Leonardo Bundle

Who Really Controls Leonardo S.p.A.?

Unraveling the ownership of a global powerhouse like Leonardo Company is key to understanding its strategic moves and future potential. From its roots in post-war Italy to its current status as a leader in aerospace, defense, and security, Leonardo's ownership structure has been a dynamic force. Knowing who holds the reins at Leonardo provides crucial insights into its past decisions and future trajectory.

As a major player in the defense and aerospace sectors, understanding Leonardo SWOT Analysis is important. The evolution of Leonardo's ownership, from its foundational stakes to the current shareholder landscape, directly influences its operational independence and investment strategies. This exploration will examine the company's ownership structure, including the Italian government's stake, major stakeholders, and the impact on its financial performance and strategic direction. Understanding the Leonardo Company ownership is crucial.

Who Founded Leonardo?

The story of Leonardo S.p.A., initially known as Finmeccanica S.p.A., began in 1948. Unlike typical startups, it wasn't founded by individual entrepreneurs. Instead, it was a strategic move by the Italian government.

The Italian government, through the Istituto per la Ricostruzione Industriale (IRI), a state-owned holding company, spearheaded its creation. IRI's role was to manage and restructure essential Italian industries after World War II. Therefore, the Italian state, via IRI, effectively served as the 'founder' and sole owner from the outset.

There were no individual founders or early investors in the traditional sense. The company's initial phase involved complete state ownership, with no equity split among individuals.

Early ownership of Leonardo S.p.A. was characterized by direct state control. IRI held 100% of Finmeccanica's shares. This setup ensured that strategic decisions, investments, and operational directives were closely aligned with national industrial policy and economic recovery goals. The focus was on critical sectors like aerospace, defense, energy, and transportation, all under state control. This structure highlights the Italian government's post-war industrial strategy.

The initial ownership of Leonardo (formerly Finmeccanica) was entirely within the Italian state's control. This was managed through IRI, a public holding company. The primary goal was to rebuild key industries after the war, ensuring alignment with national economic policies. The company's structure reflects the government's strategic focus on sectors like aerospace and defense, which is discussed in detail in Marketing Strategy of Leonardo.

- The Italian government, through IRI, was the sole owner.

- Strategic decisions were aligned with national industrial policy.

- Focus on sectors like aerospace, defense, energy, and transportation.

- No individual founders or early investors.

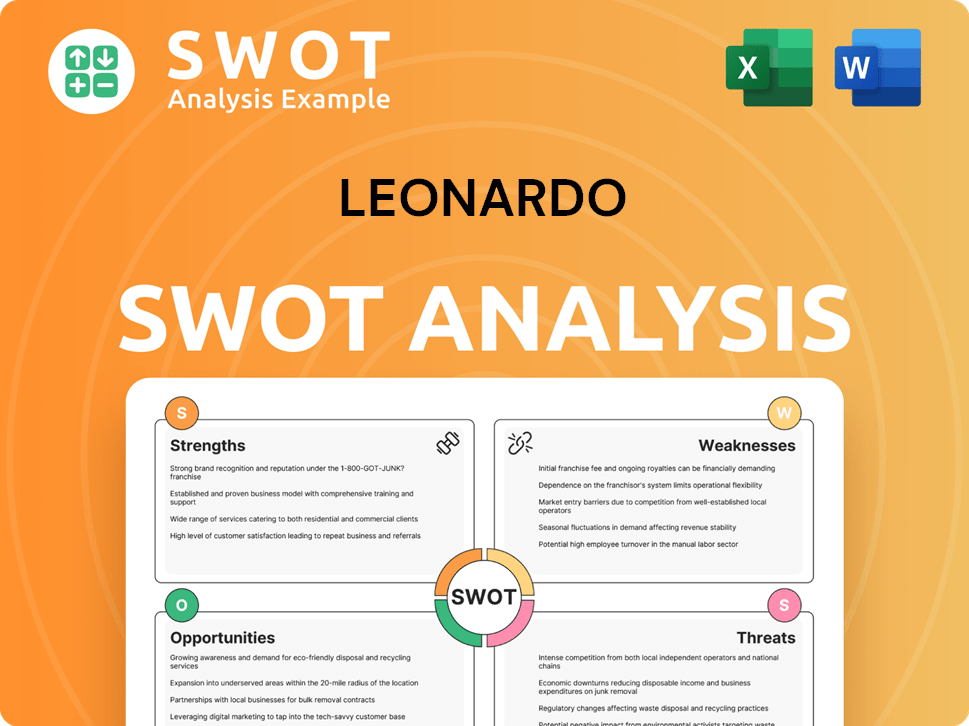

Leonardo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Leonardo’s Ownership Changed Over Time?

