LKQ Bundle

How Did LKQ Corporation Rise to Automotive Aftermarket Dominance?

LKQ Company's story is a compelling tale of strategic vision and relentless execution, transforming the auto salvage landscape since 1998. From its humble beginnings, LKQ Corporation identified an opportunity to revolutionize the vehicle repair industry. This brief history of LKQ details how it consolidated a fragmented market and became a global leader in providing cost-effective, high-quality auto parts.

LKQ's journey began with strategic LKQ acquisitions, quickly expanding its footprint across the United States. The company's innovative LKQ business model, focusing on recycled and aftermarket parts, disrupted traditional practices. Understanding LKQ's history provides valuable insights into its current market position and future potential. For a deeper dive, consider exploring the LKQ SWOT Analysis.

What is the LKQ Founding Story?

The LKQ Company, a prominent player in the automotive industry, has a compelling founding story. The company's origins are rooted in the vision of Donald Flynn, who saw an opportunity to consolidate the fragmented used auto parts market.

Flynn, drawing on his experience from Waste Management, established LKQ Corporation in February 1998. His goal was to bring efficiency and standardization to an industry dominated by small, independent businesses. The name 'LKQ' itself, derived from 'Like-Kind-Quality,' reflected the company's focus on providing reliable, high-quality alternative parts.

LKQ's initial strategy involved acquiring existing businesses to build a strong foundation. The first acquisitions were completed in February 1998, marking the beginning of LKQ's growth through strategic investments.

Here's a closer look at the key aspects of LKQ's founding:

- Founded in February 1998: LKQ Corporation was established by Donald Flynn.

- Inspiration from Waste Management: Flynn's background influenced his vision to consolidate the auto parts market.

- Initial Acquisitions: The first three acquisitions were completed in February 1998, including Triplett Auto Recyclers, Damron Auto Parts, and Star Auto Parts.

- Name Origin: 'LKQ' stands for 'Like-Kind-Quality,' emphasizing the quality of used parts.

The used auto parts market, estimated at $8 billion at the time, was highly fragmented, with over 11,000 junkyards across the United States. These businesses often lacked modern inventory systems, creating an opportunity for LKQ to introduce efficiency and improve customer service. The acquisition of Triplett Auto Recyclers, a 50-year-old family business, brought in expertise in salvaging and recycling methods. Stuart P. Willen, the former owner of Triplett, and other sellers received stock in LKQ, aligning their interests with the company's success.

Joseph M. Holsten, formerly the COO of Waste Management, was appointed CEO in November 1998. Initial funding for LKQ came from H. Wayne Huizenga's AutoNation and Dean L. Buntrock, both co-founders of Waste Management. This early financial backing helped LKQ establish itself as a significant player in the auto parts market.

LKQ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of LKQ?

The early growth of the LKQ Corporation, a key part of the

LKQ's

A significant milestone was the initial public offering (IPO) on the NASDAQ in 2003, under the symbol LKQX, which raised $91 million. In 2004, the company diversified into the aftermarket parts sector with the acquisition of Action Crash Parts. This strategic move allowed LKQ to launch aftermarket programs in new markets, expanding beyond recycled parts.

Further expansion included the acquisition of Transwheel/Transmetco in 2006, enabling wheel restoration, and Keystone Automotive Industries in 2007. By 2008, LKQ entered the heavy-duty truck recycling business with Texas Best Diesel. In 2009, LKQ acquired GreenLeaf Auto Recyclers, initially established by Ford Motor Company.

The remanufacturing space began in 2010 with PROFormance, followed by ATK Vege Engines and Yamato in 2011. International expansion started in 2011 with Euro Car Parts in the UK. This was followed by Sator Beheer in 2013, and Rhiag-Inter Auto Parts Italia in 2016. By 2024, LKQ Europe's revenue was at $6.4 billion, supplying parts to approximately 100,000 independent workshops in over 18 European countries. These strategic initiatives transformed LKQ from a domestic auto salvage company into a global provider of vehicle products and services.

