Leonardo Bundle

Unveiling the Inner Workings of Leonardo S.p.A.: How Does It Thrive?

Leonardo S.p.A., a titan in the global aerospace and defense arena, consistently demonstrates impressive financial prowess. With billions in revenue and a growing order book, the company's influence is undeniable. But how does this Italian multinational, a cornerstone of the Leonardo SWOT Analysis, truly operate and generate its substantial value?

This exploration of the Leonardo Company delves into its core strategies and operations. We'll dissect the Leonardo business model, examining its diverse revenue streams and how it maintains a competitive edge in the complex Aerospace and defense industry. Understanding the Italian defense industry leader's approach is vital for anyone seeking to navigate the evolving landscape of global security and investment opportunities, especially considering the company's extensive Leonardo products.

What Are the Key Operations Driving Leonardo’s Success?

The core operations of the Leonardo Company revolve around designing, developing, manufacturing, and supporting products across several key business areas. These include Helicopters, Electronics, Aircraft, Cyber & Security, and Space. The company serves a diverse clientele, including governments, armed forces, and commercial entities worldwide. Their operational model is characterized by vertical integration and advanced technology, encompassing manufacturing, technology development, logistics, and robust sales and customer service channels.

A significant aspect of Leonardo S.p.A.'s operational strategy involves digitalization across all business functions. This includes the implementation of advanced product lifecycle management (PLM) systems, transitioning to cloud-native platforms, and utilizing digital twin technology. They also leverage Artificial Intelligence (AI) and High-Performance Computing (HPC) to enhance their value chain, from engineering simulations to predictive maintenance and satellite image analysis. This approach aims to increase efficiency and innovation across their operations.

The value proposition of Leonardo business lies in its ability to deliver comprehensive solutions and services tailored to the specific needs of its customers. By integrating advanced technologies and fostering strategic partnerships, the company provides cutting-edge products and services. The company’s focus on multi-domain interoperability technologies and 'cyber secure by design' products further enhances its value proposition, providing significant benefits in a complex security environment.

In 2024, Leonardo's Aerostructures division delivered 49 Boeing 787 fuselage sections. This demonstrates their capability in complex aerostructures manufacturing. This highlights Leonardo's operational efficiency and its ability to meet the demanding requirements of the aerospace industry.

Leonardo is investing heavily in digital technologies, including AI and HPC, to optimize its operations. This includes using digital twins for product design and manufacturing. These efforts are aimed at improving efficiency and innovation across the company.

Leonardo operates through subsidiaries, joint ventures, and stakes, including Leonardo DRS (72.3%), MBDA (25%), ATR (50%), Hensoldt (22.8%), Telespazio (67%), and Thales Alenia Space (33%). These partnerships strengthen their supply chain and enhance their market reach. The company is focused on supply chain resilience to meet growing demand and adapt to global challenges.

A key differentiator for Leonardo is the development of multi-domain interoperability technologies. This enables seamless orchestration of military activities across land, air, maritime, and space domains. This capability, combined with its commitment to 'cyber secure by design' products, provides significant customer benefits in an increasingly complex security environment.

Leonardo's operational excellence is built on several key strengths, including advanced manufacturing capabilities, digital transformation initiatives, and strategic partnerships. These elements enable the company to deliver high-quality products and services while remaining competitive in the global market. The company's focus on innovation and strategic alliances is crucial for its continued success in the aerospace and defense sectors. Further insights into their strategic approach can be found in this article about the Marketing Strategy of Leonardo.

- Vertical Integration: Enhances control over the value chain.

- Technological Advancement: Drives innovation and efficiency.

- Strategic Partnerships: Expands market reach and capabilities.

- Cybersecurity Focus: Provides secure and reliable solutions.