The ownership of Leonardo S.p.A., formerly known as Finmeccanica, has evolved significantly. Initially fully state-owned, the company transitioned to a publicly traded entity through an Initial Public Offering (IPO) in 1992. This move opened the door for institutional and individual investors to participate. Understanding the Growth Strategy of Leonardo helps to appreciate how ownership changes have influenced the company's direction.

The Italian Ministry of Economy and Finance (MEF) continues to be a major shareholder. The IPO in 1992 marked a pivotal shift, allowing broader market participation. While specific market capitalization details from the 1992 IPO are not readily available in public summaries, the event was a key step in the company's ownership journey.

| Event | Impact on Ownership | Year |

|---|---|---|

| Initial Public Offering (IPO) | Transition from state-owned to publicly traded | 1992 |

| Strategic Divestitures | Streamlining operations, focusing on core sectors | Ongoing |

| Capital Increases | Potential dilution, new investment | Various |

As of April 2025, the Italian Ministry of Economy and Finance holds approximately 30.2% of Leonardo's share capital, making it the largest single shareholder. This significant stake allows the government to influence the company's strategic decisions, investments, and overall governance. The remaining shares are traded on the Borsa Italiana, with institutional investors and individual shareholders. The government's continued stake ensures alignment with Italy's national interests, while the public float introduces market discipline. Key events, such as strategic divestitures and capital increases, have further shaped the ownership structure, impacting the company's strategy and governance.

The Italian government, through the MEF, maintains a significant controlling stake in Leonardo. This ensures alignment with national interests while also balancing market demands.

- The IPO in 1992 was a crucial step in opening up ownership to the public.

- Institutional investors hold a significant portion of the free float.

- Ownership changes influence company strategy and governance.

- Leonardo defense and aerospace sectors are key focus areas.

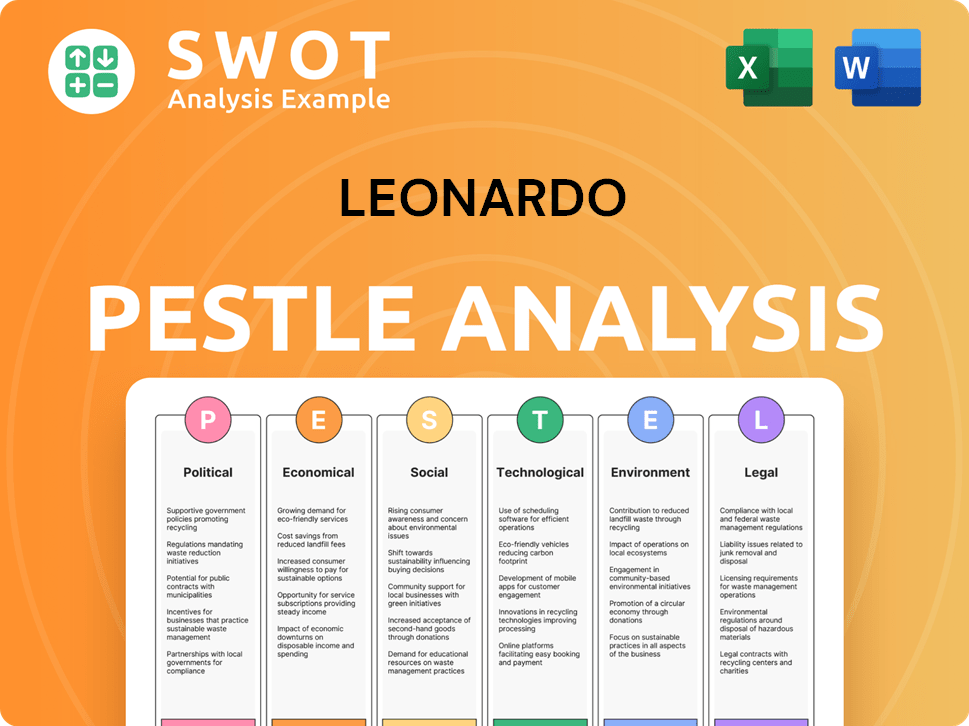

Leonardo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Leonardo’s Board?

