LKQ Bundle

How Does LKQ Corporation Stack Up in the Auto Parts Arena?

LKQ Corporation has become a major player in the global automotive aftermarket, but how does it truly fare against its rivals? Founded in 1998, LKQ has grown into a global leader, distributing essential vehicle parts and components. With a reported $14.4 billion in revenue in 2024, the company's market position demands a closer look.

This analysis will provide a detailed LKQ SWOT Analysis, evaluating LKQ's competitive landscape, including its key competitors and market share analysis. We'll explore LKQ's business strategy, dissecting its competitive advantages and disadvantages within the auto parts industry. Understanding LKQ's position requires a deep dive into its financial performance compared to competitors and how it navigates the evolving demands of the market, including the rise of electric vehicles.

Where Does LKQ’ Stand in the Current Market?

LKQ Corporation is a leading player in the auto parts industry, focusing on aftermarket, recycled, remanufactured, and OEM parts. The company's core business revolves around supplying parts for collision and mechanical repair shops. With a broad geographic reach spanning North America, Europe, and Taiwan, LKQ serves a diverse customer base, including individual vehicle owners and large repair shop chains.

The company's value proposition lies in its extensive product lines and comprehensive distribution network, providing customers with a wide selection of parts. LKQ's business strategy emphasizes operational efficiency, strategic acquisitions, and a focus on customer satisfaction. This approach allows LKQ to maintain a strong position in the competitive auto parts market.

As of Q1 2025, LKQ Corporation's market share, based on total revenue, was approximately 31.03%. Although the company's Q1 2025 revenue reached $3.5 billion, a decrease of 6.5% compared to Q1 2024, the full-year 2024 revenue reached $14.4 billion, a 3.5% increase from 2023. LKQ's European segment has shown strong performance, with a record EBITDA margin of 10.1% in Q4 2024.

LKQ's market share is a key indicator of its competitive position. The company's ability to maintain and grow its market share is crucial in the auto parts industry. Analyzing LKQ's market share trends provides insights into its performance relative to competitors.

LKQ's competitive advantages include its extensive product offerings, broad geographic presence, and diverse customer base. The company's focus on operational efficiency and strategic acquisitions further strengthens its position. These advantages enable LKQ to compete effectively in the auto parts market.

LKQ's financial performance is a critical factor in assessing its competitive standing. The company's financial health, with an annual operating cash flow of $1.1 billion and free cash flow of $0.8 billion in 2024, indicates a robust financial standing. Examining LKQ's financial metrics provides insights into its profitability and sustainability.

LKQ's business strategy involves diversifying its offerings and optimizing operations. In Europe, LKQ has reduced stocking by 17,000 SKUs and increased private label penetration. These strategic initiatives aim to streamline operations and enhance profitability, supporting LKQ's long-term competitiveness. Further details on LKQ's target market can be found in Target Market of LKQ.

LKQ's key performance indicators (KPIs) provide a comprehensive view of its competitive position. These KPIs include revenue growth, market share, EBITDA margins, and cash flow. Analyzing these metrics helps assess LKQ's performance against its competitors and industry benchmarks.

- Revenue Growth: Evaluating the rate at which LKQ's revenue increases year over year.

- Market Share: Assessing LKQ's percentage of the total auto parts market.

- EBITDA Margin: Measuring the profitability of LKQ's operations.

- Cash Flow: Examining LKQ's ability to generate cash from its operations.

LKQ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging LKQ?

The LKQ competitive landscape is complex, encompassing a range of direct and indirect rivals in the auto parts industry. Understanding these competitors is crucial for analyzing LKQ Corporation's market position and strategic direction. This analysis provides insights into LKQ's market share analysis and how it stacks up against its key rivals.

The industry is characterized by intense competition, with companies employing various strategies to gain market share. These strategies include competitive pricing, extensive product offerings, and robust distribution networks. The competitive environment is constantly evolving, influenced by mergers, acquisitions, and the emergence of new technologies and market players.

LKQ's business strategy involves both organic growth and strategic acquisitions to expand its market presence and service offerings. This approach is essential for maintaining a competitive edge in a dynamic market. The following sections will delve into the key competitors, their strategies, and how they impact LKQ's overall performance.

