Mallinckrodt Bundle

Unveiling Mallinckrodt: How Does This Pharmaceutical Giant Operate?

Ever wondered how a leading Mallinckrodt SWOT Analysis can shape the future of healthcare? Mallinckrodt, a prominent

Delving into

What Are the Key Operations Driving Mallinckrodt’s Success?

The core operations of the Mallinckrodt company revolve around the development, manufacturing, marketing, and distribution of specialty pharmaceutical products. The company primarily focuses on therapies for autoimmune and rare diseases, including conditions in neurology, rheumatology, nephrology, pulmonology, and ophthalmology. It also provides treatments for immunotherapy and neonatal respiratory critical care.

Mallinckrodt operations also include contract manufacturing services, leveraging its expertise and facilities for other pharmaceutical companies. This diversified approach allows the company to serve a broad patient base with high unmet medical needs, offering specialized treatments that often improve quality of life or are life-sustaining. The company’s business model is designed to address complex health challenges.

The value proposition of Mallinckrodt lies in its ability to provide specialized treatments for patients with rare and complex diseases. By focusing on areas with high unmet medical needs, the company offers therapeutic options where few alternatives exist. This focus, along with its contract manufacturing services, differentiates the company in the competitive biopharmaceutical landscape. To learn more about the company's strategy, read this article: Growth Strategy of Mallinckrodt.

Mallinckrodt's research and development (R&D) is essential for identifying and developing novel therapies. The company invests significantly in R&D to create new pharmaceutical products. This includes clinical trials and collaborations with other companies.

Manufacturing processes adhere to strict regulatory standards to ensure product quality and safety. The supply chain is designed to manage the complexities of specialty pharmaceuticals. This involves specialized handling and distribution to reach global markets.

Distribution networks are crucial for reaching global markets and ensuring timely access to therapies. Mallinckrodt operations also include strategic partnerships to enhance R&D capabilities. These partnerships expand the product portfolio and improve market access.

The company provides therapeutic options where few alternatives exist, improving patient outcomes. This specialized approach differentiates Mallinckrodt in the competitive biopharmaceutical landscape. The focus on specialty pharmaceuticals addresses specific patient populations.

Mallinckrodt's operational effectiveness is driven by its focused expertise in specialty areas. The company's processes include rigorous research and development, adherence to strict manufacturing standards, and a robust supply chain. These processes ensure the delivery of high-quality, specialized treatments.

- R&D focuses on novel therapies.

- Manufacturing complies with regulatory standards.

- Supply chain manages specialty pharmaceuticals.

- Distribution networks reach global markets.

