Mallinckrodt Bundle

Can Mallinckrodt Thrive in the Evolving Biopharmaceutical Landscape?

The biopharmaceutical sector is a dynamic arena, and Mallinckrodt, a global player, faces critical decisions shaping its future. Understanding Mallinckrodt SWOT Analysis is crucial to grasp the company's position within this competitive environment. This analysis delves into the company's strategic moves, particularly its acquisitions, and how these initiatives influence its long-term trajectory.

Mallinckrodt's journey, from its inception in 1867 to its current global presence, reflects its adaptability within the pharmaceutical industry. This exploration of Mallinckrodt's growth strategy examines its expansion into specialty pharmaceuticals, focusing on its product pipeline and strategic partnerships. We'll analyze the company's financial performance, considering factors like debt restructuring and the impact of the opioid settlement, to provide a comprehensive Mallinckrodt company analysis and assess its future prospects.

How Is Mallinckrodt Expanding Its Reach?

The Brief History of Mallinckrodt reveals that the company's growth strategy is significantly shaped by its expansion initiatives. These initiatives are designed to enhance market penetration and diversify the product portfolio. The focus remains on core therapeutic areas, particularly autoimmune and rare diseases, which include neurology, rheumatology, nephrology, pulmonology, and ophthalmology. This strategic focus supports the company's long-term growth potential within the pharmaceutical industry.

Mallinckrodt's approach involves optimizing its existing product portfolio, including exploring new applications for established therapies. A key example is the potential of H.P. Acthar Gel, which is being investigated for use in additional autoimmune and inflammatory conditions. The company's commitment to research and development (R&D) is evident in its pipeline development efforts, aiming to introduce new products that address unmet medical needs. The pharmaceutical industry is known for variable timelines due to regulatory processes, but investment in R&D signals a commitment to future product introductions.

Strategic partnerships and collaborations are also vital for expansion, allowing Mallinckrodt to leverage external expertise and broaden its market reach. This approach facilitates access to new technologies and helps bring specialized therapies to market more efficiently. Furthermore, the company's contract manufacturing services offer another avenue for growth, utilizing its manufacturing capabilities to serve other pharmaceutical companies. This diversification of revenue streams helps optimize asset utilization, contributing to the overall Mallinckrodt business model.

Mallinckrodt focuses on optimizing its existing product portfolio by exploring new indications for established therapies. This includes expanding the use of products like H.P. Acthar Gel. This strategy aims to maximize the value of current offerings and drive revenue growth.

The company actively invests in pipeline development to introduce new products. This is crucial for addressing unmet medical needs. While specific timelines vary, the investment in R&D signals a commitment to future product introductions, which is a key aspect of Mallinckrodt's future prospects.

Mallinckrodt utilizes strategic partnerships and collaborations to expand its market reach. These partnerships allow access to external expertise and technologies. This approach helps in bringing specialized therapies to market more efficiently.

The company leverages its manufacturing capabilities through contract manufacturing services. This diversifies revenue streams and optimizes asset utilization. This strategy supports the company's overall financial performance analysis.

Mallinckrodt's expansion initiatives are multifaceted, focusing on both internal and external growth strategies. These include optimizing the existing product portfolio, developing new products through R&D, and forming strategic partnerships.

- Focus on core therapeutic areas: Autoimmune and rare diseases.

- Investment in R&D for new product introductions.

- Strategic partnerships to leverage external expertise and broaden market reach.

- Contract manufacturing services to diversify revenue streams.

