Mallinckrodt Bundle

How Has Mallinckrodt Evolved Over Time?

From its inception as a chemical supplier in the late 19th century, Mallinckrodt's journey exemplifies remarkable adaptation within the pharmaceutical landscape. Founded in St. Louis, Missouri, this Mallinckrodt SWOT Analysis reveals a company that has navigated significant industry shifts. This Mallinckrodt company has consistently redefined its focus, evolving from a chemical company to a specialized biopharmaceutical entity.

This Mallinckrodt history reveals how a pharmaceutical company, initially focused on providing essential chemicals, has transformed. Today, it concentrates on specialty products and therapies, particularly in autoimmune and rare diseases. Understanding this evolution provides crucial insights into the strategies and challenges that have shaped this St Louis company.

What is the Mallinckrodt Founding Story?

The Mallinckrodt story began on November 1, 1867. It was founded by three brothers: Edward Mallinckrodt Sr., Otto Mallinckrodt, and Gustav Mallinckrodt. Their vision was to create a reliable source for high-quality medicinal chemicals during the post-Civil War era.

Edward Mallinckrodt Sr., with his chemistry background from Germany, led the scientific and production aspects. The company aimed to solve the problem of inconsistent quality and supply of pharmaceutical-grade chemicals in the United States. This marked the early beginnings of the

The initial business model focused on producing and selling a variety of pure chemicals. These were essential for pharmacists, physicians, and hospitals. The first products included bismuth salts, iodine preparations, and mercurials. The Mallinckrodt brothers used their personal capital to fund the company. Their dedication to purity quickly established their reputation in the American pharmaceutical market. This was vital at a time when product adulteration was a significant concern.

The founding of this

- Founded: November 1, 1867

- Founders: Edward Mallinckrodt Sr., Otto Mallinckrodt, and Gustav Mallinckrodt

- Initial Focus: Production of pure chemicals for medical use

- Funding: Personal capital of the Mallinckrodt brothers

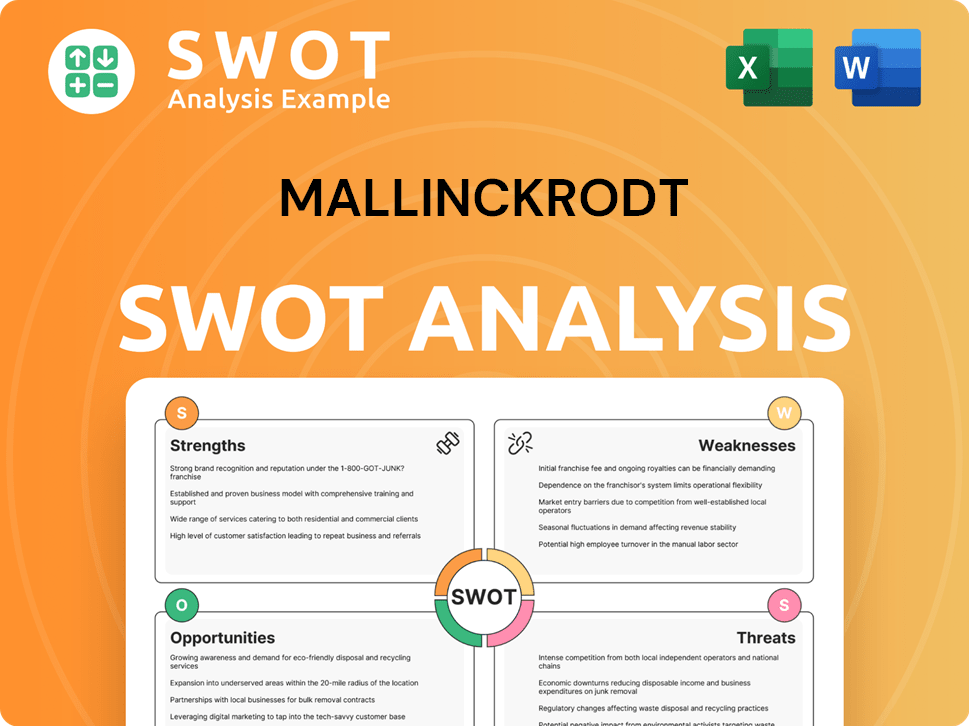

Mallinckrodt SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Mallinckrodt?

The early growth of the Mallinckrodt company was marked by a strong focus on quality and the rising need for pharmaceutical chemicals. As the 20th century began, the company broadened its product range, moving beyond basic chemicals to include more complex compounds and active pharmaceutical ingredients. Key clients during this period included pharmacies and hospitals across the United States. The company's initial team expanded to meet growing demand, adding chemists and production staff.