Direct competitors are those that offer similar products and services within the auto parts industry. These companies compete directly with LKQ for market share. They often focus on similar customer segments and distribution channels.

AutoZone Inc. is a major competitor, holding a significant market share. AutoZone focuses on retail sales of auto parts and accessories. They compete with LKQ through extensive store networks and strong brand recognition.

Advance Auto Parts Inc. is another key player in the auto parts market. They offer a broad range of products and services. Advance Auto Parts competes through a combination of retail stores and online sales, similar to AutoZone.

Genuine Parts Company operates through its NAPA Auto Parts stores and other distribution channels. They focus on both wholesale and retail markets. Genuine Parts Company competes with LKQ by offering a wide selection of parts and services.

Indirect competitors include companies that offer alternative solutions or target different segments of the auto parts market. These competitors may not directly sell the same products but still impact LKQ's market share.

Smaller, regional distributors compete by focusing on specific geographic areas. They may offer specialized parts or services. These distributors can provide customized solutions that larger companies may not.

Salvage yards offer used auto parts, providing a cost-effective alternative. They target customers looking for budget-friendly options. Salvage yards compete with LKQ by offering lower-priced parts.

Online retailers, such as Amazon and eBay, have increased their presence in the auto parts market. They offer convenience and competitive pricing. Online retailers compete with LKQ by providing a wide selection and easy access to parts.

The LKQ competitive landscape is shaped by various factors, including market share, pricing strategies, and distribution networks. As of Q1 2025, AutoZone Inc. held approximately a 35.41% market share, surpassing LKQ's 31.03%. Advance Auto Parts Inc. held an 18.06% market share. The pricing of aftermarket collision parts in regions like the UK remains a key competitive battleground. The industry also sees the impact of new and emerging players, particularly those focusing on specialized areas like electric vehicle (EV) components and technologies. For more in-depth information, you can refer to an article on 0.

LKQ's strategies for staying competitive involve several key areas. These include strategic acquisitions, optimizing distribution networks, and focusing on customer service. The company's ability to adapt to market changes and technological advancements is critical.

- Acquisitions: LKQ has a history of acquiring companies to expand its product offerings and geographic reach.

- Distribution Network: Efficient distribution is crucial for timely delivery and customer satisfaction.

- Pricing Strategies: Competitive pricing is essential to attract and retain customers.

- Technological Advancements: Embracing new technologies, such as e-commerce and digital platforms, is vital.

- Market Trends: Adapting to trends like the growing EV market is essential for long-term growth.

