LKQ Bundle

Can LKQ Corporation Maintain Its Momentum?

LKQ Corporation's strategic acquisition of Uni-Select Inc. in late 2023 signaled a bold move, reshaping its global footprint and solidifying its position in the automotive aftermarket. From its inception in 1998, LKQ has evolved from a disruptor in the recycled parts market to a multinational powerhouse. This LKQ SWOT Analysis will explore the company's growth trajectory.

This comprehensive analysis will delve into LKQ's LKQ growth strategy and LKQ future prospects, examining its LKQ business model and market position. We'll explore LKQ company analysis, including LKQ market share and potential challenges. Understanding LKQ financial performance is crucial to assessing its long term growth potential and navigating the competitive landscape analysis.

How Is LKQ Expanding Its Reach?

The expansion initiatives of LKQ Corporation are designed to bolster its market leadership through both geographical expansion and product diversification. A significant move was the acquisition of Uni-Select Inc. in Q4 2023, which considerably strengthened LKQ's presence in the North American and UK automotive aftermarket, particularly in the automotive refinish and industrial coatings sectors. This strategic acquisition aimed to reach new customer segments and diversify revenue streams beyond traditional mechanical and collision parts.

LKQ's strategy includes organic growth within its existing segments. In Europe, the company is expanding its footprint in the wholesale parts distribution market, leveraging its strong network and logistics capabilities. The company is also exploring new business models, such as subscription services for certain diagnostic tools or parts procurement, to cater to evolving customer needs and secure recurring revenue streams. The company's Owners & Shareholders of LKQ are likely to be interested in the company's growth strategies.

The integration of Uni-Select is projected to yield approximately $50 million in annual run-rate cost synergies within three years, contributing to enhanced profitability. LKQ's focus on organic growth is evident in Europe, where the company reported a 4.1% increase in like-for-like revenue in the first quarter of 2024, demonstrating consistent growth in its core markets. This growth is partly driven by an expanding product pipeline, including an increased offering of parts for electric vehicles (EVs) and advanced driver-assistance systems (ADAS), aligning with the broader industry shift towards new automotive technologies.

This acquisition expanded LKQ's reach in the North American and UK automotive aftermarket. It provided access to new customer segments and diversified revenue streams. The integration is expected to generate $50 million in annual cost synergies within three years.

LKQ is growing its presence in the European wholesale parts distribution market. The company reported a 4.1% increase in like-for-like revenue in Q1 2024. This growth is supported by an expanding product pipeline, including parts for EVs and ADAS.

LKQ's expansion strategies focus on both acquisitions and organic growth to strengthen its market position and financial performance. The company is actively pursuing strategic acquisitions to broaden its market presence and product offerings, as demonstrated by the Uni-Select acquisition. Simultaneously, LKQ is investing in organic growth initiatives, such as expanding its product lines to include parts for EVs and ADAS, and exploring new business models like subscription services.

- Strategic Acquisitions: Targeting companies to expand market reach and product offerings.

- Organic Growth: Expanding product lines to include parts for EVs and ADAS.

- New Business Models: Exploring subscription services to secure recurring revenue.

- Geographical Expansion: Strengthening presence in key markets like Europe.

LKQ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does LKQ Invest in Innovation?

The automotive industry is rapidly evolving, and the company, LKQ Corporation, is adapting through strategic investments in innovation and technology. This approach is crucial for maintaining its competitive edge and driving sustained growth in a dynamic market. The company’s focus on digital transformation, data analytics, and cutting-edge technologies reflects its commitment to enhancing operational efficiency and improving customer experiences.

LKQ's innovation strategy is multifaceted, encompassing advancements in inventory management, supply chain optimization, and the integration of new technologies to meet the changing needs of the automotive aftermarket. The company's ability to adapt to emerging trends, such as the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is vital for its long-term success. By investing in research and development and expanding its service offerings, LKQ aims to capitalize on new market opportunities.

Furthermore, LKQ is committed to sustainability initiatives, promoting the use of recycled and remanufactured parts. This approach not only contributes to environmental responsibility but also offers cost-effective solutions for customers. This commitment to innovation and technological adaptation positions LKQ to capitalize on emerging market trends and maintain its leadership in the evolving automotive aftermarket.

LKQ is investing heavily in digital technologies to streamline operations and improve customer service. This includes implementing advanced inventory management systems and enhancing its online platforms for parts sales. These efforts are designed to create a more efficient and user-friendly experience for customers.

