Leonardo Bundle

How did Leonardo S.p.A. become a global defense giant?

Embark on a journey through time to uncover the fascinating Leonardo SWOT Analysis and its remarkable transformation. From its post-war Italian roots, this Italian defense company has soared to become a titan in the aerospace industry. Discover the pivotal moments that shaped Leonardo Company's evolution and its enduring impact on defense technology.

This exploration into the brief history of Leonardo S.p.A. unveils the strategic decisions and innovations that propelled it forward. Learn about the company's key milestones, acquisitions, and its significant role in the aerospace industry. Understand how Leonardo Company has consistently adapted to the ever-changing demands of the global market, solidifying its position as a leader in defense projects and technological advancements.

What is the Leonardo Founding Story?

The story of Leonardo S.p.A. begins with the establishment of Finmeccanica on June 7, 1948. This pivotal moment occurred shortly after World War II, a time when Italy was focused on rebuilding its industries. The Italian state initiated Finmeccanica to manage its holdings in the mechanical and engineering sectors, especially those vital for national infrastructure and defense.

Finmeccanica's creation addressed the fragmentation and undercapitalization of key industrial assets, which were obstacles to Italy's economic recovery and technological advancement. The company was not founded by a single individual but was a state-led initiative. Its initial aim was to consolidate and oversee various engineering companies.

The initial business model revolved around managing stakes in various engineering firms. These included companies involved in shipbuilding, automotive manufacturing, and railway rolling stock. These early ventures were crucial for producing essential goods needed for reconstruction and transportation. Funding primarily came from state allocations and the restructuring of existing public industrial holdings. Initially, Finmeccanica functioned as a holding company, overseeing a diverse portfolio of companies rather than directly manufacturing goods.

The founding of Leonardo S.p.A., formerly Finmeccanica, was a response to post-war Italy's need for industrial recovery and technological advancement. The company's early focus was on managing participations in various engineering companies, with the state playing a crucial role in its creation and funding.

- The company was established on June 7, 1948, as Finmeccanica.

- It was created by the Italian state to manage holdings in mechanical and engineering sectors.

- The initial business model involved overseeing companies in shipbuilding, automotive, and railway rolling stock.

- Funding came from state allocations and the restructuring of public industrial holdings.

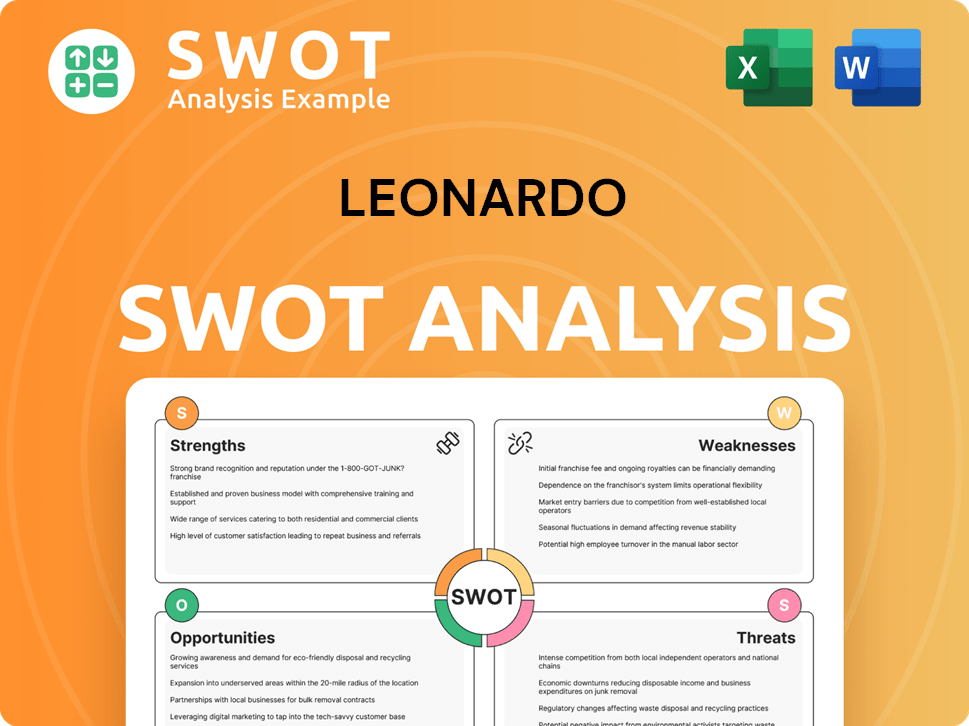

Leonardo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Leonardo?