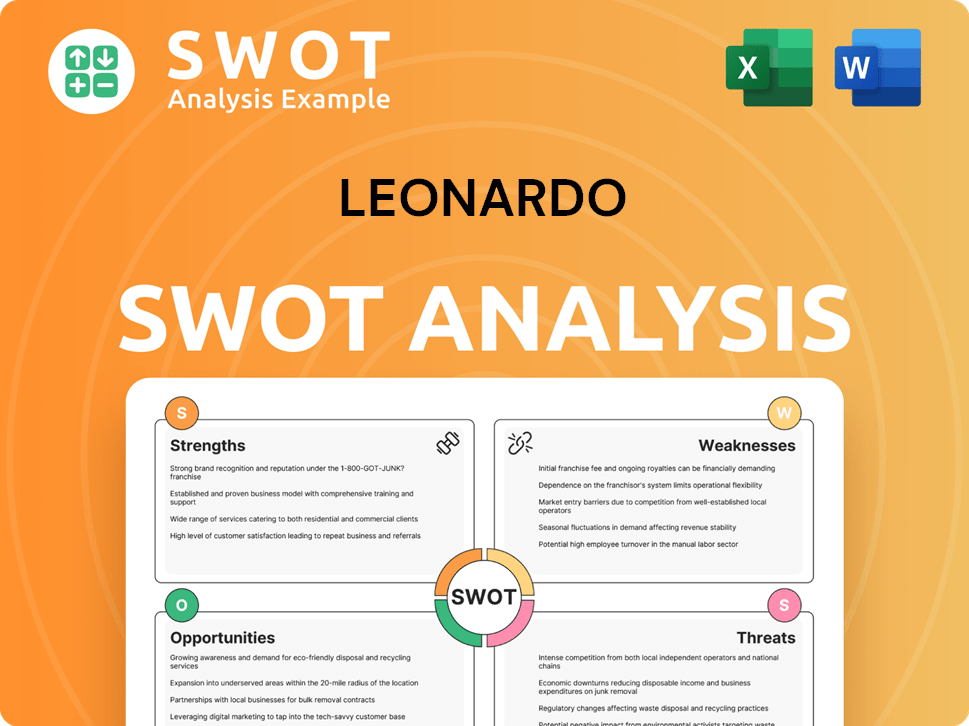

Leonardo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Leonardo Make Money?

The Leonardo Company generates revenue primarily through the sale of its aerospace, defense, and security products and services. This is complemented by associated support and maintenance contracts. The company's financial performance in 2024 provides insights into the contributions of each sector.

In 2024, Leonardo S.p.A. recorded consolidated revenues of €17.8 billion and new orders of €20.9 billion, demonstrating strong market demand. The company's monetization strategies involve direct product sales to governments, armed forces, and commercial customers, alongside revenue from services such as integrated operational support and digital offerings.

The company is evolving from a product seller to a solution provider, which implies an increasing emphasis on bundled services and integrated offerings. This shift is expected to drive future revenue growth. You can learn more about the company's strategic growth in this article: Growth Strategy of Leonardo.

Leonardo's revenue streams and monetization strategies are diverse, encompassing product sales, services, and integrated solutions. The company's focus on innovation and strategic initiatives is expected to drive future revenue growth. Key aspects include:

- Product Sales: Direct sales of aerospace and defense products to governments, armed forces, and commercial customers.

- Service Revenue: Integrated operational support, maintenance contracts, and digital offerings. For instance, the Cyber & Security Solutions segment saw a 20.9% increase in revenue in Q1 2025.

- Strategic Initiatives: Investments in new technologies and solutions, such as the Leonardo Hypercomputing Continuum (LHyC) Line of Business, are expected to generate additional revenue.

- Financial Performance: In 2024, the Helicopters division's revenue exceeded €5 billion, with 191 helicopters delivered. The Space business also delivered solid results in Q1 2025, with revenues up 25.0% to €200 million.

- Future Outlook: The company anticipates total revenue to reach €24 billion by 2029, driven by increased production capacity and new technological solutions.

