Inogen Bundle

Who Really Controls Inogen?

Understanding a company's ownership is crucial for investors and strategists alike. The Inogen SWOT Analysis reveals the inner workings of the company. From its inception, Inogen has navigated a dynamic landscape, evolving from a startup to a publicly traded entity. This journey has reshaped its ownership, influencing its strategic direction and market performance.

This analysis of Inogen ownership will explore the evolution of Inogen company, from its founders to its current Inogen investors. We'll examine the influence of Inogen leadership and major shareholders, providing insights into how these factors shape the company's future. Discover the answers to questions like "Who owns Inogen?" and understand the power dynamics behind this key player in the medical technology sector. The goal is to provide a comprehensive view of the Inogen ownership structure and its implications for anyone interested in Inogen stock and its trajectory.

Who Founded Inogen?

The origins of the Inogen company trace back to 2001, when Alison Bauerlein, Brenton Taylor, and Byron Myers, then students at the University of California, Santa Barbara, founded the company. Their venture began with a successful business plan competition, which centered around a new type of oxygen concentrator. This initial success was the catalyst for the company's establishment in Goleta, California.

Early financial backing for Inogen came through venture capital funding. By 2004, the company had secured significant investments, including a Series C round of $15 million. This funding was crucial for the initial product development and launch phases. Early investors included firms like Versant Ventures, Avalon Ventures, and Accuitive Medical Ventures.

Inogen's early years involved securing capital through venture capital, with firms like Versant Ventures, Avalon Ventures, and Accuitive Medical Ventures as early investors. The founders faced early dilution in their equity, losing 75% in their first round to raise $250,000. Despite this, the founders maintained their vision, which was reflected in the company's commitment to developing innovative portable oxygen concentrators.

Alison Bauerlein, Brenton Taylor, and Byron Myers, students at the University of California, Santa Barbara, founded the company in 2001.

Initial capital was secured through venture capital funding. By 2004, Inogen had raised significant funding, including a Series C round of $15 million.

Early investors included firms such as Versant Ventures, Avalon Ventures, and Accuitive Medical Ventures.

In 2007, Inogen secured an additional $22 million in funding, led by new investors Novo A/S and Arboretum Ventures. In April 2012, Inogen raised another $20 million in equity financing, again led by Novo A/S.

The founders experienced significant dilution in their early rounds, losing 75% in the first round.

The founders were recognized for their perseverance and leadership, receiving awards such as the 'Venky' award from UC Santa Barbara in 2014.

The Inogen company's journey began with its founders' vision and was supported by early investors. The company's success is also reflected in its innovative product development and market strategy. For more insights into the market, consider reading about the Target Market of Inogen.

Understanding the early ownership and funding rounds of Inogen provides context to its growth and development. The founders' initial vision, along with the support from early investors, played a crucial role in the company's journey.

- Inogen was founded in 2001 by Alison Bauerlein, Brenton Taylor, and Byron Myers.

- Early funding rounds included significant venture capital investments.

- Early investors included Versant Ventures, Avalon Ventures, and Accuitive Medical Ventures.

- The founders experienced dilution in early funding rounds.

- The company secured additional funding in 2007 and 2012.

