Mallinckrodt Bundle

Decoding Mallinckrodt's Competitive Arena: Who's in the Fight?

Venturing into the intricate world of biopharmaceuticals, Mallinckrodt has established a notable presence, particularly in the treatment of autoimmune and rare diseases. From its humble beginnings as a chemical manufacturer, the company has transformed into a global entity, strategically focusing on high-value specialty areas. This evolution necessitates a deep dive into its competitive landscape to understand its position within the Mallinckrodt SWOT Analysis.

This Mallinckrodt market analysis will dissect the company's competitive advantages, evaluating its strategic moves within the pharmaceutical industry. We'll explore who Mallinckrodt's competitors are and how it navigates the challenges of the rare diseases market, including its financial performance and product portfolio. Understanding the Mallinckrodt competitive landscape is crucial for investors and industry professionals alike.

Where Does Mallinckrodt’ Stand in the Current Market?

The company, a player in the pharmaceutical industry, focuses on specialty pharmaceuticals, particularly in autoimmune and rare diseases, and critical care. While specific market share data for 2024-2025 is not readily available in consolidated reports, it holds significant positions in key therapeutic areas. Its geographic presence is global, with a strong presence in the United States, serving hospitals, clinics, and government healthcare providers.

Over time, the company has shifted its focus to specialty pharmaceuticals, targeting high-need, high-value areas. This strategic move aims to capitalize on its expertise in developing and commercializing complex therapies. Amidst financial restructuring aimed at resolving legacy liabilities, the company's commitment to its core therapeutic areas and pipeline development remains a key aspect of its current positioning. Contract manufacturing services also contribute to revenue and leverage its manufacturing capabilities.

Mallinckrodt's market position is shaped by its focus on specialized therapies and its ability to navigate the complexities of the pharmaceutical market. To understand more about its strategic direction, you can explore the Growth Strategy of Mallinckrodt.

Mallinckrodt concentrates on specialty pharmaceuticals, including treatments for autoimmune and rare diseases, and critical care. This targeted approach allows the company to address specific medical needs effectively. This focus is a key element in its competitive positioning within the pharmaceutical industry.

The company has a global presence, with a strong foothold in the United States, which is its primary market. It also operates in various international regions, ensuring a broad reach for its products. This international presence is crucial for its overall market analysis.

Its specialized customer base includes hospitals, clinics, and government healthcare providers. This targeted approach allows the company to build strong relationships and provide tailored solutions. This focus on specific customer groups is a key factor in its competitive landscape.

The company has strategically moved towards specialty pharmaceuticals, focusing on high-need, high-value therapeutic areas. This shift is driven by a strategy to leverage its expertise in developing and commercializing complex therapies. This strategic pivot is a key element of its growth strategies.

Mallinckrodt operates in a dynamic market, with its position influenced by several factors. The company is navigating financial restructuring while remaining committed to its core therapeutic areas. Contract manufacturing services provide a stable revenue stream.

- Financial Restructuring: The company is undergoing financial restructuring to address legacy liabilities.

- Therapeutic Focus: It remains committed to its core therapeutic areas and pipeline development.

- Manufacturing Services: Contract manufacturing services contribute to revenue and leverage its capabilities.

- Market Challenges: The company faces challenges in the pharmaceutical market.