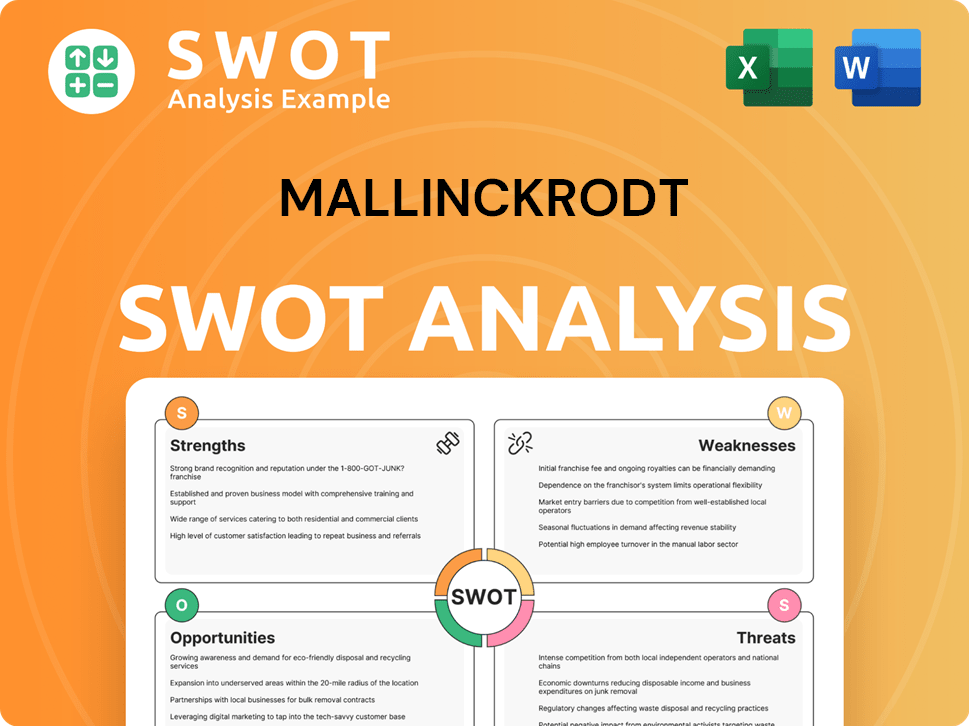

Mallinckrodt SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Mallinckrodt Invest in Innovation?

The innovation and technology strategy of Mallinckrodt is crucial for its long-term success within the biopharmaceutical sector. This strategy is heavily reliant on ongoing research and development (R&D) investments, which are essential for the discovery and development of new therapies, particularly in areas like autoimmune and rare diseases. The company's ability to innovate directly impacts its Mallinckrodt future prospects and its capacity to address complex medical conditions.

Mallinckrodt's approach to innovation involves a combination of internal expertise and external collaborations. These collaborations often include partnerships with academic institutions and biotechnology firms to explore new therapeutic modalities. This strategy is vital for maintaining a competitive edge in the specialty pharmaceuticals market. The focus on specialty pharmaceuticals means that scientific innovation is key to addressing complex medical conditions, and advancements in drug delivery systems and formulations are critical for improving patient outcomes.

While specific figures for R&D investments in 2024-2025 are not readily available in public documents, the pharmaceutical industry, including Mallinckrodt company analysis, typically allocates substantial resources to R&D as a core driver of future growth. The company's ability to maintain its position in specialized therapeutic areas depends on its continued investment in scientific breakthroughs and its agility in adopting relevant technological advancements. This includes enhancing product offerings and improving operational efficiencies.

The biopharmaceutical industry typically sees substantial R&D expenditure as a core driver of future growth. Although specific figures for 2024-2025 are not readily available, R&D investments are crucial.

Mallinckrodt leverages in-house expertise and external collaborations. These include partnerships with academic institutions and biotechnology firms to explore new therapeutic modalities and platforms.

The company focuses on specialty pharmaceuticals, which necessitates a strong emphasis on scientific innovation. This is essential for addressing complex medical conditions.

The industry is increasingly adopting technologies for R&D efficiency, clinical trial management, and supply chain optimization. This is crucial for Mallinckrodt growth strategy.

The ability to maintain leadership in specialized therapeutic areas depends on continued investment in scientific breakthroughs. This enhances product offerings and operational efficiencies.

Agility in adopting relevant technological advancements is key. This helps to enhance product offerings and improve operational efficiencies.

Mallinckrodt's approach to innovation is multifaceted, focusing on both internal R&D and external collaborations to advance its product pipeline. The company's strategy is designed to leverage scientific breakthroughs and technological advancements to enhance its offerings and operational efficiency. For more insights, see the Marketing Strategy of Mallinckrodt.

- R&D Investments: Continuous investment in research and development to discover and develop novel therapies.

- Strategic Partnerships: Collaborations with academic institutions and biotechnology firms to explore new therapeutic modalities.

- Focus on Specialty Pharmaceuticals: Emphasis on scientific innovation to address complex medical conditions.

- Technological Adoption: Integration of technologies for R&D efficiency, clinical trial management, and supply chain optimization.

- Product Enhancement: Use of technology to improve product offerings and operational efficiencies.