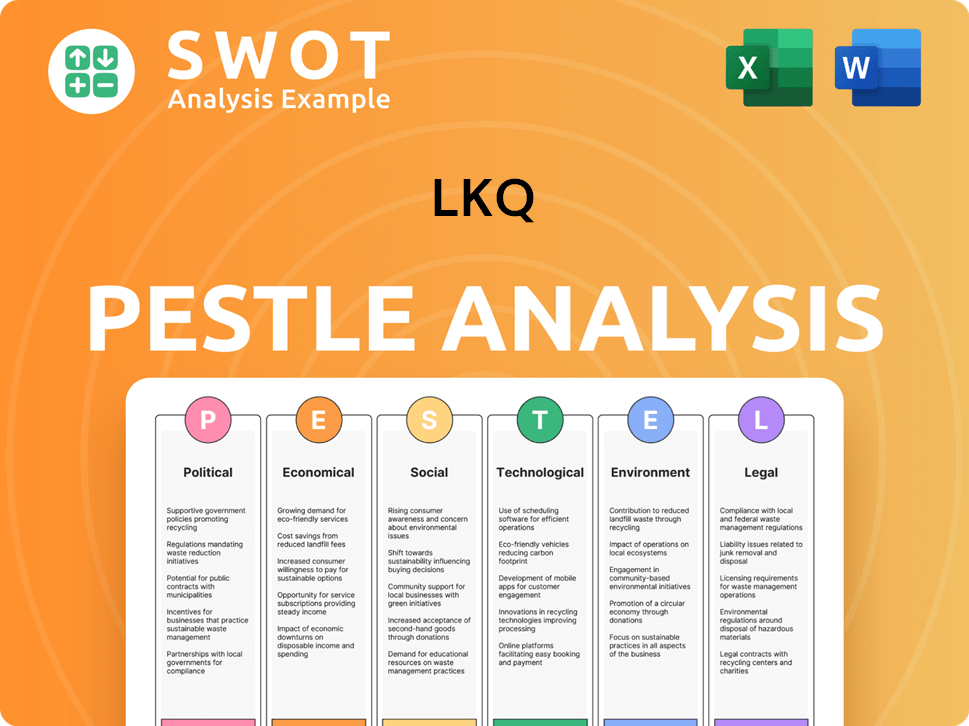

LKQ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives LKQ a Competitive Edge Over Its Rivals?

The business model of LKQ Corporation is built on several key competitive advantages that set it apart in the auto parts industry. These advantages include its expansive scale, robust distribution network, and diverse product offerings. This allows it to efficiently serve a broad customer base with competitive pricing and a wide range of parts.

LKQ's strategic moves, such as acquisitions and operational improvements, have significantly bolstered its market position. The company's ability to integrate new businesses and optimize processes contributes to its profitability and market share. These strategies are crucial for navigating the competitive landscape and maintaining a strong presence in the auto parts market.

LKQ's competitive edge stems from its ability to offer a comprehensive suite of products and services, catering to various customer needs. By focusing on both aftermarket and recycled parts, LKQ positions itself to meet the growing demand for cost-effective and sustainable solutions. The company's emphasis on operational excellence further enhances its ability to compete effectively.

LKQ benefits from significant economies of scale, allowing it to offer competitive pricing. Its extensive global distribution network, including locations in North America, Europe, and Taiwan, facilitates efficient delivery. This network supports over 100,000 workshops across 18 European countries, providing a substantial logistical advantage.

LKQ's broad product range, including aftermarket, recycled, and remanufactured parts, caters to diverse customer needs. This enhances its market appeal and resilience, allowing it to serve a wide range of customers. The company's focus on recycled products gives it a distinct advantage in the market.

LKQ has a proven track record of successful acquisitions, allowing it to effectively integrate and leverage new businesses. This strategy expands its market presence and service offerings. These acquisitions are key to maintaining a competitive edge in the auto parts industry.

LKQ emphasizes operational excellence, including cost management and process improvements. This contributes to its profitability and competitiveness. The company's focus on sustainability and the circular economy, processing approximately 735,000 vehicles and selling nearly 12 million salvaged parts in 2024, positions it favorably in an environmentally conscious market.

LKQ's competitive advantages are multifaceted, including its scale, distribution capabilities, and diverse product offerings. The company's strategic focus on acquisitions and operational excellence further strengthens its position in the auto parts industry.

- Economies of Scale: Enables competitive pricing and efficient service.

- Global Distribution: A vast network across North America, Europe, and Taiwan.

- Product Diversity: Offers aftermarket, recycled, and remanufactured parts.

- Strategic Acquisitions: Expands market presence and service offerings.

- Operational Excellence: Focus on cost management and process improvements.

- Sustainability: Commitment to the circular economy, processing a significant number of vehicles annually.

LKQ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping LKQ’s Competitive Landscape?

The automotive aftermarket industry, where LKQ Corporation operates, is experiencing significant shifts. These changes present both challenges and opportunities for companies in the auto parts industry. Understanding these trends is crucial for evaluating LKQ's competitive landscape and future prospects.

Several factors are reshaping the industry, including the rise of electric vehicles (EVs), evolving consumer preferences, and global economic pressures. Regulatory changes and the need for sustainable practices further complicate the environment. Analyzing these elements is key to assessing LKQ's strategic positioning and potential for growth.

The increasing adoption of EVs is a major trend, impacting the demand for different types of parts. Regulatory changes, like those related to sustainability reporting, are also influencing operations. Consumer demand for cost-effective and sustainable solutions is growing, favoring companies offering recycled and alternative parts. Economic factors, such as inflation, also play a role.