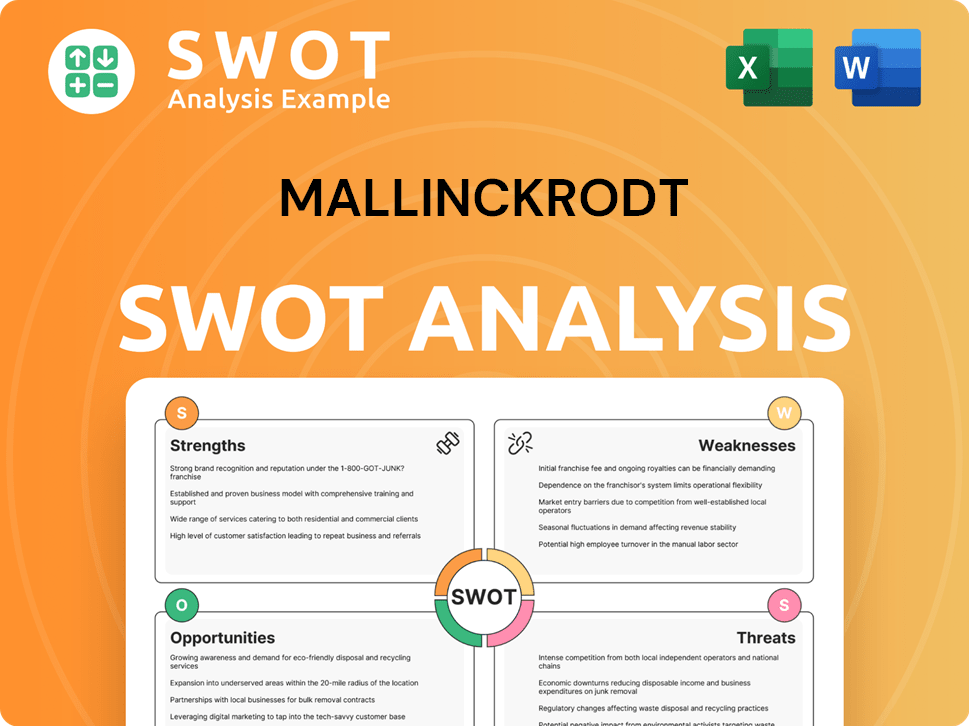

Mallinckrodt SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Mallinckrodt?

The Mallinckrodt competitive landscape is shaped by a dynamic pharmaceutical industry, where companies constantly vie for market share. This landscape includes a mix of large, established pharmaceutical giants and smaller, specialized biopharmaceutical firms. Understanding the Mallinckrodt competitors and their strategies is crucial for a comprehensive Mallinckrodt market analysis.

The specialty pharmaceuticals sector, where Mallinckrodt operates, is particularly competitive, especially within the rare diseases market. This environment demands continuous innovation, strategic partnerships, and effective commercialization to maintain and grow market presence. The competitive pressures influence everything from pricing strategies to research and development investments.

In the autoimmune and rare disease space, Mallinckrodt faces competition from companies with established portfolios and robust pipelines. These competitors often have significant resources and market presence.

AbbVie, with its strong immunology franchise including Humira and Skyrizi, is a major competitor. Humira, for instance, has generated billions in revenue annually before facing biosimilar competition. In 2023, Humira sales were still significant despite biosimilar entries.

Novartis, with its diverse portfolio, also presents a challenge. Novartis invests heavily in research and development, often focusing on innovative therapies for various diseases. Their broad portfolio allows them to compete in multiple therapeutic areas.

Sanofi is a notable competitor, particularly in the rare disease market. They have made significant investments in orphan drugs and specialized therapies. Sanofi's strategic focus on rare diseases directly impacts the competitive landscape.

Pfizer competes in the rare disease space, often through acquisitions and strategic partnerships. Pfizer's broad portfolio and global reach make them a formidable competitor. Their investments in specialized therapies challenge Mallinckrodt.

Takeda Pharmaceutical Company is another significant player in the rare disease market. They have expanded their portfolio through acquisitions and internal development. Takeda's focus on rare diseases directly impacts the competitive dynamics.

Competitors challenge Mallinckrodt through various means, including innovation in drug development, aggressive pricing strategies, and extensive marketing networks. The competitive landscape is further shaped by mergers and acquisitions.

- Innovation in Drug Development: Competitors invest heavily in research and development to bring new therapies to market. This includes novel gene therapies and highly targeted treatments.

- Pricing Strategies: Pricing plays a crucial role in market share, particularly in the specialty pharmaceuticals sector. Competitors often employ complex pricing models.

- Marketing and Sales Networks: Extensive marketing and sales networks are essential for reaching physicians and patients. Strong brand recognition also influences market dynamics.

- Mergers and Acquisitions: Large pharmaceutical companies often acquire smaller biotechs to expand their portfolios. This can significantly alter the competitive landscape. For more insights, see the Growth Strategy of Mallinckrodt.