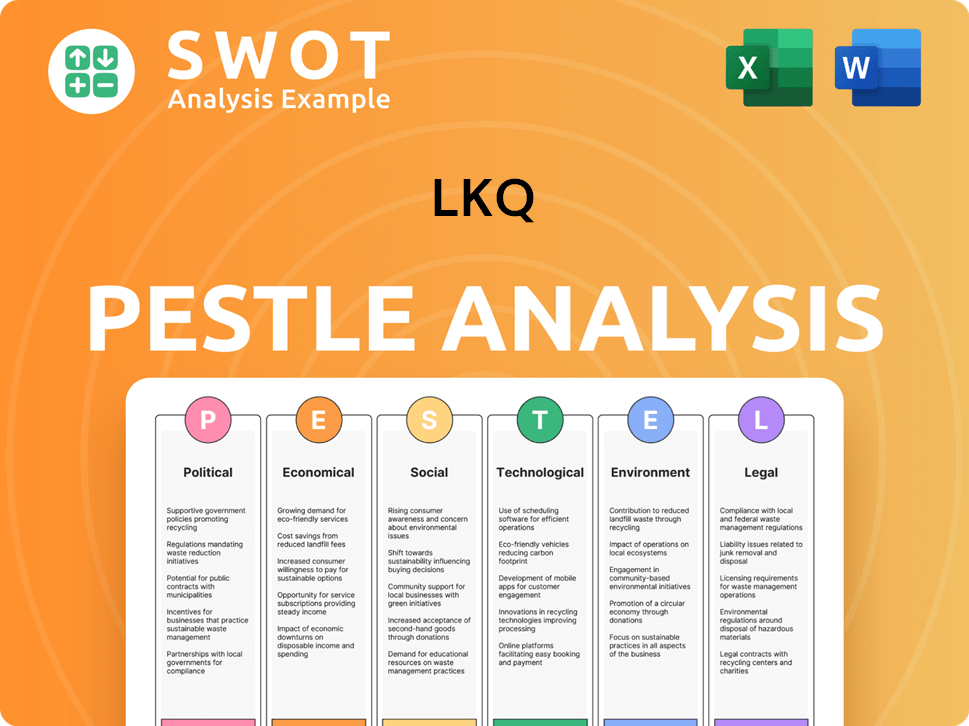

LKQ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in LKQ history?

The LKQ Corporation has a rich LKQ history marked by strategic moves and significant growth in the automotive aftermarket industry. The company's journey includes key acquisitions and innovations that have shaped its current position as a leading provider of automotive parts and services. Understanding the LKQ Company timeline reveals its evolution from a small player to a major industry force.

| Year | Milestone |

|---|---|

| 1998 | Founded with the aim to consolidate the fragmented auto salvage industry. |

| 2003 | Completed an initial public offering (IPO), marking a significant step in its growth. |

| 2007 | Acquired Keystone Automotive Industries, expanding its presence in the aftermarket parts sector. |

| 2011 | Acquired Euro Car Parts in the UK, broadening its European footprint. |

| 2016 | Acquired Rhiag-Inter Auto Parts Italia, strengthening its position in the European market. |

| 2017 | Acquired Stahlgruber, further expanding its reach in Europe. |

LKQ Corporation has been a pioneer in the automotive aftermarket, particularly in the used and recycled auto parts sector. The company's LKQ business model has focused on sustainability and efficiency, processing a large volume of vehicles and offering a wide range of parts.

LKQ Corporation institutionalized the fragmented auto salvage industry, bringing professional standards. This approach has set a new benchmark for the sector.

The company processes a large number of vehicles, contributing to reduced waste and emissions. In 2024, they processed 735,000 vehicles, showcasing their commitment to environmental sustainability.

LKQ Corporation has implemented advanced technologies, such as in-cab monitoring systems in its North American fleet. This has resulted in a nearly 40% reduction in on-the-road accidents.

The company has made numerous acquisitions to expand its product offerings and geographic reach. These acquisitions have been a core part of its expansion strategy.

LKQ Corporation continually focuses on improving its operational efficiency. This includes cost management and synergy realization to navigate market challenges effectively.

The company's sustainability report highlights its three-pillar strategy, focusing on sustainable solutions, people-led performance, and ethical practices. This demonstrates LKQ Corporation's commitment to environmental responsibility.

Despite its successes, LKQ Corporation has faced challenges, including market fluctuations and economic factors. The company has responded to these challenges through strategic initiatives and operational adjustments. For more details on the LKQ Company's growth strategy, you can read about it in the growth strategy of LKQ.

The company experienced softer overall volumes in the third quarter of 2024. This has led to a focus on executing strategic transformations to adapt to market conditions.

Revenue for the fourth quarter of 2024 decreased by 4.1% compared to the same period in 2023. This decline was primarily due to a 3.6% decrease in organic parts and services revenue.

For the full year 2024, diluted EPS decreased by 25.4% compared to 2023, and adjusted diluted EPS decreased by 9.1%. The first quarter of 2025 also saw a 6.5% decrease in revenue compared to Q1 2024.

In response to challenges, LKQ Corporation has focused on operational excellence and cost management. The company's agility in managing operating expenses has been crucial.

The company is navigating difficult macroeconomic environments. This requires strategic adjustments to maintain profitability and market position.

LKQ Corporation focuses on synergy realization to improve financial performance. This helps in overcoming market challenges and maximizing returns.

LKQ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for LKQ?