The company utilizes data analytics to optimize its supply chain, predict market trends, and make informed business decisions. By analyzing vast amounts of data, LKQ can improve its inventory management and ensure the timely delivery of parts. This data-driven approach is crucial for maintaining a competitive edge.

LKQ is adapting to the growing market for electric vehicles (EVs) and vehicles with advanced driver-assistance systems (ADAS). This includes investing in R&D to expand its offering of EV-specific parts and developing expertise in servicing these newer vehicle technologies. This strategic focus ensures LKQ remains relevant in the evolving automotive landscape.

Advanced inventory management systems are crucial for LKQ's efficiency. These systems help optimize the supply chain and ensure the timely delivery of parts. This is a critical factor in the repair and maintenance sector, where quick access to parts is essential.

LKQ emphasizes sustainability by promoting the use of recycled and remanufactured parts. This not only benefits the environment but also provides cost-effective solutions for customers. These initiatives are part of LKQ's broader commitment to corporate social responsibility.

LKQ invests in training its technicians to handle the complex electronic systems found in modern vehicles. This includes expanding diagnostic capabilities to cater to the advanced technologies in today's cars. This ensures that LKQ can provide top-tier service.

LKQ's commitment to innovation and technology is a key component of its LKQ growth strategy. The company's investments in digital transformation, data analytics, and adapting to new vehicle technologies, such as EVs and ADAS, are designed to enhance operational efficiency and customer experience. These initiatives are crucial for maintaining LKQ's market share and driving LKQ future prospects. The company's focus on sustainability, through the use of recycled and remanufactured parts, also contributes to its long-term growth potential. By strategically investing in these areas, LKQ aims to remain a leader in the automotive aftermarket, capitalizing on emerging market trends and maintaining its position in the LKQ competitive landscape analysis.

LKQ's technological investments are focused on improving efficiency, enhancing customer experience, and adapting to industry changes. These investments are essential for maintaining the company's competitive advantage and driving sustained growth.

- Digital Transformation: Implementation of advanced inventory management systems and online platforms.

- Data Analytics: Utilizing data to optimize supply chains and predict market trends.

- EV and ADAS Adaptation: Investing in R&D for EV-specific parts and technician training.

- Sustainability: Promoting the use of recycled and remanufactured parts.

- Technician Training: Expanding diagnostic capabilities to service modern vehicles.

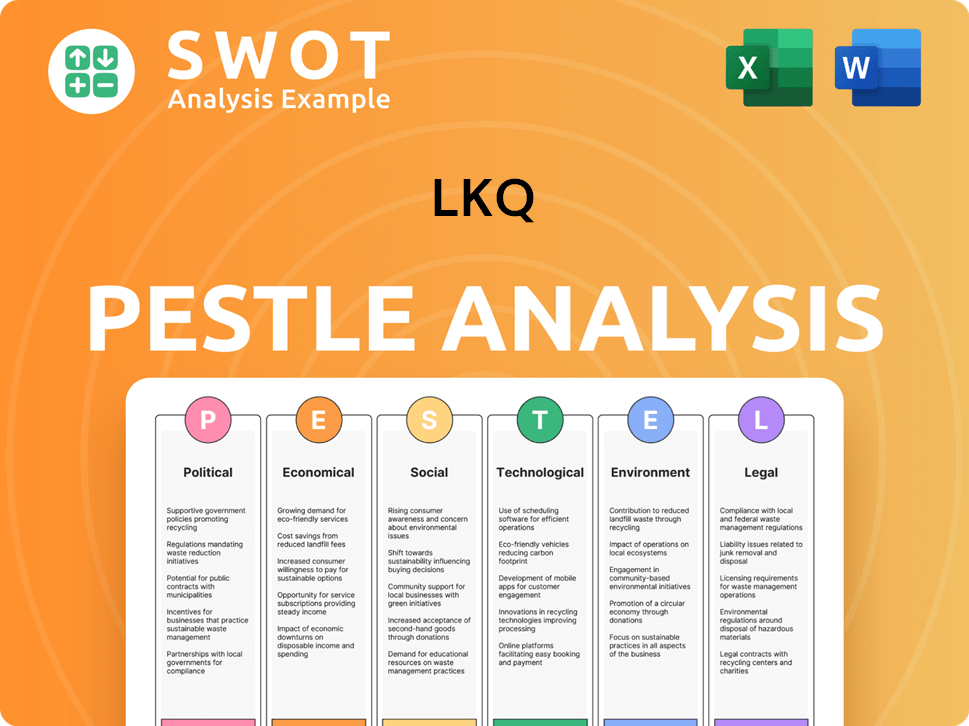

LKQ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is LKQ’s Growth Forecast?

