Leonardo Bundle

Can Leonardo Company Soar to New Heights?

In a world of evolving threats and technological leaps, Leonardo S.p.a. stands at a critical juncture. This Italian defense company, a global force in aerospace and security, is charting its course for future growth. Explore how Leonardo Company growth strategy and strategic initiatives are poised to navigate the complexities of the Aerospace and defense industry.

From its origins in post-war Italy to its current status as a global leader, Leonardo's journey is a compelling case study in strategic adaptation. Understanding Leonardo S.p.A.'s future prospects requires a deep dive into its business development plans, financial performance, and commitment to innovation. For a comprehensive overview, consider reviewing the Leonardo SWOT Analysis to understand its strengths and weaknesses.

How Is Leonardo Expanding Its Reach?

The growth strategy of Leonardo Company, a key player in the aerospace and defense industry, is built on a multi-faceted approach. This includes both expanding its geographical reach and diversifying its product offerings. A significant focus is on strengthening its international footprint, particularly in markets where defense and security spending is expected to increase.

Leonardo aims to broaden its presence in regions like the Middle East, Asia-Pacific, and North America. This will be achieved by leveraging existing relationships and tailoring offerings to meet specific national requirements. The company is actively pursuing contracts for its M-346 trainer aircraft and AWFamily helicopters in various countries, demonstrating its commitment to global market penetration and its strategic initiatives.

In terms of product and service expansion, Leonardo is heavily investing in developing next-generation solutions across its core divisions. This includes advancing its capabilities in uncrewed systems, such as drones and remotely piloted aircraft, to meet the growing demand for autonomous operations in defense and civil applications. Furthermore, the company is enhancing its cybersecurity offerings, recognizing the increasing importance of digital resilience for governments and critical infrastructure.

Leonardo focuses on expanding in key markets like the Middle East, Asia-Pacific, and North America. This involves leveraging existing relationships and tailoring offerings to meet specific national needs. For instance, the company is pursuing contracts for its M-346 trainer aircraft and AWFamily helicopters.

Leonardo is investing in next-generation solutions across its core divisions. This includes advancements in uncrewed systems and enhancing cybersecurity offerings. Strategic mergers and acquisitions are also a key part of the expansion strategy.

Strategic mergers and acquisitions remain vital for Leonardo's expansion, allowing the company to acquire specialized technologies and access new customer bases. The company continuously evaluates potential targets that align with its long-term strategic objectives. This enhances its competitive edge and diversifies revenue streams.

Leonardo is focused on advancing its capabilities in uncrewed systems, such as drones and remotely piloted aircraft. They are also enhancing their cybersecurity offerings to meet the growing demand for digital resilience. These efforts are designed to stay ahead of industry trends.

Strategic mergers and acquisitions are a vital part of Leonardo's expansion strategy. This allows the company to acquire specialized technologies and access new customer bases, thus consolidating its market position. The company continuously evaluates potential targets that align with its long-term strategic objectives, aiming to enhance its competitive edge and diversify its revenue streams. These initiatives are designed not only to capture new customers and markets but also to anticipate and stay ahead of evolving industry trends and threats. For more information on the company's core values, you can read Mission, Vision & Core Values of Leonardo.

Leonardo's strategic initiatives for 2024 and beyond include both geographical and product diversification. This is supported by investments in research and development, partnerships, and strategic acquisitions. The company aims to enhance its competitive position in the aerospace and defense industry.

- Expanding in key markets like the Middle East and Asia-Pacific.

- Developing next-generation solutions in uncrewed systems and cybersecurity.

- Strategic mergers and acquisitions to enhance market position.

- Focus on anticipating and staying ahead of industry trends.