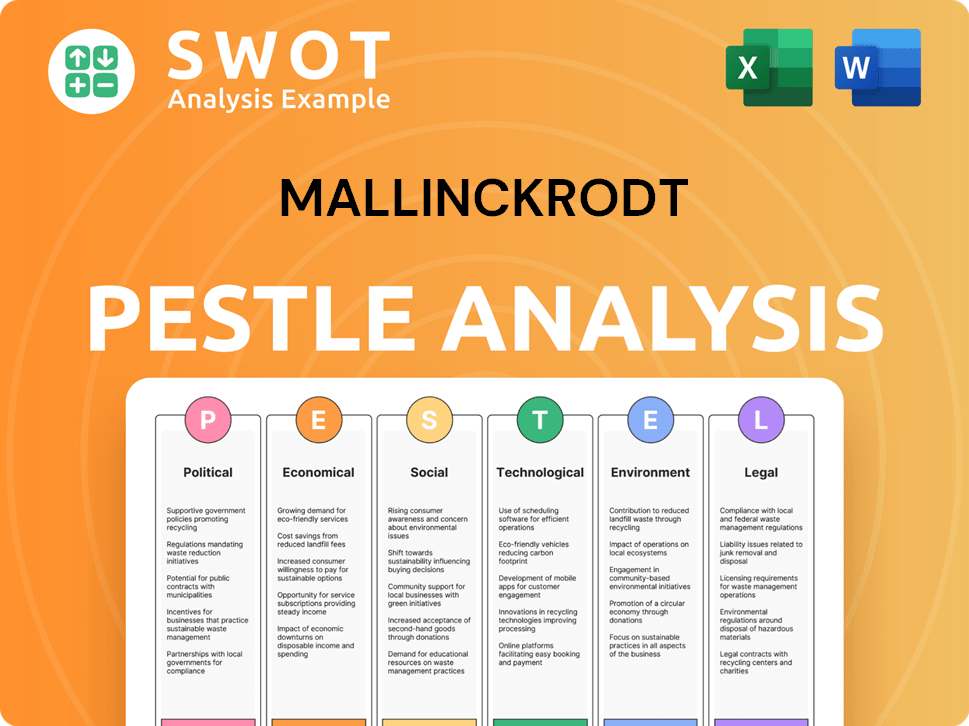

Mallinckrodt PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Mallinckrodt a Competitive Edge Over Its Rivals?

The competitive landscape for Mallinckrodt is shaped by its focus on specialty pharmaceuticals, particularly in areas like autoimmune disorders and rare diseases. This strategic focus has allowed the company to develop expertise and establish a presence in specific therapeutic niches. Mallinckrodt's ability to navigate regulatory pathways and build relationships with key opinion leaders is crucial for market access. Understanding the Mallinckrodt competitive landscape is essential for investors and industry analysts.

Mallinckrodt's competitive advantages include its established product portfolio, with brands like Acthar Gel providing a revenue base and brand recognition. Furthermore, its manufacturing capabilities, including contract manufacturing services, diversify revenue streams and leverage its infrastructure for producing complex pharmaceutical products. The company's intellectual property, such as patents and proprietary manufacturing processes, offers protection for its existing products. A thorough Mallinckrodt market analysis reveals these strengths.

However, Mallinckrodt faces ongoing challenges. These include competition from new drug development, patent expirations, and increasing scrutiny over drug pricing. Continuous innovation and strategic adaptation are necessary for the company to maintain sustainability and competitiveness. Analyzing the Mallinckrodt competitors is vital for understanding the pressures it faces.

Mallinckrodt has undergone significant restructuring, including Chapter 11 bankruptcy proceedings, to address financial challenges related to opioid litigation. The company has focused on streamlining its operations and divesting non-core assets. These strategic moves aim to improve its financial position and refocus on its core specialty pharmaceutical business.

Recent strategic moves include a focus on its core therapeutic areas and investments in research and development. Mallinckrodt is also working to resolve legal issues and manage its debt. The company is exploring opportunities to expand its product portfolio through acquisitions and partnerships, particularly in the rare diseases market.

