LKQ Bundle

Who Really Owns LKQ Corporation?

Ever wondered who pulls the strings at LKQ Corporation, a global leader in the automotive aftermarket? Understanding the LKQ SWOT Analysis is key to grasping its strategic moves. From its humble beginnings to its current status, the ownership structure of LKQ has significantly evolved.

This deep dive into LKQ Company ownership will uncover the key players, from the initial founders to the institutional investors shaping its destiny. We'll explore how the LKQ stock has performed and the impact of LKQ leadership on its trajectory. Discover the intricacies of the LKQ company ownership structure and gain insights into the forces driving this industry giant, including details on Who owns LKQ and the influence of its major shareholders.

Who Founded LKQ?

The LKQ Corporation was founded in February 1998 by Donald F. Flynn. The initial formation involved the strategic acquisition of three businesses: Triplett Auto Recyclers, Damron Auto Parts, and Star Auto Parts. Flynn served as chairman until his passing in October 2011.

While the exact equity distribution among the founders at the outset isn't publicly detailed, the company's structure was built upon Flynn's vision and capital. Early ownership likely included investors from the acquired entities. The company's growth strategy involved over 200 acquisitions of used and refurbished auto parts suppliers and manufacturers, continuously reshaping the ownership structure.

The rapid expansion through acquisitions suggests diverse financial backing beyond the initial business combinations. Public records do not explicitly identify early backers or angel investors. The company's history is marked by a focus on growth through strategic acquisitions, which has been a key factor in shaping its ownership over time.

Understanding the early ownership of LKQ Company provides context for its subsequent growth and current structure. The company's foundation was built on strategic acquisitions led by Donald F. Flynn. Knowing the early ownership helps clarify the company's evolution and the impact of its aggressive acquisition strategy.

- Donald F. Flynn founded LKQ Corporation in February 1998.

- The company's initial acquisitions included Triplett Auto Recyclers, Damron Auto Parts, and Star Auto Parts.

- The company's growth strategy involved over 200 acquisitions.

- Early ownership structure was centered around Flynn's vision and capital.

LKQ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has LKQ’s Ownership Changed Over Time?

The evolution of the LKQ Company's ownership structure has been significantly shaped by its initial public offering (IPO) in 2003. This transition marked a shift from private ownership to a predominantly public structure, opening the door for institutional and retail investors. The company's strategic decisions, including share repurchase programs, have further influenced the distribution of ownership, impacting the proportion of shares held by various investor groups. For those interested in understanding the company's customer base, you can read about the Target Market of LKQ.

As a publicly traded entity, LKQ Corporation's ownership is now largely held by institutional investors. The company's commitment to repurchasing its shares has also played a crucial role in altering the ownership dynamics, with the aim of increasing shareholder value. This strategy has led to changes in the number of outstanding shares, consequently affecting the ownership percentages of all shareholders.

| Ownership Category | Approximate Percentage (April 2025) | Key Stakeholders (March 31, 2025) |

|---|---|---|

| Institutional Investors | 83.80% to 101.85% | Vanguard Group Inc., BlackRock, Inc., Morgan Stanley, Nordea Investment Management Ab, State Street Corp |

| Insider Ownership | 0.49% | Executives and Directors |

| Public and Individual Investors | 15.45% to 27.67% | Various |

As of June 6, 2025, the share price of LKQ Corporation is $39.09 per share. The company's stock symbol is LKQ. Key institutional shareholders as of March 31, 2025, include Vanguard Group Inc. holding 30,933,776 shares and BlackRock, Inc. with 22,727,913 shares. The company has repurchased approximately 65.5 million shares since October 2018 through March 31, 2025, for a total of $2.8 billion. An aggregate balance of $1.7 billion remains for potential additional stock repurchases through October 25, 2026.

The majority of LKQ Corporation is owned by institutional investors, reflecting its status as a publicly traded company.

- Institutional investors hold a significant portion of the company's stock.

- Share repurchase programs have influenced the ownership structure.

- Insider ownership is comparatively smaller.

- The company's stock symbol is LKQ.