The early growth of the Leonardo Company, then known as Finmeccanica, was marked by strategic acquisitions and consolidation within Italy's industrial landscape. This initial phase was crucial for post-war industrial reconstruction, integrating various companies in shipbuilding, automotive, and railway sectors. As Italy's economy improved, Finmeccanica shifted towards more specialized sectors, setting the stage for its future in aerospace and defense.

Finmeccanica focused on acquiring and consolidating key Italian industrial assets, particularly in the mechanical and engineering sectors. This involved integrating companies from shipbuilding, automotive, and railway industries, which were vital for post-war reconstruction and Italy's economic recovery.

The company began to pivot towards specialized sectors, laying the groundwork for its future in the aerospace industry and defense. This strategic move was essential as Italy's economy evolved, and Finmeccanica aimed to compete in high-tech markets. Early forays into electronics and defense systems were also initiated.

Significant acquisitions and mergers, such as the gradual consolidation of Italian aerospace companies like Aeritalia, were pivotal in shaping its future direction. These strategic moves helped Finmeccanica expand its capabilities and market reach within the aerospace and defense sectors.

Major capital raises were often facilitated through state backing and later, through public listings, allowing for significant investments in research and development. Leadership transitions throughout this period guided the company's evolution from a broad industrial conglomerate to a more focused aerospace and defense entity.

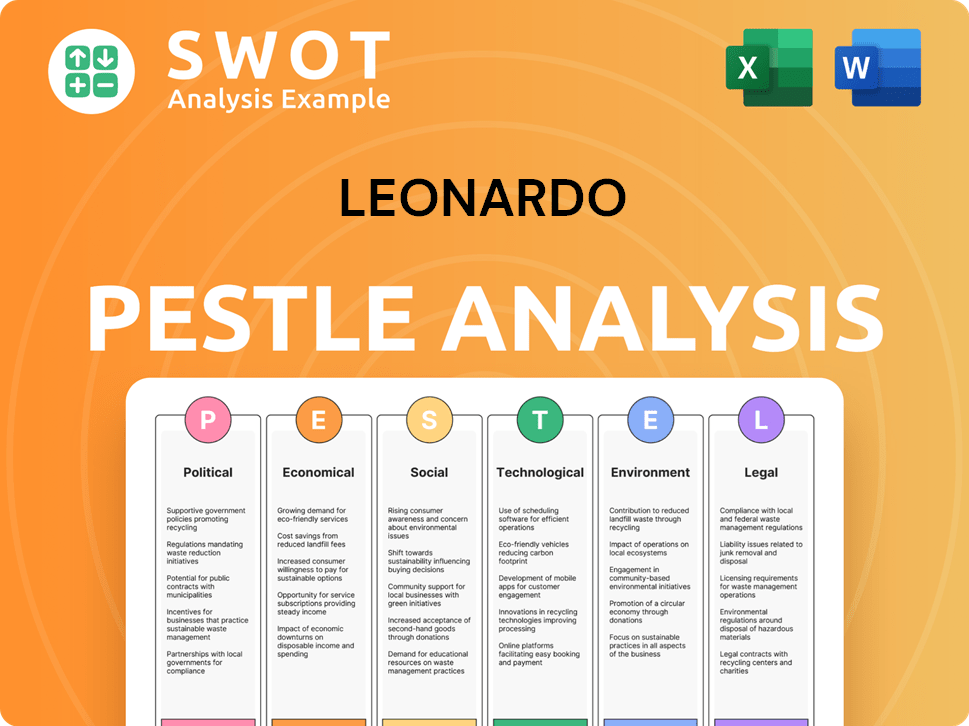

Leonardo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Leonardo history?

The Leonardo Company, formerly known as Finmeccanica, has a rich history marked by significant milestones in the aerospace industry and defense technology. This Italian defense company has evolved over the years, establishing itself as a key player in the global market.

| Year | Milestone |

|---|---|

| 1913 | Founding of the original company, which later became part of the Leonardo S.p.A. |

| 1960s-1980s | Significant advancements in avionics and helicopter technology, establishing a strong presence in the aerospace industry. |

| 2016 | Rebranding from Finmeccanica to Leonardo, reflecting a strategic shift towards a unified global brand. |

| 2024 | The Board of Directors approved preliminary consolidated results, showcasing a net result from ordinary activities of €742 million and a Free Operating Cash Flow (FOCF) of €635 million. |

Leonardo S.p.A. has consistently driven innovation, developing cutting-edge technologies for both defense and civilian applications. Its commitment to research and development has led to numerous advancements in radar systems, aircraft design, and integrated defense solutions.