The financial outlook for LKQ Corporation is centered on sustained growth, driven by strategic acquisitions, operational efficiencies, and adaptation to market trends. The company's approach demonstrates a commitment to enhancing shareholder value and maintaining healthy profit margins within the automotive parts distribution industry. This strategy is supported by a track record of growth and profitability.

For the first quarter of 2024, LKQ reported revenue of $3.7 billion, marking a significant increase. This growth was largely fueled by the acquisition of Uni-Select Inc., which contributed to a substantial increase in parts and services organic revenue. The company's financial performance reflects its ability to integrate new acquisitions and drive organic growth effectively. The company's strategic moves and financial results are key elements in any LKQ company analysis.

Looking ahead, LKQ has provided an optimistic outlook for the full year 2024. The company projects diluted earnings per share from continuing operations to be in the range of $3.90 to $4.20. This forecast is supported by continued strong demand in the automotive aftermarket and the realization of synergies from recent acquisitions. LKQ's financial performance is a key factor in understanding its LKQ future prospects.

LKQ's revenue for Q1 2024 was $3.7 billion, a 10.7% increase compared to the same period in 2023. This growth reflects the company's ability to expand its market presence and capitalize on opportunities within the automotive aftermarket. The company's revenue growth trends are a key indicator of its overall performance.

Diluted earnings per share from continuing operations for Q1 2024 stood at $0.98. The company's guidance for the full year 2024 projects EPS to be between $3.90 and $4.20. This demonstrates the company's commitment to profitability and its positive outlook for the future. Analyzing LKQ's profitability is essential.

LKQ expects free cash flow to be in the range of $800 million to $900 million for 2024. This robust cash generation capability allows the company to reinvest in growth initiatives or return capital to shareholders. This strong cash flow is a key aspect of LKQ's financial performance.

The acquisition of Uni-Select Inc. significantly boosted revenue growth. This strategic move highlights LKQ's LKQ expansion strategies and its ability to integrate and leverage new businesses. This also gives insight into the company's acquisition history.

LKQ's focus on operational improvements and strategic expansion suggests a commitment to enhancing shareholder value. The company's financial ambitions are well-aligned with its historical performance, demonstrating a track record of growth and profitability within the automotive parts distribution industry. Understanding the Competitors Landscape of LKQ is crucial for investors.

The automotive aftermarket's continued strong demand supports LKQ's positive outlook. The company's ability to adapt to market trends and capitalize on opportunities is a key factor in its success. This is essential for understanding the LKQ industry outlook.

LKQ's strategic acquisitions and operational efficiencies are central to its growth strategy. These initiatives enhance the company's market share and its ability to deliver value to shareholders. This is a key aspect of the LKQ business model.

The company's financial goals are underpinned by its historical performance. LKQ's consistent focus on operational improvements and strategic expansion demonstrates a commitment to enhancing shareholder value and maintaining healthy profit margins. This analysis provides insights into LKQ's long term growth potential.

The expected free cash flow of $800 million to $900 million in 2024 indicates strong cash generation. This allows for reinvestment in growth initiatives or returns to shareholders, supporting the company's financial goals. This is a key element of LKQ's investor relations.

While specific long-term revenue targets are not always explicitly stated, LKQ's consistent focus on operational improvements and strategic expansion suggests a commitment to enhancing shareholder value. This demonstrates LKQ's long term growth potential.

LKQ's emphasis on operational efficiencies contributes to its overall financial performance. This focus helps the company maintain healthy profit margins and drive sustainable growth. The company's supply chain management is crucial for its operational efficiency.

LKQ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow LKQ’s Growth?

The growth strategy of the company faces several risks and obstacles within the automotive aftermarket industry. The competitive landscape, regulatory shifts, and supply chain vulnerabilities present ongoing challenges. Furthermore, adapting to technological advancements and managing internal integrations are crucial for sustained success.

Market competition remains a significant hurdle, with a fragmented market and increasing pressure from original equipment manufacturers (OEMs). Regulatory changes, particularly concerning vehicle safety and environmental standards, could impact the cost of doing business. The company's reliance on a global supplier network also introduces supply chain risks.