Mallinckrodt's competitive edge lies in its expertise in specialty pharmaceuticals and its established product portfolio. Its manufacturing capabilities and intellectual property offer additional advantages. The company's focus on specific therapeutic areas allows it to build strong relationships with healthcare providers and patient advocacy groups. To further understand the competitive advantages of Mallinckrodt, consider its strategic positioning.

Mallinckrodt's financial performance has been impacted by its restructuring and legal challenges. Revenue has fluctuated, and the company has focused on reducing its debt. Financial results are closely watched by investors and analysts. For more detailed information, see Target Market of Mallinckrodt.

Mallinckrodt's success depends on its ability to innovate, manage its product portfolio, and navigate the complex regulatory environment. Key factors include its product pipeline, its presence in the pharmaceutical industry, and its ability to secure and maintain market access for its products. Understanding these factors is crucial for assessing its long-term prospects.

- Product Innovation: Continuously developing and launching new products.

- Market Access: Maintaining strong relationships with healthcare providers.

- Regulatory Compliance: Navigating complex regulatory pathways.

- Financial Stability: Managing debt and improving profitability.

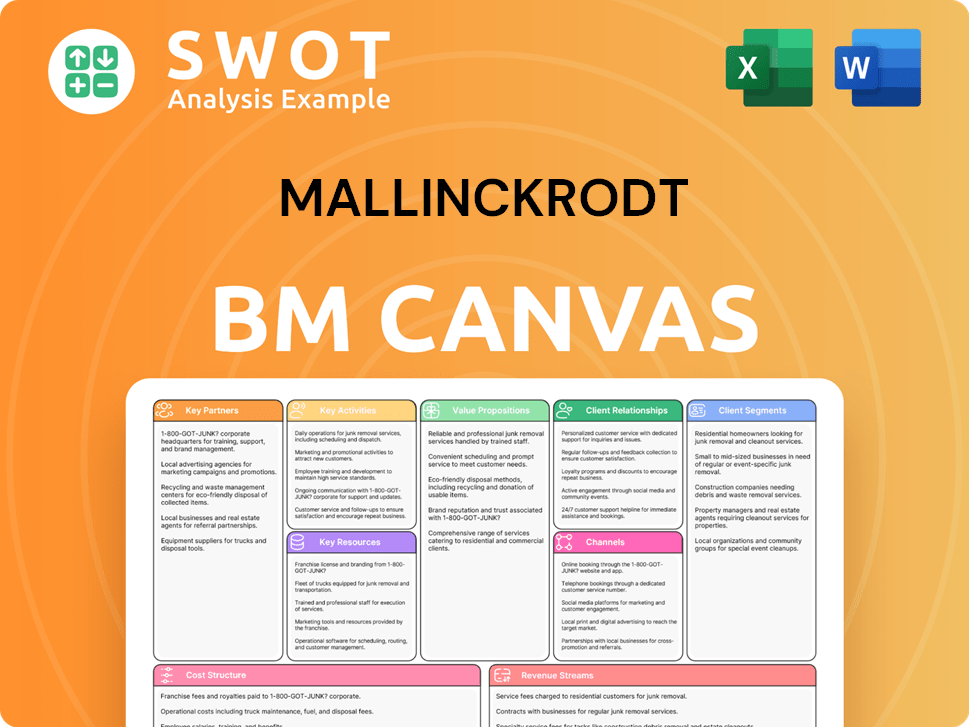

Mallinckrodt Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Mallinckrodt’s Competitive Landscape?

The biopharmaceutical industry, where Mallinckrodt operates, is subject to dynamic shifts, presenting both opportunities and challenges. Understanding the Mallinckrodt competitive landscape requires an analysis of current industry trends, potential future challenges, and the opportunities that could shape its market position. This analysis will focus on how the company can navigate the evolving pharmaceutical market and maintain its competitive edge.

Mallinckrodt market analysis reveals that the company faces the dual pressures of innovation and regulatory changes. The specialty pharmaceuticals sector, where Mallinckrodt has a significant presence, is particularly sensitive to these factors. The company’s ability to adapt to these changes will be crucial for its long-term success and for maintaining its position among its Mallinckrodt competitors.

Technological advancements, especially in gene therapy and advanced biologics, are revolutionizing treatment approaches. The growing prevalence of rare diseases is driving demand for specialized treatments. Increasing healthcare costs are pushing for greater scrutiny of drug pricing and market access globally.