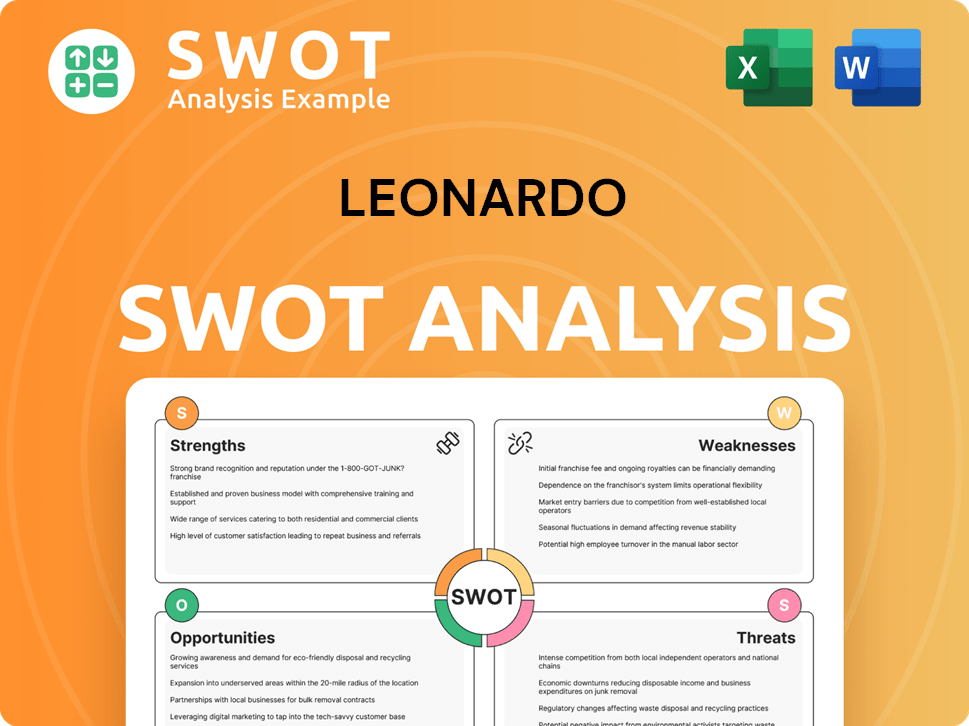

Leonardo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Leonardo Invest in Innovation?

The growth trajectory of the company, a prominent player in the aerospace and defense industry, is intricately linked to its innovation and technology strategy. This strategy prioritizes significant investments in research and development (R&D) and fosters strategic collaborations to maintain its technological leadership. The company's commitment to digital transformation, encompassing all operational aspects, is a core element of its approach.

The company's innovation strategy focuses on several key areas, including automation, artificial intelligence (AI), the Internet of Things (IoT), big data analytics, and cloud computing. These technologies are implemented to enhance efficiency, optimize processes, and develop intelligent products. The company also emphasizes sustainability initiatives, integrating environmentally friendly practices and technologies into its product development and operations.

The company's strategic initiatives are designed to offer superior performance and meet complex customer requirements. New product platforms and technical capabilities, such as advanced sensors and secure communication systems, directly contribute to its growth objectives. The company's focus on innovation and technology is further supported by its partnerships and collaborations, which enhance its ability to develop cutting-edge solutions. For more information, consider reading about the Target Market of Leonardo.

The company allocates a substantial portion of its revenue to R&D. In recent years, this investment has been critical in driving innovation and maintaining a competitive edge in the aerospace and defense industry. These investments are crucial for developing new products and technologies.

Digital transformation is a key strategic focus, permeating all areas of operations. This includes the adoption of AI, IoT, and big data analytics to improve efficiency and develop intelligent products. The company is also investing in cybersecurity solutions to protect its digital assets.

The company is developing advanced capabilities in predictive maintenance using AI and data analytics. This aims to improve the operational availability of its platforms and reduce downtime. This is a key area of innovation.

Sustainability is a growing focus, with the company integrating environmentally friendly practices into its product development. This includes developing green aerospace technologies. This also opens new business opportunities.

The development of advanced sensors, secure communication systems, and multi-domain integration is a priority. These technologies are designed to meet complex customer requirements and offer superior performance. This drives revenue growth.

The company frequently collaborates with leading research institutions and innovative startups. These partnerships are crucial for accelerating innovation and accessing cutting-edge technologies. This approach supports its growth objectives.

The company's focus on innovation leads to significant technological advancements. These advancements are crucial for its Leonardo Company growth strategy and future prospects in the aerospace and defense industry. The company's investment in R&D supports its long-term goals.

- AI and Machine Learning: Implementation in predictive maintenance and data analysis.

- Cybersecurity: Development of advanced secure communication systems.

