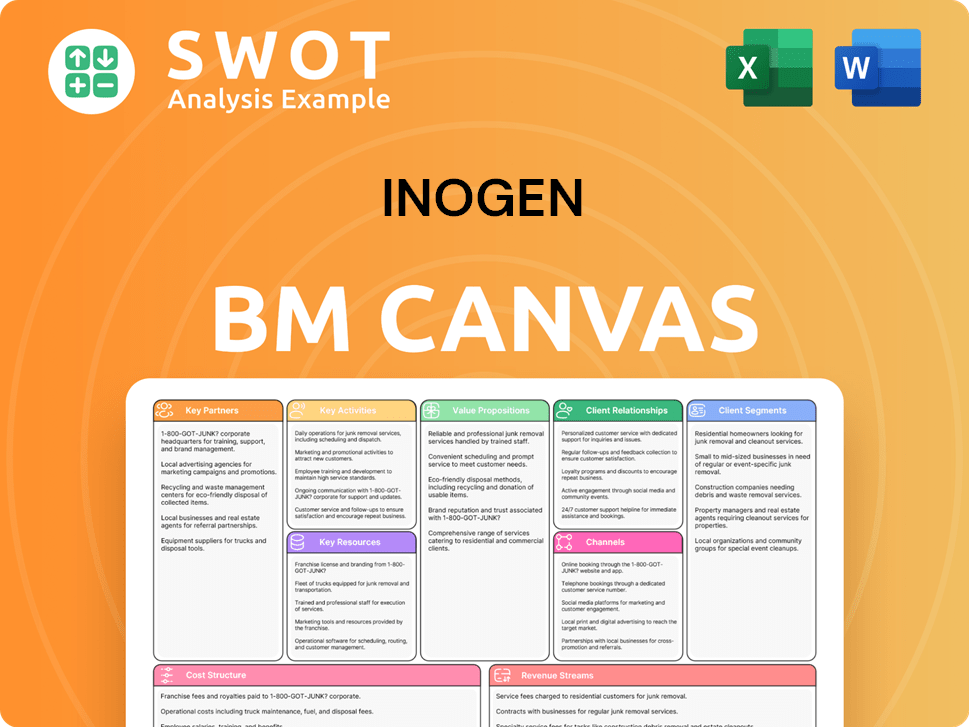

Inogen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Inogen’s Most Notable Campaigns?

The key campaigns for driving sales and market presence for Inogen in 2024 and 2025 revolve around strategic initiatives and product launches. While specific marketing campaign details are not always publicly available, the focus has been on returning to growth and profitability, significantly driven by business-to-business (B2B) channels. These efforts are critical components of their overall Inogen sales strategy.

A core element of their strategy involves expanding relationships with new and existing customers, with providers increasingly recognizing the advantages of Inogen's solutions. Product launches, such as the Rove 4 portable oxygen concentrator and the Simeox airway clearance device, are also pivotal. These launches broaden their offerings beyond portable oxygen concentrators (POCs), establishing them as a more comprehensive respiratory care provider, impacting their Inogen marketing strategy.

A recent partnership with Jiangsu Yuyue Medical Equipment & Supply Co., Ltd. ("Yuwell") is poised to significantly impact their market trajectory. This collaboration is expected to drive growth and broaden Inogen's global reach, particularly in the rapidly growing Chinese respiratory market. The strategic initiatives and product launches collectively form Inogen's key 'campaigns' for driving growth, profitability, and market expansion in 2024 and 2025. For more insights, you can explore the Revenue Streams & Business Model of Inogen.

In 2024, Inogen saw strong double-digit growth in its B2B sales. Domestic B2B revenue increased by 26.2%, while international B2B revenue rose by 31.1%. This trend continued into Q1 2025, with domestic B2B revenue up 29.9% and international B2B revenue up 22.9%.

The Rove 4 portable oxygen concentrator was launched in the U.S. and European Union in October 2024, highlighting its lightweight design and high oxygen production. The FDA 510(k) clearance for the Simeox airway clearance device in December 2024 expanded Inogen's product range. These product launches are integral to the Inogen sales process analysis.

In January 2025, Inogen partnered with Jiangsu Yuyue Medical Equipment & Supply Co., Ltd. ("Yuwell"). This collaboration expands Inogen's product portfolio with a stationary oxygen concentrator. Yuwell invested $27.2 million for a 9.9% stake in Inogen, underscoring the strategic importance of this alliance.

Inogen is now focused on commercializing Simeox and pursuing reimbursement in the United States. This involves engaging medical and marketing teams with physicians to discuss its benefits. This initiative is key to the Inogen's customer acquisition strategies.

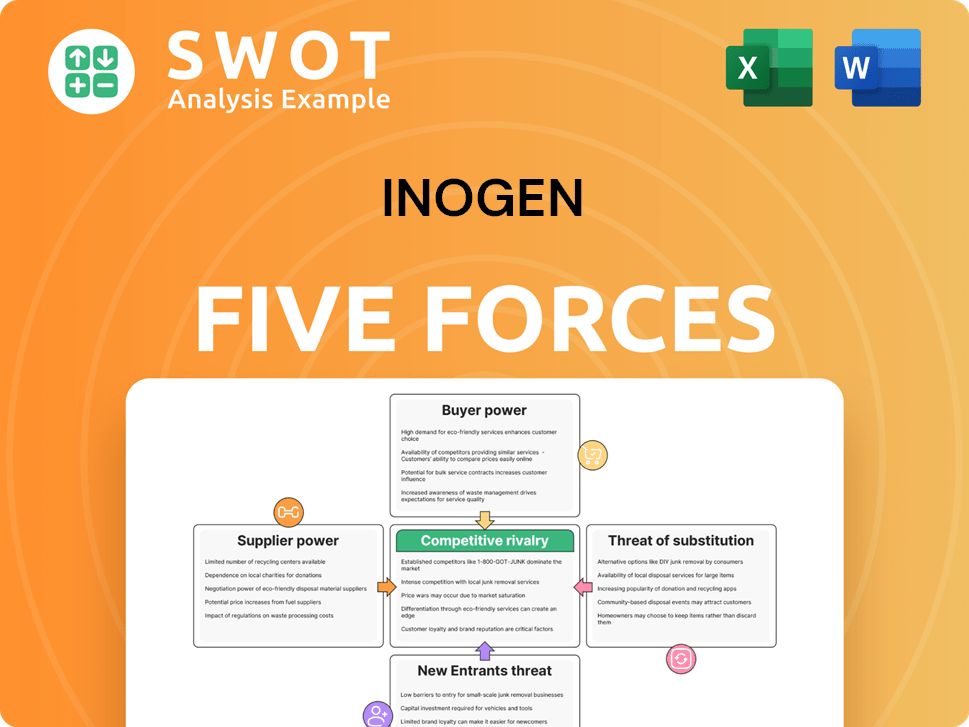

Inogen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Inogen Company?

- What is Competitive Landscape of Inogen Company?

- What is Growth Strategy and Future Prospects of Inogen Company?

- How Does Inogen Company Work?

- What is Brief History of Inogen Company?

- Who Owns Inogen Company?

- What is Customer Demographics and Target Market of Inogen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.