Stringent regulatory changes regarding drug pricing and market access could impact profitability. Competitors developing superior or more cost-effective treatments pose a threat. The need for robust clinical evidence and real-world data to justify pricing for rare disease therapies is increasing.

Strategic partnerships and targeted R&D can lead to new therapies and market expansion. Emerging markets offer growth potential with expanding healthcare infrastructure. Demonstrating the long-term value of therapies through strong clinical data can justify pricing.

Mallinckrodt must navigate its financial restructuring effectively. A focus on pipeline development is crucial for future growth. The company should capitalize on the growing global prevalence of rare diseases.

Mallinckrodt's strengths and weaknesses are critical to understanding its competitive position. The company’s focus on specialty pharmaceuticals, including therapies for rare diseases, positions it in a market with high growth potential. However, the pharmaceutical industry is highly competitive, and Mallinckrodt's challenges in the pharmaceutical market are significant.

- Rare Diseases Market: The rare diseases market is experiencing rapid growth, creating opportunities for specialized treatments.

- R&D Investments: Mallinckrodt's research and development investments must be targeted to maintain a competitive product pipeline.

- Strategic Partnerships: Forming Mallinckrodt's strategic partnerships can enhance market access and R&D capabilities.

- Financial Performance: Mallinckrodt's financial performance compared to competitors is a key indicator of its market position.

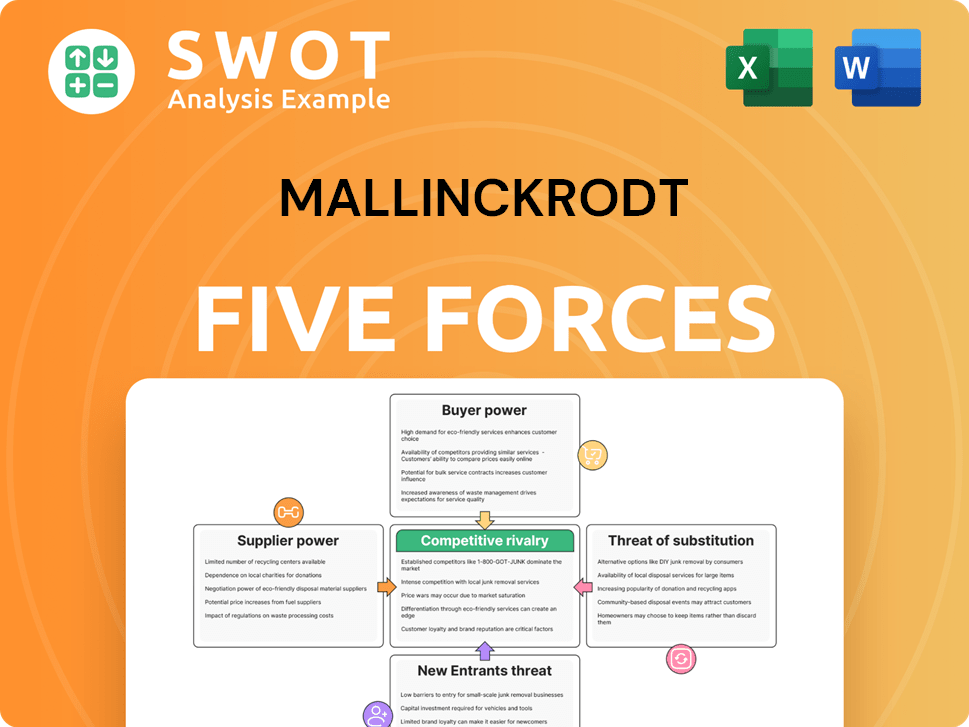

Mallinckrodt Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mallinckrodt Company?

- What is Growth Strategy and Future Prospects of Mallinckrodt Company?

- How Does Mallinckrodt Company Work?

- What is Sales and Marketing Strategy of Mallinckrodt Company?

- What is Brief History of Mallinckrodt Company?

- Who Owns Mallinckrodt Company?

- What is Customer Demographics and Target Market of Mallinckrodt Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.