LKQ Bundle

How Does LKQ Corporation Thrive in the Auto Parts Market?

LKQ Corporation, a global powerhouse, dominates the alternative vehicle parts industry, boasting over $13.9 billion in revenue in 2023. This financial giant offers a compelling solution for cost-effective and sustainable vehicle repairs, serving both North America and Europe. With its extensive reach and comprehensive product offerings, LKQ significantly impacts the automotive repair ecosystem.

This deep dive will explore the LKQ SWOT Analysis, examining its core value propositions, diverse revenue streams, and strategic advantages. Understanding the LKQ business model is crucial for investors evaluating its long-term potential, while customers benefit from insights into LKQ parts availability. We'll dissect how LKQ Company generates profit and maintains its market leadership, covering aspects like LKQ auto parts, its history, and its impact on the environment.

What Are the Key Operations Driving LKQ’s Success?

The core operations of LKQ Corporation revolve around sourcing, processing, and distributing a wide array of vehicle products. This includes recycled OEM parts, aftermarket collision and mechanical parts, refurbished engines and transmissions, and automotive paint and supplies. The company's primary customers are collision and mechanical repair shops, but they also serve dealerships, new car manufacturers, and individual consumers. The LKQ business model focuses on providing cost-effective and sustainable solutions within the automotive parts market.

LKQ Company acquires salvage vehicles, primarily from insurance companies, and dismantles them to recover usable parts. These parts are then inspected, cataloged, and warehoused. The company also sources aftermarket parts through a global network, ensuring they meet quality standards. This operational model allows LKQ to offer a broad selection of parts with rapid delivery times, a critical factor for repair shops. The company's supply chain is highly integrated, encompassing salvage yards, dismantling facilities, warehouses, and a vast distribution network.

The value proposition of LKQ Corporation lies in offering high-quality, affordable alternatives to new OEM parts. This approach helps reduce repair costs for consumers and promotes environmental sustainability through recycling and reconditioning. The company's operational effectiveness stems from its economies of scale, extensive inventory, and efficient logistics. For more insights into the company's structure, you can explore Owners & Shareholders of LKQ.

LKQ auto parts are categorized into several key areas. These include recycled OEM parts, aftermarket collision parts, and mechanical components. The company also offers refurbished engines and transmissions, along with automotive paint and supplies. This diverse product range caters to various vehicle repair needs.

LKQ Company sources parts through a multifaceted supply chain. This includes acquiring salvage vehicles, a global network for aftermarket parts, and efficient logistics. The supply chain is highly integrated, from salvage yards to distribution centers, ensuring a steady flow of LKQ parts.

The primary customers for LKQ are collision and mechanical repair shops. The company also serves dealerships, new car manufacturers, and individual consumers. This broad customer base reflects the diverse needs for LKQ auto parts and services.

LKQ Corporation provides high-quality, affordable alternatives to new OEM parts. This value proposition reduces repair costs and promotes environmental sustainability. The focus on recycled and reconditioned parts offers significant cost savings for consumers.

LKQ's operational strengths include economies of scale, an extensive inventory, and efficient logistics. These factors enable rapid delivery and a broad selection of parts. The company's integrated supply chain ensures operational efficiency.

- Extensive inventory management systems.

- Efficient distribution network, including company-owned fleets.

- Global sourcing capabilities for aftermarket parts.

- Focus on providing cost-effective solutions.

LKQ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does LKQ Make Money?

The LKQ Corporation generates revenue through a multifaceted approach, primarily centered on the automotive parts industry. Their business model focuses on providing a wide range of products, from recycled and aftermarket parts to refurbished engines and transmissions. This comprehensive strategy allows them to serve various customer needs within the automotive repair and maintenance sector.

Key revenue streams for LKQ Company include sales from its North American and European segments, encompassing a diverse portfolio of products. The company strategically sources and distributes parts, leveraging its extensive network and operational capabilities to meet market demands. This approach supports their overall financial performance and market position.

The company's ability to monetize its operations is significantly influenced by its pricing strategies and product offerings. LKQ auto parts are sold through various channels, including direct sales and partnerships with repair shops. They also focus on cross-selling opportunities to maximize revenue from each customer interaction.

The primary revenue streams for LKQ Corporation are derived from the sale of automotive parts. This includes recycled OEM parts, aftermarket collision parts, and mechanical products. The company also generates revenue from the sale of refurbished engines and transmissions, as well as automotive paint and supply products. LKQ's monetization strategies involve competitive and value-based pricing, catering to different customer segments and product types. A deeper understanding of LKQ's growth strategy can be found in this article: Growth Strategy of LKQ.

- Product Sales: The majority of LKQ's revenue comes from selling recycled OEM and aftermarket parts.