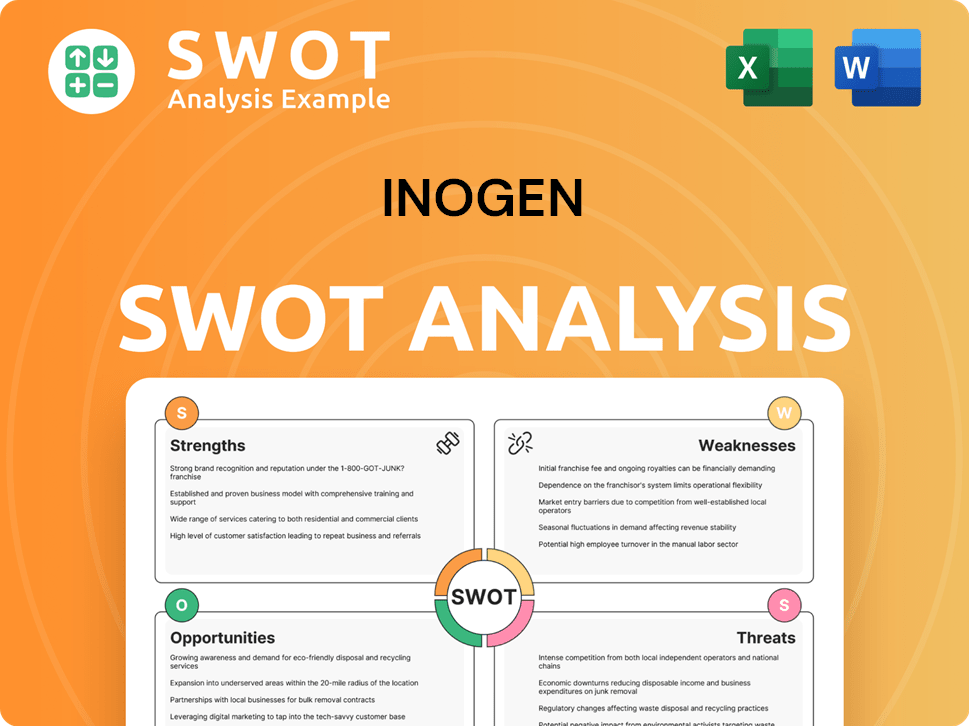

Inogen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Inogen’s Ownership Changed Over Time?

The ownership structure of the Inogen company underwent a significant transformation with its Initial Public Offering (IPO) on NASDAQ in February 2014. This IPO, under the ticker symbol INGN, successfully raised approximately $86 million. This influx of capital was instrumental in scaling operations and expanding sales channels, including the direct-to-consumer model. The evolution from a private to a public entity marked a pivotal shift in the company's ownership dynamics, introducing a diverse mix of institutional and individual investors.

As a publicly traded entity, Inogen's ownership is now distributed among a variety of stakeholders. These include institutional investors, retail investors, and company insiders. The shift to a public structure has influenced the company's strategic direction, including collaborations aimed at market expansion. For a deeper understanding of the company's origins, you can explore the Brief History of Inogen.

| Stakeholder Category | Approximate Ownership (May 2025) | Key Details |

|---|---|---|

| Institutional Investors | ~70.39% | Major shareholders include BlackRock, Vanguard, and others. |

| Individual Insiders | ~2.39% | Includes founders and executives. |

| Yuwell (Hong Kong) Holdings Limited | ~9.9% | Completed an equity investment in February 2025. |

Major institutional shareholders include BlackRock, Inc., holding 1,776,190 shares, representing 6.61% as of March 31, 2025, and Vanguard Group Inc., owning 1,540,631 shares, representing 5.73% as of March 31, 2025. Individual insiders, such as William J. Link, hold a notable percentage, with 3.70 million shares, representing 13.75% of the company as of early 2025. Another significant insider shareholder is Novo Holdings, with 2.08 million shares, representing 7.73%. In February 2025, Yuwell (Hong Kong) Holdings Limited invested in Inogen, purchasing 2,626,425 shares, approximately 9.9% of outstanding common stock.

The ownership structure of Inogen is primarily composed of institutional investors, with a significant portion held by major financial institutions.

- Institutional ownership accounts for approximately 70.39% of the company as of May 2025.

- Individual insiders hold a smaller, but notable, percentage of the stock.

- Yuwell (Hong Kong) Holdings Limited made a significant investment in February 2025.

- The IPO in 2014 was a major event.

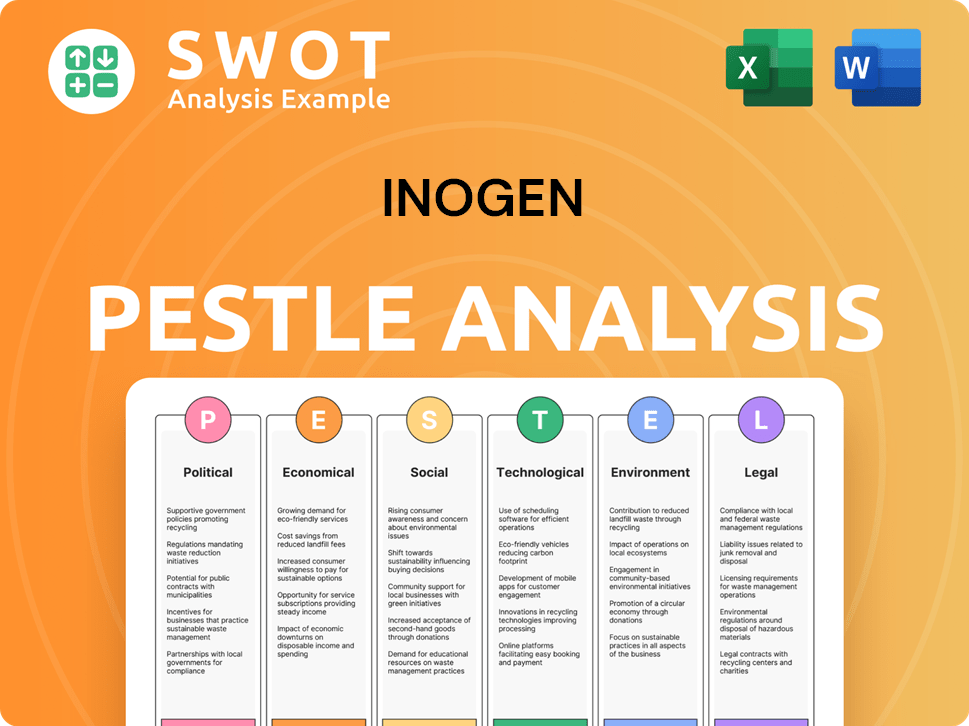

Inogen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Inogen’s Board?