Development of sophisticated avionics systems for both military and commercial aircraft, enhancing flight safety and operational capabilities.

Pioneering advancements in helicopter design and technology, including improved performance, safety, and operational efficiency.

Creation of advanced radar systems for surveillance, target acquisition, and electronic warfare, enhancing situational awareness.

Innovative aircraft designs that improve aerodynamic performance, fuel efficiency, and operational capabilities.

Development of integrated defense systems that combine various technologies to provide comprehensive protection and support.

Development of cybersecurity solutions to protect critical infrastructure and sensitive data from cyber threats.

Throughout its history, Leonardo has faced several challenges, including market fluctuations and competitive pressures. The company has demonstrated resilience by adapting to evolving industry trends and maintaining a strong focus on innovation and strategic partnerships.

Economic downturns and shifts in defense spending have required strategic adjustments to maintain profitability and market share.

Competition from established global players and emerging technological disruptors has consistently pushed Leonardo to innovate and optimize its operations.

Rare product failures have led to valuable lessons and refinements in development processes, ensuring continuous improvement.

Internal crises, often related to corporate governance or restructuring efforts, have been addressed through comprehensive reforms.

The rapid advancement of technology requires continuous adaptation and investment in new capabilities to stay ahead of the curve.

Geopolitical instability and changing defense priorities can impact contracts and require strategic adjustments to maintain market position.

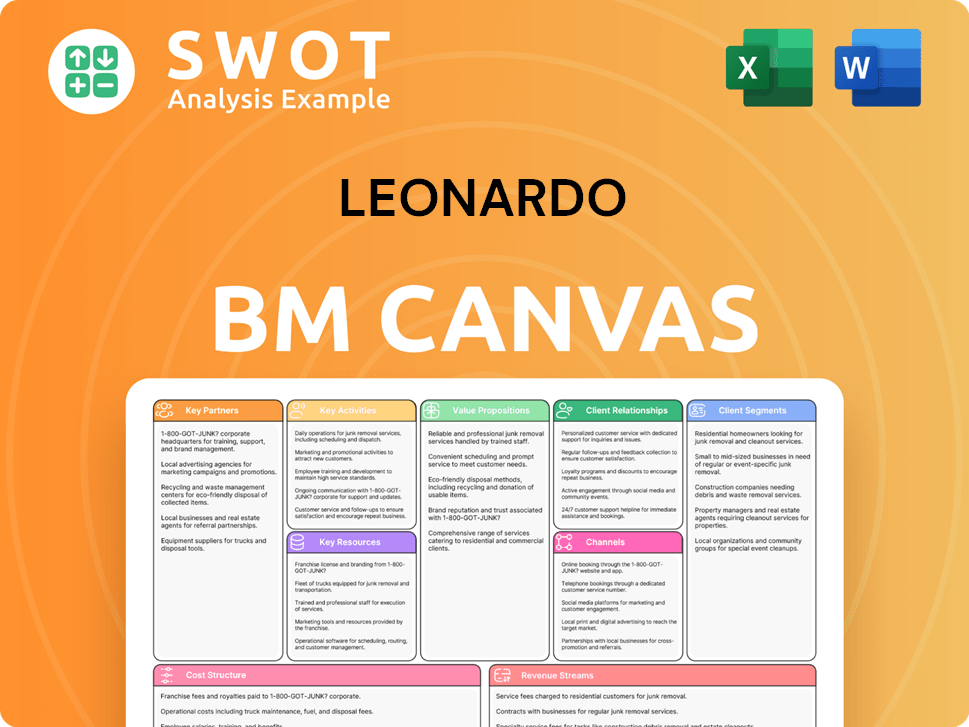

Leonardo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Leonardo?