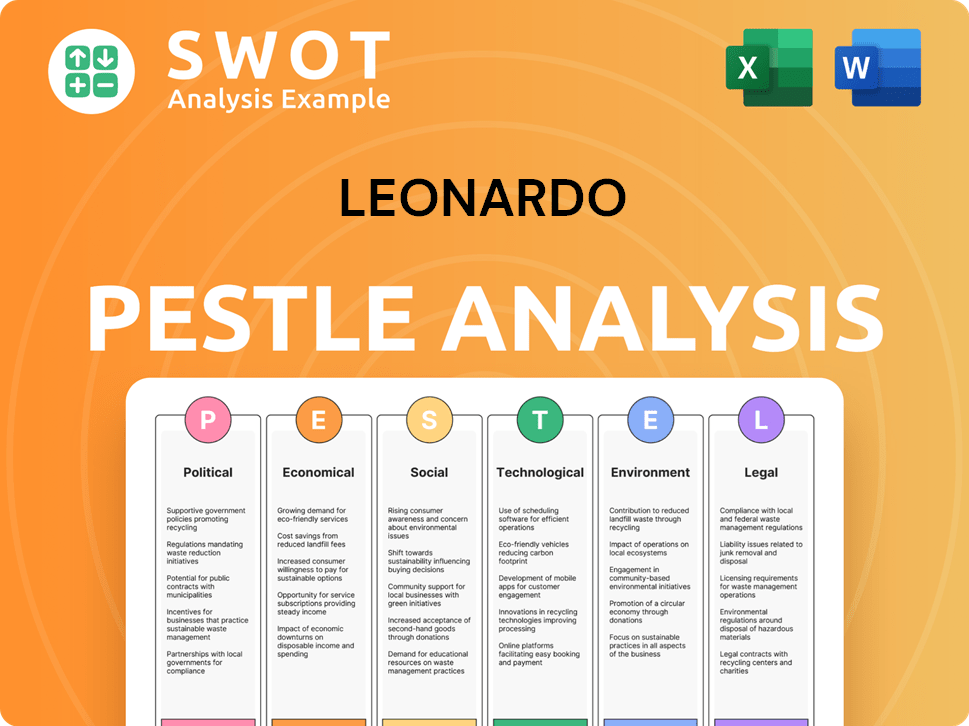

Leonardo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Leonardo’s Business Model?

The strategic journey of the Leonardo Company, also known as Leonardo S.p.A., has been marked by significant milestones and strategic shifts. The company's Industrial Plan for 2025-2029 is a central element of its strategy, designed to strengthen core business areas, foster innovation, and achieve ambitious financial targets. This includes a revenue projection of €24 billion by 2029, highlighting the company's growth ambitions and strategic focus on the aerospace and defense sectors.

A key strategic move has been the accelerated efficiency plan, which yielded savings of €191 million in 2024, surpassing initial expectations. This plan aims for gross savings of €1.8 billion over its duration through digitalization and the rationalization of products and services. These initiatives are crucial for enhancing operational efficiency and supporting Leonardo's long-term financial goals. The company's focus on innovation and digital transformation is a key aspect of its competitive strategy, as detailed in an article on the Growth Strategy of Leonardo.

Operational challenges, such as those faced by the Aerostructures segment, which saw a revenue decrease of 14.3% in Q1 2025, have prompted strategic responses. These include a dedicated industrial plan for the segment, focusing on optimization, supply chain restructuring, and revenue diversification. Leonardo is actively seeking an investment partner for its Aerostructures unit to ensure a strong and sustainable long-term business. These efforts are vital for maintaining a competitive edge in the Italian defense industry.

The Industrial Plan for 2025-2029 aims for €24 billion in revenue by 2029. The accelerated efficiency plan resulted in €191 million in savings in 2024. The Aerostructures segment faced a 14.3% revenue decrease in Q1 2025.