- Pricing Strategies: The company uses competitive pricing for aftermarket parts and value-based pricing for recycled OEM components.

- Cross-Selling: LKQ offers a wide range of products and services to repair shops, encouraging them to fulfill all their parts needs through LKQ.

- Strategic Acquisitions: Over time, LKQ has expanded its revenue sources through strategic acquisitions, integrating new product lines and market segments.

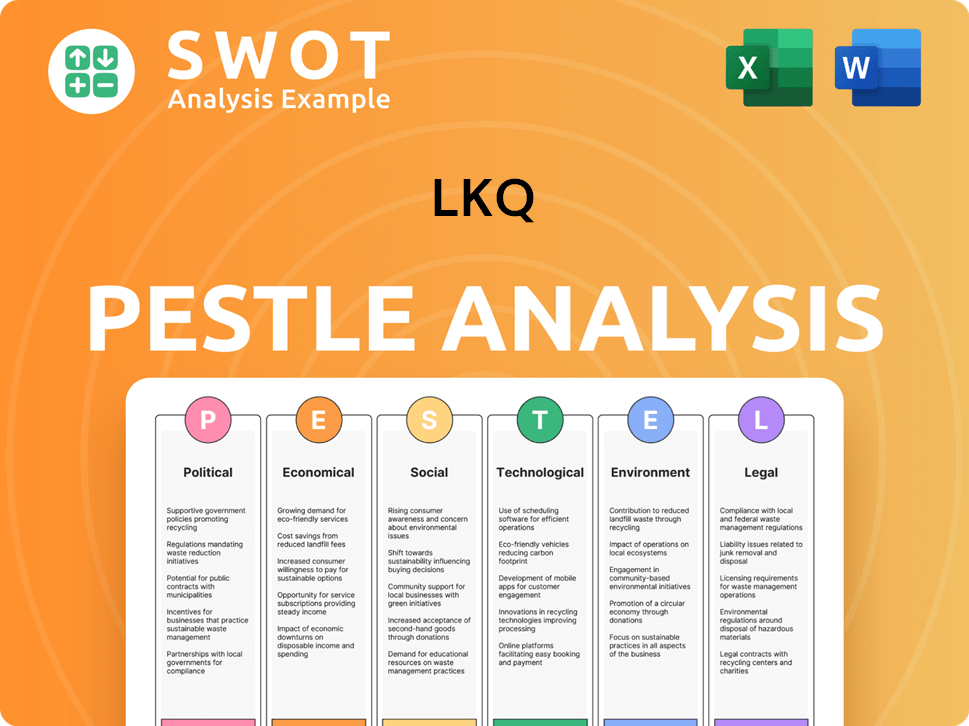

LKQ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped LKQ’s Business Model?

The story of LKQ Corporation is one of strategic growth, marked by key acquisitions that have reshaped the automotive parts industry. Its journey includes significant moves in the aftermarket collision parts sector and a growing global presence. The company's ability to adapt to market changes has been crucial to its success.

A pivotal moment for LKQ Corporation was the acquisition of Keystone Automotive Industries in 2007. This expanded its reach in the aftermarket collision parts sector. More recently, the purchase of Uni-Select Inc. in 2023 for around $2.1 billion further solidified its global footprint. These strategic moves have been central to LKQ's business model and its ability to meet the evolving demands of the automotive industry.

The company has navigated challenges like supply chain disruptions by leveraging its extensive inventory and diverse sourcing channels. LKQ benefits from economies of scale, lowering per-unit costs. Its vast inventory of recycled OEM parts provides a cost-effective, environmentally friendly option. The company continues to adapt, investing in reconditioning and expanding its offerings to meet changing vehicle specifications. For more insights, you can explore the Marketing Strategy of LKQ.

The acquisition of Keystone Automotive Industries in 2007 was a major step. This acquisition significantly expanded LKQ's presence in the aftermarket collision parts sector. The purchase of Uni-Select Inc. in 2023 for approximately $2.1 billion further strengthened its global position.

Strategic acquisitions have been central to LKQ's growth. The company has focused on expanding its product offerings. It has also enhanced its distribution network to better serve customers.

LKQ offers a vast inventory of recycled OEM parts, providing cost-effective and environmentally friendly alternatives. The company's extensive distribution network and strong relationships with repair shops contribute to its brand strength. It benefits from economies of scale, which helps to lower costs.

LKQ is investing in reconditioning capabilities. It is also expanding its offerings of new aftermarket parts to meet evolving vehicle specifications. The company is adapting to the increasing complexity of vehicle technology.

The company's competitive advantages include a vast inventory of recycled OEM parts and significant economies of scale. LKQ benefits from a strong distribution network and strong relationships with repair shops. These factors contribute to its brand strength and customer loyalty.

- Extensive inventory of recycled OEM parts.