The Leonardo Company, a prominent player in the Italian defense company sector, has a rich history marked by significant milestones and strategic shifts, evolving into a global leader in aerospace, defense, and security.

| Year | Key Event |

|---|---|

| 1948 | The company's roots trace back to the founding of Finmeccanica, a state-owned holding company that would later become a major shareholder. |

| 1970s-1990s | Finmeccanica expanded its portfolio through acquisitions and partnerships in the aerospace industry and defense technology, laying the groundwork for future growth. |

| 1990s-2000s | Finmeccanica underwent restructuring and privatization, with the Italian government gradually reducing its stake. |

| 2016 | Finmeccanica was rebranded as Leonardo S.p.A., reflecting its focus on the legacy of Leonardo da Vinci and its commitment to technological innovation. |

| 2017-2023 | Leonardo streamlined its business portfolio through strategic divestitures and acquisitions, focusing on core areas such as helicopters, defense electronics, and cybersecurity. |

Leonardo continues to invest heavily in research and development, particularly in areas such as artificial intelligence, autonomous systems, and advanced sensors. The company aims to enhance its product offerings and maintain a competitive edge in the aerospace industry and defense technology. In 2024, Leonardo invested approximately €1.6 billion in R&D.

Leonardo is actively pursuing opportunities in international markets, with a focus on expanding its presence in regions like the Middle East, Asia-Pacific, and North America. This includes securing new contracts, forming strategic partnerships, and establishing local manufacturing capabilities. The company's international sales accounted for over 70% of its revenues in 2024.

Leonardo is committed to sustainability, with initiatives aimed at reducing its environmental footprint and promoting responsible business practices. This includes efforts to improve energy efficiency, reduce emissions, and develop sustainable products and services. The company is targeting a 15% reduction in carbon emissions by 2027.

Leonardo is actively seeking collaborations with other companies in the aerospace and defense sectors. These partnerships are intended to leverage complementary technologies, expand market reach, and share the costs of research and development. The company has announced several new partnerships in early 2025, aimed at developing next-generation defense systems.

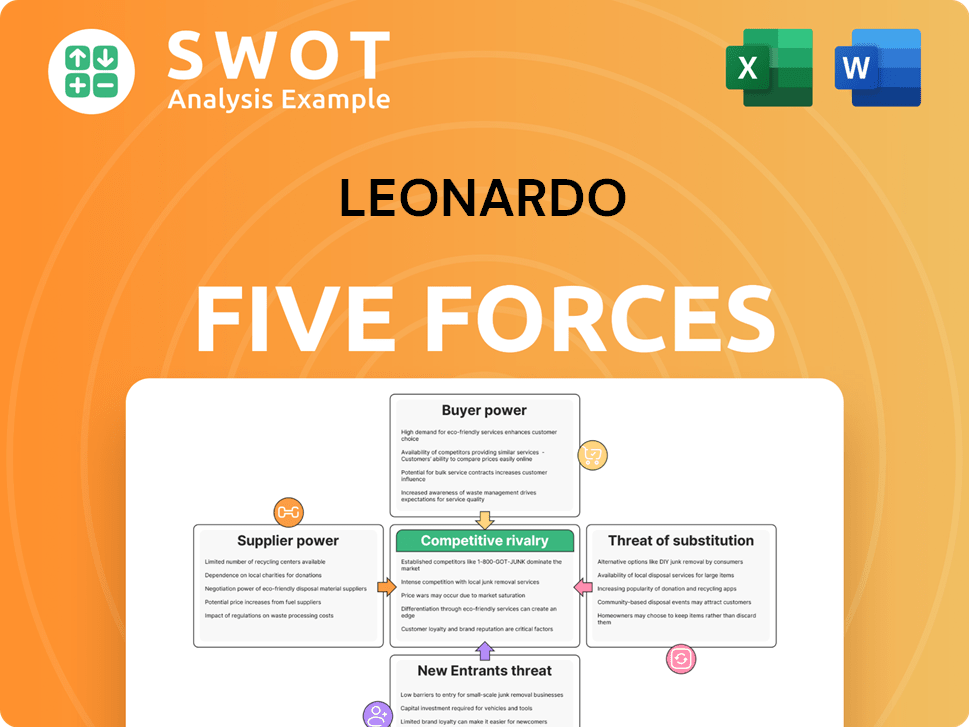

Leonardo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Leonardo Company?

- What is Growth Strategy and Future Prospects of Leonardo Company?

- How Does Leonardo Company Work?

- What is Sales and Marketing Strategy of Leonardo Company?

- What is Brief History of Leonardo Company?

- Who Owns Leonardo Company?

- What is Customer Demographics and Target Market of Leonardo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.