The Board of Directors at the Inogen company oversees the CEO and senior management's performance, ensuring stockholder interests are prioritized. They also establish corporate governance standards and business integrity, adhering to SEC and Nasdaq regulations. The Nominating and Governance Committee manages CEO succession planning and monitors succession plans for other key executives. The board's composition includes individuals with diverse expertise, including healthcare and biotechnology veterans. While a complete list of current board members and their specific affiliations for 2024-2025 isn't readily available in the provided search results, historical information indicates representation from co-founders and early investors.

Early investors, such as Heath Lukatch of Novo A/S, have historically joined the board, demonstrating that major early backers had direct representation. Alison Bauerlein, a co-founder and former CFO, has experience in SEC reporting and corporate governance, highlighting the historical connection between founders and board representation. The board's structure and composition are designed to ensure effective oversight and strategic guidance for the company. For more details about the company's financial aspects, you can read about the Revenue Streams & Business Model of Inogen.

| Board Role | Description | Key Responsibilities |

|---|---|---|

| Board of Directors | Oversees the CEO and senior management. | Ensuring stockholder interests are served, setting corporate governance standards, and adhering to SEC and Nasdaq regulations. |

| Nominating and Governance Committee | Part of the Board of Directors. | Manages CEO succession planning and monitors management's succession plans for other key executives. |

| Diverse Expertise | Composed of individuals. | Healthcare and biotechnology veterans. |

Inogen's voting structure generally follows a one-share-one-vote principle. SEC filings reveal beneficial ownership by entities like The Vanguard Group, which holds significant shares and has considerable influence as an institutional investor. As of June 30, 2023, The Vanguard Group reported beneficial ownership of 1,480,064 shares, representing 6.40% of the class. There is no readily available information about recent proxy battles, activist investor campaigns, or governance controversies specifically impacting Inogen's decision-making in 2024-2025.

The Inogen ownership structure involves a board of directors overseeing the company's operations and major institutional investors holding significant shares.

- The board ensures that the best interests of stockholders are served.

- The Vanguard Group is a significant institutional investor in Inogen.

- The company follows a one-share-one-vote principle.

- The board includes individuals with expertise in healthcare and biotechnology.

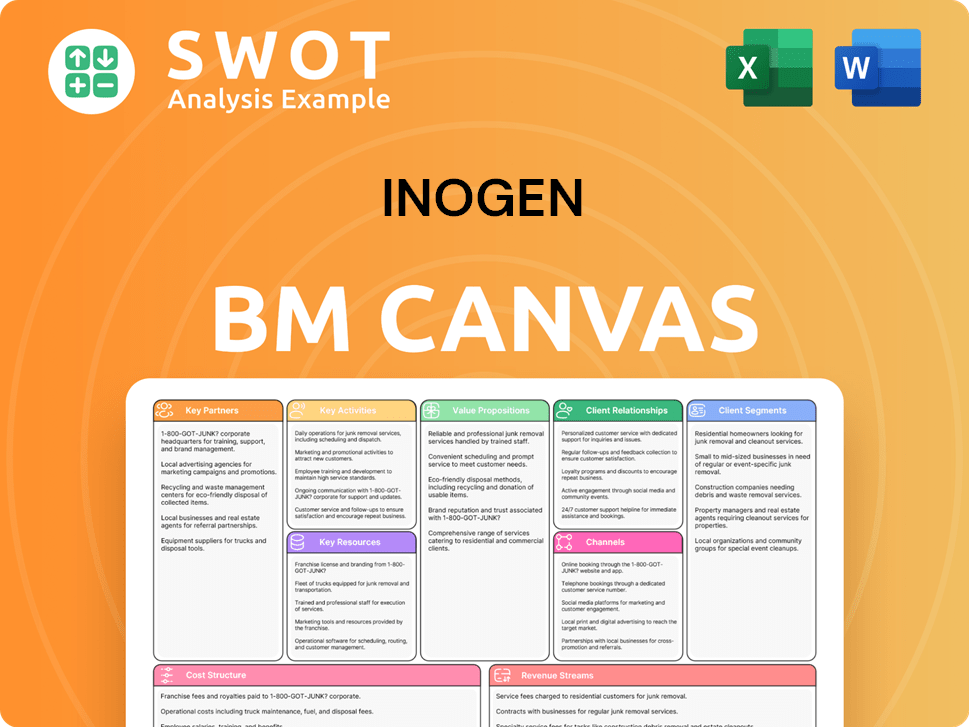

Inogen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Inogen’s Ownership Landscape?