- Sustainable Technologies: Integration of green practices in product development.

- Advanced Sensors: Development of cutting-edge sensors for enhanced performance.

- Multi-Domain Integration: Focus on integrating systems across various domains.

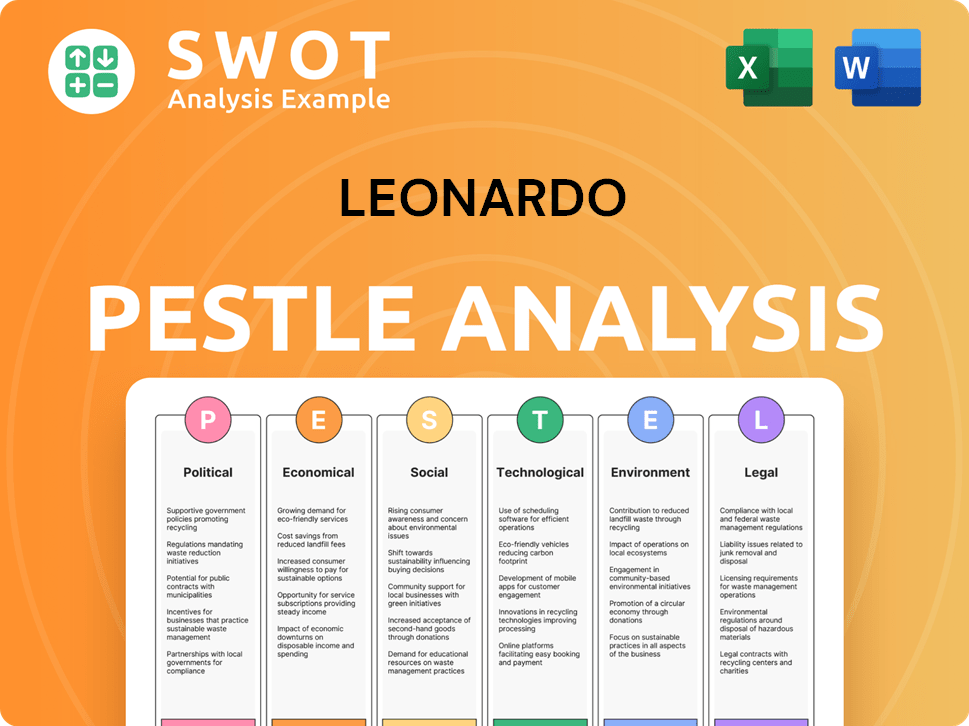

Leonardo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Leonardo’s Growth Forecast?

The financial outlook for Leonardo reflects a strong commitment to sustainable growth, supported by solid projections and strategic investments. The company's strategic vision, outlined in its 2024-2028 Industrial Plan, sets ambitious targets for revenue and profitability. This plan emphasizes a balanced approach to growth, profitability, and financial stability, ensuring resources are available to execute expansion and innovation initiatives. This approach is crucial for maintaining a competitive edge in the Owners & Shareholders of Leonardo.

Leonardo's financial strategy is designed to drive significant growth, with a focus on expanding its order book and increasing revenue. The company anticipates substantial improvements in Free Operating Cash Flow (FOCF) and a strong Return on Capital Employed (ROCE) by 2028. These financial goals are benchmarked against historical performance and industry averages, highlighting a commitment to delivering value to shareholders. The company's financial narrative underscores a strategic balance between growth, profitability, and financial stability.

Leonardo's financial performance is expected to be robust, with several key metrics indicating positive trends. The company's order backlog, which provides strong revenue visibility, and its strategic investments in R&D and acquisitions, are expected to fuel future growth. Leonardo's financial plans highlight a commitment to disciplined capital allocation, which is essential for achieving its financial goals.

Leonardo's growth strategy focuses on increasing orders and revenue through strategic initiatives. The company aims to achieve significant growth in its order book, targeting €21.2 billion by 2028. This growth is supported by investments in R&D and strategic acquisitions.

The company projects substantial improvements in key financial metrics. Leonardo anticipates revenues of €19 billion in 2028, up from €15.3 billion in 2023. The Free Operating Cash Flow (FOCF) is projected to reach €1.9 billion by 2028.