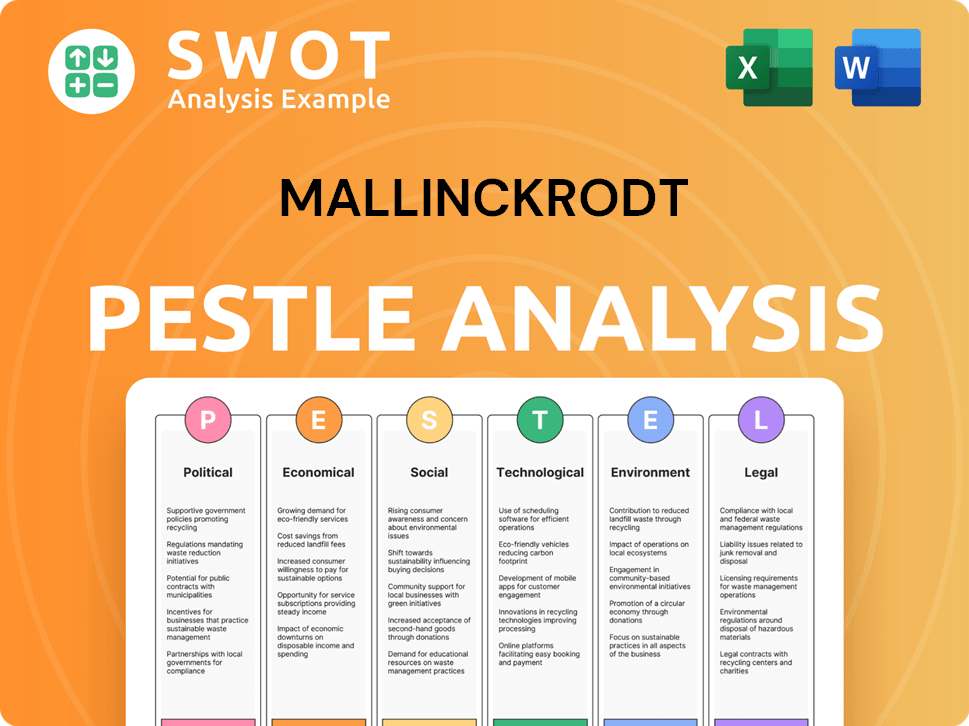

Mallinckrodt PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Mallinckrodt’s Growth Forecast?

The financial outlook is a critical component of the Mallinckrodt growth strategy, offering insights into its expected performance and ability to fund future initiatives. Following its emergence from Chapter 11 bankruptcy in August 2022, the company has been focused on stabilizing its financial position and executing its business plan. This involves managing debt, optimizing the capital structure, and investing in growth opportunities within the specialty pharmaceuticals sector.

For the first quarter of 2024, the company reported net sales of $396.9 million, reflecting a decrease compared to the prior year period. This indicates ongoing challenges and the need for strategic adjustments to drive revenue growth. The company's Adjusted EBITDA for the same quarter was $92.7 million. These figures are crucial for investors and analysts assessing the company's financial health and its capacity for sustained growth in the competitive biopharmaceutical market.

Mallinckrodt reaffirmed its full-year 2024 financial guidance, projecting net sales to be between $1.535 billion and $1.615 billion, and Adjusted EBITDA to be between $400 million and $440 million. These projections are key indicators of the company's anticipated revenue and profitability targets for the near term. The ability to meet these targets is essential for funding expansion initiatives, research and development efforts, and potential strategic acquisitions, which are all vital for long-term growth.

Mallinckrodt's financial strategy includes managing its debt obligations and optimizing its capital structure to support its operations and growth investments. This involves careful allocation of resources and strategic decision-making to ensure financial stability. Effective financial management is crucial for navigating the complexities of the pharmaceutical industry.

Investors and analysts will closely monitor key financial metrics, including revenue, Adjusted EBITDA, cash flow generation, and debt reduction. These metrics provide insights into the company's financial health and its capacity for sustained growth. Analyzing these figures helps in understanding the Mallinckrodt future prospects.

The biopharmaceutical market is highly competitive, and Mallinckrodt faces various challenges, including legal issues and the impact of opioid settlements. The company's ability to adapt to market dynamics and maintain financial stability is crucial for its long-term success. Understanding the Mallinckrodt business model is essential.

The company's financial performance will directly impact its ability to fund expansion initiatives, R&D efforts, and strategic acquisitions. These investments are crucial for driving Mallinckrodt revenue growth drivers. Strategic partnerships and a robust product pipeline are also essential.