Implementation of the accelerated efficiency plan to achieve €1.8 billion in gross savings. Implementation of a stand-alone industrial plan for the Aerostructures segment. Actively seeking an investment partner for the Aerostructures unit.

Global presence with over 60,000 employees worldwide. Focused R&D expenditure on AI, Cloud, and Supercomputing. Active forging of international alliances and strategic partnerships.

Revenue target of €24 billion by 2029. Gross savings target of €1.8 billion through the efficiency plan. Focus on digitalization and rationalization of products and services to improve financial performance.

Leonardo's competitive advantages stem from its brand strength, global presence, and technological leadership. The company's commitment to digital transformation, including the use of digital twins and AI in defense operations, further enhances its technological edge. Economies of scale are evident in its widespread operations and participation in major international programs.

- Global presence with over 60,000 employees.

- Focused R&D on AI, Cloud, and Supercomputing.

- Active international alliances and strategic partnerships.

- Participation in major international programs.

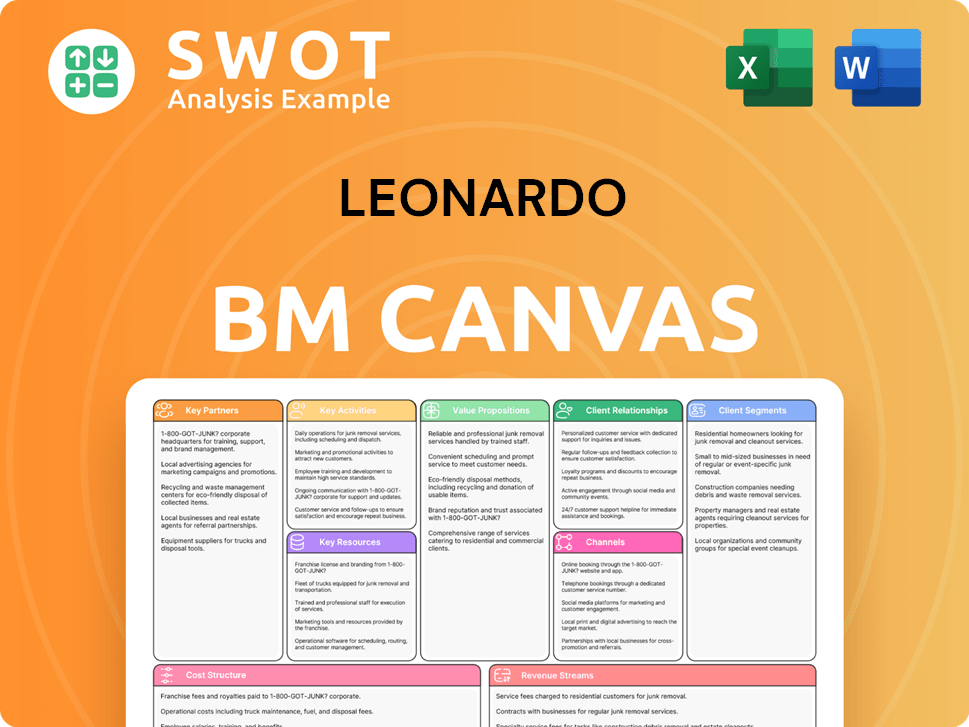

Leonardo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Leonardo Positioning Itself for Continued Success?

The Owners & Shareholders of Leonardo holds a prominent position in the global Aerospace, Defense, and Security (AD&S) sector. As a major player in the helicopter market, particularly in Europe and Asia, the company demonstrates strong customer loyalty, as evidenced by a record backlog. The company's financial performance showcases continued strong demand for its products and solutions.

However, the company faces several key risks, including geopolitical tensions, supply chain disruptions, and regulatory changes. The industry's susceptibility to technological disruption and the need for continuous innovation are also significant challenges. These factors could impact the company's competitiveness and financial results.

The company is a leading player in the Aerospace and defense sector, particularly in the helicopter market. With a fleet of 2,263 operational helicopters, it maintains a strong presence in Europe and Asia. The company's robust order backlog and new orders reflect a solid market position and customer trust.