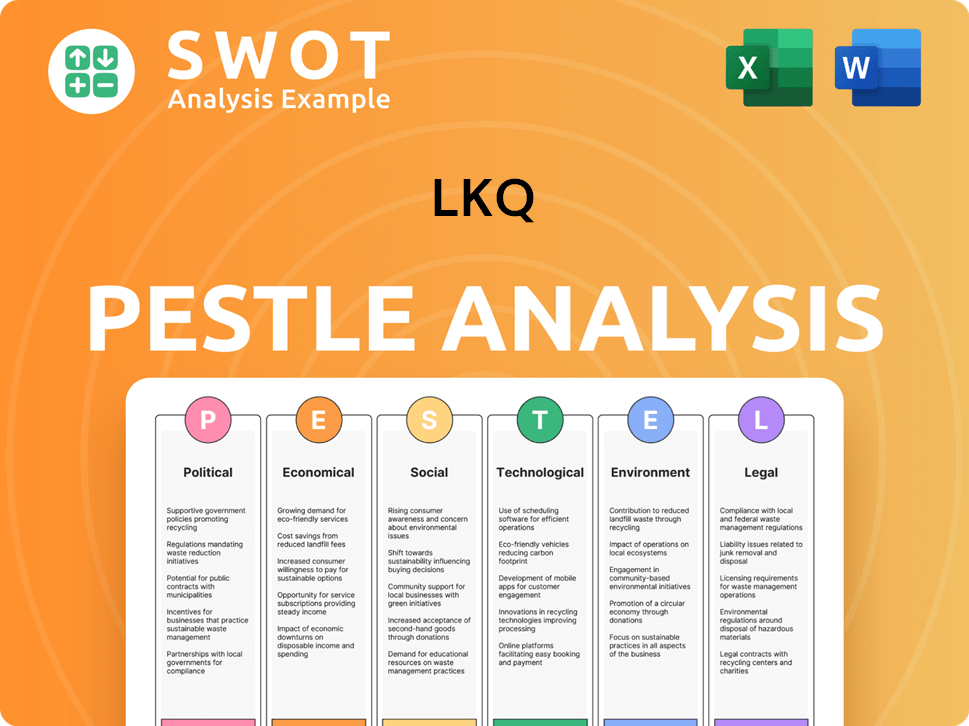

LKQ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on LKQ’s Board?

The current board of directors of LKQ Corporation plays a vital role in the company's governance and strategic direction. The Annual Meeting of Stockholders, held virtually on May 7, 2025, saw the election of 11 directors for the upcoming year, highlighting the importance of shareholder participation in the company's leadership structure. The company's bylaws underscore that holders of common stock possess the sole voting power, with each stockholder entitled to vote at a meeting and able to authorize a proxy.

As of February 5, 2025, the board expanded to 13 members with the appointments of Sue Gove and Michael Powell. These appointments resulted from a cooperation agreement with investor parties, including Ancora Catalyst Institutional, LP, and Engine Capital, LP, demonstrating the influence of significant shareholders on board composition. Gove and Powell also joined a new Finance Committee, alongside existing directors Andrew Clarke, John Mendel, and Xavier Urbain, with Clarke as chair, focusing on capital allocation and business portfolio recommendations.

| Board Member | Role | Affiliation |

|---|---|---|

| Sue Gove | Director | N/A |

| Michael Powell | Director | N/A |

| Andrew Clarke | Director & Chair of Finance Committee | N/A |

| John Mendel | Director | N/A |

| Xavier Urbain | Director | N/A |

While the company generally operates under a one-share-one-vote structure for common stock, the impact of large institutional investors is significant, even without special voting rights. Detailed information on board members and their affiliations can be found in the company's SEC filings, including proxy statements and annual reports, which provide transparency into LKQ Company's leadership and governance.

The board of directors oversees the strategic direction and governance of LKQ Corporation. The board composition can be influenced by significant shareholders, as seen with recent appointments. The Finance Committee plays a key role in capital allocation and portfolio strategy.

- Shareholders have sole voting power.

- The board consists of 13 members as of February 2025.

- A Finance Committee guides capital allocation.

- Detailed information is available in SEC filings.

LKQ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped LKQ’s Ownership Landscape?

Over the past few years, the ownership of LKQ Corporation has been shaped by financial activities and industry trends. In the first quarter of 2025, LKQ returned $118 million to stockholders, including share repurchases and dividends. This follows a significant stock repurchase program initiated in late October 2018, totaling approximately 65.5 million shares for $2.8 billion through March 31, 2025, with $1.7 billion remaining for future repurchases through October 25, 2026. For the full year 2024, the company returned $678 million to shareholders, including $360 million in share repurchases and $318 million in cash dividends.