Mallinckrodt strategically entered new product categories to fuel its growth. A notable example was its move into photographic chemicals, leveraging its expertise in chemical synthesis. This diversification helped expand its market presence. The company's manufacturing facilities, initially established in St. Louis, Missouri, were crucial for its production capabilities.

Leadership transitions within the founding family ensured continuity and a sustained focus on the company's core mission. The market responded positively to Mallinckrodt's products, largely due to their reputation for purity and consistency. The competitive landscape allowed Mallinckrodt to establish a significant niche through its quality-first approach, laying the groundwork for its transformation into a diversified healthcare company.

The strategic focus on quality and expansion into new product areas, such as photographic chemicals, helped Mallinckrodt grow. This was supported by continuous innovation in chemical processes and product development. The company's early efforts set the stage for its later evolution into a more specialized pharmaceutical entity, demonstrating a clear strategic vision.

To understand more about the financial aspects, business model, and revenue streams of Mallinckrodt, you can explore the details in this article: Revenue Streams & Business Model of Mallinckrodt. This provides a deeper insight into how the company generated revenue and managed its finances during its early growth phases.

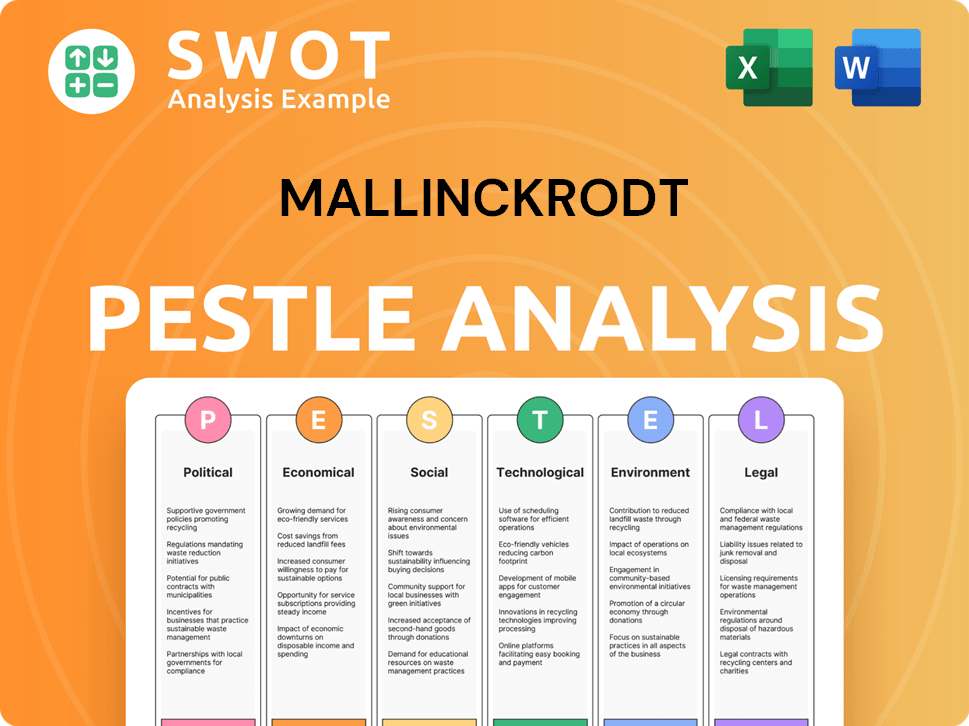

Mallinckrodt PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Mallinckrodt history?

The Mallinckrodt company has a rich history marked by significant milestones that have shaped its trajectory as a pharmaceutical company. The Mallinckrodt history is a testament to its adaptability and resilience in the face of industry changes and challenges.

| Year | Milestone |

|---|---|

| 1867 | The company was founded in St. Louis, Missouri, initially focusing on the production of fine chemicals. |

| Mid-20th Century | Mallinckrodt became a pioneer in the development and production of radioactive isotopes for medical use, particularly for diagnostic imaging. |

| Various Years | Secured numerous patents for novel compounds and drug delivery systems, expanding its research capabilities. |

| 2022 | Emergence from Chapter 11 bankruptcy in June, following restructuring to address opioid-related liabilities. |

Mallinckrodt has consistently demonstrated innovation in the pharmaceutical sector, particularly in the development of new compounds and drug delivery systems. These advancements have been crucial in expanding its research capabilities and product offerings.

Mallinckrodt played a pivotal role in producing radioactive isotopes for medical diagnostics, a significant innovation in healthcare. This move showcased the company's ability to adapt its chemical expertise to emerging medical technologies.