The LKQ Corporation, founded by Donald Flynn, has a rich LKQ history marked by strategic growth and significant LKQ acquisitions. From its humble beginnings in 1998, the company quickly expanded its network of auto salvage yards and broadened its LKQ business model to become a global leader in the automotive aftermarket.

| Year | Key Event |

|---|---|

| 1998 | Donald Flynn founded LKQ Corporation in February, initiating the company with acquisitions of wholesale recycled-products businesses. |

| 1999 | LKQ expanded rapidly, acquiring a total of 35 companies and significantly increasing its network of auto salvage yards. |

| 2003 | LKQ went public on the NASDAQ under the symbol LKQX, marking a significant milestone in its growth. |

| 2004 | LKQ entered the aftermarket parts business through the acquisition of Action Crash Parts and also entered the self-service business. |

| 2007 | Keystone Automotive Industries was acquired, further solidifying LKQ's position in the auto parts industry. |

| 2008 | LKQ entered the heavy-duty truck recycling business, diversifying its offerings. |

| 2009 | GreenLeaf Auto Recyclers, a major competitor in recycled parts, was acquired. |

| 2011 | LKQ expanded into Europe with the acquisition of Euro Car Parts in the UK. |

| 2013 | Sator Beheer was acquired, expanding LKQ's operations into the Netherlands, Belgium, Luxembourg, and Northern France. |

| 2016 | Rhiag-Inter Auto Parts Italia, a leading pan-European distributor, was acquired, along with Pittsburgh Glass Works. |

| 2017 | Stahlgruber was acquired, further strengthening LKQ's presence in continental Europe. |

| 2024 | LKQ reported full-year revenue of $14.4 billion, processed 735,000 vehicles, sold nearly 12 million salvaged parts, and divested operations in Poland and Bosnia. |

| 2025 | LKQ announced Q1 2025 results with revenue of $3.5 billion and published its 2024 Global Sustainability Report. |

LKQ's 2024 full-year revenue reached $14.4 billion, demonstrating strong financial performance. The company's Q1 2025 revenue was reported at $3.5 billion. Analysts project an EPS of $3.61 for fiscal 2025, a 3.7% increase from fiscal 2024.

The company's 'Charting Our Future' strategy, launched in 2024, focuses on operational excellence and sustainable growth. LKQ plans to expand salvage and remanufacturing operations in Europe. The company aims for 0% to 2% organic revenue growth for parts and services in 2025.

LKQ is committed to sustainability, aiming to reduce global Scope 1 and 2 emissions by 30% by 2030 compared to a 2022 baseline. The company is targeting net-zero emissions by 2050. They achieved their goal of 20% female representation in the global workforce in 2024.

LKQ prioritizes shareholder returns, having repurchased $80 million of shares in the fourth quarter of 2024. In 2024, over 80% of free cash flow was returned to shareholders through share repurchases and cash dividends. The company projects operating cash flow between $1.075 billion and $1.275 billion for 2025.

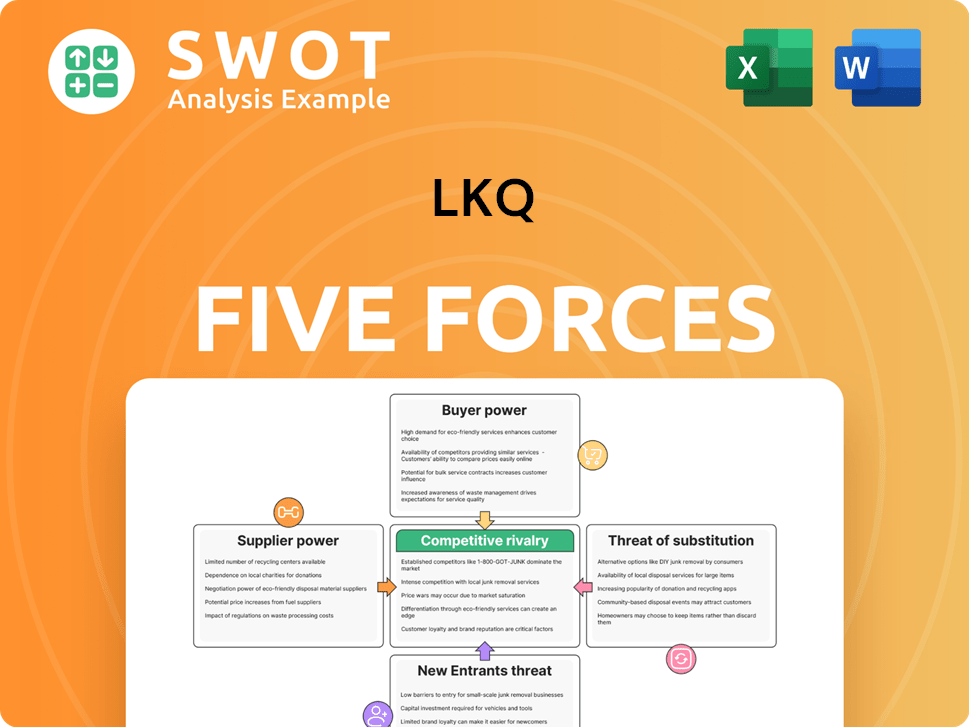

LKQ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of LKQ Company?

- What is Growth Strategy and Future Prospects of LKQ Company?

- How Does LKQ Company Work?

- What is Sales and Marketing Strategy of LKQ Company?

- What is Brief History of LKQ Company?

- Who Owns LKQ Company?

- What is Customer Demographics and Target Market of LKQ Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.