A notable development in early 2025 was the appointment of Sue Gove and Michael Powell to the Board of Directors on February 5, 2025, stemming from a cooperation agreement with activist investor parties. This highlights the influence of activist investors on company strategy and governance. The acquisition of Uni-Select Inc. in 2023 further expanded LKQ's market position, potentially influencing its ownership structure.

| Ownership Category | Details | As of April 2025 |

|---|---|---|

| Institutional Ownership | Vanguard Group Inc., BlackRock, Inc., Morgan Stanley, and others | Substantial, potentially over 100% of outstanding shares |

| Insider Holdings | Changes in early 2025 | Slight changes, with some insiders decreasing and others increasing holdings |

| Share Repurchases | Stock repurchase program | Approximately 65.5 million shares repurchased for $2.8 billion through March 31, 2025; $1.7 billion remaining for future repurchases through October 25, 2026 |

Industry trends indicate a high level of institutional ownership in LKQ Corporation. The company's focus in 2025, as indicated by public statements and analyst coverage, is on operational excellence and cost optimization. To learn more about the company's strategic direction, consider reading the Growth Strategy of LKQ.

LKQ returned $118 million to stockholders in Q1 2025. This includes share repurchases and dividends. The company also returned $678 million to shareholders in 2024.

Institutional investors hold a significant stake in LKQ. Key holders include Vanguard Group Inc. and BlackRock, Inc. Some sources suggest holdings of over 100%.

The appointment of new board members in early 2025 reflects the influence of activist investors. This suggests changes in company strategy. Ancora Catalyst Institutional, LP, and Engine Capital, LP, were involved.

The acquisition of Uni-Select Inc. in 2023 expanded LKQ's market position. This likely influenced its ownership structure. The company distributes automotive products.

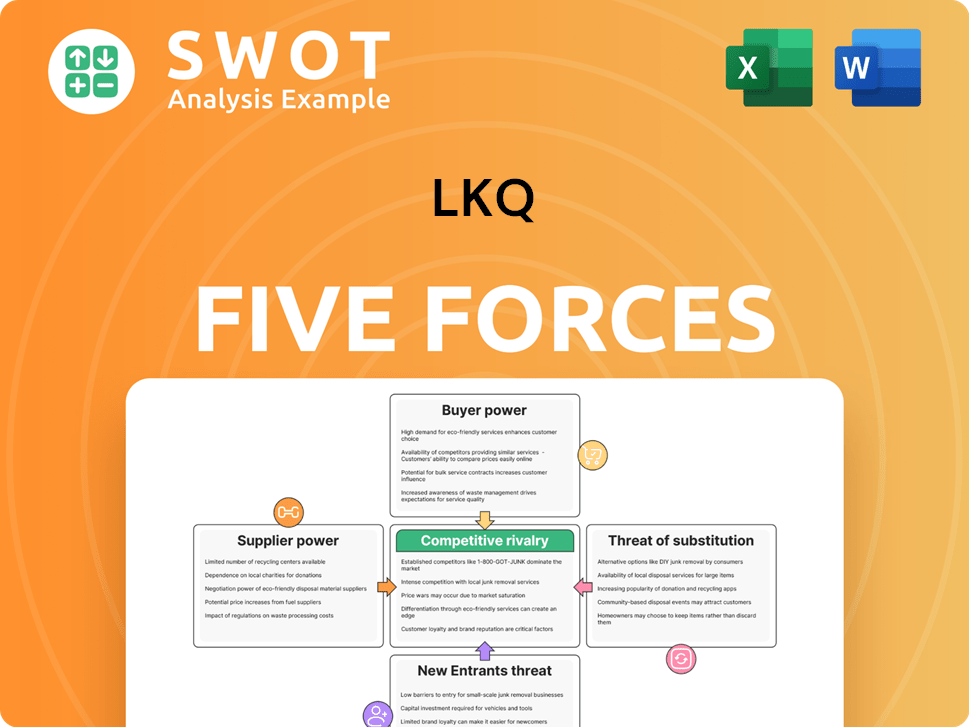

LKQ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LKQ Company?

- What is Competitive Landscape of LKQ Company?

- What is Growth Strategy and Future Prospects of LKQ Company?

- How Does LKQ Company Work?

- What is Sales and Marketing Strategy of LKQ Company?

- What is Brief History of LKQ Company?

- What is Customer Demographics and Target Market of LKQ Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.