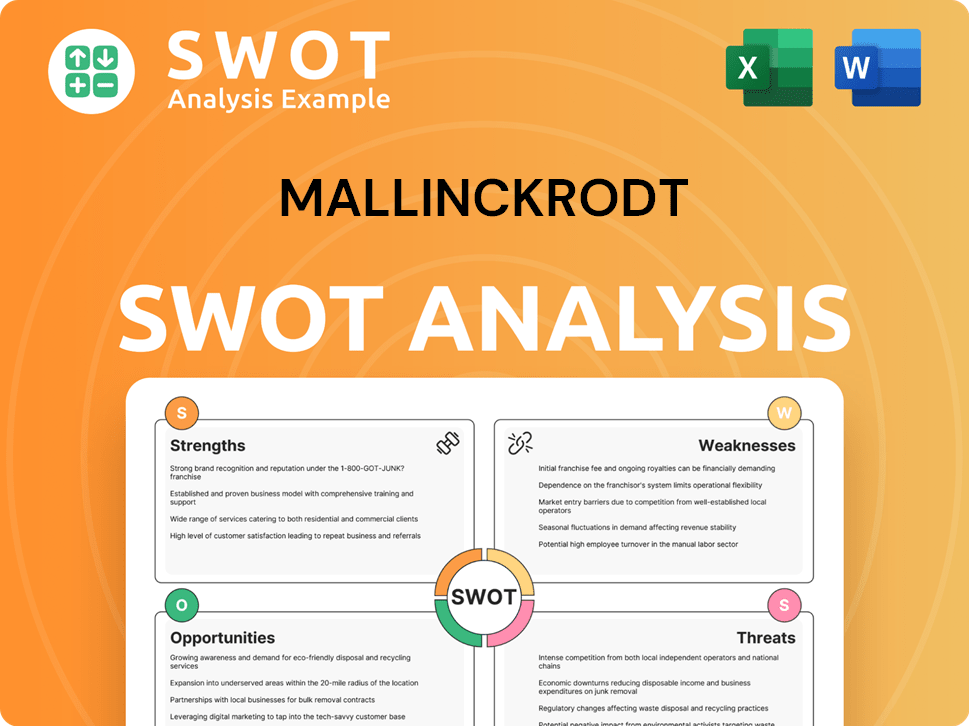

Mallinckrodt SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Mallinckrodt Make Money?

The Mallinckrodt company primarily generates revenue through the sale of its specialty pharmaceutical products. These products cater to various therapeutic areas, including autoimmune and rare diseases, as well as critical care. The company's business model focuses on high-value, specialized drugs.

In addition to product sales, Mallinckrodt operations include revenue from contract manufacturing services. This segment utilizes the company's manufacturing capabilities to produce pharmaceuticals for other organizations, offering an additional income stream. The monetization strategy involves premium pricing for specialty products, reflecting R&D investments and the nature of the therapies.

The company's revenue streams are influenced by its key specialty product performance and the demand for contract manufacturing. New product launches, patent expirations, and market demand shifts for specific therapies often drive changes in revenue sources. For more details on the company's ownership structure, you can explore Owners & Shareholders of Mallinckrodt.

The core of Mallinckrodt's revenue comes from selling specialty pharmaceuticals. These include products for autoimmune and rare diseases. This is a crucial part of their financial strategy.

The company also generates income by manufacturing drugs for other companies. This leverages their production expertise. It helps optimize asset utilization.

Specialty products often have premium pricing. This reflects the high R&D costs and the specialized nature of the treatments. Patient access programs are also used to ensure therapies reach those in need.

Revenue changes are driven by factors such as new product launches and patent expirations. Market demand for specific therapies also plays a significant role in the company's financial performance. The revenue mix is largely influenced by the performance of its key specialty products.

Changes in revenue sources are influenced by new product launches. Patent expirations and shifts in market demand for specific therapies also affect revenues. This shows the dynamic nature of the pharmaceutical industry.

The financial performance of Mallinckrodt is closely tied to the success of its key specialty products. The company's ability to manage pricing and reimbursement complexities is crucial. This affects their overall financial health.

The company's revenue strategies involve a combination of product sales and contract manufacturing. Pricing strategies are designed to maximize revenue from specialty drugs, considering R&D investments and market conditions.

- Focus on high-value, low-volume specialty drugs.

- Utilize contract manufacturing to leverage production capabilities.

- Employ premium pricing for specialty products.

- Implement patient access programs.

- Adapt to market changes and patent expirations.