Business development at Leonardo involves strategic acquisitions and investments in R&D. The company is focused on expanding its market presence and enhancing its product portfolio. This includes exploring opportunities in the aerospace and defense industry.

As an Italian defense company, Leonardo plays a crucial role in the national economy. The company's financial performance and strategic initiatives have a significant impact on the Italian economy. Leonardo is committed to delivering value to its stakeholders.

Leonardo's future prospects are promising, with a clear path towards increased profitability and revenue. The company's strategic initiatives are aimed at driving long-term growth and enhancing shareholder value. The company's order backlog stood at €39.2 billion at the end of 2023, providing solid revenue visibility.

- Revenue Growth: The company targets revenues of €19 billion by 2028, up from €15.3 billion in 2023, representing an average annual growth rate of 5.9%.

- Order Growth: Leonardo aims to increase orders to €21.2 billion by 2028, a significant rise from €17.7 billion in 2023.

- FOCF Improvement: The company projects Free Operating Cash Flow (FOCF) to reach €1.9 billion by 2028, compared to €1.3 billion in 2023.

- ROCE Target: Leonardo aims for a Return on Capital Employed (ROCE) of 17% by 2028.

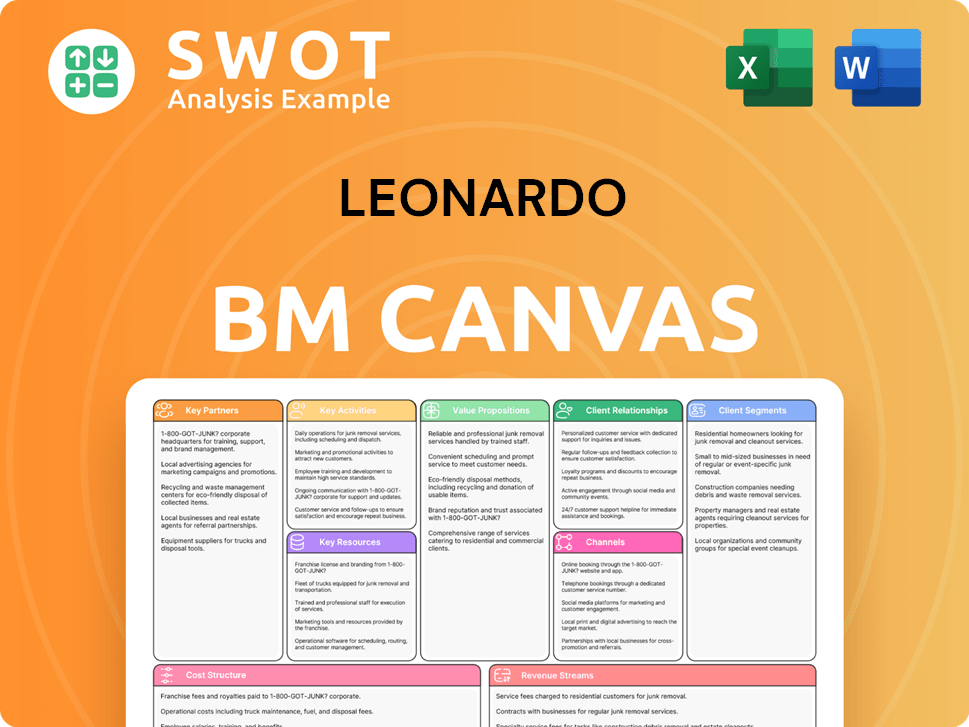

Leonardo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Leonardo’s Growth?

The success of Leonardo's growth strategy is not without its challenges. The aerospace and defense industry is highly competitive, and the company faces numerous strategic and operational risks. These obstacles could potentially impact its future prospects and ambitions.

Market competition is a significant factor, with established global players and new entrants constantly vying for lucrative defense and aerospace contracts. Regulatory changes, especially concerning export controls, environmental regulations, and adherence to international defense standards, also present considerable hurdles. This demands continuous adaptation and vigilance.

Supply chain vulnerabilities, exacerbated by geopolitical tensions and global events, introduce a notable risk. Disruptions in the availability of essential components or raw materials can lead to production delays and increased costs. Furthermore, the rapid pace of technological advancements requires Leonardo to invest heavily in research and development to maintain its competitive edge.