Over the past few years, the ownership landscape of the Inogen company has seen notable shifts. A significant event was the retirement of CEO Scott Wilkinson, with Kevin R. Smith taking over the role in November 2023. This transition was crucial for maintaining operational continuity. Another important development is the strategic investment from Jiangsu Yuyue Medical Equipment & Supply Co., Ltd. ('Yuwell').

In February 2025, Yuwell, through its subsidiary, acquired approximately 9.9% of Inogen's outstanding common stock, investing around $27.2 million. This partnership aims to enhance collaboration in respiratory health and potentially expand Inogen's presence in the Chinese market. These changes highlight the evolving dynamics of Inogen’s ownership, with a focus on strategic partnerships and leadership transitions.

| Ownership Category | November 2024 | May 2025 |

|---|---|---|

| Institutional Ownership | 88.35% | 70.39% |

| Insider Ownership | 1.56% | 2.39% |

| Mutual Funds | 47.60% | 47.52% |

Institutional investors remain a significant part of the Inogen ownership structure, holding approximately 70.39% of shares as of May 2025. While institutional ownership decreased slightly from 88.35% in November 2024, it still indicates a high level of confidence from major Inogen investors. Insider holdings have also increased, rising from 1.56% to 2.39% during the same period. The company's revenue projections for 2025, estimated between $352 million and $355 million, suggest positive growth. For more insights, you can check out the Marketing Strategy of Inogen.

The investment from Yuwell signifies a strategic move to strengthen Inogen's market position. This partnership is expected to open new opportunities.

Despite a slight decrease, institutional investors continue to hold a major stake in Inogen. This suggests a positive outlook for the company.

The appointment of a new CEO in 2023 reflects the company's ongoing efforts to adapt and grow. This ensures stability.

With an estimated revenue of $352 million to $355 million for 2025, Inogen is poised for continued growth.

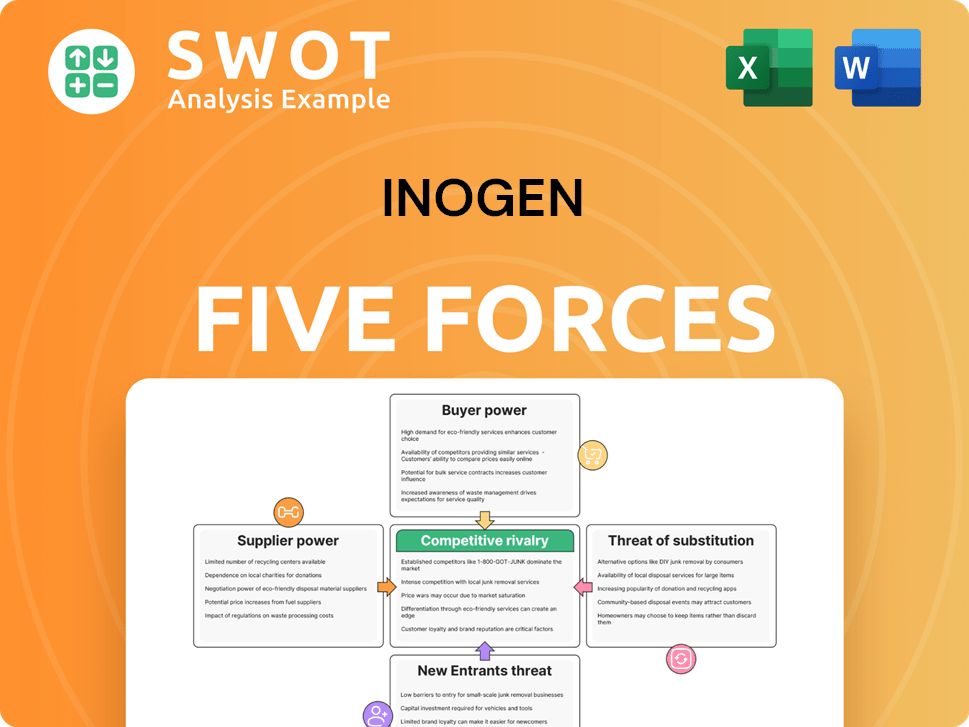

Inogen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Inogen Company?

- What is Competitive Landscape of Inogen Company?

- What is Growth Strategy and Future Prospects of Inogen Company?

- How Does Inogen Company Work?

- What is Sales and Marketing Strategy of Inogen Company?

- What is Brief History of Inogen Company?

- What is Customer Demographics and Target Market of Inogen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.