The company has secured numerous patents for novel drug delivery systems, enhancing the effectiveness and efficiency of pharmaceutical products. This commitment to innovation has helped Mallinckrodt stay competitive in the market.

Mallinckrodt has formed key partnerships to expand its reach and research capabilities, fostering collaboration within the industry. These partnerships have been instrumental in driving growth and innovation.

Despite its successes, Mallinckrodt has faced considerable challenges throughout its history, including market downturns and intense competition. The company has also navigated significant legal and financial hurdles related to its opioid business.

Mallinckrodt's involvement in the opioid crisis led to substantial legal and financial challenges, causing the company to restructure. This crisis forced the St Louis company to re-evaluate its strategic focus.

The company emerged from Chapter 11 bankruptcy in June 2022, as a result of opioid-related liabilities. The restructuring involved divesting assets and streamlining operations.

Mallinckrodt has faced challenges from market downturns and competitive threats, requiring it to adapt its business model. The company has had to navigate a dynamic pharmaceutical landscape.

Strategic pivots often involved divesting non-core assets and acquiring companies that aligned with its evolving focus on rare and autoimmune diseases. These moves reflect Mallinckrodt's efforts to remain competitive.

Mallinckrodt has developed strengths in navigating complex regulatory environments and adapting its business model to changing market dynamics. The company has learned to manage legal and regulatory risks.

In 2024, Mallinckrodt continues to focus on its specialty pharmaceutical segment. You can learn more about the Owners & Shareholders of Mallinckrodt.

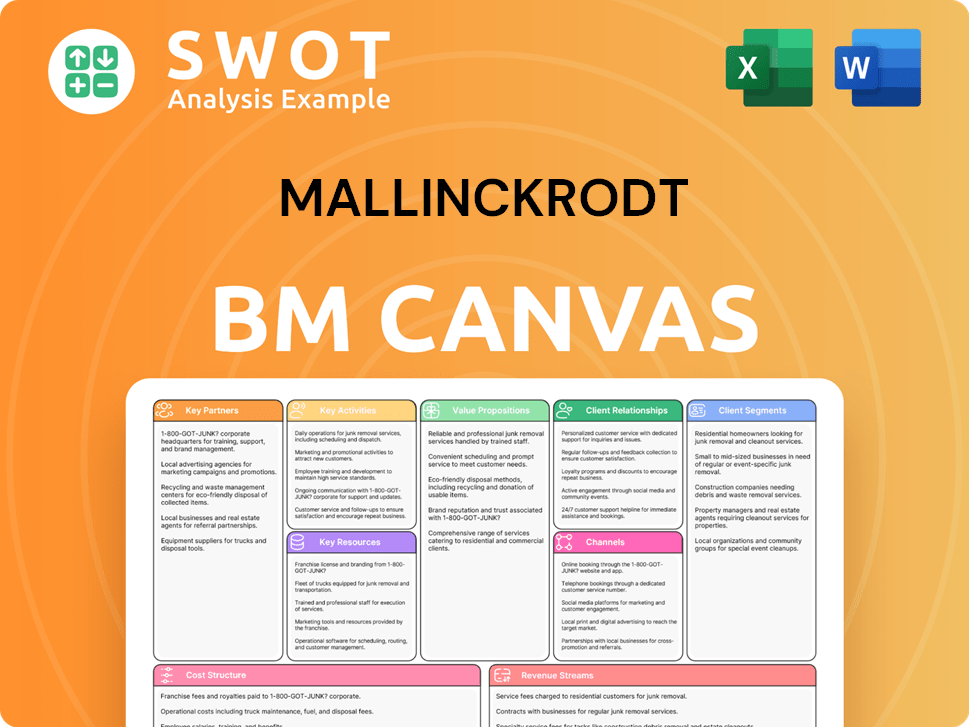

Mallinckrodt Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Mallinckrodt?

The Mallinckrodt history is marked by significant pivots and transformations, starting in 1867 in St. Louis, Missouri, as a chemical company. Over time, it expanded into pharmaceuticals, becoming a pioneer in medical isotopes and expanding its drug portfolio through strategic acquisitions. Key milestones include the acquisition of Abbott Laboratories' pharmaceutical division in 1982 and the 2013 separation from Covidien. The company faced challenges, including opioid-related liabilities, leading to Chapter 11 bankruptcy in 2020. However, it emerged from bankruptcy in June 2022, positioning itself to focus on specialty pharmaceuticals, particularly in autoimmune and rare diseases.