Technological disruption, such as the rise of electric vehicles (EVs), necessitates continuous adaptation. The company must also effectively manage the integration of large acquisitions to achieve projected synergies. Addressing these risks requires a proactive approach, including diversification, robust risk management, and scenario planning.

The automotive aftermarket is highly competitive, with numerous independent distributors and OEMs. The company's market share is constantly challenged by these entities. Competitive pricing and service offerings are crucial for maintaining and growing its market position.

Changes in vehicle safety standards, environmental regulations, and trade policies can significantly impact the company. Compliance costs and the availability of certain parts may be affected. Evolving regulations regarding vehicle repair and data access could also influence service offerings.

The company depends on a global network of suppliers, making it susceptible to disruptions. Geopolitical events, natural disasters, and manufacturing issues can increase costs and delay product availability. Managing these complexities requires a robust supply chain management strategy.

The rapid adoption of electric vehicles (EVs) and increasing vehicle electronics complexity demand continuous adaptation. The company must invest in new product lines and service capabilities. Failure to adapt could hinder its long-term growth potential.

Integrating large acquisitions, such as the Uni-Select acquisition, poses operational challenges. These include system consolidation, cultural alignment, and achieving projected synergies. Successful integration is critical for realizing the financial benefits of these acquisitions.

Economic downturns can decrease demand for auto parts and services. Reduced consumer spending and lower vehicle miles traveled can negatively impact the company's revenue. The company needs to be prepared to adjust strategies during economic downturns.

The company's supply chain management involves a multifaceted approach to mitigate risks. This includes diversifying its supplier base across various geographical locations. Regular monitoring and assessment of supplier performance are essential. The company also employs risk management tools to anticipate and respond to potential disruptions, ensuring a steady supply of parts.

Adaptation to technological advancements is a key priority for the company. It invests in research and development to expand its product portfolio to include parts for electric vehicles. The company also focuses on providing training to its workforce to handle the increasing complexity of vehicle electronics. Strategic partnerships can also help the company stay ahead of technological changes.

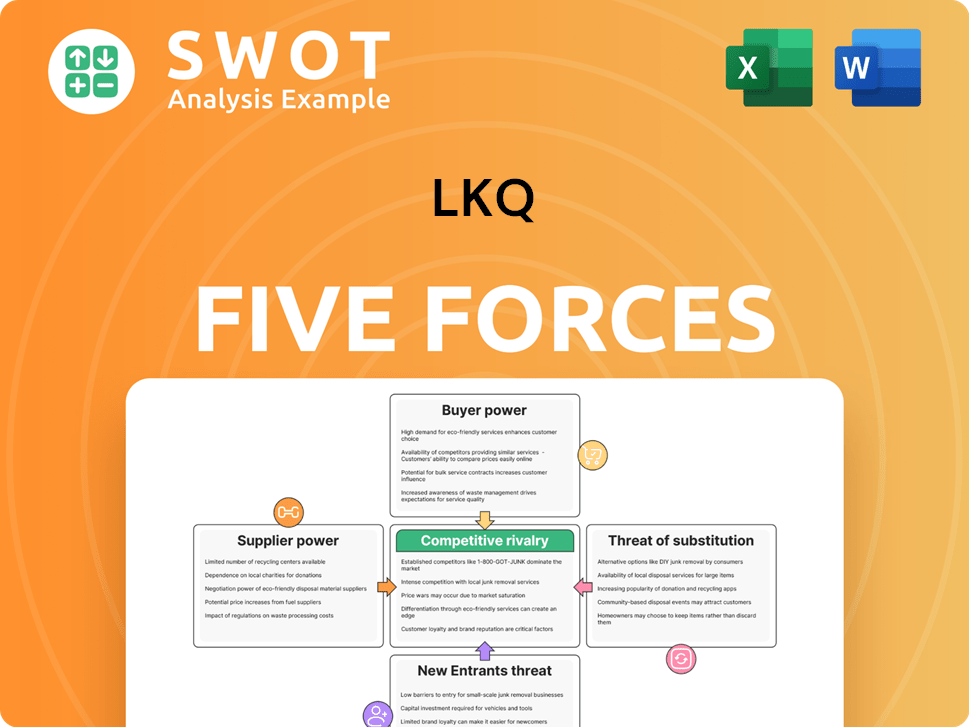

LKQ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.