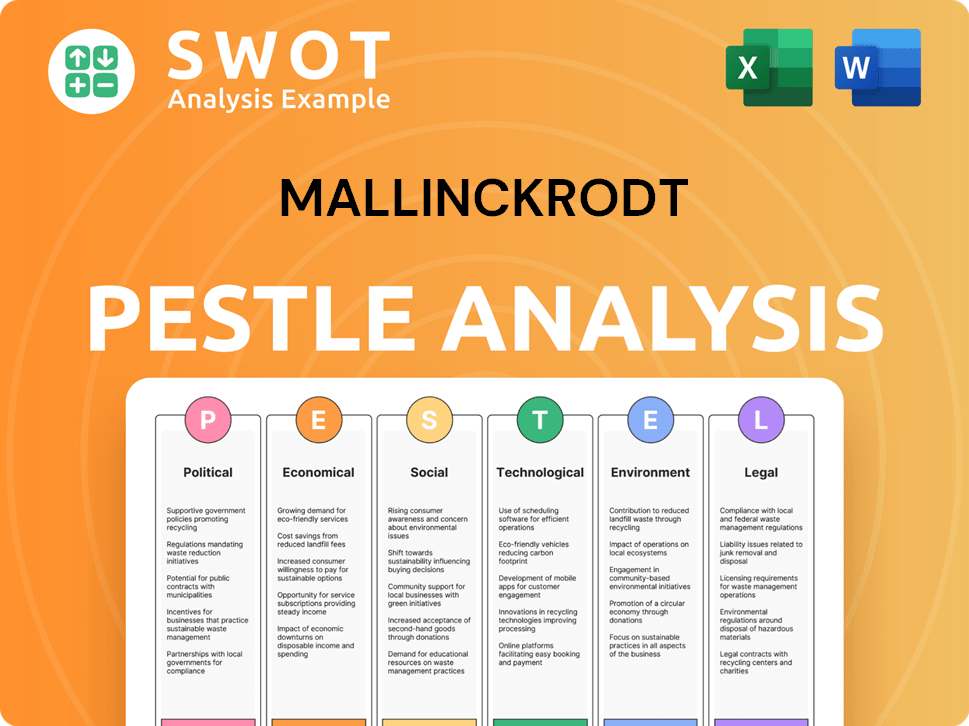

Mallinckrodt PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Mallinckrodt’s Business Model?

The journey of the Mallinckrodt company has been shaped by pivotal moments, influencing its operational and financial strategies. A major shift involved focusing on specialty pharmaceuticals, particularly in areas like autoimmune and rare diseases. This strategic move allowed the company to establish a strong presence in the competitive pharmaceutical market. New product introductions in neurology, rheumatology, and neonatal critical care have been key drivers of growth.

Mallinckrodt operations have also included strategic partnerships to broaden its research and development capabilities and enhance its product pipeline. Navigating complex regulatory environments, especially in the pharmaceutical sector, and managing the financial impacts of past legal challenges, such as those related to opioid litigation, have been significant challenges. The company responded through strategic restructuring, including a Chapter 11 reorganization, to address its debt and concentrate on its core specialty pharmaceutical business. This restructuring, which concluded in late 2022, was a critical operational adjustment to ensure long-term viability.

Mallinckrodt's competitive advantages stem from its specialized product portfolio addressing high-unmet-need conditions, its expertise in complex manufacturing processes, and its established relationships within the healthcare community. While brand strength is important, its competitive edge is more rooted in the efficacy and unique applications of its specialty therapies. The company continues to adapt to new trends, such as advancements in gene therapy and personalized medicine, and competitive threats by focusing on innovation within its core therapeutic areas and optimizing its operational efficiency. For more insights into the company's target market, consider reading Target Market of Mallinckrodt.

Key milestones for Mallinckrodt include strategic shifts towards specialty pharmaceuticals and navigating significant legal and regulatory hurdles. The company's restructuring efforts, including a Chapter 11 reorganization, were critical in managing its financial obligations and refocusing its business strategy. These moves have been crucial for the company's long-term stability and market position.

Strategic moves have involved a focus on specialty pharmaceuticals, particularly in areas with high unmet medical needs. Partnerships have been essential for expanding research and development. The company has also adapted to market challenges through restructuring and operational adjustments to maintain its competitive edge.

Mallinckrodt's competitive advantages include a specialized product portfolio, expertise in complex manufacturing, and established healthcare relationships. The company's focus on innovation within its core therapeutic areas and operational efficiency is crucial. Adapting to advancements in gene therapy and personalized medicine also plays a significant role.

Recent financial data shows the impact of the restructuring. For the fiscal year ending September 29, 2023, Mallinckrodt reported a net loss. The company continues to focus on reducing its debt and improving its financial position. The company's ability to generate revenue from its core products and manage its operational costs is critical for future financial performance.