| Year | Key Event |

|---|---|

| 1867 | Founded in St. Louis, Missouri, as a chemical company. |

| Early 1900s | Expanded into photographic chemicals. |

| Mid-20th Century | Became a pioneer in producing radioactive isotopes for medical use. |

| 1982 | Acquired the pharmaceutical division of Abbott Laboratories. |

| 2000 | Merged with Tyco International Ltd. |

| 2013 | Separated from Covidien and became an independent, publicly traded company. |

| 2014 | Acquired Questcor Pharmaceuticals, adding Acthar Gel to its portfolio. |

| 2017 | Acquired Sucampo Pharmaceuticals, expanding its rare disease pipeline. |

| 2020 | Filed for Chapter 11 bankruptcy due to opioid-related liabilities. |

| June 2022 | Emerged from Chapter 11 bankruptcy, reducing debt and resolving opioid claims. |

| 2023-2024 | Continued focus on core specialty pharmaceutical products and pipeline development. |

| 2025 | Expected to continue strategic focus on rare and autoimmune diseases. |

The future of Mallinckrodt is centered on specialty pharmaceuticals, particularly for autoimmune and rare diseases. This strategic direction leverages its existing portfolio, including Acthar Gel, and invests in research and development for new therapies. The company aims to capitalize on the growing trends of personalized medicine and orphan drugs within the biopharmaceutical industry.

Key strategic initiatives include optimizing commercial operations, managing debt, and exploring targeted acquisitions or partnerships. This approach aligns with its specialized focus and is designed to support sustainable growth. The company's leadership emphasizes a commitment to patients with unmet medical needs.

Analyst predictions suggest that companies with strong pipelines in rare diseases and effective commercialization strategies will thrive. The biopharmaceutical industry's shift towards personalized medicine and orphan drugs gives Mallinckrodt a competitive advantage. The company is positioned to benefit from these market trends.

The future outlook for the Mallinckrodt company is influenced by its recent restructuring and focus on specialty pharmaceuticals. The company's commitment to patients and sustainable growth reinforces its long-term vision. The strategic emphasis on rare and autoimmune diseases aligns with its founding vision, ensuring a specialized approach to complex medical conditions.

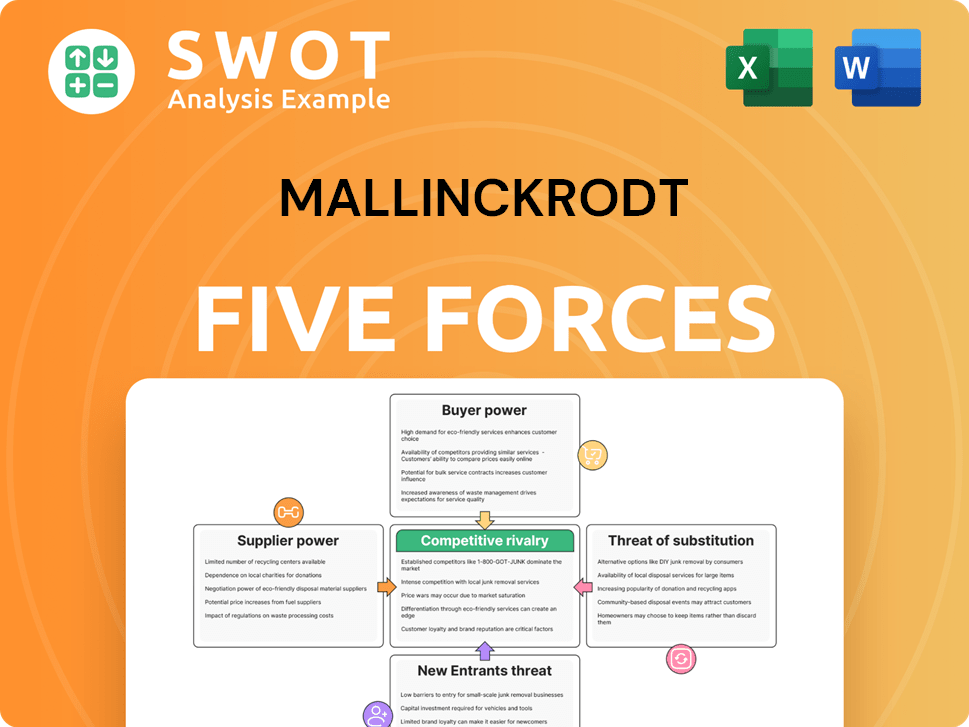

Mallinckrodt Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Mallinckrodt Company?

- What is Growth Strategy and Future Prospects of Mallinckrodt Company?

- How Does Mallinckrodt Company Work?

- What is Sales and Marketing Strategy of Mallinckrodt Company?

- What is Brief History of Mallinckrodt Company?

- Who Owns Mallinckrodt Company?

- What is Customer Demographics and Target Market of Mallinckrodt Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.