Leonardo operates within a fiercely competitive global market. Competitors include major players in the aerospace and defense sectors. Continuous innovation and competitive pricing strategies are essential for securing contracts and maintaining market share.

Changes in regulations, especially export controls and environmental standards, pose significant challenges. Compliance with international defense standards requires constant monitoring and adaptation. The company must stay updated on evolving legal frameworks.

Supply chain disruptions, amplified by geopolitical events, present a major risk. Delays in the delivery of critical components can hinder production and increase costs. Diversification of suppliers and robust risk management are crucial.

The rapid pace of technological change necessitates ongoing investment in R&D. Advancements in areas like quantum computing and advanced materials require continuous innovation. Failure to adapt can lead to obsolescence.

Availability of skilled talent, especially in areas like cybersecurity and AI, poses a potential obstacle. Attracting and retaining top talent is vital for maintaining a competitive edge. Internal resource constraints can hinder growth.

Increased scrutiny on environmental, social, and governance (ESG) factors is influencing Leonardo's future. The company must integrate sustainability more deeply into its operations and strategy. This includes setting ambitious targets.

To address these risks, the company employs a comprehensive risk management framework. This includes diversifying its product portfolio and geographical markets. Scenario planning helps anticipate potential disruptions and develop contingency plans. For example, to understand more about the company you can read Brief History of Leonardo.

Recent examples of navigating obstacles include adapting to supply chain challenges during global crises. The company has also responded to evolving cybersecurity threats by strengthening its internal capabilities and offerings. These proactive measures demonstrate resilience.

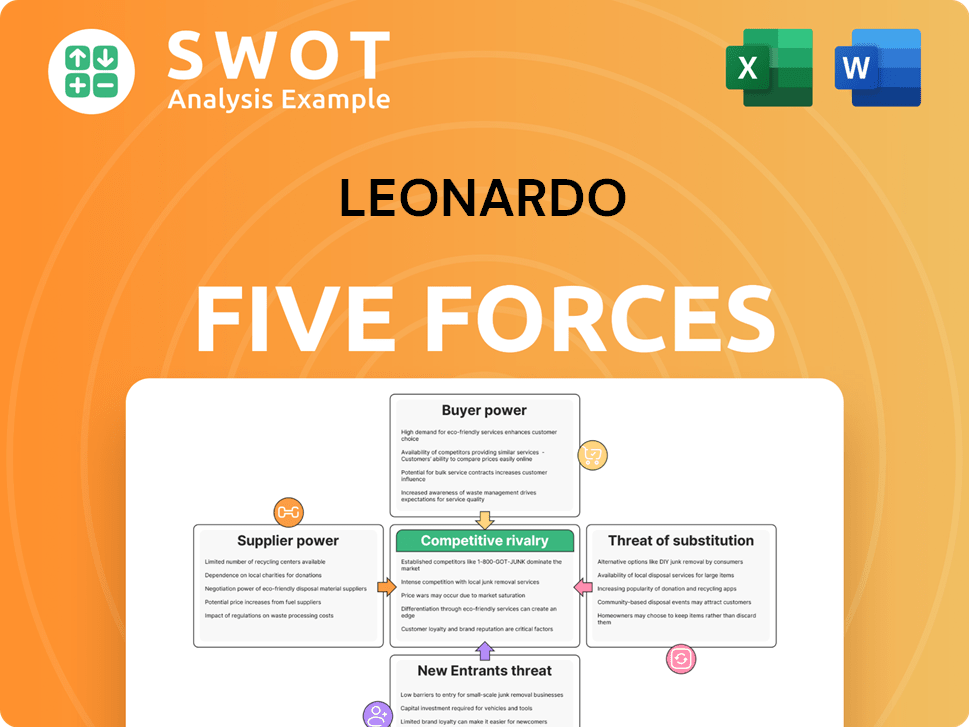

Leonardo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Leonardo Company?

- What is Competitive Landscape of Leonardo Company?

- How Does Leonardo Company Work?

- What is Sales and Marketing Strategy of Leonardo Company?

- What is Brief History of Leonardo Company?

- Who Owns Leonardo Company?

- What is Customer Demographics and Target Market of Leonardo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.