Mallinckrodt has faced significant operational challenges, including navigating complex regulatory environments and managing legal issues, particularly related to opioid litigation. The company responded to these challenges through strategic restructuring and operational adjustments.

- Chapter 11 Reorganization: This restructuring aimed to address the company's debt burden and focus on its core specialty pharmaceutical business.

- Strategic Restructuring: The company has made strategic adjustments to streamline operations and improve efficiency.

- Focus on Core Business: Mallinckrodt has concentrated its efforts on its specialty pharmaceutical products.

- Legal and Regulatory Compliance: The company continues to work to comply with all legal and regulatory requirements.

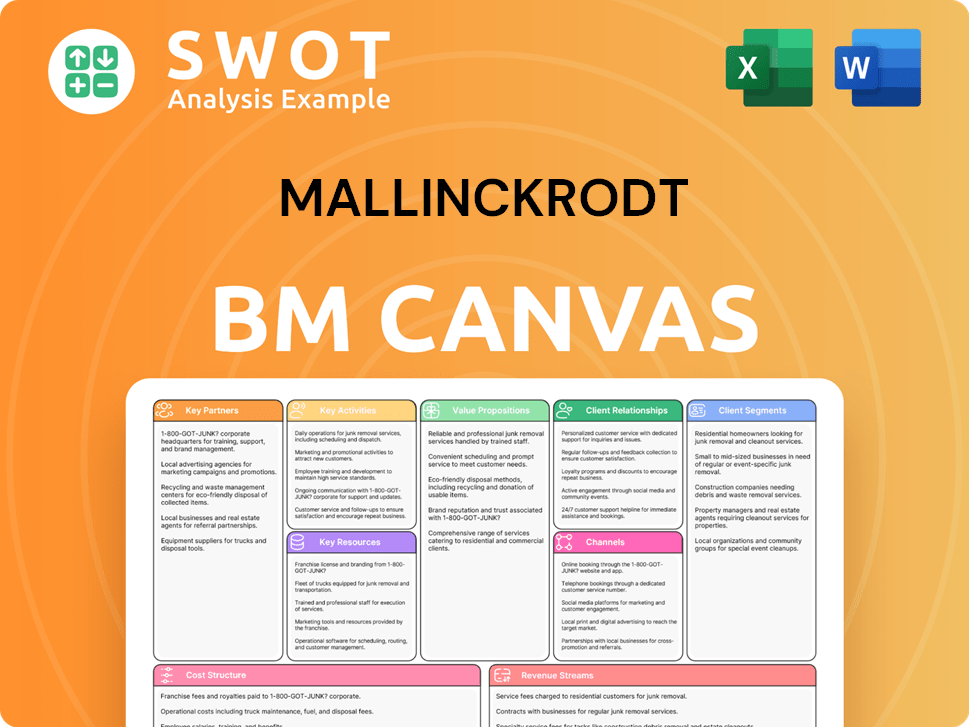

Mallinckrodt Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Mallinckrodt Positioning Itself for Continued Success?

The Mallinckrodt company operates within the specialty pharmaceutical industry, focusing on niche therapeutic areas such as autoimmune and rare diseases, neurology, and neonatal critical care. This strategic focus allows Mallinckrodt operations to maintain a competitive edge by addressing specific patient needs with specialized products. Its global presence ensures distribution across various international markets, though it faces challenges typical of the biopharmaceutical sector.

Several risks and challenges impact Mallinckrodt's performance, including ongoing regulatory scrutiny, particularly regarding drug pricing and manufacturing compliance. Competition within the biopharmaceutical industry also poses a constant threat, along with the financial implications of past legal issues. The company's future outlook emphasizes revenue generation through innovation and strategic investments, aiming to capitalize on the increasing demand for specialized treatments.

Mallinckrodt holds a significant position within the specialty pharmaceuticals market, focusing on specific therapeutic areas. Its competitive advantage stems from its specialized product portfolio, which addresses unique patient needs. Customer loyalty is often driven by the efficacy of its therapies for severe conditions. For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of Mallinckrodt.