The Board of Directors of Leonardo S.p.a. currently balances representatives from the Italian Ministry of Economy and Finance, independent members, and executive directors. As of early 2025, the board typically includes members nominated by the Italian government and those proposed by minority shareholders. The Chairman is often a government nominee, while the CEO is appointed by the Board, usually with the government's approval. The Board generally includes individuals with backgrounds in finance, industry, and public administration.

The composition of the board and its decision-making processes are continually shaped by the need to balance the interests of its primary state shareholder with those of its diverse public investor base, ensuring both national security objectives and shareholder value creation. The Target Market of Leonardo includes a diverse range of stakeholders.

| Board Member Category | Typical Representation | Key Responsibilities |

|---|---|---|

| Government Nominees | Often the Chairman | Strategic oversight, alignment with national interests |

| Independent Directors | Significant portion | Ensuring corporate governance, representing minority shareholders |

| Executive Directors | CEO and other key executives | Day-to-day operations, implementation of strategic plans |

The voting structure of Leonardo S.p.a. follows the principle of 'one-share-one-vote.' However, the Italian Ministry of Economy and Finance holds a significant stake, approximately 30.2%, which grants it substantial influence. This stake is typically sufficient to influence key decisions, including the appointment of board members and major strategic initiatives. The company operates under intense scrutiny regarding ethical practices, compliance, and financial performance.

Leonardo Company ownership is primarily influenced by the Italian government, holding a significant stake. The board structure reflects a balance between government representatives and independent members.

- The Italian government's stake is approximately 30.2%.

- The voting structure is 'one-share-one-vote,' but the government's stake provides substantial control.

- The board includes government nominees, independent directors, and executive directors.

- Leonardo operates under scrutiny regarding ethical practices and financial performance.

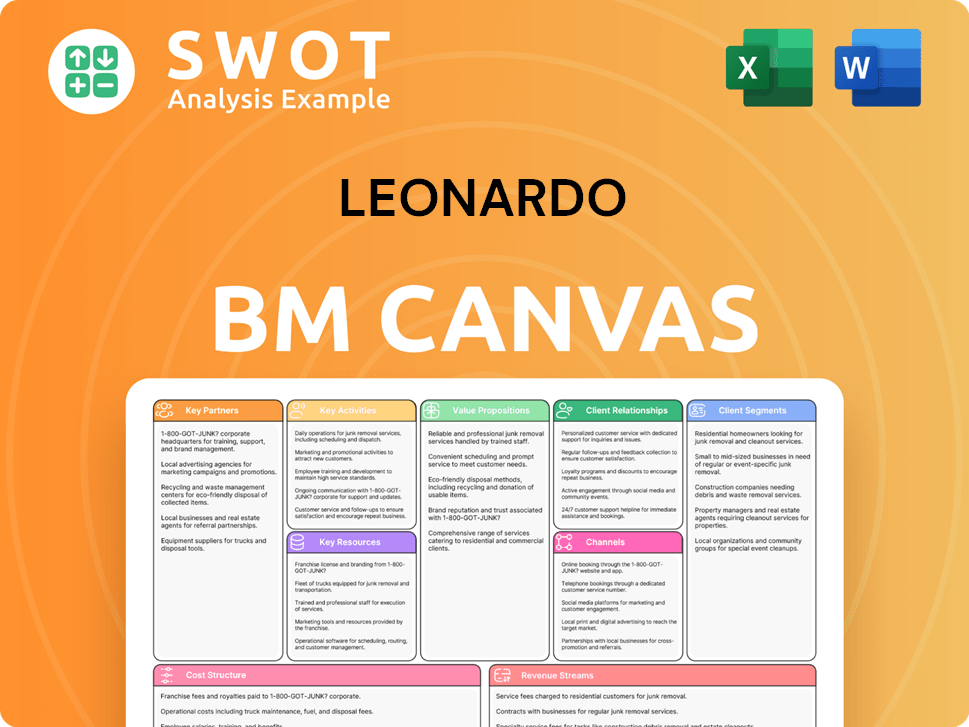

Leonardo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Leonardo’s Ownership Landscape?

Over the past few years, roughly spanning from 2022 to 2025, the ownership structure of Leonardo S.p.A. has largely remained consistent. The Italian Ministry of Economy and Finance continues to hold a significant stake, ensuring stable control. There haven't been any major shifts in the government's holding, which stands at approximately 30.2%, maintaining its influence over this key national asset. The focus has been on strategic portfolio optimization and increasing operational efficiency.