New market entrants specializing in EV components pose a competitive threat. Declining demand for traditional parts and more stringent regulations could impact profitability. Aggressive pricing strategies from competitors could also squeeze margins. The rising cost of auto insurance, which increased over 20% in the US in 2024, may drive insurance carriers to seek cost-saving measures, potentially affecting the demand for certain parts.

The aging of the car parc in various markets, particularly in Europe, drives sustained demand for replacement parts. Investments in advanced remanufacturing and repair capabilities can capitalize on vehicle circularity. Product innovations, especially in EV components, offer new revenue streams. Strategic partnerships and technology integration can improve operations and customer experience.

LKQ's 'Charting Our Future' strategy, launched in 2024, focuses on operational excellence and sustainable growth. The company aims for 0-2% organic revenue growth for parts and services in 2025. Strategies include portfolio simplification, cost optimization, and leveraging its strong balance sheet. These measures aim to navigate challenges and seize opportunities in the evolving competitive landscape.

The LKQ competitive landscape is influenced by multiple factors, including the shift towards EVs and the need for sustainable practices. The company's main competitors include established players in the auto parts industry. Understanding the dynamics of the LKQ market analysis is essential for strategic planning.

- LKQ's competitive advantages and disadvantages are determined by its ability to adapt to changing market conditions, including the increasing demand for EV components.

- LKQ's strategies for staying competitive involve investments in remanufacturing and technology, as well as strategic partnerships.

- The company's financial performance, compared to rivals, is a key indicator of its success in the auto parts market.

- LKQ's recent acquisitions and their impact on competition can significantly alter its market position and competitive dynamics.

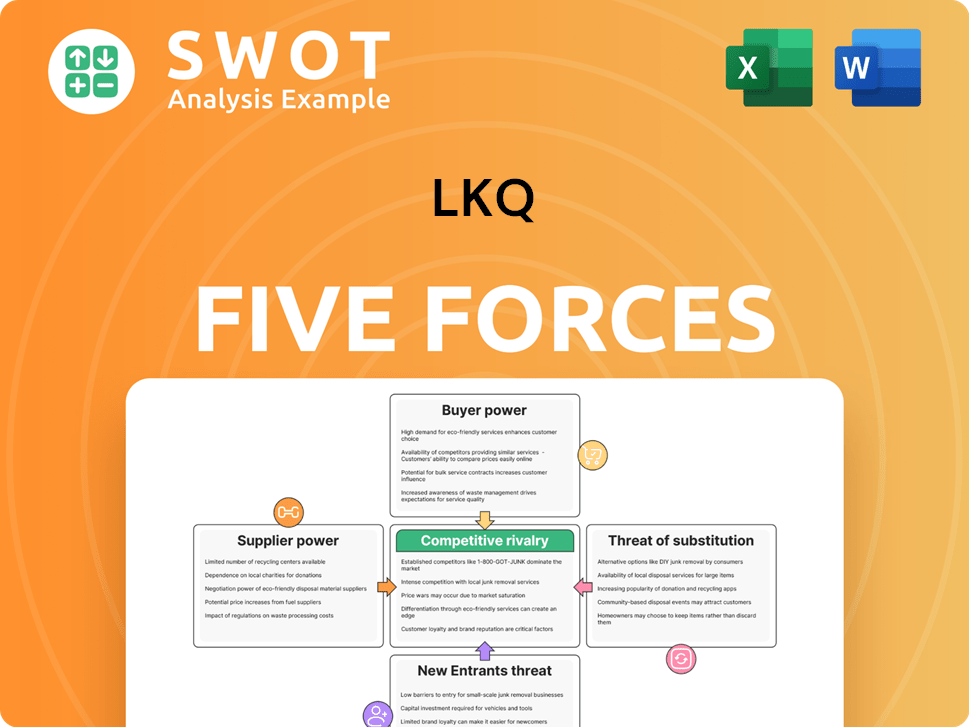

LKQ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LKQ Company?

- What is Growth Strategy and Future Prospects of LKQ Company?

- How Does LKQ Company Work?

- What is Sales and Marketing Strategy of LKQ Company?

- What is Brief History of LKQ Company?

- Who Owns LKQ Company?

- What is Customer Demographics and Target Market of LKQ Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.