Key risks include regulatory scrutiny concerning drug pricing and manufacturing. The biopharmaceutical industry's competitive nature and potential technological disruptions also pose challenges. Additionally, the financial implications of past legal issues continue to impact the company's operations. These factors can affect Mallinckrodt's financial performance and operational flexibility.

Mallinckrodt's future outlook focuses on sustaining revenue through innovation in its core therapeutic areas. Strategic initiatives include investing in research and development and optimizing its existing product portfolio. The company aims to leverage its expertise to meet evolving medical needs. A disciplined approach to R&D and commercialization is crucial.

Mallinckrodt's financial performance is influenced by its product sales, R&D investments, and legal settlements. Recent financial data indicates the impact of opioid litigation and the company's restructuring efforts. The company's ability to manage these financial challenges will be critical. Specific financial figures for 2024 and 2025 are not available in the provided context.

Mallinckrodt is focused on several strategic initiatives to enhance its market position and financial stability. These include a strong emphasis on research and development to bring new therapies to market and optimize the existing product portfolio. The company aims to leverage its expertise in specialty pharmaceuticals to address evolving medical needs.

- Investing in R&D for new therapies.

- Optimizing the existing product portfolio.

- Focusing on core therapeutic areas.

- Maintaining a disciplined approach to commercialization.

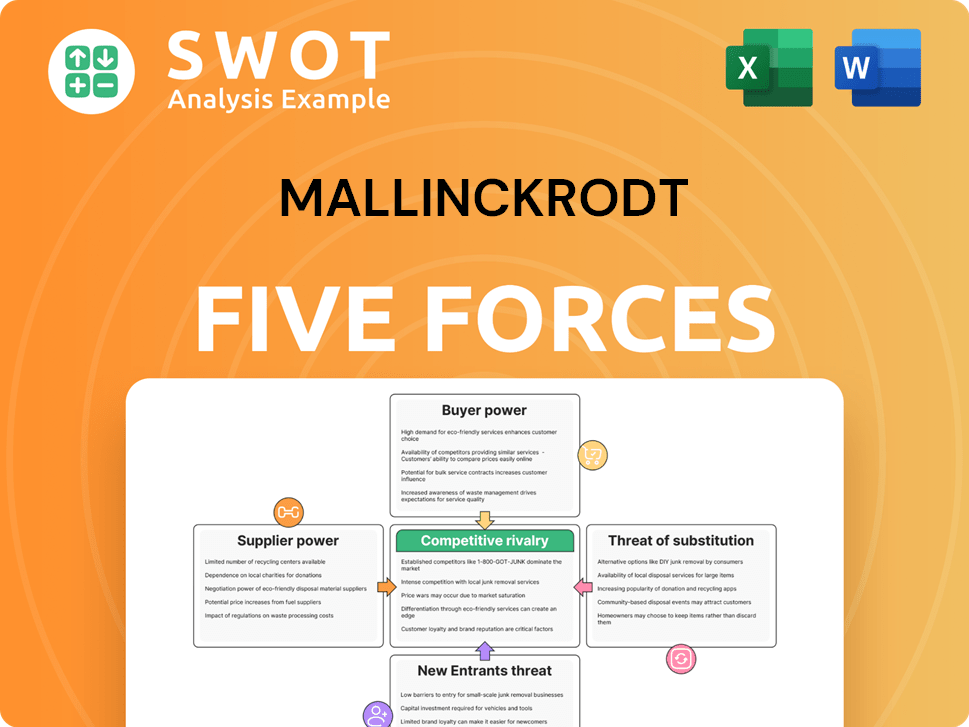

Mallinckrodt Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mallinckrodt Company?

- What is Competitive Landscape of Mallinckrodt Company?

- What is Growth Strategy and Future Prospects of Mallinckrodt Company?

- What is Sales and Marketing Strategy of Mallinckrodt Company?

- What is Brief History of Mallinckrodt Company?

- Who Owns Mallinckrodt Company?

- What is Customer Demographics and Target Market of Mallinckrodt Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.