Institutional investors have played a dynamic role in the public float, reflecting broader trends in the aerospace, defense, and security sectors. This sector has seen increased institutional ownership globally, driven by its resilience and long-term contract visibility. While founder dilution isn't applicable to Leonardo, given its state-originated nature, the company has seen evolving participation from various institutional funds. The company has continued to streamline its portfolio, focusing on core businesses like helicopters, aircraft, and electronics. For more insights into the company's operations, you can explore Revenue Streams & Business Model of Leonardo.

| Ownership Category | Approximate Percentage | Notes |

|---|---|---|

| Italian Ministry of Economy and Finance | 30.2% | Consistent control, strategic influence. |

| Institutional Investors | Variable | Public float participation, reflecting market trends. |

| Other Shareholders | Variable | Includes public market participants. |

Public statements from Leonardo and analysts often highlight the stability provided by the government's anchor shareholding. This can be viewed as both a strength, offering long-term strategic alignment, and potentially a constraint on purely commercial decisions. There have been no public announcements regarding a planned privatization or a significant reduction in the government's stake. The company's future ownership is likely to remain a mixed model, balancing state control with public market participation, reflecting its dual role as a strategic national asset and a publicly traded global enterprise.

The Italian government maintains a significant stake in Leonardo, ensuring strategic control. Institutional investors actively participate in the public float. The ownership structure reflects a balance between state control and public market participation.

No major shifts in government ownership have been reported. The company focuses on strategic portfolio optimization and operational efficiency. Increased institutional ownership is a trend in the sector.

Government control provides long-term strategic alignment. State ownership can sometimes constrain purely commercial decisions. The mixed model reflects Leonardo's dual role as a national asset and a global enterprise.

The current mixed ownership model is likely to continue. No plans for privatization or significant stake reduction have been announced publicly. The company will likely maintain a balance between state control and public market participation.

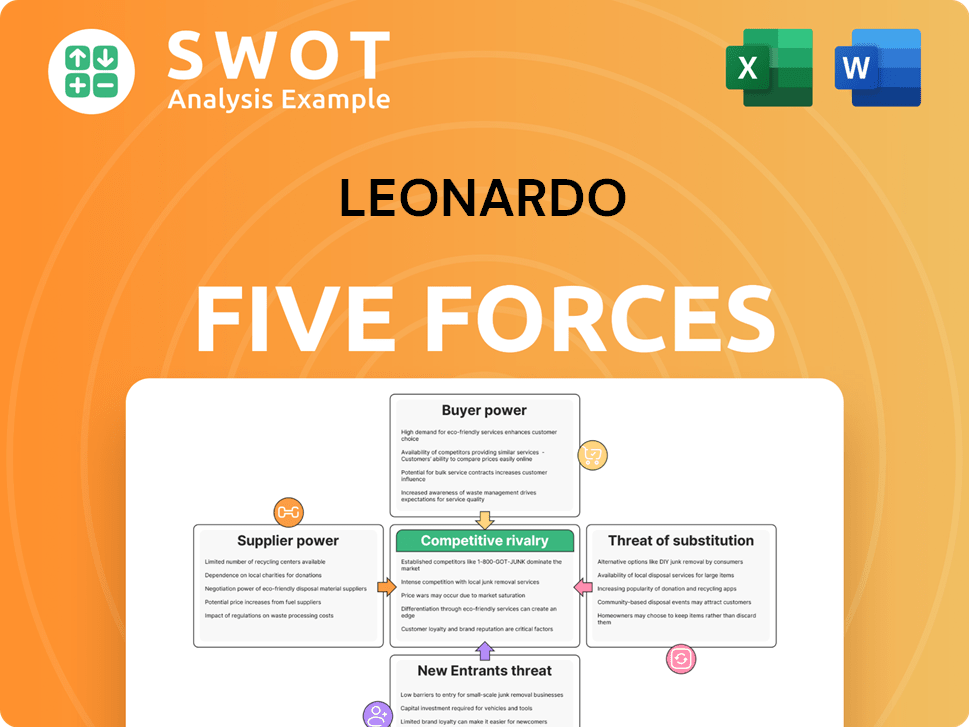

Leonardo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Leonardo Company?

- What is Competitive Landscape of Leonardo Company?

- What is Growth Strategy and Future Prospects of Leonardo Company?

- How Does Leonardo Company Work?

- What is Sales and Marketing Strategy of Leonardo Company?

- What is Brief History of Leonardo Company?

- What is Customer Demographics and Target Market of Leonardo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.