Mallinckrodt's financial outlook is significantly influenced by its debt restructuring and ongoing legal challenges, including the opioid settlement impact. Effective management of these issues is vital for long-term financial stability. Addressing Mallinckrodt legal challenges is a priority.

Analyzing the Mallinckrodt competitive landscape is essential for understanding its market position. The company operates in a dynamic environment where strategic partnerships and innovation are key to success. Staying competitive requires continuous adaptation and strategic investments.

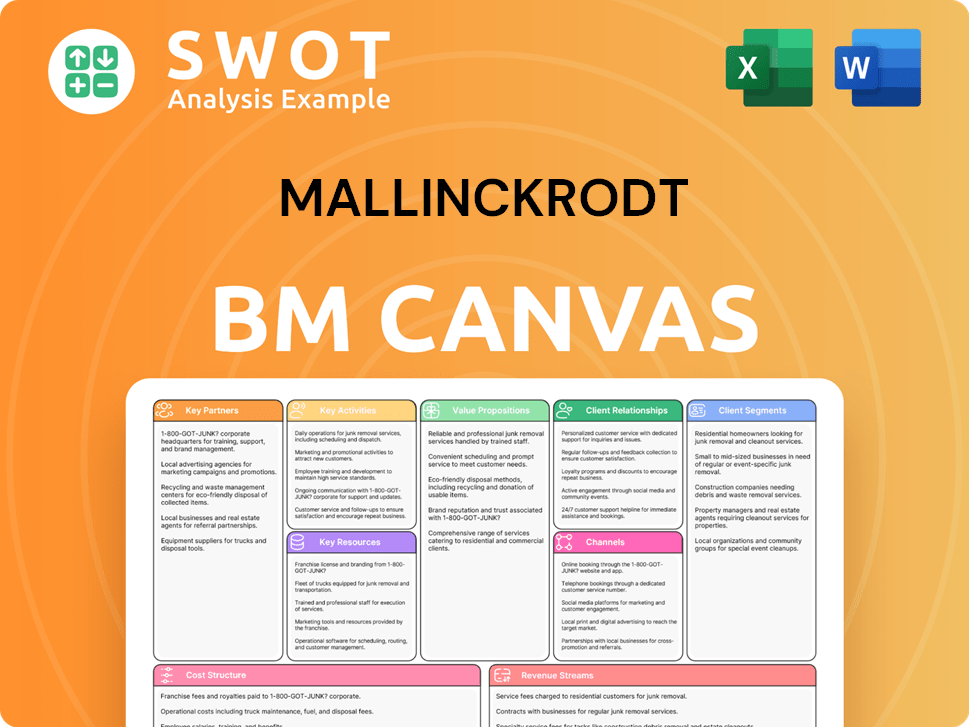

Mallinckrodt Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Mallinckrodt’s Growth?

The biopharmaceutical industry presents several strategic and operational risks that could impact the Mallinckrodt growth strategy. These challenges range from intense market competition to the complexities of regulatory changes and supply chain vulnerabilities. Understanding and effectively managing these risks are crucial for realizing the company’s future objectives.

Mallinckrodt company analysis reveals that the company must navigate a landscape where established and emerging firms compete fiercely in specialty pharmaceutical segments. This competition can lead to pricing pressures and increased marketing expenses, necessitating continuous innovation. Furthermore, the evolving healthcare policies and drug approval processes add another layer of complexity.

Operational risks, such as supply chain disruptions and intellectual property challenges, also pose significant hurdles. These factors can affect the availability of products and expose key products to generic competition. Addressing these multifaceted risks is critical for Mallinckrodt future prospects and maintaining its market position. For further insights into the company's structure, consider exploring the perspectives of Owners & Shareholders of Mallinckrodt.

The Pharmaceutical industry is highly competitive, particularly in specialty pharmaceuticals. This competitive pressure can lead to reduced profit margins and the need for continuous innovation to stay ahead. Companies must invest heavily in research and development to maintain a competitive edge.

Evolving healthcare policies and drug approval processes across different geographies can significantly impact product development and market access. Stringent regulatory requirements can delay or prevent the approval of new drugs, affecting revenue streams. Changes in orphan drug designations can also influence a company's product pipeline.