Geopolitical instability and conflicts pose significant risks to eligible markets and supply chains. Supply chain disruptions and inflationary pressures continue to challenge operations, as seen in the Aerostructures segment. Regulatory changes and the need for technological innovation also present challenges.

The company's strategic initiatives focus on sustainable growth and expansion. The Industrial Plan 2025-2029 targets cumulative orders of €118 billion and revenues of €106 billion by 2029. Strategic acquisitions and increased dividends reflect confidence in future performance.

The company is strengthening its core business through portfolio rationalization and digitalization. It is also developing new technologies, including a focus on the New Space Division and the Leonardo Hypercomputing Continuum. Strategic acquisitions in Cyber and Space domains will accelerate growth.

The company’s financial performance is marked by a strong backlog and new orders, indicating robust demand. The company is focused on innovation and international collaboration to adapt to market changes. The company aims to increase its dividend by 90% in 2025.

- Record backlog of over €40 billion in 9M 2023.

- New orders reached €20.9 billion in 2024.

- Industrial Plan 2025-2029 targets €118 billion in cumulative orders.

- Focus on strategic acquisitions in Cyber and Space.

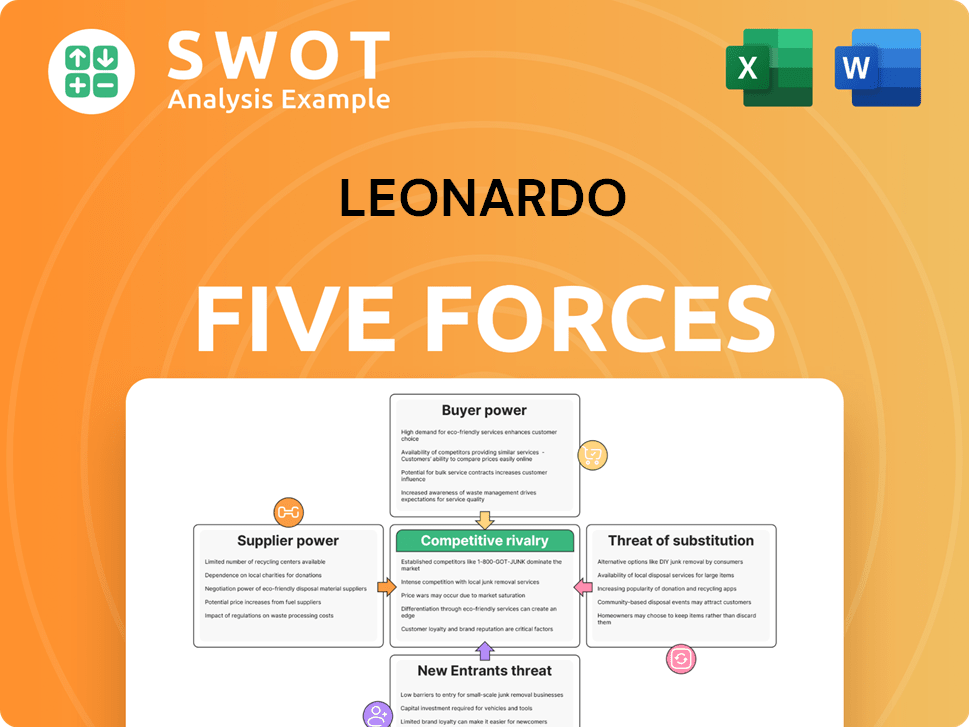

Leonardo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Leonardo Company?

- What is Competitive Landscape of Leonardo Company?

- What is Growth Strategy and Future Prospects of Leonardo Company?

- What is Sales and Marketing Strategy of Leonardo Company?

- What is Brief History of Leonardo Company?

- Who Owns Leonardo Company?

- What is Customer Demographics and Target Market of Leonardo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.