- Economies of scale in sourcing, processing, and distribution.

- Strong distribution network and customer relationships.

- Adaptation to new trends in vehicle technology.

LKQ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is LKQ Positioning Itself for Continued Success?

The LKQ Corporation holds a prominent position in the global automotive aftermarket parts industry. It has a substantial market share in North America and is expanding its presence in Europe. Its extensive product catalog and robust distribution network contribute to strong customer loyalty among collision and mechanical repair shops. In 2023, LKQ reported a total revenue of $13.9 billion, underscoring its strong market presence.

Despite its strong market position, LKQ faces several key risks. These include potential regulatory changes impacting vehicle repair practices, intense competition, and the ongoing technological disruption within the automotive industry, such as the shift towards electric vehicles (EVs). Changes in consumer preferences could also impact revenue. To learn more about the company's origins, check out the Brief History of LKQ.

LKQ is a leading player in the automotive aftermarket, specializing in LKQ parts and LKQ auto parts. It has a significant market share, especially in North America. The company's strong distribution network helps it maintain a competitive edge.

The company faces risks from regulatory changes, competition from other parts distributors, and technological advancements like EVs. Shifts in consumer preferences towards new OEM parts could also affect revenue. These factors could influence the LKQ business model.

LKQ focuses on strategic initiatives to drive growth, including investments in European operations and supply chain optimization. The company aims to leverage its operational efficiencies to maintain its competitive edge. This includes expanding offerings for the evolving automotive repair market.

The automotive aftermarket is dynamic, influenced by factors like vehicle technology and consumer behavior. Understanding these dynamics is crucial for LKQ to maintain its market position. The company's ability to adapt to these changes will be key to its future success.

LKQ's future strategy involves several key initiatives aimed at sustaining and expanding its market presence. These initiatives are designed to address the evolving needs of the automotive repair market and capitalize on emerging opportunities.

- Continued investment in European operations to capture growth opportunities.

- Optimization of the supply chain to improve efficiency and reduce costs.

- Expansion of product offerings to cater to the growing demand for EV parts.

- Leveraging scale and operational efficiencies to maintain a competitive edge.

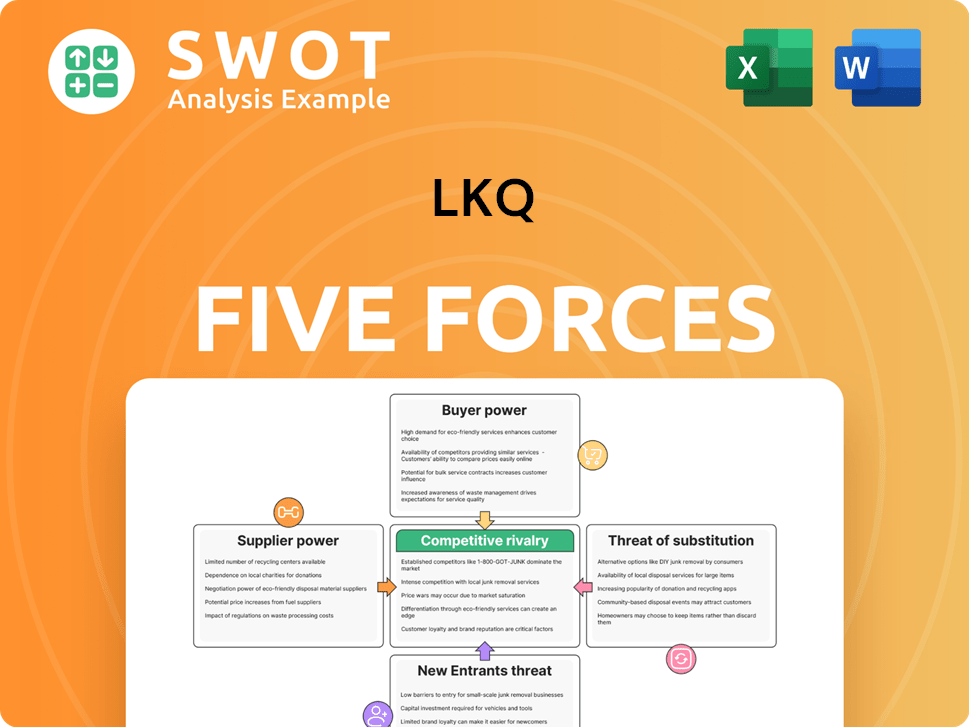

LKQ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LKQ Company?

- What is Competitive Landscape of LKQ Company?

- What is Growth Strategy and Future Prospects of LKQ Company?

- What is Sales and Marketing Strategy of LKQ Company?

- What is Brief History of LKQ Company?

- Who Owns LKQ Company?

- What is Customer Demographics and Target Market of LKQ Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.