Disruptions in the supply chain due to geopolitical events, natural disasters, or manufacturing issues can impact the availability of raw materials and finished products. These disruptions can lead to delays, revenue losses, and increased operational costs. Companies need robust risk management strategies to mitigate these risks.

Patent expirations and intellectual property challenges expose key products to generic competition. This can lead to a decline in sales and market share as generic alternatives enter the market. Companies must proactively manage their patent portfolios and develop strategies to protect their intellectual property.

The company's experience with its Chapter 11 restructuring underscores the importance of financial resilience. Navigating significant challenges requires strong financial planning and adaptability. Effective debt restructuring and financial management are crucial for long-term success.

The ability to adapt to changing market conditions and regulatory environments is essential. This adaptability includes diversifying the product portfolio and continuously monitoring the competitive landscape. A proactive approach to risk management is key to maintaining a strong market position.

The competitive landscape in the specialty pharmaceuticals market includes both established and emerging companies. Key competitors often have strong portfolios and significant resources. Mallinckrodt market share and Mallinckrodt competitive landscape are affected by these dynamics, requiring continuous innovation and strategic partnerships.

The regulatory environment significantly impacts Mallinckrodt's business model. Changes in drug approval processes and reimbursement policies can affect product development timelines and market access. Adapting to these changes requires proactive engagement with regulatory bodies and strategic planning.

Effective supply chain management is crucial to mitigate risks related to raw material availability and manufacturing disruptions. Diversifying suppliers and maintaining robust inventory management systems are essential. Mallinckrodt research and development efforts depend on a stable supply chain.

Protecting intellectual property through patents and other means is critical to maintaining a competitive advantage. Proactive patent portfolio management and strategies to address potential infringements are essential. Mallinckrodt's acquisition strategy may include acquiring companies with strong IP.

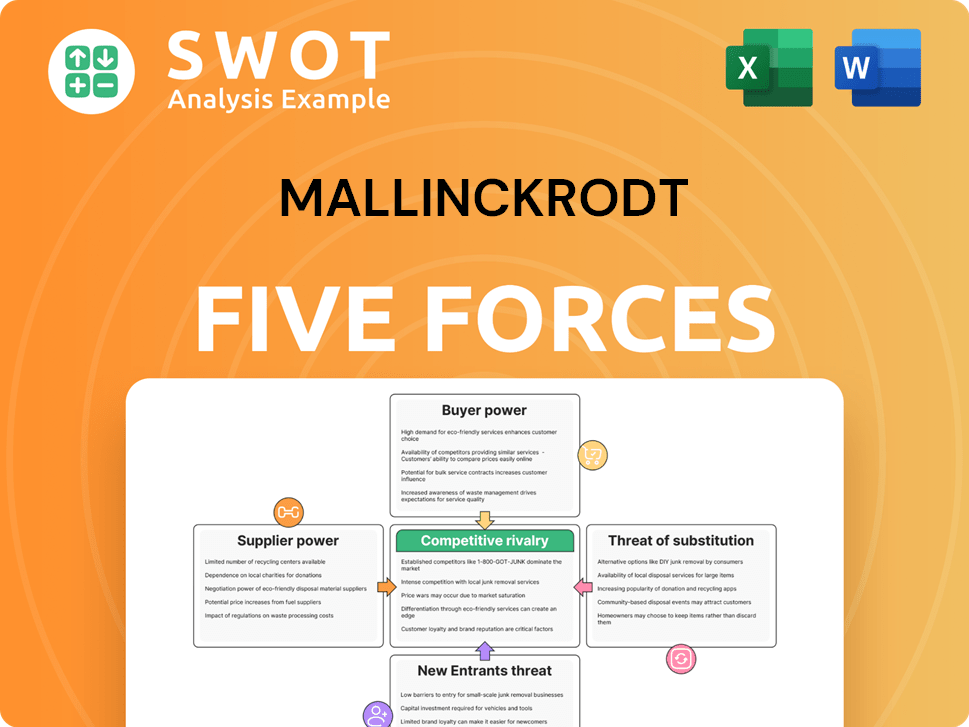

Mallinckrodt Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mallinckrodt Company?

- What is Competitive Landscape of Mallinckrodt Company?

- How Does Mallinckrodt Company Work?

- What is Sales and Marketing Strategy of Mallinckrodt Company?

- What is Brief History of Mallinckrodt Company?

- Who Owns Mallinckrodt Company?

- What is Customer Demographics and Target Market of Mallinckrodt Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.